UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 14C

Information

Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

[X] Preliminary Information Statement

[ ] Confidential, for Use of the Commission Only (as

permitted by Rule 14c-5(d)(2))

[ ] Definitive Information Statement

TIERRA GRANDE RESOURCES INC.

(Name of Registrant As Specified In Charter)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act

Rules 14c-5(g) and 0-11.

(1) Title of each class of securities to which transaction

applies: common stock, $0.0001 par value

(2) Aggregate number of securities to which transaction applies:

N/A

(3) Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): N/A

(4) Proposed maximum aggregate value of transaction: N/A

(5) Total fee paid: N/A

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as

provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

TIERRA GRANDE RESOURCES INC.

666

Stirling Hwy

Mosman Park, WA 6012

+61 8 9384 6835

June 26, 2013

Dear Stockholder:

We are furnishing the enclosed Information Statement to you in

connection with the appointment of three (3) new directors to our Board of

Directors.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT

TO SEND US A PROXY.

Our Board of Directors has reviewed and unanimously approved

the director appointments by resolutions dated June 21, 2013. The holders of a

majority of our issued and outstanding common stock also approved the

appointments by written consent dated June 21, 2013. However, pursuant to

applicable securities laws, these appointments will not be effected until at

least 20 days after a Definitive Information Statement is filed with the

Securities and Exchange Commission and sent to our stockholders.

By Order of the Board of Directors,

/s/ Simon

Eley

Simon

Eley

Chairman and Director

2

INFORMATION STATEMENT

Introduction

The holders of a majority of our issued and outstanding common

stock and our directors have taken an action by written consent without a

meeting, pursuant to Chapter 78 of the Nevada Revised Statutes, to approve the

appointment of three (3) new directors to our Board of Directors. The

appointment of the directors relates to a proposed change in our management and

the direction of our operations.

This Information Statement is being filed pursuant to Section

14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and provided to our stockholders pursuant to Rule 14c-2 under the Exchange Act.

WE ARE NOT ASKING FOR A PROXY AND YOU ARE REQUESTED

NOT

TO SEND US A PROXY.

We are a fully-reporting Exchange Act company incorporated in

the State of Nevada. Our common stock is quoted on the OTC Bulletin Board under

the trading symbol “TGRI”. Information about us can be found in our most recent

Quarterly Report on Form 10-Q for the period ended February 28, 2013 and

subsequently filed Current Reports on Form 8-K, and our Annual Report on Form

10-K for the fiscal year ended May 31, 2012, all filed with the United States

Securities and Exchange Commission (the “SEC”). Additional information about us

can be found in our public filings that can be accessed electronically by means

of the SEC's home page on the Internet at http://www.sec.gov, as well as by

other means from the offices of the SEC. See “Incorporation by Reference” below.

We will incur all costs associated with preparing, printing and

mailing this Information Statement.

Item 1. Information Required by Items of Schedule 14A

Date, Time and Place Information

There will not be a meeting of our stockholders to approve the

director appointments, and we are not required to hold a meeting under the

Nevada Revised Statutes as such appointments have been approved by the written

consent of holders of a majority of our common stock. This Information Statement

is expected to be mailed on or about July 7, 2013 to the holders of our common

stock as of June 25, 2013.

Dissenters’ Right of Appraisal

Under the Nevada Revised Statutes or pursuant to our Articles

of Incorporation and Bylaws, our stockholders do not have dissenters' rights in

connection with the director appointments.

Voting Securities and Principal Holders Thereof

The record date for the determination of stockholders entitled

to consent to the director appointments was June 25, 2013 (the “Record Date”).

As of that date, we had 78,769,712 outstanding shares of common stock, $0.0001

par value, and no outstanding shares of preferred stock, $0.0001 par value. Each

share of our common stock entitles the holder thereof to one vote on each matter

that may come before a meeting or vote of our stockholders.

3

The director appointments were approved by the holders of a

majority of our common stock entitled to vote on June 21, 2013. We are not

permitted to effect the director appointments until at least 20 days after we

file with the SEC and distribute a Definitive Information Statement to our

stockholders.

Security Ownership of Certain Beneficial Owners and

Management:

The following table sets forth the ownership, as of the Record

Date, of our common stock by each of our directors, director nominees and

executive officers, by all of our executive officers, directors and director

nominees as a group and by each person known to us to be the beneficial owner of

more than 5% of any class of our securities. As of the Record Date, there were

78,769,712 shares of our common stock issued and outstanding. All persons named

have sole voting and investment power with respect to the securities held by

them, except as otherwise noted. The number of securities described below

includes shares which the beneficial owner has the right to acquire within 60

days of the date of this Information Statement.

Title of Class

|

Name

of Beneficial

Owner

|

Amount and Nature of

Beneficial Ownership

|

Percent of

Class

|

|

Common Stock

|

Simon Eley

|

1,850,000(1)

|

2.3%

|

|

Common Stock

|

Andrew Gasmier

|

1,000,000

|

1.3%

|

|

Common Stock

|

Brad Evans

|

150,000(2)

|

0.2%

|

|

Common Stock

|

Mark Kalajzich

|

0

|

0%

|

|

Common Stock

|

Miguel Cardozo

|

0

|

0%

|

|

Common Stock

|

Eduardo Ferrero

|

0

|

0%

|

|

All Officers, Directors and Director Nominees as a Group

|

2,150,000(1)(2)

|

2.7%

|

|

Common Stock

|

Christopher Robin Relph

|

6,805,208(3)

|

8.4%

|

|

Common Stock

|

Aviador Corporation Pty. Ltd.

|

22,500,000(4)

|

26.1%

|

|

Common Stock

|

BC & N Pollard ATF Geovet Family Trust

|

5,400,000(5)

|

6.7%

|

|

Common Stock

|

Six Fingers Pty Ltd.

|

8,160,000(6)

|

10.1%

|

|

Common Stock

|

Smart Train Australian Pty Ltd.

|

5,400,000(7)

|

6.7%

|

|

Common Stock

|

Resmin Pty Ltd.

|

4,500,000(8)

|

5.6%

|

|

(1)

|

In addition, Aviador Corporation Pty. Ltd. (“Aviador”)

owns 15,000,000 shares of common stock and warrants to acquire 7,500,000

shares of common stock of the Company and Resmin Pty Ltd. (“Resmin”) owns

3,000,000 shares of common stock and warrants to acquire 1,500,000 shares

of common stock of the Company. Mr. Eley is a director of both Aviador and

Resmin and disclaims beneficial ownership of these securities as

investment and voting control over these securities rests with the board

of directors of Aviador and Resmin, respectively.

|

|

|

|

|

(2)

|

These shares are held by CLM Resources Pty. Ltd. Mr.

Evans is a director and officer of CLM Resources and disclaims beneficial

ownership of these securities as investment and voting control over these

securities rests with the board of directors of CLM Resources.

|

|

|

|

|

(3)

|

Mr. Relph resigned as a director and officer in September

2012. Represents 4,805,208 shares of common stock and warrants to acquire

2,000,000 shares of common stock of the Company held by Mr.

Relph.

|

4

|

(4)

|

Represents 15,000,000 shares of common stock and warrants

to acquire 7,500,000 shares of common stock of the Company.

|

|

|

|

|

(5)

|

Represents 3,600,000 shares of common stock and warrants

to acquire 1,800,000 shares of common stock of the Company.

|

|

|

|

|

(6)

|

Represents 6,360,000 shares of common stock and warrants

to acquire 1,800,000 shares of common stock of the Company.

|

|

|

|

|

(7)

|

Represents 3,600,000 shares of common stock and warrants

to acquire 1,800,000 shares of common stock of the Company.

|

|

|

|

|

(8)

|

Represents 3,000,000 shares of common stock and warrants

to acquire 1,500,000 shares of common stock of the

Company.

|

Corporate Actions

Appointment of Directors

Our bylaws allow the number of directors to be fixed by the

Board of Directors. Our Board of Directors has fixed the number of directors at

ten. We currently have three directors. On June 21, 2013, our Board of Directors

and our stockholders owning a majority of our voting securities approved the

appointments of Mark Kalajzich, Miguel Cardozo and Eduardo Ferrero as directors

of our company.

Our current directors, proposed directors and executive

officers are as follows:

|

Name

|

Age

|

Position

|

|

|

|

|

|

Simon Eley

|

40

|

Director and

Chairman

|

|

|

|

|

|

Allister Blyth

|

31

|

Chief Financial

Officer

|

|

|

|

|

|

Andrew Gasmier

|

40

|

Director

|

|

|

|

|

|

Brad Evans

|

37

|

Director

|

|

|

|

|

|

Mark Kalajzich

|

32

|

Proposed Director

(1), President and Chief Executive Officer

|

|

|

|

|

|

Miguel Cardozo

|

63

|

Proposed Director

(1)

|

|

|

|

|

|

Eduardo Ferrero

|

39

|

Proposed Director

(1)

|

|

1.

|

Directorship to be effective 20 days from the filing and mailing of this

document to stockholders.

|

Our directors serve as directors until our next annual

shareholders’ meeting or until a successor is elected and qualified. Officers

hold their positions at the discretion of the Board of Directors. There are no

arrangements, agreements or understandings between non-management shareholders

and management under which non-management shareholders may directly or

indirectly participate in or influence the management of our affairs.

5

Simon Eley, Chairman and Director

Mr. Eley has been a director since December 20, 2010, Chief

Executive Officer since September 22, 2011 and Chief Financial Officer since

September 12, 2012. He is an Australian solicitor with wide experience in the

resources sector. Mr. Eley is currently a director of Auricup Resources Ltd and was a director of Aragon Resources Ltd. He led the team

that secured the Central Murchison Gold Project which became Aragon's core asset

with approximately 2 million ounces in JORC compliant resources. Aragon was

taken over by Westgold Resources Ltd in 2011 valuing Aragon at $76 million. He

worked for Woodside in Mauritania, West Africa in an advisory and commercial

role dealing with government, joint venture partners and local and international

contractors. He has also worked for Aquila Resources, Manhattan Corporation,

Clough and Clayton Utz. Mr. Eley’s experience includes capital raisings,

corporate matters, various commercial arrangements (including joint venture and

farm-in agreements), and matters relating to mining law, toll treatment

arrangements, litigation and alternative dispute resolution. At Aquila and

Manhattan he was engaged in corporate management and strategy. He also has hands

on experience in operating base metal and gold mines in Western Australia and

the Northern Territory.

Allister Blyth, Chief Financial Officer

Mr. Blyth has been Chief Financial Officer since December 3,

2012. Mr. Blyth is a Certified Practicing Accountant in Australia with over 10

years of experience with both the public and private companies and specializes

in financial management, reporting and strategic corporate planning. He has held

financial controller and senior management positions with companies across

various industries including mining exploration and development, and has been

responsible for reporting compliance for various companies. Mr. Blyth has also

actively participated in establishing a start-up exploration company in

Australia. Mr. Blyth is a partner at Blyth Partners, a distinguished public

accounting and business advisory firm based in Subiaco, Western Australia.

Andrew Gasmier, Director

Mr. Gasmier is a West Australian School of Mines educated

Mining Engineer with over 16 years’ experience in both underground and open pit

operations. He has extensive experience in the assessment, evaluation and

feasibility of mineral projects in Africa, Australia, Laos and Russia. Mr.

Gasmier has held General Management roles in operations in Queensland and

Western Australia, and in the past five years Mr. Gasmier has held senior

positions for Metals X, Monarch Gold, AngloGold Ashanti and Mining Plus. Mr.

Gasmier is a current member of AusIMM, holds First Class Mine Managers

Certificate of Competency and holds a West Australian Underground Supervisor’s

Certificate of Competency.

Brad Evans, Director

Mr. Evans has been the General Manager of Mining Plus Pty. Ltd.

for the past five years and has more than 15 years of experience in the mining

industry in a diverse range of roles, from production, planning and management

of mine sites, to organizational leadership. He has led the growth in Mining

Plus from 10 to 70 employees with five offices around the world. Mr. Evans has a

Bachelor of Engineering (Mining) degree from the University of Ballarat in

Australia and holds a Mine Managers Certificates of Competency in Western

Australia and New South Wales.

Mark Kalajzich, President and Chief Executive Officer,

Proposed Director

Mark Kalajzich has held senior executive roles in the

Telecommunications, Workforce Management and Retail sectors in Australia and

Asia. Mark also has significant experience in Equity Capital Markets and Stock

Broking with a fundamental focus of Global Resources and Commodities. He has

been heavily involved in the operation and listing of resource companies and for

the past 2 years, Mark has successfully foundered and held Executive Director

roles in a number of successful start-up entities. Mark continues to hold

a Directors role in the Private Venture Capital and Greenfields Investment

Company, Chapman Valley Capital. Throughout these positions, Mark has

traditionally focused on the creation of corporate structures, the execution of

capital management strategies and driven change through management outcomes.

6

Miguel Cardozo, Proposed Director

Dr. Cardozo has over 39 years of gold and base metals

experience throughout the Americas, holding senior management roles with

companies such as Newmont, North Ltd. and Teck Cominco, as well as in consulting

roles to Placer Dome and AurionGold, and he is a Director of Rio Cristal

Resources and Minandex, junior exploration companies. As Senior Geologist with

Newmont between 1985 and 1995, Dr. Cardozo was responsible for the exploration

program that led to the discovery of the Yanacocha gold district, and the Galeno

copper-gold porphyry in Peru. He is a member of the Society of Economic

Geologists (currently holding the position of Council for the period 2010-2012),

the Colegio de Ingenieros del Perú, the Instituto de Ingenieros de Minas del

Perú, the Sociedad Geológica del Perú and the Society for Geology Applied to

Mineral Deposits. Dr. Cardozo is the current Vice President of the Canada Peru

Chamber of Commerce and a former President of its Mining and Exploration

Committee. Since 2009, he is the President of the Organizing Committee of the

Peruvian Delegation to the yearly PDAC Convention in Toronto. He is also a

former President of the Explorers Association of Peru and of the Mining

Committee of the Canada Peru Chamber of Commerce

Eduardo Ferrero, Proposed Director

Mr Ferrero is an Australian-Peruvian Executive with more than

16 years professional experience in the fields of Engineering, Banking &

Finance, Management Consulting and Business Start-Ups. Mr Ferrero has extensive

business networks across Corporates, Banks and Government in Australia and Peru.

He is a Director of LaEncontre.com, Social Coil, Re/max-Pro and Delante

Consultores, and currently lives in Lima with his family.

See “Incorporation by Reference” below for further information.

Item 2. Statement that Proxies are not Solicited

WE ARE NOT ASKING FOR A PROXY AND YOU ARE REQUESTED

NOT

TO SEND US A PROXY.

Item 3. Interest of Certain Persons in or in Opposition to

Matters to be Acted Upon

Except as disclosed elsewhere in this Information Statement,

none of the following persons have any substantial interest, direct or indirect,

by security holdings or otherwise, in any matter to be acted upon:

|

|

1.

|

any director or officer of our company since May 31,

2012, being the commencement of our last completed financial

year;

|

|

|

|

|

|

|

2.

|

any proposed nominee for election as a director of our

Company; and

|

|

|

|

|

|

|

3.

|

any associate or affiliate of any of the foregoing

persons.

|

7

The shareholdings of our directors and officers are set forth

above in the section entitled "Security Ownership of Certain Beneficial Owners

and Management." To our knowledge, no director has advised that he intends to

oppose the director appointments as more particularly described herein.

Item 4. Proposals by Security Holders

None.

Item 5. Delivery of Documents to Security Holders Sharing an

Address

We will deliver only one copy of this Information Statement and

any information or document incorporated by reference herein to multiple

stockholders sharing an address unless we have received contrary instructions

from one or more of such stockholders.

We undertake to deliver promptly upon written or oral request a

separate copy of this Information Statement and any information or document

incorporated by reference herein to any stockholder at a shared address to which

a single copy of the document was delivered. A stockholder can notify us that he

or she wishes to receive a separate copy of this Information Statement and any

information or document incorporated by reference herein or any future

Information Statement and and any information or document incorporated by

reference therein by writing to us at PO Box 116, West Perth, Western Australia

6012, Australia or by telephoning us at +61 8 9384 6835.

Stockholders sharing the same address can also request delivery

of a single copy of annual reports to security holders, information statements

or Notices of Internet Availability of Proxy Materials if they are receiving

multiple of such documents in the same manner.

8

Incorporation by Reference

We are “incorporating by reference” certain information we file

with the SEC into this Information Statement, which means that we are disclosing

important information to you by referring you to those documents. Information

that is incorporated by reference is an important part of this Information

Statement. We incorporate by reference into this Information Statement the

documents listed below, which were filed with the SEC, and such documents form

an integral part of this Information Statement:

-

Annual Report on Form 10-K for the fiscal year ended May 31, 2012;

-

Quarterly Reports on Form 10-Q for the quarters ended August 31, 2012,

November 30, 2012 and February 28, 2013; and

-

Current Reports on Form 8-K filed on May 7, 2013 and June 24, 2013.

|

|

By Order of the Board of

Directors:

|

|

|

|

|

|

Dated: June 26, 2013

|

By:

|

/s/ Simon Eley

|

|

|

|

Simon Eley

|

|

|

|

Chairman and Director

|

9

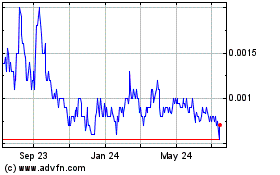

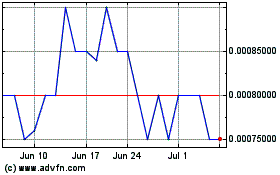

VNUE (PK) (USOTC:VNUE)

Historical Stock Chart

From May 2024 to Jun 2024

VNUE (PK) (USOTC:VNUE)

Historical Stock Chart

From Jun 2023 to Jun 2024