UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 10, 2024

CLS HOLDINGS USA, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 000-55546 | | 45-1352286 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| 516 S. 4th Street | | |

| Las Vegas, Nevada | | 89101 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (888) 359-4666

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Securities Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On September 10, 2024, CLS Holdings USA, Inc. closed a transaction to redeem certain unsecured debentures, shares of the Company’s common stock, and warrants to purchase the Company’s common stock held by Navy Capital Green Fund, L.P., and related entities. The Company’s Redemption Agreement with Navy Capital Green Fund and related entities redeemed unsecured debentures in aggregate original principal amount of $3,022,507 (the “Debentures”), related warrants to purchase 6,177,216 shares of the Company’s common stock (the “Warrants”), and 15,488,901 shares (the “Shares”) of the Company’s common stock (the “Redemption”). As a result of the Redemption the Company retired $2,793,282.51 in outstanding principal payable under the Debentures. The Company financed the Redemption with the proceeds of a Convertible Promissory Note in original principal amount of $2,600,000 (the “Note”). After the issuance of shares pursuant to the Note and the Redemption of the Shares, the Company’s outstanding shares of common stock increased by a net 51,694,562 shares.

Item 3.02 Unregistered Sales of Equity Securities

The Company converted the Note, in accordance with its terms, to 67,183,463 shares of the Company’s Common Stock.

Item 9.01 Financial Statements and Exhibits.

Exhibits

|

10.1

|

|

Redemption Agreement dated September 3, 2024, by and among the Company, Navy Capital Green Fund, L.P., Navy Capital Green Co-Invest Fund, LLC, and Navy Capital Green Holdings II, LLC.

|

|

10.2

|

|

Convertible Promissory Note to FK Legacy Trust ($2,600,000)

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

CLS HOLDINGS USA, INC.

|

| |

|

|

| |

|

|

|

Date: September 10, 2024

|

|

By: /s/ Andrew Glashow

|

| |

|

Andrew Glashow

Chairman and Chief Executive Officer

|

false

0001522222

true

0001522222

2024-09-10

2024-09-10

Exhibit 10.1

EXECUTION COPY

REDEMPTION AGREEMENT

This REDEMPTION AGREEMENT (this “Agreement”) is made as of September 10, 2024 (the “Effective Date”), by and among Navy Capital Green Fund, LP, a Delaware limited partnership (“Green Fund”), Navy Capital Green Co-Invest Fund, LLC, a Delaware limited liability company (“Co-Invest Fund”), and Navy Capital Green Holdings II, LLC, a Delaware limited liability company (“Green Holdings,” and together with Green Fund and Co-Invest Fund, “Navy Funds” or the “Seller”), and CLS Holdings USA, Inc., a Nevada corporation (the “Company”).

WHEREAS, (i) Green Fund owns 3,409,055, (ii) Co-Invest Fund owns 11,203,620 and (iii) Green Holdings owns 876,226 shares of the Company’s common stock (together, the “Shares”);

WHEREAS, Navy Funds hold warrants to purchase an aggregate of 6,177,216 shares of the Company’s common stock (the “Warrants”);

WHEREAS, Green Fund purchased from the Company: (i) that certain Second Amended and Restated Unsecured Debenture No. CLSH2023-AD6, dated December 31, 2023 in original principal amount of $500,000 (with a current outstanding balance of $347,120.63, after taking account of the assignment of $89,219.57 of the principal amount of such Debenture to Green Holdings); (ii) that certain Third Amended and Restated Debenture, dated December 29, 2023 in the original principal amount of $504,500.05 (with a current outstanding balance of $375,000.70, after taking account of the assignment of $96,386.24 of the principal amount of such Debenture to Green Holdings); and (iii) Co-Invest Fund purchased from the Company that certain Third Amended and Restated Debenture, dated December 29, 2023 in original principal amount of

$2,018,007.24 (with a current outstanding balance of $1,885,555.37) (together, the debentures described in this paragraph, the “Debentures”);

WHEREAS, the Navy Funds desire to sell, and the Company desires to redeem, the Shares, Warrants and Debentures (together, the “Redeemed Securities”) on the terms set forth in this Agreement;

NOW, THEREFORE, in consideration of the mutual covenants herein contained, and for other good and valuable consideration the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

| |

1.

|

Purchase Price. The Company shall redeem the Redeemed Securities as of the Effective Date for the aggregate purchase price of Two Million, Six Hundred Thousand and 00/100 Dollars ($2,600,000.00) (the “Purchase Price”). Six Hundred Thousand and 00/100 Dollars ($600,000.00) shall be allocated to the redemption of the Shares at a price of $0.0387 per share. Two Million and 00/100 Dollars ($2,000,000.00) shall be allocated to the redemption of the aggregate $2,793,282.51 (principal amount) of the Debentures along with the warrant rights and any other rights under the Debentures. The Company shall cancel the Warrants upon the completion of these redemptions. |

| |

2.

|

Payment of Purchase Price; Further Actions.

|

| |

a.

|

Company Payment. Two (2) business days prior to September 3, 2024 (the “Closing Date”), the Company shall deposit the Purchase Price with Arizona Escrow, an independent third party who will act as “Escrow Agent.” The Company will pay

|

| |

|

all of the Escrow Agent’s fees in relation to this escrow. Promptly following the confirmation from VStock Transfer, the Company’s transfer agent, that the Navy Funds have transferred the Shares to the Company, the Company and Green Fund shall jointly instruct the Escrow Agent, by electronic mail or other written communication, to pay the Purchase Price to the Navy Funds by wire transfer of immediately available funds to the accounts designated in writing by the Navy Funds. |

| |

b.

|

Share Cancellation. The Navy Funds shall, or shall cause their broker to, deliver to VStock Transfer a OWAC Withdrawal and Shares Cancellation Form (the “Cancellation Form”) with respect to the shares of Company common stock held by each of Green Fund, Co-Invest Fund, and Green Holdings using the form provided by VStock Transfer and attached hereto as Exhibit A. The Navy Funds shall notify the Company, which notification may be in the form of electronic mail, when the Cancellation Form has been delivered to VStock Transfer.

|

| |

c.

|

Debenture and Warrant Cancellation. On or before the Effective Date, Seller shall send the Warrants to the Company for cancellation. No later than two (2) business days following the date the Company makes the payments of the Purchase Price to Seller, the Company shall send copies of (i) the Debentures marked “Paid In Full” and (ii) the Warrants marked “Cancelled” to Seller by electronic mail.

|

| |

4.

|

Representations and Warranties.

|

| |

a.

|

Representations and Warranties by the Navy Funds.

|

| |

•

|

The Navy Funds represent and warrant to the Company that the Navy Funds are the absolute beneficial owner of the Shares, the Debentures and the Warrants, with good and marketable title thereto, free and clear of any liens, charges, encumbrances, security interests or rights of others, and that the Navy Funds are exclusively entitled to possess and dispose of same.

|

| |

•

|

The Navy Funds represent and warrant to the Company that the Shares, the Debentures and the Warrants are the only securities of the Company owned by the Navy Funds, and that after the transactions contemplated by this Agreement have been completed, the Navy Funds will not own any securities of the Company.

|

| |

b.

|

Representations and Warranties by the Company. The Company represents and warrants to the Navy Funds that the Company is not bound by any agreement that would prevent or prohibit the transactions contemplated in this Agreement. This Agreement is not in violation of any applicable federal or state law, rule, regulation, or judgment including applicable securities acts and regulations.

|

| |

5.

|

Governing Law; Venue. This Agreement, and all questions concerning the construction, validity, and interpretation of this Agreement, shall be governed by and construed in accordance with the internal laws of the State of Nevada, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of Nevada or any other jurisdiction) that would cause the application of the laws of any other jurisdiction.

|

| |

|

The Company and the Navy Funds hereby submit to the jurisdiction of the state courts of Arizona and to the jurisdiction of the United States District Court for the District of Nevada.

|

| |

6.

|

Attorneys’ Fees. The prevailing party in any action under this Agreement shall be entitled to reasonable attorneys’ fees, costs, and necessary disbursements in addition to any other relief to which such party may be entitled.

|

| |

7.

|

Waiver. No waiver by any party of any right on any occasion shall be construed as a bar to or waiver of any right or remedy on any future occasion.

|

| |

8.

|

Severability. If any provision of this Agreement shall be held or deemed to be invalid, inoperative, or unenforceable, the remaining provisions herein contained shall nonetheless continue to be valid, operative, and enforceable as though the invalid, inoperative or unenforceable provision had not been included in this Agreement.

|

| |

9.

|

Captions. All paragraph titles or captions contained in this Agreement are for convenience only and shall not be deemed part of the content of this Agreement.

|

| |

10.

|

Agreement Binding. This Agreement shall be binding upon and inure to the benefit of the respective successors and assigns of the parties hereto.

|

| |

11.

|

Amendment. This Agreement may be altered, amended, or modified only by a writing signed by the parties hereto.

|

| |

12.

|

Further Assurances. The parties hereto and their respective successors and assigns, officers, and directors, shall do all such things, execute all such documents, and provide all such reasonable assurances as may be required to carry out the terms and purposes of this Agreement.

|

| |

13.

|

Counterparts. This Agreement may be executed in counterparts, all of which taken together shall be deemed one original.

|

[Signature Page Follows]

IN WITNESS WHEREOF, the Company and the Navy Funds have executed this Redemption Agreement as of the date first written above.

|

COMPANY:

|

NAVY FUNDS:

|

| |

|

|

CLS HOLDINGS USA, INC.

|

NAVY CAPTIAL GREEN FUND, LP

|

| |

|

|

By: /s/ Andrew Glashow

|

By: Navy Capital Green Management, LLC

|

|

Name: Andrew Glashow

|

Title: Investment Manager

|

|

Title: Chairman and CEO

|

|

| |

|

| |

By: /s/ Kevin McLaughlin

|

| |

Name: Kevin McLaughlin

|

| |

Title: CFO

|

| |

|

| |

|

| |

NAVY CAPITAL GREEN CO-INVEST FUND, LLC

|

| |

|

| |

By: Navy Capital Green Management, LLC

|

| |

Title: Investment Manager

|

| |

|

| |

By: /s/ Kevin McLaughlin

|

| |

Name: Kevin McLaughlin

|

| |

Title: CFO

|

| |

|

| |

|

| |

NAVY CAPITAL GREEN HOLDINGS II, LLC

|

| |

|

| |

By: Navy Capital Green Management, LLC

|

| |

Title: Manager

|

| |

|

| |

By: /s/ Kevin McLaughlin

|

| |

Name: Kevin McLaughlin

|

| |

Title: CFO

|

EXHIBIT A

[See attached]

18 Lafayette Place ♦ Woodmere, NY 11598 ♦ (212) 828-8436 Main ♦ (646) 536-3179 Fax

DWAC Withdrawal and Shares Cancellation Form

Company Name: Symbol: CUSIP No:

Brokerage Firm: DTC Participant Number:

Account Name: Account Number:

Number of Shares Being Withdrawn:

Current Shareholder:

Address:

SS or Tax ID Number:

Telephone: E-Mail:

REQUEST TO CANCEL SHARES AND RETURN TO TREASURY:

You are hereby authorized and directed to cancel on your books and return to treasury the above identified shares of common stock. Please return the shares to Lans Holdings Inc. unissued status effective upon withdrawal.

Current Owner(s) Signatures: Today’s Date:

Medallion Guarantee Stamp Area: For registration/ownership changes - the owner of the shares must have their signature “medallion guaranteed” by an approved bank, broker, or other financial institution associated with the medallion program, such as STAMP, SEMP or MSP.

Exhibit 10.2

No. CLSH2024-PN9

CONVERTIBLE PROMISSORY NOTE

THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (“SECURITIES ACT”), OR ANY APPLICABLE STATE (“BLUE SKY LAWS”) OR FOREIGN SECURITIES LAWS AND WILL BE ISSUED IN RELIANCE UPON AN EXEMPTION FROM SUCH REGISTRATION REQUIREMENTS PROVIDED BY RULE 506(b) OF REGULATION D AND/OR SECTION 4(a)(2) UNDER THE SECURITIES ACT AND OUTSIDE THE UNITED STATES PURSUANT TO OTHER APPLICABLE REGULATIONS UNDER THE SECURITIES ACT. ANY SALE, PLEDGE, ENCUMBRANCE OR OTHER TRANSFER (ANY, A “TRANSFER”) OF ALL OR ANY PORTION OF SUCH SECURITIES WILL BE INVALID UNLESS SUBJECT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND AS REQUIRED BY APPLICABLE BLUE SKY AND/OR FOREIGN LAWS AS TO SUCH TRANSFER OR IN THE OPINION OF COUNSEL SATISFACTORY TO THE BORROWER SUCH REGISTRATION IS UNNECESSARY IN ORDER FOR SUCH TRANSFER TO COMPLY WITH THE SECURITIES ACT AND APPLICABLE BLUE SKY LAWS. BY ITS ACQUISITION HEREOF, THE HOLDER (1) REPRESENTS THAT (A) IT IS NOT A U.S. PERSON AND IS ACQUIRING THIS SECURITY IN AN OFFSHORE TRANSACTION IN COMPLIANCE WITH RULE 904 UNDER THE SECURITIES ACT OR (B) IT IS AN ACCREDITED INVESTOR AS DEFINED IN RULE 501 UNDER THE SECURITIES ACT AND THAT IS ACQUIRING THE SECURITY FOR ITS OWN ACCOUNT.

| $2,600,000 |

August 28, 2024 |

For Value Received, CLS Holdings USA, Inc, a Nevada corporation with its principal address at 516 S. 4th Street, Las Vegas, Nevada 89101 (“Maker”), under the terms of this Convertible Note (“Note”), promises to pay to the order of FK Legacy Trust (“Purchaser”), the principal amount of $2,600,000 (the “Principal Amount”), in Maker’s stock as set forth below, on or before August 30, 2024 (the “Maturity Date”).

1. Payment. Maker shall make payment to the Purchaser as follows: On or before August 30, 2024, issue to Purchaser the entire Principal Amount in unregistered shares of CLS Holdings USA Inc. at a per-share-price of 0.0387 (3.87 cents per share) in full satisfaction of this debt. The Principal Amount is equal to $2,600,000 and, therefore, the Purchaser would receive 67,183,463 shares of Maker’s stock.

2. Default. With respect to the Note, the following is an “Event of Default”: Default of Maker in the payment of shares under the Note when due.

3. Unsecured. This Note is an unsecured obligation of Maker.

4. Notices. Any notice, request or other communication required or permitted hereunder shall be in writing and shall be deemed to have been duly given if personally delivered or if faxed with confirmation of receipt or if mailed by registered or certified mail, postage prepaid, at the address of Maker or Purchaser. Any Party hereto may by notice so given change its address for future notice hereunder. Notice shall conclusively be deemed to have been received when personally delivered or faxed, or five business days after being deposited in the mail in the manner set forth above.

5. WAIVER OF RIGHT TO TRIAL BY JURY. THE PARTIES HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVE THE RIGHT ANY OF THEM MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION BASED HEREON OR ARISING OUT OF, UNDER OR IN CONNECTION WITH THIS AGREEMENT OR ANY TRANSACTION DOCUMENT OR ANY COURSE OF CONDUCT, COURSE OF DEALING, STATEMENTS (WHETHER VERBAL OR WRITTEN) OR ACTIONS OF ANY PARTY. THIS PROVISION IS A MATERIAL INDUCEMENT FOR THE PARTIES' ACCEPTANCE OF THIS AGREEMENT.

6. Governing Law; Jurisdiction. Maker and Purchaser each hereby submits to personal jurisdiction in the State of Nevada, consents to the exclusive jurisdiction of any competent state or federal district court sitting in Clark County, Nevada, and waives any and all rights to raise lack of personal jurisdiction as a defense in any action, suit, or proceeding in connection with this Note or any related matter. This Note shall be governed by, and construed and interpreted in accordance with, the laws of the State of Nevada, without reference to conflicts of law provisions of such state. Exclusive venue for any legal proceedings brought in connection with, or relating to, this Note shall be in Clark County, Nevada.

7. Successors. The provisions of this Note shall inure to the benefit of and be binding on any permitted successor of Purchaser.

This Note is executed in the State of Nevada as of the date first set forth above.

CLS Holdings, USA, Inc., a Nevada corporation

By: /s/ Andrew Glashow

Andrew Glashow

CEO and Chairman

Agreed to and accepted:

By: /s/ Frank Koretsky

Frank Koretsky

Trustee of FK Legacy Trust

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

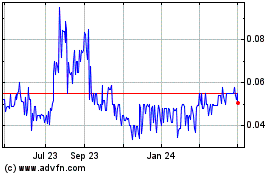

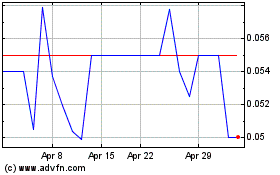

CLS Holdings USA (QB) (USOTC:CLSH)

Historical Stock Chart

From Sep 2024 to Oct 2024

CLS Holdings USA (QB) (USOTC:CLSH)

Historical Stock Chart

From Oct 2023 to Oct 2024