TomCo Energy PLC Appointment of Joint Broker / Liquidity Facility (4360W)

January 28 2013 - 2:00AM

UK Regulatory

TIDMTOM

RNS Number : 4360W

TomCo Energy PLC

28 January 2013

28 January 2013

TomCo Energy Plc

("TomCo" or "the Company")

Appointment of Fox-Davies Capital as Joint Broker

Liquidity Facility with Windsor Capital and

Issue of 100 Million Ordinary Shares

TomCo Energy Limited (AIM: TOM), the oil shale exploration and

development company focused on using innovative technology to

unlock unconventional hydrocarbon resources, is pleased to announce

the appointment of Fox-Davies Capital Limited ("Fox-Davies

Capital") as Joint Broker to the Company with immediate effect.

TomCo also announces that it has entered into a Liquidity

Facility Agreement and an associated Promissory Note (together the

"Liquidity Facility") with Windsor Capital Partners Limited

("Windsor Capital"), an affiliate of Fox-Davies Capital. Under the

Liquidity Facility TomCo has issued and allotted 100 million

ordinary shares of 0.5 pence each ("Ordinary Shares"), representing

an increase of 6% on the current number of shares in issue, to

Windsor Capital in exchange for the Promissory Note.

The Liquidity Facility allows the Company to access capital

using the natural liquidity that is available in the Company's

shares in a more cost-effective manner than a traditional equity

line product.

At the closing mid-market share price of 1.575 pence on 25

January 2012, the value of the Ordinary Shares issued to Windsor

Capital is estimated at GBP1.575 million. The Promissory Note

delivers to TomCo the proceeds of the sale of the Ordinary Shares

over the life of the Promissory Note based on the occurrence of

"Liquidity Trigger Days". Liquidity Trigger Days are those days on

which the volume of shares traded is greater than 80% of the

trailing 90 day weighted average daily trading volume. On Liquidity

Trigger Days, Windsor Capital will seek to sell Ordinary Shares, up

to a maximum of 10% of the daily volume averaged over any 5 day

period, on a best effort basis at the AIM Market offer-price or

higher. The Liquidity Facility can be suspended at the Company's

discretion in periods of adverse market conditions and minimum

share prices can also be stipulated.

Windsor Capital has entered into an agreement with Fox-Davies

Capital to effect these trades through a combination of access to

its market making desk and/or Retail Service Provider networks

("RSP"). Windsor Capital will remit the net proceeds of any sales

of Ordinary Shares on a monthly basis against the outstanding

amount of the Promissory Note. As such, there are no guaranteed

minimum proceeds and any net proceeds to TomCo will reflect the

actual value of any sales of Ordinary Shares achieved less a

transaction fee of 3% payable to Windsor Capital. The Liquidity

Facility is for a period of 12 months and no other cash fees or

warrants are payable to Windsor Capital. At the end of the one year

period any shares left unsold through the facility will be returned

to the Company and taken into treasury, or the parties may agree to

the extension of the facility.

The Company will provide further updates with regards to the

proceeds it receives under the Liquidity Facility on a periodic

basis, as appropriate. As announced on 23 October 2012, the

Company's cash balance at 30 September 2012 was GBP411,000, with no

debt and the Company continues with its prudent cash management.

The Company expects that any net proceeds will assist with its

working capital position and it will continue to explore other

options in order to provide necessary funding for its

operations.

The Ordinary Shares are expected to be admitted to trading on

AIM on 31 January 2013. Following admission of the Ordinary Shares,

the total number of shares in issue will be 1,721,049,218.

CEO Paul Rankine commented: "This product enables TomCo to

benefit from the natural liquidity in our shares without the undue

downward pressure on our share price that is typically seen in more

conventional equity line products. This represents a timely and

cost-effective mechanism for raising modest amounts of capital at

market prices when market conditions are favourable."

Enquiries:

TomCo Energy Limited

Paul Rankine, CEO +44 20 7766 0070

Numis Securities Limited

Nomad and Joint Broker

Alastair Stratton / Oliver Cardigan (Nomad)

James Black (Broker) +44 20 7260 1000

Fox-Davies Capital Limited

Joint Broker

Daniel Fox-Davies, Richard Hail +44 020 3463 5000

Tavistock Communications

Financial PR & IR

Ed Portman/Conrad Harrington/Jos Simson +44 20 7920 3150

Notes to Editors:

TomCo Energy Limited (AIM: TOM) is a London based, AIM-listed

company, with substantial Oil Shale assets in Utah, USA.

TomCo holds a 100% interest in two Oil Shale leases, comprising

5 blocks covering 2,919 acres in Uintah County, Utah. Independent

natural resources consultants SRK Consultants Ltd, part of the

internationally recognised SRK Group, has declared a surface

mineable JORC compliant Measured Resource of 126 million barrels on

the main tract of TomCo's Holliday Block lease.

The Company has entered into a licence agreement with Red Leaf

Resources Inc ("Red Leaf") for the use of their EcoShale(TM)

In-Capsule Process, a proven and environmentally sensitive

technology, to extract Oil from TomCo's leases.

Additionally, Red Leaf is planning a 9,800 bopd commercial

operation at their Seep Ridge site, which lies about 15 miles SW of

TomCo's Holliday Block lease.

Led by a highly experienced management team, TomCo's strategy is

to develop the Holliday Block lease as a similar follow-on project

to Seep Ridge using the EcoShale(TM) In-Capsule Process, with the

same targeted production of 9,800 bopd.

Glossary:

bopd: barrels of oil per day

JORC Code: The mineral resource classification code devised by

the Australasian Joint Ore Reserves Committee

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLLFFDLAIEFIV

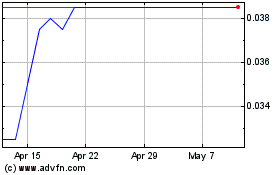

Tomco Energy (LSE:TOM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Tomco Energy (LSE:TOM)

Historical Stock Chart

From Nov 2023 to Nov 2024