Nike Treads New Sales Path -- WSJ

July 06 2017 - 3:02AM

Dow Jones News

By Sara Germano

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 6, 2017).

With the retail sector in flux, Nike Inc. is looking for new

ways to sell sneakers and shirts, but some industry watchers worry

that the company's efforts to broaden its reach could damage its

cultural cachet.

The world's largest sportswear maker has begun selling goods

through Amazon.com Inc. and increasingly is using its mobile apps

as sales tools, attempting to connect with consumers who are buying

more online. Already, sales on Nike.com and the company's apps have

doubled to more than $2 billion since 2015, the company said last

month.

Those initiatives mark a shift away from how Nike has

traditionally released its most desirable products. Five years ago,

the company had to tell longtime sales partners Foot Locker Inc.

and Dick's Sporting Goods Inc. to move limited-shoe releases to the

morning hours from midnight because shoppers who camped outside

stores were getting out of hand. Frequent online releases of

coveted Jordan shoes could make them less rare and not as much in

demand anymore, some industry watchers say.

By making certain shoes available only through Nike channels or

big chains such as Foot Locker, the company is diminishing the

mom-and-pop shops that have served as community stewards of

cool.

"They're putting their foot on the gas in terms of releases,"

said Matt Halfhill, founder of sneaker-news site Nice Kicks, which

chronicles new releases across major shoe brands. Mr. Halfhill, who

said he has been involved in sneaker culture since the 1990s,

believes the push toward direct sales actually hurts Nike's

connection with consumers.

"It's a great way to sell commoditized shoes, but most boutiques

even discourage you from buying on the phone. They only sell shoes

in stores to customers, where you see everyone in line waiting for

shoes talking to each other," he said.

A Nike spokesman said the company is focused on "disrupting the

sneaker shopping experience" by offering different types of

releases, some in nontraditional places. Last month, the company

released a limited edition sneaker in collaboration with acclaimed

chef David Chang. Users of the Nike SNKRS app could purchase the

shoe at Mr. Chang's Fuku restaurant in New York through

augmented-reality technology by taking a photo of the menu within

the app, which unlocked a sales portal.

Wall Street has taken note of the choppy waters for Nike, which

has to navigate North America's retail downturn, in particular the

troubles facing sporting-goods stores. "The big picture concerns

are competition is gaining on Nike, 'athleisure' is slowing, and

the shift to online spending is proving highly disruptive to Nike's

wholesale business," Morgan Stanley analyst Jay Sole wrote in a

research note.

Nike's share of the U.S. retail sneaker market fell 1 percentage

point to 50% this year through May, according to industry tracker

NPD Group, while rival Adidas AG climbed to 11% from 7% over the

same period. Adidas's gains come about two years after the company

changed its leadership and refocused on sales in the U.S., where

the German company has struggled for years.

Adidas's resurgence includes new "franchises" -- such as the NMD

and Kanye West's Yeezy line -- that have gained a youthful

following and made inroads on Nike's cultural dominance.

Nick Santora, a former sneaker-store owner and editor of online

sneaker magazine Classic Kicks, said Adidas is more on point with

youth culture of late.

"It took them a while, but things are coming together the right

way," Mr. Santora said. "Kanye, for some people, for certain kids,

that brand is now acceptable," he said. "Nike was always 'sports,

sports, sports,' but if you're over 11 years old right now,

musicians are where it's at."

Nike has released collaborations with hip-hop artists such as

Drake and A$AP Bari among others, and a training shoe with actor

and comedian Kevin Hart. The company says it has relationships with

entertainers as well as thousands of athletes, and it develops

signature sneaker lines for only a select few.

Although Mr. Santora, 39, said he is a lifelong Nike fan, he

admits to some brand fatigue.

"I haven't bought a pair of Nikes in a couple of years," he

said. "I don't need to be that cool anymore."

Write to Sara Germano at sara.germano@wsj.com

Corrections & Amplifications Matt Halfhill said he has been

involved in sneaker culture since the 1990s. An earlier version of

this article incorrectly said he has been involved since the 1980s.

(July 5)

(END) Dow Jones Newswires

July 06, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

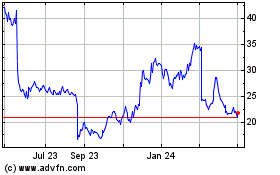

Foot Locker (NYSE:FL)

Historical Stock Chart

From Mar 2024 to Apr 2024

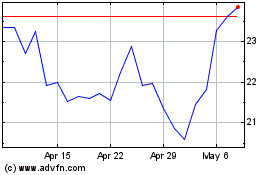

Foot Locker (NYSE:FL)

Historical Stock Chart

From Apr 2023 to Apr 2024