RNS Number:8245T

Braemar Shipping Services PLC

07 May 2008

BRAEMAR SEASCOPE GROUP plc

Results - Year ended 28 February 2007

Braemar Seascope Group plc (the "Group"), a leading provider of shipping

services, today announced full year unaudited results for the year ended 28

February 2007.

HIGHLIGHTS

* Adjusted pre-tax profits #11.0m (2006: #10.3m) *

* Pre-tax profit #10.1m (2006: #10.3m)

* Adjusted EPS 37.64p (2006: 37.03p)*

* Basic EPS 32.83p (2006: 37.03p)

* Forward book at record level with US$30m deliverable this year

* Net cash #14.6m (2006: #13.6m)

* Final dividend 12.25p per share (up 6.5%), full year 19.0p (2006: 18.00p)

up 5.6%

*Adjusted profits and earnings are adjusted to exclude an impairment charge of

#950,000 taken at the half year 2006/7.

Commenting on the results and outlook, Sir Graham Hearne, Chairman, said:

"The Group is performing well and has posted results reflecting another good

year."

"Shipping has experienced large and rapid changes in freight rates and vessel

values over the course of the last five years. This volatility is likely to

remain while the demand for seaborne trade continues to grow and we expect our

broadly-based shipping services business to benefit while these conditions

persist. "

For further information, contact:

Braemar Seascope Group plc

Alan Marsh, Chief Executive Tel 020 7535 2650

James Kidwell, Finance Director Tel 020 7535 2881

Aquila Financial

Peter Reilly Tel 020 7202 2601

Charles Stanley Securities

Philip Davies and Anthony Noakes Tel 020 7149 6457

Notes to editors:

Through its subsidiaries Braemar Seascope Group plc's services comprise:

Braemar Seascope Specialised shipbroking and consultancy services to

international ship owners and charterers in the sale &

purchase, tanker, gas, chemicals, offshore, container and dry

bulk markets.

www.braemarseascope.com

DV Howells Pollution response service primarily in the UK for marine and

rail operations

www.dvhowells.co.uk

Cory Brothers Shipping Agency Port agency, freight forwarding and logistics services within

the UK.

www.cory.co.uk

Wavespec Marine engineering and naval architecture consultants to the

shipping and offshore markets.

www.wavespec.com

PRELIMINARY ANNOUNCEMENT - YEAR ENDED 28 FEBRUARY 2007

CHAIRMAN'S STATEMENT

The Group is performing well and has posted results reflecting another good

year. The adjusted pre-tax profits increased by 7% to #11.0m compared to #10.3m

last year and adjusted earnings per share were 37.64 pence compared to 37.03 in

2006. Reported pre-tax profits were #10.1m (2006: #10.3m) and reported earnings

per share were 32.83 pence. The difference between the adjusted and reported

result was attributable to an impairment charge taken in the first half of

#0.95m.

The Group's shipbroking operations benefited from trading conditions which

remained generally favourable during the year and performed well though the

results were adversely affected by a weaker US dollar. Continued newbuilding

activity and an increase in long-term chartering business saw growth in the

forward order book to a record level which helps to underpin future years'

earnings. We expanded our international footprint through the establishment of

new dry cargo chartering offices in Singapore and Sao Paolo and we also

consolidated our interest in the container market through the acquisition of the

50% minority interest in Braemar Container Shipping and Chartering Limited for

#1.2m.

Our strategy for extending the range of shipping services provided has begun to

bear fruit and our non-broking businesses contributed 17% of the adjusted

operating profits, driven by strong year-on-year income and profit growth from

both Cory Brothers and Wavespec. During the year these services were expanded

with the creation of an environmental services division through the acquisition

of DV Howells in March 2006 and Hi-bar in September 2006 for a maximum combined

consideration of #0.9m. DV Howells provides pollution incident response services

for the oil majors and other transportation companies and we are very proud of

the role they played and their continuing involvement in the environmental

protection of the UK coastline where the container vessel MSC Napoli is beached.

We have also increased our presence in the UK ship agency market through the

purchase of Gorman Cory which will take place over two years. We are pleased

with the progress made in building our non-broking businesses and we expect to

continue to invest in these sectors as attractive opportunities arise.

The Directors are recommending that the name of the company changes to Braemar

Shipping Services PLC. The name Braemar Seascope is identifiable with our

shipbroking business and we do not intend to change the name for our shipbroking

trading companies around the world. However, the Group has now successfully

extended its services beyond shipbroking and will continue to do so. We have

reached a point when we consider it both helpful and appropriate to recognise

the broadening of the business with a change in the name which reflects its

current and future composition.

The Directors are recommending for approval at the Annual General Meeting a

final dividend of 12.25 pence per ordinary share, to be paid on 31 July 2007 to

shareholders on the register at the close of business on 6 July 2007. Together

with the 6.75p interim dividend the Company's dividend for the year is 19.0

pence (2006: 18.0 pence), a rise of 5.6%. The dividend is covered 2.0 times by

adjusted earnings.

These results are a testament to the skill, hard work and commitment of staff

across the Group and on behalf of the Board I thank all concerned for their

contribution to this year.

After many years as an executive director Iain Shaw retired from the Group in

June 2006 and I would like to express our gratitude for his significant

contribution both as a shipbroker and director. I am delighted that Denis

Petropoulos and Quentin Soanes agreed to join the Board in January 2007 as

executive directors. They have both worked for the Group for many years and

their experience will be of great value in the future.

Shipping has experienced large and rapid changes in freight rates and vessel

values over the course of the last five years. This volatility is likely to

remain while the demand for seaborne trade continues to grow and we expect our

broadly-based shipping services business to benefit while these conditions

persist.

Sir Graham Hearne

10 May 2007

CHIEF EXECUTIVE'S REVIEW OF THE BUSINESS

The progress made across the Group over the last year continues to be

encouraging. All of our operations have been performing well and we have grown

the business in line with our strategy of expanding into complementary service

areas and by increasing our geographic presence. We now have more than 400

employees worldwide based at 35 offices, of which eight are overseas and our

shipping services business is more diverse than ever before. With shipping

activity remaining strong, we see no shortage of opportunity to continue our

controlled growth in the same vein. A review of the market and our activities

during the year is set out by segment below.

Shipbroking

Shipbroking activities are undertaken under the name of Braemar Seascope from

offices in London, Shanghai, Beijing, Singapore, Melbourne, Perth and Aberdeen.

Revenues in 2006/7 increased to #40.5m (2006: #39.7m) and adjusted operating

profits were #8.7m (2006: #9.0m). The operating profit margin (before impairment

charge) for the division was 21.6% in 2007 (2006: 22.7%), reflecting a shift

towards lower margin chartering business in the year. There was an average of

205 employees of whom 68% were fee earning and 25% were based overseas (2006 -

189 employees).

In each of the dry market sectors freight rates dipped from the start of our

financial year when the Baltic Dry Index ("BDI") stood at 2,708, reaching a low

in May 2006 (BDI 2,416) before recovering over the remainder of the financial

year (BDI 4,765). The BDI currently stands at 6,585. The capesize market curve

was particularly steep in both directions with the strong recovery driven by

Chinese demand, during which we were able to conclude a number of long-term

period charters at high rates. There has also been a considerable growth in

vessel supply although there is still sufficient market tightness to produce

significant fluctuations in rates from time to time. Currently the market is

affected by load port congestion, especially in the east coast coal ports of

Australia. This has helped reduce the supply of vessels and thereby to

strengthen freight rates. Following our investment in Australia, this year we

opened an office in Singapore and in Sao Paolo, both of which are becoming

increasingly important as shipping centres. In view of the strength of the

market and our investments, we expect our dry activities to become a more

significant part of our business in future.

Deep sea tanker chartering increased both income and transaction volumes over

last year, and the value of longer term period business grew significantly over

the year. At the start of the financial year the Baltic Dirty Tanker Index ("

BDTI") stood at 1,109 falling to a low of 951 in April 2006 but recovering

strongly to reach a 12 month peak of 1,602 in August and closing at 1,101 on 28

February 2007. It currently stands at 1,296. The weakness in tanker freight

rates at the start of the financial year was caused by OPEC cutbacks which led

to reduced refining. However as the oil price rose from $60/barrel to $70/barrel

supply restraints were relaxed and refineries moved quickly to source crude

which became much in demand causing a rapid rise in freight rates. With

increased refining came the increased demand for the carriage of refined

products and although rates did not return to the high levels of the previous

year, they did remain steady for most of the second and third quarters. In

addition the constant Chinese and Indian demand for crude supplied not only from

the Middle East but also from Atlantic producers in West Africa and the

Caribbean maintained a healthy employment of large crude carriers. Delivery of

newbuildings into the tanker markets during the course of 2006 has increased the

deadweight available to carry oil which has meant that after the market weakened

in the fourth quarter, rates did not recover as quickly following the increased

volumes at the start of our new year. However, it is encouraging to note that

despite the steady growth of the fleet during the first quarter of our new year

the spot market was notably active with short-term demand for crude. As the year

progresses we expect to see continuing demand from the major refining centres,

but the growth in the tanker fleet prior to the phasing out of older tonnage

will mean the market is likely to be more volatile.

The coastal tanker market benefited from larger contract volumes and falling

bunker costs towards the end of the year providing a stimulus to activity. Deep

sea chemical parcel tankers had a steady year with an upturn in rates in the

fourth quarter due to a combination of increasing demand and the prospect of the

latest biofuel regulations coming into force. This trend should continue during

2007 through to 2008 and while there will be seasonal fluctuations the market is

expected to remain firm.

The LPG freight market is expected to strengthen over the next twelve months as

new product streams and market participants, such as China, compete in the

market for tonnage.

The LNG transportation market remains at low levels for short-term employment

due to the delivery of new vessels, committed for long-term LNG transportation,

the projects for which have since been delayed by between one and three years.

However, such vessels will be absorbed in the long-term projects that they were

originally intended for and while there are some uncommitted vessels in the

market these will, in time, achieve gainful employment.

Sale and purchase enjoyed another very successful year. There was a shift in the

business with less high value second hand transactions than in 2005/6 but a

record year for newbuildings where the income is received over 2-3 years on

average. The demand for new ships is borne out in the extended shipyard order

books and in a tendency for payment terms to reflect larger up-front contracted

values. The newbuilding forward order book is now at its highest level (both in

terms of the number of ships and commission value) with ship deliveries

stretching out to 2010/11. Over the last six months there has been a very

significant increase in the market value of bulk carriers which is commensurate

with the rise in dry freight rates and we have recently concluded a number of

transactions at historically high values. Demolition business remains a small

part of sale and purchase activity but we expect it to increase in the coming

years in line with the phase-out of single hull tankers.

Offshore had its best ever year driven by high activity levels and charter rates

and the successful conclusion of some good sale and purchase and project

transactions, some of which will benefit the company for many years to come.

Worldwide oil and gas exploration has been very active and continues to be so,

giving confidence for the coming year.

We consolidated our container business midway through the financial year with

the purchase of the remaining 50% interest in August 2006. After a reasonably

strong market in the first half of the year container charter rates fell in the

second half of the year before recovering strongly during the first quarter of

2007. During 2006 global growth in container volume was 10.8% and fleet capacity

grew by 16.5%, and in 2007 the growth is expected to be in the region of 10-11%

for container volumes and 14.5-15% for growth in fleet capacity. The desk

performed well throughout the year in a rapidly changing market and we expect a

similar performance to last year given the forecast growth in capacity,

providing world trade is maintained.

As at 1 March 2007 we had concluded business that should generate revenues in

excess of $30m in the new financial year (1 March 2006 for the next twelve

months: US$26m).

Ship agency, forwarding and logistics

Revenues increased to #23.4m (2006: #15.9m) and operating profits were #0.9m

(2006: #0.6m) and the company's achievements were also recognised by its

customers when in April 2007 Cory was voted number one in the Lloyds Loading

List Customer Service Awards 2006.

The year overall has seen Cory consolidating its acquisitions made late 2005 and

early 2006, and concentrating on organic growth with average staffing increasing

from 120 to 149. Growth was driven primarily by the liner, logistics and

forwarding business, where revenues showed month on month improvements

throughout the financial year.

The increase in liner, logistics and forwarding was driven primarily by

sustained strong demand with in excess of 13,200 forwarding jobs being handled

in the year compared with 9,700 last year. These were mostly on key logistics

contracts supplemented with a number of one-off projects. Whilst most of the

activity is handled out of Felixstowe, we have been developing forwarding

activities from certain existing agency locations, thereby increasing the scope

and capability of Cory as a whole. Planetwide, the forwarding acquisition made

in 2005 performed in line with our growth expectations. During the year it

handled 1,860 of the forwarding jobs and was also able to add new consolidation

routes to the Middle East.

Port agency handled 17% more port calls in 2006/7 maintaining a leading position

in an increasingly competitive market. New income streams commencing in early

2007 should see this growth continue through the remainder of 2007 and into

2008. The acquisition of the business and assets of Gorman Shipping, which

handles over 750 vessels per annum concentrated on the Mersey and the Manchester

Ship Canal, has significantly strengthened our UK agency activities. The

business has been combined with the existing Cory Liverpool office making it one

of the foremost ships' agents in the area. Morrison Tours, a highly seasonal

business linked closely to the cruise industry around the UK has added to its

customer base and improved the take-up of the shore excursions on offer.

With further new pieces of business being won in both in agency and liner,

logistics and forwarding, activity levels should continue to be maintained in

all areas in the coming year.

Technical shipping support - Wavespec

Revenues increased to #6.6m (2006: #5.2m) and operating profits were #0.6m

(2006: #0.3m) in line with the growth in activity levels. Average headcount

during the year was 18 employees (2006: 17 employees) with a further 50

engineers sub-contracted to clients within this segment (2006: 45 consultants).

Currently, the company has site supervision teams at three shipyards for the

construction of up to 48 new LNG vessels in connection with the Qatargas II

project and this is expected to generate a positive contribution for the company

for several years. It is also fulfilling a similar role in connection with LNG

vessel construction for use on the Sakhalin gas project. Wavespec has also

been active in the development of the seaborne transportation of compressed

natural gas, working with Braemar Seascope to provide technical and commercial

assistance for a number of projects.

Environmental Services - DV Howells

DV Howells was acquired in March 2006 and has contributed revenue of #3.2m and

operating profits of #0.2m in the eleven months since it joined the group. The

average headcount during the year was 39 full time employees compared to 34 at

acquisition. The addition of Hi-bar in September 2006 completed the response

coverage across the UK and enhanced the company's training and consultancy

capability. The company has had a busy year and has integrated well into the

Group. Of particular note is the major role the company has played following the

grounding of the mini-bulker Sumni in the Orkney Islands and the container

vessel, MSC Napoli in Devon. Services provided, some of which are still

on-going, include pollution control, beach clearance, decontamination wash-down

facility and the handling of hazardous container cargoes. The company also won

important contracts to provide incident response services in Angola and for the

MOD, both of which illustrate the potential of the business to grow in the UK

and overseas.

Bunker Trading

Revenues increased to #33.4m (2006: #7.7m), representing a full year's

contribution, and operating profits were #62,000 (2006: #30,000).

Bunker sales have been lower than expected due to a combination of the drought

conditions and high oil prices, which has to some extent limited demand in the

Australasian region. Looking forward, the Australian resources and minerals

sector is enjoying significant growth which should be a basis for increased

bunker sales in the future. We are currently in the process of reviewing our

strategic options with regard to this business.

Financial Review

Profits and earnings

Reported pre-tax profits were #10.1m (2006: #10.3m). Adjusted pre-tax profits

(before an impairment charge) increased by 7% to #11.0m on revenues of #107.2m

(2006: #68.5m). As indicated at the half year, given the performance of all

business segments in broadly favourable markets, we expected the operating

profits in the second half of the year to show an improvement over the first

half. Second half operating profits for 2006/7 were #5.8m compared with #4.7m

(before impairment) in the first half and #4.7m in the second half of 2005/6.

The trading improvement shows sustained business growth across all segments.

A reconciliation of reported profits to adjusted profits is set out in the table

below. The impairment charge is not a cash cost and arose because at the half

year, after a relatively weak market, a more prudent view was taken of the

estimated future earnings from the Australian business.

2006/7 2005/6

#000 #000

Adjusted profits before impairment charge and tax 11,026 10,293

Impairment of Braemar Seascope Pty goodwill (950) -

Reported profit before tax 10,076 10,293

Pence Pence

EPS (pre impairment charge) 37.64 37.03

Impairment of goodwill (4.81) -

Basic EPS 32.83 37.03

The weighted average number of shares increased from 19.38m to 19.72m for 2006/

7.

Margins

Operating profits are stated after deducting both cost of sales and operating

costs. Cost of sales comprises bunker payments, freight and haulage and payments

to sub-contractors. The operating profit margin (before impairment) of 9.8% in

2007 compares with 14.4% in 2006. The reduction is mainly due to the increased

relative contributions of the non-broking businesses which generate returns at

lower margins but which are more predictable. The margin in shipbroking was

lower due to an increase in operating costs totalling 3.4% mainly in respect of

staff costs and the establishment of new overseas offices. A summary of the

segment margins is set out below.

Operating margins before impairment

2006/7 2005/6

Shipbroking 21.6% 22.7%

Ship agency, forwarding and logistics 3.9% 3.6%

Technical shipping support 8.3% 5.6%

Environmental services 7.0% 'n/a

14.1% 16.2%

Bunker trading 0.2% 0.4%

Total 9.8% 14.4%

Foreign exchange

The average rate of exchange for conversion of US dollar income during the

financial year, after taking account of hedging, was $1.86/# (2006: $1.80/#) and

at 28 February 2007 the balance sheet rate for conversion was $1.97/# (28

February 2006: $1.75/#). If the 2006/7 US dollar denominated income had been

translated at the 2005/6 average exchange rate, it would have been higher by

approximately #1.2 million. At 28 February 2007 the Group held forward currency

contracts to sell US$6 million at an average rate of $1.95/# and currency

options giving the right to sell US$1.1 million for AU$ at a rate of 0.78.

Taxation

The tax rate on reported profit before tax was 35.8% (2006: 30.3%). The

underlying rate, excluding the share of net profits from joint ventures and the

effect of the impairment charge, was 33.3% (2006: 31.0%).

Cash flow and acquisitions

The cash balance increased over the year by #1.0m to #14.6m (2006: #13.6m).

Operating cash flow generated in the year was #9.7m, from which the major cash

outflows before expenditure on acquisitions were #0.7m for the purchase of fixed

assets, #3.4m on corporation tax and #3.6m for dividend payments.

Net cash expended on acquiring businesses was #2.5m, offset by #0.7m of cash in

the acquired balance sheets, in respect of DV Howells and Hi-bar (#0.6m), 50 per

cent of Braemar Container Shipping and Chartering (#1.2m), 41 per cent of Gorman

Cory (#0.2m) and Planetwide (#0.5m). This does not include further potential

cash consideration of, in aggregate, #1.1m dependent on profitability.

Treasury risk management

The Board sets the Group's treasury policy covering financing decisions and

treasury risk management, the objective of which is to manage the Group's

financial risk exposures in an effective manner. The Finance Director is

responsible for day-to-day treasury risk monitoring and activity which is

reviewed by the Board through regular reporting. The Group uses financial

instruments to hedge underlying exposures and not for speculative purposes.

Liquidity risk: The Group has no net debt and did not have at any time during

the year. An overdraft facility of #3.0m with the Group's principal relationship

bank, the Royal Bank of Scotland plc, is maintained for financial flexibility

and in order to improve treasury efficiency and performance.

Foreign exchange risk: The majority of the Company's shipbroking, technical

services and bunker trading income is US dollar denominated and changes in the

rate of exchange relative to # sterling, and to a lesser extent the Australian

and Singapore dollar, can have an effect on the reported results and net assets.

From time to time the Group enters into forward foreign exchange contracts and

currency options to limit the effect of currency fluctuations.

Interest rate risk: The Group has an exposure to interest rates in relation to

its cash balances, the majority of which are held in the UK. Surplus cash (in #s

or US$s) is deposited at institutions with strong credit ratings and deposits

are short term in nature.

Alan Marsh

10 May 2007

Braemar Seascope Group PLC

Consolidated income statement for the year ended 28 February 2007

Year ended Year ended

28 Feb 2007 28 Feb 2006

Continuing operations Notes #'000 #'000

Revenue 3 107,200 68,497

Cost of sales (53,529) (21,271)

Gross profit 53,671 47,226

Operating costs (44,121) (37,336)

Amortisation of other intangibles (284) (287)

Impairment of goodwill (950) -

Operating costs excluding (42,887) (37,049)

amortisation of other intangibles and

impairment of goodwill

Operating profit 3 9,550 9,890

Finance income 335 162

Finance costs (16) (2)

Share of profit from joint ventures 207 243

and associates

Profit before taxation 10,076 10,293

Taxation (3,604) (3,115)

Profit for the year 6,472 7,178

Attributable to:

Equity holders of the parent 6,367 7,178

Minority interest 105 -

Profit for the year 6,472 7,178

Earnings per ordinary share

Basic - pence 5

32.83 p 37.03 p

Diluted - pence

32.39 p 36.18 p

Braemar Seascope Group PLC

Statement of recognised income and expenses for the year ended 28 February 2007

Year ended Year ended

28 Feb 2007 28 Feb 2006

#'000 #'000

Profit attributable to shareholders 6,472 7,178

Foreign exchange differences on retranslation of foreign (70) 83

operations

Tax on items taken directly to or transferred from equity 260 576

Cash flow hedges:

- Transferred to income statement in year 40 (1,401)

- Losses deferred in equity 17 (40)

Recognised income and expense for the year 6,719 6,396

Attributable to:

Ordinary shareholders 6,614 6,396

Minority interest 105 -

6,719 6,396

Braemar Seascope Group PLC

Consolidated Balance sheet as at 28 February 2007

As at As at

28 Feb 07 28 Feb 06

Assets Notes #'000 #'000

Non-current assets

Goodwill 22,606 22,480

Other intangible assets 1,582 462

Property, plant and equipment 5,478 5,034

Investments 1,538 1,611

Deferred tax assets 642 510

Other receivables 81 58

31,927 30,155

Current assets

Inventories 70 -

Trade and other receivables 21,750 17,717

Derivative financial instruments 27 12

Cash and cash equivalents 14,634 13,567

36,481 31,296

Total assets 68,408 61,451

Liabilities

Current liabilities

Derivative financial instruments - 99

Trade and other payables 29,011 25,490

Current tax payable 2,402 2,224

Finance leases - 11

Provisions 294 288

31,707 28,112

Non-current liabilities

Deferred tax liabilities 283 139

Provisions 169 343

452 482

Total liabilities 32,159 28,594

Total assets less total liabilities 36,249 32,857

Equity

Share capital 2,023 1,988

Capital redemption reserve 396 396

Share premium 8,554 8,046

Merger reserve 21,346 21,346

Other reserves (722) 47

Shares to be issued (1,047) (997)

Retained earnings 5,390 2,031

Group shareholders' equity 7 35,940 32,857

Minority interest 309 -

Total equity 36,249 32,857

Braemar Seascope Group PLC

Consolidated Cash flow statement for the year ended 28 February 2007

Year ended Year ended

28 Feb 07 28 Feb 06

Notes #'000 #'000

Cash flows from operating activities

Cash generated from operations 6 9,668 13,769

Interest received 335 156

Interest paid (16) (1)

Tax paid (3,413) (3,210)

Net cash generated from operating activities 6,574 10,714

Cash flows from investing activities

Dividends received from joint 263 239

ventures

Acquisition of subsidiaries, net of cash acquired (1,844) (521)

Purchase of property, plant and equipment (654) (387)

Proceeds from sale of property, plant and equipment 25 29

Purchase of investments - (36)

Other long term assets (23) 37

Net cash used in investing (2,233) (639)

activities

Cash flows from financing activities

Proceeds from issue of ordinary 569 535

shares

Dividends paid (3,595) (3,194)

Dividends paid to minority interest (100) -

Purchase of own shares (50) (360)

Payment of principal under finance leases (11) (28)

Net cash used in financing (3,187) (3,047)

activities

Increase in cash and cash equivalents 1,154 7,028

Cash and cash equivalents at beginning of the year 13,567 6,539

Foreign exchange differences (87) -

Cash and cash equivalents at end of the year 14,634 13,567

Balance sheet analysis of cash and cash equivalents

Cash and cash equivalents 14,634 13,567

Short term borrowings - -

Cash and cash equivalents at end of the year 14,634 13,567

Braemar Seascope Group PLC

Notes to the financial statements

Note 1 - General Information

The Preliminary Announcement of results for the year ended 28 February 2007 is

an extract from the forthcoming 2007 Annual Report and Accounts and does not

constitute the Group's statutory accounts of 2007 nor 2006. Statutory accounts

for 2006 have been delivered to the Registrar of Companies, and those for 2007

will be delivered following the company's Annual General Meeting. The auditors

have reported on the 2006 accounts; their report was unqualified and did not

contain statements under Sections 237(2) or (3) of the Companies Act 1985.

Note 2 - Accounting policies

Whilst the financial information included in this preliminary announcement has

been prepared in accordance with International Financial Reporting Standards

(IFRSs) adopted for use in the European Union, this announcement does not itself

contain sufficient information to comply with IFRSs. The company expects to

distribute full accounts that comply with IFRSs on 25 May 2007.

Note 3 - Segmental results

Revenue Profit for the year

2007 2006 2007 2006

#'000 #'000 #'000 #'000

Shipbroking 40,530 39,745 8,749 9,003

Ship agency, forwarding & logistics 23,449 15,851 911 568

Technical shipping support 6,623 5,202 553 289

Environmental services 3,229 - 225 -

Revenue / operating profit excluding bunker 73,831 60,798 10,438 9,860

trading and impairment

Bunker trading 33,369 7,699 62 30

Revenue / operating profit excluding 107,200 68,497 10,500 9,890

impairment

Impairment - shipbroking - - (950) -

Revenue / operating profit 107,200 68,497 9,550 9,890

Finance income/ (cost)- net 319 160

Share of profit from joint ventures and associates 207 243

Profit before taxation 10,076 10,293

Taxation (3,604) (3,115)

Profit for the year (before deducting minority interest) 6,472 7,178

Note 4 - Dividend

The proposed final dividend of 12.25 pence per share (2006: final 11.5 pence)

takes the total dividend for the year to 19.0 pence (2006: 18.0 pence). The cost

of the final dividend will be #2.4m (2006: #2.2m) based on 19,899,846 shares

(being the total in issue less shares held in the ESOP for which the dividend

has been waived) and will be charged to equity in the 2007/8 financial year.

Note 5 - Earnings per share

Basic earnings per share is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary shares

outstanding during the year, excluding 331,495 ordinary shares held by the

employee share trust (2006:321,495) which are treated as cancelled.

For diluted earnings per share, the weighted average number of ordinary shares

in issue is adjusted to assume conversion of all dilutive ordinary shares. The

Group has one class of potential dilutive ordinary shares being those granted to

employees where the exercise price is less than the average market price of the

Company's ordinary shares during the year.

2007 2007 2007 2006 2006 2006

From continuing operations Earnings Weighted Per share Earnings Weighted Per share

#'000s average amount #'000s average amount

number of pence number of pence

shares shares

Profit for the year attributable 6,472 19,715,846 32.83 7,178 19,385,615 37.03

to shareholders

Effect of dilutive share options - 264,693 (0.44) - 452,339 (0.85)

Fully diluted earnings per share 6,472 19,980,539 32.39 7,178 19,837,954 36.18

2007 2007 2007 2006 2006 2006

From continuing operations Earnings Weighted Per share Earnings Weighted Per

#'000s average amount #'000s average share

number of pence number of amount

shares shares pence

Basic earnings from above 6,472 19,715,846 32.83 7,178 19,385,615 37.03

Impairment of goodwill 950 - 4.81 - - -

Adjusted earnings per share 7,422 19,715,846 37.64 7,178 19,385,615 37.03

Note 6 - Reconciliation of operating profit to net cash flow from operating

activities

2007 2006

#'000 #'000

Profit for the year attributable to shareholders 6,472 7,178

Adjustments for:

Taxation 3,604 3,115

Depreciation 518 339

Profit on sale of property, plant and equipment (12) (17)

Impairment of goodwill 950 -

Amortisation of intangibles 284 287

Share based payments 309 244

Finance income (335) (162)

Finance costs 16 2

Share of profit from joint ventures and associates (207) (243)

Changes in working capital (excluding effects of acquisitions

of subsidiaries)

Decrease in stocks 7 -

(Increase)/decrease in trade and other receivables (3,874) (129)

Increase/(decrease) in trade and other payables 2,098 2,913

Increase/(decrease) in provisions (162) 242

Cash generated from operations 9,668 13,769

Note 7 - Statement of changes in total equity

Group Share Capital Shares Other Retained Total Minority Total

capital redemption earnings interest equity

reserve to be reserves

issued

#'000 #'000 #'000 #'000 #'000 #'000

At 1March 2005 1,945 396 (637) 29,824 (2,362) 29,166 - 29,166

Recognised income and expense for - - - (926) 7,322 6,396 - 6,396

the year

Dividends paid - - - - (3,173) (3,173) - (3,173)

Issue of shares 43 - - 541 - 584 - 584

Purchase of shares to be issued - - (360) - - (360) - (360)

Credit in respect of share option - - - - 244 244 - 244

schemes

At 28 February 2006 1,988 396 (997) 29,439 2,031 32,857 - 32,857

Recognised income and expense for - - - (31) 6,645 6,614 105 6,719

the year

Acquisition - - - - - - 304 304

Dividends paid - - - - (3,595) (3,595) (100) (3,695)

Issue of shares 35 - - 508 - 543 - 543

Deferred share consideration - - - (738) - (738) - (738)

Purchase of shares to be issued - - (50) - - (50) - (50)

Credit in respect of share option - - - - 309 309 - 309

schemes

At 28 February 2007 2,023 396 (1,047) 29,178 5,390 35,940 309 36,249

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAXSKEFAPEFE

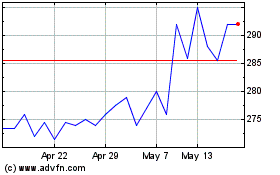

Braemar (LSE:BMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Braemar (LSE:BMS)

Historical Stock Chart

From Jul 2023 to Jul 2024