Camellia PLC Proposed Move to AIM (0406M)

July 11 2014 - 2:00AM

UK Regulatory

TIDMCAM

RNS Number : 0406M

Camellia PLC

11 July 2014

11 July 2014

Camellia Plc

Proposed Delisting from the Official List and Admission to

trading on AIM

Camellia (CAM.L), the global agriculture and horticulture group,

whose activities also extend to engineering, food storage and

distribution, banking and financial services, announces today

that the Board proposes to cancel the listing of the Company's

Ordinary Shares on the Official List and to trading on the Main

Market and to apply for admission of the entire issued share

capital of the Company to trading on AIM.

The proposed Move to AIM is subject to approval by Shareholders

at a General Meeting. Details of the proposals together with

a notice convening the Shareholder General Meeting are contained

in a circular which will be posted to Shareholders later today.

The General Meeting will be held at The Rubens Hotel, 39 Buckingham

Palace Road, London, SW1W 0PS on 6 August 2014 at 11.30 a.m.

The circular will be available shortly on the Company's website

at www.Camellia.plc.uk and will be submitted to the National

Storage Mechanism where it will shortly be available at www.morningstar.co.uk/uk/nsm.

Background to and reasons for the Move to AIM

The Board has undertaken a comprehensive review in order to

determine the most appropriate trading platform for the Company's

Ordinary Shares for the benefit of the Shareholders. The Board

has considered carefully the proposed Move to AIM and believes

that it is in the best interests of the Company and its Shareholders

as a whole for the following reasons:

* AIM is a market appropriate for a company of

Camellia's size and nature, and is a market which

will help attract new investors, providing a platform

to promote the Company and trading in its shares;

* Shares in companies that are traded on AIM are deemed

to be unlisted for the purposes of certain areas of

UK taxation. The Board has taken advice and believes

that, following Admission, the Ordinary Shares in the

Company should currently constitute 'relevant

business property' for the purposes of UK inheritance

tax business property relief. Accordingly, following

the Move to AIM, individuals who hold Ordinary Shares

and who meet the two year ownership condition may be

eligible for UK inheritance tax business property

relief, although based on the current nature of the

Group and its assets, it is not considered that full

relief at 100 per cent. would be available.

Shareholders and prospective investors should consult

their own professional advisers on whether an

investment in AIM securities is suitable for them and

to what extent any potential UK inheritance tax

benefit referred to above is available to them;

* Shares traded on AIM can be held in ISAs (in the same

way as shares traded on the Main Market);

* The UK government has announced its intention to

offer full relief from stamp duty and stamp duty

reserve tax on transactions in securities admitted to

trading on AIM with effect from 28 April 2014.

Provided the legislation implementing this measure

receives Royal Assent in July 2014, this may help

increase liquidity in the trading of shares on AIM;

* The Company's share price has experienced a level of

volatility over the last few years by virtue of

moving into, out of and then back into the FTSE All

Share Index. This is driven in part by automated

share trading of Index Tracker Funds and similar

investment products. Following Admission, the Company

will no longer be eligible for inclusion in the FTSE

All Share Index which will reduce some of the

associated share price volatility that this has

generated. Subject to Admission, the Company will be

one of the largest companies on AIM and is

anticipated to be eligible for inclusion in the FTSE

AIM UK 50 Index, although the Index Tracker Funds for

the FTSE AIM UK 50 Index are much smaller and fewer

in number and do not typically generate significant

share price volatility;

* The Company should continue to appeal to

institutional investors following the Move to AIM and,

in light of the possible tax benefits mentioned above,

the Directors believe that being admitted to AIM will

make the Company's shares more attractive to retail

investors, thereby increasing liquidity;

* AIM will offer greater flexibility with regard to

potential future corporate transactions and should

enable the Company to agree and execute certain

transactions more quickly and cost effectively than a

company on the Official List; and

* AIM provides a more suitable market and environment

that should simplify the administrative and

regulatory requirements of the Company.

Details of the Cancellation and Admission

In order to effect the Move to AIM, the Company will require,

inter alia, Shareholder approval of the Resolution at the General

Meeting to be held at The Rubens Hotel, 39 Buckingham Palace

Road, London, SW1W 0PS at 11.30 a.m. on 6 August 2014. The Notice

of General Meeting sets out the terms of the Resolution which

will be proposed at the General Meeting as a special resolution

in order to approve the Move to AIM. In accordance with the

Listing Rules, the Resolution is subject to approval being obtained

from not less than (i) 75 per cent. of all Shareholders; and

(ii) as the Company has a controlling shareholder, a simple

majority of the independent Shareholders (being all Shareholders

other than Camellia Holding AG, which holds 1,427,000 Ordinary

Shares representing 51.67 per cent. of the total voting rights

of the Company as at 10 July 2014), in each case voting in person

or by proxy and, if it is not passed, the Company will retain

its premium listing on the Official List and its Ordinary Shares

will remain traded on the Main Market.

Assuming the Resolution is passed, the Company will apply to

cancel the listing of its Ordinary Shares on the Official List

and to trading on the Main Market and will give 20 Business

Days' notice of its intention to seek admission to trading on

AIM.

It is expected that the last day of dealings in the Ordinary

Shares on the Main Market will be 5 September 2014 and that

the Cancellation will take effect at 8.00 a.m. on 8 September

2014, being not less than 20 Business Days from the passing

of the Resolution. Admission is expected to take place, and

dealings in Ordinary Shares are expected to commence on AIM

at 8.00 a.m. on 8 September 2014.

Irrevocable undertakings

The Directors have received an irrevocable undertaking to vote

in favour of the Resolution from Camellia Holding AG which holds

in aggregate 51.67 per cent. of the total voting rights as at

10 July 2014, being the last practicable day prior to this announcement.

Recommendation

The Board considers that the Cancellation and Admission are

in the best interests of the Company and Shareholders as a whole.

Accordingly, the Board unanimously recommends that Shareholders

vote in favour of the Resolution set out in the Notice of General

Meeting, as the Directors intend to do in respect of their own

beneficial holdings amounting to, in aggregate, 1,873 Ordinary

Shares representing approximately 0.07 per cent. of the total

voting rights as at 10 July 2014, being the last practicable

day prior to this announcement.

Expected timetable of Principal Events

The Company will apply to cancel the listing of the Ordinary

Shares on the premium segment of the Official List and to trading

on the London Stock Exchange's main market for listed securities,

conditional on the resolution being approved at the General

Meeting. The expected timetable of principal events is as follows:

Latest time and date for receipt of 11.30 a.m. on 4 August

Forms of Proxy 2014

General Meeting 11.30 a.m. on 6 August

2014

Last day of dealings in Ordinary Shares 5 September 2014

on the Main Market

Cancellation of listing of Ordinary 8.00 a.m. on 8 September

Shares on the Official List 2014

Admission and commencement of dealings 8.00 a.m. on 8 September

on AIM 2014

For further information please contact:

Camellia Plc 01622 746655

Malcolm Perkins, Chairman

Anil Mathur, Finance Director

Julia Morton, Company Secretary

Charles Stanley Securities 020 7149 6000

Russell Cook

Carl Holmes

Definitions

"Admission" the admission of the entire issued

share capital of the Company to

trading on AIM in accordance with

the AIM Rules for Companies

"AIM" the AIM market operated by the London

Stock Exchange

"AIM Rules" the AIM Rules for Companies and

the AIM Rules for Nominated Advisers

"AIM Rules for Companies" the rules which set out the obligations

and responsibilities in relation

to companies whose shares are admitted

to AIM as published by the London

Stock Exchange from time to time

"AIM Rules for Nominated Advisers" the rules which set out the eligibility,

obligations and certain disciplinary

matters in relation to nominated

advisers as published by the London

Stock Exchange from time to time

"Business Day" any day on which the London Stock

Exchange is open for the transaction

of business

"Cancellation" the cancellation of admission to

the premium segment of the Official

List and to trading on the Main

Market

"Charles Stanley" Charles Stanley Securities, a division

of Charles Stanley & Co. Ltd, the

proposed Nominated Adviser

"Circular" the circular to be sent to Shareholders

setting out details of the proposed

Move to AIM

"Company" or "Camellia" Camellia Plc, a company registered

in England and Wales with registered

number 29559

"Directors" or "Board" the existing directors of the Company

"FCA" the Financial Conduct Authority

"FSMA" the Financial Services and Markets

Act 2000, as amended from time to

time

"General Meeting" the general meeting of the Company

convened for 11.30 a.m. on 6 August

2014 at The Rubens Hotel, 39 Buckingham

Palace Road, London, SW1W 0PS by

the Notice of General Meeting

"Group" the Company and its subsidiaries

"Listing Rules" the listing rules and regulations

published by the UKLA acting under

Part VI of FSMA as amended from

time to time

"London Stock Exchange" London Stock Exchange plc

"Main Market" the London Stock Exchange's main

market for listed securities

"Move to AIM" the Cancellation and Admission

"Nominated Adviser" a nominated adviser, as required

for the purposes of the AIM Rules

"Notice of General Meeting" the notice of General Meeting as

set out in the Circular

"Official List" the list maintained by the UKLA

in accordance with section 74(1)

of FSMA for the purposes of Part

VI of FSMA

"Ordinary Shares" ordinary shares of 10 pence each

in the capital of the Company

"Resolution" the resolution set out in the Notice

of General Meeting

"Shareholder" a holder of Ordinary Shares from

time to time

"UK" the United Kingdom of Great Britain

and Northern Ireland

"UKLA" the FCA, acting in its capacity

as the competent authority for the

purposes of Part VI of FSMA

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCQKKDBFBKDNOD

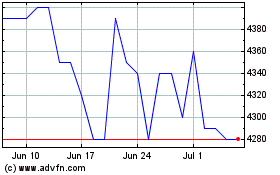

Camellia (LSE:CAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

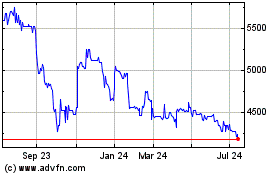

Camellia (LSE:CAM)

Historical Stock Chart

From Jul 2023 to Jul 2024