U.S. Futures Decline Ahead of Triple Witching, Oil Prices Edge Lower

June 21 2024 - 8:00AM

IH Market News

U.S. index futures are moderately lower in pre-market trading

this Friday as Wall Street prepares for triple witching, a

significant quarterly event. During this period, derivative

contracts tied to stocks, index options, and futures all expire

simultaneously, forcing traders to roll over their positions or

open new ones. This can increase market volatility, with

approximately $5.5 trillion set to expire on Friday, according to

the options platform SpotGamma.

At 6:52 AM, Dow Jones (DOWI:DJI) futures fell 42 points, or

0.11%. S&P 500 futures declined 0.15%, and Nasdaq-100 futures

lost 0.11%. The yield on 10-year Treasury bonds was at 4.228%.

In the commodities market, West Texas Intermediate crude for

August fell 0.07% to $81.24 per barrel. Brent crude for August fell

0.11%, near $85.62 per barrel. Iron ore traded on the Dalian

exchange fell 0.36% to $111.76 per metric ton.

Friday’s economic calendar begins at 9:45 AM with the release of

preliminary readings of the manufacturing and services Purchasing

Managers’ Indexes (PMI), expected at 51 and 53.7, respectively. At

10:00 AM, the U.S. Department of Commerce will publish data on

May’s existing home sales.

Asian markets mostly ended lower on Friday, impacted by the

Nasdaq’s decline, which affected tech stocks in Hong Kong, South

Korea, and Taiwan. The Hang Seng Index fell -1.67%, while the Kospi

Index fell -0.83%. In mainland China, markets also retreated, with

the Shanghai SE falling -0.24%, pressured by consumer sectors. In

contrast, Japan’s Nikkei had a slight decline of -0.09%. Japan’s

manufacturing PMI rose to 50.5, signaling expansion. The yen is

under watch after recent declines increased the risk of currency

intervention. Bucking the trend, Australia’s ASX 200 rose

+0.34%.

European markets are down today, influenced by the U.S. and the

yen’s depreciation. Despite a brief recovery after the European

Parliament elections and new elections called in France, stocks

fell again. Today, investors are focused on various central bank

decisions and new economic data. The Stoxx 600 index is down, with

the banking and construction sectors leading the losses.

Carlsberg (TG:CBGB) shares fell 7.7% after Britvic

rejected two acquisition proposals, while Britvic

(LSE:BVIC) shares rose 6.9% following the announcement.

On Thursday, major U.S. indexes moved in opposite directions.

The Dow Jones had its best day of the month, rising 0.77% to close

at 39,134.76 points, driven by gains in Salesforce

(NYSE:CRM) and Chevron (NYSE:CVX). In contrast,

the S&P 500 fell 0.25% to 5,473.17 points, and the Nasdaq

dropped 0.79% to 17,721.59 points, with Nvidia (NASDAQ:NVDA)

falling 3.5%. Unemployment claims signaled moderation in employment

growth, falling to 238,000. Meanwhile, housing starts plummeted

5.5% in May, contrary to expectations of a rise. Building permits

fell 3.8%, reflecting weak demand. The data suggested a stable

labor market but potential weakening in the housing sector.

In terms of quarterly reports, Carmax

(NYSE:KMX) and FactSet (NYSE:FDS) are scheduled to

report before the market opens.

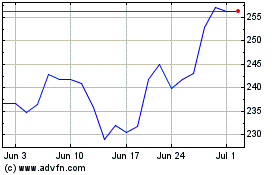

Salesforce (NYSE:CRM)

Historical Stock Chart

From May 2024 to Jun 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Jun 2023 to Jun 2024