0000822370

false

0000822370

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 14, 2023

Emmaus Life Sciences,

Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-35527 |

|

87-0419387 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 21250 Hawthorne Boulevard, Suite 800, Torrance, CA |

|

90503 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code (310) 214-0065

(Former name or former address, if changed, since last

report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| None |

|

|

|

|

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operation and Financial Condition.

On August 14, 2023, Emmaus

Life Sciences, Inc. issued a press release announcing the results of operations and financial condition as of and for the six months

ended June 30, 2023. A copy of the press release is included as Exhibit 99.1 to this Current Report and incorporated herein by reference.

The

information included in this Item 2.02 and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934 (“Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in

such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

See the accompanying Index to Exhibits, which information

is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: August 14, 2023 |

Emmaus Life Sciences, Inc. |

| |

|

|

| |

By: |

/s/ YASUSHI NAGASAKI |

| |

|

Name: |

Yasushi Nagasaki |

| |

|

Title: |

Chief Financial Officer |

INDEX

TO EXHIBITS

Exhibit 99.1

Emmaus Life Sciences Reports Q2 2023 Financial Results

Record Net Revenues Contributed to Income

from Operations

Sixth Straight Quarterly Increase in Net Revenues

Torrance CA, August 14, 2023 - Emmaus Life

Sciences, Inc. (OTCQX: EMMA), a commercial-stage biopharmaceutical company and leader in the treatment of sickle cell disease, today

reported on its financial condition and results of operations as of and for the three and six months ended June 30, 2023.

Recent Highlights

“We are pleased to report record net revenues

for the quarter and six months ended June 30 owing to a jump in sales in the Middle East North Africa region and continuing recovery in

U.S. sales compared to 2022. As a result, we were able to generate over $3.3 million in quarterly income from operations. Net revenue

growth accelerated in the quarter, and we hope to continue this trend through the end of the year even without regard to the prospects

for potential marketing approval of Endari in the Kingdom of Saudi Arabia,” remarked Yutaka Niihara, M.D., M.P.H., Chairman and

Chief Executive Officer of Emmaus.

Financial and Operating Results

Net Revenues. Net revenues for the three months

and six months ended June 30, 2023 were $10.8 million and $17.5 million, respectively, compared to $4.3 million and $7.5 million, respectively,

for same periods in 2022. The increased net revenues were primarily attributable to a $4.1 million increase in net revenues from sales

in the Middle East North Africa (MENA) region in Q2 2023. Net revenues in Q2 and the three months and six months ended June 30, 2023 also

were positively affected by increased U.S. sales compared to the same periods in 2022.

Operating Expenses. Total operating expenses

for the three months ended June 30, 2023 were $6.9 million, compared with $5.3 million for the same periods in 2022. Of the increased

operating expenses in Q2 2023, $0.6 million was attributable to an increase in payroll expenses related to sales personnel and $1.0 million

increase in general and administrative expenses. Total operating expenses for the six months ended June 30, 2023 were $14.4 million, compared

with $10.6 million for the same period in 2022. The increase was due to a $1.2 million increase in share-based compensation, a $0.8 million

increase in payroll expenses and a $0.6 million increase in consulting fees.

Income From Operations. Income from operations

for the three months ended June 30, 2023 was $3.3 million, compared to a loss from operations of $1.4 million in the same periods in 2022.

Income from operations for the six months ended June 30, 2023 increased to $2.2 million, compared to a loss from operations of $4.5 million

for the same period last year. The increase income from operation resulted from higher new revenues in 2023 compared to 2022. Income from

operations in Q2 2023 also increased by $4.5 million, or 385%, from $1.2 million loss from operations in Q1 2023 as a result of the increase

in net revenues in Q2 2023.

Other Expense. Other expenses decreased to

$4.8 million for the three months ended June 30, 2023, compared to $7.3 million in the same period in 2022. Other expenses for the six

months ended June 30, 2023 increase to $7.2 million from $5.8 million in the same period in 2022. Other expenses in Q2 2023 included a

decrease of $2.6 million in change in fair value of embedded conversion option of convertible promissory notes, partially offset by a

$0.5 million increase in interest expense compared to Q2 2022.

Net Loss. For the quarter, the company

realized a net loss of $1.5 million, or $0.03 per share based on approximately 52.9 million weighted average basic and diluted common

shares. This compares to a net loss of $8.9 million, or $0.18 per share based on approximately 49.3 million weighted average basic and

diluted common shares for the second quarter of 2022. The decrease in net loss was primarily attributable to the increase in income from

operations and decrease in other expenses discussed above.

For the six months ended June 30, 2023, the company

reported a net loss of $5.0 million, or $0.10 per share, based on approximately 51.8 million weighted average basic and

diluted common shares. This compares to a net loss of $10.4 million, or $0.21 per share, based on approximately 49.3 million

weighted average basic and diluted common shares for the six months ended June 30, 2022. The decrease was due to the increase in

net revenues, partially offset by the increase in operating expenses.

Liquidity and Capital Resources. On June 30,

2023, the company had cash and cash equivalents of $1.4 million, compared with $2.0 million on December 31, 2022.

About Emmaus Life Sciences

Emmaus Life Sciences, Inc. is a commercial-stage biopharmaceutical

company and leader in the treatment of sickle cell disease. Endari® (L-glutamine oral powder), indicated to reduce the acute complications

of sickle cell disease in adults and children 5 years and older, is approved for marketing in the United States, Israel, Kuwait, Qatar,

the United Arab Emirates, Bahrain and Oman and is available on a named patient or early access basis in France, the Netherlands, and the

Kingdom of Saudi Arabia, where Emmaus’ application for marketing authorization is awaiting final action by the Saudi Food &

Drug Authority. For more information, please visit www.emmausmedical.com.

About Endari® (prescription grade

L-glutamine oral powder) Endari®, Emmaus’ prescription grade L-glutamine oral powder, was approved by the U.S. Food and

Drug Administration (FDA) in July 2017 for treating sickle cell disease in adult and pediatric patients five years of age and

older.

Indication

Endari® is indicated to reduce the acute complications

of sickle cell disease in adult and pediatric patients five years of age and older.

Important Safety Information

The most common adverse reactions (incidence >10

percent) in clinical studies were constipation, nausea, headache, abdominal pain, cough, pain in extremities, back pain, and chest pain.

Adverse reactions leading to treatment discontinuation

included one case each of hypersplenism, abdominal pain, dyspepsia, burning sensation, and hot flash.

The safety and efficacy of Endari® in pediatric

patients with sickle cell disease younger than five years of age has not been established.

For more information, please see full Prescribing

Information of Endari® at: www.ENDARIrx.com/PI.

About Sickle Cell Disease

There

are approximately 100,000 people living with sickle cell disease (SCD) in the United States and millions more globally. The

sickle gene is found in every ethnic group, not just among those of African descent; and in the United States an estimated

1-in-365 African Americans and 1-in-16,300 Hispanic Americans are born with SCD.1 The genetic mutation responsible for

SCD causes an individual's red blood cells to distort into a "C" or a sickle shape, reducing their ability to transport oxygen

throughout the body. These sickled red blood cells break down rapidly, become very sticky, and develop a propensity to clump together,

which causes them to become stuck and cause damage within blood vessels. The result is reduced blood flow to distal organs, which leads

to physical symptoms of incapacitating pain, tissue and organ damage, and early death.2

1Source: Data & Statistics on Sickle Cell

Disease – National Center on Birth Defects and Developmental Disabilities, Centers for Disease Control and Prevention, December

2020.

2Source: Committee on Addressing Sickle Cell Disease – A Strategic Plan and Blueprint for Action -- National Academy

of Sciences Press, 2020.

Forward-looking Statements

This press release contains forward-looking statements

made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended, including statements

regarding the trend in sales in the MENA region and in the U.S. and need for related-party loans or other financing needed to meet our

current liabilities and fund our business and operations. These forward-looking statements are subject to numerous assumptions, risks

and uncertainties which change over time, including factors disclosed in the company’s Annual Report on Form 10-K for the year ended

December 31, 2022 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023 and June 30, 2023 filed with the Securities

and Exchange Commission on March 31, 2023, May 15, 2023 and August 14, 2023, respectively, and actual results may differ materially. Such

forward-looking statements speak only as of the date they are made, and Emmaus assumes no duty to update them, except as may be required

by law.

Company Contact:

Emmaus Life Sciences, Inc.

Willis Lee

Chief Operating Officer

(310) 214-0065, Ext. 1130

wlee@emmauslifesciences.com

(Financial Tables Follow)

Emmaus Life Sciences, Inc.

Condensed Consolidated Statement of Operations and Comprehensive Income Loss

(In thousands, except share and per share amounts) (Unaudited)

| | |

Three Months Ended

June 30 | | |

Six Months Ended

June 30 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues, Net | |

$ | 10,759 | | |

$ | 4,287 | | |

$ | 17,512 | | |

$ | 7,521 | |

| Cost of Goods Sold | |

| 508 | | |

| 396 | | |

| 937 | | |

| 1,403 | |

| Gross Profit | |

| 10,251 | | |

| 3,891 | | |

| 16,575 | | |

| 6,118 | |

| Operating Expenses | |

| 6,925 | | |

| 5,331 | | |

| 14,414 | | |

| 10,626 | |

| Income (Loss) from Operations | |

| 3,326 | | |

| (1,440 | ) | |

| 2,161 | | |

| (4,508 | ) |

| Total Other Expenses | |

| (4,842 | ) | |

| (7,270 | ) | |

| (7,155 | ) | |

| (5,847 | ) |

| Net Loss | |

| (1,482 | ) | |

| (8,892 | ) | |

| (5,009 | ) | |

| (10,434 | ) |

| Comprehensive Income (Loss) | |

| 1,381 | | |

| (12,664 | ) | |

| (2,504 | ) | |

| (13,518 | ) |

| Net Loss Per Share | |

($ | 0.03 | ) | |

($ | 0.18 | ) | |

($ | 0.10 | ) | |

($ | 0.21 | ) |

| Weighted Average Common Shares Outstanding | |

| 52,865,353 | | |

| 49,319,995 | | |

| 51,793,445 | | |

| 49,315,952 | |

Emmaus Life Sciences, Inc.

Condensed Consolidated Balance Sheets

(In thousands)

| | |

As of | |

| | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | |

| |

| Current Assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 1,361 | | |

$ | 2,021 | |

| Accounts receivable, net | |

| 5,573 | | |

| 375 | |

| Inventories, net | |

| 1,814 | | |

| 2,379 | |

| Prepaid expenses and other current assets | |

| 1,099 | | |

| 1,514 | |

| Total Current Assets | |

| 9,847 | | |

| 6,289 | |

| Property and equipment, net | |

| 68 | | |

| 75 | |

| Equity method investment | |

| 18,302 | | |

| 18,828 | |

| Right of use assets | |

| 2,585 | | |

| 2,799 | |

| Investment in convertible bond | |

| 19,210 | | |

| 19,971 | |

| Other Assets | |

| 276 | | |

| 263 | |

| Total Assets | |

$ | 50,288 | | |

$ | 48,225 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Deficit | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 15,200 | | |

$ | 13,549 | |

| Conversion feature derivative, notes payable | |

| 4,217 | | |

| 3,248 | |

| Notes payable, current portion | |

| 8,462 | | |

| 6,814 | |

| Convertible notes payable, net of discount | |

| 14,306 | | |

| 14,655 | |

| Other current liabilities | |

| 19,362 | | |

| 16,057 | |

| Total Current Liabilities | |

| 61,547 | | |

| 54,323 | |

| Notes payable, less current portion | |

| 0 | | |

| 380 | |

| Other long-term liabilities | |

| 23,773 | | |

| 27,613 | |

| Total Liabilities | |

| 85,320 | | |

| 82,316 | |

| Stockholders’ Deficit | |

| (35,032 | ) | |

| (34,091 | ) |

| Total Liabilities & Stockholders’ Deficit | |

$ | 50,288 | | |

$ | 48,225 | |

5

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

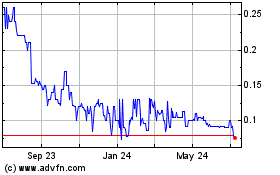

Emmaus Life Sciences (QX) (USOTC:EMMA)

Historical Stock Chart

From May 2024 to Jun 2024

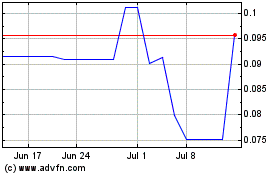

Emmaus Life Sciences (QX) (USOTC:EMMA)

Historical Stock Chart

From Jun 2023 to Jun 2024