Current Report Filing (8-k)

March 09 2022 - 5:10PM

Edgar (US Regulatory)

0001389518

false

0001389518

2022-03-03

2022-03-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 3, 2022

CLUBHOUSE

MEDIA GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

333-140645 |

|

99-0364697 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

3651

Lindell Road, D517

Las

Vegas, Nevada 89103

(Address

of principal executive offices) (Zip code)

(702)

479-3016

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

March 3, 2022, Clubhouse Media Group, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Coventry

SPA”) by and between the Company and Coventry Enterprises, LLC (“Coventry”). Pursuant to the terms of the Coventry

SPA, the Company agreed to issue and sell, and Coventry agreed to purchase (the “Purchase”), a promissory note in the aggregate

principal amount of $150,000 (the “Coventry Note”). The Coventry Note has an original issue discount of $30,000, resulting

in gross proceeds to the Company of $120,000. Pursuant to the terms of the Coventry SPA, the Company also agreed to issue 150,000 shares

of restricted common stock to Coventry as additional consideration for the purchase of the Coventry Note.

The

Coventry Note bears interest at a rate of 10% per annum, with guaranteed interest (the “Guaranteed Interest”) of $15,000

is deemed earned as of March 3, 2022. The Coventry Note matures on March 3, 2023. The principal amount and the Guaranteed Interest is

due and payable in seven equal monthly payments of $23,571.42, beginning on August 3, 2022 and continuing on the third day of each month

thereafter until paid in full not later than March 3, 2023.

Any

or all of the principal amount and the Guaranteed Interest may be prepaid at any time and from time to time, in each case without penalty

or premium.

If

an Event of Default (as defined in the Note) occurs, consistent with the terms of the Note, the Note will become convertible, in whole

or in part, into shares of the Company’s common stock at Coventry’s option, subject to a 4.99% equity blocker (which may

be increased up to 9.99% by Coventry). The conversion price is 90% of the lowest per-share trading price during the 10-trading day period

before conversion.

In

addition to certain other remedies, if an Event of Default occurs, consistent with the terms of the Note, the Note will bear interest

on the aggregate unpaid principal amount and Guaranteed Interest at the rate of the lesser of 18% per annum or the maximum rate permitted

by law.

The

foregoing description of the Coventry SPA and the Coventry Note does not purport to be complete and is qualified in its entirety by reference

to the Coventry SPA and the Coventry Note, copies of which are filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K and

which are incorporated herein by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information provided in Item 1.01 above regarding the Coventry Note is incorporated by reference into this Item 2.03.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

March 9, 2022 |

CLUBHOUSE

MEDIA GROUP, INC. |

| |

|

|

| |

By: |

/s/

Amir Ben-Yohanan |

| |

|

Amir

Ben-Yohanan |

| |

|

Chief

Executive Officer |

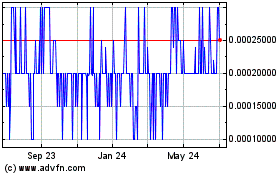

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Aug 2024 to Sep 2024

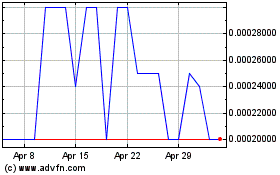

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Sep 2023 to Sep 2024