Trisura Group Ltd. (“Trisura” or “Trisura Group”) (TSX: TSU), a

leading international specialty insurance provider, today announced

financial results for the first quarter of 2020.

David Clare, President and CEO of Trisura,

stated, “We are pleased with Trisura’s first quarter results,

generating net income of $8.4 million, vs. $2.5 million in Q1 2019

driven by increasing profitability from our US platform and

continued strength in Canada.

Our US operations bound $120.7 million of gross

premiums written and generated $2.6 million in net income. In

Canada, disciplined underwriting and enhanced investment returns

sustained our industry-leading 19.3% return on equity.

Importantly, improved asset-liability matching

in our international reinsurance operations limited volatility in a

challenging environment.

Notwithstanding our improved net income, book

value per share decreased as a result of mark-to-market losses in

the investment portfolio. However, our balance sheet remains

healthy. Regulatory capital levels are strong despite market

volatility while liquidity has been enhanced through an increase in

available capacity from our revolving credit facility.”

Highlights

- Gross and net written premiums growth of 108.8% and 46.1% in

Q1, supported by continued momentum in our US operations and

continued growth in Canada.

- Net income of $8.4 million vs. $2.5 million in Q1 2019, driven

by strong underwriting performance and investment income in Canada,

and growing profitability in the US. We also recognized a gain

related to the recognition of previously generated tax

losses.

- EPS of $0.94 in Q1 2020, compared to $0.37 in Q1

2019.

- Book value per share of $21.23, a 1.6% decrease from $21.58 at

December 31, 2019 as a result of unrealized losses in the

investment portfolio.

- Industry-leading results from our Canadian business, achieving

a combined ratio of 82.0% in the current quarter vs. 83.5% in Q1

2019, and producing a 19.3% LTM ROE.

- Continued acceleration in our US. operations, producing $120.7

million in GPW in the quarter vs. $41.9 million in Q1 2019; $2.6

million in net income, and a 9.3% LQA ROE demonstrate the potential

of our maturing platform.

- Increased our revolving credit facility capacity to $50.0

million, at consistent pricing, with the ability to draw proceeds

in Canadian or US dollars. Debt-to-capital ratio was 15.3% at

March 31, 2020, below our long-term target of 20.0%.

|

Amounts in C$ millions |

Q1 2020 |

|

Q1 2019 |

Variance |

|

|

Gross premiums written |

170.0 |

|

81.4 |

108.8% |

|

|

Net premiums written |

41.5 |

|

28.4 |

46.1% |

|

|

Net underwriting income (loss) |

0.6 |

|

(8.3) |

nm |

|

|

Net investment income |

8.5 |

|

4.3 |

97.9% |

|

|

Net income |

8.4 |

|

2.5 |

232.6% |

|

|

EPS - diluted, $ |

0.94 |

|

0.37 |

154.9% |

|

|

Book value per share, $ |

21.2 |

|

20.4 |

4.0% |

|

|

Debt-to-Capital ratio |

15.3% |

|

18.0% |

(2.7pts) |

|

|

LTM ROE |

6.8% |

|

7.2% |

(0.4pts) |

|

|

Combined ratio - Canada |

82.0% |

|

83.5% |

(1.5pts) |

|

|

LTM ROE - Canada |

19.3% |

|

21.3% |

(2.0pts) |

|

COVID-19

- Preliminary results for the month of April have demonstrated

resilience, however Q2 2020 premium generation and claims activity

may be impacted by the length and depth of the pandemic-related

economic slowdown, as well as the effectiveness of government

support programs. Depending on these factors, premium growth

could slow and claims activity could increase.

- The most direct financial impact observed during the quarter

related to COVID-19 was the mark-to-market volatility in our

investment portfolio.

- In April, we did not observe a significant impact on

underwriting results; our policies generally do not provide

pandemic coverage and many surety bonds are focused on

infrastructure projects deemed essential.

- Trisura employees are working effectively from home.

Underwriting

- Disciplined underwriting from our Canadian operations,

achieving a loss ratio of 24.3% in the quarter, supported by strong

underwriting across all lines. Improvements in expense ratio

driven by operational efficiency resulted in a combined ratio of

82.0%

- Accelerating growth in our US platform, with GPW of $120.7

million in Q1 2020 compared to $95.4 million in Q4 2019, and fee

income of $4.1 million in Q1 2020 compared to $3.1 million in Q4

2019.

- Improved asset-liability matching in our international

reinsurance operations limited volatility in the quarter.

Capital

- The minimum capital test (“MCT”) ratio of our Canadian

operations was 233% (258% as at December 31, 2019), which

comfortably exceeded regulatory requirements of 150%.

- Trisura US’s capital of $81.3 million USD as at March 31, 2020

($83.3 million USD as at December 31, 2019) was in excess of the

minimum requirement of the Oklahoma Insurance Department.

- Trisura International’s capital of $13.0 million USD as at

March 31, 2020 ($14.2 million USD as at December 31, 2019) was

greater than the FSC’s regulatory capital

requirement.

- Consolidated debt-to-capital ratio of 15.3% as at March 31,

2020 is below our long-term target of 20.0%.

Investments

- In Q1 2020, net investment income of $8.5 million compared to

$4.3 million in Q1 2019. The improvement was driven by an increase

in interest and dividend income in North America, as well as longer

duration reinsurance assets, which generated strong results in a

declining interest rate environment.

- In Canada, interest and dividend income increased 28.1% in Q1

2020, over Q1 2019, as we continued to benefit from an improved

asset mix.

- In the US, interest and dividend income increased 41.2% in Q1

2020, over Q1 2019, as we benefited both from diversification of

the portfolio and increased capital following our equity raise in

September 2019.

- European rates fell in Q1 2020, which resulted in net

investment gain of $5.5 million in Trisura International, offset by

reserve increases.

- Other comprehensive (loss) income was negatively impacted by

unrealized losses in the preferred share and equity portfolios in

both Canada and the US, stemming from the sell-off related to the

COVID-19 pandemic.

- Foreign exchange differences, arising from the translation of

financial statements of our US and International operations,

provided a benefit in the quarter. We have initiated a hedging

program to mitigate future currency-related volatility.

Corporate Development

- Following the close of the acquisition of Trisura Insurance

Company (formerly known as 21st Century Preferred Insurance

Company) on November 1, 2019, Trisura continues to grow its

capabilities with the intention of securing admitted licenses in

all 50 states.

About Trisura Group

Trisura Group Ltd. is an international specialty

insurance provider operating in the surety, risk solutions,

corporate insurance and reinsurance segments of the market. Trisura

has three principal regulated subsidiaries: Trisura Guarantee

Insurance Company in Canada, Trisura Specialty Insurance Company in

the US and Trisura International Insurance Ltd. in Barbados.

Trisura Group is listed on the Toronto Stock Exchange under the

symbol “TSU”.

Further information is available at

http://www.trisura.com/group. Important information may be

disseminated exclusively via the website; investors should consult

the site to access this information. Details regarding the

operations of Trisura Group are also set forth in regulatory

filings. A copy of the filings may be obtained on Trisura Group’s

SEDAR profile at www.sedar.com.

For more information, please contact: Name:

Bryan SinclairTel: 416 607 2135 Email:

bryan.sinclair@trisura.com

Trisura Group Ltd. Consolidated

Statements of Financial PositionAs at March 31,

2020 and December 31, 2019(in thousands of

Canadian dollars, except as otherwise noted)

|

As at |

March 31, 2020 |

December 31, 2019 |

|

Cash and cash equivalents, and short-term securities |

84,352 |

85,905 |

|

Investments |

394,484 |

392,617 |

|

Premiums and accounts receivable, and other assets |

124,661 |

86,669 |

|

Recoverable from reinsurers |

394,224 |

293,068 |

|

Deferred acquisition costs |

124,861 |

104,197 |

|

Capital assets and intangible assets |

14,507 |

14,477 |

|

Deferred tax assets |

5,975 |

1,460 |

|

Total assets |

1,143,064 |

978,393 |

|

Accounts payable, accrued and other liabilities |

37,035 |

40,916 |

|

Reinsurance premiums payable |

103,517 |

80,186 |

|

Unearned premiums |

401,642 |

328,091 |

|

Unearned reinsurance commissions |

68,463 |

51,291 |

|

Unpaid claims and loss adjustment expenses |

311,483 |

257,880 |

|

Loan payable |

33,704 |

29,700 |

|

Total liabilities |

955,844 |

788,064 |

|

Shareholders' equity |

187,220 |

190,329 |

|

Total liabilities and shareholders' equity |

1,143,064 |

978,393 |

Trisura Group

Ltd.Consolidated Statements of Comprehensive

(Loss) IncomeFor the three months ended March

31(in thousands of Canadian dollars, except as

otherwise noted)

|

|

Q1 2020 |

Q1 2019 |

|

Gross premiums written |

169,952 |

|

81,383 |

|

|

Net premiums written |

41,500 |

|

28,410 |

|

|

Net premiums earned |

30,567 |

|

22,093 |

|

|

Fee income |

7,541 |

|

4,349 |

|

|

Total underwriting revenue |

38,108 |

|

26,442 |

|

|

Net claims |

(14,186 |

) |

(14,894 |

) |

|

Net commissions |

(11,233 |

) |

(8,518 |

) |

|

Operating expenses and premium taxes |

(12,085 |

) |

(11,290 |

) |

|

Net claims and expenses |

(37,504 |

) |

(34,702 |

) |

|

Net underwriting income (loss) |

604 |

|

(8,260 |

) |

|

Net investment income |

8,534 |

|

4,313 |

|

|

Settlement from structured insurance assets |

- |

|

8,077 |

|

|

Net (losses) gains |

(2,054 |

) |

655 |

|

|

Interest expense |

(400 |

) |

(345 |

) |

|

Income before income taxes |

6,684 |

|

4,440 |

|

|

Income tax benefit (expense) |

1,687 |

|

(1,923 |

) |

|

Net income |

8,371 |

|

2,517 |

|

|

Other comprehensive (loss) income |

(11,370 |

) |

2,658 |

|

|

Comprehensive (loss) income |

(2,999 |

) |

5,175 |

|

Trisura Group

Ltd.Consolidated Statements of Cash

FlowsFor the three months ended March

31(in thousands of Canadian dollars, except as

otherwise noted)

|

|

Q1 2020 |

Q1 2019 |

| Net income from

operating activities |

8,371 |

|

2,517 |

|

| Non-cash items to be

deducted |

(1,813 |

) |

1,378 |

|

| Stock options

granted |

152 |

|

65 |

|

| Change in working

capital operating items |

(539 |

) |

(2,435 |

) |

| Realized (gains) on AFS

investments |

(2,821 |

) |

(1,421 |

) |

| Income taxes paid |

(3,279 |

) |

(860 |

) |

|

Interest paid |

(436 |

) |

(283 |

) |

| Net cash used in

operating activities |

(365 |

) |

(1,039 |

) |

|

Proceeds on disposal of investments |

27,062 |

|

13,540 |

|

| Purchases of

investments |

(33,769 |

) |

(23,793 |

) |

|

Net purchases of capital and intangible assets |

(371 |

) |

(200 |

) |

|

Net cash used in investing activities |

(7,078 |

) |

(10,453 |

) |

| Dividends paid |

- |

|

(24 |

) |

| Loans received |

32,700 |

|

- |

|

| Repayment of loan

payable |

(29,700 |

) |

- |

|

|

Lease payments |

(480 |

) |

(313 |

) |

|

Net cash from (used in) financing activities |

2,520 |

|

(337 |

) |

| Net decrease in

cash |

(4,923 |

) |

(11,829 |

) |

| Cash at beginning of the

period |

85,905 |

|

95,212 |

|

|

Currency translation |

3,370 |

|

(1,311 |

) |

|

Cash at the end of the period |

84,352 |

|

82,072 |

|

Cautionary Statement Regarding Forward-Looking

Statements and Information

Note: This news release contains

“forward-looking information” within the meaning of Canadian

provincial securities laws and “forward-looking statements” within

the meaning of applicable Canadian securities regulations.

Forward-looking statements include statements that are predictive

in nature, depend upon or refer to future events or conditions,

include statements regarding the operations, business, financial

condition, expected financial results, performance, prospects,

opportunities, priorities, targets, goals, ongoing objectives,

strategies and outlook of the Company and its subsidiaries, as well

as the outlook for North American and international economies for

the current fiscal year and subsequent periods, and include words

such as “expects,” “likely,” “anticipates,” “plans,” “believes,”

“estimates,” “seeks,” “intends,” “targets,” “projects,” “forecasts”

or negative versions thereof and other similar expressions, or

future or conditional verbs such as “may,” “will,” “should,”

“would” and “could”.

Although we believe that our anticipated future

results, performance or achievements expressed or implied by the

forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on forward-looking statements and information

because they involve known and unknown risks, uncertainties and

other factors, many of which are beyond our control, which may

cause the actual results, performance or achievements of our

Company to differ materially from anticipated future results,

performance or achievement expressed or implied by such

forward-looking statements and information.

Factors that could cause actual results to

differ materially from those contemplated or implied by

forward-looking statements include, but are not limited to:

developments related to COVID-19, including the impact of COVID-19

on the economy and global financial markets; the impact or

unanticipated impact of general economic, political and market

factors in the countries in which we do business; the behaviour of

financial markets, including fluctuations in interest and foreign

exchange rates; global equity and capital markets and the

availability of equity and debt financing and refinancing within

these markets; strategic actions including dispositions; the

ability to complete and effectively integrate acquisitions into

existing operations and the ability to attain expected benefits;

changes in accounting policies and methods used to report financial

condition (including uncertainties associated with critical

accounting assumptions and estimates); the ability to appropriately

manage human capital; the effect of applying future accounting

changes; business competition; operational and reputational risks;

technological change; changes in government regulation and

legislation within the countries in which we operate; governmental

investigations; litigation; changes in tax laws; changes in capital

requirements; changes in reinsurance arrangements; ability to

collect amounts owed; catastrophic events, such as earthquakes,

hurricanes or pandemics; the possible impact of international

conflicts and other developments including terrorist acts and

cyberterrorism; and other risks and factors detailed from time to

time in our documents filed with securities regulators in

Canada.

We caution that the foregoing list of important

factors that may affect future results is not exhaustive.

When relying on our forward-looking statements, investors and

others should carefully consider the foregoing factors and other

uncertainties and potential events. Except as required by

law, Trisura Group Ltd. undertakes no obligation to publicly update

or revise any forward-looking statements or information, whether

written or oral, that may be as a result of new information, future

events or otherwise.

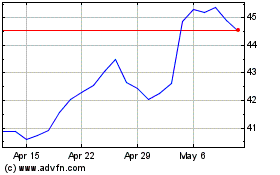

Trisura (TSX:TSU)

Historical Stock Chart

From Mar 2024 to Apr 2024

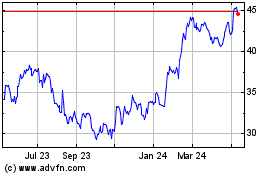

Trisura (TSX:TSU)

Historical Stock Chart

From Apr 2023 to Apr 2024