TIDMRGL

RNS Number : 7689R

Regional REIT Limited

02 July 2020

2 July 2020

REGIONAL REIT Limited

("Regional REIT", the "Group" or the "Company")

20.2% ERV Uplift from Asset Management Initiatives

Regional REIT (LSE: RGL), the regional real estate investment

specialist focused on building a diverse portfolio of income

producing regional UK core and core plus office and industrial

property assets, is pleased to announce several new office,

warehouse and retail lease renewals and extensions as part of the

asset manager's active approach to optimising portfolio value. The

rents amount to GBP531,364 with a total uplift of 20.2% to the

estimated rental value ("ERV"), being predominately sourced from

government-designated essential service occupiers.

Solihull Parkway, Birmingham Business Park, Solihull : A new

office tenancy agreement has been signed with the tenant taking

some 4,762 sq.ft.. The lease is for 10 years until June 2030 with a

break option on 31 May 2025. Headline rent is GBP92,589 pa

(GBP19.44/sq.ft.).

Marston Moor Business Park, Tockwith, York : A new office lease

has been agreed for 11,673sq.ft.. The lease runs until June 2026

with a break option in June 2023. Headline rent is GBP79,400 pa

(GBP6.80/sq.ft.), 70.0% above the ERV.

Marston Business Park, Tockwith, York : Three new leases across

three units for use as a warehouse and distribution centre with the

tenant amounting to 9,449sq.ft.. The leases run until June 2026

with break option in June 2023. Headline rent is GBP68,000 pa

(GBP7.20/sq. ft.) for the three units, 19.9% above the ERV.

Unit 3, Acorn Business Park, Killingbeck Drive, York Road, Leeds

: The tenant, Pivot Academy Leeds Ltd., has signed a lease until

June 2025 for 3,345sq. ft. for office space, with a break option in

June 2023. Headline rent is GBP34,300 pa (GBP10.25/sq. ft.) for the

three units, 28.0% above the ERV.

Woodlands Court, Ash Ridge Road, Bristol : The office lease has

been renewed with the existing tenant for two years until June 2022

(3,584 sq. ft.). Headline rent is GBP65,520 pa (GBP18.28/sq. ft.)

for the three units, 14.3% above the ERV.

Witham Park, Waterside South, Lincoln: The office lease has been

extended for one year with the tenant until July 2021, including a

rolling break subject to 3-mths notice and a rent of GBP71,055 pa

(GBP8.96sq.ft.). Following a recent refurbishment, the tenant has

already taken 17,000 sq. ft.

York House, 102a Hamilton Road, Felixstowe : Tenant retained

beyond break and lease secured until November 2022 (1,358 sq. ft.).

Rent is set at GBP13,500 (GBP9.94sq.ft.) until November 2021 and

GBP14,000 (GBP10.31sq.ft.) thereafter.

High Street, Dumfries : The tenant has extended the lease on the

13,687 sq. ft. of retail space from 2025 to September 2029, some

65.1% above ERV.

Stephen Inglis, Chief Executive Officer of London & Scottish

Property Investment Management Limited, the Asset Manager

commented:

"Good progress is being made and today's announcement further

demonstrates that Regional REIT has a successful strategy and

model, adaptable to meet our clients' needs, even in these testing

times. The positive progress achieved as part of our ongoing asset

management plan has resulted in ERV uplifts amounting to 20.2% and

follows on from our strong Q1 rental collection previously

announced. More than ever, our close relationships with tenants and

the strength of experience in the asset management team that spans

previous financial crises, continue to be invaluable in creating

exemplary usable spaces suitable for the new environment that meet

the needs of tenants and optimise value for shareholders."

- ENDS -

Enquiries:

Regional REIT Limited

Toscafund Asset Management Tel: +44 (0) 20 7845

6100

Investment Manager to the Group

Adam Dickinson, Investor Relations, Regional

REIT Limited

London & Scottish Property Investment Management Tel: +44 (0) 141

248 4155

Asset Manager to the Group

Stephen Inglis

Buchanan Communications Tel: +44 (0) 20 7466

5000

Financial PR regional@buchanan.uk.com

Charles Ryland / Victoria Hayns / Henry

Wilson

About Regional REIT

Regional REIT Limited ("Regional REIT" or the "Company") and its

subsidiaries (the "Group") is a United Kingdom ("UK") based real

estate investment trust that launched in November 2015. It is

managed by London & Scottish Property Investment Management

Limited, the Asset Manager, and Toscafund Asset Management LLP, the

Investment Manager.

Regional REIT's commercial property portfolio is comprised

wholly of income producing UK assets and comprises, predominantly,

offices and industrial units located in the regional centres

outside of the M25 motorway. The portfolio is highly diversified,

with 160 properties, 904 tenants as at 31 December 2019, with a

valuation of GBP787.9m.

Regional REIT pursues its investment objective by investing in,

actively managing and disposing of regional core and core plus

property assets. It aims to deliver an attractive total return to

its Shareholders, targeting greater than 10% per annum, with a

strong focus on income supported by additional capital growth

prospects.

The Company's shares were admitted to the Official List of the

UK's Financial Conduct Authority and to trading on the London Stock

Exchange on 6 November 2015. For more information, please visit the

Group's website at www.regionalreit.com .

Cautionary Statement

This document has been prepared solely to provide additional

information to Shareholders to assess the Group's performance in

relation to its operations and growth potential. The document

should not be relied upon by any other party or for any other

reason. Any forward looking statements made in this document are

done so by the Directors in good faith based on the information

available to them up to the time of their approval of this

document. However, such statements should be treated with caution

due to the inherent uncertainties, including both economic and

business risk factors, underlying any such forward-looking

information.

ESMA Legal Entity Identifier ("LEI"): 549300D8G4NKLRIKBX73

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFZGGNKMLGGZM

(END) Dow Jones Newswires

July 02, 2020 02:00 ET (06:00 GMT)

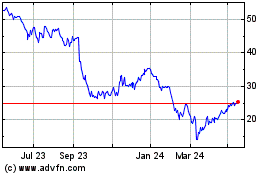

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jun 2024 to Jul 2024

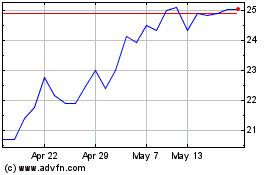

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jul 2023 to Jul 2024