IBM Revenue Grows for the First Time Since 2012 -- 2nd Update

January 18 2018 - 6:20PM

Dow Jones News

By Ted Greenwald

International Business Machines Corp. reported higher revenue

for the first time in 23 quarters and signaled continued growth

into 2018, giving Chief Executive Ginni Rometty breathing space as

she tries to turn around the century-old tech giant.

Fourth-quarter revenue rose 3.6% to $22.54 billion from a year

earlier. The last time IBM had revenue growth from the prior year

was the first quarter of 2012, Ms. Rometty's first as chief.

Several factors were key in helping IBM achieve growth in the

quarter: sales of industrial-strength computers the company

typically refreshes every few years rose 32% to $3.33 billion,

while cloud revenue rose 30% to $5.5 billion. Also, currency

exchange rates have been working in its favor lately, accounting

for 3 percentage points of revenue after years of being a

headwind.

IBM said it took a $5.5 billion charge related to the new U.S.

tax law, pushing it into the red. In all, the company reported a

quarterly loss of $1.05 billion, or $1.14 a share, compared with

profit of $4.5 billion, or $4.72 a share, a year earlier.

On an adjusted basis, IBM had profit of $5.18 a share, a penny

more than the $5.17 expected by analysts, according to Thomson

Reuters.

James Kavanaugh, IBM's new finance chief, said the company is

"ahead of track" in its previously stated goal of generating $40

billion in revenue over 12 months from newer, fast-growing

businesses by the end of 2018.

"That gives us the confidence to say we're going to grow revenue

overall in 2018," Mr. Kavanaugh said in an interview.

Since becoming CEO, Ms. Rometty has struggled to shift IBM from

older, shrinking businesses such as selling and maintaining

equipment in customers' own facilities to newer ones that promise

rapid growth.

She has staked out a position helping large corporate customers

integrate their operations with the cloud, and has focused on buzzy

areas such as artificial intelligence and the internet-based ledger

technology known as blockchain.

But growth has been elusive, as even high-profile initiatives

such as its Watson AI, a collection of cloud tools as well as apps

for industries including medicine and finance, haven't had a

considerable positive impact on finances.

Even some of Ms. Rometty's biggest fans have lost patience.

IBM's largest and arguably most prominent stakeholder -- Warren

Buffett's Berkshire Hathaway Inc., which sank more than $10 billion

into buying a 5.4% stake in 2011 -- sold more than half its

holdings last year. Berkshire held about 37 million shares as of

Sept. 30.

Shares of the 106-year-old tech company dropped 4.3% in

after-hours trading after finishing Thursday with a marginal gain

at $169.12. The price stands roughly where it did a year ago, while

the S&P 500 index has risen more than 23%.

While achieving quarterly growth is noteworthy, IBM is chasing

what it sees as a more significant milestone: getting more than

half its revenue from so-called strategic imperatives -- newer

technologies such as AI that customers can access in the cloud.

Revenue from strategic imperatives made up 49% of the total in

the quarter, edging toward that point at which sales of the

higher-growth offerings will outweigh the rest of IBM, presumably

allowing for faster growth overall.

Jim Lebenthal, a portfolio manager at HPM Partners LLC, said

there is visible evidence of Ms Rometty's progress. He sold his

stake in 2015 after "a lot of disappointments" but recently added

the company to his stable of 20 stocks. He is betting IBM's

newfound revenue growth is sustainable and that strategic

imperatives will grow to more than 50% of sales in 2018.

When Ms. Rometty took the CEO reins from Samuel Palmisano in

January 2012, revenue started slipping almost immediately and the

threat of cloud computing to IBM's traditional businesses became

evident. Ms. Rometty purchased cloud-computing platform SoftLayer

Technologies Inc. the following year and committed to developing

Watson into a flagship offering.

By 2014, it was clear IBM had diverged from Mr. Palmisano's

financial road map of $20-a-share in profit by 2015. Ms. Rometty

set aside that goal, reorganized the company around her strategic

imperatives and redirected about $4 billion away from stock

repurchases toward priorities such as Watson and the cloud,

according to Steven Milunovich of UBS.

IBM's challenges now include holding on to its large customers

as cloud leaders such as Amazon.com Inc., Microsoft Corp. and

Alphabet Inc.'s Google beckon.

"Strategic imperative revenue may cross over the core franchises

later this year," Mr. Milunovich said, "but there are a lot of

industry trends working against a large incumbent like IBM."

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

January 18, 2018 18:05 ET (23:05 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

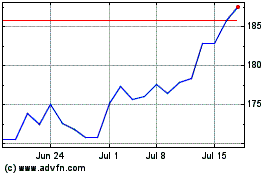

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024