UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

OF

THE SECURITIES EXCHANGE ACT OF 1934

Dated: November 21, 2017

Commission File

No. 001-33311

NAVIOS MARITIME HOLDINGS INC.

7 Avenue de

Grande Bretagne, Office 11B2

Monte Carlo, MC 98000 Monaco

(Address of Principal Executive Offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form

20-F

or Form

40-F:

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(7):

Yes ☐ No ☒

Closing of Notes Offering

On November 21, 2017, Navios Maritime Holdings Inc. (“Navios Holdings” or the “Company”) and Navios Maritime Finance

II (US) Inc., its wholly owned subsidiary (“Navios Finance” and, together with the Company, the

“Co-Issuers”),

completed the sale of $305.0 million in aggregate principal amount of

11.25% Senior Secured Notes due 2022 (the “Notes”). A copy of the press release announcing the closing of the Notes offering is furnished as Exhibit 99.1 to this Report on Form

6-K

and is

incorporated herein by reference.

In connection with the closing of the Notes offering, the

Co-Issuers

and the guarantors of the Notes and Wells Fargo Bank, National Association, as trustee and collateral trustee, entered into the Indenture, dated as of November 21, 2017, relating to the Notes

(the “Indenture”). Interest on the Notes will be payable on February 15 and August 15 of each year, beginning February 15, 2018, and the Notes will mature on August 15, 2022. On or after November 21, 2017, the

Co-Issuers

may redeem some or all of the Notes at the redemption prices set forth in the Indenture. The

Co-Issuers

may also redeem all, but not less than all, of the Notes at

a price equal to 100% of the principal amount plus accrued and unpaid interest, if any, upon certain changes in law that would trigger the payment of withholding taxes. Furthermore, upon the occurrence of certain change of control events, the

Co-Issuers

may be required to offer to purchase Notes from holders.

The Notes are the senior secured

obligations of the

Co-Issuers

and rank equal in right of payment to all of their existing and future senior indebtedness and senior in right of payment to all of their future subordinated indebtedness. The

Notes and the guarantees are effectively subordinated to their existing and future secured indebtedness and that of the guarantors to the extent of the assets such indebtedness. The Notes will also be structurally subordinated to the obligations of

any existing or future

non-guarantor

subsidiary. The Notes are secured by a first priority lien on the capital stock owned by certain of the subsidiary guarantors in each of Navios Maritime Partners, L.P.,

Navios GP L.L.C., Navios Maritime Acquisition Corporation, Navios South American Logistics Inc. and Navios Maritime Containers Inc. (collectively, the “Collateral”). The Notes are fully and unconditionally guaranteed, jointly and

severally, on a senior basis by all of Navios Holdings’ direct and indirect subsidiaries, except for certain subsidiaries designated as unrestricted subsidiaries, including Navios South American Logistics Inc. The Indenture contains restrictive

covenants that limit, among other things, the ability of the

Co-Issuers

and their subsidiaries to incur additional indebtedness, pay dividends and make distributions on common and preferred stock, make other

restricted payments, make investments, incur liens, consolidate, merge, sell or otherwise dispose of all or substantially all of their assets and enter into certain transactions with affiliates, in each case, subject to exclusions, and other

customary covenants. The Indenture also contains customary events of default. Additional terms and conditions of the Notes are contained in the Indenture, which is attached as Exhibit 99.2 to this Report on Form

6-K

and is incorporated herein by reference.

Expiration of Tender Offer Early Tender Deadline

On November 21, 2017, Navios Holdings announced the expiration of the November 20, 2017 early tender deadline under its previously

announced cash tender offer (the “Tender Offer”) for any and all of the

Co-Issuers

outstanding 8 1/8% Senior Notes due 2019 (the “2019 Notes”). A copy of the press release is furnished as

Exhibit 99.3 to this Report on Form

6-K

and is incorporated herein by reference.

Pursuant to the

terms of the Tender Offer, on November 21, 2017, the

Co-Issuers

accepted for payment, and paid for, all 2019 Notes validly tendered and not validly withdrawn prior to the consent payment deadline,

comprising $266,261,000 in aggregate principal amount (representing approximately 91.47%) of outstanding 2019 Notes. After the purchase by the

Co-Issuers

of all 2019 Notes validly tendered and not validly

withdrawn prior to the early tender deadline, the

Co-Issuers

satisfied and discharged the indenture governing the 2019 Notes and issued a notice of redemption as described in more detail below.

Any 2019 Notes validly tendered after the early tender deadline but before the expiration of the Tender Offer will be eligible to receive the

tender offer consideration of $973.75 per $1,000 principal amount of 2019 Notes, plus accrued and unpaid interest to, but not including, the final payment date for the tendered 2019 Notes, but not the early tender premium. The Tender Offer remains

open and is scheduled to expire at 12:00 midnight, New York City time, on December 5, 2017, unless extended by the

Co-Issuers

(the “Expiration Time”). Other than as required by applicable law,

tendered 2019 Notes may not be withdrawn. The

Co-Issuers

currently expect to have a final payment date promptly following the Expiration Time for any 2019 Notes tendered after the early tender deadline.

Redemption of Remaining 2019 Notes

On November 21, 2017, the

Co-Issuers

also announced that they will redeem for cash all 2019 Notes

that remain outstanding on December 5, 2017 after completion of the Tender Offer, at a redemption price of $1,000 per $1,000 principal amount of 2019 Notes, plus accrued and unpaid interest to, but not including, that redemption date. The

Co-Issuers

issued an official notice of redemption to holders of the 2019 Notes on November 21, 2017 and satisfied and discharged the indenture governing the 2019 Notes.

The information contained in this Report is incorporated by reference into the Registration Statement on Form

S-8,

File

No. 333-202141,

the Registration Statement on Form

S-8,

File

No. 333-147186,

and the related prospectuses, unless otherwise indicated above.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

NAVIOS MARITIME HOLDINGS INC.

|

|

|

|

|

By:

|

|

/s/ Angeliki Frangou

|

|

Name:

|

|

Angeliki Frangou

|

|

Title:

|

|

Chairman of the Board and Chief Executive Officer

|

|

Date:

|

|

November 21, 2017

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Exhibit

|

|

|

|

|

99.1

|

|

Press release, dated November 21, 2017.

|

|

|

|

|

99.2

|

|

Indenture, dated as of November 21, 2017.

|

|

|

|

|

99.3

|

|

Press release, dated November 21, 2017.

|

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Mar 2024 to Apr 2024

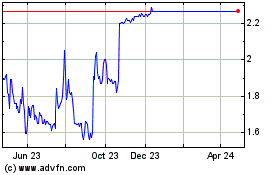

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Apr 2023 to Apr 2024