GBPJPY Price Analysis – June 21

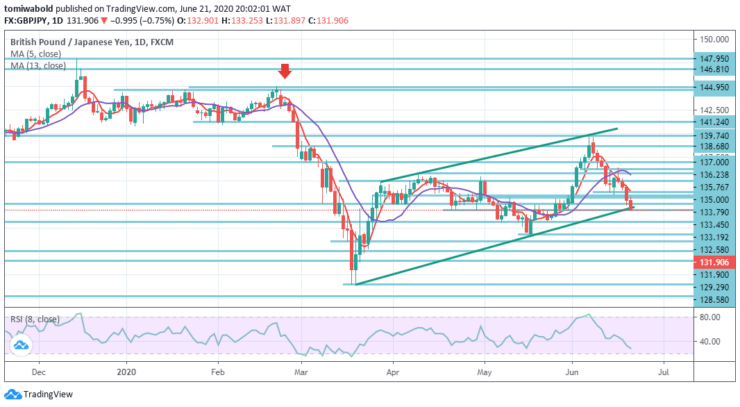

In the last session, the GBPJPY cross lost some extra ground and slipped to new monthly lows while staying beneath the 132.00 level. The collapse was supported by the strongly offered tone encircling the British pound which accompanied the last session’s policy decision by the Bank of England (BoE).

Key Level

Resistance Levels: 147.95, 139.74, 136.23

Support Levels: 129.29, 123.99, 122.75

GBPJPY Long term Trend: Ranging

GBPJPY Long term Trend: Ranging

In the wider context, we’re witnessing price actions from 122.75 (low) level, which is observed as a sideways consolidation trend. So long the resistance level of 147.95 holds, there is a potential downside breakout in support.

A strong breach of 147.95 level may however increase the risk of a long-term bullish reversal. Then the emphasis is shifted to the level of resistance of 156.59 for validation.

GBPJPY Short term Trend: Bearish

GBPJPY Short term Trend: Bearish

GBPJPY’s decline from the short term high level of 139.74 stretched to as low as last week’s level of 131.90. A recent trend implies a corrective recovery from level 123.99 has been accomplished with 3 phases to level 139.74. This week’s initial bias stays on the downside with support level 129.29.

A strong breach there will affirm this bearish scenario and open the way for low-level retests of 123.99. On the positive side, to signify the finalization of the collapse, a breakage of 136.23 minor resistance level is required. Alternatively, in the circumstance of recovery, further collapse is anticipated.

Source: https://learn2.trade