Nanophase Reports Third Quarter 2017 Financial Results

October 25 2017 - 4:00PM

Nanophase Technologies Corporation (OTCQB:NANX), a technology

leader in nanomaterials and advanced nanoengineered products, today

reported financial results for the third quarter ended September

30, 2017.

“We continue to drive revenue growth, as our

results clearly demonstrate,” commented Nanophase CEO and President

Jess Jankowski. “And this is before significant revenue from

our fully formulated skin care portfolio flows to the top line,

which we see approaching. This investment has negatively

impacted our bottom line, but we believe it will be well worth it,

as we expect the first commercial shipments outside of the

evaluation process to begin during the fourth quarter.”

Nine Months Ended September 30, 2017

Financial Highlights

- Revenue for the first nine months of 2017 was $9.9 million, vs.

the $8.4 million reported during the same period of

2016.

- The net loss for the first nine months of both 2017 and 2016

was $0.6 million, or $0.02 per share.

- The Company finished the quarter with approximately $1.1

million in cash and cash equivalents, and $250,000 borrowed on its

working capital credit facility that was repaid on October 3,

2017.

Third Quarter 2017 Financial

Highlights

- Revenue for the third quarter was $2.8 million in 2017 and $2.5

million in 2016.

- The net loss for the quarter was $0.6 million in 2017, or $0.02

per share, compared to a net loss for the quarter of $0.4 million,

or $0.01 per share, for 2016.

Jankowski continued, “This is a very exciting

time to be at Nanophase.”

Shareholders and members of the financial

community are encouraged to participate in the upcoming conference

call, where Mr. Jankowski will discuss the company’s current and

long-term prospects.

Third Quarter 2017 Conference

Call The Nanophase conference call, to be hosted by

Jess Jankowski, the Company’s President & CEO, is scheduled for

October 26, 2017, at 10:00 a.m. CDT, 11:00 a.m. EDT. The conference

call dial-in number for U.S. callers is 877-312-8776 and for

international callers is 408-774-4007. The conference ID is

90542986. Please dial in to the conference at least five

minutes before the call is scheduled to begin.

The call may also be accessed through the

company’s website, at www.nanophase.com, by clicking on Investor

Relations, Investor News and the link in the conference call

announcement release.

Use of Non-GAAP Financial

InformationNanophase believes that the presentation of

results excluding certain items, such as non-cash equity

compensation charges, provides meaningful supplemental information

to both management and investors, facilitating the evaluation of

performance across reporting periods. The Company uses these

non-GAAP measures for internal planning and reporting purposes.

These non-GAAP measures are not in accordance with, or an

alternative for, generally accepted accounting principles and may

be different from non-GAAP measures used by other companies. The

presentation of this additional information is not meant to be

considered in isolation or as a substitute for net income or net

income per share prepared in accordance with generally accepted

accounting principles.

About Nanophase

TechnologiesNanophase Technologies Corporation (NANX),

www.nanophase.com, is a leader in nanomaterials technologies and

provides nanoengineered solutions for multiple industrial product

applications. Using a platform of patented and proprietary

integrated nanomaterial technologies, the Company creates products

with unique performance attributes from two ISO 9001:2008 and ISO

14001 facilities. Nanophase delivers commercial quantity and

quality nanoparticles, coated nanoparticles, and nanoparticle

dispersions in a variety of media.

Forward-Looking StatementsThis

press release contains words such as “expects,” ”shall,” “will,”

“believes,” and similar expressions that are intended to identify

forward-looking statements within the meaning of the Safe Harbor

Provisions of the Private Securities Litigation Reform Act of 1995.

Such statements in this announcement are made based on the

Company’s current beliefs, known events and circumstances at the

time of publication, and as such, are subject in the future to

unforeseen risks and uncertainties that could cause the Company’s

results of operations, performance and achievements to differ

materially from current expectations expressed in, or implied by,

these forward-looking statements. These risks and uncertainties

include, without limitation, the following: the Company’s ability

to be consistently profitable despite the losses it has incurred

since its incorporation; a decision by a customer to cancel a

purchase order or supply agreement in light of the Company’s

dependence on a limited number of key customers; the terms of the

Company’s supply agreements with BASF Corporation, which could

trigger a requirement to transfer technology and/or sell equipment

to that customer; the Company’s potential inability to obtain

working capital when needed on acceptable terms or at all; the

Company’s ability to obtain materials at costs it can pass through

to its customers, including Rare Earth elements, specifically

cerium oxide, as well as high purity zinc; uncertain demand

for, and acceptance of, the Company’s nanocrystalline materials;

the Company’s manufacturing capacity and product mix flexibility in

light of customer demand; the Company’s limited marketing

experience; changes in development and distribution relationships;

the impact of competitive products and technologies; the Company’s

dependence on patents and protection of proprietary information;

the resolution of litigation or other legal proceedings in which

the Company may become involved; the impact of any potential new

government regulations that could be difficult to respond to or too

costly to comply with while remaining financially viable; the

ability of the Company to maintain an appropriate electronic

trading venue for its securities; and other factors described in

the Company’s Form 10-K filed March 29, 2017. In addition, the

Company’s forward-looking statements could be affected by general

industry and market conditions and growth rates. Except as required

by federal securities laws, the Company undertakes no obligation to

update or revise these forward-looking statements to reflect new

events, uncertainties or other contingencies.

COMPANY CONTACTInvestor

Relations630-771-6705

| NANOPHASE TECHNOLOGIES

CORPORATION |

| |

|

|

|

| BALANCE SHEETS |

| |

|

|

|

| |

|

|

|

| |

September

30, |

|

|

| |

2017 |

|

December

31, |

|

ASSETS |

(Unaudited) |

|

2016 |

| |

|

|

|

|

Current assets: |

|

|

|

| Cash and

cash equivalents |

$ |

1,070,155 |

|

|

$ |

1,779,027 |

|

| Trade

accounts receivable, less allowance for doubtful accounts |

|

|

|

| of $5,000

on September 30, 2017 and December 31, 2016 |

|

1,581,118 |

|

|

|

434,226 |

|

| Other

receivable |

|

312 |

|

|

|

96 |

|

|

Inventories, net |

|

876,193 |

|

|

|

771,975 |

|

| Prepaid

expenses and other current assets |

|

388,906 |

|

|

|

441,634 |

|

| Total

current assets |

|

3,916,684 |

|

|

|

3,426,958 |

|

| |

|

|

|

| Equipment

and leasehold improvements, net |

|

1,424,782 |

|

|

|

1,395,441 |

|

| Other

assets, net |

|

18,034 |

|

|

|

19,893 |

|

| |

$ |

5,359,500 |

|

|

$ |

4,842,292 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

|

Short-term debt |

|

250,000 |

|

|

|

- |

|

| Current

portion of capital lease obligations |

|

130,069 |

|

|

|

107,021 |

|

| Accounts

payable |

|

971,718 |

|

|

|

669,025 |

|

| Accrued

expenses |

|

759,138 |

|

|

|

521,302 |

|

| Total

current liabilities |

|

2,110,925 |

|

|

|

1,297,348 |

|

| |

|

|

|

| Long-term

portion of capital lease obligations |

|

271,149 |

|

|

|

109,448 |

|

| Long-term

deferred rent |

|

423,805 |

|

|

|

465,850 |

|

| Asset

retirement obligation |

|

182,983 |

|

|

|

178,378 |

|

| Total

long-term liabilities |

|

877,937 |

|

|

|

753,676 |

|

| |

|

|

|

| |

|

|

|

| Stockholders'

equity: |

|

|

|

| Preferred

stock, $.01 par value, 24,088 shares authorized and |

|

|

|

| no shares

issued and outstanding |

|

- |

|

|

|

- |

|

| Common

stock, $.01 par value, 42,000,000 and 35,000,000 shares

authorized; |

|

|

|

|

|

|

31,275,330 and 31,229,996 shares issued and outstanding on

September 30, 2017 |

|

|

|

|

|

| and

December 31, 2016, respectively |

|

312,753 |

|

|

|

312,300 |

|

|

Additional paid-in capital |

|

97,512,451 |

|

|

|

97,359,324 |

|

|

Accumulated deficit |

|

(95,454,566 |

) |

|

|

(94,880,356 |

) |

| Total

stockholders' equity |

|

2,370,638 |

|

|

|

2,791,268 |

|

| |

$ |

5,359,500 |

|

|

$ |

4,842,292 |

|

| |

|

|

|

| NANOPHASE TECHNOLOGIES

CORPORATION |

|

|

|

| STATEMENTS OF OPERATIONS |

|

|

|

| (Unaudited) |

|

|

|

| |

|

Three months ended |

|

Nine months ended |

|

| |

|

September 30, |

|

September 30, |

|

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

Revenue: |

|

| Product revenue, net |

|

|

$ |

2,523,584 |

|

|

$ |

2,509,648 |

|

|

$ |

9,524,848 |

|

|

$ |

8,376,747 |

|

|

| Other revenue |

|

|

|

260,976 |

|

|

|

11,375 |

|

|

|

327,304 |

|

|

|

38,456 |

|

|

| Net revenue |

|

|

|

2,784,560 |

|

|

|

2,521,023 |

|

|

|

9,852,152 |

|

|

|

8,415,203 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Operating expense: |

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

|

2,200,066 |

|

|

|

1,841,080 |

|

|

|

6,862,471 |

|

|

|

5,766,284 |

|

|

| Gross profit |

|

|

|

584,494 |

|

|

|

679,943 |

|

|

|

2,989,681 |

|

|

|

2,648,919 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Research and development expense |

|

|

|

494,076 |

|

|

|

386,081 |

|

|

|

1,353,830 |

|

|

|

1,059,507 |

|

|

| Selling, general and administrative expense |

|

|

723,979 |

|

|

|

715,765 |

|

|

|

2,203,026 |

|

|

|

2,151,726 |

|

|

|

Income/(Loss) from operations |

|

|

|

(633,561 |

) |

|

|

(421,903 |

) |

|

|

(567,175 |

) |

|

|

(562,314 |

) |

|

| Interest

income |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| Interest

expense |

|

|

|

(8,486 |

) |

|

|

(3,179 |

) |

|

|

(24,911 |

) |

|

|

(11,309 |

) |

|

| Other, net |

|

|

|

(665 |

) |

|

|

- |

|

|

|

17,876 |

|

|

|

551 |

|

|

|

Income/(Loss) before provision for income taxes |

|

|

(642,712 |

) |

|

|

(425,082 |

) |

|

|

(574,210 |

) |

|

|

(573,072 |

) |

|

| Provision

for income taxes |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| Net

income/(loss) |

|

|

$ |

(642,712 |

) |

|

$ |

(425,082 |

) |

|

$ |

(574,210 |

) |

|

$ |

(573,072 |

) |

|

|

|

|

|

|

|

|

|

| Net

income/(loss) per share- basic and diluted |

|

|

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.02 |

) |

|

|

|

| Weighted

average number of basic and diluted |

|

|

|

|

|

|

|

|

|

| common shares outstanding |

|

|

|

31,239,678 |

|

|

|

31,211,132 |

|

|

|

31,234,735 |

|

|

|

30,805,053 |

|

|

|

|

| NANOPHASE TECHNOLOGIES

CORPORATION |

|

|

|

| STATEMENTS OF OPERATIONS - EXPANDED

SCHEDULE |

|

|

|

| (Unaudited) |

|

|

|

| |

|

Three months ended |

|

Nine months ended |

|

| |

|

September 30, |

|

September 30, |

|

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product

revenue, net |

|

$ |

2,523,584 |

|

|

$ |

2,509,648 |

|

|

$ |

9,524,848 |

|

|

$ |

8,376,747 |

|

|

| Other

revenue |

|

|

260,976 |

|

|

|

11,375 |

|

|

|

327,304 |

|

|

|

38,456 |

|

|

| Net

revenue |

|

|

2,784,560 |

|

|

|

2,521,023 |

|

|

|

9,852,152 |

|

|

|

8,415,203 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expense: |

|

|

|

|

|

|

|

|

|

| Cost of

revenue detail: |

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

68,519 |

|

|

|

108,525 |

|

|

|

211,405 |

|

|

|

391,158 |

|

|

| Non-Cash

equity compensation |

|

|

6,012 |

|

|

|

5,584 |

|

|

|

18,085 |

|

|

|

17,100 |

|

|

| Other

costs of revenue |

|

|

2,125,535 |

|

|

|

1,726,971 |

|

|

|

6,632,981 |

|

|

|

5,358,026 |

|

|

| Cost of

revenue |

|

|

2,200,066 |

|

|

|

1,841,080 |

|

|

|

6,862,471 |

|

|

|

5,766,284 |

|

|

| Gross

profit |

|

|

584,494 |

|

|

|

679,943 |

|

|

|

2,989,681 |

|

|

|

2,648,919 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Research

and development expense detail: |

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

8,212 |

|

|

|

25,248 |

|

|

|

37,981 |

|

|

|

82,835 |

|

|

| Non-Cash

equity compensation |

|

|

11,771 |

|

|

|

9,053 |

|

|

|

36,266 |

|

|

|

27,264 |

|

|

| Other

research and development expense |

|

|

474,093 |

|

|

|

351,780 |

|

|

|

1,279,583 |

|

|

|

949,408 |

|

|

| Research

and development expense |

|

|

494,076 |

|

|

|

386,081 |

|

|

|

1,353,830 |

|

|

|

1,059,507 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Selling,

general and administrative expense detail: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

4,349 |

|

|

|

7,876 |

|

|

|

12,988 |

|

|

|

28,412 |

|

|

| Non-Cash

equity compensation |

|

|

27,925 |

|

|

|

26,317 |

|

|

|

85,199 |

|

|

|

84,176 |

|

|

| Other

selling, general and administrative expense |

|

|

691,705 |

|

|

|

681,572 |

|

|

|

2,104,839 |

|

|

|

2,039,138 |

|

|

| Selling,

general and administrative expense |

|

|

723,979 |

|

|

|

715,765 |

|

|

|

2,203,026 |

|

|

|

2,151,726 |

|

|

| Income/(Loss) from

operations |

|

|

(633,561 |

) |

|

|

(421,903 |

) |

|

|

(567,175 |

) |

|

|

(562,314 |

) |

|

| Interest income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| Interest expense |

|

|

(8,486 |

) |

|

|

(3,179 |

) |

|

|

(24,911 |

) |

|

|

(11,309 |

) |

|

| Other, net |

|

|

(665 |

) |

|

|

- |

|

|

|

17,876 |

|

|

|

551 |

|

|

| Income/(Loss) before

provision for income taxes |

|

|

(642,712 |

) |

|

|

(425,082 |

) |

|

|

(574,210 |

) |

|

|

(573,072 |

) |

|

| Provision for income

taxes |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| Net income/(loss) |

|

$ |

(642,712 |

) |

|

$ |

(425,082 |

) |

|

$ |

(574,210 |

) |

|

$ |

(573,072 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Non-GAAP Disclosure (see note regarding Non-GAAP

disclosures): |

|

|

|

|

|

|

|

| Addback

Interest, net |

|

|

8,486 |

|

|

|

3,179 |

|

|

|

24,911 |

|

|

|

11,309 |

|

|

| Addback

Depreciation/Amortization |

|

|

81,080 |

|

|

|

141,649 |

|

|

|

262,374 |

|

|

|

502,405 |

|

|

| Addback

Non-Cash Equity Compensation |

|

|

45,708 |

|

|

|

40,954 |

|

|

|

139,550 |

|

|

|

128,540 |

|

|

|

|

| Adjusted

EBITDA |

|

$ |

(507,438 |

) |

|

$ |

(239,300 |

) |

|

$ |

(147,375 |

) |

|

$ |

69,182 |

|

|

|

|

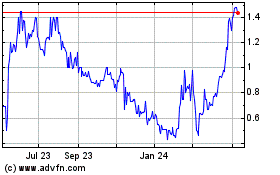

Nanophase Technologies (QB) (USOTC:NANX)

Historical Stock Chart

From Mar 2024 to Apr 2024

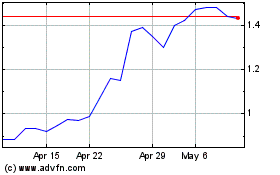

Nanophase Technologies (QB) (USOTC:NANX)

Historical Stock Chart

From Apr 2023 to Apr 2024