TIDMTOM

RNS Number : 2332F

TomCo Energy PLC

13 June 2012

13 June 2012

TOMCO ENERGY PLC

("Tomco" or the "Company")

UNAUDITED INTERIM RESULTS FOR THE SIX MONTHS ENDED 31 MARCH

2012

TomCo Energy Plc (AIM:TOM), the US focused petroleum exploration

and production company, announces its interim results for the six

months ended 31 March 2012.

HIGHLIGHTS:

-- Converted outstanding loans with Kenglo One Ltd into shares.

Company has no outstanding loans

-- Exercise of 34,666,667 warrants raising cash of GBP520,000

-- Invests $5 million in Red Leaf Resources Inc

Post Period End Highlights

-- Paul Rankine continues role as CEO on a permanent basis

-- SRK Consulting updates Holliday Block to 126 million barrels

in the JORC Code Measured category

Paul Rankine, CEO of TomCo, commented "The $5 million investment

in Red Leaf highlights the confidence that we have in Red Leaf and

the EcoShale process whilst the conversion of the outstanding loans

during the period has further consolidated the company's finances

moving forward.

SRK's update on the Company's Holliday Block to a JORC compliant

Measured resource of 126 million barrels, combined with Total's

commitment of $320 million for its 50% participation in Red Leaf's

Utah assets provides us with further confidence that we have an

outstanding, viable asset that will deliver significant shareholder

value and we view the future with confidence."

Enquiries

TomCo Energy - 020 7766 0078

Sir Nicolas Bonsor, Chairman

Numis - Nominated Adviser 020 7260 1000

Alastair Stratton/Oliver Cardigan, Corporate Finance

James Black, Corporate Broking

Newgate Threadneedle - 020 7653 9840

Josh Royston, Richard Gotla

CHAIRMAN'S STATEMENT & REVIEW OF OPERATIONS

A lot has been achieved since we released our Annual Report and

Financial Statements in March this year. We were pleased to

disclose that our $5 million investment in Red Leaf Resources Inc.

("Red Leaf") was part of a $100 million raising by Red Leaf that

created a Joint Venture ("JV") with Total E&P USA Oil Shale,

LLC ("Total"), an affiliate of Total SA, the 5(th) largest

international integrated oil and gas company. The JV is for the

development of the Red Leaf Oil Shale assets in Utah using Red

Leaf's proprietary "EcoShale" processing technology to manufacture

oil from near surface shale rock. These assets are located close to

those of TomCo's Holliday Block in Utah and TomCo has an existing

commercial agreement to utilise the EcoShale technology. This is a

highly significant development, not only for us but also

potentially for energy markets in general. Commercial oil shale

mining could unlock one of the world's great oil resources. The

deal between Total and Red Leaf has fully funded what is

anticipated to be the first commercial scale "EcoShale" process.

Total's full commitment of $320 million for its 50% participation

in Red Leaf's Utah assets is a meaningful investment. Red Leaf's

Seep Ridge is approximately the same size as our Holliday Block and

will have the same target full production rate of 9,800 barrels per

day. Red Leaf has now secured the funding and key permits to fully

develop the Seep Ridge project and TomCo will continue the process

towards production at our Holliday Block.

We were also pleased to announce that SRK Consulting (UK)

Limited ("SRK") has reviewed recent work carried out by TomCo on

the Company's Holliday Block and has issued an updated JORC Code

mineral resource statement. In doing this, SRK has upgraded the 123

million barrels previously reported in the Indicated category to

126 million barrels in the Measured category. The SRK revised

mineral resource statement not only gives us increased confidence

on the oil contained within our Holliday Block lease up to a JORC

compliant Measured Resource, but also increases the resource

magnitude from 123 to 126 million barrels. We are now working on

providing SRK with the required technical reports to enable this

JORC compliant Resource to be upgraded to a JORC compliant Ore

Reserve.

Finally, I am delighted that Paul will continue as CEO of TomCo

on a permanent basis, effective 1(st) June. Paul has vast

experience at board level with AIM-listed mining companies and

coupled with his considerable knowledge of the oil shale process I

am confident that the company will continue to move forward and

deliver on its stated strategy.

Sir Nicholas Bonsor Bt DL

Condensed consolidated statement of comprehensive income

For the period ended 31 March 2012

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2012 2011 2011

------------------------------------ ------------ ------------ --------------

GBP'000 GBP'000 GBP'000

------------------------------------ ------------ ------------ --------------

Revenue 7 8 16

Cost of sales (2) (2) (5)

------------------------------------ ------------ ------------ --------------

Gross profit 5 6 11

Administrative expenses 4 (636) (521) (1,687)

------------------------------------ ------------ ------------ --------------

Operating loss (631) (515) (1,676)

Finance income 1 - 131

Finance costs - (209) (356)

Derivative expense - - (295)

------------------------------------ ------------ ------------ --------------

Loss on ordinary activities

before taxation (630) (724) (2,196)

Taxation - - -

------------------------------------ ------------ ------------ --------------

Loss from continuing operations (630) (724) (2,196)

------------------------------------ ------------ ------------ --------------

Loss for the year and total

comprehensive income attributable

to equity shareholders of the

parent (630) (724) (2,196)

------------------------------------ ------------ ------------ --------------

Unaudited Unaudited Audited

Six months Six months Year

Note ended ended ended

31 March 31 March 30 September

2012 2011 2011

Pence per Pence per Pence per

share share share

-------------------------------- ------ ------------ ------------ --------------

Loss per share attributable

to the equity shareholders of

the parent

-------------------------------- ------ ------------ ------------ --------------

Basic & Diluted Loss per share 5 (0.04) (0.09) (0.25)

-------------------------------- ------ ------------ ------------ --------------

Condensed consolidated statement of financial position

As at 31 March 2012

Note Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2012 2011 2011

GBP'000 GBP'000 GBP'000

---------------------------------- ----- ------------ ------------ --------------

Assets

Non--current assets

Intangible assets 6 11,215 7,923 7,945

Property, plant and equipment 11 15 13

11,226 7,938 7,958

---------------------------------- ----- ------------ ------------ --------------

Current assets

Trade and other receivables 28 38 202

Cash and cash equivalents 905 259 1,363

---------------------------------- ----- ------------ ------------ --------------

933 297 1,565

---------------------------------- ----- ------------ ------------ --------------

TOTAL ASSETS 12,159 8,235 9,523

Liabilities

Current liabilities

Trade and other payables (103) (315) (327)

Convertible loan - (3,865) (888)

Derivative liability - - (295)

(103) (4,180) (1,510)

---------------------------------- ----- ------------ ------------ --------------

Net current assets/(liabilities) 830 (3,883) 55

---------------------------------- ----- ------------ ------------ --------------

TOTAL LIABILITIES (103) (4,180) (1,510)

---------------------------------- ----- ------------ ------------ --------------

Total net assets 12,056 4,055 8,013

---------------------------------- ----- ------------ ------------ --------------

Shareholders' equity

Share capital 7 8,077 3,798 6,555

Share premium 13,724 7,907 10,573

Warrant reserve 360 928 492

Retained deficit (10,105) (8,578) (9,607)

---------------------------------- ----- ------------ ------------ --------------

Total equity 12,056 4,055 8,013

---------------------------------- ----- ------------ ------------ --------------

The financial information on pages 3 to 8 was approved and

authorised for issue by the Board of Directors on 11 June and were

signed on its behalf by:

Paul Rankine Miikka Haromo

Director Director

Condensed consolidated statement of changes in equity

For the six months ended 31 March 2012

Share Share Warrant Retained

capital premium reserve deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- -------- -------- -------- --------- --------

Opening balance at 1 October

2010 (audited) 3,798 7,907 928 (7,854) 4,779

-------------------------------- -------- -------- -------- --------- --------

Total comprehensive loss

for the period - - - (724) (724)

At 31 March 2011 (unaudited) 3,798 7,907 928 (8,578) 4,055

-------------------------------- -------- -------- -------- --------- --------

Total comprehensive loss

for the period - - - (1,472) (1,472)

Issue of warrants - - 7 - 7

Expired warrants - - (443) 443 -

Issue of share capital 2,757 2,666 - - 5,423

-------------------------------- -------- -------- -------- --------- --------

At 30 September 2011 (audited) 6,555 10,573 492 (9,607) 8,013

-------------------------------- -------- -------- -------- --------- --------

Total comprehensive loss

for the period - - - (630) (630)

Expired warrants - - (132) 132 -

Issue of share capital 1,522 3,151 - - 4,673

-------------------------------- -------- -------- -------- --------- --------

At 31 March 2012 (unaudited) 8,077 13,724 360 (10,105) 12,056

-------------------------------- -------- -------- -------- --------- --------

Condensed consolidated statement of cash flows

For the period ended 31 March 2012

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2012 2011 2011

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ ------------ --------------

Cash flows from operating activities

Loss after tax (630) (724) (2,196)

Depreciation 2 2 4

Share based payments - - 7

Finance income (1) - (131)

Finance costs - 209 651

(Increase)/decrease in trade

and other receivables 174 - (164)

(Decrease)/increase in trade

and other payables (224) 70 109

--------------------------------------- ------------ ------------ --------------

Cash used in operations (679) (443) (1,720)

--------------------------------------- ------------ ------------ --------------

Cash flows from investing activities

Purchase of technology licence - (647) (647)

Investment in oil & gas assets (3,213) (263) (249)

Net cash used in investing activities (3,213) (910) (896)

--------------------------------------- ------------ ------------ --------------

Cash flows from financing activities

Issue of share capital 3,434 - 3,435

Proceeds from issue of loan note - 1,000 1,000

Loan repayment - - (1,000)

Loan interest paid - - (68)

--------------------------------------- ------------ ------------ --------------

Net cash generated from financing

activities 3,434 1,000 3,367

--------------------------------------- ------------ ------------ --------------

Net increase/(decrease) in cash

and cash equivalents (458) (353) 751

Cash and cash equivalents at

beginning of financial period 1,363 612 612

--------------------------------------- ------------ ------------ --------------

Cash and cash equivalents at

end of financial period 905 259 1,363

--------------------------------------- ------------ ------------ --------------

UNAUDITED NOTES FORMING PART OF THE CONDENSED CONSOLIDATED

INTERIM FINANCIAL STATEMENTS

For the six months ended 31 March 2012

1. Accounting Policies

Basis of Preparation

The condensed interim financial information has been prepared

using policies based on International Financial Reporting Standards

(IFRS and IFRIC interpretations) issued by the International

Accounting Standards Board ("IASB") as adopted for use in the EU.

The condensed interim financial information has been prepared using

the accounting policies which will be applied in the Group's

statutory financial information for the year ended 30 September

2012.

Going concern

The Directors are confident that the Group has sufficient funds

to meet its working capital requirements and commitments for a

period of not less than twelve months from the date of signing of

these financial statements and as a result the financial statements

have been prepared on the going concern basis.

2. Financial reporting period

The condensed interim financial information incorporates

comparative figures for the interim period 1 October 2010 to 30

September 2011 and the audited financial year to 30 September 2011.

The condensed interim financial information for the period 1

October 2011 to 31 March 2012 is unaudited. In the opinion of the

Directors the condensed interim financial information for the

period presents fairly the financial position, results from

operations and cash flows for the period in conformity with the

generally accepted accounting principles consistently applied.

The financial information contained in this interim report does

not constitute statutory accounts as defined by the Isle of Man

Companies Act 2006. The comparatives for the full year ended 30

September 2011 are not the Company's full statutory accounts for

that year. A copy of the statutory accounts for the year ended 30

September 2011 has been delivered to the Registrar of Companies.

The auditors' report on those accounts was unqualified, did not

include references to any matters to which the auditors drew

attention by way of emphasis without qualifying their report and

did not contain a statement under the provisions of the Isle of Man

Companies Act 2006.

3. Revenue

Revenue is attributable to one continuing activity, which is oil

production from a wholly-owned subsidiary of the Group, located in

the United States.

4. Operating Loss

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 March 31 March 30 September

(unaudited) (unaudited) (audited)

2012 2011 2011

---------------------------------------------------- ------------- ------------- --------------

The following items have been charged/(credited)in GBP'000 GBP'000 GBP'000

arriving at operating loss:

---------------------------------------------------- ------------- ------------- --------------

Depreciation of property, plant and equipment 2 2 4

Directors' fees 287 139 489

Share--based payments charge - statement

of comprehensive income - - 7

Auditors' remuneration:

- audit services 22 30 62

-non audit services - 6 36

Rentals payable in respect of land and buildings 25 46 60

---------------------------------------------------- ------------- ------------- --------------

In relation to his termination of appointment as director in the

six months to 31 March 2012, Stephen Komlosy received a

compensation payment of GBP123,693.

5. Loss per share

Basic loss per share is calculated by dividing the losses

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

Reconciliations of the losses and weighted average number of shares

used in the calculations are set out below.

Weighted average

Number Per share

Losses of shares Amount

Six months ended 31 March 2012 GBP'000 '000 Pence

---------------------------------------- -------- ------------------ ----------

Basic and Diluted EPS

Losses attributable to ordinary

shareholders on continuing operations (630) 1,416,071 (0.04)

---------------------------------------- -------- ------------------ ----------

Total losses attributable to ordinary

shareholders (630) 1,416,071 (0.04)

---------------------------------------- -------- ------------------ ----------

Weighted average

Number Per share

Losses of shares Amount

Six months ended 31 March 2011 GBP'000 '000 Pence

---------------------------------------- -------- ------------------ ----------

Basic and Diluted EPS

Losses attributable to ordinary

shareholders on continuing operations (724) 759,549 (0.09)

---------------------------------------- -------- ------------------ ----------

Total losses attributable to ordinary

shareholders (724) 759,549 (0.09)

---------------------------------------- -------- ------------------ ----------

Weighted average

Number Per share

Losses of shares Amount

Financial year ended 30 September GBP'000 '000 Pence

2011

---------------------------------------- -------- ------------------ ----------

Basic and Diluted EPS

Losses attributable to ordinary

shareholders on continuing operations (2,196) 877,371 (0.25)

---------------------------------------- -------- ------------------ ----------

Total losses attributable to ordinary

shareholders (2,196) 877,371 (0.25)

---------------------------------------- -------- ------------------ ----------

6. Intangible assets

Oil & Gas Oil & Gas Oil & Gas

Available Exploration Technology Total

for sale and development licence

financial licence

assets

GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ----------- ----------------- ----------- --------

Cost

At 1 October 2010 - 6,382 667 7,049

---------------------- ----------- ----------------- ----------- --------

Additions - 227 647 874

---------------------- ----------- ----------------- ----------- --------

At 31 March 2011 - 6,609 1,314 7,923

---------------------- ----------- ----------------- ----------- --------

Additions - 22 - 22

---------------------- ----------- ----------------- ----------- --------

At 30 September 2011 - 6,631 1,314 7,945

Additions 3,148 122 - 3,270

Net book value

At 31 March 2012 3,148 6,753 1,314 11,215

---------------------- ----------- ----------------- ----------- --------

At 30 September 2011 - 6,631 1.314 7,945

---------------------- ----------- ----------------- ----------- --------

At 31 March 2011 - 6,609 1,314 7,923

---------------------- ----------- ----------------- ----------- --------

On 30 March 2012, the company announced its intention to make a

$5 million investment in Red Leaf Resources Inc. ("Red Leaf") as

part of a $100 million raising from Red Leaf in conjunction with

the closing of a Joint Venture ("JV") with Total E&P USA Oil

Shale, LLC. The completion of the investment was announced on 2

April 2012. The Investment included a GBP2,957,500 subscription by

Altima Global Special Situations Master Fund Ltd ("AGSS"), Dominic

Redfern and Mark Donegan with TomCo at 1.75p per ordinary share

(the closing mid market price the day prior to the announcement of

the Investment). The balance of the Investment was financed from

TomCo's existing cash resources. As a result of the Investment,

TomCo received 3,333.33 shares in Red Leaf Resources Inc.

7. Share Capital

Six months Six months

ended ended Year ended

31 March 31 March 30 September

2012 2011 2011

(Unaudited) (Unaudited) (Audited)

Number of GBP,000 GBP'000 GBP,000

shares

---------------------------------- ------------ ------------- ------------- --------------

Issued and fully paid

At 1 October 6,555 3,798 3,798

Allotted during period:

July 2011 - placing at 1 pence

per share 551,346,803 - - 2,757

October 2011 - loan conversion

at 1 pence per share 100,920,548 504 - -

January 2012 - conversion of

warrants at 1.5 pence per share 34,666,667 173 - -

March 2012 - subscription at

1.75 pence per share 169,000,000 845 - -

---------------------------------- ------------ ------------- ------------- --------------

1,615,483,169 (March 2011:

759,549,151; September 2011:

1,310,895,954) ordinary shares

of GBP0.005 each 8,077 3,798 6,555

---------------------------------- ------------ ------------- ------------- --------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UUVNRUUANAAR

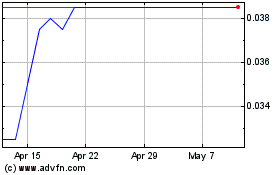

Tomco Energy (LSE:TOM)

Historical Stock Chart

From Sep 2024 to Oct 2024

Tomco Energy (LSE:TOM)

Historical Stock Chart

From Oct 2023 to Oct 2024