TIDMESC

RNS Number : 7445Y

Escape Hunt PLC

13 May 2019

13 May 2019

Escape Hunt plc

("Escape Hunt" or the "Company" or the "Group")

2018 Full Year Audited Results

Escape Hunt plc (AIM:ESC), a global leader in the high growth

"escape rooms sector" announces its audited results for the year

ending 31 December 2018.

Year ended 31 Year Ended

Dec 2017 (GBPm) 31 Dec 2018

(GBPm)

Revenue 0.87 2.17

----------------- -------------

Gross Profit 0.51 0.04

----------------- -------------

Adjusted EBITDA (0.79) (3.09)

----------------- -------------

Loss per share (24.77p) (49.38p)

----------------- -------------

Net Cash GBP10.65m GBP2.66m

----------------- -------------

Operational highlights:

-- Opened eight owner-operated UK sites in Bristol, Birmingham,

Edinburgh, Leeds, Liverpool, Manchester, Oxford and Reading

-- Received outstanding customer feedback on TripAdvisor with

the first four sites to be opened reaching #1, the next three

reaching #2, with the last already at #7

-- Delivered Escape Hunt's first licensed IP deal with the BBC,

opening Doctor Who themed escape rooms for fans and customers

-- Maintained a successful franchise network globally and set

the foundations necessary to attract large partners to roll-out at

scale

-- Built from scratch the infrastructure required for our growth

plan. Included moving the operations from Asia to the UK, creating

a game design studio in London, rolling-out of the new Escape Hunt

Brand across the business, and establishing a capable Head Office

team, all requiring minimal additional expenditure

Financial highlights:

-- UK owner-operated sites delivered sales in line and EBITDA

slightly ahead of expectations for the year

-- Group revenue up 149% to GBP2.17m (2017: GBP0.87m), driven by

the partial first year contribution of the owner-operated sites in

the UK

-- Reduction in gross profits from GBP0.51m to GBP0.04m driven

by the costs of sites in their pre-opening phase and the subsequent

period as these sites grow revenues to maturity

-- Group Adjusted EBITDA loss of GBP3.09m in line with expectations

-- Pre-tax losses of GBP9.98m (2017: GBP4.13m) reflect the

amortisation of the IP purchased at acquisition (GBP3.7m),

exceptional costs relating to the Bangkok closure (GBP0.3m), and an

impairment charge of GBP2.3m for goodwill and IP intangibles,

driven by the decision to delay the roll-out of UK sites in 2017

while we rebranded the business.

-- Cash position of GBP2.66m as at 31 December 2018 (2017: GBP10.65m)

-- Cash reduction of GBP8m reflects the Adjusted EBITDA loss of

GBP3.09m and investment in infrastructure, especially capex of

GBP4.27m and intangible assets of GBP0.49m

-- Basic loss per share ('EPS') of 49.38 pence (2017: 24.77 pence).

Post-period Highlights:

-- Detailed heads of terms have been agreed with a US

franchising partner to roll-out new franchisee sites across the US

and Canada

-- The first tranche of three UK sites continue to trade well

and the second tranche of five less mature sites are so far

building more quickly than the first with both sales and EBITDA

ahead of Board expectations

-- The UK owner-operated estate of nine sites is now generating positive EBITDA as a group.

-- The Company has today announced a proposed equity placing

("Placing") to be undertaken by Stockdale Securities Ltd and Peel

Hunt Ltd to raise a minimum of GBP4m (before expenses) by way of an

accelerated bookbuild primarily to fund the Company's roll-out of

new sites in the UK

Chief Executive Officer, Richard Harpham, comments:

"It has been a significant year of progress with elements of the

business reorganised and eight owner-operated sites successfully

rolled-out across the UK. I am also delighted to report that the

inaugural performance and revenue generated from these sites has

been in line with expectations.

"The strength of the Escape Hunt brand helped us secure a major

licensing agreement with the BBC, to create Doctor Who themed

escape rooms. This was an important milestone for the Group and has

helped us to deliver on our strategy of being the premier brand in

the escape rooms sector. The demand for experiential leisure is

reflected in our success and ability to attract growing footfall

and we look forward to opening more UK sites during 2019 whilst

expanding our franchise overseas."

The Annual Report and Accounts will be sent to shareholders in

due course.

Enquiries

Escape Hunt plc

Richard Harpham (Chief Executive Officer)

Alistair Rae (Chief Financial Officer)

Mustapha Omar (Commercial Director) +44 207 846 3322

Stockdale Securities Ltd - NOMAD and Joint

Broker

Daniel Harris, David Coaten (Corporate Finance) +44 (0) 20 7601

Fiona Conroy (Corporate Broking) 6100

Peel Hunt LLP - Joint Broker

George Sellar +44 (0) 20 7418

Guy Pengelley 8900

Yellow Jersey - Financial PR

Tim Thompson

Harriet Jackson +44 (0) 20 3004

Henry Wilkinson 9512

About Escape Hunt

The Escape Hunt Group is a global leader in providing live

escape-the-room experiences with a network of owner-operated sites

in the UK and a global network of franchised outlets in six

continents. The Company was re-admitted to AIM in May 2017 and has

a strategy of creating high quality premium games and experiences,

which incorporates branded IP content.

FINANCIAL AND OPERATIONAL HIGHLIGHTS

CHAIRMAN'S STATEMENT

I am delighted to report that we have made excellent progress in

executing our strategy, and that trading performance has met our

expectations.

Having spent time positioning our brand to underpin our

ambitious roll-out plans, we are delighted with the very positive

customer feedback, as evidenced by achieving #1 on TripAdvisor at

all of our UK mature sites. Our brand strength also enabled us to

achieve a very significant IP deal with the BBC to secure exclusive

rights to Doctor Who, which has since been rolled-out across our UK

network with great success.

We have completed building the team and infrastructure to

underpin and support our growth plans. We have also made good

progress in building a robust supply chain, overcoming some

challenges we faced in our early days of operation, by moving our

games design facility from Bangkok to London, and by working with a

number of UK based production houses (one of which we have invested

in).

The first eight owner-operated sites were opened during the

year. Despite some challenges in opening these as quickly as we had

originally hoped (as previously reported) and which have led to the

impairment charge in 2018 mentioned in the financial review, they

have achieved the desired sales levels, whilst slightly exceeding

our EBITDA expectations. The first three of these have reached

mature trading levels and continue their strong progress and for

the five new owner-operated sites both sales and EBITDA performance

are ahead of our expectations. With the marketing experience gained

and applied, the subsequent five new sites are seeing higher

initial revenues than the first three sites at their equivalent

stage of development.

Our success and ability to attract footfall has been recognised

by many retail landlords who are now offering attractive potential

sites and fit-out / lease incentives which will further enhance our

site investment case going forward.

Our established franchise network performed to plan during the

year. We have previously stated that we wish to accelerate our

overseas footprint by partnering with established operators who

have sufficient scale and financial resource to achieve meaningful

penetration in our chosen territories. We were recently delighted

to announce the first such partnership where exclusive heads of

terms have been agreed to effect a franchise roll-out across the US

and Canada.

The cash raised during our IPO in May 2017 has been invested in

building the infrastructure, enhanced games design capability and

central resource and in setting up the first eight owner-operated

sites and funding their initial trading losses. With our UK sites

now being cash generative, our fit-out model now refined and

landlord fit-out contributions expected, the new cash we are

raising will be directed to executing our growth plans and to

provide working capital.

We feel we have achieved key milestones we set ourselves during

the year under review and have demonstrated our site investment

case and now look forward to executing our growth plans with

confidence, enthusiasm and vigour.

Richard Rose

Non-Executive Chairman

13 May 2019

STRATEGIC REPORT

2018 was an exciting year for Escape Hunt, which saw the

business execute against its strategy of developing an

owner-operated business in the UK, create from scratch a game

design studio in London, and set the foundations for significant

future growth. We were delighted to sign our first licensed IP deal

with the BBC to bring Doctor Who to life in our rooms, and have

been proud of the incredible customer feedback received across the

estate.

The unit economics of the eight newly opened owner-operated

sites have performed in line with Board expectations, and the

broader market for experiential leisure continues to flourish.

UK Owner-Operated Sites - Escape Hunt opened three sites in the

first half of 2018 and a further five in Q4 2018 to take the total

of newly opened venues to eight. Showcasing games designed by our

London Studio, customer feedback has been outstanding, with the

first four sites to open reaching #1 on TripAdvisor, the next three

reaching number #2 so far, and the last to open already at #7 and

climbing.

Within the nine owner-operated sites, 38 game rooms were opened

last year, a further nine rooms have opened already in 2019 and the

remaining two rooms are scheduled to open in Q2 2019, so the full

revenue benefit from these sites will accrue in the second half of

2019. As mentioned in our trading statement in January, the first

tranche of three sites continue with their strong progress, and

although still relatively immature, we are pleased to see that the

second tranche of five sites opened in Q4 2018 is on a steeper

revenue trajectory than the first. The relatively fixed nature of

the cost base means that the majority of incremental sales flow to

EBITDA, reinforcing our confidence in the overall economic model.

The results for the year have been materially impacted by

pre-opening costs associated with a significant roll-out of new

owner-operated sites, in addition to a full year of the head office

cost burden without the full scale of operating businesses being in

place to support them. The decision to delay the roll-out of

owner-operated sites as the business was rebranded has driven its

outstanding customer feedback and helped secure the Doctor Who

licensing agreement with the BBC, but has also resulted in an

impairment charge(described further in Note 2) since the time to

break even has extended.

Branded IP Content - Escape Hunt identified the strategic

importance of branded IP in driving occupancy and further

differentiating us. The first IP content deal was signed in July

2018 with BBC Worldwide for a five-year exclusive licence to create

Doctor Who themed escape rooms in the UK. The installation of the

first Doctor Who game was completed in December 2018 and these

games are currently playing in six UK sites. The roll-out of the

second Doctor Who game is due to be completed in the coming months.

There have been strong forward bookings for Doctor Who themed rooms

from the outset and the average room occupancy has been running at

approximately 60% in the few weeks from opening until the end of

February, which is in line with expectations and well above

expected occupancy rates of unbranded rooms.

The Company believes that IP will continue to play an important

role in the content strategy of the business and is considering

several similar opportunities to bring branded IP alive for

customers and fans.

Additional Sales Opportunities - Escape Hunt's site performance

to date has been driven predominantly by B2C sales and corporate

entertainment. The Company identified an additional opportunity to

tap into the market for gamified learning and launched its

proprietary corporate learning and development ("L&D")

proposition in February 2019. Designed to provide an immersive,

gamified, experiential solution for employee engagement, its use

spans staff recruitment, retention and development programmes for

companies. Escape Hunt is exploiting two routes to market by

contacting potential corporate clients directly and also indirectly

via other L&D firms who are selling the offering to their

client base. Escape Hunt expects to generate high margin,

additional sales at the start of the week where customer occupancy

is typically lower, whilst improving the level of repeat business

by forging relationships with businesses.

Franchise Network - Two thirds of Escape Hunt's franchise

business is generated by four master franchisees, namely

France/Benelux, Australia/NZ, the Middle East and the Nordics.

These territories have continued to perform well and have expanded

with several new site openings.

Escape Hunt rationalised an element of its franchise tail

through the year, and closed a number of weak franchise performers

in territories with low GDP/Capita or under-performing management.

At the year end, Escape Hunt had 42 franchise sites compared with

43 at the end of 2017. Most businesses in the network have now been

rebranded and the remaining few will be completed in 2019.

Management's strategy to grow the franchise network by identifying

well capitalised and experienced players able to open and manage

multiple units is beginning to bear fruit and Escape Hunt has been

negotiating a deal with a potential US partner to commence a

significant roll-out of franchises across the USA and Canada. A

detailed heads of terms, incorporating the key commercial terms,

was signed on 26 April 2019.

Strategy for 2019

Conditional upon completing the Placing, the two immediate

strategic targets for the Group are to open a further 4-6 sites in

2019 (taking the total UK estate to 13-15) and to embark upon the

franchisee roll-out in North America.

In order to fund the UK owner-operated roll-out, the Company has

announced separately today that it is conducting a Placing to raise

a minimum of GBP4m, before expenses.

Additional focus for the Management team in 2019 will

include:

-- Securing new sites with significant landlord contributions

towards build costs, recognizing landlord demand for experiential

leisure in retail schemes

-- Identifying franchise partners for the remaining territories

within Europe and conclude two large scale franchise deals

(including the US deal mentioned above)

-- Securing further brand IP license deals to bolster the content strategy of the business.

-- Growing the Learning & Development offering to corporates

with the ultimate objective of corporate clients using an Escape

Hunt branded tool to assess their staff's capabilities.

Growth Strategy and Outlook

-- The Group's strategy is to continue the roll-out of

owner-operated sites in the UK, with an aim to reach 50 in the

medium term, and to grow the franchise estate by two to three times

over the medium term in conjunction with well-resourced

partners

-- We will continue our focus on game production cost reduction

and monetisation and to further drive occupancy through securing

new IP content deals

-- We have been pleased with the customer reception to our games

at our UK sites which we opened in 2018 and our game design team is

currently designing the next series of games for future sites

-- Trading in the first three months of 2019 has been in line

with expectations and although still immature, the UK

owner-operated estate is already generating positive EBITDA as a

group of nine sites

Richard Harpham

Chief Executive Officer

13 May 2019

FINANCIAL REVIEW

Group results

Revenue for the year grew from GBP872k in 2017 to GBP2,172k. The

increase was partly due to a full 12 months contribution of

GBP1,095k from the franchisee business in 2018, compared to only

eight months in 2017 (GBP798k). The major increase in revenue was

driven by the first year contribution of the owner-operated sites

in the UK, which was GBP1,002k (2017: GBP74k). The first three

sites in the UK were opened during March 2018 and the next five

sites were all opened on time in the last quarter of the year.

The operating loss for the year was GBP10,012k (2017: Loss of

GBP4,134k) and the adjusted loss before tax, depreciation,

amortisation and interest ("Adjusted EBITDA") was a loss of

GBP3,087k (2017: GBP790k). Set out below is a reconciliation

between the operating loss and the Adjusted EBITDA loss:-

2018 2017

GBP'000 GBP'000

Operating loss (10,012) (4,134)

Amortisation of intangibles 3,656 2,375

Impairment of intangible

assets 2,345 -

Depreciation 545 22

Write-off of assets 45 -

Branch closure costs 291 -

Foreign currency losses 31 34

Transaction costs - 870

Share-based payment

expense (12) 43

-------- -------

Adjusted EBITDA (3,087) (790)

The EBITDA loss has been adjusted for the write-off of GBP45k of

assets in the Bangkok business at the time of the closure of the

office and the branch, the cash costs of GBP291k which were

principally the employee redundancy and notice period payments to

the employees and former owner of the business and the costs of

vacating the two properties. A further GBP12k has been charged to

income for the share-based payment expense which relates to the

growth shares for three of the senior management which were issued

in 2017. No new share options were issued in 2018.

These costs and items as shown above have been deducted from

EBITDA loss to arrive at the Adjusted EBITDA loss since they are

either non-cash costs or are required to be adjusted in order to

provide a consistent comparison to last year in that they are

one-off items which will not be expected to recur in future

periods. EBITDA is used as the basis of this performance measure as

it most appropriately captures the ongoing ability of the business

to generate operating cash flows which contribute to capital

investment that supports further growth.

Amortisation in 2018 was GBP3,656k (2017: GBP2,375k) and is

comprised largely of the annual charge of GBP3.4m for the IP of

GBP10.2m that was acquired at the time of the acquisition of the

business in May 2017 and which is being written down over three

years. The balance comprises the writing down of other intangible

assets as they come into use. This includes both third party and

staff costs for the creation of certain games that have been

designed in the UK and the app that was acquired with the business

in 2017. These are written down over two years.

The decision in 2017 to delay the UK roll-out of sites whilst we

rebranded the business has proven successful, as it has underpinned

our outstanding TripAdvisor scores and enabled us to secure the

Doctor Who licensing agreement with the BBC. However, it had the

effect of pushing back the break-even point for the business, which

has led to an impairment charge of GBP2,345k (2017: GBPnil).

Goodwill of GBP1,393k relating to the Experiential Ventures Ltd

acquisition in 2017 was written off, alongside a further impairment

charge of GBP952,000, which together comprise the impairment charge

against the carrying value of intellectual property, driven by the

delay in the start of our UK roll-out schedule. This non-cash

balance sheet adjustment has no bearing on performance going

forwards.

Franchisee business

In dollar terms the revenue was $1,386k (2017: $1,650k). This

has been calculated by translating revenues into US dollars based

on the prevailing rate at the time of invoicing, noting most of the

franchisees are invoiced in US dollars. This has been presented as

such in order to provide an indicator of overall performance by our

franchisees in a manner which is unaffected by movements in foreign

exchange rates during the year. For those franchisees who are not

invoiced in US dollars, conversion to US dollars is made at the

prevailing US dollar rate when the invoices are raised.

Franchisee numbers at 31 December 2018 were 42 (2017: 43.).

Smaller and unprofitable single site franchisees closed and 7 new

sites opened. These new sites were mainly additional sites opened

by master franchisees entering into further sub-franchisee

agreements or, in the case of the Scandinavian Master Franchise

Agreement, opening new wholly owned sites. The operating profit was

GBP239k and after adding back depreciation of GBP118k resulted in

an EBITDA of GBP357k (2017: GBP273k). Account management staff were

recruited in the UK, together with games design staff, ahead of

closing the Bangkok studio in July. A total of 42 new games,

including adaptations of older games were produced by both the UK

and the Bangkok teams in 2018 for franchisees, together with eight

games that were produced in London for the UK owner-operated sites.

Of these, five have already been taken up by franchisees.

The new Escape Hunt brand was rolled-out to the franchisees

progressively during 2018 and this programme is due to complete

shortly. Escape Hunt assisted the franchisees in the process with

new digital marketing collateral and contributions to each site's

capital costs. The new website and improved booking engine are also

due to be rolled-out to franchisees in the first half of 2019 after

the investment and testing in the UK in 2018.

The franchising activities recorded an operating profit of

GBP239k (2017:GBP183k); which is an encouraging result given the

redomiciling of the business from Bangkok to London and additional

work to enhance the offering to the customers of the franchisees

was undertaken during the year.

Owner-operated business

The total revenue of the owner-operated business was GBP1,077k,

of which GBP1,002k was generated in the UK and the balance of

GBP75k from the Bangkok branch. The cost of sales was GBP1,950k to

give a gross loss of GBP873k. Cost of sales comprises site property

and utility costs, site staff costs as well as directly

attributable marketing costs. The gross loss reflects the fact that

all the Escape Hunt sites were opened during the course of the year

and in addition to bearing pre-opening costs, the majority have yet

to reach their full maturity, with most of the sites only opening

from October onwards.

Administrative costs and other overheads of GBP825k were

incurred, being principally central marketing and agency costs and

game design management costs.

As noted above, the IP of GBP10.2m that was acquired as part of

the consideration at the time of the acquisition is being amortised

over three years and which results in an annual charge of GBP3.4m.

This has been charged to the owner-operated activity and forms the

majority of the amortisation charge of GBP3,656k across the Group

and of the GBP4,109k of amortisation and depreciation charges in

the owner-operated activity. The impairment charge of GBP2,345k

relates to the owner-operated business as a result of the Company

updating the assumptions from those in place during the original

acquisition including the growth of the owner-operated estate

arising over a more extended period of time than first

anticipated.

Central overheads

The administrative and overhead charges were GBP2,113k,

comprising the management and marketing staff, advisory fees and

the head office property costs. Staff numbers in the London office

increased during the year as the business transitioned from Bangkok

to London and as the owner-operated sites in the UK developed,

requiring marketing, finance and operational staff.

Cashflow and capital expenditure

The operating cashflow before working capital changes was an

outflow of GBP3,380k, and reduced to GBP2,916k after working

capital changes. GBP4,276k was incurred in fixed asset capital

expenditure, of which GBP2,204k was in leasehold site fit-out costs

and GBP1,813k in games and props assets. A further GBP495k was

incurred on a wide range of intangible assets, including GBP302k on

acquiring game software, game intellectual property, third party

game design costs as well as GBP74k of Escape Hunt game design

staff costs.

Cash at 31 December 2018 was GBP2.66m.

IFRS 16

From 1 January 2019, the Group has adopted the new accounting

standard, IFRS 16. The standard requires companies for the first

time with leasehold properties to capitalise all leases on the

balance sheet as a right of use asset and also to recognise on the

balance sheet the present value of the obligations to make lease

payments. The rents which are currently charged to the Income

Statement (GBP388k in 2018) will instead be replaced by a

depreciation charge and a finance charge. In 2018, these would have

been GBP302k and GBP158k respectively had the Standard been adopted

for the whole of 2018.

Innovation

A number of innovation issues were identified in 2017 and 2018

which have led the management to develop an innovation programme

for the Group. These issues related, for example, to developing

puzzles for new games combined with site fit-out and site

construction and which have been commented on in our trading

statements during 2018. Finding suitable production partners has

also been one of the problems which management have had to

overcome.

A decision was made in 2018 to apply for a Research and

Development grant from Scottish Enterprise to establish a programme

of innovation in Scotland with three separate objectives. The first

is to improve the understanding of how customers solve clues and

the typical time taken so that the design of puzzles can be

improved; the second is to use gaming data to analyse human

behaviour in an escape room setting and provide this data to

corporate clients. This brings together psychometrics and video

tracking for example, together with experienced facilitators to

provide an informative analysis for clients on team performance.

The third is to understand how to develop puzzles that can be

delivered in alternative format, such as through virtual reality or

tablet based applications.

A grant for GBP2m was agreed in March 2019 and will now be

activated. The grant commencement date is April 2018, which was

when the application was first lodged and the grant period is two

and a half years. Accordingly, the Company will now establish a

total of three sites in Scotland, one of which was established in

2018, containing an average of six rooms at each site to conduct

these activities. Each site will be able to carry out normal

commercial activities and indeed needs to do so in order to achieve

each of the three objectives outlined above.

To assist in resolving elements of the game design process,

Escape Hunt Innovations Ltd subscribed a nominal sum in cash for a

51% interest in a small design and production workshop near

Edinburgh in December 2018.

Two patents were also applied for in 2018. The first patent

relates to a process to make an escape room more or less difficult,

based on the identity of the player and the second relates to a

process to obtain identity consent. The related work for these

patents is expected to be performed in Scotland.

Advance Assurance was applied for to the HMRC in February 2019

for Research and Development tax credits for the years 2017, 2018

and 2019. Separate to the work being carried out in Scotland, the

London based game design studio continues to use and enhance the IP

acquired at the time of the acquisition, which inter alia consisted

of the large library of games and the design process. In addition,

development work has been carried out in England on developing and

trialling both new puzzles and prop construction with a number of

manufacturers.

Consolidated Statement of Comprehensive Income for the year

ended 31 December 2018

All figures in GBP'000s Year ended Year ended

31 December 31 December

Continuing operations 2018 2017

Revenue 2,172 872

Cost of sales (2,137) (364)

Gross profit 35 508

Transaction expenses - (957)

Administrative expenses (10,047) (3,685)

Operating loss (10,012) (4,134)

Adjusted EBITDA (3,087) (790)

Amortisation of intangibles (3,656) (2,375)

Impairment of intangible assets (2,345) -

Depreciation (545) (22)

Loss on disposal of tangible assets (45) -

Branch closure costs (291) -

Foreign currency losses (31) (34)

Transaction costs - (870)

Share-based payment expense (12) (43)

----------- -----------

Operating loss (10,012) (4,134)

------------------------------------------------- ----------- -----------

Interest received 34 9

Loss before taxation (9,978) (4,125)

Taxation (26) (4)

Loss after taxation (10,004) (4,129)

Other comprehensive income:

Items that may or will be reclassified

to profit or loss:

Exchange differences on translation

of foreign operations 26 (15)

Total comprehensive loss (9,978) (4,144)

Loss attributable to:

Equity holders of Escape Hunt plc (10,004) (4,129)

Non-controlling interests - -

----------- -----------

(10,004) (4,129)

Total comprehensive loss attributable

to:

Equity holders of Escape Hunt plc (9,978) (4,144)

Non-controlling interests - -

----------- -----------

(9,978) (4,144)

----------- -----------

Loss per share attributable to equity

holders:

Basic and diluted (Pence) (49.38) (24.77)

----------- -----------

Consolidated Statement of Financial Position

As at 31 December 2018

As at As at

31 December 31 December

2018 2017

GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 4,366 670

Intangible assets 4,792 10,280

Rent deposits 36 32

Loan to franchisee 300 -

9,494 10,982

Current assets

Inventories 15 -

Trade receivables 121 15

Other receivables and prepayments 501 305

Cash and bank balances 2,657 10,645

3,294 10,965

TOTAL ASSETS 12,788 21,947

LIABILITIES

Current liabilities

Trade payables 670 507

Deferred income 244 83

Other payables and accruals 967 479

1,881 1,069

Consolidated Statement of Financial Position

As at 31 December 2018 (continued)

As at As at

31 December 31 December

2018 2017

GBP'000 GBP'000

Non-current liabilities

Deferred income 419 456

Provisions 40 -

459 456

TOTAL LIABILITIES 2,340 1,525

NET ASSETS 10,448 20,422

EQUITY

Capital and reserves attributable to

equity holders of Escape Hunt Plc

253 253

Share capital 21,076 21,076

Share premium account 21,076

Merger relief reserve 4,756 4,756

Accumulated losses (15,741) (5,737)

Currency translation reserve 11 (15)

Capital redemption reserve 46 46

Share-based payment reserve 55 43

10,456 20,422

Non-controlling interests (8) -

TOTAL EQUITY 10,448 20,422

Consolidated Statements of Changes in Equity

For the year ended 31 December 2018

Attributable to owners of the parent

Share Merger Currency Capital Share-based

Share premium relief translation redemption payment Accumulated Non-controlling

capital account reserve reserve reserve reserve losses Total interest Total

Year ended

31 December

2018 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- -------- -------- ------------ ----------- ------------ ------------ --------- ---------------- ---------

Balance

as at

1 January

2018 253 21,076 4,756 (15) 46 43 (5,737) 20,422 - 20,422

Loss for

the year - - - - - - (10,004) (10,004) - (10,004)

Other

comprehensive

income - - - 26 - - - 26 - 26

-------- -------- -------- ------------ ----------- ------------ ------------ --------- ---------------- ---------

Total

comprehensive

loss - - - 26 - - (10,004) (9,978) - (9,978)

-------- -------- -------- ------------ ----------- ------------ ------------ --------- ---------------- ---------

Acquisition

of subsidiary - - - - - - - - (8) (8)

Share-based

payment

charge - - - - - 12 - 12 - 12

-------- -------- -------- ------------ ----------- ------------ ------------ --------- ---------------- ---------

Transactions

with owners - - - - - 12 - 12 (8) 4

-------- -------- -------- ------------ ----------- ------------ ------------ --------- ---------------- ---------

Balance

as at

31 December

2018 253 21,076 4,756 11 46 55 (15,741) 10,456 (8) 10,448

-------- -------- -------- ------------ ----------- ------------ ------------ --------- ---------------- ---------

Year ended

31 December

2017:

Balance

as at

1 January

2017 125 8,941 - - - - (1,608) 7,458 - 7,458

Loss for

the period - - - - - - (4,129) (4,129) - (4,129)

Other

comprehensive

income - - - (15) - - - (15) - (15)

-------- -------- -------- ------------ ----------- ------------ ------------ --------- ---------------- ---------

Total

comprehensive

loss - - - (15) - - (4,129) (4,144) - (4,144)

-------- -------- -------- ------------ ----------- ------------ ------------ --------- ---------------- ---------

Issue

of shares 174 13,870 4,756 - - - - 18,800 - 18,800

Share

issue

costs - (1,689) - - - - - (1,689) - (1,689)

Buy-back

of shares (46) (46) - - 46 - - (46) - (46)

Share-based

payment

charges - - - - - 43 - 43 - 43

Transactions

with owners 129 12,135 4,756 - 46 43 - 17,109 - 17,109

-------- -------- -------- ------------ ----------- ------------ ------------ --------- ---------------- ---------

Balance

as at

31 December

2017 253 21,076 4,756 (15) 46 43 (5,737) 20,422 - 20,422

-------- -------- -------- ------------ ----------- ------------ ------------ --------- ---------------- ---------

Consolidated Statement of Cash Flows

For the year ended 31 December 2018

Year Year

ended ended

31 December 31 December

2018 2017

GBP'000 GBP'000

Cash flows from operating activities

Loss before income tax (9,978) (4,125)

Adjustments:

Depreciation of property, plant and

equipment 545 22

Amortisation of intangible assets 3,655 2,375

Impairment of intangible assets 2,345 -

Write-off of non-current assets 45 -

Gain on disposal of plant and equipment (1) -

Net foreign exchange differences 31 -

Share-based payment expense 12 43

Interest income (34) (9)

Operating cash flow before working

capital changes (3,380) (1,694)

Increase in trade and other receivables (273) (161)

Increase in inventories (11) -

Increase in provisions 40 1

Increase in trade and other payables 584 298

Increase / (decrease) in deferred

income 124 (48)

Cash used in operations (2,916) (1,604)

Income taxes paid (8) (28)

Net cash used in operating activities (2,924) (1,632)

Cash flows from investing activities

Purchase of property, plant and equipment (4,276) (585)

Purchase of intangibles (495) (240)

Payment of deposits (4) (32)

Loan made to master franchisee (300) -

Acquisition of subsidiary, net of

cash acquired (10) (7,044)

Interest received 34 9

Net cash used in investing activities (5,051) (7,892)

Cash flows from financing activities

Proceeds from issue of ordinary shares

(net of buy-back) - 13,954

Proceeds from issue of G shares - 1

Share issue costs - (1,688)

Net cash from financing activities - 12,267

Net (decrease)/ increase in cash and

cash equivalents (7,975) 2,743

Cash and cash equivalents at beginning

of year 10,645 7,923

Effects of exchange rate changes on

the balance of cash held in foreign

currencies (13) (21)

Cash and cash equivalents at end of

year 2,657 10,645

NOTES TO THE FINANCIAL STATEMENTS

1. General Information

Basis of preparation

These financial statements have been prepared in accordance with

International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board and the Companies Act 2006

applicable to companies reporting under IFRS.

The financial statements have been prepared under the historical

cost convention.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 December 2018

or 2017 but is derived from those accounts. Statutory accounts for

2017 have been delivered to the registrar of companies, and those

for 2018 will be delivered in due course. The auditor has reported

on those accounts; their reports were (i) unqualified, (ii) did not

include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006.

Going concern

As at 31 December 2018 the Group has current assets of

GBP1,414,000 and cash and bank balances of GBP2,657,000. During the

year the Group suffered a loss after tax of GBP10,004,000 and had

net cash outflows from operating activities of GBP2,939,000. The

cash flows for the current year have had to bear both pre-opening

costs at our newly opened owner-operated businesses and a full year

of head office costs without a full year of trade from the

owner-operated sites, and as such the Directors are expecting a

substantially improved profit and cash generation in the coming

year. These accounts have been prepared on a going concern basis as

described below.

In order to fund the business strategy of growth via new

openings, the Group is undergoing a fundraising via a

non-pre-emptive secondary placing which is expected to raise a

minimum of GBP4m before expenses. The Placing is subject to

approval by shareholders at a General Meeting to be held on 31 May

2019.

The Directors have considered alternatives for the business in

the event of the placing failing to complete in accordance with its

terms and have developed a secondary business plan which would be

activated in event this were necessary. This would involve

increased focus on the less capital-intensive franchise business

and generating cost savings by scaling the head office function to

match the size of the business. When preparing cash flow forecasts

for the secondary business plan, the directors have also considered

the key risks affecting the business including Brexit and consider

that the Group has sufficient cash reserves that it reasonably

expects to be sufficient to meet its liabilities as they fall due.

Accordingly, the Directors consider that the Group has adequate

financial resources to continue operating for the next 12 months

and that it is therefore appropriate to adopt the going concern

basis in preparing the financial statements.

2. Significant accounting policies

Key estimates in the current year

Impairment reviews

IFRS requires management to undertake an annual test for

impairment of indefinite lived assets and, for finite lived assets,

to test for impairment if events or changes in circumstances

indicate that the carrying amount of an asset may not be

recoverable.

Impairment testing is an area involving management judgement in

determining estimates, requiring assessment as to whether the

carrying value of assets can be supported by the net present value

of future cash flows derived from such assets using cash flow

projections which have been discounted at an appropriate rate. In

calculating the net present value of the future cash flows, certain

assumptions are required to be made in respect of highly uncertain

matters including management's expectations of:

-- growth in EBITDA, calculated as adjusted operating profit

before depreciation and amortisation;

-- average occupancy rate of an escape room;

-- the level of capital expenditure to open new sites and the costs of disposals;

-- long-term growth rates; and

-- the selection of discount rates to reflect the risks involved.

The Group prepares and approves a detailed annual budget and

five-year strategic plan for its operations, which are used in the

fair value calculations.

Changing the assumptions selected by management, in particular

the discount rate and growth rate assumptions used in the cash flow

projections, could significantly affect the Group's impairment

evaluation and hence results.

Goodwill of GBP1.4m relating to the acquisition of EV in 2017

was allocated to the owner-operated business and represents a group

of Cash Generating Units ("CGU") and tested for impairment as of

the reporting date. The carrying value of the owner-operated

business was tested for impairment on the basis of fair value less

costs to sell, including a discount rate of 16.2% based on the rate

that would be used by a market participant. These impairment tests

indicated an impairment loss is required and this loss has been

first taken to reduce the carrying value of goodwill, with the

remaining impairment allocated to intellectual property.

The sensitivity of impairment tests to changes in underlying

assumptions is summarised below:

Occupancy rates

The impairment tests have assumed an average occupancy rate of

the owner-operated escape rooms of 42% of available rooms. If the

occupancy rate achieved is 1% lower than budget, this would lead to

the recognition of an additional impairment loss on the

intellectual property of GBP1.37m.

Discount rate

If the discount rate was increased by 1%, this would have led to

the recognition of an additional impairment loss on the

intellectual property of GBP1m.

EBITDA growth

If growth in EBITDA was on average GBP100,000 lower in each

year, this would lead to the recognition of an additional

impairment loss on the intellectual property of GBP628,000.

Long-term perpetuity growth rates

The terminal rate used for the fair value calculation has been

assumed at 2% per annum. If this rate was decreased by 1%, this

would have led to the recognition of an additional impairment loss

on the intellectual property of GBP593,000.

Capital expenditure

Total capital expenditure of GBP6,740,000 over the five-year

strategic plan has been assumed. If such expenditure was 10% higher

than budgeted, this would lead to the recognition of an additional

impairment loss on intellectual property of GBP533,000.

Estimation of useful life and amortisation rates for

intellectual property assets

The useful life used to amortise intangible assets relates to

the expected future performance of the assets acquired and

management's estimate of the period over which economic benefit

will be derived from the asset.

The estimated useful life principally reflects management's view

of the average economic life of each asset and is assessed by

reference to historical data and future expectations. Any reduction

in the estimated useful life would lead to an increase in the

amortisation charge. The average economic life of the intellectual

property has been estimated at 3 years. If the estimation of

economic lives was reduced by one year, the amortisation charge for

IP would have increased by GBP1,709,000 (year ended 31 December

2017: GBP1,133,000).

3. Revenue

Year Year

ended ended

31 December 31 December

2018 2017

GBP'000 GBP'000

New branch upfront location exclusivity

fees 123 101

Game design fees 118 88

Support and administrative fees 94 65

Franchise revenues 741 540

Owned branch revenues 1,077 75

Other 19 3

2,172 872

------------ ------------

4. Segment information

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the group of executive directors

and the chief executive officer who make strategic decisions.

The Company was an investing company and did not trade until its

acquisition of Experiential Ventures Limited ("EV") on 2 May 2017.

Since the acquisition, management considers that the Group has two

operating segments. Revenues are reviewed based on the nature of

the services provided as follows:

1. The franchise business, where all franchised branches are

operating under effectively the same model; and

2. The owner-operated branch business, which currently consists of 9 sites in the UK.

The Group operates on a global basis. At present, the Company

has active franchisees in 22 countries. The Company does not

presently analyse or measure the performance of the franchising

business into geographic regions or by type of revenue, since this

does not provide meaningful analysis to managing the business.

Segment results, assets and liabilities include items directly

attributable to a segment as well as those that can be allocated on

a reasonable basis.

The cost of sales in the owner-operated business comprise site

staff costs, premises costs, including rent, rates, service charges

and utilities, and site-specific marketing and also including any

pre-opening costs. Cost of sales also includes site pre-opening

costs. In the franchisee business, the cost of sales comprises

principally game design fees and game design staff costs.

Owner- Franchise- Unallocated Total

operated operated

Year ended 31 December GBP'000 GBP'000 GBP'000 GBP'000

2018

Revenue 1,077 1,095 - 2,172

Cost of sales (1,950) (187) - (2,137)

--------- ---------- ----------- --------

Gross profit/(loss) (873) 908 - 35

Profit/(loss) from operations

Interest income - - 34 34

Expenses

- Administrative (825) (551) (2,113) (3,489)

- Depreciation and amortisation (4,109) (118) - (4,227)

- Impairment losses (2,345) - - (2,345)

- Share-based payment

expenses - - (12) (12)

Profit/(loss) from operations

before tax (8,126) 239 (2,091) (9,978)

Taxation (26) - - (26)

--------- ---------- ----------- --------

Profit/(loss) for the

year (8,152) 239 (2,091) (10,004)

--------- ---------- ----------- --------

Other information:

Non-current assets 8,508 986 - 9,494

--------- ---------- ----------- --------

Owner- Franchise- Unallocated Total

operated operated

Year ended 31 December GBP'000 GBP'000 GBP'000 GBP'000

2017

Revenue 74 798 - 872

Cost of sales (55) (275) (34) (364)

--------- ---------- ----------- -------

Gross profit/(loss) 19 523 (34) 508

Profit/(loss) from operations

Interest income - - 9 9

Expenses

- Administrative (18) (250) (977) (1,245)

- Depreciation and amortisation (2,307) (90) - (2,397)

- Transaction - - (957) (957)

- Share-based payment

expenses - - (43) (43)

Profit/(loss) from operations

before tax (2,306) 183 (2,002) (4,125)

Taxation (2) (2) - (4)

--------- ---------- ----------- -------

Profit/(loss) for the

year (2,308) 181 (2,002) (4,129)

--------- ---------- ----------- -------

Other information:

Non-current assets 10,056 893 - 10,949

--------- ---------- ----------- -------

5. Staff costs

Year Year

Ended ended

31 December 31 December

2018 2017

GBP'000 GBP'000

Wages salaries and benefits

(including directors) 1,921 626

Share-based payments 12 13

Social security costs 180 69

Other post-employment benefits 36 22

Less amounts capitalised (150) (45)

1,999 685

------------ ------------

6. Property, plant and equipment

Leasehold Office Computers Furniture Escape Total

property equipment and fixtures games

---------- ----------- -------------- -------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost:

At 1 January 2017 - - - - - -

Additions 576 16 37 5 59 693

Currency translation

differences (1) (1) (1) - - (3)

As at 31 December

2017 575 15 36 5 59 690

Additions 2,204 18 70 171 1,813 4,276

Disposals (28) (22) (37) (9) - (96)

---------- ----------- ---------- -------------- -------- --------

As at 31 December

2018 2,751 11 69 167 1,872 4,870

---------- ----------- ---------- -------------- -------- --------

Accumulated depreciation:

As at 1 January - - - - - -

2017

Depreciation charge (5) (3) (12) (1) (1) (22)

Currency translation

differences 1 - 1 - - 2

As at 31 December

2017 (4) (3) (11) (1) (1) (20)

Depreciation charge (241) (5) (24) (16) (259) (545)

Disposals 13 6 31 11 - 61

---------- ----------- ---------- -------------- -------- --------

As at 31 December

2018 (232) (2) (4) (5) (260) (504)

---------- ----------- ---------- -------------- -------- --------

Net book value

As at 31 December

2018 2,519 9 65 161 1,612 4,366

---------- ----------- ---------- -------------- -------- --------

As at 31 December

2017 571 12 25 4 58 670

---------- ----------- ---------- -------------- -------- --------

The amount of expenditure recognised in the carrying value of

leasehold improvements in the course of construction at 31 December

2018 is GBP153,000 (2017: GBP215,000).

7. Intangible assets

Internally

Intellectual generated Franchise App

Goodwill Trademarks property IP agreements Quest Portal Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January

2017 - - - - - - - -

Additions through

business

combinations 11 - - - - - 50 61

Arising on

purchase price

allocation 1,393 - 10,195 - 802 - - 12,390

Additions arising

from internal

development - - - - - - 50 50

Other additions - 13 - - - 141 154

Transfers - - - - - 100 (100) -

----------- ----------- ------------- ----------- ------------ -------- -------- --------

At 31 December

2017 1,404 13 10,195 - 802 100 141 12,655

Additions through

business

combinations 29 - - - - - - 29

Additions arising

from acquisition - 65 - - - - 128 193

Additions arising

from internal

development - - - 302 - - - 302

Disposals (11) - - - - - - (11)

----------- ----------- ------------- ----------- ------------ -------- -------- --------

As at 31 December

2018 1,422 78 10,195 302 802 100 269 13,168

----------- ----------- ------------- ----------- ------------ -------- -------- --------

Accumulated

amortisation

At 1 January

2017 - - - - - - -

Amortisation

for the year - - (2,266) - (76) (33) - (2,375)

----------- ----------- ------------- ----------- ------------ -------- -------- --------

At 31 December

2017 - - (2,266) - (76) (33) - (2,375)

Amortisation

for the year - (11) (3,398) (21) (115) (50) (61) (3,656)

Impairment

provision (1,393) - (952) - - - - (2,345)

----------- ----------- ------------- ----------- ------------ -------- -------- --------

As at 31 December

2018 (1,393) (11) (6,616) (21) (191) (83) (61) (8,376)

----------- ----------- ------------- ----------- ------------ -------- -------- --------

Carrying amounts

At 31 December

2018 29 67 3,579 281 611 17 208 4,792

=========== =========== ============= =========== ============ ======== ======== ========

At 31 December

2017 1,404 13 7,929 - 726 67 141 10,280

=========== =========== ============= =========== ============ ======== ======== ========

.

8. Loan to franchisee

A secured loan of GBP300,000 is due from a master franchisee

which bears interest at 5% per annum plus 2% of the franchisee's

revenues and is repayable in instalments between January 2021 and

June 2023.

The majority of income receivable under the terms of the loan

relates to interest at a fixed rate. The valuation of this loan

also takes account of the expected income under the revenue share;

however, the impact of this estimate is not significant to the

valuation. The carrying value of the loan approximates fair value.

Credit risk is not considered to be significant.

9. Trade and other payables (current)

As at As at

31 December 31 December

2018 2017

GBP'000 GBP'000

Trade payables 670 507

Accruals 796 259

Deferred income 244 83

Taxation 23 5

Other taxes and social security 112 185

Other payables 36 30

1,881 1,069

------------ -------------

10. Deferred income

As at As at

31 December 31 December

2018 2017

GBP'000 GBP'000

Contract liabilities (deferred

income):

Balance at beginning of year 539 -

Revenue recognised in the year that was included

in the deferred income balance at the beginning (103) -

of the year

Arising on business combination - 666

Increases due to cash received, excluding amounts

recognised as revenue during the period 218 139

Decreases in deferred income as a result of

changes in the measure of progress (release

on recognition of revenue arising from contract

liabilities) (4) (202)

Decreased on termination of franchises (17) (39)

Translation differences 30 (25)

Transaction price allocated to the remaining

performance obligations 663 539

------------ -------------

11. Operating leases

As at the reporting date, the Group had commitments for future

minimum lease payments under non-cancellable operating leases as

follows:

As at As at

31 December 31 December

2018 2017

GBP'000 GBP'000

Within one year 388 82

Between one and five years 1,610 664

More than five years 1,981 710

3,979 1,456

------------ -------------

Amount recognised in profit or loss:

Lease expenses 476 60

---- ---

12. Related party transactions

Related parties are entities with common direct or indirect

shareholders and/or directors. Parties are considered to be related

if one party has the ability to control the other party in making

financial and operating decisions.

During the period under review, in addition to those disclosed

elsewhere in these financial statements, the following significant

transactions took place at terms agreed between the parties:

A salary of GBP33,000 and other benefits of GBP2,000 were paid

to close family members of two of the directors (2017: salary of

GBP14,000) on an arm's length basis.

Interests in the share capital of the Company

Details of the Directors' interests in the share capital and

share options of the Company are disclosed in the Directors

Report.

13. Subsequent events

There have been two events that have occurred since the year end

that require disclosure. After the year end, the Group agreed a

grant with Scottish Enterprise whereby Scottish Enterprise would

make GBP2m available as a contribution to the development of the

Group's activities in Scotland, including the site which opened in

Edinburgh in October 2018. In addition to its commercial

activities, the Group will base certain game design functions and

activities in Scotland.

In order to fund the business strategy of growth via new

openings, the Group is undergoing a fundraising via a

non-pre-emptive secondary placing which is expected to raise a

minimum of GBP4m before expenses. The Placing is subject to

approval by shareholders at a General Meeting to be held on 31 May

2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR KMGMKLZDGLZM

(END) Dow Jones Newswires

May 13, 2019 02:00 ET (06:00 GMT)

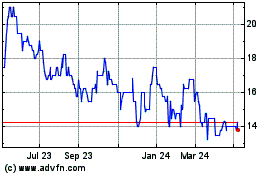

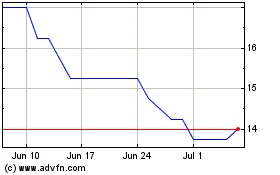

Xp Factory (LSE:XPF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Xp Factory (LSE:XPF)

Historical Stock Chart

From Jul 2023 to Jul 2024