QuickLinks

-- Click here to rapidly navigate through this document

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

Filed by the Registrant

o

|

|

|

|

|

Filed by a Party other than the Registrant

þ

|

|

|

Check the appropriate box:

|

|

|

|

|

|

|

|

o

|

|

Preliminary Proxy Statement

|

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

þ

|

|

Definitive Proxy Statement

|

|

o

|

|

Definitive Additional Materials

|

|

o

|

|

Soliciting Material Under Rule 14a-12

|

EQT Corporation

(Name of Registrant as Specified In Its Charter)

JANA Partners LLC

Scott Ostfeld

David DiDomenico

Sam Assamongkol

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

|

|

Payment of Filing Fee (check the appropriate box):

|

þ

|

|

No fee required.

|

o

|

|

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11.

|

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act

|

|

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

5)

|

|

Total fee paid:

|

o

|

|

Fee paid previously with preliminary materials.

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

|

Amount Previously Paid:

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

4)

|

|

Date Filed:

|

October 13,

2017

Dear

Fellow EQT Shareholders:

The

attached proxy statement and the enclosed

GOLD

proxy card are being furnished to you, the shareholders of EQT Corporation, a

Pennsylvania corporation ("EQT"), in connection with the solicitation of proxies by JANA Partners LLC and the other participants listed on Annex I to the proxy statement (collectively,

"we") for use at the special meeting of shareholders of EQT and at any adjournments or postponements thereof (the "Special Meeting"), relating to the proposed acquisition (the "Merger") of Rice

Energy Inc. ("Rice") by EQT. In connection with the proposed Merger, EQT entered into an Agreement and Plan of Merger, dated as of June 19, 2017, with Rice and Eagle Merger Sub

I, Inc.

Pursuant

to the attached proxy statement, we are soliciting proxies from holders of shares of EQT common stock to vote

AGAINST

the

proposed issuance of shares of EQT common stock to Rice stockholders in connection with the Merger.

The

Special Meeting will be held on November 9, 2017 at EQT Plaza, 625 Liberty Avenue, Pittsburgh, PA 15222, at 8:00 a.m. Eastern Standard Time.

We

recommend that you carefully consider the information contained in the attached proxy statement and then support our efforts by signing, dating and returning the enclosed

GOLD

proxy card today, or by

voting against the Merger via the internet or telephone. The attached proxy statement and the enclosed

GOLD

proxy card are first being furnished to the shareholders on or about October 14, 2017.

If you have already voted for management's proposals relating to the Merger, you have every right to change your vote by signing, dating and returning a later

dated proxy card or by voting via the internet or telephone.

If

you have any questions or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at their address and toll-free numbers listed below.

|

|

|

|

|

|

|

|

|

Thank you for your support,

|

|

|

|

|

|

JANA Partners LLC

|

|

|

|

|

|

|

|

If you have any questions, require assistance in voting your

GOLD

proxy card or voting via the internet or telephone, or need

additional copies of JANA Partners LLC's proxy materials, please call Okapi Partners LLC at the phone numbers listed below.

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, NY 10036

Call

Toll-Free: (855) 208-8902

Banks and Brokerage Firms Call: (212) 297-0720

Email: info@okapipartners.com

SPECIAL MEETING OF SHAREHOLDERS OF

EQT CORPORATION

625 Liberty Avenue

Pittsburgh, Pennsylvania 15222

PROXY STATEMENT

OF

PLEASE SIGN, DATE AND MAIL THE ENCLOSED

GOLD

PROXY CARD TODAY

JANA Partners LLC ("JANA" or "we") is a significant shareholder of EQT Corporation ("EQT" or the "Company"). We are writing to you in connection with the proposed

acquisition (the "Merger") of Rice Energy Inc. ("Rice") by EQT. In connection with the proposed Merger, EQT entered into an Agreement and Plan of Merger (the "Merger Agreement"), dated as of

June 19, 2017, with Rice and Eagle Merger Sub I, Inc. The Board of Directors of EQT (the "Board") has scheduled a special meeting of shareholders for the purpose of adopting the Merger

Agreement (the "Special Meeting"). The Special Meeting is scheduled to be held on November 9, 2017 at EQT Plaza, 625 Liberty Avenue, Pittsburgh, PA 15222, at 8:00 a.m. Eastern Standard

Time (EST).

For

the reasons set forth in this Proxy Statement, we oppose the proposed issuance of shares of EQT common stock to Rice stockholders in connection with the Merger because we believe it is not in the

best interests of shareholders, and we are soliciting proxies from the shareholders of EQT to vote

AGAINST

the following Merger proposals (the "Merger

Proposals"):

|

|

|

|

|

|

Proposal

|

|

Our Recommendation

|

|

1.

|

|

EQT's proposal to issue shares of EQT common stock to Rice stockholders in connection with the Merger (the "Share Issuance Proposal").

|

|

AGAINST

|

|

|

|

|

|

|

2.

|

|

EQT's proposal to approve an amendment and restatement of EQT's Restated Articles of Incorporation to provide that the number of members of the Board be not less than five nor more than thirteen (the "Charter Amendment

Proposal").

|

|

AGAINST

|

|

|

|

|

|

|

3.

|

|

EQT's proposal to approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to approve the Share Issuance Proposal (the "Adjournment Proposal").

|

|

AGAINST

|

|

|

|

|

|

|

|

|

To transact any other business that properly comes before the Special Meeting, including any postponement or adjournment thereof.

|

|

|

EQT

has set the record date for determining shareholders entitled to notice of and to vote at the Special Meeting as September 25, 2017 (the "Record Date"). Shareholders of record at the close

of business on the Record Date will be entitled to vote at the Special Meeting. At the close of business on the Record Date, there were 173,832,392 shares of common stock, no par value ("Shares"),

outstanding and entitled to vote at the Special Meeting according to the Company's definitive proxy statement filed with the Securities and Exchange Commission (the "SEC") on October 12, 2017

(the "Company's Proxy Statement"). As of the close of business on October 13, 2017, JANA beneficially owns 10,257,129 Shares, representing approximately 5.9% of the outstanding Shares of the

Company as further described on Annex I. We intend to vote our Shares

AGAINST

EQT's Merger Proposals.

We

urge you to sign, date and return the

GOLD

proxy card voting

"AGAINST"

EQT's Merger Proposals.

This

Proxy Statement and

GOLD

proxy card are first being mailed or given to the Company's shareholders on or about

October 14, 2017.

This Proxy Solicitation is being made by JANA and its employees named on Annex I hereto (the "JANA Participants"), and not on behalf of the Board or management of the

Company or any other third party.

We are not aware of any other matters to be brought before the Special

Meeting other than as described herein. Should other matters be brought before the Special Meeting, the persons named as proxies in the enclosed

GOLD

proxy card will vote on such matters in their

discretion.

If you have already voted using the Company's white proxy card, you have every right to change your vote by completing and mailing the enclosed

GOLD

proxy card in the enclosed pre-paid envelope or by voting via Internet or by telephone by following the instructions on the

GOLD

proxy

card to vote

AGAINST

the Merger Proposals.

Only the latest validly executed proxy that you submit will be counted; any proxy may be revoked at any

time prior to its exercise at the Special Meeting by following the instructions under "Can I change my vote or revoke my proxy?" in the Questions and Answers section.

For instructions on how to vote and other information about the proxy materials, see the Questions and Answers section starting on page 7.

We urge you to promptly sign, date and return your

GOLD

proxy card.

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Okapi Partners LLC, toll free at (855) 208-8902

or email at info@okapipartners.com.

2

|

PROPOSAL 1: SHARE ISSUANCE PROPOSAL

|

You

are being asked by EQT to approve the issuance of Shares to Rice stockholders in connection with the Merger. In connection with the Merger, EQT plans to issue shares of common stock of EQT to

stockholders of Rice. Under the rules of the New York Stock Exchange ("NYSE"), EQT is required to obtain shareholder approval of the share issuance. For the reasons discussed below, we oppose the

Share Issuance Proposal. To that end, we are soliciting your proxy to vote

AGAINST

Proposal 1.

We recommend that you demonstrate your opposition to the proposed Merger and send a message to the Board that the proposed Merger is not in the best interest of EQT

shareholders by signing, dating and returning the enclosed

GOLD

proxy card as soon as possible. You may also vote via the internet or by telephone at any time before 11:59

PM EST on November 8, 2017 by following the instructions on your

GOLD

voting information card.

|

R

EASONS TO

V

OTE

A

GAINST THE

P

ROPOSED

A

CQUISITION:

|

The Rice Acquisition Would Destroy Shareholder Value

EQT

is proposing to purchase Rice for a total consideration of approximately $6.7 billion. We believe that the proposed acquisition of Rice at a substantial premium would destroy shareholder

value. We also believe that EQT has overstated the financial benefits of the proposed acquisition for EQT shareholders.

Destruction of Shareholder Value

Under

the proposed acquisition terms, EQT will finance the acquisition with over ninety million shares of EQT stock which we believe EQT management has acknowledged are undervalued.

1

We

believe that EQT has the ability to unlock shareholder value immediately by separating its E&P and midstream businesses into two separate companies. We believe that the proposed acquisition of Rice

would not only delay the possibility and potentially increase the cost (given potential tax limitations created by the acquisition)

2

of an EQT separation, but also dilute the benefit of

an eventual separation to current EQT shareholders by issuing significantly undervalued shares to help pay for the acquisition.

As

set forth in management's proxy statement,

3

the midpoint value of EQT's stand-alone-sum-of-the-parts is $87.80 per share as calculated by EQT's financial advisors based on

empirically-observed peer multiples, or approximately a 50% premium to EQT's price at the announcement of the acquisition of $58.77. By adding the standalone values of EQT and RICE, subtracting the

value of cash consideration, and dividing the difference by the pro forma share count, the pro forma sum-of-the-parts value for a combined EQT and Rice is $80.35 per share. This means that

approximately $7.50 per pro forma share, or $2 billion, in value would be destroyed upon

1

EQT's management acknowledged the "persistent sum-of-the-parts discount at EQT" on the RICE acquisition conference call on June 19, 2017

and has repeatedly made similar statements on conference calls including on April 28, 2016 and July 23, 2015.

2

Generally under Section 355(e) of the Internal Revenue Code, there is a presumption that any acquisition occurring two years before or

after a tax-free spin-off under Section 355 is part of a plan that would not be afforded tax-free treatment.

3

EQT, Joint Proxy Statement/Prospectus (Form S-4) (July 27, 2017).

3

the

consummation of the proposed acquisition before accounting for the potentially hundreds of millions of dollars of tax leakage from a separation following the transaction and the lost time value of

money from delaying a separation.

Overstatement of Financial Benefits of the Acquisition

We

believe that EQT has overstated the synergy value created by the proposed acquisition. Prior to our involvement, EQT had claimed that the acquisition would generate $2.5 billion of NPV

synergy.

4

However, upon closer scrutiny, we believe that management understated the value transferred to Rice shareholders and overstated the value created by any synergies. Most

notably, in its calculation, management has included opportunities that EQT and Rice can pursue on their own rather than only those generated by the acquisition, including lateral length extension of

Marcellus wells that is already evident in 2017 and will likely grow further in future years. Based on our work to date (which is ongoing), we estimate that the actual synergies could fall short by at

least $1.3 billion, in addition to value lost from issuing undervalued EQT shares to acquire Rice. With only 65% of these synergies accruing to current EQT shareholders (or approximately

$800 million) and given an

acquisition premium of approximately $1.8 billion, we estimate that EQT shareholders would actually be giving away approximately $1 billion of value.

After

we raised our concerns to management, instead of explaining why shareholders should support the acquisition despite the value transfer described above, EQT management put forth that there may be

additional value created by other potential synergies. Upon further analysis, we believe that such additional potential synergies are flawed and note that management has failed to commit to their

estimate of additional value.

Conflicting Interests

Management Incentive

We

do not believe that management's incentive to pursue this acquisition is aligned with shareholders' interests. As detailed in EQT's proxy and 10-K filings, management's long-term incentive

compensation is significantly influenced by EQT's 3-year average production growth. This growth, however, is not measured on a per share basis. Instead, an acquisition, like the proposed acquisition,

that is extremely dilutive to shareholder value can still increase management compensation by millions of dollars by allowing management to achieve its incentive targets by acquiring production volume

regardless of its value to shareholders. The proposed Rice acquisition does not appear to be the first instance where EQT management has used value destructive acquisitions to help achieve production

growth targets. Prior to the Rice acquisition, since May 2016 the Company has spent approximately $1.6 billion of shareholder capital on acquisitions, 90% of which have been in West Virginia, a

state in which the Company recently announced it would curtail drilling just one year after acquiring the acreage after incurring permitting challenges and deeming it unattractive. Should EQT continue

its prior practice of calculating the maximum bonus pool at 2% of EBITDA (regardless of whether growth from the prior year is the result of M&A), we estimate that the proposed acquisition would

increase the senior management cash bonus pool by approximately $130 million for the 2018 to 2021 period while diluting value to current shareholders.

4

EQT, Analyst Presentation (July 27, 2017).

4

Governance Issues

The

pursuit by management of the proposed acquisition coupled with what we believe to be a suboptimal incentive structure for management brings into question larger governance issues regarding the

Board. The Board has at least two members with over 10 years of tenure, bringing into question their independence.

5

The lead director has sat on the Board for 20 years and

sits on the compensation committee, while the compensation committee is chaired by another director who has sat on the Board for over 10 years. Also, when the Board is not in session, EQT's

executive committee has the power to take action on behalf of the full Board.

6

Such committee includes the CEO, the lead director and the executive chairman (who is the former CEO).

Accordingly,

JANA recommends that you vote

AGAINST

the Merger Proposals. Other than soliciting your vote

AGAINST

the Merger Proposals, we do not intend to make any

other proposals in person at the Special Meeting regarding the Merger, although we reserve

the right to make such proposals at a later meeting of shareholders or through a separate consent solicitation.

We urge shareholders to vote

AGAINST

the Share Issuance Proposal on the

GOLD

proxy card.

Consequences of Defeating the Proposed Merger

In

the event that the Merger Agreement is terminated as a result of the failure to obtain the requisite vote of EQT's shareholders, EQT will be required to pay Rice $67 million for expenses

incurred in connection with the Merger Agreement or the transactions contemplated therein.

In

the event that the Merger Agreement is terminated as a result of the failure to obtain the requisite vote of EQT shareholders and if (i) there is a "Parent Competing Proposal" (as such term

is defined in the Merger Agreement) announced, disclosed or otherwise communicated to EQT on or before the date of such termination, which has not been publicly withdrawn at least three business days

prior to the Special Meeting and (ii) within 12 months of such termination, EQT enters into a definitive agreement with respect to a Parent Competing Proposal or any transaction meeting

the parameters of a Parent Competing Proposal (provided that references to 20% in the definition of "Parent Competing Proposal" shall be changed to more than 50%) and such Parent Competing Proposal is

consummated, then EQT is required to pay Rice a termination fee of $255 million (less any Rice expenses previously paid by EQT).

Vote Required.

According

to the Company's Proxy Statement, the approval of the Share Issuance Proposal requires the affirmative vote of a majority of the votes cast by holders of EQT's common stock. An abstention

vote will have no effect on this Proposal. We therefore urge shareholders to vote "

AGAINST

" the Share Issuance Proposal to make sure their voices are

heard.

We urge you to sign, date and return our

GOLD

proxy card.

If you have already voted using the Company's white proxy card, you have

every right to change your vote by completing and mailing the enclosed

GOLD

proxy card in the enclosed pre-paid envelope or

by voting via Internet or by telephone by following the instructions on the

GOLD

proxy card. Only the latest validly

executed

5

The leading proxy advisory firm, Institutional Shareholder Services (ISS), has noted that a "tenure of more than nine years is considered to

potentially compromise a director's independence."

ISS Governance QuickScore 3.0: Overview and Updates

11 (Revised May 2015),

https://www.issgovernance.com/file/products/quickscore_techdoc.pdf.

6

EQT, Proxy Statement (Form DEF14A) (Feb. 17, 2017).

5

proxy

that you submit will be counted; any proxy may be revoked at any time prior to its exercise at the Special Meeting by following the instructions under "Can I change my vote or revoke my proxy?"

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Okapi Partners LLC, toll free at (855) 208-8902 or email at

info@okapipartners.com.

We Recommend a Vote

AGAINST

the Share Issuance Proposal on the

GOLD

proxy card.

|

PROPOSAL 2: CHARTER AMENDMENT PROPOSAL

|

You

are being asked by EQT to approve an amendment and restatement of EQT's Restated Articles of Incorporation to provide that the number of members of the Board be not less than five nor more than

thirteen. The proposed restatement of EQT's Restated Articles of Incorporation will have the effect of amending Section 3.1(a) as follows:

(a) The

Board of Directors shall consist of not less than 5 nor more than 13 persons, the exact number to be fixed from time to time by the Board of Directors pursuant to a resolution

adopted by a majority vote of the directors then in office.

According

to the Company's Proxy Statement, the Charter Amendment Proposal allows EQT to appoint two Rice designees in connection with the Merger. For the reasons discussed above in "REASONS TO VOTE

AGAINST THE PROPOSED ACQUISITION," we oppose the proposed Merger. To that end, we are soliciting your proxy to vote

AGAINST

Proposal 2.

JANA recommends that you vote AGAINST EQT's Charter Amendment Proposal.

Vote Required.

According

to the Company's Proxy Statement, the approval of the Charter Amendment Proposal requires the affirmative vote of a majority of the votes cast by holders of EQT's common stock. An abstention

vote will have no effect on this Proposal.

We Recommend a Vote

AGAINST

the Charter Amendment Proposal on the

GOLD

proxy card.

|

PROPOSAL 3: ADJOURNMENT PROPOSAL

|

You

are being asked by EQT to approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to approve the Share Issuance

Proposal. Under EQT's bylaws, the presence, in person or by proxy, of the holders of a majority of the voting power of all shareholders constitutes a quorum for the Special Meeting. For the reasons

discussed above in "REASONS TO VOTE AGAINST THE PROPOSED ACQUISITION," we oppose the proposed Merger. To that end, we are soliciting your proxy to vote AGAINST Proposal 3.

6

JANA recommends that you vote AGAINST EQT's Adjournment Proposal.

Vote Required.

According

to the Company's Proxy Statement, the approval of the Adjournment Proposal requires the affirmative vote of a majority of the votes cast by holders of EQT's common stock. An abstention vote

will have no effect on this Proposal.

We Recommend a Vote

AGAINST

the Adjournment Proposal on the

GOLD

proxy card.

7

|

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE SPECIAL MEETING

|

Only

holders of voting stock at the close of business on the Record Date, September 25, 2017, are entitled to notice of and to vote at the Special Meeting. Shareholders who

sold Shares before the Record Date (or acquire them without voting rights after the Record Date) may not vote such Shares. Shareholders of record on the Record Date will retain their voting rights in

connection with the Special Meeting even if they sell such Shares after the Record Date (unless they also transfer their voting rights).

Shares held in record name.

If your Shares are registered in your own name, please vote today by signing, dating and returning the enclosed

GOLD

proxy card in the postage-paid envelope provided. Execution and delivery of a proxy by a record holder of Shares will

be presumed to be a proxy with respect to all Shares held by such record holder unless the proxy specifies otherwise.

Shares beneficially owned or held in "street" name.

If you hold your Shares in "street" name with a broker, bank, dealer, trust company or other nominee, only that

nominee can exercise the right to vote with respect to the Shares that you beneficially own through such nominee and only upon receipt of your specific instructions.

Accordingly, it is

critical that you promptly give instructions to your broker, bank, dealer, trust company or other nominee to vote

AGAINST

the Merger Proposals

. Please follow the instructions to vote provided

on the enclosed

GOLD

proxy card. If your broker, bank, dealer, trust company, or other nominee provides for proxy

instructions to be delivered to them by telephone or Internet, instructions will be included on the enclosed

GOLD

proxy

card. We urge you to confirm in writing your instructions to the person responsible for your account and provide a copy of those instructions by emailing them to info@okapipartners.com or mailing them

to JANA Partners LLC, c/o Okapi Partners, 1212 Avenue of the Americas, 24th Floor, New York, NY 10036, so

that we will be aware of all instructions given and can attempt to ensure that such instructions are followed.

Note:

Shares represented by properly executed

GOLD

proxy cards will be voted at the

Special Meeting as marked and, in the absence of specific instructions, "

AGAINST

" the Merger Proposals.

|

How should I vote on each proposal?

|

We

recommend that you vote your shares on the

GOLD

proxy card as follows:

"AGAINST"

the Share Issuance Proposal (Proposal 1);

"AGAINST"

the Charter Amendment Proposal (Proposal 2); and

"AGAINST"

the Adjournment Proposal (Proposal 3).

8

|

How many shares must be present to hold the Special Meeting?

|

Under

EQT's bylaws, the presence, in person or by proxy, of the holders of a majority of the voting power of all shareholders constitutes a quorum for the Special Meeting. According

to the Company's Proxy Statement, abstentions (Shares for which proxies have been received but for which the holders have abstained from voting) and broker non-votes, which are described below, will

be included in the calculation of the number of Shares present at the meeting for purposes of determining whether a quorum has been met. Broker shares that are not voted on any matter will not be

included in determining whether a quorum is present.

|

What are "broker non-votes" and what effect do they have on the proposals?

|

Generally,

broker non-votes occur when shares held by a broker, bank or other nominee in "street name" for a beneficial owner are not voted with respect to a particular proposal

because the broker, bank or other nominee has not received voting instructions from the beneficial owner and lacks discretionary voting power to vote those shares with respect to that particular

proposal. If your shares are held in the name of a brokerage firm, and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal,

the brokerage firm cannot vote the shares on that proposal unless it is a "routine" matter. Under the NYSE Rules, there are no "routine" proposals in a contested proxy solicitation such as this one.

Broker

non-votes, if any, with respect to the proposals set forth in this Proxy Statement will not count as votes present and entitled to vote and therefore will not be counted in determining the

outcome of any of the Merger Proposals.

|

What should I do if I receive a proxy card from the Company?

|

You

may receive proxy solicitation materials from EQT, including a merger proxy statement and white proxy card. We are not responsible for the accuracy of any information contained

in any proxy solicitation materials used by the Company or any other statements that it may otherwise make.

We recommend that you disregard any proxy card or solicitation materials that may be sent to you by the Company. If you have already voted using the Company's white proxy card,

you have every right to change your vote by completing and mailing the enclosed

GOLD

proxy card in the enclosed pre-paid envelope or by voting via Internet or by telephone

by following the instructions on the

GOLD

proxy card. Only the latest validly executed proxy that you submit will be counted; any proxy may be revoked at any time prior to

its exercise at the Special Meeting by following the instructions below under "Can I change my vote or revoke my proxy?" If you have any questions or require any assistance with voting your shares,

please contact our proxy solicitor, Okapi Partners LLC, toll free at (855) 208-8902 or via email at info@okapipartners.com.

|

Can I change my vote or revoke my proxy?

|

If

you are the shareholder of record, you may change your proxy instructions or revoke your proxy at any time before your proxy is voted at the Special Meeting. Proxies may be

revoked by any of the following actions:

-

•

-

signing, dating and returning the enclosed

GOLD

proxy card (the

latest dated proxy is the only one that counts);

9

-

•

-

delivering a written revocation or a later dated proxy for the Special Meeting to JANA Partners LLC, c/o Okapi Partners, 1212 Avenue of

the Americas, 24th Floor, New York, NY 10036,or to the secretary of the Company; or

-

•

-

attending the Special Meeting and voting in person (although attendance at the Special Meeting will not, by itself, revoke a proxy).

If

your shares are held in a brokerage account by a broker, bank or other nominee, you should follow the instructions provided by your broker, bank or other nominee. If you attend the Special Meeting

and you beneficially own Shares but are not the record owner, your mere attendance at the Special Meeting WILL NOT be sufficient to revoke your prior given proxy card. You must have written authority

from the record owner to vote your shares held in its name at the meeting. Contact Okapi Partners LLC, toll free at (855) 208-8902 or via email at info@okapipartners.com for assistance

or if you have any questions.

IF YOU HAVE ALREADY VOTED USING THE COMPANY'S WHITE PROXY CARD, WE URGE YOU TO REVOKE IT BY FOLLOWING THE INSTRUCTIONS ABOVE.

Although a revocation is

effective if delivered to the Company, we request that either the original or a copy of any revocation be mailed to JANA Partners LLC, c/o Okapi Partners, 1212 Avenue of the Americas,

24th Floor, New York, NY 10036.

|

Who is making this Proxy Solicitation and who is paying for it?

|

The

solicitation of proxies pursuant to this Proxy Solicitation is being made by the JANA Participants named on Annex I hereto. Proxies may be solicited by mail, facsimile,

telephone, telegraph, Internet, in person and by advertisements. The JANA Participants will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. JANA has

requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the Shares they hold of record. JANA will reimburse

these record holders for their reasonable out-of-pocket expenses in so doing.

JANA

has retained Okapi Partners LLC ("Okapi") to provide solicitation and advisory services in connection with this solicitation. Okapi will be paid a fee of no less than $150,000 based upon

the campaign services provided. In addition, JANA will reimburse Okapi for its reasonable out-of-pocket expenses and will indemnify Okapi against certain liabilities and expenses, including certain

liabilities under the federal securities laws. Okapi will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. It is anticipated that Okapi will employ up

to 50 persons to solicit the Company's shareholders as part of this solicitation. Okapi does not believe that any of its directors, officers, employees, affiliates or controlling persons, if any, is a

"participant" in this Proxy Solicitation.

The

costs related to this Proxy Solicitation will be borne by JANA. Costs of this Proxy Solicitation are currently estimated to be approximately $1,000,000. The actual amount could be higher or lower

depending on the facts and circumstances arising in connection with the solicitation. We estimate

that through the date hereof, JANA's expenses in connection with this Proxy Solicitation are approximately $500,000. If successful, JANA may seek reimbursement of these costs from the Company. In the

event that JANA decides to seek reimbursement of its expenses, JANA does not intend to submit the matter to a vote of the Company's shareholders. The Board would be required to evaluate the requested

reimbursement consistent with its fiduciary duties to the Company and its shareholders. Costs related to the solicitation of proxies include expenditures for attorneys, public

10

relations

and other advisors, solicitors, printing, advertising, postage, transportation and other costs incidental to the solicitation.

|

Where can I find additional information concerning EQT and the Merger?

|

Pursuant

to Rule 14a-5(c) promulgated under the Securities Exchange Act of 1934 (the "Exchange Act"), we have omitted from this proxy statement certain disclosure required by

applicable law to be included in the Company's Proxy Statement in connection with the Special Meeting. Such disclosure includes:

-

•

-

a summary term sheet of the Merger;

-

•

-

the terms of the Merger Agreement and the Merger and related transactions;

-

•

-

any reports, opinions and/or appraisals received by EQT in connection with the Merger;

-

•

-

past contacts, transactions and negotiations by and

among the parties to the Merger and their respective affiliates and advisors;

-

•

-

federal and state regulatory requirements that must be complied with and approvals that must be obtained in connection with the Merger;

-

•

-

security ownership of certain beneficial owners and management of EQT, including 5% owners;

-

•

-

the trading prices of EQT stock over time;

-

•

-

the establishment of a quorum;

-

•

-

the compensation paid and payable to EQT's directors and executive officers;

-

•

-

the requirements for the submission of shareholder proposals to be considered for inclusion in EQT's proxy statement for the 2018 annual

meeting of shareholders; and

-

•

-

appraisal rights and dissenters' rights.

We

take no responsibility for the accuracy or completeness of information contained in the Company's Proxy Statement. Except as otherwise noted herein, the information in this proxy statement

concerning the Company has been taken from or is based upon documents and records on file with the SEC and other publicly available information.

This

proxy statement and all other solicitation materials in connection with this Proxy Solicitation will be available on the internet, free of charge, on the SEC's website at https://www.sec.gov.

11

We

urge you to carefully consider the information contained in this proxy statement and then support our efforts by signing, dating, and returning the enclosed

GOLD

proxy card today to vote

AGAINST

the

Merger Proposals.

Thank

you for your support,

October 13, 2017

12

|

ANNEX I: INFORMATION ON THE PARTICIPANTS

|

This

Proxy Solicitation is being made by JANA Partners LLC, Scott Ostfeld ("Mr. Ostfeld"), David DiDomenico ("Mr. DiDomenico") and Sam Assamongkol ("Mr. Assamongkol" and

together with JANA, Mr. Ostfeld and Mr. DiDomenico, the "JANA Participants"). JANA is a private money management firm which holds Shares of the Company in various accounts under its

management and control. The principal owner of JANA is Barry Rosenstein ("Mr. Rosenstein"). The principal occupation of Mr. Ostfeld is to serve as a Partner and Co-Portfolio Manager at

JANA. The principal occupation of Mr. DiDomenico is to serve as a Partner and Co-Portfolio Manager at JANA. The principal occupation of Mr. Assamongkol is to serve as a Managing Director

at JANA. The principal business address of each of the JANA Participants and Mr. Rosenstein is 767 Fifth Avenue, 8th Floor, New York, New York 10153.

As

of the close of business on October 13, 2017, JANA beneficially owns 10,257,129 Shares, representing approximately 5.9% of the Shares outstanding. JANA has sole voting and dispositive power

over the 10,257,129 Shares, which power is exercised by Mr. Rosenstein.

Such

Shares were acquired with investment funds in accounts managed by JANA and margin borrowings described in the following sentence. Such Shares are held by the investment funds managed by JANA in

commingled margin accounts, which may extend margin credit to JANA from time to time, subject to applicable federal margin regulations, stock exchange rules and credit policies. In such instances, the

positions held in the margin accounts are pledged as collateral security for the repayment of debit balances in the account. The margin accounts bear interest at a rate based upon the broker's call

rate from time to time in effect. Because other securities are held in the margin accounts, it is not possible to determine the amounts, if any, of margin used to purchase the Shares reported herein.

JANA

has entered into a nominee agreement (the "Nominee Agreement") with each of Jonathan Z. Cohen ("Mr. J. Cohen") and Daniel C. Herz ("Mr. Herz" and together with Mr. J. Cohen,

the "Potential Nominees") whereby each Potential Nominee agreed to become a member of a slate of nominees (the "Slate") and stand for election as a director of the Company in connection with a proxy

solicitation (the "Proxy Solicitation") which may be conducted by JANA in respect of the 2018 annual meeting of shareholders of the Company (the "2018 Annual Meeting"). Pursuant to each Nominee

Agreement, JANA has agreed to pay the costs of soliciting proxies in connection with the 2018 Annual Meeting, and to defend and indemnify each Potential Nominee against, and with respect to, any

losses that may be incurred by them in the event they become a party to litigation based on their nomination as a candidate for election to the Board and the solicitation of proxies in support of

their election. Each Potential Nominee received compensation under the Nominee Agreement in the amount of $75,000, and an additional $180,000 in the event of his or her appointment or election. Each

Potential Nominee agreed to hold Shares with a market-value equal to $255,000 (adjusted for taxes) as of the date of his or her appointment, subject to certain exceptions until the later of when such

Potential Nominee is no longer a director of the Company and three years. JANA also entered into a cooperation agreement (the "Cooperation Agreement") with Edward E. Cohen ("Mr. E.

Cohen") whereby Mr. E. Cohen has agreed to comply with certain confidentiality obligations and trading restrictions. None of Messrs. Mr. J. Cohen, Mr. Herz and

Mr. E. Cohen will solicit proxies or finance the solicitation of proxies by JANA in connection with the Special Meeting.

By

virtue of the Nominee Agreements and the Cooperation Agreement, the JANA Participants, each of the Potential Nominees and Mr. E. Cohen may be deemed to have formed a "group" within the

13

meaning

of Section 13(d)(3) of the Exchange Act and may be deemed to beneficially own an aggregate of 10,374,129 Shares, representing approximately 6.0% of the outstanding Shares. Each

Potential Nominee expressly disclaims beneficial ownership of the Shares beneficially owned by

JANA, each other Potential Nominee and Mr. E. Cohen. JANA expressly disclaims beneficial ownership of the Shares beneficially owned by each Potential Nominee and Mr. E. Cohen.

Mr. E. Cohen expressly disclaims beneficial ownership of the Shares beneficially owned by JANA and each Potential Nominee.

Except

as set forth in this Proxy Statement (including the Annexes), (i) during the past ten years, no JANA Participant has been convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors); (ii) each JANA Participant does not directly or indirectly beneficially own any securities of the Company; (iii) each JANA Participant does not own any

securities of the Company which are owned of record but not beneficially; (iv) each JANA Participant has not purchased or sold any securities of the Company during the past two years;

(v) no part of the purchase price or market value of the securities of the Company owned by JANA is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding

such securities; (vi) each JANA Participant is not, or within the past year was not, a party to any contract, arrangements, or understandings with any person with respect to any securities of

the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or

withholding of proxies; (vii) no associate of any JANA Participant owns beneficially, directly or indirectly, any securities of the Company; (viii) each JANA Participant does not own

beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) none of the JANA Participants nor any of their associates were a party to any transaction,

or series of similar transactions, since the beginning of the Company's last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company

or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) none of the JANA Participants nor any of their associates have any arrangement or

understanding with any person with respect to any future employment by the Company or its affiliates, nor with respect to any future transactions to which the Company or any of its affiliates will or

may be a party; and (xi) no person, including any JANA Participant, has a substantial interest, direct or indirect, by security holdings or otherwise in any matter to be acted on as set forth

in this Proxy Statement. There are no material proceedings to which any JANA Participant or any of their associates is a party adverse to the Company or any of its subsidiaries or has a material

interest adverse to the Company or any of its subsidiaries.

14

|

Transactions by the Participants with respect to the Company's securities

|

The

following tables set forth all transactions effected during the past two years by JANA with respect to securities of the Company. The Shares reported herein are held in either

cash accounts or margin accounts in the ordinary course of business. Unless otherwise indicated, all transactions were effected on the open market. Except for JANA, no other JANA Participant has

effected any transactions during the past two years with respect to securities of the Company.

Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of

Purchase/Sale

|

|

|

|

Shares

Purchased/(Sold)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1/6/2016

|

|

|

|

(40,000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1/8/2016

|

|

|

|

20,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1/8/2016

|

|

|

|

20,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2/19/2016

|

|

|

|

50,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2/19/2016

|

|

|

|

60,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2/19/2016

|

|

|

|

50,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2/19/2016

|

|

|

|

(30,000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2/19/2016

|

|

|

|

(30,000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2/23/2016

|

|

|

|

(100,000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/3/2016

|

|

|

|

100,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/3/2016

|

|

|

|

(25,000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/3/2016

|

|

|

|

(50,000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/3/2016

|

|

|

|

(25,000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/5/2017

|

|

|

|

150,536

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/5/2017

|

|

|

|

122,433

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/6/2017

|

|

|

|

148,817

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/6/2017

|

|

|

|

33,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/6/2017

|

|

|

|

105,813

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/7/2017

|

|

|

|

108,662

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/7/2017

|

|

|

|

76,046

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/7/2017

|

|

|

|

3,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/7/2017

|

|

|

|

11,800

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/10/2017

|

|

|

|

10,512

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/10/2017

|

|

|

|

6,752

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/10/2017

|

|

|

|

125,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/11/2017

|

|

|

|

24,800

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/11/2017

|

|

|

|

261,471

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/11/2017

|

|

|

|

26,096

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/11/2017

|

|

|

|

30,087

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/11/2017

|

|

|

|

18,558

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/12/2017

|

|

|

|

151,105

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/12/2017

|

|

|

|

5,300

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/12/2017

|

|

|

|

94,200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/13/2017

|

|

|

|

98,992

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/13/2017

|

|

|

|

14,821

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/13/2017

|

|

|

|

71,888

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/27/2017

|

|

|

|

54,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/27/2017

|

|

|

|

154,928

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/27/2017

|

|

|

|

18,600

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4/27/2017

|

|

|

|

75,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/19/2017

|

|

|

|

116,556

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/19/2017

|

|

|

|

13,575

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/22/2017

|

|

|

|

66,462

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/22/2017

|

|

|

|

70,945

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/23/2017

|

|

|

|

101,374

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/23/2017

|

|

|

|

77,683

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/24/2017

|

|

|

|

115,416

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/24/2017

|

|

|

|

99,824

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/25/2017

|

|

|

|

653,795

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/26/2017

|

|

|

|

58,540

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/26/2017

|

|

|

|

59,362

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/30/2017

|

|

|

|

110,812

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/30/2017

|

|

|

|

123,021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/31/2017

|

|

|

|

182,038

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/31/2017

|

|

|

|

122,959

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/1/2017

|

|

|

|

292,933

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/1/2017

|

|

|

|

85,449

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/1/2017

|

|

|

|

15,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/2/2017

|

|

|

|

423,585

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/2/2017

|

|

|

|

15,535

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/2/2017

|

|

|

|

210,880

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/7/2017

|

|

|

|

42,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/7/2017

|

|

|

|

363,532

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/7/2017

|

|

|

|

144,468

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/8/2017

|

|

|

|

59,127

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/8/2017

|

|

|

|

75,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/8/2017

|

|

|

|

113,100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/9/2017

|

|

|

|

122,229

|

|

|

|

|

|

|

|

|

|

|

|

|

15

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/9/2017

|

|

|

|

63,192

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/13/2017

|

|

|

|

226,100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/13/2017

|

|

|

|

32,128

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/14/2017

|

|

|

|

109,064

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/14/2017

|

|

|

|

4,600

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/15/2017

|

|

|

|

165,178

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/15/2017

|

|

|

|

79,093

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/15/2017

|

|

|

|

13,800

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/16/2017

|

|

|

|

100,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/16/2017

|

|

|

|

49,293

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/19/2017

|

|

|

|

131,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/19/2017

|

|

|

|

122,645

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/23/2017

|

|

|

|

132,434

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/23/2017

|

|

|

|

50,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/26/2017

|

|

|

|

50,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/26/2017

|

|

|

|

55,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/26/2017

|

|

|

|

38,487

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/27/2017

|

|

|

|

212,759

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/28/2017

|

|

|

|

48,200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/28/2017

|

|

|

|

199,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/29/2017

|

|

|

|

216,110

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/30/2017

|

|

|

|

100,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7/3/2017

|

|

|

|

5,833

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7/3/2017

|

|

|

|

11,296

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8/4/2017

|

|

|

|

387,500*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8/21/2017

|

|

|

|

240,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8/31/2017

|

|

|

|

1,476,000*

|

|

|

|

|

|

|

|

|

|

|

|

|

* Acquired via the exercise of call options.

16

IMPORTANT

Tell

your Board what you think! YOUR VOTE IS VERY IMPORTANT, no matter how many or how few shares you own. Please give us your proxy

"AGAINST"

EQT's

Merger Proposals by taking three steps:

-

•

-

SIGNING the enclosed

GOLD

proxy card,

-

•

-

DATING the enclosed

GOLD

proxy card, and

-

•

-

MAILING the enclosed

GOLD

proxy card TODAY in the envelope

provided (no postage is required if mailed in the United States).

If any of your shares are held in the name of a broker, bank, bank nominee, or other institution, only it can vote your shares and only upon receipt of your specific

instructions.

Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. You may also vote by signing, dating and

returning the enclosed

GOLD

voting form in the postage-paid envelope provided, and to ensure that your shares are voted,

you should also contact the person responsible for your account and give instructions for a

GOLD

proxy card to be issued

representing your shares.

After

signing the enclosed

GOLD

proxy card,

DO NOT SIGN OR RETURN EQT'S WHITE PROXY CARD UNLESS YOU

INTEND TO CHANGE YOUR VOTE

, because only your latest dated proxy card will be counted.

If

you have previously signed and returned a white proxy card to EQT, you have every right to change your vote. Only your latest dated proxy card will count. You may revoke any proxy card already sent

to EQT by signing, dating and mailing the enclosed

GOLD

proxy card in the postage-paid envelope provided or by voting by

telephone or Internet. Any proxy may be revoked at any time prior to the Special Meeting by delivering a written notice of revocation or a later dated proxy for the Special Meeting or by voting in

person at the Special Meeting. Attendance at the Special Meeting will not in and of itself constitute a revocation.

If you have any questions concerning this proxy statement, would like to request additional copies of this proxy statement, or need help voting your shares, please contact our

proxy solicitor:

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, NY 10036

Call Toll-Free: (855) 208-8902

Banks and Brokerage Firms Call: (212) 297-0720

Email: info@okapipartners.com

FORM OF GOLD PROXY CARD

EQT CORPORATION

SPECIAL MEETING OF SHAREHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF JANA PARTNERS LLC

THE BOARD OF DIRECTORS OF EQT CORPORATION IS NOT SOLICITING THIS PROXY

The undersigned appoints Charles Penner, Eleazer Klein and Bruce Goldfarb, and each of them, attorneys and agents with full power of substitution to vote all shares of common stock of EQT Corporation, a Pennsylvania corporation (the “Company”), that the undersigned would be entitled to vote at the Special Meeting of shareholders of the Company scheduled to be held on Thursday, November 9, 2017 at EQT Plaza, 625 Liberty Avenue, Pittsburgh, PA 15222, at 8:00 a.m. Eastern Standard Time, including at any adjournments or postponements thereof, with all powers that the undersigned would possess if personally present, upon and in respect of the instructions indicated herein, with discretionary authority as to any and all other matters that may properly come before the meeting or any adjournment, postponement or substitution thereof that are unknown to us a reasonable time before this solicitation.

The undersigned hereby revokes any other proxy or proxies heretofore given to vote or act with respect to said shares, and hereby ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may lawfully take by virtue hereof. This proxy will be valid until the sooner of one year from the date indicated on the reverse side and the completion of the Special Meeting (including any adjournments or postponements thereof).

If this proxy is signed and returned, it will be voted in accordance with your instructions. If you do not specify how the proxy should be voted, this proxy will be voted “AGAINST” Proposals 1, 2 and 3.

None of the matters currently intended to be acted upon pursuant to this proxy are conditioned on the approval of other matters.

INSTRUCTIONS:

FILL IN VOTING BOXES “

o

” IN BLACK OR BLUE INK)

JANA recommends that you vote “

AGAINST

” each of the Proposals:

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

|

|

|

|

|

|

|

|

Proposal 1 –

EQT’s Share Issuance Proposal

|

|

o

|

|

o

|

|

o

|

|

|

|

|

|

|

|

|

|

Proposal 2

- EQT’s Charter Amendment Proposal

|

|

o

|

|

o

|

|

o

|

|

|

|

|

|

|

|

|

|

Proposal 3 –

EQT’s Adjournment Proposal

|

|

o

|

|

o

|

|

o

|

IN ORDER FOR YOUR PROXY TO BE VALID, IT MUST BE DATED.

|

|

|

|

|

Signature (Capacity)

|

|

Date

|

|

|

|

|

|

|

|

|

|

Signature (Joint Owner) (Capacity/Title)

|

|

Date

|

NOTE:

Please sign exactly as your name(s) appear(s) on stock certificates or on the label affixed hereto. When signing as attorney, executor, administrator or other fiduciary, please give full title as such. Joint owners must each sign personally.

ALL HOLDERS MUST SIGN.

If a corporation or partnership, please sign in full corporate or partnership name by an authorized officer and give full title as such.

PLEASE

SIGN

,

DATE

AND

PROMPTLY RETURN

THIS PROXY IN THE ENCLOSED RETURN ENVELOPE THAT IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES.

QuickLinks

IMPORTANT

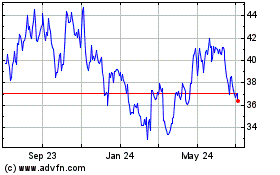

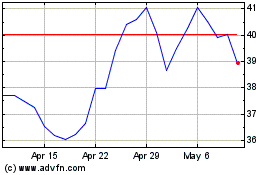

EQT (NYSE:EQT)

Historical Stock Chart

From Mar 2024 to Apr 2024

EQT (NYSE:EQT)

Historical Stock Chart

From Apr 2023 to Apr 2024