Trending: Shell's 2Q Update Boosts Investor Confidence in 2nd Half Buyback Plans

July 07 2023 - 7:50AM

Dow Jones News

1120 GMT - Shell is among the most mentioned companies in the

news over the past six hours, according to Factiva data, after the

energy major posted a trading update ahead of interim results later

in the month. Shell said it expects a large working-capital release

in the range of $2 billion to $6 billion in the second quarter.

Analysts say this should embolden investors who believe Shell's

first half-year run-rate of buybacks will continue, despite the

softening market conditions. "With the macro weakening, this should

help net debt decline quarter-on-quarter, which in turn, should

give investors confidence around the trajectory of gearing and

Shell's statements on "at least $5 billion" buybacks in the second

half-year," RBC Capital Markets analyst Biraj Borkhataria wrote in

a note. Shell said its second-quarter upstream production fell on

quarter to 1.7 million-1.8 million barrels of oil equivalent a day

compared with 1.9 million BOE a day in the first quarter, which was

largely anticipated, Borkhataria says. Shell's weaker trading

on-quarter in its integrated gas unit was also unsurprising, given

the strong first three months of the year, UBS analysts Henri

Patricot and Christabel Kelly says in a note. Dow Jones & Co.

owns Factiva. (christian.moess@wsj.com)

(END) Dow Jones Newswires

July 07, 2023 07:35 ET (11:35 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

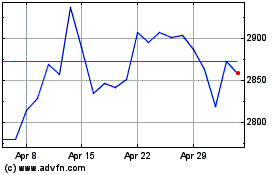

Shell (LSE:SHEL)

Historical Stock Chart

From May 2024 to Jun 2024

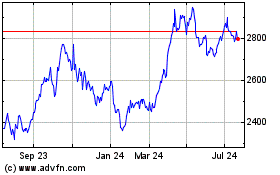

Shell (LSE:SHEL)

Historical Stock Chart

From Jun 2023 to Jun 2024