Current Report Filing (8-k)

March 18 2020 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 17, 2020

RISE GOLD CORP.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

Nevada

|

|

000-53848

|

|

30-0692325

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

650 – 669 Howe Street

Vancouver, British Columbia

Canada

(Address of principal executive offices)

V6C 0B4

(Zip Code)

Registrant’s telephone number, including area code: (604) 260-4577

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the exchange Act (17 CFR 240.13e -4)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company þ

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. q

Item 3.02

Unregistered Sales of Securities

On March 17, 2020, we granted 75,000 stock options to an investor relations consultant, Capital Markets Advisory CA, pursuant to the company’s stock option plan. Each option vests immediately and is exercisable into one share of common stock at a price of CAD$0.50 per share until March 17, 2023.

We granted the options in reliance on the exclusion from registration provided by Rule 903 of Regulation S under the Securities Act of 1933, as amended (“Regulation S”). The corporation’s reliance on Rule 903 was based on the fact that the options were granted in “offshore transactions”, as defined in Rule 902(h) of Regulation S, and subject to applicable offering restrictions.

Item 8.01

Other Events

On March 17, 2020, we provided an update on the application for a Use Permit to Nevada County for the re-opening of the historic past-producing Idaho-Maryland Gold Mine.

The Company previously submitted an application for a Use Permit to Nevada County as discussed in the news release dated November 21st, 2019.

All technical reports required for the Draft Environmental Impact Report (“DEIR”) are now either complete or in final draft. The timeline, from the application submission in November 2019 to land use approval, is expected to range from 12-18 months. Construction and operational permits would follow as needed.

The technical reports conclude that the Idaho-Maryland Project (“IM Project”) has no significant environmental impacts after mitigation has been incorporated. Preparation of the DEIR, in accordance with the California Environmental Quality Act (“CEQA”), is expected to commence shortly. In accordance with CEQA, the County will retain a 3rd party independent consultant to peer review the technical studies and conclusions and prepare the DEIR. The DEIR will provide a description of existing site conditions, project operations, and how the project may impact the existing conditions. Accordingly, the final judgement of the significance of impacts and mitigation measures are determined by the County in consultation with its independent consultant. However, based on the results of the technical studies, the Company believes the DEIR will arrive at a similar conclusion with no significant environmental impacts after mitigation is incorporated.

The Company’s technical reports included the participation of numerous highly qualified independent consultants and were completed over a ~9-month period at a total combined cost of over US $1 million. The strong financial condition of the Company allowed extra work to be conducted in numerous areas to bolster the conclusions. Additional work in hydrology, including the digital modelling of groundwater and robust geomorphology studies, was completed with the participation of five experts with doctorate degrees in their fields.

Item 9.01

Financial Statements and Exhibits

Exhibit

No.

Description

99.1

Press release dated March 17, 2020

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 17, 2020

RISE GOLD CORP.

/s/ Benjamin Mossman

Benjamin Mossman

Chief Executive Officer

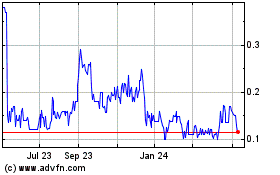

Rise Gold (QX) (USOTC:RYES)

Historical Stock Chart

From Jun 2024 to Jul 2024

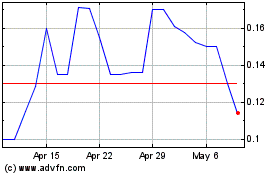

Rise Gold (QX) (USOTC:RYES)

Historical Stock Chart

From Jul 2023 to Jul 2024