TIDMXPF

RNS Number : 9104A

XP Factory PLC

28 September 2022

28 September 2022

XP Factory plc

("XP Factory", the "Company" or the "Group")

Interim Results

XP Factory plc (AIM: XPF), a global leader in the experiential

leisure sector, is pleased to announce its unaudited interim

results for the six months ended 30 June 2022 ("H1 2022").

Half year Half year

ended 30 June ended 30 June

2022 (GBP'000) 2021 (GBP'000)

Revenue 8,120 1,178

---------------- ----------------

Gross Profit 5,096 801

---------------- ----------------

Adjusted EBITDA [1]

profit / (loss) 1,070 (796)

---------------- ----------------

Loss per share (pence) (2.20) (2.81)

---------------- ----------------

FINANCIAL HIGHLIGHTS

-- Group revenue of GBP8.1m (2021: GBP1.2m) demonstrates

a significant growth in scale and includes:

* Escape Hunt owner operated site revenue increased to

GBP4.3m (2021: GBP0.9m)

* Boom Battle Bar ("Boom") revenue of GBP3.6m comprised

GBP2.2 from owner operated sites and GBP1.4m from

franchises

-- Group Adjusted EBITDA(1) profit of GBP1.1m (H1 2021: loss

GBP0.8m)

-- Site level EBITDA profit of GBP3.1m (H1 2021: profit GBP0.4m)

-- Group Operating loss of GBP2.4m (H1 2021: loss GBP2.2m)

-- Loss per share of 2.2p (H1 2021: loss of 2.81p)

-- Cash at 30 June 2022 of GBP5.2m (30 June 2021: GBP2.4m)

OPERATING HIGHLIGHTS

-- Significant progress made in establishing the UK owner

operated network both for Escape Hunt and Boom

-- 17 UK Boom sites open at 30 June 2022 - 4 owner operated

and 13 franchised

-- 19 owner-operated Escape Hunt sites open at 30 June 2022

-- Pipeline of additional new sites well established for both

businesses

-- Escape Hunt exceeded its pre IFRS 16 target site level

EBITDA margin (39% vs 30%)

-- Boom Battle Bar owner operated sites already beginning

to demonstrate their ability to achieve mature target EBITDA

margins

POST PERIOD- HIGHLIGHTS

-- Escape Hunt and Boom currently performing well with pleasing

level of sales being achieved

-- Continuing growth in the returns being achieved across

the Boom owner operated sites

-- Acquisition of the former Boom franchise site in Cardiff

completed on 8 September 2022

-- Acquisition of the former Boom franchise site in Norwich

completed on 16 August 2022

-- Further owner operated Boom sites opened in September

2022 in Edinburgh and Plymouth and an additional Boom

franchise sites opened in Sheffield in July 2022 and Chelmsford

in September 2022 taking the total to 21 open sites, comprising

8 owner operated and 13 franchise sites

-- 2 further owner operated Escape Hunt sites opened, in

Norwich in August 2022 and Edinburgh in September 2022,

taking the total to 21 owner operated sites

-- Additional owner operated Boom sites in build in London

(Oxford Street), Leeds, and Birmingham

-- Further franchised Boom sites in build in Southampton

and Bournemouth

-- Additional owner operated Escape Hunt sites in build in

London (Oxford Street) and Bournemouth

-- All UK Escape Hunt owner operated sites operating for

more than a year awarded 'Traveller's Choice Awards' by

Tripadvisor (TM)

-- Boom consumer ratings significantly outperforming peers

and the industry

Recent performance across the estate has been encouraging with

no discernible impact from consumer weakness. The Board remains

focussed on providing the best possible customer experience to an

ever growing number of customers across the UK and beyond and will

keep a careful eye on consumer behaviour in the context of the

macro-economic environment and be ready to react if there is any

sign of an impact.

Notwithstanding the encouraging recent performance, the Group's

full year results are heavily weighted to the final quarter's

trading and will be influenced by, inter alia, the dates on which

sites currently in build are able to open, how quickly the

performance at those sites tracks through the maturity curve, and

the strength of pre-Christmas trading generally.

Richard Harpham, Chief Executive of XP Factory, commented :

"2022 represents an important year in our evolution as we continue

to build the platform for a sustainable, cash generative and

profitable experiential leisure business.

We have made significant progress towards our goals, growing the

Boom estate to 21 sites today from only seven when we acquired it

in November 2021 . We have also grown our Escape Hunt business to

21 owner operated sites today, with the brand continuing to perform

well, generating strong returns at a site level.

With each successive week, Boom's trading performance reinforces

our belief that it is a very attractive proposition, capable of

delivering strong margins and an exceedingly attractive return on

capital. We are delighted with the progress we have made and

believe that by the end of the year, the foundations will be firmly

set for the business in 2023 and beyond."

[1] Earnings before interest, tax, depreciation and

amortization, calculated before pre-opening losses, exceptional

items, and other non-cash items. A full reconciliation to operating

loss is provided below in the text of the announcement.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries

XP Factory plc

Richard Harpham (Chief Executive Officer)

Graham Bird (Chief Financial Officer) +44 (0) 20 7846

Kam Bansil (Investor Relations) 3322

Shore Capital - NOMAD and Joint Broker +44 (0) 20 7408

Tom Griffiths, David Coaten (Corporate Advisory) 4050

IFC Advisory - Financial PR

Graham Herring +44 (0) 20 3934

Florence Chandler 6630

About XP Factory plc

The XP Factory Group is one of the UK's pre-eminent experiential

leisure businesses which currently operates two fast growing

leisure brands. Escape Hunt is a global leader in providing

escape-the-room experiences delivered through a network of

owner-operated sites in the UK, an international network of

franchised outlets in five continents, and through digitally

delivered games which can be played remotely.

Boom Battle Bar is a fast-growing network of owner-operated and

franchised sites in the UK that combine competitive socialising

activities with themed cocktails, drinks and street food in a high

energy setting. Activities include a range of games such as

augmented reality darts, Bavarian axe throwing, 'crazier golf',

shuffleboard and others. The Group's products enjoy premium

customer ratings and cater for leisure or teambuilding, in small

groups or large, and are suitable for consumers, businesses and

other organisations. The Company has a strategy to expand the

network in the UK and internationally, creating high quality games

and experiences delivered through multiple formats and which can

incorporate branded IP content. ( https://xpfactory.com/ )

CHIEF EXECUTIVE'S REPORT

INTRODUCTION

The first half of 2022 has been transformational. In November

2021 we acquired Boom Battle Bar ("Boom") and renamed the Group XP

Factory plc, creating one of the UK's pre-eminent experiential

businesses, operating two fast growing bands, Escape Hunt(TM) and

Boom Battle Bar(TM). At the time of acquisition, Boom was a very

young business, with just seven UK sites open; six of which were

franchised and one of which was owner operated and all of which had

less than twelve months' operating history.

We set ambitious targets to grow the footprint alongside our

existing Escape Hunt network. Activity in the first half of the

year has been focused on bringing the businesses together,

executing on the ambitious site roll-out plans and investing in the

operations of the new business. As at 30 June 2022, the Boom estate

stood at 17 opened sites; four owner operated and 13

franchises.

We also extended our Escape Hunt estate, adding a site in

Exeter, co-located with Boom, bringing the owner operated estate to

19. Since 30 June 2022, we have further extended the estate,

acquiring former Boom franchise sites in both Cardiff and Norwich,

opening a further co-located owner-operated Boom and Escape Hunt

site in Edinburgh, opening a new Escape Hunt site in Norwich,

opening a new Boom owner operated site in Plymouth, and opening

Boom franchise sites in Sheffield and Chelmsford. Several more

sites are in build as set out below.

This activity has set the scene for a year which will deliver a

group of significantly larger scale and capability compared to a

year ago. The objective for the year is to build the foundations of

a network of Boom Battle Bar and Escape Hunt owner operated and

franchise sites capable of delivering strong cashflows and a high

return on capital for years to come. Alongside the efforts to open

new sites, we have also focused on building capability in our

operational teams, who are now delivering the financial model we

believed Boom could be capable of, whilst continuing to nurture

Escape Hunt. We are delighted to have made such significant

progress towards these goals.

With such an aggressive rate of new site openings relative to

the Group's small size at the beginning of the year, it would be

almost impossible to predict with total accuracy the specific week

in which each new site would open. Whilst most of our owner

operated builds have been delivered broadly in line with our

expectations, there have been delays in the openings of certain

owner-operated sites and in a number of the franchise sites, but

nonetheless the Board remains confident that its target of 27 open

sites for the year end will be achieved. We are of course acutely

aware of the current pressures on consumer discretionary spend. As

a high margin business we feel as confident as we can be that we

can absorb the inflationary pressures and weather the storm by

continuing to focus on providing an outstanding customer experience

and value for money. Indeed we have been very encouraged by the

resilience in trading in the weeks post 30 June 2022.

Our full year outcome is skewed heavily towards performance in

the second half of the year, notably the final quarter, and this is

further amplified in the current year given the number of

additional site opening that are still to come. However, we believe

the results for the first half represent a solid performance which

sets the business up well for the remainder of the year and

beyond.

BOOM BATTLE BARS

Much focus during the period has been on Boom Battle Bars; the

expansion of the network in line with previously announced plans,

both owner operated and franchised sites; the integration of the

business into the Group; and development of the operational

processes and teams to deliver on Boom's potential.

Owner operated

We have made excellent progress towards our objectives. At the

start of the year, we had two owner operated sites open; one at

Lakeside shopping centre in Essex and one in the O2 Arena. The O2

site was opened shortly before Christmas, although we delayed the

formal launch due to the spread of the Omicron virus and subsequent

cancellation of all events at the O2 during January and most of

February 2022. Although open in the intervening period, the O2 Boom

held its formal opening event in April 2022. We also opened a new

site co-located with Escape Hunt in Exeter in late April and our

fourth site, located in Manchester, opened in late June 2022. At

the end of the period we had four owner operated sites open.

All four sites have shown encouraging performance in the months

of operating, in line with an expected maturity curve typical for

hospitality businesses. We expect sites to run at a loss for a

number of weeks as awareness grows and translates into revenue

growth, whilst labour and other costs will start higher than the

longer-term target and be brought down as the sites find their

operating rhythm. The owner operated estate delivered unaudited

revenue of GBP2.2m in the six months to 30 June 2022 and a site

EBITDA loss of GBP164k (GBP729k loss before IFRS16) reflecting the

maturity curve of the new sites. Performance across the estate has

shown the steady improvement we would expect, with target margins

being achieved as the sites mature. We remain confident that the

business model and returns profile for sites will be delivered,

with target EBITDA margins in excess of 20% and a target cash

return on capital of over 40%.

Our sites in central London (Oxford Street) and in Edinburgh

have caused some frustrations. In both cases, planning and other

landlord-related formalities have resulted in significant delays

compared to our original plans. We are pleased that our Edinburgh

site recently opened on 23 September 2022, and we are now 7 weeks

into the build at our site on Oxford Street, which is scheduled to

open before Christmas.

We are not immune to inflationary cost pressures, notably in

energy prices. We also anticipate wage pressure as inflation

filters through the system. The former represents a relatively low

proportion of our costs whilst we are confident the latter can be

managed through labour flexibility and, in future, by passing on an

element of our increased costs through prices. As a result, we have

no reason to believe our expectation of the potential margins from

our sites should change meaningfully.

Since 30 June 2022, we have commenced builds on four

owner-operated sites, in London (Oxford Street), Birmingham,

Plymouth and Leeds. Plymouth opened on 22 September 2022 and the

others are all expected to open during Q4 2022. We have also

completed the acquisition of the former franchise sites in Cardiff

and Norwich. Together with the owner operated sites in Edinburgh

and Plymouth that have since opened, these developments will take

our owner operated estate to 11, well ahead of our previously

announced objective of 7 by the end of 2022 and establishing a

strong baseline for 2023.

Franchise

The Boom franchise network was expanded significantly in the six

months to 30 June 2022 with the addition of a further seven

franchise sites. As at 30 June 2022 there were 13 franchise sites

open. Two further franchise sites have since opened; the first in

Sheffield opened in July, and a second in Chelmsford opened in

September. Another two sites are currently in build in Bournemouth

and Southampton. A further site in Telford has been signed and

several more sites are in advanced legals. Whilst we factor in

potential delays to franchise site openings, timing is not in our

control. On average, sites have been several months later to open

than initially indicated.

Boom franchise activities delivered unaudited revenue of GBP1.4m

and EBITDA of GBP0.9m in the six months ended 30 June 2022.

ESCAPE HUNT

Owner operated

The Escape Hunt owner operated estate generated unaudited

revenue of GBP4.3m, representing a 361% increase on the GBP0.9m

delivered in the same period in 2021, although all our UK venues

and our venues in Paris and Brussels were closed for the majority

of the comparable period in 2021. Site level EBITDA rose to GBP2.1m

from GBP0.2m. On a pre-IFRS16 basis, site level EBITDA was GBP1.7m

(H1 2021: loss GBP46k), representing a margin of 39%, significantly

ahead of our internal target of 30% EBITDA margin. The margin

outperformance was helped by the reduced VAT rate and business

rates reduction applied between January and March 2022 and which

ended on 1 April 2022. Underlying EBITDA margins, excluding the VAT

benefit, continue to track ahead of our internal target.

We have made further progress on the growth of the network and

integration with Boom. A new owner operated site, co-located with

Boom Battle Bar opened in Exeter in late April 2022. We opened a

second owner-operated site in Norwich shortly after the period end

in August 2022 and, after frustrating delays, opened a third

co-located site in Edinburgh on 23 September 2022. Two further

sites are in build in London (Oxford Street), co-located with Boom,

and in Bournemouth, where our site is adjacent to a Boom franchise

site, also in build.

The network today comprises 21 owner-operated sites and the

completion of sites in Bournemouth and Oxford Street will take the

total to 23.

Franchise

The franchise estate delivered unaudited revenue of GBP0.2m. The

Australian network performed in line with the same period in 2021

and we have seen a recovery within the European network compared to

the same period in 2021 during which many of the sites were closed.

This increase is offset by lower upfront and other fixed fees.

Some modest progress was made in the USA in late 2021. The

franchise site in Houston, which is operated by our partners,

Proprietary Capital Holdings, added two new generation games in

December 2021 and is now set up as a reference site to demonstrate

to potential franchise partners in North America. Performance in

Houston has been tracking strongly in 2022. Franchise recruitment

activity all but ceased during Covid and has been slow to

re-start. We expect to give greater attention to the US potential in 2023.

FINANCIAL REVIEW

Financial performance

Unaudited group revenue in the six months to 30 June 2022 was

GBP8.1m, an increase of 589% over the same period in 2021. The

period to 30 June 2022 includes GBP3.6m of revenue from Boom

owner-operated and franchise activities (2021: nil.. The increase

also reflects that the majority of Escape Hunt venues were closed

for much of the first half of 2021 due to Covid restrictions.

Site level EBITDA was GBP3.1m (2021: GBP0.4m), offset by central

costs of GBP2.0m (2021: GBP1.2m). As a result, Group Adjusted

EBITDA was GBP.1.1m compared to a loss of GBP0.8m in H1 of

2021.

Six months Six months

ended June ended June

2022 2021

GBP'000 GBP'000

Adjusted EBITDA 1,070 (796)

Amortisation of intangibles (455) (216)

Depreciation (1,720) (1,038)

Rent credits recognised 25 25

Loss on disposal of tangible assets (156) (18)

Profit on closure/modification of

leases 105 -

Branch closure costs and other exceptional

costs (288) (147)

Branch pre-opening costs (881) -

Provision against loan to franchisee (21) -

Foreign currency gains / (losses) 44 (6)

IFRS 9 provision for guarantee losses (57)

Share-based payment expense (34) (26)

---------------------------------------------- ----------- ------------

Operating loss (2,368) (2,222)

Of the GBP881k of branch pre-opening costs, GBP52k related to

Escape Hunt owner operated sites, GBP821k related to Boom Battle

Bar owner operated sites, and GBP7k related to Boom Battle Bar

franchise sites. Pre-opening costs (whilst not all cash) include

costs accrued before the site is opened to the public, such as rent

and other property costs, staff recruitment and training costs.

The branch closure costs and the loss on disposal of tangible

assets relate to the closure of the Escape Hunt Edinburgh site and

the final liquidation of Escape Hunt's original subsidiaries in

Malaysia and Thailand, for which the process has taken several

years to complete.

Unaudited group operating loss was GBP2.4m (2021: GBP2.2m)

Cashflow

The Group generated GBP0.8m of cash from operations (2021: cash

utilised of GBP0.1m). GBP3.4m (net of capital contributions) was

invested in plant and equipment and intangibles. This comprised

total investment of GBP3.4m offset by GBP0.8m of capital

contributions for Boom owner-operated sites and GBP0.8m investment

in Escape Hunt owner operated sites.

Cash at 30 June 2022 was GBP5.2m (30 Jun 2021: GBP2.4m) and

GBP3.7m as at 31 August 2022.

Financial position

The increase in property plant and equipment reflects the

investment in owner operated sites outlined above, offset by

depreciation. The increase in right of use assets is matched by an

increase in lease liabilities and relates to the IFRS 16 accounting

for new owner operated sites signed during the six month period.

The finance lease receivable relates to the IFRS 16 accounting for

a sub-let of the Bournemouth venue to a Boom Battle Bar franchisee

as XP Factory holds the master lease.

The largest movement in current assets related to the receipt of

the GBP1.8m (net) R&D credit paid in January 2022.

Provisions of GBP9.9m includes deferred and contingent

consideration relating to the acquisition of Boom Battle Bars in

November 2021. GBP9.4m is the valuation of contingent

consideration, inclusive of 13.7% p.a. notional interest rolled up

from the date of acquisition, the payment of which depends on the

achievement of certain turnover and site numbers from the Boom

acquisition in the year to 31 December 2022. Details of the

contingent consideration are outlined in the Company's Annual

Report for the year to 31 December 2021. The contingent

consideration is payable by the issue of up to 25m XP Factory plc

shares, valued at the date of acquisition at 35.8p. The balance

relates to a working capital and net debt adjustment for the Boom

acquisition, provided for post acquisition.

GBP340k of convertible loan notes issued in July 2020, together

with GBP54k of rolled up interest were converted to equity on 2

February 2022 at 9.0p per share, resulting in the issue of 4.4m

shares. There were no convertible loan notes in issue at 30 June

2022. GBP404k of vendor loan notes (GBP360k relating to the

acquisition of Boom in November 2021 and GBP44k relating to the

acquisition of the French master franchise in March 2021) remained

outstanding at 30 June 2022. Other loans outstanding at 30 June

2022 totalling GBP755k relate to fit-out finance for Boom sites, of

which GBP418k is offset by corresponding back-to-back receivable

amounts.

Net assets as at 30 June 2022 stood at GBP18.8m (31 December

2021: GBP21.8m)

STRATEGY

At the time of the acquisition of Boom Battle Bars in November

2021 we set out a four-point plan to increase shareholder value.

Progress has made in each of these medium-term objectives as set

out above. Our objectives are to:

1. Maximise the UK footprint by rolling out each brand,

either through direct investment into owner operated sites

or through franchise arrangements

2. Accelerate growth in international territories, predominantly

through franchise

3. Continue to develop new products and markets which facilitate

the growth of B2B sales

4. Integrate the businesses, exploit synergies where possible

and develop an infrastructure that supports scale and future

growth

Details of our progress in growing the UK footprint and the

integration of Boom have been described in some detail above. We

have intentionally de-emphasised international expansion in the

period as we focused on the intensive roll-out strategy in the UK.

We expect to place greater emphasis on international opportunities

once we have a period of profitable operating experience in the UK.

Our efforts to build a greater B2B business are being rewarded,

particularly within Boom. Corporate sales represented approximately

6% of sales in the six months to 30 June 2022. In the period since

then, we have seen a marked increase in corporate sales, and in the

period since 30 June 2022 corporate sales have grown to represent

approximately 12% of sales. We expect this to grow further in Q4

2022.

POST PERIOD TRADING AND OUTLOOK

Trading since 30 June 2022 has continued positively. In the 10

weeks to 12 September 2022 UK Escape Hunt owner-operated estate

generated unaudited turnover of approximately GBP1.7m, an increase

of 11% compared to the same ten-week period in 2021. Adjusting for

the VAT benefit received in 2021, the underlying increase was 27%,

reflecting an enlarged network and 8% like-for-like growth from

sites which were open in the same period in 2021. Escape Hunt site

level EBITDA margins continue to exceed the Board's internal

benchmark of 30%.

The Boom owner operated sites [2] delivered unaudited turnover

of approximately GBP1.4m for the ten weeks to 12 September 2022 and

each of the Group's sites has proved capable of delivering margins

in line with our expected box economics within the first few months

of operating, underpinning c onfidence in the Group's business

model. Boom franchise royalties in the 10 weeks to 12 September

2022 totalled approximately GBP0.3m.

(2) 6 weeks with 4 sites open; 3.5 weeks with 5 sites open; and

0.5 weeks with 6 sites open.

This performance provides the Board with continued confidence

for the future potential for the Group.

Recent performance across the estate has been encouraging with

no discernible impact from consumer weakness. The Board remains

focussed on providing the best possible customer experience to an

ever growing number of customers across the UK and beyond. The

Board will keep a careful eye on consumer behaviour in the context

of the macro-economic environment and be ready to react if there is

any sign of an impact.

Notwithstanding the recent performance, the Group's full year

results are heavily weighted to the final quarter's trading and

will be influenced by, inter alia, the dates on which sites

currently in build are able to open and how quickly the performance

at those sites tracks through the maturity curve, and the strength

of pre Christmas trading generally

Richard Harpham

Chief Executive Officer

27 September 2022

STATEMENT OF DIRECTORS' RESPONSIBILITIES IN RESPECT OF THE

CONDENSED INTERIM REPORT AND CONDENSED FINANCIAL STATEMENTS

The directors confirm that the condensed consolidated interim

financial information has been prepared in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', and that the Interim Report includes a fair review of

the information required by DTR 4.2.7R and DTR 4.2.8R, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed

consolidated interim financial information, and a description

of the principal risks and uncertainties for the remaining

six months of the financial year; and

-- material related-party transactions in the first six months

and any material changes in the related-party transactions

described in the last Annual Report.

A list of current directors is maintained on the Company's web

site: https://www.xpfactory.com/investors/key-people

By order of the Board

Richard Rose

Non-Executive Chairman

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2022

Six months Six months

ended ended

30 June 2022 30 June 2021

Note Unaudited Unaudited

GBP'000 GBP'000

Continuing operations

Revenue 8,120 1,178

Cost of sales (3,024) (377)

Gross profit 5,096 801

Other income 128 341

Administrative expenses (7,592) (3,364)

Operating loss (2,368) (2,222)

Adjusted EBITDA 1,070 (796)

Amortisation of intangibles (455) (216)

Depreciation (1,720) (1,038)

Rent credits recognised 25 25

Loss on disposal of tangible assets (156) (18)

Profit on closure/modification of

leases 105 -

Branch closure costs and other exceptional

costs (288) (147)

Branch pre-opening costs (881) -

Provision against loan to franchisee (21) -

Foreign currency gains / (losses) 44 (6)

IFRS 9 provision for guarantee losses (57) -

Share-based payment expense (34) (26)

------------ ------------

Operating loss (2,368) (2,222)

------------------------------------------- ---- ------------ ------------

Interest received 13 8

Interest expense (583) (22)

Lease finance charges 11 (367) (102)

Loss before taxation (3,305) (2,338)

Taxation 7 56 (13)

Loss after taxation (3,249) (2,351)

Other comprehensive income:

Items that may or will be reclassified

to profit or loss:

Exchange differences on translation

of foreign operations (120) (39)

Total comprehensive loss (3,369) (2,390)

Loss attributable to:

Equity holders of XP Factory plc (3,249) (2,351)

(3,249) (2,351)

------------ ------------

Total comprehensive loss attributable

to:

Equity holders of XP Factory plc (3,369) (2,390)

(3,369) (2,390)

------------ ------------

Loss per share attributable to equity

holders: (2.20) (2.81)

Basic (Pence) 6 (2.20) (2.81)

------------ ------------

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2022

As at

2012201 As at

2 2012201 2

30 June 31 December

2022 2021

Note Unaudited Audited

GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 8 7,556 5,516

Right-of-use assets 9 17,098 7,602

Intangible assets 10 21,681 22,046

Rental deposits 22 44

Finance lease receivable 12 1,333 -

Loan to franchisee 31 84

47,721 35,292

Current assets

Inventories 119 24

Trade receivables 1,588 848

Other receivables and prepayments 2,218 4,142

Stocks and work in progress - 438

Cash and bank balances 5,164 8,225

9,089 13,677

TOTAL ASSETS 56,810 48,969

LIABILITIES

Current liabilities

Trade payables 2,150 1,527

Contract liabilities 1,197 1,201

Loan notes 404 404

Other loans 256 256

Lease liabilities 12 393 393

Other payables and accruals 2,489 2,889

Provisions 11 9,898 637

16,787 7,307

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30

JUNE 2022 (continued)

As at As at

30 June 31 December

2022 2021

Note Unaudited Audited

GBP'000 GBP'000

Non-current liabilities

Contract liabilities 62 491

Provisions 11 305 9,248

Loan notes - 373

Other Loans 499 620

Deferred tax liability 1,045 1,101

Lease liabilities 12 19,302 8,012

-

--------- -----------

21,213 19,845

TOTAL LIABILITIES 38,000 27,152

NET ASSETS 18,810 21,817

EQUITY

Capital and reserves attributable

to equity holders of XP Factory plc

Share capital 12 1,825

1,880

Share premium account 44,704 44,366

Merger relief reserve 4,756 4,756

Convertible loan note reserve - 68

Accumulated losses (32,566) (29,317)

Currency translation reserve (203) (83)

Capital redemption reserve 46 46

Share-based payment reserve 193 158

TOTAL EQUITY 18,810 21,817

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Attributable to owners of the parent

Convertible

Share Merger Currency Capital Share-based loan

Share premium relief translation redemption payment note Accumulated

capital account reserve reserve reserve reserve reserve losses Total

Six months

ended

30 June

2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- --------- --------- ------------ ----------- ------------ ------------ ------------ --------

Balance

as at

1 January

2022 1,825 44,366 4,756 (83) 46 158 68 (29,317) 21,819

Loss for

the period - - - - - - - (3,249) (3,249)

Other

comprehensive

income - - - (120) - - - - (120)

-------- --------- --------- ------------ ----------- ------------ ------------ ------------ --------

Total

comprehensive

loss - - - (120) - - - (3,249) (3,369)

Issue of

shares 55 338 - - - - (68) - 325

Share issue

costs - - - - - - - - -

Share-based

payment

charge - - - - - 35 - - 35

-------- --------- --------- ------------ ----------- ------------ ------------ ------------ --------

Transactions

with owners 55 338 - - - 35 (68) - 359

-------- --------- --------- ------------ ----------- ------------ ------------ ------------ --------

Balance

as at 30

June 2022 1,880 44,704 4,756 (203) 46 193 - (32,566) 18,810

-------- --------- --------- ------------ ----------- ------------ ------------ ------------ --------

Six months

ended

30 June

2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- --------- --------- ------------ ----------- ------------ ------------ ------------ --------

Balance

as at

1 January

2021 1,005 27,758 4,756 (81) 46 96 68 (28,444) 5,204

Loss for

the period - - - - - - - (2,390) (2,390)

Other

comprehensive

income - - - (39) - - - - 18

-------- --------- --------- ------------ ----------- ------------ ------------ ------------ --------

Total

comprehensive

loss - - - (39) - - - (2,390) (2,429)

-------- --------- --------- ------------ ----------- ------------ ------------ ------------ --------

Issue of

shares 103 1,320 - - - - - - 1,423

Share issue

costs - (67) - - - - - - (67)

Share-based

payment

charge - - - - - 26 - - 26

-------- --------- --------- ------------ ----------- ------------ ------------ ------------ --------

Transactions

with owners 103 1,253 - - - 26 - - 1,382

-------- --------- --------- ------------ ----------- ------------ ------------ ------------ --------

Balance

as at 30

June 2021 1,108 29,011 4,756 (120) 46 122 68 (30,834) 4,157

-------- --------- --------- ------------ ----------- ------------ ------------ ------------ --------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2022

Six months Six months

ended ended

30 June 2022 30 June 2021

Unaudited Unaudited

Cash flows from operating activities Note GBP'000 GBP'000

Loss before income tax (3,305) (2,338)

Adjustments:

Depreciation of property, plant and

equipment 8 1,127 799

Depreciation of right-of-use assets 9 589 239

Amortisation of intangible assets 10 455 216

Provision against non-current assets 21 69

Loss on write-off of property, plant

and equipment 156 18

Share-based payment expense 34 26

Foreign currency movements (172) (2)

Lease interest charges 12 367 102

Rent concessions received 12 (25) (25)

Profit on closure/modification of

leases (105) (31)

Profit on early redemption of Convertible

Loan notes (8) -

Interest expense / (income) 570 (8)

Operating cash flow before working

capital changes (296) (935)

Decrease in trade and other receivables 1,094 23

Increase in stock and WIP 343 (5)

Increase in trade and other payables 439 706

Increase in provisions (393) 32

Increase in deferred income (433) 87

------------ ------------

Cash generated / (used) in operations 754 (92)

Income taxes paid - (8)

Net cash generated / (used) in operating

activities 754 (100)

Cash flows from investing activities

Purchase of property, plant and equipment 8 (3,323) (1,001)

Disposal of property, plant and equipment - -

Purchase of intangibles 10 (90) (70)

Receipt of deposits 22 18

Movement in Loans advanced to franchisees 32 (146)

Acquisition of subsidiary, net of

cash acquired - (139)

Interest received 21 8

Net cash used in investing activities (3,338) (1,330)

Cash flows from financing activities

Proceeds from issue of ordinary shares 13 - 1,423

Share issue costs 13 - (67)

Finance lease payments 12 (362) (224)

Movements on loans (167) (18)

Net cash generated / (used) from

financing activities (529) 1,114

Net increase / (decrease) in cash

and bank balances (3,113) (316)

Cash and cash equivalents at beginning

of period 8,225 2,722

Exchange rate changes on cash held

in foreign currencies 51 8

Cash and cash equivalents at end

of period 5,163 2,414

------------ ------------

NOTES TO THE UNAUDITED INTERIM REPORT

FOR THE SIX MONTHSED 30 JUNE 2022

1. General information

The Company was incorporated in England on 17 May 2016 under the

name of Dorcaster Limited with registered number 10184316 as a

private company with limited liability under the Companies Act

2006. The Company was re-registered as a public company on 13 June

2016 and changed its name to Dorcaster Plc on 13 June 2016. On 8

July 2016, the Company's shares were admitted to AIM.

Until its acquisition of Experiential Ventures Limited on 2 May

2017, the Company was an investing company (as defined in the AIM

Rules for Companies) and did not trade.

On 2 May 2017, the Company ceased to be an investing company on

the completion of the acquisition of the entire issued share

capital of Experiential Ventures Limited. Experiential Ventures

Limited was the holding company of the Escape Hunt Group, the

activities of which related solely to franchise.

On 2 May 2017, the Company's name was changed to Escape Hunt plc

and became the holding company of the enlarged Escape Hunt Group.

Thereafter the group established the Escape Hunt owner operated

business which operates through a UK subsidiary. All of the Escape

Hunt franchise activity was subsequently transferred to a UK

subsidiary. On 22 November 2021, the Company acquired BBB Franchise

Limited, together with its subsidiaries operating collectively as

Boom Battle Bars. At the same time, the Group took steps to change

its name to XP Factory Plc with the change taking effect on 3

December 2021.

XP Factory Plc currently operates two fast growing leisure

brands. Escape Hunt is a global leader in providing escape-the-room

experiences delivered through a network of owner-operated sites in

the UK, an international network of franchised outlets in five

continents, and through digitally delivered games which can be

played remotely.

Boom Battle Bar is a fast-growing network of owner-operated and

franchise sites in the UK that combine competitive socialising

activities with themed cocktails, drinks and street food in a high

energy, fun setting. Activities include a range of games such as

augmented reality darts, Bavarian axe throwing, 'crazier golf',

shuffleboard and others.

The Company's registered office is Belmont House, Station Way,

Crawley, RH10 1JA.

The consolidated interim financial information represents the

unaudited consolidated results of the Company and its subsidiaries,

(together referred to as "the Group"). The Consolidated Interim

Financial Statements are presented in Pounds Sterling, which is the

currency of the primary economic environment in which the Company

operates.

2. Basis of preparation

These interim consolidated financial statements have been

prepared in accordance with IAS 34 Interim Financial Reporting.

They do not include all disclosures that would otherwise be

required in a complete set of financial statements and should be

read in conjunction with the 2021 annual report. The statutory

financial statements for the year ended 31 December 2021 were

prepared in accordance with International Financial Reporting

Standards in accordance with the requirements of the Companies Act

2006. The auditors reported on those financial statements; their

Audit Report was unqualified.

The interim financial information is unaudited and does not

constitute statutory accounts as defined in the Companies Act

2006.

The interim financial information was approved and authorised

for issue by the Board of Directors on 27 September 2022.

3. Going concern

The financial statements have been prepared on a going concern

basis which contemplates the continuity of normal business

activities and the realisation of assets and the settlement of

liabilities in the ordinary course of business.

The directors have assessed the Group's ability to continue in

operational existence for the foreseeable future in accordance with

the Financial Reporting Council's Guidance on the going concern

basis of accounting and reporting on solvency and liquidity risks

issued in April 2016.

The Board has prepared detailed cashflow forecasts covering a

thirty-month period from the reporting date. The forecasts take

into account the Group's plans to continue to expand the network of

both Boom Battle Bar and Escape Hunt sites through organic growth.

The forecasts consider downside scenarios reflecting the potential

impact of an economic slowdown, delays in the roll out of sites and

inflationary pressures. Based on the assumptions contained in the

scenarios considered and taking into account mitigating actions

that could be taken in the event of adverse circumstances, the

directors consider there are reasonable grounds to believe that the

Group will be able to pay its debts as and when they become due and

payable, as well as to fund the Group's future operating expenses.

The going concern basis preparation is therefore considered to be

appropriate in preparing these financial statements.

4. Significant accounting policies

The Company has applied the same accounting policies,

presentation, methods of computation, significant judgements and

the key sources of estimation of uncertainties in its interim

consolidated financial statements as in its audited financial

statements for the year ended 31 December 2021, which have been

prepared in accordance with International Financial Reporting

Standards in accordance with international accounting standards in

conformity with the requirements of the Companies Act 2006.

5. Segment information

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the group of executive directors

and the chief executive officer who make strategic decisions.

Management considers that the Group has four operating segments.

Revenues are reviewed based on the nature of the services provided

under each of the Escape Hunt(TM) and Boom Battle Bar(TM) brands as

follows:

1. The Escape Hunt franchise business, where all franchised

branches are operating under effectively the same model;

2. The Escape Hunt owner-operated branch business, which as at

30 June 2022 consisted of 16 Escape Hunt sites in the UK, one in

Dubai, one in Paris and one in Brussels;

3. The Boom Battle Bar franchise business, where all franchised

branches operate under the same model within the Boom Battle

Bar(TM) brand; and

4. The Boom Battle Bar owner-operated business, which as at 30

June 2022 comprised 4 Boom Battle Bar sites in the UK.

The Group operates on a global basis. As at 30 June 2022, the

Company had active Escape Hunt franchisees in 10 countries. The

Company does not presently analyse or measure the performance of

the franchising business into geographic regions or by type of

revenue, since this does not provide meaningful analysis to

managing the business.

Escape

Hunt Owner Escape Boom Owner Boom Franchise

operated Hunt Franchise operated Unallocated Total

Six months ended 30 June GBP'000 GBP'000

2022 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 4,313 241 2,183 1,383 - 8,120

Cost of sales (1,355) - (1,192) (477) - (3,024)

----------- --------------- ------------ ---------------- ----------- -------

Gross profit 2,958 241 991 906 - 5,096

Site level operating costs (1,289) - (1,720) - - (3,009)

Other income 72 - - - - 72

IFRS 16 Adjustment 335 - 565 - - 900

Site level EBITDA 2,076 241 (164) 906 - 3,059

Centrally incurred overheads (875) - (16) (8) (1,146) (2,045)

Other income - - - 24 32 56

Adjusted EBITDA 1,201 241 (180) 922 (1,114) 1,070

Interest income - - - - 13 13

Interest expense - - - - (583) (583)

Finance lease charges (338) - (29) - - (367)

Depreciation and amortisation (1,128) (57) (175) (219) (7) (1,586)

Depreciation of right-of-use

assets (171) - (418) - - (589)

Exceptional professional

and branch closures - - - - (288) (288)

Profit on closure/modification

of leases 105 - - - - 105

Pre-opening costs (52) - (822) (7) - (881)

Provision against loan - - - - (21) (21)

Provision against guarantee

losses (57) - (57)

Loss on disposal of assets (156) - - - - (156)

Foreign currency gains - - - - 44 44

Rent credits recognised 25 - - - - 25

Share-based payment expenses - - (34) (34)

Profit/(loss) from operations

before tax (514) 184 (1,624) 639 (1,990) (3,305)

Taxation - - - - 56 56

----------- --------------- ------------ ---------------- ----------- -------

Profit / (loss) for the

period (514) 184 (1,624) 639 (1,934) (3,249)

----------- --------------- ------------ ---------------- ----------- -------

Other information :

Non-current assets 7,613 474 18,021 3,944 17,669 47,721

----------- --------------- ------------ ---------------- ----------- -------

Owner Franchise

operated operated Unallocated Total

Six months ended 30 June

2021 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 936 242 - 1,178

Cost of sales (377) - - (377)

--------- --------- ----------- -------

Gross profit 559 242 - 801

Other income 341 - - 341

Site level operating costs (701) - - (701)

Site level EBITDA 199 242 - 441

Centrally incurred overheads (146) (99) (992) (1,237)

Adjusted EBITDA 53 143 (992) (796)

Interest income - - 8 8

Interest expense - - (22) (22)

Finance lease charges (81) - (21) (102)

Depreciation and amortisation (1,049) (9) (196) (1,254)

Exceptional professional

and branch closures (11) - (67) (78)

Provision against loan - - (69) (69)

Loss on disposal of assets (11) - (7) (18)

Foreign currency losses - (6) - (6)

Rent credits recognised 16 - 9 25

Share-based payment expenses - - (26) (26)

Profit/(loss) from operations

before tax (1,083) 128 (1,383) (2,338)

Taxation - - (13) (13)

--------- --------- ----------- -------

Profit / (loss) for the

period (1,083) 128 (1,396) (2,351)

--------- --------- ----------- -------

Other information :

Non-current assets 7,024 30 1,326 8,380

--------- --------- ----------- -------

6. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to equity holders by the weighted average number of

ordinary shares in issue during the period. Diluted loss per share

is not presented as the potential issue of ordinary shares from the

exercise of options are anti-dilutive.

Six months Six months

ended ended

30 June 30 June

2022 2021

Unaudited Unaudited

GBP GBP

Loss after tax (GBP000) (3,249) (2,344)

Weighted average number of

shares:

* Basic and diluted 147,780,320 83,628,885

Loss per share (pence)

* Basic and diluted 2.20 2.81

7. Taxation

The tax charge is based on the expected effective tax rate for

the year. The Group estimates it has tax losses of approximately

GBP24.7m as at 30 June 2022 (2021: GBP21.5m) which, subject to

agreement with taxation authorities, would be available to carry

forward against future profits. The estimated tax value of such

losses amounts to approximately GBP4.7m (2021: GBP4.1m).

8. Property, plant and equipment

Leasehold Office Furniture Games Total

property equipment Computers and fixtures

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 31 December 2021 5,465 50 165 824 5,526 12,030

Additions arising

from internal purchase 2,299 - 48 195 781 3,323

Disposals / adjustments (238) - (7) (29) (336) (610)

As at 30 June 2022 7,526 50 206 990 5,971 14,743

------------ -------------- --------- ---------------- ------------ -----------

Accumulated depreciation

At 31 December 2021 (2,785) (49) (101) (270) (3,309) (6,514)

Depreciation charge (504) (1) (16) (72) (534) (1,127)

Disposals / adjustments 146 - 7 18 283 454

As at 30 June 2022 (3,143) (50) (110) (324) (3,560) (7,187)

Carrying amounts

At 31 December 2021 2,680 1 64 554 2,217 5,516

============ ============== ========= ================ ============ ===========

At 30 June 2022 4,383 - 96 666 2,411 7,556

============ ============== ========= ================ ============ ===========

9. Right-of-use assets

As at As at

30 June 31 Dec

2022 2021

GBP'000 GBP'000

Land and buildings - right-of-use

asset cost b/f 8,920 3,884

Closures / leases ended for renegotiation

during the period (402) (211)

Additions during the year, including

through acquisition 10,487 5,400

Newly negotiated leases - 86

Less: Accumulated depreciation b/f (1,318) (944)

Depreciation charged for the period (589) (613)

Net book value 17,098 7,602

--------- --------

The additions of in the period relate to new leases signed. The

Group leases land and buildings for its offices and escape room

venues under agreements of between five to fifteen years with, in

some cases, options to extend. The leases have various escalation

clauses. On renewal, the terms of the leases are renegotiated.

10. Intangible assets

Internally

Trademarks Intellectual generated Franchise App

Goodwill and patents property IP agreements Quest Portal Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 31 December

2021 17,696 78 10,195 1,715 5,248 100 317 35,349

Additions

arising

from internal

development - - - 90 - - - 90

Disposals /

adjustments - - - - - - - -

As at 30 June

2022 17,696 78 10,195 1,805 5,248 100 317 35,439

----------- ------------- ------------- ----------- ------------ -------- -------- ---------

Accumulated

amortisation

At 31 December

2021 (1,393) (60) (10,195) (669) (580) (100) (306) (13,303)

Amortisation - (6) - (167) (281) - (1) (455)

At 30 June 2022 (1,393) (66) (10,195) (836) (861) (100) (307) (13,758)

=========== ============= ============= =========== ============ ======== ======== =========

Carrying amounts

At 31 December

2021 16,303 18 - 1,046 4,668 - 11 22,046

======== ========

At 30 June 2022 16,303 12 - 969 4,387 - 10 21,681

=========== ============= ============= =========== ============ ======== ======== =========

11. Provisions

As at As at 31

30 June Dec 2021

2022

GBP'000 GBP'000

Provision for contingent consideration 9,642 9,056

Provision for deferred consideration 257 637

Dilapidations provisions 215 162

Other provisions 6 5

Provision for financial guarantee

contracts 83 26

Provisions at end of period 10,203 9,885

--------- ----------

The movement on provisions in the

period can be analysed as follows:

Six months Six months

ended ended

30 June 30 June

2022 2021

GBP'000 GBP'000

Balance at beginning of period 9,885 128

Reduction in deferred consideration (380) -

Movement in dilapidations provision 54 32

IFRS 9 Provision for lease guarantees 57

Finance cost recognised on contingent 586 -

consideration

Movement in other provisions 1

Provisions at end of period 10,203 160

----------- -----------

12. Lease liabilities

Six months Six months

ended ended

30 June 30 June

2022 2021

GBP'000 GBP'000

In respect of right-of-use assets

Balance at beginning of period 8,405 3,742

Closures / leases ended for renegotiation

during the period (508) (411)

Additions during the period 11,819 282

Newly re-negotiated leases - (16)

Interest Incurred 367 102

Repayments during the period (363) (122)

Rent concessions received (25) (24)

Reallocated from accruals and trade

payables - 135

Lease liabilities at end of period 19,695 3,688

----------- -----------

As at As at

30 June 30 Dec

2022 2021

GBP'000 GBP'000

Maturity

< 1month 33 42

1 - 3 months 66 84

3 - 12 months 295 290

Non-current 19,302 7,989

Total lease liabilities 19,695 8,405

Lease liabilities includes a master lease in Bournemouth. Part

of the site is occupied by an Escape Hunt owner operated site and

the remainder is sub-let to a Boom franchisee. A liability of

GBP1,666k for the master lease has been recognised and is included

in the balances shown above. The sub-lease gives rise to a finance

lease receivable of GBP1,333k, whilst the property occupied by

Escape Hunt gives rise to a right of use asset of GBP333k.

13. Share capital

Six months Year

ended ended

30 June 31 December

2022 2021

Unaudited Audited

GBP'000 GBP'000

As at beginning of period / year

* 146,005,098 (2021: 80,369,044)

Ordinary shares of 1.25 pence each 1,825 1,005

Issued during the period / year

* 4,378,082 Ordinary shares 55 820

As at end of period / year

* 150,383,180 (2021: 146,005,098)

Ordinary shares of 1.25 pence each 1,880 1,825

----------- ------------------------------------

During the six months ended 30 June 2022 the Company converted

GBP340,000 convertible loan notes, together with GBP54,027 of

rolled up interest at price of 9 pence per share, leading to the

issue of 4,378,082 Ordinary shares of 1.25 pence each.

Share option and incentive plans

XP Factory plc Enterprise Management Incentive Plan

On 15 July 2020, the Company established the XP Factory plc

Enterprise Management Incentive Plan ("2020 EMI Plan"). The 2020

EMI Plan is an HMRC approved plan which allows for the issue of

"qualifying options" for the purposes of Schedule 5 to the Income

Tax (Earnings and Pensions) Act 2003 ("Schedule 5"), subject to the

limits specified from time to time in paragraph 7 of Schedule 5,

and also for the issue of non qualifying options.

It is the Board's intention to make awards under the 2020 EMI

Plan to attract and retain senior employees. The 2020 EMI Plan is

available to employees whose committed time is at least 25 hours

per week or 75% of his or her "working time" and who is not

precluded from such participation by paragraph 28 of Schedule 5 (no

material

interest). The 2020 EMI Plan will expire on the 10th anniversary of its formation.

The Company has made three awards to date as set out in the

table below. The options are exercisable at their relevant exercise

prices and vest in three equal tranches on each of the first,

second and third anniversary of the grants, subject to the employee

not having left employment other than as a Good Leaver. The number

of options that vest are subject to a performance condition based

on the Company's share price. This will be tested on each vesting

date and again between the third and fourth anniversaries of

awards. If the Company's share price at testing equals the first

vesting price, one third of the vested options will be exercisable.

If the Company's share price at testing equals the second vesting

price, 90 per cent of the vested options will be exercisable. If

the Company's share price at testing equals or exceeds the third

vesting price, 100% of the vested options will be exercisable. The

proportion of vested options exercisable for share prices between

the first and second vesting prices will scale proportionately from

one third to 90 per cent. Similarly, the proportion of options

exercisable for share prices between the second and third vesting

prices will scale proportionately from 90 per cent to 100 per

cent.

The options will all vest in the case of a takeover. If the

takeover price is at or below the exercise price, no options will

be exercisable. If the takeover price is greater than or equal to

the second vesting price, 100 per cent of the options will be

exercisable. The proportion of options exercisable between the

first and second vesting prices will scale proportionately from nil

to 100 per cent.

If not exercised, the options will expire on the fifth

anniversary of award. Options exercised will be settled by the

issue of ordinary shares in the Company.

Awards #1 #2 #3

---------------------------------------- --------------- ---------- ----------

Date of award 15-Jul-20 18-Nov-21 23-Nov-21

Date of expiry 15-Jul-25 18-Nov-26 23-Nov-26

Exercise price 7.5p 35.0p 35.0p

Qualifying awards - number of shares

under option 13,333,332 700,001 533,334

Non-qualifying awards - number of

shares under option 2,400,000 0 0

First vesting price 11.25p 43.75p 43.75p

Second vesting price 18.75p 61.25p 61.25p

Third vesting price 25.00p 70.00p 70.00p

Proportion of awards vesting at first

vesting price 33.33% 33.33% 33.33%

Proportion of awards vesting at second

vesting price 90.00% 90.00% 90.00%

Proportion of awards vesting at third

vesting price 100% 100% 100%

As at 30 June 2022, 16,966,667 options were outstanding under

the 2020 EMI Plan (31 Dec 2021: 16,996,667) exercisable at the

prices shown above. No options were exercised during the period,

and no options expired or had lapsed and none had vested or were

exercisable as at 30 June 2022.

The sum of GBP34,268 has been recognised as a share-based

payment and charged to the profit and loss during the period (6

months ended 30 Jun 2021: GBP25,611). The fair value of the options

granted during the period has been calculated using the Black &

Scholes formula with the following key assumptions:

Table 2

Awards #1 #2 #3

------------------------------ ---------- ---------- ----------

Exercise price 7.5p 35.0p 35.0p

Volatility 34.60% 31% 31%

Share price at date of award 7.375p 33.50p 32.00p

Option exercise date 15-Jul-24 18-Nov-25 23-Nov-25

Risk free rate -0.05% 1.55% 1.55%

The performance conditions were taking into account as

follows:

The value of the options have then been adjusted to take account

of the performance hurdles by assuming a lognormal distribution of

share price returns, based on an expected return on the date of

issue. This results in the mean expected return calculated using a

lognormal distribution equaling the implied market return on the

date of issue validating that the expected return relative to the

volatility is proportionately correct. This was then used to

calculate an implied probability of the performance hurdles being

achieved within the four year window and the Black & Scholes

derived option value was adjusted accordingly.

Time based vesting: It has been assumed that there is between a

90% and 95% probability of all share option holders for each award

remaining in each consecutive year thereafter.

The weighted average remaining contractual life of the options

outstanding at 30 June 2022 is 42.1 months (31 Dec 2021: 48.0

months).

An option-holder has no voting or dividend rights in the Company

before the exercise of a share option.

Escape Hunt Employee Share Incentive Scheme

In November 2020, the Company established the Escape Hunt Share

Incentive Plan ("SIP").

The SIP has been adopted to promote and support the principles

of wider share ownership amongst all the Company's employees. The

Plan is available to all eligible employees, including Escape

Hunt's executive directors, and invites individuals to elect to

purchase ordinary shares of 1.25p each in the Company via the SIP

trustee using monthly salary deductions. Shares are be purchased

monthly by the SIP trustee on behalf of the participating employees

at the prevailing market price. Individual elections can be as

little as GBP10 per month, but may not, in aggregate, exceed

GBP1,800 per employee in any one tax year. The Ordinary Shares

acquired in this manner are referred to as "Partnership Shares"

and, for each Partnership Share purchased, participants are awarded

one further Ordinary Share, known as a "Matching Share", at nil

cost.

Matching Shares must normally be held in the SIP for a minimum

holding period of 3 years and, other than in certain exceptional

circumstances, will be forfeited if, during that period, the

participant in question ceases employment or withdraws their

corresponding Partnership Shares from the Plan.

On 4 February 2021, the Company issued 125,000 shares to the

trustee of the scheme to be allocated to individuals as Matching

Shares during the operation of the scheme. As at 30 June 2020,

101,694 matching shares had been awarded and were held by the

trustees for release to employees pending satisfaction of their

retention conditions. As such no share based payment charge has

been recognised for the period (2021: nil)

14. Key management personnel compensation

Six months Six months

ended ended

30 June 30 June

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

Salaries and benefits (including directors) 427 293

Share-based payments 20 26

Social security costs 56 47

Other post-employment benefits 22 4

Less amounts capitalised (7) (18)

Total 518 352

------------- -------------

Related party transactions

During the period under review, the Directors are not aware of

any significant transactions with related parties (six months ended

30 June 2021: nil).

15. Government Grants and Government Assistance

The following Government grants were received and have been

recognised during the period:

Six months Six months

ended ended

30 June 30 June

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

Coronavirus Job Retention Scheme grants 0 474

Local authority Small Business Grants 68 341

Total 68 815

------------- -------------

16. Subsequent Events

There are no material subsequent events requiring

disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LRMPTMTTTBMT

(END) Dow Jones Newswires

September 28, 2022 02:02 ET (06:02 GMT)

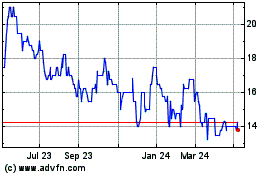

Xp Factory (LSE:XPF)

Historical Stock Chart

From Jun 2024 to Jul 2024

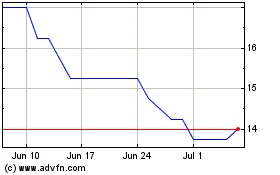

Xp Factory (LSE:XPF)

Historical Stock Chart

From Jul 2023 to Jul 2024