Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration No.

333-256120 June 3, 2021 INVESTOR PRESENTATION JUNE 3, 2021Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration No. 333-256120 June 3, 2021 INVESTOR PRESENTATION JUNE 3, 2021

Forward-Looking Statements This presentation contains forward-looking

statements that relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Examples of forward-looking statements include, among

others, statements we make regarding our expectations with regard to our business, financial and operating results, future economic performance and dividends, future capital ratios, the impact of the AmeriHome acquisition, and the impact of the

COVID-19 pandemic and related economic conditions. The forward-looking statements contained herein reflect our current views about future events and financial performance and are subject to risks, uncertainties, assumptions and changes in

circumstances that may cause our actual results to differ significantly from historical results and those expressed in any forward-looking statement. Some factors that could cause actual results to differ materially from historical or expected

results include, among others: the risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, in each case

as filed with the Securities and Exchange Commission; the potential adverse effects of the ongoing COVID-19 pandemic and any governmental or societal responses thereto, including the distribution and effectiveness of COVID-19 vaccines, or other

unusual and infrequently occurring events; changes in general economic conditions, either nationally or locally in the areas in which we conduct or will conduct our business; inflation, interest rate, market and monetary fluctuations; our ability to

successfully integrate and operate AmeriHome; increases in competitive pressures among financial institutions and businesses offering similar products and services; higher defaults on our loan portfolio than we expect; changes in management’s

estimate of the adequacy of the allowance for credit losses; our ability to successfully implement strategies to improve our capital ratios; legislative or regulatory changes including in response to the COVID-19 pandemic such as the Coronavirus

Aid, Relief and Economic Security Act of 2020 and the rules and regulations that may be promulgated thereunder; or changes in accounting principles, policies or guidelines; supervisory actions by regulatory agencies which may limit our ability to

pursue certain growth opportunities, including expansion through acquisitions; additional regulatory requirements resulting from our continued growth; management’s estimates and projections of interest rates and interest rate policy; the

execution of our business plan; and other factors affecting the financial services industry generally or the banking industry in particular. Any forward-looking statement made by us in this presentation is based only on information currently

available to us and speaks only as of the date on which it is made. We do not intend and disclaim any duty or obligation to update or revise any industry information or forward-looking statements, whether written or oral, that may be made from time

to time, set forth in this press release to reflect new information, future events or otherwise. Non-GAAP Financial Measures This presentation contains both financial measures based on GAAP and non-GAAP based financial measures, which are used where

management believes them to be helpful in understanding the Company’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the

comparable GAAP financial measure, can be found in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2021. These disclosures should not be viewed as a substitute for operating results determined in accordance with

GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. 2Forward-Looking Statements This presentation contains forward-looking statements that relate to expectations, beliefs, projections,

future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Examples of forward-looking statements include, among others, statements we make regarding our expectations with

regard to our business, financial and operating results, future economic performance and dividends, future capital ratios, the impact of the AmeriHome acquisition, and the impact of the COVID-19 pandemic and related economic conditions. The

forward-looking statements contained herein reflect our current views about future events and financial performance and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ

significantly from historical results and those expressed in any forward-looking statement. Some factors that could cause actual results to differ materially from historical or expected results include, among others: the risk factors discussed in

the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, in each case as filed with the Securities and Exchange Commission; the

potential adverse effects of the ongoing COVID-19 pandemic and any governmental or societal responses thereto, including the distribution and effectiveness of COVID-19 vaccines, or other unusual and infrequently occurring events; changes in general

economic conditions, either nationally or locally in the areas in which we conduct or will conduct our business; inflation, interest rate, market and monetary fluctuations; our ability to successfully integrate and operate AmeriHome; increases in

competitive pressures among financial institutions and businesses offering similar products and services; higher defaults on our loan portfolio than we expect; changes in management’s estimate of the adequacy of the allowance for credit

losses; our ability to successfully implement strategies to improve our capital ratios; legislative or regulatory changes including in response to the COVID-19 pandemic such as the Coronavirus Aid, Relief and Economic Security Act of 2020 and the

rules and regulations that may be promulgated thereunder; or changes in accounting principles, policies or guidelines; supervisory actions by regulatory agencies which may limit our ability to pursue certain growth opportunities, including expansion

through acquisitions; additional regulatory requirements resulting from our continued growth; management’s estimates and projections of interest rates and interest rate policy; the execution of our business plan; and other factors affecting

the financial services industry generally or the banking industry in particular. Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made.

We do not intend and disclaim any duty or obligation to update or revise any industry information or forward-looking statements, whether written or oral, that may be made from time to time, set forth in this press release to reflect new information,

future events or otherwise. Non-GAAP Financial Measures This presentation contains both financial measures based on GAAP and non-GAAP based financial measures, which are used where management believes them to be helpful in understanding the

Company’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the

Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2021. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP

performance measures that may be presented by other companies. 2

Preliminary Term Sheet Issuer • Western Alliance Bancorporation

• Subordinated Notes Security Offered Term • 10-year Structure • Fixed-to-Floating Rate (10 year non-call for 5 years) Expected Security • Baa2 by Moody’s, BBB+ by KBRA, BBB+ by EJ Ratings Offering Type • SEC

registered • General corporate purposes Use of Proceeds Book-Running • Piper Sandler & Co.; JP Morgan Securities LLC Managers • Wells Fargo Corporate & Investment Banking; Jefferies LLC; Co-Managers RBC Capital Markets;

Wedbush Securities 3Preliminary Term Sheet Issuer • Western Alliance Bancorporation • Subordinated Notes Security Offered Term • 10-year Structure • Fixed-to-Floating Rate (10 year non-call for 5 years) Expected Security

• Baa2 by Moody’s, BBB+ by KBRA, BBB+ by EJ Ratings Offering Type • SEC registered • General corporate purposes Use of Proceeds Book-Running • Piper Sandler & Co.; JP Morgan Securities LLC Managers • Wells

Fargo Corporate & Investment Banking; Jefferies LLC; Co-Managers RBC Capital Markets; Wedbush Securities 3

Investment Highlights Seasoned Leadership Team Diversified Business Model

– Sustainable Across Market Cycles Diverse, High Quality Loan Portfolio Conservative Credit Culture – Superior Asset Quality Stable, Low-Cost Deposit Franchise Well Capitalized with Excess Liquidity 4Investment Highlights Seasoned

Leadership Team Diversified Business Model – Sustainable Across Market Cycles Diverse, High Quality Loan Portfolio Conservative Credit Culture – Superior Asset Quality Stable, Low-Cost Deposit Franchise Well Capitalized with Excess

Liquidity 4

Management & Leadership Overview Kenneth A. Vecchione Dale M. Gibbons

President & Chief Executive Officer Vice Chairman, Chief Financial Officer 13 total years at WAL 17 years at WAL 35+ years experience, including senior positions in 30+ years in commercial banking financial services • Appointed CEO in

April 2018 • Ranked #1 Best CFO overall, among Mid-cap and Small-cap • Has served on Western Alliance Board of Directors since 2007 and banks, by Institutional Investor magazine (2017 & 2018) was WAL’s COO from 2010 –

2013 • CFO and Secretary of the Board at Zions Bancorporation (1996 – • Previously, served in senior leadership positions at MBNA Corp., 2001) Apollo Global Management, and Citi Card Services Tim R. Bruckner Timothy W. Boothe Chief

Credit Officer Chief Operating Officer 4 years at WAL 5 years at WAL 15+ years in senior credit administration 20+ years in commercial banking • Previously, served as Managing Director of Arizona Commercial • Previously, served as

President of Bridge Bank, a division of Banking at BMO Harris Bank and as a Senior Vice President in a Western Alliance Bank, from July 2015 through October 2019 variety of divisions including Manager of the Special Assets • Also served as

Chief Operating Officer of Bridge Bank from 2006 Division, President of M&I Business Credit and President of M&I until its acquisition by WAL in July 2015 Equipment Finance 5Management & Leadership Overview Kenneth A. Vecchione Dale M.

Gibbons President & Chief Executive Officer Vice Chairman, Chief Financial Officer 13 total years at WAL 17 years at WAL 35+ years experience, including senior positions in 30+ years in commercial banking financial services • Appointed CEO

in April 2018 • Ranked #1 Best CFO overall, among Mid-cap and Small-cap • Has served on Western Alliance Board of Directors since 2007 and banks, by Institutional Investor magazine (2017 & 2018) was WAL’s COO from 2010 –

2013 • CFO and Secretary of the Board at Zions Bancorporation (1996 – • Previously, served in senior leadership positions at MBNA Corp., 2001) Apollo Global Management, and Citi Card Services Tim R. Bruckner Timothy W. Boothe Chief

Credit Officer Chief Operating Officer 4 years at WAL 5 years at WAL 15+ years in senior credit administration 20+ years in commercial banking • Previously, served as Managing Director of Arizona Commercial • Previously, served as

President of Bridge Bank, a division of Banking at BMO Harris Bank and as a Senior Vice President in a Western Alliance Bank, from July 2015 through October 2019 variety of divisions including Manager of the Special Assets • Also served as

Chief Operating Officer of Bridge Bank from 2006 Division, President of M&I Business Credit and President of M&I until its acquisition by WAL in July 2015 Equipment Finance 5

Summary Western Alliance Bancorporation Overview National Commercial Bank

Strategy NYSE Headquarters A national banking platform of specialized financial services paired with WAL Phoenix, AZ attractive regional markets provides complementary, diversified revenue streams and high operating leverage to produce superior

financial returns 1 IPO Market Cap 2005 $10.3bn Serving a wide range of commercial and consumer related clients nationwide, from corporate and small business to public and non-profit Branches Employees borrowers 38 1,900+ Diversified business model

provides flexibility to adapt business and capital Total Assets TCE/TA allocation in response to changing environment to sustain results across $43.4B 7.9% market cycles 2 NPAs/Assets Tier 1 Leverage 8.8% 0.27% FORBES S&P GLOBAL MI Institutional

Investor LTM NCOs/ Total RBC #1 Best-Performing of the 50 One of the “Most Honored Top 15 “Best Banks in Avg. Loans 12.6% Largest Public U.S. Banks, America” list 2016 - 2021 Companies in America,” 2021 2020 0.07% Note:

Financial data as of March 31, 2021 1)Market data as of May 28, 2021 6 2)Nonperforming assets includes nonaccrual loans and repossessed assetsSummary Western Alliance Bancorporation Overview National Commercial Bank Strategy NYSE Headquarters A

national banking platform of specialized financial services paired with WAL Phoenix, AZ attractive regional markets provides complementary, diversified revenue streams and high operating leverage to produce superior financial returns 1 IPO Market

Cap 2005 $10.3bn Serving a wide range of commercial and consumer related clients nationwide, from corporate and small business to public and non-profit Branches Employees borrowers 38 1,900+ Diversified business model provides flexibility to adapt

business and capital Total Assets TCE/TA allocation in response to changing environment to sustain results across $43.4B 7.9% market cycles 2 NPAs/Assets Tier 1 Leverage 8.8% 0.27% FORBES S&P GLOBAL MI Institutional Investor LTM NCOs/ Total RBC

#1 Best-Performing of the 50 One of the “Most Honored Top 15 “Best Banks in Avg. Loans 12.6% Largest Public U.S. Banks, America” list 2016 - 2021 Companies in America,” 2021 2020 0.07% Note: Financial data as of March 31,

2021 1)Market data as of May 28, 2021 6 2)Nonperforming assets includes nonaccrual loans and repossessed assets

Highlights Historical Financial Trends (10 years) Net Income ($ million)

• Consistently profitable organic growth Total Assets • Organic growth comes with less $36.5 $507 $499 operational and execution risk $436 $26.8 • Targeted opportunistic M&A $325 $23.1 $20.3 • Tuck-in acquisitions where

appropriate $260 $17.2 to supplement income diversity and $14.3 $194 reduce risk $148 $10.6 $9.3 $115 $7.6 $6.8 • 2 whole bank acquisitions and 3 $73 $31 business line acquisitions in past 10 years 2011 2012 2013 2014 2015 2016 2017 2018 2019

2020 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 • Prudent capital management Total Risk Based Capital Ratio Deposits • Efficient capital stack helps produce 1 industry leading returns $31.9 13.2% 13.3% 13.2% 12.8% 12.6% •

Cultural focus on credit 12.6% 12.5% 12.4% 12.2% $22.8 11.7% • Consistent industry leading returns, efficiency $19.2 $17.0 ratio, net interest margin, and core non- $14.5 1 $12.0 interest-bearing deposits $8.9 $7.8 $6.5 $5.7 2011 2012 2013

2014 2015 2016 2017 2018 2019 2020 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Dollars in billions, unless otherw ise indicated 1) Peers consist of major exchange traded banks w ith total assets betw een $15B and $150B as of December 31, 2020,

excluding target banks of pending acquisitions; S&P Global Market Intelligence 7Highlights Historical Financial Trends (10 years) Net Income ($ million) • Consistently profitable organic growth Total Assets • Organic growth comes

with less $36.5 $507 $499 operational and execution risk $436 $26.8 • Targeted opportunistic M&A $325 $23.1 $20.3 • Tuck-in acquisitions where appropriate $260 $17.2 to supplement income diversity and $14.3 $194 reduce risk $148

$10.6 $9.3 $115 $7.6 $6.8 • 2 whole bank acquisitions and 3 $73 $31 business line acquisitions in past 10 years 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 • Prudent capital

management Total Risk Based Capital Ratio Deposits • Efficient capital stack helps produce 1 industry leading returns $31.9 13.2% 13.3% 13.2% 12.8% 12.6% • Cultural focus on credit 12.6% 12.5% 12.4% 12.2% $22.8 11.7% • Consistent

industry leading returns, efficiency $19.2 $17.0 ratio, net interest margin, and core non- $14.5 1 $12.0 interest-bearing deposits $8.9 $7.8 $6.5 $5.7 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2011 2012 2013 2014 2015 2016 2017 2018 2019

2020 Dollars in billions, unless otherw ise indicated 1) Peers consist of major exchange traded banks w ith total assets betw een $15B and $150B as of December 31, 2020, excluding target banks of pending acquisitions; S&P Global Market

Intelligence 7

Q1 2021 Highlights Net Interest Drivers Spot Rate Spot Rate Total

Investments and Yield Loans and Yield • Loan yields declined 8bps following mix 2.47% 4.46% shift into residential loans and general 3.02% 2.98% 2.79% reduction in loan yields, partially offset by 2.61% 5.27% 2.37% 4.82% 4.59% 4.67% 4.47%

increased PPP yields $7.9 $28.7 • Yield on PPP loans of 4.19% $27.1 $26.0 $25.0 $23.2 (3.67% in Q4) $5.5 $4.7 $4.4 $4.2 • QTD average balances for loans ($26.7bn) and investments ($6.5bn) lower than quarter-end levels Q1-20 Q2-20 Q3-20

Q4-20 Q1-21 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 • Cost of interest-bearing deposits decreased 3bps due to repricing efforts in a lower rate environment, driving total cost Spot Rate Spot Rate Interest Bearing Deposits and Cost Deposits, Borrowings

& Cost of Liability Funding 0.21% 0.20% of funds down 3bps to 0.19% 0.64% 0.30% 0.28% • CD rates continue to decline with a 0.22% 0.19% 0.90% 0.22% 0.40% 0.31% 19bps decrease for the quarter 0.25% $17.5 • Spot rate for cost of

interest-bearing $13.4 $13.0 deposits of 21bps (11bps, including $20.9 $12.2 $9.9 $18.5 non-interest DDA) mainly driven by $15.8 $20.9 the roll-off of higher cost CDs $15.3 $18.5 $14.9 $14.9 $15.3 $15.8 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q1-20 Q2-20

Q3-20 Q4-20 Q1-21 Non-Interest Bearing Deposits Total Borrowings Dollars in billions, unless otherw ise indicated 8Q1 2021 Highlights Net Interest Drivers Spot Rate Spot Rate Total Investments and Yield Loans and Yield • Loan yields declined

8bps following mix 2.47% 4.46% shift into residential loans and general 3.02% 2.98% 2.79% reduction in loan yields, partially offset by 2.61% 5.27% 2.37% 4.82% 4.59% 4.67% 4.47% increased PPP yields $7.9 $28.7 • Yield on PPP loans of 4.19%

$27.1 $26.0 $25.0 $23.2 (3.67% in Q4) $5.5 $4.7 $4.4 $4.2 • QTD average balances for loans ($26.7bn) and investments ($6.5bn) lower than quarter-end levels Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 • Cost of

interest-bearing deposits decreased 3bps due to repricing efforts in a lower rate environment, driving total cost Spot Rate Spot Rate Interest Bearing Deposits and Cost Deposits, Borrowings & Cost of Liability Funding 0.21% 0.20% of funds down

3bps to 0.19% 0.64% 0.30% 0.28% • CD rates continue to decline with a 0.22% 0.19% 0.90% 0.22% 0.40% 0.31% 19bps decrease for the quarter 0.25% $17.5 • Spot rate for cost of interest-bearing $13.4 $13.0 deposits of 21bps (11bps, including

$20.9 $12.2 $9.9 $18.5 non-interest DDA) mainly driven by $15.8 $20.9 the roll-off of higher cost CDs $15.3 $18.5 $14.9 $14.9 $15.3 $15.8 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Non-Interest Bearing Deposits Total Borrowings

Dollars in billions, unless otherw ise indicated 8

Q1 2021 Highlights Profitability Highlights¹ • Top decile NIM,

efficiency ratio, and ROAA PPNR¹, Net Income & ROA Net Interest Income and NIM 2 among peers on an LTM basis $317.3 $314.8 2.69% $298.4 • PPNR decreased $4.4 million from the 2.37% 2.24% $284.7 2.22% prior quarter, but increased $48.4

million or 2.03% $269.0 31.5% from the same period last year 2.22% 1.93% 4.22% 4.19% 1.22% 3.79% 3.84% 1.22% • NIM decline mainly driven by excess 1.66% 4.22% 4.12% 3.37% 3.80% 3.71% liquidity and mix of interest earning assets 3.29% $206.4

$202.0 $204.9 $193.6 $192.5 • Higher efficiency ratio¹ was driven by the $181.2 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 modest decline in non-interest income, a Net Interest Income NIM NIM ex. PPP $153.6 marginal increase in expenses, mainly $135.8

attributable to deposit costs, which were Non-Interest Expenses and Efficiency Ratio partially offset by higher net interest 42.9% $93.3 39.7% income 38.2% 39.1% $83.9 35.1% $135.0 $132.2 • Low efficiency ratio leaves room for $120.5 $124.1

$114.8 investment in risk management and technology Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 PPNR Net Income PPNR ROA ROA Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Non-Interest Expenses Efficiency Ratio Dollars in millions 1)Refer to slide 2 for further discussion of

Non-GAAP financial measures. 2)Peers consist of major exchange traded banks w ith total assets betw een $15B and $150B as of December 31, 2020, 9 excluding target banks of pending acquisitions; S&P Global Market IntelligenceQ1 2021 Highlights

Profitability Highlights¹ • Top decile NIM, efficiency ratio, and ROAA PPNR¹, Net Income & ROA Net Interest Income and NIM 2 among peers on an LTM basis $317.3 $314.8 2.69% $298.4 • PPNR decreased $4.4 million from the

2.37% 2.24% $284.7 2.22% prior quarter, but increased $48.4 million or 2.03% $269.0 31.5% from the same period last year 2.22% 1.93% 4.22% 4.19% 1.22% 3.79% 3.84% 1.22% • NIM decline mainly driven by excess 1.66% 4.22% 4.12% 3.37% 3.80% 3.71%

liquidity and mix of interest earning assets 3.29% $206.4 $202.0 $204.9 $193.6 $192.5 • Higher efficiency ratio¹ was driven by the $181.2 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 modest decline in non-interest income, a Net Interest Income NIM NIM

ex. PPP $153.6 marginal increase in expenses, mainly $135.8 attributable to deposit costs, which were Non-Interest Expenses and Efficiency Ratio partially offset by higher net interest 42.9% $93.3 39.7% income 38.2% 39.1% $83.9 35.1% $135.0 $132.2

• Low efficiency ratio leaves room for $120.5 $124.1 $114.8 investment in risk management and technology Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 PPNR Net Income PPNR ROA ROA Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Non-Interest Expenses Efficiency Ratio Dollars in

millions 1)Refer to slide 2 for further discussion of Non-GAAP financial measures. 2)Peers consist of major exchange traded banks w ith total assets betw een $15B and $150B as of December 31, 2020, 9 excluding target banks of pending acquisitions;

S&P Global Market Intelligence

Highlights Five Quarter Loan Growth and Composition • Diverse mix of

regionally-focused commercial banking divisions & nationally- $5.5 Billion Year-Over-Year Growth oriented specialized businesses • Deep segment expertise fuels specialized Total Loans $23.1 $25.0 $26.0 $27.1 $28.7 banking services for

attractive niche Qtr. Change +$2.0 +$1.9 +$1.0 +$1.0 +$1.7 markets across the country $3.1 10.9% • National banking platform of specialized $2.5 $2.4 financial services support industry and $2.8 9.6% $2.5 $2.4 nationwide geographic

diversification with $2.3 9.9% $2.3 $2.2 centralized, sophisticated management Commercial & $5.7 $2.1 8.9% 19.8% $5.7 Industrial $5.4 $5.3 • Segment-focused model leads to superior 22.8% $5.3 $2.0 CRE, Owner 7.2% $2.2 client value, strong

returns and effective $2.2 Occupied $2.3 company risk management 9.9% $2.3 CRE, Non-Owner Occupied Construction & 52.5% $15.1 $14.3 $13.7 Land $12.8 $11.2 48.5% Residential & Consumer 1 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Dollars in billions,

unless otherw ise indicated 1)Includes Round 1 and Round 2 PPP loans of $1.5 billion as of March 31, 2021. During Q1-21: 10 • PPP1 payoffs of $479 million and • PPP2 originations of $560 millionHighlights Five Quarter Loan Growth and

Composition • Diverse mix of regionally-focused commercial banking divisions & nationally- $5.5 Billion Year-Over-Year Growth oriented specialized businesses • Deep segment expertise fuels specialized Total Loans $23.1 $25.0 $26.0

$27.1 $28.7 banking services for attractive niche Qtr. Change +$2.0 +$1.9 +$1.0 +$1.0 +$1.7 markets across the country $3.1 10.9% • National banking platform of specialized $2.5 $2.4 financial services support industry and $2.8 9.6% $2.5 $2.4

nationwide geographic diversification with $2.3 9.9% $2.3 $2.2 centralized, sophisticated management Commercial & $5.7 $2.1 8.9% 19.8% $5.7 Industrial $5.4 $5.3 • Segment-focused model leads to superior 22.8% $5.3 $2.0 CRE, Owner 7.2% $2.2

client value, strong returns and effective $2.2 Occupied $2.3 company risk management 9.9% $2.3 CRE, Non-Owner Occupied Construction & 52.5% $15.1 $14.3 $13.7 Land $12.8 $11.2 48.5% Residential & Consumer 1 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21

Dollars in billions, unless otherw ise indicated 1)Includes Round 1 and Round 2 PPP loans of $1.5 billion as of March 31, 2021. During Q1-21: 10 • PPP1 payoffs of $479 million and • PPP2 originations of $560 million

Highlights Loan Composition by Classification & Borrower Type •

Loan portfolio has maintained low losses Classification Borrower Type throughout pandemic • Trailing four quarters net charge-offs Residential & Consumer 10.9% were $19.0 million, or 7 bps Construction & Other Land • Over 40% of

portfolio in essentially no-to- C&D Warehouse 9.6% 0.5% 9.6% low-loss categories; Mortgage Warehouse, Lending 17.1% 1-4 Family Residential, Capital Call Residential C&I CRE, Non- 52.5% 10.6% Ow ner lending, Public Finance, Resort Finance

Occupied and HOA 19.8% Municipal & Nonprofit CRE, Ow ner Occupied 5.8% • 71% of CRE & CLD are in branch footprint Hotel 7.2% Franchise Finance Tech & 7.1% • 16.3% of loans are to borrowers in Innovation Loan Distribution by

Property Location 8.8% industries that are generally considered to be the most impacted by the COVID-19 California 39.5% CRE, Non- Owner pandemic. No deferrals in these categories Arizona 12.3% Occupied Nevada 9.5% • 7.9% Hotel 12.6% CRE, New

York 4.6% Other C&I Owner • 4.0% Investor Dependent 21.5% Florida 3.8% Occupied • 2.4% Retail 6.3% Texas 3.7% Pennsylvania 2.3% • 2.0% Gaming Washington 1.9% Other 22.3% • A majority of the Company’s assets are

floating rate loans, subject to caps or floors 11Highlights Loan Composition by Classification & Borrower Type • Loan portfolio has maintained low losses Classification Borrower Type throughout pandemic • Trailing four quarters net

charge-offs Residential & Consumer 10.9% were $19.0 million, or 7 bps Construction & Other Land • Over 40% of portfolio in essentially no-to- C&D Warehouse 9.6% 0.5% 9.6% low-loss categories; Mortgage Warehouse, Lending 17.1% 1-4

Family Residential, Capital Call Residential C&I CRE, Non- 52.5% 10.6% Ow ner lending, Public Finance, Resort Finance Occupied and HOA 19.8% Municipal & Nonprofit CRE, Ow ner Occupied 5.8% • 71% of CRE & CLD are in branch footprint

Hotel 7.2% Franchise Finance Tech & 7.1% • 16.3% of loans are to borrowers in Innovation Loan Distribution by Property Location 8.8% industries that are generally considered to be the most impacted by the COVID-19 California 39.5% CRE,

Non- Owner pandemic. No deferrals in these categories Arizona 12.3% Occupied Nevada 9.5% • 7.9% Hotel 12.6% CRE, New York 4.6% Other C&I Owner • 4.0% Investor Dependent 21.5% Florida 3.8% Occupied • 2.4% Retail 6.3% Texas 3.7%

Pennsylvania 2.3% • 2.0% Gaming Washington 1.9% Other 22.3% • A majority of the Company’s assets are floating rate loans, subject to caps or floors 11

Highlights Net Interest Income and NIM Selected Portfolios Hotel Franchise

Finance ($2.3bn) • No losses were recognized within hotel Statistics • Strong and sophisticated sponsor backing provides ongoing support franchise finance since the beginning of the • Financial flexibility is maximized through deep

industry expertise, strong • Loan ACL / Loans: 2.26% pandemic operating partners, and conservative underwriting structure • All hotel loans are paying as agreed • 85% of the portfolio is with the top three Franchisors: Marriott,

Hilton & • Classified / Loans: 3.69% IHG (only 1 Flag represents more than 10% of Portfolio) • 52% of Portfolio located in Top 25 MSAs (68.2% in Top 50 MSAs) Tech & Innovation: Investor Dependent ($1.1bn) Statistics •

Significant sponsor support continues • Primarily focused on established growth companies with successful products and strong investor support, which provides greater flexibility • Tech & Innovation in total accounted for •

Loan ACL / Loans: 1.89% • Bridge Bank (acquired in Jun-15) has a long-standing, successful track-record approximately $760 million of deposit growth in in national technology lending dated back to 2001 • Classified / Loans: 2.83% Q1 2021

• Holistic banking relationship (TM, WC / AR lines, etc.) provides line-of-sight • Since 2007, total warrant income >2x into business operations, performance against plan, and financial health cumulative NCOs CRE: Retail ($698mm)

Statistics • Primarily focus on local services with limited merchandise strip retail exposure • Throughout 2020, WAL’s portfolio modestly • Loan ACL / Loans: 1.16% • National averages of rent collections for CRE Retail

shopping center exceeded the national averages on rent tenants have increased from ~50% in May 2020 to ~90% in March 2021 collections • Classified / Loans: 1.24% • No destination mall exposure 12Highlights Net Interest Income and NIM

Selected Portfolios Hotel Franchise Finance ($2.3bn) • No losses were recognized within hotel Statistics • Strong and sophisticated sponsor backing provides ongoing support franchise finance since the beginning of the • Financial

flexibility is maximized through deep industry expertise, strong • Loan ACL / Loans: 2.26% pandemic operating partners, and conservative underwriting structure • All hotel loans are paying as agreed • 85% of the portfolio is with

the top three Franchisors: Marriott, Hilton & • Classified / Loans: 3.69% IHG (only 1 Flag represents more than 10% of Portfolio) • 52% of Portfolio located in Top 25 MSAs (68.2% in Top 50 MSAs) Tech & Innovation: Investor

Dependent ($1.1bn) Statistics • Significant sponsor support continues • Primarily focused on established growth companies with successful products and strong investor support, which provides greater flexibility • Tech &

Innovation in total accounted for • Loan ACL / Loans: 1.89% • Bridge Bank (acquired in Jun-15) has a long-standing, successful track-record approximately $760 million of deposit growth in in national technology lending dated back to 2001

• Classified / Loans: 2.83% Q1 2021 • Holistic banking relationship (TM, WC / AR lines, etc.) provides line-of-sight • Since 2007, total warrant income >2x into business operations, performance against plan, and financial health

cumulative NCOs CRE: Retail ($698mm) Statistics • Primarily focus on local services with limited merchandise strip retail exposure • Throughout 2020, WAL’s portfolio modestly • Loan ACL / Loans: 1.16% • National

averages of rent collections for CRE Retail shopping center exceeded the national averages on rent tenants have increased from ~50% in May 2020 to ~90% in March 2021 collections • Classified / Loans: 1.24% • No destination mall exposure

12

Q1 2021 Highlights Asset Quality Classified Assets Special Mention Loans

• At quarter end, Total Deferrals were $68.5MM (24bps of Total Loans); nearly all $326 low LTV residential forbearances $298 1.83% $281 1.67% 1.65% 1.58% $247 $224 $171 $149 • Total Classified Assets of $281 million $477 $474 $163 $451

(65bps to Total Assets) increased $57 $396 $150 $107 0.45% million in Q1 • Classified Assets rose due to $140 $146 $115 $114 $86 remaining COVID impact to travel, $104 $4 $9 $11 $9 $2 leisure and entertainment sectors Q1-20 Q2-20 Q3-20 Q4-20

Q1-21 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 • Borrowers remain stable, liquid and OREO Non-Performing Classified Accruing Loans Special Mention Loans SM to Funded supported 1 Loans Loans • Non-Performing Loans + OREO of $118 million (27bps to

Total Assets) Asset Quality Ratios an increase of $1 million in Q1 0.98% 0.94% 0.85% 0.65% 0.61% • Over last 5+ years, less than 1% of Special Mention loans have migrated to lossh 0.47% 0.47% 0.33% 0.32% 0.27% Q1-20 Q2-20 Q3-20 Q4-20 Q1-21

Classified Assets to Total Assets Non-Performing Loans + OREO to Total Assets Dollars in millions 1)Includes HFS Loans. 13Q1 2021 Highlights Asset Quality Classified Assets Special Mention Loans • At quarter end, Total Deferrals were $68.5MM

(24bps of Total Loans); nearly all $326 low LTV residential forbearances $298 1.83% $281 1.67% 1.65% 1.58% $247 $224 $171 $149 • Total Classified Assets of $281 million $477 $474 $163 $451 (65bps to Total Assets) increased $57 $396 $150 $107

0.45% million in Q1 • Classified Assets rose due to $140 $146 $115 $114 $86 remaining COVID impact to travel, $104 $4 $9 $11 $9 $2 leisure and entertainment sectors Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 • Borrowers

remain stable, liquid and OREO Non-Performing Classified Accruing Loans Special Mention Loans SM to Funded supported 1 Loans Loans • Non-Performing Loans + OREO of $118 million (27bps to Total Assets) Asset Quality Ratios an increase of $1

million in Q1 0.98% 0.94% 0.85% 0.65% 0.61% • Over last 5+ years, less than 1% of Special Mention loans have migrated to lossh 0.47% 0.47% 0.33% 0.32% 0.27% Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Classified Assets to Total Assets Non-Performing Loans +

OREO to Total Assets Dollars in millions 1)Includes HFS Loans. 13

Q1 2021 Highlights Credit Losses and ACL Ratios Allowance for Credit

Losses Gross Charge-offs and Recoveries • Provision expense release of $32.4 million, driven by improved macroeconomic factors $6 Gross Charge Offs $7 $8.8 and loan growth in lower loss segments $44 $36 Recoveries $7 $37 $9 2 $3 $33 $5.7

• Total Loan ACL / Funded Loans $30 $5.7 decreased 20bps to 0.97% in Q1 as a result of provision expense release $311 $311 $279 $2.1 $247 $235 • Excluding PPP at 1.03% $0.1 • Q4-19 at 0.84% (prior to the ($0.2) adoption of CECL)

($0.7) ($0.6) Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 ($1.8) 1 Allowance for Loan & Lease Losses Unfunded Loan Commits. • Net Charge-Offs of $1.4 million, 2bps, ($3.3) HTM Securities compared to $3.9 million, 6bps, in Q4-20 Q1-20 Q2-20 Q3-20 Q4-20

Q1-21 • Estimated remaining average maturity of Loan ACL Adequacy Ratios loan portfolio is 2.5 years 142% 2.50% 120% 112% 112% 101% 1.37% 1.39% 1.50% 1.14% 1.17% 0.97% 0.50% Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 2 Total Loan ACL /Non-Performing Loans

+ Classified Loans Total Loan ACL/Funded Loans Dollars in millions 1)Included as a component of other liabilities on the balance sheet. 2)Total Loan ACL includes allow ance for unfunded commitments. 14Q1 2021 Highlights Credit Losses and ACL Ratios

Allowance for Credit Losses Gross Charge-offs and Recoveries • Provision expense release of $32.4 million, driven by improved macroeconomic factors $6 Gross Charge Offs $7 $8.8 and loan growth in lower loss segments $44 $36 Recoveries $7 $37

$9 2 $3 $33 $5.7 • Total Loan ACL / Funded Loans $30 $5.7 decreased 20bps to 0.97% in Q1 as a result of provision expense release $311 $311 $279 $2.1 $247 $235 • Excluding PPP at 1.03% $0.1 • Q4-19 at 0.84% (prior to the ($0.2)

adoption of CECL) ($0.7) ($0.6) Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 ($1.8) 1 Allowance for Loan & Lease Losses Unfunded Loan Commits. • Net Charge-Offs of $1.4 million, 2bps, ($3.3) HTM Securities compared to $3.9 million, 6bps, in Q4-20 Q1-20

Q2-20 Q3-20 Q4-20 Q1-21 • Estimated remaining average maturity of Loan ACL Adequacy Ratios loan portfolio is 2.5 years 142% 2.50% 120% 112% 112% 101% 1.37% 1.39% 1.50% 1.14% 1.17% 0.97% 0.50% Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 2 Total Loan ACL

/Non-Performing Loans + Classified Loans Total Loan ACL/Funded Loans Dollars in millions 1)Included as a component of other liabilities on the balance sheet. 2)Total Loan ACL includes allow ance for unfunded commitments. 14

Highlights Five Quarter Deposit Growth and Composition

Quarter-over-quarter deposit growth of $6.5 billion driven by (in millions): $13.6 Billion Year-Over-Year Growth Non-Interest-Bearing DDA $4,080 Total Deposits $24.8 $27.5 $28.8 $31.9 $38.4 Savings and MMDA 2,863 Qtr. Change +$2.0 +$2.7 +$1.3 +$3.1

+$6.5 CDs 23 4.4% Offset by decrease in: $1.7 Interest-Bearing DDA (503) $1.7 Total $6,463 $15.3 39.8% $1.7 $2.0 $12.4 $2.4 9.6% $10.6 Non-Interest Year-over-year deposit growth of $13.6 $9.8 Bearing DDA $3.9 10.1% billion driven by (in millions):

$9.0 36.2% Interest Bearing $4.4 DDA $3.5 Non-Interest Bearing DDA $7,656 $3.5 $3.5 Savings and 14.4% Savings and MMDA 6,298 MMDA 45.7% $17.5 Interest-Bearing DDA 315 $13.5 $13.0 CDs $12.2 39.8% $9.9 Offset by decrease in: CDs (706) Q1-20 Q2-20

Q3-20 Q4-20 Q1-21 Total $13,563 Dollars in billions, unless otherw ise indicated 15Highlights Five Quarter Deposit Growth and Composition Quarter-over-quarter deposit growth of $6.5 billion driven by (in millions): $13.6 Billion Year-Over-Year

Growth Non-Interest-Bearing DDA $4,080 Total Deposits $24.8 $27.5 $28.8 $31.9 $38.4 Savings and MMDA 2,863 Qtr. Change +$2.0 +$2.7 +$1.3 +$3.1 +$6.5 CDs 23 4.4% Offset by decrease in: $1.7 Interest-Bearing DDA (503) $1.7 Total $6,463 $15.3 39.8%

$1.7 $2.0 $12.4 $2.4 9.6% $10.6 Non-Interest Year-over-year deposit growth of $13.6 $9.8 Bearing DDA $3.9 10.1% billion driven by (in millions): $9.0 36.2% Interest Bearing $4.4 DDA $3.5 Non-Interest Bearing DDA $7,656 $3.5 $3.5 Savings and 14.4%

Savings and MMDA 6,298 MMDA 45.7% $17.5 Interest-Bearing DDA 315 $13.5 $13.0 CDs $12.2 39.8% $9.9 Offset by decrease in: CDs (706) Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Total $13,563 Dollars in billions, unless otherw ise indicated 15

Highlights Interest Rate Profile Parallel Shift Rate Scenario Interest

Rate Ramp Scenario • Asset sensitive balance sheet poised for net interest income expansion in rising rate +9.2% +17.1% environment Net Interest Income Net Interest Income • Conservative ALCO approach favors prudent management over

interest rate +3.9% “bets” +6.1% • $13.4Bn, or 77%, of variable rate loans have floors 0.0% 0.0% • 97% of variable rate loans with floors (0.9%) (1.6%) are at floors Down 100 Base Up 100 Up 200 Down 100 Base Up 100 Up 200

• Fixed rate loans are 34% of total loans Economic Value of Equity • Variable rate loans at floors, when combined with fixed rate and long-term +19.8% Net Present Value adjustable rate loans, totals $24.1Bn +14.7% +8.8% • 84% of

loan portfolio is acting as +4.3% fixed rate 0.0% • AmeriHome acquisition provides (7.3%) complementary income profile during flat to downward rate environments Down 100 Base Up 100 Up 200 Up 300 Up 400 Dollars in millions 16Highlights

Interest Rate Profile Parallel Shift Rate Scenario Interest Rate Ramp Scenario • Asset sensitive balance sheet poised for net interest income expansion in rising rate +9.2% +17.1% environment Net Interest Income Net Interest Income •

Conservative ALCO approach favors prudent management over interest rate +3.9% “bets” +6.1% • $13.4Bn, or 77%, of variable rate loans have floors 0.0% 0.0% • 97% of variable rate loans with floors (0.9%) (1.6%) are at floors

Down 100 Base Up 100 Up 200 Down 100 Base Up 100 Up 200 • Fixed rate loans are 34% of total loans Economic Value of Equity • Variable rate loans at floors, when combined with fixed rate and long-term +19.8% Net Present Value adjustable

rate loans, totals $24.1Bn +14.7% +8.8% • 84% of loan portfolio is acting as +4.3% fixed rate 0.0% • AmeriHome acquisition provides (7.3%) complementary income profile during flat to downward rate environments Down 100 Base Up 100 Up 200

Up 300 Up 400 Dollars in millions 16

Highlights Diversified Investment Portfolio • >80% of the

portfolio is investment grade Investment Type Investment Rating • Of that >50% is AAA/AA+ or better BB+ and below Other AFS CRA Pref. stock 1% • ~89% of the liquid portfolio is investment 1% 1% 2% BBB+ grade Treasuries to BBB- Unrated

0% 4% • Of that >55% is AAA/AA+ or better 10% HTM AAA 9% 25% Tax-exempt CLO 17% Comm'l MBS A+ • Low risk securities portfolio of ~$8 billion 12% 1% to A- with majority of balance made up of MBS 13% Corp. debt • 85% of securities

portfolio is rated 4% A- or better AA+ Resi. MBS to AA- AAA/ Priv. label 29% 16% AA+ • CLO portfolio A rated or better resi. MBS 31% 24% • Average rating of AA 17Highlights Diversified Investment Portfolio • >80% of the

portfolio is investment grade Investment Type Investment Rating • Of that >50% is AAA/AA+ or better BB+ and below Other AFS CRA Pref. stock 1% • ~89% of the liquid portfolio is investment 1% 1% 2% BBB+ grade Treasuries to BBB- Unrated

0% 4% • Of that >55% is AAA/AA+ or better 10% HTM AAA 9% 25% Tax-exempt CLO 17% Comm'l MBS A+ • Low risk securities portfolio of ~$8 billion 12% 1% to A- with majority of balance made up of MBS 13% Corp. debt • 85% of securities

portfolio is rated 4% A- or better AA+ Resi. MBS to AA- AAA/ Priv. label 29% 16% AA+ • CLO portfolio A rated or better resi. MBS 31% 24% • Average rating of AA 17

Business Overview AmeriHome Mortgage Company Acquisition • AmeriHome

is a leading national multi- On April 7, 2021, WAL completed the acquisition of Aris Mortgage Holding Company, LLC, the parent channel mortgage purchaser and servicer company for AmeriHome Mortgage Company, LLC for total consideration of $1.2

billion in cash • 3rd largest correspondent mortgage acquirer with ~6% market share Strategic Rationale • Founded in 2013, licensed in 49 states • Leading scale position in complementary national platform • HQ in Thousand

Oaks, CA with locations • 3rd largest correspondent mortgage producer delivers scalability, flexibility and consistent profitability in Dallas and Irvine • Purpose-built proprietary platform with tech-enabled, scalable, low-cost

operating model • Geographically diversified B2B network and • Revenue diversification across economic cycles • Mortgage business provides natural macro offset to asset sensitivity to generate consistent growth MSR portfolio across

market cycles • Highly seasoned founder-led management • Diversifies revenue mix and commercial-focused portfolio team with ~27 years of average experience • Strong cultural fit • WAL client for 4+ years with strong

historical ties at the C-suite level • Chief Executive Officer: Jim Furash • All 11 founders still with the company (29 years of experience) • Chief Investment Officer: Josh Adler Financial Rationale Business Diversification (25

years of experience) 2022E Op. Rev.² Rev Mix • EPS accretion of over 30%¹ • Growing Consumer direct channel protects NII Fee Income WAL Commercial 5% MSR values through recapture and provides WAL Cons. Related • Projected

incremental net income contribution of $159M and 31% AmeriHome optionality for lead generation $234M in 2021 and 2022, respectively, drives capital accumulation • Increases fee income ratio from 5% to >30% 99% 95% • 724 approved

correspondent sellers provide 29% 69% 53% access to $635bn of LTM “looks,” • Anticipated TBVPS earnback within one year 18% (representing ~19% of total market) 1% • Significant funding synergies WAL AMH Pro Forma 1)Excludes

merger costs, build out costs, and other one-time transaction related expenses 2)WAL Commercial and Consumer Related operating revenue split excluding AMH impact (75% / 25%) based on gross 18 loans breakdow n for both businesses as of December 31,

2020, applied to 2022E consensus operating revenue as of February 2021Business Overview AmeriHome Mortgage Company Acquisition • AmeriHome is a leading national multi- On April 7, 2021, WAL completed the acquisition of Aris Mortgage Holding

Company, LLC, the parent channel mortgage purchaser and servicer company for AmeriHome Mortgage Company, LLC for total consideration of $1.2 billion in cash • 3rd largest correspondent mortgage acquirer with ~6% market share Strategic

Rationale • Founded in 2013, licensed in 49 states • Leading scale position in complementary national platform • HQ in Thousand Oaks, CA with locations • 3rd largest correspondent mortgage producer delivers scalability,

flexibility and consistent profitability in Dallas and Irvine • Purpose-built proprietary platform with tech-enabled, scalable, low-cost operating model • Geographically diversified B2B network and • Revenue diversification across

economic cycles • Mortgage business provides natural macro offset to asset sensitivity to generate consistent growth MSR portfolio across market cycles • Highly seasoned founder-led management • Diversifies revenue mix and

commercial-focused portfolio team with ~27 years of average experience • Strong cultural fit • WAL client for 4+ years with strong historical ties at the C-suite level • Chief Executive Officer: Jim Furash • All 11 founders

still with the company (29 years of experience) • Chief Investment Officer: Josh Adler Financial Rationale Business Diversification (25 years of experience) 2022E Op. Rev.² Rev Mix • EPS accretion of over 30%¹ • Growing

Consumer direct channel protects NII Fee Income WAL Commercial 5% MSR values through recapture and provides WAL Cons. Related • Projected incremental net income contribution of $159M and 31% AmeriHome optionality for lead generation $234M in

2021 and 2022, respectively, drives capital accumulation • Increases fee income ratio from 5% to >30% 99% 95% • 724 approved correspondent sellers provide 29% 69% 53% access to $635bn of LTM “looks,” • Anticipated

TBVPS earnback within one year 18% (representing ~19% of total market) 1% • Significant funding synergies WAL AMH Pro Forma 1)Excludes merger costs, build out costs, and other one-time transaction related expenses 2)WAL Commercial and Consumer

Related operating revenue split excluding AMH impact (75% / 25%) based on gross 18 loans breakdow n for both businesses as of December 31, 2020, applied to 2022E consensus operating revenue as of February 2021

Q1 2021 Highlights Capital Management • Conservative credit culture

affords Leverage Ratio CET1 Ratio shareholder friendly capital management 10.3% 10.2% 10.0% 10.0% 9.9% 10.2% • Significant profitability and capital retention 9.5% 9.3% 9.2% 8.8% fund organic growth • Recent stock performance enhanced

efficient and opportunistic capital raise • Continued focus on regulatory capital ratios enables continued growth Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Total Risk Based Capital Ratio Tangible Common Equity / Tangible

Assets 13.4% 13.0% 12.6% 12.5% 12.3% 9.4% 8.9% 8.9% 8.6% 7.9% Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 1)Refer to slide 2 for further discussion of Non-GAAP financial measures 19Q1 2021 Highlights Capital Management •

Conservative credit culture affords Leverage Ratio CET1 Ratio shareholder friendly capital management 10.3% 10.2% 10.0% 10.0% 9.9% 10.2% • Significant profitability and capital retention 9.5% 9.3% 9.2% 8.8% fund organic growth • Recent

stock performance enhanced efficient and opportunistic capital raise • Continued focus on regulatory capital ratios enables continued growth Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Total Risk Based Capital Ratio Tangible

Common Equity / Tangible Assets 13.4% 13.0% 12.6% 12.5% 12.3% 9.4% 8.9% 8.9% 8.6% 7.9% Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 1)Refer to slide 2 for further discussion of Non-GAAP financial measures 19

Illustrative Debt Coverage & Double Leverage Double Leverage Ratio

($Millions) As of, Pro Forma Dec-19 Dec-20 Mar-21 Mar-21¹ Bank-Level Equity 3,022 3,414 3,698 4,198 Consolidated Equity 3,017 3,414 3,713 3,713 Double Leverage Ratio 1.00 1.00 1.00 1.13 1,2 Illustrative Pro Forma Interest Coverage ($Millions)

For the Twelve Months Ended, Year-to-Date Dec-18 Dec-19 Dec-20 Mar-21 Deposit Expense 90.5 158.4 70.4 10.8 Interest on Existing Debt 22.3 23.4 23.9 5.9 All Other Interest 4.8 2.8 0.6 0.1 Interest Expense Before New Subordinated Debt (A) 117.6 184.6

94.9 16.8 Incremental Expense from AmeriHome (B) 53.6 61.0 56.2 21.3 New Subordinated Debt Interest (C) 16.3 16.3 16.3 4.1 Total Pro Forma Interest Expense (D = A + B + C) 187.5 261.9 167.4 42.2 Pre-Tax Income (E) 510.3 604.2 622.5 234.4 Pre-Tax

Income from AmeriHome (F) 123.9 187.9 545.0 (6.4) Total Pre-Tax Income (G = E + F) 634.2 792.1 1,167.5 228.0 Net Income Available to Service All Interest (H = A + B + G) 805.4 1,037.7 1,318.6 266.1 Total Pro Forma Interest Expense (D) 187.5 261.9

167.4 42.2 Interest Coverage (I = H / D) 4.3 4.0 7.9 6.3 1)For illustrative purposes, assumes gross proceeds of $500 million from the issuance of subordinated notes at an illustrative coupon rate of 3.25% w ill be contributed to bank subsidiary 20

2)Reflects unadjusted pre-acquisition historical results, w hich is expected to decrease significantly as post-acquisition funding w ill be provided by low -cost depositsIllustrative Debt Coverage & Double Leverage Double Leverage Ratio

($Millions) As of, Pro Forma Dec-19 Dec-20 Mar-21 Mar-21¹ Bank-Level Equity 3,022 3,414 3,698 4,198 Consolidated Equity 3,017 3,414 3,713 3,713 Double Leverage Ratio 1.00 1.00 1.00 1.13 1,2 Illustrative Pro Forma Interest Coverage ($Millions)

For the Twelve Months Ended, Year-to-Date Dec-18 Dec-19 Dec-20 Mar-21 Deposit Expense 90.5 158.4 70.4 10.8 Interest on Existing Debt 22.3 23.4 23.9 5.9 All Other Interest 4.8 2.8 0.6 0.1 Interest Expense Before New Subordinated Debt (A) 117.6 184.6

94.9 16.8 Incremental Expense from AmeriHome (B) 53.6 61.0 56.2 21.3 New Subordinated Debt Interest (C) 16.3 16.3 16.3 4.1 Total Pro Forma Interest Expense (D = A + B + C) 187.5 261.9 167.4 42.2 Pre-Tax Income (E) 510.3 604.2 622.5 234.4 Pre-Tax

Income from AmeriHome (F) 123.9 187.9 545.0 (6.4) Total Pre-Tax Income (G = E + F) 634.2 792.1 1,167.5 228.0 Net Income Available to Service All Interest (H = A + B + G) 805.4 1,037.7 1,318.6 266.1 Total Pro Forma Interest Expense (D) 187.5 261.9

167.4 42.2 Interest Coverage (I = H / D) 4.3 4.0 7.9 6.3 1)For illustrative purposes, assumes gross proceeds of $500 million from the issuance of subordinated notes at an illustrative coupon rate of 3.25% w ill be contributed to bank subsidiary 20

2)Reflects unadjusted pre-acquisition historical results, w hich is expected to decrease significantly as post-acquisition funding w ill be provided by low -cost deposits

Illustrative Pro Forma Capital Impact WAL as Adjusted WAL as Further WAL

Actual for AmeriHome Impact of Sub Debt Adjusted for ($Millions) Acquisition¹ MSR Sales² Offering³ Q1-21 Sub Debt Regulatory Capital Tier 1 CET Capital 3,437 2,505 590 – 3,095 Trust preferred securities 82 82 – – 82

Tier 1 Capital 3,519 2,586 590 – 3,177 Subordinated debt 449 449 – 500 949 Adjusted allowances for credit losses (AACL) 233 233 – – 233 Tier 2 Capital 683 683 – 500 1,183 Total Capital 4,202 3,269 590 500 4,360 Total

Assets for Regulatory Ratios Total Assets for the Leverage Ratio 40,073 46,587 (153) 500 46,934 Total Risk-Weighted Assets 33,326 36,330 (382) – 35,948 Capital Ratios Tier 1 Leverage Ratio 8.8% 5.6% 6.8% Common Equity Tier 1 Capital Ratio

10.3% 6.9% 8.6% Tier 1 Capital Ratio 10.6% 7.1% 8.8% Total Capital Ratio 12.6% 9.0% 12.1% 1)Pro forma for the acquisition of AmeriHome w hich closed on April 7, 2021 2)Includes consideration of $146 million from mortgage servicing sales that have

been completed and $597 million that are subject to a Definitive 21 Agreement; Excludes $135 million w here the Company has entered into a Letter of Intent to sell. All amounts are net of any related transfer costs 3)For illustrative purposes,

assumes $500 million of gross proceeds from the subordinated notes invested in 0% risk-w eighted assetsIllustrative Pro Forma Capital Impact WAL as Adjusted WAL as Further WAL Actual for AmeriHome Impact of Sub Debt Adjusted for ($Millions)

Acquisition¹ MSR Sales² Offering³ Q1-21 Sub Debt Regulatory Capital Tier 1 CET Capital 3,437 2,505 590 – 3,095 Trust preferred securities 82 82 – – 82 Tier 1 Capital 3,519 2,586 590 – 3,177 Subordinated debt

449 449 – 500 949 Adjusted allowances for credit losses (AACL) 233 233 – – 233 Tier 2 Capital 683 683 – 500 1,183 Total Capital 4,202 3,269 590 500 4,360 Total Assets for Regulatory Ratios Total Assets for the Leverage Ratio

40,073 46,587 (153) 500 46,934 Total Risk-Weighted Assets 33,326 36,330 (382) – 35,948 Capital Ratios Tier 1 Leverage Ratio 8.8% 5.6% 6.8% Common Equity Tier 1 Capital Ratio 10.3% 6.9% 8.6% Tier 1 Capital Ratio 10.6% 7.1% 8.8% Total Capital

Ratio 12.6% 9.0% 12.1% 1)Pro forma for the acquisition of AmeriHome w hich closed on April 7, 2021 2)Includes consideration of $146 million from mortgage servicing sales that have been completed and $597 million that are subject to a Definitive 21

Agreement; Excludes $135 million w here the Company has entered into a Letter of Intent to sell. All amounts are net of any related transfer costs 3)For illustrative purposes, assumes $500 million of gross proceeds from the subordinated notes

invested in 0% risk-w eighted assets

Conclusion Seasoned Leadership Team Diversified Business Model –

Sustainable Across Market Cycles Diverse, High Quality Loan Portfolio Conservative Credit Culture – Superior Asset Quality Stable, Low-Cost Deposit Franchise Well Capitalized with Excess Liquidity 22Conclusion Seasoned Leadership Team

Diversified Business Model – Sustainable Across Market Cycles Diverse, High Quality Loan Portfolio Conservative Credit Culture – Superior Asset Quality Stable, Low-Cost Deposit Franchise Well Capitalized with Excess Liquidity

22

AppendixAppendix

Highlights 1st Quarter 2021 | Financial Highlights Earnings &

Profitability Q1-21 Q4-20 Q1-20 $192.5 $193.6 $83.9 Net Income Net Income EPS $317.3 $314.8 $269.0 Net Interest Income 1 Pre Provision Net Revenue $202.0 $206.4 $153.6 $192.5 million $1.90 EPS $1.90 $1.93 $0.83 Net Interest Margin 3.37% 3.84% 4.22%

1 1 1 Efficiency Ratio 39.1% 38.2% 42.9% PPNR Growth ROTCE ROAA 1.93% 2.22% 1.22% Q1: $(4.4) million 24.2% 1 ROTCE 24.2% 25.7% 12.2% 31% YoY Balance Sheet & Capital $28,711 $27,053 $23,166 Total Loans, Gross Total Deposits $38,393 $31,931

$24,831 Loan Growth Deposit Growth CET1 Ratio 10.3% 9.9% 10.0% 1 Q1: $1.7 billion Q1: $6.5 billion TCE Ratio 7.9% 8.6% 9.4% 1 24% YoY 55% YoY Tangible Book Value per Share $33.02 $30.90 $26.73 Asset Quality 2 $(32.4) $(34.2) $51.2 (Recovery of)

Provision for Credit losses Tangible Book NPAs / Net Charge-Offs (Recoveries) $1.4 $3.9 $(3.2) 1 Value PER SHARE Total Net Charge-Offs (Recoveries)/Avg. Loans 0.02% 0.06% (0.06)% $33.02 Total Loan ACL/Funded Loans 0.97% 1.17% 1.14% 0.27% 2 24% YoY

NPAs /Total Assets 0.27% 0.32% 0.33% Dollars in millions, except EPS 1)Refer to slide 2 for further discussion of Non-GAAP financial measures. 2)Nonperforming assets includes nonaccrual loans and repossessed assets. 24Highlights 1st Quarter 2021 |

Financial Highlights Earnings & Profitability Q1-21 Q4-20 Q1-20 $192.5 $193.6 $83.9 Net Income Net Income EPS $317.3 $314.8 $269.0 Net Interest Income 1 Pre Provision Net Revenue $202.0 $206.4 $153.6 $192.5 million $1.90 EPS $1.90 $1.93 $0.83

Net Interest Margin 3.37% 3.84% 4.22% 1 1 1 Efficiency Ratio 39.1% 38.2% 42.9% PPNR Growth ROTCE ROAA 1.93% 2.22% 1.22% Q1: $(4.4) million 24.2% 1 ROTCE 24.2% 25.7% 12.2% 31% YoY Balance Sheet & Capital $28,711 $27,053 $23,166 Total Loans, Gross

Total Deposits $38,393 $31,931 $24,831 Loan Growth Deposit Growth CET1 Ratio 10.3% 9.9% 10.0% 1 Q1: $1.7 billion Q1: $6.5 billion TCE Ratio 7.9% 8.6% 9.4% 1 24% YoY 55% YoY Tangible Book Value per Share $33.02 $30.90 $26.73 Asset Quality 2 $(32.4)

$(34.2) $51.2 (Recovery of) Provision for Credit losses Tangible Book NPAs / Net Charge-Offs (Recoveries) $1.4 $3.9 $(3.2) 1 Value PER SHARE Total Net Charge-Offs (Recoveries)/Avg. Loans 0.02% 0.06% (0.06)% $33.02 Total Loan ACL/Funded Loans 0.97%

1.17% 1.14% 0.27% 2 24% YoY NPAs /Total Assets 0.27% 0.32% 0.33% Dollars in millions, except EPS 1)Refer to slide 2 for further discussion of Non-GAAP financial measures. 2)Nonperforming assets includes nonaccrual loans and repossessed assets.

24

Q1 2021 Highlights Consolidated Balance Sheet Q1-21 Q4-20 Q1-20 Loans

increased $1.7 billion, or 6.1%, Investments & Cash $13,235 $8,177 $4,771 1 over prior quarter and $5.5 billion, or Loans $28,711 1 $27,053 $23,166 23.9%, over prior year Allowance for Loan Losses (247) (279) (235) Deposits increased $6.5

billion, or 2 Other Assets 1,698 1,510 1,456 20.2%, over prior quarter and $13.6 Total Assets $43,397 $36,461 $29,158 billion, or 54.6%, over prior year Shareholders' Equity increased $299 3 2 Deposits $38,393 $31,931 $24,831 million over prior

quarter and increased $713 million over prior year as Net Borrowings $565 $570 $721 Income growth was partially offset by Other Liabilities $726 $547 $606 share repurchases and dividends in Total Liabilities $39,684 $33,048 $26,158 2020 3

Shareholders’ Equity $3,713 $3,413 $3,000 • During Q1-21, WAL completed a common stock offering of 2.3 Total Liabilities and Equity $43,397 $36,461 $29,158 million shares for an aggregate amount of $209 million 1 4 Tangible Book Value

Per Share $33.02 $30.90 $26.73 1 Tangible Book Value/Share increased 4 $2.12, or 6.9%, over prior quarter and $6.29, or 23.5%, over prior year Dollars in millions 1)Refer to slide 2 for further discussion of Non-GAAP financial measures. 25Q1 2021

Highlights Consolidated Balance Sheet Q1-21 Q4-20 Q1-20 Loans increased $1.7 billion, or 6.1%, Investments & Cash $13,235 $8,177 $4,771 1 over prior quarter and $5.5 billion, or Loans $28,711 1 $27,053 $23,166 23.9%, over prior year Allowance

for Loan Losses (247) (279) (235) Deposits increased $6.5 billion, or 2 Other Assets 1,698 1,510 1,456 20.2%, over prior quarter and $13.6 Total Assets $43,397 $36,461 $29,158 billion, or 54.6%, over prior year Shareholders' Equity increased $299 3

2 Deposits $38,393 $31,931 $24,831 million over prior quarter and increased $713 million over prior year as Net Borrowings $565 $570 $721 Income growth was partially offset by Other Liabilities $726 $547 $606 share repurchases and dividends in Total

Liabilities $39,684 $33,048 $26,158 2020 3 Shareholders’ Equity $3,713 $3,413 $3,000 • During Q1-21, WAL completed a common stock offering of 2.3 Total Liabilities and Equity $43,397 $36,461 $29,158 million shares for an aggregate amount

of $209 million 1 4 Tangible Book Value Per Share $33.02 $30.90 $26.73 1 Tangible Book Value/Share increased 4 $2.12, or 6.9%, over prior quarter and $6.29, or 23.5%, over prior year Dollars in millions 1)Refer to slide 2 for further discussion of

Non-GAAP financial measures. 25

Q1 2021 Highlights Quarterly Income Statement Q1-21 Q4-20 Q1-20 Net

Interest Income increased $2.5 million, Interest Income $334.1 $331.6 $307.2 1 primarily as a result of loan growth, PPP Interest Expense (16.8) (16.8) (38.2) loan fee recognition and lower interest $317.3 1 $314.8 $269.0 Net Interest Income costs

Investment Related Income and Gains $6.1 2 $11.1 $(7.5) Investment Related Income and Gains Other 13.6 12.7 12.6 2 consist of warrant income related to tech $19.7 $23.8 $5.1 Non-Interest Income lending of $7.3 million in Q1, offset by FMV $337.0

$338.6 $274.1 Net Revenue losses on equity securities Salaries and Employee Benefits (83.7) (83.1) (72.1) Deposit costs increased as lower rates Deposit Costs (6.3) 3 (4.5) (7.3) 3 were offset by higher average balances Gain (Loss) on OREO 0.3 0.2

1.4 Other (45.3) (44.8) (42.5) 4 Includes $0.4 million of merger expenses, 4 which is expected to increase in Q2 as $ (135.0) $ (132.2) $ (120.5) Non-Interest Expense AmeriHome integration efforts progress 1 $202.0 5 $206.4 $153.6 Pre-Provision Net

Revenue 6 Recovery of (Provision for) Credit Losses 32.4 34.2 (51.2) PPNR decreased $4.4 million, primarily as 5 $234.4 $240.6 $102.4 Pre-Tax Income a result of an increase in expenses and reduced investment income and gains Income Tax (41.9) (47.0)

(18.5) $192.5 $193.6 $83.9 Net Income Recovery of Credit Losses of $32.4 million 6 101.4 100.4 101.7 Diluted Shares as economic forecasts improved relative to st $1.90 $1.93 $0.83 Earnings Per Share December 31 and loan growth continued in segments

with lower loss rates Dollars in millions, except EPS 1)Refer to slide 2 for further discussion of Non-GAAP financial measures. 26Q1 2021 Highlights Quarterly Income Statement Q1-21 Q4-20 Q1-20 Net Interest Income increased $2.5 million, Interest

Income $334.1 $331.6 $307.2 1 primarily as a result of loan growth, PPP Interest Expense (16.8) (16.8) (38.2) loan fee recognition and lower interest $317.3 1 $314.8 $269.0 Net Interest Income costs Investment Related Income and Gains $6.1 2 $11.1

$(7.5) Investment Related Income and Gains Other 13.6 12.7 12.6 2 consist of warrant income related to tech $19.7 $23.8 $5.1 Non-Interest Income lending of $7.3 million in Q1, offset by FMV $337.0 $338.6 $274.1 Net Revenue losses on equity

securities Salaries and Employee Benefits (83.7) (83.1) (72.1) Deposit costs increased as lower rates Deposit Costs (6.3) 3 (4.5) (7.3) 3 were offset by higher average balances Gain (Loss) on OREO 0.3 0.2 1.4 Other (45.3) (44.8) (42.5) 4 Includes

$0.4 million of merger expenses, 4 which is expected to increase in Q2 as $ (135.0) $ (132.2) $ (120.5) Non-Interest Expense AmeriHome integration efforts progress 1 $202.0 5 $206.4 $153.6 Pre-Provision Net Revenue 6 Recovery of (Provision for)

Credit Losses 32.4 34.2 (51.2) PPNR decreased $4.4 million, primarily as 5 $234.4 $240.6 $102.4 Pre-Tax Income a result of an increase in expenses and reduced investment income and gains Income Tax (41.9) (47.0) (18.5) $192.5 $193.6 $83.9 Net Income

Recovery of Credit Losses of $32.4 million 6 101.4 100.4 101.7 Diluted Shares as economic forecasts improved relative to st $1.90 $1.93 $0.83 Earnings Per Share December 31 and loan growth continued in segments with lower loss rates Dollars in

millions, except EPS 1)Refer to slide 2 for further discussion of Non-GAAP financial measures. 26

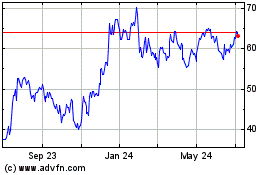

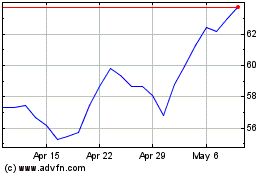

Western Alliance Bancorp... (NYSE:WAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Western Alliance Bancorp... (NYSE:WAL)

Historical Stock Chart

From Apr 2023 to Apr 2024