Filed Pursuant to Rule 424(b)(3)

Registration No. 333-218876

This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or

jurisdiction where the offer or sale is not permitted.

PROSPECTUS

4,806,710 shares

Common Stock

This prospectus

relates to the offer for sale of 4,806,710 shares of common stock, par value $1.00, of FB Financial Corporation, a bank holding company headquartered in Nashville, Tennessee, by the selling shareholders identified in this prospectus or in any

supplement to this prospectus or any transferee, assignee or

successor-in-interest

of any selling shareholder. For a more detailed description of the selling

shareholders, see “selling shareholders” below.

We are not selling any of the shares described in this prospectus, and,

accordingly, we will not receive any proceeds from the sale of any of the shares by the selling shareholders hereunder. The selling shareholders will receive all of the net proceeds from the sale of the shares.

The shares may be offered from time to time by one or more of the selling shareholders for their own account as described under “Plan of

Distribution” below. The selling shareholders may offer the shares for sale to or through underwriters, broker-dealers or agents, who may receive compensation in the form of commissions, discounts or concessions. The selling shareholders may

sell the shares at any time at fixed prices that may be changed, at market prices prevailing at the time of sale, at prices related to prevailing market prices, at varying prices determined at the time of sale or at prices otherwise negotiated. This

prospectus describes the general manner in which the shares may be offered and sold by the selling shareholders. If necessary, the specific manner in which the shares may be offered or sold will be described in a supplement to this prospectus.

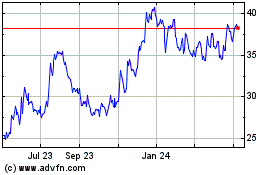

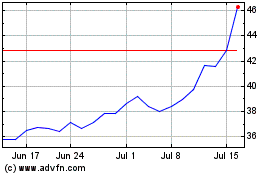

Our common stock is listed on the New York Stock Exchange under the symbol “FBK.” The last reported sale price of our common stock

on November 6, 2017 was $41.06 per share.

We are an “emerging growth company” as defined in the Jumpstart Our Business

Startups Act of 2012 and, as a result, are subject to reduced public company disclosure standards. See “Implications of being an emerging growth company.”

Investing in

our common stock involves risks. See “

Risk factors

” to read about factors you should consider before investing in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

These

securities do not represent deposits, savings accounts or other obligations of any bank or savings association and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

This prospectus is not an offer to sell any securities other than the shares of our common stock offered hereby. This prospectus is not an

offer to sell securities in any jurisdictions or in any circumstances in which such offer is unlawful.

The date of

this prospectus is November 9, 2017.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus incorporates by reference important business and financial information about us that is not included in or delivered with this

document. This information incorporated by reference is considered to be part of this prospectus, and information that we file later with the Securities and Exchange Commission (the “SEC”) will automatically update and supersede this

information. This information is available without charge upon written or oral request. See “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

You should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not

authorized anyone to provide you with different or additional information. We take no responsibility for, and can provide no assurance as to the reliability of, any different or additional information that others may give you. If anyone provides you

with different or inconsistent information, you should not rely on it.

The selling shareholders are not making an offer to sell these

shares in any jurisdiction where the offer or sale is not permitted. The information contained in or incorporated by reference in this prospectus is accurate only as of the date of this prospectus, regardless of the time of the delivery of this

prospectus or any sale of our common stock. Our business, financial condition, results of operations and growth prospects may have changed since that date. Information contained on, or accessible through, our website is not part of this prospectus.

In certain circumstances, we may provide a prospectus supplement that will contain specific information about the terms of a particular

offering by the selling shareholders. Any prospectus supplement and any free writing prospectus may also add to, update, supplement or clarify information contained or incorporated by reference in this prospectus. Any statement that we make in this

prospectus will be modified or superseded by any inconsistent statement made by us in a prospectus supplement.

In this prospectus,

“we,” “our,” “us,” “FB Financial” or “the Company” refers to FB Financial Corporation, a Tennessee corporation, and our consolidated banking subsidiary, FirstBank, a Tennessee state chartered bank,

unless the context indicates that we refer only to the parent company, FB Financial Corporation. In this prospectus, “Bank” or “FirstBank” refers to FirstBank, our consolidated banking subsidiary. In this prospectus, the

“Clayton Banks” refers to Clayton Bank and Trust, a Tennessee state bank, and American City Bank, a Tennessee state bank, “Clayton HC” refers to Clayton HC, Inc., a Tennessee Corporation and sole shareholder of the Clayton Banks,

and “Mr. Clayton” refers to James L. Clayton, the primary shareholder of Clayton HC. In this prospectus, references to the “selling shareholders” refer to the selling shareholders named in the table under the heading

“selling shareholders” in this prospectus.

1

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company”

under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally

applicable to other public companies. As an emerging growth company:

|

|

•

|

|

we are exempt from the requirement to provide an auditor attestation from our auditors on management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, as

amended, or the Sarbanes-Oxley Act;

|

|

|

•

|

|

we may choose not to comply with any new requirements adopted by the Public Company Accounting Oversight Board, or PCAOB, requiring mandatory audit firm rotation or a supplement to the auditor’s report providing

additional information about the audit and our audited financial statements;

|

|

|

•

|

|

we are permitted to provide less extensive disclosure regarding our executive compensation arrangements pursuant to the rules applicable to smaller reporting companies, which means we do not have to include a

compensation discussion and analysis and certain other disclosure regarding our executive compensation in this prospectus; and

|

|

|

•

|

|

we are not required to hold nonbinding advisory votes on executive compensation or golden parachute arrangements.

|

We may take advantage of these provisions for up to five years from the completion of our initial public offering in September 2016 unless we

earlier cease to be an emerging growth company. We will cease to be an emerging growth company if we have more than $1.0 billion in annual gross revenues, have more than $700.0 million in market value of our common stock held by

non-affiliates,

or issue more than $1.0 billion of

non-convertible

debt in a three-year period. We have elected to adopt the reduced disclosure requirements described

above regarding our executive compensation arrangements for purposes of the registration statement of which this prospectus is a part. In addition, we expect to take advantage of certain of the reduced reporting and other requirements of the JOBS

Act with respect to the periodic reports we will file with the SEC and proxy statements that we use to solicit proxies from our shareholders.

The JOBS Act also permits us an extended transition period for complying with new or revised financial accounting standards affecting public

companies until they would apply to private companies. However, we have elected not to take advantage of this extended transition period, which means that the financial statements included or incorporated by reference in this prospectus, as well as

any financial statements that we file in the future, will be subject to all new or revised accounting standards generally applicable to public companies. Our election not to take advantage of the extended transition period is irrevocable.

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the information included or incorporated by reference in this prospectus, contains statements which are

forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements include statements

relating to the outlook for the Company’s future business and financial performance and/or the performance of the banking industry and economy in general. These statements, which are based on certain assumptions and estimates and describe our

future plans, results, strategies and expectations, can generally be identified by the use of the words and phrases “may,” “will,” “should,” “could,” “would,” “goal,” “plan,”

“potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target,” “aim,” “predict,” “continue,” “seek,”

“projection” and other variations of such words and phrases and similar expressions.

We have made the forward-looking

statements included or incorporated by reference in this prospectus based on assumptions and estimates that we believe to be reasonable in light of the information available to us at the time of such statements. However, these forward-looking

statements are subject to significant risks and uncertainties, and could be affected by many factors. Factors that could have a material adverse effect on our business, financial condition, results of operations and future growth prospects can be

found in the “Risk factors” section of this prospectus, elsewhere in this prospectus and in the documents incorporated by reference in this prospectus. These factors include, but are not limited to, the following:

|

|

•

|

|

business and economic conditions nationally, regionally and in our target markets, particularly in Tennessee and the geographic areas in which we operate;

|

|

|

•

|

|

concentration of our loan portfolio in real estate loans and changes in the prices, values and sales volumes of commercial and residential real estate;

|

|

|

•

|

|

the concentration of our business within our geographic areas of operation in Tennessee and neighboring markets;

|

|

|

•

|

|

credit and lending risks associated with our commercial real estate, commercial and industrial, and construction portfolios;

|

|

|

•

|

|

increased competition in the banking and mortgage banking industry, nationally, regionally or locally;

|

|

|

•

|

|

our ability to execute our business strategy to achieve profitable growth;

|

|

|

•

|

|

the dependence of our operating model on our ability to attract and retain experienced and talented bankers in each of our markets;

|

|

|

•

|

|

risks that our cost of funding could increase, in the event we are unable to continue to attract stable,

low-cost

deposits and reduce our cost of deposits;

|

|

|

•

|

|

our ability to increase our operating efficiency;

|

|

|

•

|

|

failure to keep pace with technological change or difficulties when implementing new technologies;

|

|

|

•

|

|

risks related to the ability of our operational framework to manage risks associated with our business such as credit risk and operational risk, including third-party vendors and other service providers, which could,

among other things, result in a breach of operating or security systems as a result of a cyber-attack or similar act;

|

|

|

•

|

|

our ability to identify and address cyber-security risks such as data security breaches, malware, “denial of service” attacks, “hacking” and identity theft, a failure of which could disrupt our

business and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information; disruption or damage to our systems; increased costs; significant losses; or adverse effects to our reputation;

|

3

|

|

•

|

|

the risk that the anticipated benefits of our recent acquisition of the Clayton Banks, including any accretive impact to the Company’s earnings per share, may not be fully realized or may take longer to realize

than expected;

|

|

|

•

|

|

the risk that the Clayton Banks may not be successfully integrated in the Company’s business and that the costs associated with the integration are higher than expected;

|

|

|

•

|

|

negative impact in our mortgage banking services, including declines in our mortgage originations or profitability due to rising interest rates and increased competition and regulation, the Bank’s or third

party’s failure to satisfy mortgage servicing obligations, and the possibility of the Bank being required to repurchase mortgage loans or indemnify buyers;

|

|

|

•

|

|

our ability to attract and maintain business banking relationships with well-qualified businesses, real estate developers and investors with proven track records in our market areas;

|

|

|

•

|

|

our ability to attract sufficient loans that meet prudent credit standards, including in our commercial and industrial and owner-occupied commercial real estate loan categories;

|

|

|

•

|

|

failure to maintain adequate liquidity and regulatory capital and comply with evolving federal and state banking regulations;

|

|

|

•

|

|

inability of our risk management framework to effectively mitigate credit risk, interest rate risk, liquidity risk, price risk, compliance risk, operational risk, strategic risk and reputational risk;

|

|

|

•

|

|

develop new, and grow our existing, streams of noninterest income;

|

|

|

•

|

|

oversee the performance of third party service providers that provide material services to our business;

|

|

|

•

|

|

maintain expenses in line with their current projections;

|

|

|

•

|

|

our dependence on our management team and our ability to motivate and retain our management team;

|

|

|

•

|

|

risks related to any future acquisitions, including failure to realize anticipated benefits from future acquisitions, costs incurred in connection with future acquisitions, diversion of management’s attention from

our business results from such acquisitions, and difficulty integrating acquisitions;

|

|

|

•

|

|

inability to find acquisition candidates that will be accretive to our financial condition and results of operations;

|

|

|

•

|

|

system failures, data security breaches, including as a result of cyber-attacks, or failures to prevent breaches of our network security;

|

|

|

•

|

|

data processing system failures and errors;

|

|

|

•

|

|

fraudulent and negligent acts by our clients, employees or vendors;

|

|

|

•

|

|

fluctuations in the market value and its impact in the securities held in our securities portfolio;

|

|

|

•

|

|

the adequacy of our reserves (including allowance for loan losses) and the appropriateness of our methodology for calculating such reserves;

|

|

|

•

|

|

the makeup of our asset mix and investments;

|

|

|

•

|

|

our focus on small and

mid-sized

businesses;

|

|

|

•

|

|

an inability to raise necessary capital to fund our growth strategy, operations or to meet increased minimum regulatory capital levels;

|

|

|

•

|

|

the sufficiency of our capital, including sources of such capital and the extent to which capital may be used or required;

|

|

|

•

|

|

interest rate shifts and its impact on our financial condition and results of operation;

|

4

|

|

•

|

|

the institution and outcome of litigation and other legal proceeding against us or to which we become subject;

|

|

|

•

|

|

changes in our accounting standards;

|

|

|

•

|

|

the impact of recent and future legislative and regulatory changes;

|

|

|

•

|

|

governmental monetary and fiscal policies;

|

|

|

•

|

|

changes in the scope and cost of Federal Deposit Insurance Corporation, or FDIC, insurance and other coverage;

|

|

|

•

|

|

future equity issuances under our 2016 Incentive Plan and our Employee Stock Purchase Plan and future sales of our common stock by us, our controlling shareholder or our executive officers or directors; and

|

|

|

•

|

|

other factors and risks described under the “Risk Factors” section of this prospectus and in Part II, Item 1A of our most recently filed Annual Report on Form

10-K

under the caption “Risk Factors.”

|

Because of these risks and other uncertainties, our actual results, performance

or achievement, or industry results, may be materially different from the anticipated or estimated results discussed in the forward-looking statements in this prospectus. Our past results of operations are not necessarily indicative of our future

results. You should not rely on any forward-looking statements, which represent our beliefs, assumptions and estimates only as of the dates on which they were made, as predictions of future events. We undertake no obligation to update these

forward-looking statements, even though circumstances may change in the future, except as required under federal securities law. We qualify all of our forward-looking statements by these cautionary statements.

5

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and may not contain all of the information that is important to

you. You should read this entire prospectus carefully, including the information set forth in “Risk Factors,” and the documents identified in the sections “Where You Can Find More Information” and “Incorporation of Certain

Documents by Reference” in this prospectus before making an investment decision.

Our Company

We are a bank holding company, headquartered in Nashville, Tennessee. Our wholly-owned bank subsidiary, FirstBank, is the third largest

Tennessee-headquartered bank, based on total assets. FirstBank provides a comprehensive suite of commercial and consumer banking services to clients in select markets in Tennessee, North Alabama and North Georgia. Our footprint includes 63

full-service bank branches serving the Tennessee metropolitan markets of Nashville, Chattanooga, Knoxville, Memphis, Jackson, and Huntsville (AL) in addition to 24 community markets. FirstBank also provides mortgage banking services utilizing its

bank branch network and mortgage banking offices strategically located throughout the southeastern United States in addition to a national internet delivery channel.

On July 31, 2017, we completed our acquisition of the Clayton Banks from Clayton HC, Inc. The Clayton Banks operated a total of 18

branches in Tennessee and, as of the closing date, had combined total assets of $1.2 billion, combined total loans of $1.1 billion and combined total deposits of $979 million.

As of September 30, 2017, we had total assets of $4.6 billion, total loans held for investment of $3.1 billion, deposits of

$3.7 billion, and shareholder’s equity of $573 million.

The Private Placement and Clayton Banks Acquisition

Clayton Banks Acquisition

On February 8, 2017, we, along with our wholly-owned banking subsidiary FirstBank, entered into a Stock Purchase Agreement (as amended,

the “Clayton Purchase Agreement”) with Clayton HC, the Clayton Banks and Mr. Clayton, pursuant to which we agreed to purchase from Clayton HC all of the issued and outstanding shares of the Clayton Banks. On May 26, 2017, we

entered into an amendment (the “Amendment”) to the Clayton Purchase Agreement to (i) reduce the number of shares of the Company’s common stock to be received by Clayton HC as partial consideration for the Clayton Banks

Acquisition from 5,860,000 shares to 1,521,200 shares and (ii) provide for a cash payment by the Company to Clayton HC equal to $124,200,000 (the “Cash Consideration”). On July 31, 2017, we completed the acquisition of the

Clayton Banks (the “Acquisition”). Following the closing of the Acquisition, we merged the Clayton Banks with and into FirstBank, with FirstBank continuing as the surviving banking corporation.

Private Placement

On May 26, 2017, we entered into Securities Purchase Agreements (the “Securities Purchase Agreements”) with accredited investors

pursuant to which we agreed to sell an aggregate of 4,806,710 shares of our common stock in a private placement (the “Private Placement”) at a purchase price of $33.00 per share. The Private Placement was conducted to fund the Cash

Consideration payable to Clayton HC under the amended terms of the Clayton Purchase Agreement. The Private Placement closed on June 1, 2017.

Pursuant to the Securities Purchase Agreements, we filed with the SEC a registration statement, which this prospectus is a part, to register

the resale of the shares of our common stock issued in the Private Placement.

6

The foregoing descriptions of the Clayton Purchase Agreement and Amendment and the

Securities Purchase Agreements are only summaries and are qualified in their entirety by reference to the complete text of the Clayton Purchase Agreement and Amendment and the Form of Securities Purchase Agreement, which are included as exhibits to

the registration statement of which this prospectus is a part.

Corporate Information

Our principal executive office is located at 211 Commerce Street, Suite 300, Nashville, Tennessee 37201, and our telephone number is (615)

313-0080.

Through FirstBank, we maintain an Internet website at www.firstbankonline.com. The information contained on or accessible from our website does not constitute a part of this prospectus and is not

incorporated by reference herein.

7

THE OFFERING

The following summary contains basic information about the shares of common stock and is not intended to be complete and does not contain all

the information that is important to you. For a more complete understanding of the shares, you should read the section of this prospectus entitled “Description of Capital Stock—Common Stock” and “selling shareholders.”

|

Issuer

|

FB Financial Corporation

|

|

Maximum number of shares of common stock offered by selling shareholders

|

4,806,710 shares, as described in “Prospectus Summary—The Private Placement and Clayton Banks Acquisition.”

|

|

Shares Outstanding as of September 30, 2017

|

30,526,592 shares.

|

|

|

Unless otherwise noted, references in this prospectus to the number of shares of our common stock outstanding after this offering are based on 30,526,592 shares of our common stock issued and outstanding as of

September 30, 2017 and exclude the 300,383 shares of our common stock underlying our converted EBI Units to restricted stock units, the 907,731 shares of our common stock underlying our outstanding restricted stock units and deferred stock

units and the additional 1,894,349 shares of our common stock reserved for future issuance under our 2016 Incentive Plan and the 2,460,965 shares of our common stock reserved for future issuance under our Employee Stock Purchase Plan.

|

|

Use of Proceeds

|

All of the shares of common stock sold pursuant to this prospectus will be sold by the selling shareholders. We will not receive any of the proceeds from such sales.

|

|

Risk Factors

|

An investment in our shares of common stock is subject to risks. Please refer to the information contained under the caption “Risk Factors” and other information included or incorporated by reference in this prospectus for a discussion

of factors you should carefully consider before investing in our shares.

|

8

RISK FACTORS

An investment in our common stock involves a high degree of risk. When considering an investment in the shares being offered hereby, you

should carefully read and consider the risk factors included in our most recent annual report on Form

10-K

as supplemented by our quarterly reports on Form

10-Q

and

other reports we file with the SEC, each of which is incorporated herein by reference, and those specific risk factors that may be included in any prospectus supplement, together with all of the other information presented in this prospectus, any

prospectus supplement and the documents we incorporate by reference. If any of the events described in those risk factors actually occurs, our business, financial condition or operating results, as well as the market price of our common stock, could

be materially adversely affected.

USE OF PROCEEDS

All shares of common stock sold pursuant to this prospectus will be offered and sold by the selling shareholders. We will not receive any of

the proceeds from such sales.

DESCRIPTION OF CAPITAL STOCK

The following is a description of our capital stock and the material provisions of our amended and restated charter and amended and

restated bylaws and other agreements to which we and our shareholders are parties. The following is only a summary and is qualified by applicable law and by the provisions of the amended and restated certificate of incorporation and amended and

restated bylaws and other agreements, copies of which are available as set forth under the caption entitled “Where you can find more information.”

General

Our authorized capital stock

consists of 75,000,000 shares of common stock, par value $1.00 per share, and 7,500,000 shares of preferred stock, no par value.

Common stock

Common stock outstanding

. As of September 30, 2017 there were 30,526,592 shares of common stock outstanding. All outstanding shares

of common stock are fully paid and

non-assessable,

and the shares of common stock to be issued upon completion of this offering will be fully paid and

non-assessable.

Voting rights

. The holders of common stock are entitled to one vote per share on all matters to be voted upon by the shareholders,

and are not entitled to cumulative voting in the election of directors. At any meeting of the shareholders, the holders of a majority of the outstanding stock of the Company then having voting rights, present in person or by proxy, shall constitute

a quorum for all purposes. If a quorum exists, action on a matter (other than the election of directors) by a voting group is approved if the votes cast within the voting group favoring the action exceeds the votes cast opposing the action, unless

otherwise provided by the charter or bylaws.

Dividend rights

. Subject to the rights that may be applicable to any outstanding

preferred stock and all other classes of stock at the time outstanding having prior rights as to dividends, the holders of common stock are entitled to receive ratably such dividends, if any, as may be declared from time to time by the Board of

Directors out of funds legally available therefor.

In addition, as a bank holding company, any dividends paid by us are subject to

various federal and state regulatory limitations and also may be subject to the ability of the Bank to make distributions or pay dividends to

9

us. The Bank is also subject to various legal, regulatory and other restrictions on its ability to pay dividends and make other distributions and payments to us. Our ability to pay dividends is

limited by minimum capital and other requirements prescribed by law and regulation. Furthermore, we are generally prohibited under Tennessee corporate law from making a distribution to a shareholder to the extent that, at the time of the

distribution, after giving effect to the distribution, we would not be able to pay our debts as they become due in the usual course of business or our total assets would be less than the sum of its total liabilities plus (unless the charter permits

otherwise) the amount that would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of any shareholders who may have preferential rights superior to those receiving the

distribution. In addition, financing arrangements that we may enter into in the future may include restrictive covenants that may limit our ability to pay dividends.

Rights upon liquidation

. In the event of liquidation, dissolution or winding up of the Company, either voluntarily or involuntarily,

the holders of common stock are entitled to share ratably in all assets remaining after payment of liabilities, subject to prior distribution rights of preferred stock, if any, then outstanding.

Other rights

. The holders of our common stock have no preemptive or conversion rights or other subscription rights. There are no

redemption or sinking fund provisions applicable to the common stock. The rights, preferences and privileges of holders of our common stock are subject to, and may be adversely affected by, the rights of holders of our preferred stock.

Preferred stock

Our Board of Directors

has the authority to issue preferred stock from time to time in one or more series and to establish the number of shares to be included in each such series, and to fix the designation, powers, preferences, and relative rights of the shares of each

such series and the qualifications, or restrictions thereof. At present, the Company has no shares of preferred stock outstanding.

The

issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of the Company without further action by the shareholders and may adversely affect the voting and other rights of the holders of common stock.

The authority of the Board of Directors with respect to each such series includes, among others:

|

|

•

|

|

the number of shares constituting the series;

|

|

|

•

|

|

general or specific voting rights;

|

|

|

•

|

|

preferential liquidation rights;

|

|

|

•

|

|

preferential cumulative or noncumulative dividend rights;

|

|

|

•

|

|

redemption or put rights; and

|

We may issue shares of, or rights to purchase shares of, one or more

series of our preferred stock that have been designated from time to time, the terms of which might:

|

|

•

|

|

adversely affect the voting or other rights evidenced by, or amounts otherwise payable with respect to, the common stock or other series of preferred stock;

|

|

|

•

|

|

discourage an unsolicited proposal to acquire us; or

|

|

|

•

|

|

facilitate a particular business combination involving us.

|

Election and removal of directors

Our board of directors will consist of between one and fifteen directors. Directors are elected by a plurality of the votes cast by the shares

entitled to vote in the election at a meeting at which a quorum is present. The exact

10

number of directors will be fixed from time to time by resolution of our board of directors. Our bylaws provide that shareholders may remove any director, with cause only, by the affirmative vote

of the holders of a majority of the issued and outstanding stock of the Company then having voting rights at a shareholder meeting called for that purpose.

Pursuant to the shareholder’s agreement that we entered into with Mr. Ayers in connection with our initial public offering,

Mr. Ayers has certain rights to designate directors to our board of directors. See the “Shareholder’s Agreement and Board Designation Rights” section of our proxy statement on Schedule 14A filed with the SEC on April 21,

2017, which section is incorporated by reference in this prospectus.

Advance notice for shareholder proposals or making nominations at meetings

Our bylaws establish an advance notice procedure for shareholder proposals to be brought before a meeting of our shareholders and for

nominations by shareholders of candidates for election as directors at an annual meeting or a special meeting at which directors are to be elected. Subject to any other applicable requirements, only such business may be conducted at a meeting of

shareholders as has been brought before the meeting by, or at the direction of, our board of directors or an authorized committee thereof, the Chairman of our board of directors, our Chief Executive Officer, or by a shareholder who has given to our

Secretary timely written notice in proper form, of the shareholder’s intention to bring that business before the meeting. The presiding officer at such meeting has the authority to make such determinations. Only persons who are selected and

recommended by our board of directors, or the committee of our board of directors designated to make nominations, or who are nominated by a shareholder who has given timely written notice, in proper form, to the Secretary prior to a meeting at which

directors are to be elected will be eligible for election as directors.

To be timely, notice of nominations or other business to be

brought before any meeting must be delivered to our principal executive offices and within the following time periods:

|

|

(i)

|

in the case of an annual meeting of shareholders, not earlier than the close of business on the 120th day and not later than the close of business on the 90th day prior to the first anniversary of the preceding

year’s annual meeting; provided, however, that in the event the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, notice by the shareholder to be timely must be so delivered not earlier

than the close of business on the 120th day prior to the date of such annual meeting and not later than the close of business on the later of the 90th day prior to the date of such annual meeting or, if the first public announcement of the date of

such annual meeting is less than 100 days prior to the date of such annual meeting, the 10th day following the day on which public announcement of the date of such meeting is first made by us; and

|

|

|

(ii)

|

in the case of a special meeting of shareholders called for the purpose of electing directors, not earlier that the close of business on the 120th day prior to such special meeting and not later than the close of

business on the later of the 90

th

day prior to such special meeting or the 10th day following the date on which notice of the date of the special meeting was mailed or public disclosure of

the date of the special meeting was made, whichever first occurs.

|

In no event shall any adjournment or postponement of an

annual meeting, or the announcement thereof, commence a new time period for the giving of a shareholder’s notice as described above.

The notice of any shareholder proposal or nomination for election as director must set forth various information required under the bylaws.

The person submitting the notice of nomination and any person acting in concert with such person must provide, among other things, the name and address under which they appear on our books (if they so appear) and the class and number of shares of

our capital stock that are beneficially owned by them.

11

Amendment of charter and bylaws

Under the Tennessee Business Corporation Act (“TBCA”), our charter generally may not be amended without shareholder approval. Except

as provided in the charter and subject to the voting rights, any amendment to our charter submitted for shareholder approval at a shareholders’ meeting is generally approved if the number of votes cast in favor of the amendment exceeds the

number of votes cast against the amendment. Our charter provides that certain provisions of our charter may only be amended upon the affirmative vote of the holders of at least eighty percent (80%) of our issued and outstanding voting stock.

Our shareholders may amend our bylaws only upon the affirmative vote of the holders of at least eighty percent (80%) of our issued

and outstanding voting stock. Additionally, our Board of Directors may amend our bylaws upon the affirmative vote of a majority of the directors then in office, unless a bylaw provision approved by our shareholders expressly provides that any such

bylaw may not be amended or repealed by our Board of Directors or unless the TBCA or our charter provides otherwise.

Ownership limitation

The Company is a bank holding company. A holder of common stock (or group of holders acting in concert) that (i) directly or indirectly

owns, controls or has the power to vote more than 5% of the total voting power of the Company, (ii) directly or indirectly owns, controls or has the power to vote 10% or more of any class of voting securities of the Company, if certain

presumptions are not rebutted, (iii) directly or indirectly owns, controls or has the power to vote 25% or more of any class of voting securities, (iv) owns a combination of voting and

non-voting

securities representing

one-third

or more of the total equity of the Company, or (vi) is otherwise deemed to “control” the Company under applicable regulatory standards may be subject to

important restrictions, such as prior regulatory notice or approval requirements and applicable provisions of the FDIC Policy Statement.

Special

meetings

Under our bylaws, only the Chairman of our board of directors, our Chief Executive Officer, or a majority of directors then

in office may call special meetings of the shareholders. Our shareholders are not permitted to call special meetings of the shareholders.

Limitation

of liability of directors and officers

The TBCA provides that a corporation may indemnify any of its directors and officers against

liability incurred in connection with a proceeding if: (a) such person acted in good faith; (b) in the case of conduct in an official capacity with the corporation, he reasonably believed such conduct was in the corporation’s best

interests; (c) in all other cases, he reasonably believed that his conduct was at least not opposed to the best interests of the corporation; and (d) in connection with any criminal proceeding, such person had no reasonable cause to

believe his conduct was unlawful. In actions brought by or in the right of the corporation, however, the TBCA provides that no indemnification may be made if the director or officer was adjudged to be liable to the corporation. The TBCA also

provides that in connection with any proceeding charging improper personal benefit to an officer or director, no indemnification may be made if such officer or director is adjudged liable on the basis that such personal benefit was improperly

received. In cases where the director or officer is wholly successful, on the merits or otherwise, in the defense of any proceeding instigated because of his or her status as a director or officer of a corporation, the TBCA mandates that the

corporation indemnify the director or officer against reasonable expenses incurred in the proceeding. The TBCA provides that a court of competent jurisdiction, unless the corporation’s charter provides otherwise, upon application, may order

that an officer or director be indemnified for reasonable expenses if, in consideration of all relevant circumstances, the court determines that such individual is fairly and reasonably entitled to indemnification, notwithstanding the fact that

(a) such officer or director was adjudged liable to the corporation in a proceeding by or in the right of the

12

corporation; (b) such officer or director was adjudged liable on the basis that personal benefit was improperly received by him; or (c) such officer or director breached his duty of

care to the corporation. Our charter provides that the Company shall, to the fullest extent permitted by the TBCA, indemnify its directors and officers, and may indemnify all other person whom it has the power to indemnify under the TBCA. The right

of any director or officer of the Company to indemnification conferred in our charter shall also include the right to be paid by the Company the expenses incurred in connection with any such proceeding in advance of its final disposition to the

fullest extent authorized by Tennessee law.

Anti-takeover effects of some provisions

Some provisions of our charter and bylaws could make more difficult the removal of our incumbent officers and directors. These provisions, as

well as our ability to issue preferred stock, are designed to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our

Board of Directors. We believe that the benefits of increased protection give us the potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us, and that the benefits of this increased

protection outweigh the disadvantages of discouraging those proposals, because negotiation of those proposals could result in an improvement of their terms.

Our charter provides that our Board of Directors may issue “blank check” preferred stock without shareholder approval. Some of the

rights and preferences of these shares of preferred stock would be superior to the rights and preferences of shares of our common stock. Accordingly, the issuance of new shares of preferred stock may adversely affect the rights of the holders of

shares of our common stock.

Anti-takeover provisions in the TBCA

In addition to certain of the provisions in our charter discussed above, the State of Tennessee has adopted statutes that can have an

anti-takeover effect and may delay or prevent a tender offer or takeover attempt that a shareholder might consider in its best interest, including those attempts that might result in a premium over the market price for shares of our common stock.

The Tennessee Control Share Acquisition Act generally provides that, except as stated below, “control shares” will not have any

voting rights. Control shares are shares acquired by a person under certain circumstances which, when added to their shares owned, would give such person effective control over

one-fifth

or more, or a majority

of all voting power (to the extent such acquired shares cause such a person to exceed

one-fifth

or

one-third

of all voting power) in the election of a Tennessee

corporation’s directors. However, voting rights will be restored to control shares by resolutions approved by the affirmative vote of the holders of a majority of the corporation’s voting stock, other than shares held by the owner of the

control shares. If voting rights are granted to control shares which give the holder a majority of all voting power in the election of the corporation’s directors, then the corporation’s other shareholders may require the corporation to

redeem their shares at fair value.

The Tennessee Control Share Acquisition Act is not applicable to us because our charter does not

contain a specific provision “opting in” to the act, as is required.

The Tennessee Investor Protection Act provides that unless

a Tennessee corporation’s board of directors has recommended a takeover offer to shareholders, no offeror beneficially owning 5% or more of any class of equity securities of the offeree company, any of which was purchased within the preceding

year, may make a takeover offer for any class of equity security of the offeree company if after completion the offeror would be a beneficial owner of more than 10% of any class of outstanding equity securities of the company unless the offeror,

before making such purchase: (1) makes a public announcement of his or her intention with respect to changing or influencing the management or control of the offeree company; (2) makes a full, fair and effective disclosure of

13

such intention to the person from whom he or she intends to acquire such securities; and (3) files with the Tennessee Commissioner of Commerce and Insurance, or Commissioner, and the offeree

company a statement signifying such intentions and containing such additional information as may be prescribed by the Commissioner.

The

offeror must provide that any equity securities of an offeree company deposited or tendered pursuant to a takeover offer may be withdrawn by an offeree at any time within seven days from the date the offer has become effective following filing with

the Commissioner and the offeree company and public announcement of the terms or after 60 days from the date the offer has become effective. If the takeover offer is for less than all the outstanding equity securities of any class, such an offer

must also provide for acceptance of securities pro rata if the number of securities tendered is greater than the number the offeror has offered to accept and pay for. If such an offeror varies the terms of the takeover offer before its expiration

date by increasing the consideration offered to offerees, the offeror must pay the increased consideration for all equity securities accepted, whether accepted before or after the variation in the terms of the offer.

The Tennessee Investor Protection Act does not apply to us, as it does not apply to bank holding companies subject to regulation by a federal

agency and does not apply to any offer involving a vote by holders of equity securities of the offeree company.

The Tennessee Business

Combination Act, generally prohibits a “business combination” by a company or any of our subsidiaries with an “interested shareholder” within five years after the shareholder becomes an interested shareholder. The company or any

of its subsidiaries can, however, enter into a business combination within that period if, before the interested shareholder became such, the company’s board of directors approved the business combination or the transaction in which the

interested shareholder became an interested shareholder. After that five-year moratorium, the business combination with the interested shareholder can be consummated only if it satisfies certain fair price criteria or is approved by

two-thirds

(2/3) of the other shareholders.

For purposes of these provisions of the Tennessee

Business Combination Act, a “business combination” includes mergers, share exchanges, sales and leases of assets, issuances of securities, and similar transactions. An “interested shareholder” is generally any person or entity

that beneficially owns 10% or more of the voting power of any outstanding class or series of our stock.

The Tennessee Greenmail Act

applies to a Tennessee corporation that has a class of voting stock registered or traded on a national securities exchange or registered with the SEC pursuant to Section 12(g) of the Exchange Act. Under the Tennessee Greenmail Act, a company

may not purchase any of its shares at a price above the market value of such shares from any person who holds more than 3% of the class of securities to be purchased if such person has held such shares for less than two years, unless the purchase

has been approved by the affirmative vote of a majority of the outstanding shares of each class of voting stock issued by the company or the company makes an offer, or at least equal value per share, to all shareholders of such class.

Listing and trading market for common stock

Our common stock is listed on the NYSE under the symbol FBK.

Transfer agent and registrar

The

transfer agent and registrar for the common stock is Computershare Trust Company, N.A.

14

SELLING SHAREHOLDERS

When we refer to the “selling shareholders” in this prospectus, we mean the persons listed in the table below. The selling

shareholders may from time to time offer and sell any or all of the shares set forth below pursuant to this prospectus. We do not know when or in what amounts the selling shareholders may offer the shares for sale. It is possible that the selling

shareholders will not sell any or all of the shares offered under this prospectus.

The selling shareholders acquired the shares covered

by this prospectus in the Private Placement as described in “Prospectus Summary – The Private Placement and Clayton Banks Acquisition.” The selling shareholders may, at any time and from time to time, offer and sell pursuant to this

prospectus any or all of the shares in any type of transaction as more fully described in “Plan of Distribution.” Except for Mr. Inman, none of the selling shareholders has, or within the past three years has had, any position, office

or other material relationship with us. Mr. Inman was appointed as an emeritus director of FB Financial in 2017, and prior to that he served in a

non-executive

officer capacity as Chairman of Middle

Tennessee since 2012 and as a director of FirstBank.

Securities Covered by this Prospectus Held by selling shareholders

The table below sets forth the names of the selling shareholders and their ownership of shares to be offered pursuant to this prospectus. We do

not know when or in what amounts the selling shareholders may offer the shares for sale, if at all. It is possible that the selling shareholders will not sell any or all of the shares offered under this prospectus. Because the selling shareholders

may offer all, some or none of the shares pursuant to this prospectus, we cannot estimate the number of shares that will be held by the selling shareholders after completion of the offering. For purposes of the table below, we have assumed that

selling shareholders would sell all of the shares held by them and therefore would hold no shares following the offering and hold zero percentage of the shares following the offering.

15

The following table sets forth information regarding the selling shareholders and the number of

shares of common stock each such selling shareholder from the Private Placement was offering as of July 7, 2017, the original effectiveness of this registration statement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock

Beneficially Owned

Before Offering

|

|

|

Shares of

Common

Stock

Offered in

the Offering

|

|

|

Shares of Common Stock

to be Beneficially

Owned After Offering

|

|

|

Name of selling shareholder

|

|

Number

|

|

|

Percent(1)

|

|

|

Number

|

|

|

Number

|

|

|

Percent(1)(2)

|

|

|

T. Rowe Price

Small-Cap

Stock Fund, Inc.(3)

|

|

|

970,948

|

|

|

|

3.18

|

%

|

|

|

345,320

|

|

|

|

625,628

|

|

|

|

2.05

|

%

|

|

T. Rowe Price Institutional

Small-Cap

Stock

Fund(3)

|

|

|

384,600

|

|

|

|

1.26

|

%

|

|

|

135,200

|

|

|

|

249,400

|

|

|

|

|

*

|

|

T. Rowe Price Personal Strategy Income Fund(3)

|

|

|

5,800

|

|

|

|

|

*

|

|

|

2,000

|

|

|

|

3,800

|

|

|

|

|

*

|

|

T. Rowe Price Personal Strategy Balanced Fund(3)

|

|

|

10,500

|

|

|

|

|

*

|

|

|

3,500

|

|

|

|

7,000

|

|

|

|

|

|

|

T. Rowe Price Personal Strategy Growth Fund(3)

|

|

|

12,600

|

|

|

|

|

*

|

|

|

4,100

|

|

|

|

8,500

|

|

|

|

|

*

|

|

T. Rowe Price Personal Strategy Balanced Portfolio(3)

|

|

|

830

|

|

|

|

|

*

|

|

|

280

|

|

|

|

550

|

|

|

|

|

*

|

|

T. Rowe Price U.S.

Small-Cap

Core Equity Trust(3)

|

|

|

104,600

|

|

|

|

|

*

|

|

|

37,100

|

|

|

|

67,500

|

|

|

|

|

*

|

|

T. Rowe Price

Small-Cap

Value Fund, Inc.(3)

|

|

|

968,739

|

|

|

|

3.17

|

%

|

|

|

357,420

|

|

|

|

611,319

|

|

|

|

2.00

|

%

|

|

T. Rowe Price U.S.

Small-Cap

Value Equity

Trust(3)

|

|

|

121,369

|

|

|

|

|

*

|

|

|

43,900

|

|

|

|

77,469

|

|

|

|

|

*

|

|

T. Rowe Price U.S. Equities Trust(3)

|

|

|

10,353

|

|

|

|

|

*

|

|

|

3,380

|

|

|

|

6,973

|

|

|

|

|

*

|

|

T. Rowe Price Financial Services Fund, Inc.(3)

|

|

|

69,385

|

|

|

|

|

*

|

|

|

25,600

|

|

|

|

43,785

|

|

|

|

|

*

|

|

U.S.

Small-Cap

Stock Trust(3)

|

|

|

35,800

|

|

|

|

|

*

|

|

|

12,500

|

|

|

|

23,300

|

|

|

|

|

*

|

|

VALIC Company I – Small Cap Fund(3)

|

|

|

10,300

|

|

|

|

|

*

|

|

|

3,600

|

|

|

|

6,700

|

|

|

|

|

*

|

|

TD Mutual Funds – TD U.S.

Small-Cap

Equity

Fund(3)

|

|

|

28,200

|

|

|

|

|

*

|

|

|

10,000

|

|

|

|

18,200

|

|

|

|

|

*

|

|

Minnesota Life Insurance Company(3)

|

|

|

9,800

|

|

|

|

|

*

|

|

|

3,500

|

|

|

|

6,300

|

|

|

|

|

*

|

|

Costco 401(k) Retirement Plan(3)

|

|

|

35,900

|

|

|

|

|

*

|

|

|

12,600

|

|

|

|

23,300

|

|

|

|

|

*

|

|

Mendon Capital Master Fund Ltd.(4)

|

|

|

294,220

|

|

|

|

|

*

|

|

|

294,220

|

|

|

|

0

|

|

|

|

0

|

|

|

Mendon Capital QP LP(4)

|

|

|

250,088

|

|

|

|

|

*

|

|

|

250,088

|

|

|

|

0

|

|

|

|

0

|

|

|

Iron Road Multi-Strategy Fund LP(4)

|

|

|

41,910

|

|

|

|

|

*

|

|

|

41,910

|

|

|

|

0

|

|

|

|

0

|

|

|

Monashee Capital Master Fund LP

|

|

|

125,000

|

|

|

|

|

*

|

|

|

125,000

|

|

|

|

0

|

|

|

|

0

|

|

|

CVI Investments, Inc.(5)

|

|

|

40,000

|

|

|

|

|

*

|

|

|

40,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Forest Hill Strategic Value Fund, L.P.

|

|

|

195,500

|

|

|

|

|

*

|

|

|

195,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Forest Hill Select Fund, L.P.

|

|

|

80,000

|

|

|

|

|

*

|

|

|

80,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Zweig-DiMenna Partners, L.P.(6)

|

|

|

19,000

|

|

|

|

|

*

|

|

|

19,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Zweig-DiMenna International Ltd.(6)

|

|

|

81,000

|

|

|

|

|

*

|

|

|

81,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Stieven Financial Investors, L.P.(7)

|

|

|

145,200

|

|

|

|

|

*

|

|

|

145,200

|

|

|

|

0

|

|

|

|

0

|

|

|

Stieven Financial Offshore Investors, Ltd.(7)

|

|

|

29,800

|

|

|

|

|

*

|

|

|

29,800

|

|

|

|

0

|

|

|

|

0

|

|

|

Hudson Bay Master Fund Ltd.(8)

|

|

|

150,000

|

|

|

|

|

*

|

|

|

150,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Malta Hedge Fund, L.P.(9)

|

|

|

13,100

|

|

|

|

|

*

|

|

|

13,100

|

|

|

|

0

|

|

|

|

0

|

|

|

Malta Hedge Fund II, L.P.(9)

|

|

|

158,800

|

|

|

|

|

*

|

|

|

158,800

|

|

|

|

0

|

|

|

|

0

|

|

|

Malta Offshore, Ltd.(9)

|

|

|

94,700

|

|

|

|

|

*

|

|

|

94,700

|

|

|

|

0

|

|

|

|

0

|

|

|

Malta Market Neutral Master Fund, Ltd.(9)

|

|

|

33,800

|

|

|

|

|

*

|

|

|

33,800

|

|

|

|

0

|

|

|

|

0

|

|

|

Malta MLC Fund, L.P.(9)

|

|

|

54,200

|

|

|

|

|

*

|

|

|

54,200

|

|

|

|

0

|

|

|

|

0

|

|

|

Malta MLC Offshore, Ltd.(9)

|

|

|

5,400

|

|

|

|

|

*

|

|

|

5,400

|

|

|

|

0

|

|

|

|

0

|

|

|

Malta Titan Fund, L.P.(9)

|

|

|

90,000

|

|

|

|

|

*

|

|

|

90,000

|

|

|

|

0

|

|

|

|

0

|

|

|

JAM Partners, L.P.(10)

|

|

|

415,000

|

|

|

|

1.36

|

%

|

|

|

300,000

|

|

|

|

115,000

|

|

|

|

|

*

|

|

Financial Opportunity Fund LLC

|

|

|

300,000

|

|

|

|

|

*

|

|

|

300,000

|

|

|

|

0

|

|

|

|

0

|

|

16

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock

Beneficially Owned

Before Offering

|

|

|

Shares of

Common

Stock

Offered in

the Offering

|

|

|

Shares of Common Stock

to be Beneficially

Owned After Offering

|

|

|

Name of selling shareholder

|

|

Number

|

|

|

Percent(1)

|

|

|

Number

|

|

|

Number

|

|

|

Percent(1)(2)

|

|

|

Schonfeld Strategic 460 Fund LLC

|

|

|

150,000

|

|

|

|

|

*

|

|

|

150,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Banc Fund VIII L.P.

|

|

|

90,000

|

|

|

|

|

*

|

|

|

10,000

|

|

|

|

80,000

|

|

|

|

|

*

|

|

Banc Fund IX L.P.

|

|

|

90,000

|

|

|

|

|

*

|

|

|

10,000

|

|

|

|

80,000

|

|

|

|

|

*

|

|

EJF Financial Services Fund LP

|

|

|

450,000

|

|

|

|

1.47

|

%

|

|

|

450,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Financial Stocks Limited Partnership(11)

|

|

|

185,000

|

|

|

|

|

*

|

|

|

125,000

|

|

|

|

60,000

|

|

|

|

|

*

|

|

Hutchin Hill Capital Primary Fund, Ltd.

|

|

|

175,000

|

|

|

|

|

*

|

|

|

175,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Consector Partners LP(12)

|

|

|

55,000

|

|

|

|

|

*

|

|

|

55,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Gordon E. Inman (13)

|

|

|

200,916

|

|

|

|

|

|

|

|

150,000

|

|

|

|

50,916

|

|

|

|

|

*

|

|

Joseph Russell

|

|

|

90,000

|

|

|

|

|

*

|

|

|

60,000

|

|

|

|

30,000

|

|

|

|

|

*

|

|

James A. McPherson

|

|

|

30,303

|

|

|

|

|

*

|

|

|

30,303

|

|

|

|

0

|

|

|

|

0

|

|

|

Daniel G. Crockett

|

|

|

30,303

|

|

|

|

|

*

|

|

|

30,303

|

|

|

|

0

|

|

|

|

0

|

|

|

Gary Sasser

|

|

|

30,303

|

|

|

|

|

*

|

|

|

30,303

|

|

|

|

0

|

|

|

|

0

|

|

|

(1)

|

Percentages for the Selling Shareholders are calculated based on an aggregate of 30,526,592 shares of our common stock issued and outstanding as of September 30, 2017. Such issued and outstanding shares include the

shares offered hereby.

|

|

(2)

|

Assumes all shares offered are sold.

|

|

(3)

|

T. Rowe Price

Small-Cap

Stock Fund, Inc., T. Rowe Price Institutional

Small-Cap

Stock Fund, T. Rowe Price Personal Strategy Income Fund, T.

Rowe Price Personal Strategy Balanced Fund, T. Rowe Price Personal Strategy Growth Fund, T. Rowe Price Personal Strategy Balanced Portfolio, T. Rowe Price U.S.

Small-Cap

Core Equity Trust, T. Rowe Price

Small-Cap

Value Fund, Inc., T. Rowe Price U.S.

Small-Cap

Value Equity Trust, T. Rowe Price U.S. Equities Trust, T. Rowe Price Financial Services Fund, Inc., U.S.

Small-Cap

Stock Trust, VALIC Company I – Small Cap Fund, TD Mutual Funds – TD U.S.

Small-Cap

Equity Fund, Minnesota Life Insurance Company and Costco 401(k)

Retirement Plan are managed by T. Rowe Price Associates, Inc., a registered investment adviser (“Fund Manager” or “TRPA”). Fund Manager is affiliated with a registered broker-dealer, T. Rowe Price Investment Services, Inc.

(“TRPIS”). TRPIS is a subsidiary of the Fund Manager and was formed primarily for the limited purpose of acting as the principal underwriter and distributor of shares of funds in the T. Rowe Price fund family. T. Rowe Price Associates,

Inc. serves as investment adviser with power to direct investments and/or sole power to vote the securities owned by the funds listed in this table. For purposes of reporting requirements of the Securities Exchange Act of 1934, TRPA may be deemed to

be the beneficial owner of all of the shares listed in this table; however, TRPA expressly disclaims that it is, in fact, the beneficial owner of such securities. TRPA is the wholly owned subsidiary of T. Rowe Price Group, Inc., which is a publicly

traded financial services holding company. Common Stock registered in this offering are presently held in the funds’ nominee names.

|

|

(4)

|

RMB Capital Management LLC (“RMB Capital”) is the investment manager of Mendon Capital QP LP and Iron Road Multi-Strategy Fund LP and is the

sub-advisor

of Mendon

Capital Master Fund Ltd. RMB Capital Holdings LLC (“RMB Holdings”) is the ultimate parent company of RMB Capital. The managers of RMB Holdings are Richard M. Burridge, Jr., Frederick Paulman and Walter Clark along with Christopher Graff, a

member of RMB Holdings and the Managing Director of Asset Management for RMB Capital, are the natural persons with voting and dispositive power over the shares

|

|

(5)

|

Heights Capital Management, Inc., the authorized agent of CVI Investments, Inc., has discretionary authority to vote and dispose of the shares held by CVI Investments, Inc. and may be deemed to be the beneficial holder

of these shares. Martin Kobinger, in his capacity as Investment Manager of Heights Capital Management, Inc., may also be deemed to have investment discretion and voting power over the shares held by CVI Investments, Inc. Mr. Kobinger disclaims

any such beneficial ownership of the shares.

|

|

(6)

|

Joseph A. DiMenna may be deemed to have investment power and voting control over the shares held by both of these selling shareholders.

|

17

|

(7)

|

Stieven Capital GP, LLC is the general partner of Stieven Financial Investors, L.P., and in such capacity has voting and investment control over the shares held by this selling shareholder. Stieven Capital Advisors,

L.P. is the investment manager of Stieven Financial Investors, L.P. and Stieven Financial Offshore Investors, Ltd., and in such capacity has voting and investment control over the shares held by both of these selling shareholders. Joseph A. Stieven,

Stephen L. Covington, Daniel M. Ellefson and Mark J. Ross are members of the general partner and managing directors of the investment manager, and as a result, they may each be deemed to have voting and investment control over shares held by both of

these selling shareholders

|

|

(8)

|

Hudson Bay Capital Management LP, the investment manager of Hudson Bay Master Fund Ltd., has voting and investment power over these shares. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the

general partner of Hudson Bay Capital Management LP. Each of Hudson Bay Master Fund Ltd. and Sander Gerber disclaims beneficial ownership over these shares.

|

|

(9)

|

Maltese Capital Management LLC is the investment manager of each of Malta Hedge Fund, L.P., Malta Hedge Fund II, L.P., Malta Offshore, Ltd., Malta Market Neutral Master Fund, Ltd., Malta MLC Fund, L.P., Malta MLC

Offshore, Ltd. and Malta Titan Fund, L.P. Terry Maltese is the managing member of Maltese Capital Management LLC. In such capacities, each of Maltese Capital Management LLC and Mr. Maltese may be deemed to have voting and dispositive power over

the shares held by Malta Hedge Fund, L.P., Malta Hedge Fund II, L.P., Malta Offshore, Ltd., Malta Market Neutral Master Fund, Ltd., Malta MLC Fund, L.P., Malta MLC Offshore, Ltd. and Malta Titan Fund, L.P. Each of Maltese Capital Management LLC and

Mr. Maltese disclaims beneficial ownership of these shares except to the extent of its pecuniary interest therein

|

|

(10)

|

Jacobs Asset Management, LLC (“JAM”) is the investment manager of JAM Partners, L.P., and in such capacity has voting and investment control over these shares. Sy Jacobs is the managing member of both JAM and

JAM Managers, LLC, which is the general partner of JAM Partners, L.P., and as a result, each may also be deemed to have voting and investment control over shares held by this selling shareholder. Each of JAM, JAM Managers, LLC and Sy Jacobs disclaim

beneficial ownership over the shares held by JAM Partners, L.P., except to the extent of their pecuniary interest therein.

|

|

(11)

|

FSI Group, LLC is controlled by John M. Stein and Steven N. Stein and is the general partner of Financial Stocks Limited Partnership, which is the record owner of the common stock and over which FSI Group, LLC has

trading discretion. Therefore, FSI Group, LLC, John M. Stein and Steven N. Stein share with Financial Stocks Limited Partnership the power to vote and dispose of such shares, and, accordingly, may be deemed the beneficial owners of such shares. FSI

Group, LLC, Steven N. Stein and John M. Stein disclaim beneficial ownership of the shares owned by Financial Stocks Limited Partnership, except to the extent of their pecuniary interest therein.

|

|

(12)

|

Consector Advisors, LLC is the general partner of Consector Partners, LP. William J. Black is the natural person with voting and dispositive power over the shares held by Consector Partners, LP.

|

|

(13)

|

Gordon Inman was appointed as an emeritus director of FB Financial in 2017, prior to that he served in a

non-executive

officer capacity as Chairman of Middle Tennessee since 2012

and as a director of FirstBank.

|

|

*

|

Ownership less than 1%.

|

The information included in the table above as to the selling

shareholders has been furnished to us by or on behalf of the selling shareholders for inclusion in this prospectus. The selling shareholders identified above may have sold, transferred, or otherwise disposed of some or all of their shares since the

date as of which the information in the table above is presented in transactions exempt from or not subject to the registration requirements of the Securities Act and of which we are not aware. The term “selling shareholder” includes

donees, pledgees, transferees, or other

successors-in-interest

selling securities received from the named selling shareholders as a gift, pledge, shareholder

distribution, or other

non-sale

related transfer after the date of this prospectus. Beneficial ownership of the shares has been and will be determined in accordance with the rules of the SEC. Under the rules

of the SEC, beneficial ownership includes shares over which the indicated beneficial owner exercises voting or investment power. Unless otherwise indicated, based on information furnished by such selling shareholders, management of our Company