JZ Capital Ptnrs Ltd Net Asset Value(s)

December 23 2019 - 12:45PM

UK Regulatory

TIDMJZCP TIDMJZCC TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-end collective investment scheme incorporated with limited liability

under the laws of Guernsey with registered number 48761)

LEI: 549300TZCK08Q16HHU44

THIS ANNOUCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET

ABUSE REGULATION (EU) NO. 596/2014

Monthly Net Asset Value ("NAV")

The unaudited Net Asset Value per Ordinary Share of the Company as at the close

of business on November 30, 2019 was as follows:

Company Date NAV per Ordinary Share

Name

JZ Capital Partners November 30, 2019 US$ 8.54

Limited

30 November 2019

JZCP's NAV at November 30, 2019 is $8.54 per share ($9.43 at October 31, 2019).

The decrease in NAV per share of (89 cents) per share is due to investment

losses of (108 cents), expenses and finance costs of (4 cents) and net FX

losses of (1 cent) offset by accrued income of 1 cent, escrow receipts of 2

cents and a write-back of the Investment Adviser's incentive fee provision of

21 cents.

Investment losses of (108 cents) are comprised primarily of the write-off of

the principal balance of the direct loan to Ombuds (18 cents) and a write-down

of (90 cents) on the Design District assemblage in Miami, Florida (see below).

Currently, the Borrower, in which JZCP is an investor, is in negotiations with

the Lender on the Design District assemblage to sign a non-binding term sheet

for a Forbearance Agreement, which will relieve the Company of more than $30

million in expected carrying costs for the Design District in late 2019 and

calendar year 2020. The Borrower is contemplating signing a non-binding term

sheet by December 31, 2019 and a definitive Forbearance Agreement by late

January 2020. As currently contemplated, the Lender will take approximately

40-60% of the equity of the Borrower upon execution of the Forbearance

Agreement. Although no term sheet or definitive agreement has been executed,

the Board has decided to take an approximate 50% markdown as of November 30,

2019 against JZCP's equity value in the Design District as of August 31, 2019,

in anticipation of entering into this Forbearance Agreement. A markdown of this

nature was contemplated within the range included in the announcement made by

the Company on October 30, 2019. Alongside the Lender, the Borrower

contemplates attempting to sell the property with an ultimate anticipated sale

date by the end of Q2 2020.

Enquiries:

Company website: www.jzcp.com

This announcement is issued on behalf of the Company by Sam Walden of Northern

Trust International Fund Administration Services (Guernsey) Limited Email:

jzcp@ntrs.com

About JZCP

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of micro-cap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

END

(END) Dow Jones Newswires

December 23, 2019 12:45 ET (17:45 GMT)

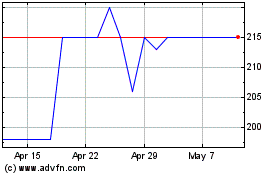

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From May 2024 to Jun 2024

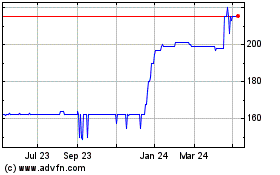

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2023 to Jun 2024