Back in 2008, the world faced one of the worst crises ever experienced by our economic systems. Theoretically, this tragic experience should have taught us not to inflate new bubbles and use monetary policies with caution. Unfortunately, time has shown that central banks will do everything to keep economies growing and stabilizing national currencies, as Mario Draghi stated at speech in London on July 26, 2012, “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

Despite deteriorating macroeconomic data, certain instability and, of course, Coronavirus, markets continue to grow. A huge mass of liquidity does not allow indexes to fall, despite the high risks of the global economy. No one can yet predict or calculate the possible losses of the world economy from coronavirus. All estimates are purely theoretical, because we still do not know when the epidemic is going to end. According to the latest data, about 40 thousand are ill, and the number of deaths exceeded 900. Thus, the current virus already surpassed the SARS epidemic in 2002-2003. DataTrek Research co-founder Nicholas Colas said, in turn, that it is “useless to compare how US/Global equities fared under SARS in 2003 to the coronavirus today,” as the economic backdrop in 2002 and 2003 was very different from what it is today.

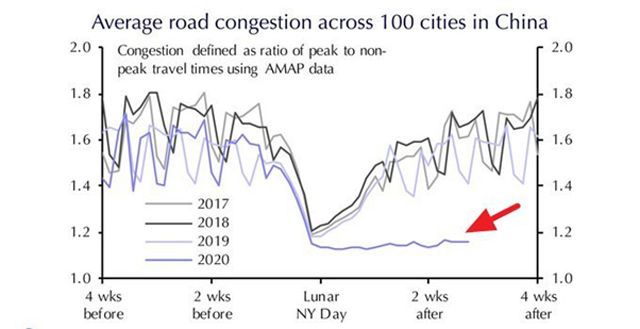

Either way, it is worth paying tribute to the Chinese government as they are doing everything they can to stop further spread of the virus.

According to approximate estimations, Hubei represents around 4,5% or $640 billion in Chinese GDP. Back in 2015 Hubei ranked 2nd among the six provinces in central China and 8th among all provinces in China. If we consider that during the quarantine period the province does not contribute to the economy, then every day of idleness costs about $1.8 billion. If the situation continues during the following month, Chinese GDP may lose almost 0,6% in 2020. In other words, if previously we expected Chinese economy to grow 6,0% in 2020, it may show only 5,$% growth.

Nevertheless, markets are still showing growth… What does all this mean? A huge bubble is brewing. It can grow for a long time, and can explode at any time. The question is when. In order to find the right answer we would recommend following the inflation. As noted by Economist, Guillermo Padron, the velocity of money slows during recessions, and the slowdown can linger for many months. He suggests comparing 1972 vs 2019, paying closer attention to the following events:

- Large increase of money supply in late 60s

- Recovering from a recession

- FED lowers interest rated persuaded by Nixon

- Stock Market rises due to low interest rates

- M2 Velocity dropping, preventing inflation until we reach Dec 31 1972 when M2 Velocity starts to gain momentum, triggering a “Monetary chain reaction”, impossible to stop.

Meantime, investors’ appetite for risks is growing, investors are being pushed into a high-risk zone, and they are buying without thinking about the consequences. Eventually, tsunami will come but until the Fed continues purchasing T- bills, things will continue to go smoothly.

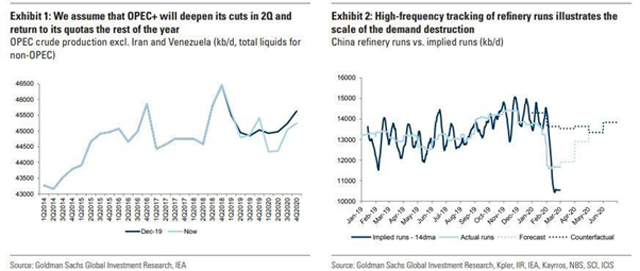

Finally yet importantly, Goldman has cut its oil price target by $10 to $53 in Q1 through the end of the year, due to a loss of as much as 4 million barrels per day out of China.

The previous week in the markets

Currency Indices

On Monday, we have Presidents’ Day holiday, thus U.S. financial markets closed.

On Tuesday, the Housing Market Index will be released.

On Wednesday, minutes from January 28–29 meeting of the U.S. Federal Reserve Board, Housing starts and Producer Price Index, will be published.

On Thursday, we will pay attention to the Conference Board Leading Economic Index for the U.S.

On Friday, existing home sales will be provided.