As filed with the Securities and Exchange Commission on November 13, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

|

|

|

|

|

|

|

|

|

|

|

UNITY SOFTWARE INC.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

27-0334803

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

30 3rd Street

|

|

|

|

San Francisco, California 94103‑3104

|

|

|

|

(Address, including zip code, of principal executive offices)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unity Software Inc. 2019 Stock Plan

|

|

|

|

Unity Software Inc. 2009 Stock Plan

|

|

|

|

(Full title of the plan)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John Riccitiello

|

|

|

|

President and Chief Executive Officer

|

|

|

|

Unity Software Inc.

|

|

|

|

30 3rd Street

|

|

|

|

San Francisco, California 94103‑3104

|

|

|

|

(415) 539‑3162

|

|

|

|

(Name, address and telephone number, including area code, of agent for service)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copies to:

|

|

|

|

|

|

Rachel Proffitt

Jon Avina

Jonie Kondracki

Cooley LLP

101 California Street, 5th Floor

San Francisco, California 94111

(415) 693-2000

|

|

Ruth Ann Keene

Nora Go

Unity Software Inc.

30 3rd Street

San Francisco, CA, 94103

(415) 539-3162

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

Large accelerated filer

|

☐

|

|

Accelerated filer

|

☐

|

|

Non‑accelerated filer

|

☒

|

|

Smaller reporting company

|

☐

|

|

|

|

|

Emerging growth company

|

☒

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

Title of securities

to be registered

|

Amount

to be

registered (1)

|

Proposed

maximum

offering price

per share (2)

|

Proposed

maximum

aggregate

offering price

|

Amount of

registration fee

|

|

Common stock, $0.000005 par value per share (3)

|

791,708

|

$102.10

|

$80,833,387

|

$8,819

|

1.Pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s common stock that become issuable under the stock option awards set forth herein by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without receipt of consideration that increases the number of outstanding shares of the Registrant’s common stock.

2.Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(h) of the Securities Act. The proposed maximum offering price per share and the proposed maximum aggregate offering price are based on the average of the high and low prices of the Registrant’s common stock on November 10, 2020 as reported on the New York Stock Exchange.

3.Represents (i) 1,031 shares of common stock under the Unity Software Inc. 2019 Stock Plan (the “2019 Plan”) and (ii) 790,677 shares of common stock under the Unity Software Inc. 2009 Stock Plan (the “2009 Plan,” together with the 2019 Plan, the “Plans”), in each case issued to certain directors and executive officers of the Registrant upon exercise of stock option awards.

EXPLANATORY NOTE

This registration statement contains a “reoffer prospectus” prepared in accordance with Part I of Form S-3 (in accordance with Instruction C of the General Instructions to Form S-8). This reoffer prospectus may be used for reoffers and resales on a continuous or delayed basis of certain of those shares of common stock (the “Shares”) of Unity Software Inc. (“us”, “we” or the “Registrant”) referred to above that constitute “control securities” within the meaning of the Securities Act, by certain executive officers and directors and a principal stockholder, of the Registrant (the “Selling Stockholders”), each of whom is deemed to be an “affiliate” of the Registrant, as that term is defined in Rule 405 under the Securities Act, for their own accounts. As specified in General Instruction C of Form S-8, the amount of securities to be reoffered or resold under the reoffer prospectus by each Selling Stockholder and any other person with whom he or she is acting in concert for the purpose of selling the Registrant’s securities, may not exceed, during any three-month period, the amount specified in Rule 144(e) under the Securities Act.

REOFFER PROSPECTUS

UNITY SOFTWARE INC.

791,708 Shares of Common Stock

This prospectus relates to 791,708 shares of common stock, par value $0.000005 per share (the “Shares”), of Unity Software Inc., which may be offered from time to time by certain of our current executive officers and directors and a principal stockholder (the “Selling Stockholders”), each of whom is deemed to be our “affiliate”, as that term is defined in Rule 405 under the Securities Act, for their own accounts. We will not receive any of the proceeds from the sale of Shares by the Selling Stockholders made hereunder. The Shares were or will be acquired by the Selling Stockholders pursuant to our employee benefit plans.

The Selling Stockholders may sell the securities described in this prospectus in a number of different ways and at varying prices, including sales in the open market, sales in negotiated transactions and sales by a combination of these methods. The Selling Stockholders may sell any, all or none of the Shares and we do not know when or in what amount the Selling Stockholders may sell their Shares hereunder following the effective date of this registration statement. The price at which any of the Shares may be sold, and the commissions, if any, paid in connection with any such sale, are unknown and may vary from transaction to transaction. The Shares may be sold at the market price of the common stock at the time of a sale, at prices relating to the market price over a period of time, or at prices negotiated with the buyers of shares. The Shares may be sold through underwriters or dealers which the Selling Stockholders may select. If underwriters or dealers are used to sell the Shares, we will name them and describe their compensation in a prospectus supplement. We provide more information about how the Selling Stockholders may sell their Shares in the section titled “Plan of Distribution.” The Selling Stockholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection with the registration and offering that are not borne by the Selling Stockholders will be borne by us.

Our common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “U.” On November 12, 2020, the last reported sale price of our common stock was $101.74 per share.

The amount of securities to be offered or resold under this reoffer prospectus by each Selling Stockholder or other person with whom he or she is acting in concert for the purpose of selling our securities, may not exceed, during any three month period, the amount specified in Rule 144(e) under the Securities Act.

We are an “emerging growth company” as defined under the federal securities laws, and as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and may elect to do so in future filings.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in “Risk Factors” beginning on page 2 of this prospectus.

If any of the Selling Stockholders utilize a broker-dealer in the sale or distribution of the Shares, such broker-dealer may receive commissions in the form of discounts, concessions, or commissions from such Selling Stockholder or commissions from purchasers of the Shares for whom they may act as agent or to whom they may sell as principal.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 13, 2020.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any accompanying prospectus supplement by us or on our behalf. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Shares. Our business, financial condition, results of operations and prospects may have changed since that date.

The Unity design logos, “Unity” and our other registered or common law trademarks, service marks, or trade names appearing in this prospectus are the property of Unity Software Inc. or its affiliates. Other trade names, trademarks, and service marks used in this prospectus are the property of their respective owners.

Unless the context otherwise requires, all references in this prospectus to “we,” “us,” “our,” “our company,” “Unity,” and “Unity Technologies” refer to Unity Software Inc. and its consolidated subsidiaries.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THE COMPANY

|

|

|

|

|

|

|

|

Unity Software Inc.

|

|

|

|

|

|

|

|

Unity is the world’s leading platform for creating and operating interactive, real-time 3D content.

|

|

|

|

|

|

|

|

Our platform provides a comprehensive set of software solutions to create, run and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. As of September 30, 2020, we had approximately 1.5 million monthly active creators in over 190 countries and territories worldwide. The applications developed by these creators were downloaded over three billion times per month in 2019 on over 1.5 billion unique devices.

|

|

|

|

|

|

|

|

Our platform consists of two distinct, but connected and synergistic, sets of solutions: Create Solutions and Operate Solutions. Our Create Solutions are used by content creators—developers, artists, designers, engineers and architects—to create interactive, real-time 2D and 3D content. Content can be created once and deployed to more than 20 platforms, including Windows, Mac, iOS, Android, PlayStation, Xbox, Nintendo Switch, and the leading augmented and virtual reality platforms, among others. Our Operate Solutions offer customers the ability to grow and engage their end-user base, as well as run and monetize their content with the goal of optimizing end-user acquisition and operational costs while increasing the lifetime value of their end-users

|

|

|

|

|

|

|

|

Corporate Information

|

|

|

|

|

|

|

|

Our principal executive offices are located at 30 3rd Street, San Francisco, California 94103, and our telephone number is (415) 539-3162. We are an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (JOBS Act), and therefore we are subject to reduced public company reporting requirements.

|

|

|

|

|

|

|

|

Our website address is www.unity.com. The information on, or that can be accessed through, our website is not part of this prospectus.

|

|

|

|

|

|

RISK FACTORS

An investment in shares of our common stock is highly speculative and involves a high degree of risk. We face a variety of risks that may affect our operations or financial results and many of those risks are driven by factors that we cannot control or predict. Before investing in our common stock, you should carefully consider the risks set forth under the caption “Risk Factors” in our most recent Quarterly Report on Form 10-Q (File No. 001-39497), filed with the Securities and Exchange Commission on November 13, 2020, which are incorporated by reference herein, and subsequent reports filed with the SEC, together with the financial and other information contained or incorporated by reference in this prospectus. If any of these risks actually occurs, our business, prospects, financial condition and results of operations could be materially adversely affected. In that case, the trading price of our common stock would likely decline and you may lose all or a part of your investment. Only those investors who can bear the risk of loss of their entire investment should invest in our common stock.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained or incorporated by reference in this prospectus, including statements regarding our future results of operations or financial condition, business strategy and plans, and objectives of management for future operations are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “toward,” “will,” “would,” or the negative of these words or other similar terms or expressions. These forward-looking statements include, but are not limited to, statements concerning the following:

•our expectations regarding our financial performance, including revenue, cost of revenue, gross profit or gross margin, operating expenses, key metrics, and our ability to achieve or maintain future profitability;

•our ability to effectively manage our growth;

•anticipated trends, growth rates, and challenges in our business and in the markets in which we operate;

•our expectations regarding the demand for real-time 3D content in gaming and other industries and our ability to increase revenue from these industries;

•economic and industry trends;

•our ability to increase sales of our solutions;

•our ability to attract and retain customers;

•our ability to expand our offerings and cross-sell to our existing customers;

•our expectations regarding the plans announced by Apple with respect to access of advertising identifiers and related matters, and the potential impact on our financial performance;

•our ability to maintain and expand our relationships with strategic partners;

•our ability to continue to grow across all major global markets;

•the effects of increased competition in our markets and our ability to successfully compete with companies that are currently in, or may in the future enter, the markets in which we operate;

•our estimated market opportunity;

•our ability to timely and effectively scale and adapt our solutions;

•our ability to continue to innovate and enhance our solutions;

•our ability to develop new products, features and use cases and bring them to market in a timely manner, and whether our customers and prospective customers will adopt these new products, features and use cases;

•our ability to maintain, protect, and enhance our brand and intellectual property;

•our ability to identify and complete acquisitions that complement and expand the functionality of our platform;

•our ability to comply or remain in compliance with laws and regulations that currently apply or become applicable to our business in the United States and globally;

•our reliance on key personnel and our ability to attract, maintain, and retain management and skilled personnel;

•the effects of the COVID-19 pandemic or other public health crises;

•the increased expenses associated with being a public company; and

•the future trading prices of our common stock.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this prospectus or the documents incorporated by reference herein.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this prospectus and the documents incorporated by reference herein primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors described in the section titled “Risk Factors” and elsewhere in this prospectus and the documents incorporated by reference herein. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained or incorporated by reference in this prospectus. The results, events, and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this prospectus. While we believe such information provides a reasonable basis for these statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made or incorporated by reference in this prospectus relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this prospectus to reflect events or circumstances after the date of this prospectus or to reflect new information, actual results, revised expectations, or incorporated by reference or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of the Shares. All proceeds from the sale of the Shares will be for the account of the Selling Stockholders, as described below. See the sections titled “Selling Stockholders” and “Plan of Distribution” described below.

SELLING STOCKHOLDERS

The following table sets forth information regarding beneficial ownership of our common stock as of September 30, 2020, as adjusted to reflect the Shares that may be sold from time to time pursuant to this prospectus, for all Selling Stockholders, consisting of the individuals shown as having shares listed in the column entitled “Shares Being Offered.”

The Shares offered by the Selling Stockholders hereunder represents an aggregate of 791,708 Shares of our common stock acquired or that may be acquired by certain of our current executive officers and directors and a principal stockholder upon the exercise of stock options. We have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares that they beneficially own, subject to community property laws where applicable. In computing the number of shares of our common stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of our common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of September 30, 2020. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person.

We have based percentage ownership of our common stock prior to this offering on 241,082,826 shares of our common stock (including shares of our convertible preferred stock on an as-converted basis) outstanding as of September 30, 2020, unless otherwise noted.

Unless otherwise indicated, the address of each beneficial owner listed below is c/o Unity Software Inc., 30 3rd Street, San Francisco, California 94103.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned Prior

to the Offering

|

|

Shares Being

Offered

|

|

Shares Beneficially Owned After

the Offering (1)

|

|

Selling Stockholder

|

|

Shares

|

|

Percentage

|

|

Shares

|

|

Shares

|

|

Percentage

|

|

John Riccitiello (2)

|

|

6,783,732

|

|

3.3

|

%

|

|

209,999

|

|

6,573,733

|

|

2.7

|

%

|

|

Brett Bibby (3)

|

|

878,000

|

|

*

|

|

131,700

|

|

746,300

|

|

*

|

|

Clive Downie (3)

|

|

1,132,500

|

|

*

|

|

169,874

|

|

962,626

|

|

*

|

|

Ralph Hauwert (3)

|

|

171,436

|

|

*

|

|

25,714

|

|

145,722

|

|

*

|

|

Kimberly Jabal (3)

|

|

312,500

|

|

*

|

|

42,186

|

|

270,314

|

|

*

|

|

Ruth Ann Keene (3)

|

|

280,000

|

|

*

|

|

40,968

|

|

239,032

|

|

*

|

|

Ingrid Lestiyo (4)

|

|

266,667

|

|

*

|

|

23,270

|

|

243,397

|

|

*

|

|

Dave Rhodes (3)

|

|

421,041

|

|

*

|

|

58,468

|

|

362,573

|

|

*

|

|

Joachim Ante (5)

|

|

29,514,500

|

|

12.2

|

%

|

|

63,750

|

|

29,450,750

|

|

12.2

|

%

|

|

Alyssa Henry (3)

|

|

60,833

|

|

*

|

|

7,905

|

|

52,928

|

|

*

|

|

Robynne Sisco (3)

|

|

131,353

|

|

*

|

|

17,874

|

|

113,479

|

|

*

|

|

|

|

|

|

|

|

|

*

|

Represents beneficial ownership of less than 1%.

|

1.Assumes that all of the Shares held by each Selling Stockholder and being offered under this prospectus are sold, and that no Selling Stockholder will acquire additional shares of common stock before the completion of this offering.

2.Consists of (i) 1,400,000 shares subject to options that are exercisable within 60 days of September 30, 2020, which includes all of the shares offered by Mr. Riccitiello and (ii) 5,383,732 shares held of record by Mr. Riccitiello.

3.Represents shares subject to options that are exercisable within 60 days of September 30, 2020, all of which are vested as of such date.

4.Consists of (i) 158,267 shares subject to options that are exercisable within 60 days of September 30, 2020, which includes all of the shares offered by Ms. Lestiyo and (ii) 108,400 shares held by the Flynn-Lestiyo Living Trust.

5.Consists of (i) 425,000 shares subject to options held by Joachim Ante that are exercisable within 60 days of September 30, 2020, which includes all of the shares being offered by Mr. Ante, and (ii) 29,514,500 shares held of record by OTEE 2020 ApS. Mr. Ante, our former director, and David Helgason, a current member of our board of directors, are the sole shareholders of OTEE 2020 ApS and have equal voting and dispositive power over the shares held by OTEE 2020 ApS. Mr. Helgason has a pecuniary interest in 10,427,500 shares and Mr. Ante has a pecuniary interest in 19,087,000 shares held by OTEE 2020 ApS.

PLAN OF DISTRIBUTION

We are registering the Shares covered by this prospectus to permit the Selling Stockholders to conduct public secondary trading of these Shares from time to time after the date of this prospectus. We will not receive any of the proceeds of the sale of the Shares offered by this prospectus. The aggregate proceeds to the Selling Stockholders from the sale of the Shares will be the purchase price of the Shares less any discounts and commissions. We will not pay any brokers’ or underwriters’ discounts and commissions in connection with the registration and sale of the Shares covered by this prospectus. The Selling Stockholders reserve the right to accept and, together with their respective agents, to reject, any proposed purchases of Shares to be made directly or through agents.

The Shares offered by this prospectus may be sold from time to time to purchasers:

•directly by the Selling Stockholders, or

•through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, commissions or agent’s commissions from the Selling Stockholders or the purchasers of the Shares.

If any of the Selling Stockholders utilize a broker-dealer in the sale or distribution of the Shares, such broker-dealer may receive commissions in the form of discounts, concessions, or commissions from such Selling Stockholder or commissions from purchasers of the Shares for whom they may act as agent or to whom they may sell as principal. The Shares may be sold in one or more transactions at:

•fixed prices;

•prevailing market prices at the time of sale;

•prices related to such prevailing market prices;

•varying prices determined at the time of sale; or

•negotiated prices.

These sales may be effected in one or more transactions:

•on any national securities exchange or quotation service on which the Shares may be listed or quoted at the time of sale, including the NYSE;

•in the over-the-counter market;

•in transactions otherwise than on such exchanges or services or in the over-the-counter market;

•any other method permitted by applicable law; or

•through any combination of the foregoing.

These transactions may include block transactions or crosses. Crosses are transactions in which the same broker acts as an agent on both sides of the trade.

At the time a particular offering of the Shares is made, a prospectus supplement, if required, will be distributed, which will set forth the name of the Selling Stockholders, the aggregate amount of Shares being offered and the terms of the offering, including, to the extent required, (1) the name or names of any underwriters, broker-dealers or agents, (2) any discounts, commissions and other terms constituting compensation from the Selling Stockholders and (3) any discounts, commissions or concessions allowed or reallowed to be paid to broker-dealers.

The Selling Stockholders will act independently of us in making decisions with respect to the timing, manner, and size of each resale or other transfer. There can be no assurance that the Selling Stockholders will sell any or all of the Shares under this prospectus. Further, we cannot assure you that the Selling Stockholders will not transfer, distribute, devise or gift the Shares by other means not described in this prospectus. In addition, any Shares covered by this prospectus that qualify for sale under Rule 144 of the Securities Act may be sold under Rule 144 rather than under this prospectus. The Shares may be sold in some states only through registered or licensed brokers or dealers. In addition, in some states the Shares may not be sold unless they have been registered or qualified for sale or an exemption from registration or qualification is available and complied with.

The Selling Stockholders and any other person participating in the sale of the Shares will be subject to the Exchange Act. The Exchange Act rules include, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the Shares by the Selling Stockholders and any other person. In addition, Regulation M may restrict the ability of any person engaged in the distribution of the Shares to engage in market-making activities with respect to the particular Shares being distributed. This may affect the marketability of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

The Selling Stockholders may indemnify any broker or underwriter that participates in transactions involving the sale of the Shares against certain liabilities, including liabilities arising under the Securities Act.

LEGAL MATTERS

The validity of the Shares offered hereby has been passed upon by Cooley LLP, San Francisco, California.

EXPERTS

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial statements at December 31, 2018 and 2019, and for each of the two years in the period ended December 31, 2019, as set forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

INFORMATION INCORPORATED BY REFERENCE

The following documents filed with the SEC are hereby incorporated by reference in this prospectus:

•The Registrant’s Prospectus filed on September 18, 2020 pursuant to Rule 424(b) under the Securities Act, relating to the Registration Statement on Form S-1, as amended (File No. 333-248255), which contains the Registrant’s audited financial statements for the latest fiscal year for which such statements have been filed.

•The Registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on September 22, 2020 (File No. 001-39497).

•The description of the Registrant’s common stock which is contained in a registration statement on Form 8-A filed on September 9, 2020 (File No. 001-39497) under the Exchange Act, including any amendment or report filed for the purpose of updating such description.

All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished and not filed in accordance with the rules of the SEC shall not be deemed incorporated by reference into this Registration Statement.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document which also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and other reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, including any amendments to those reports, and other information that we file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act can also be accessed free of charge by linking directly from our website at www.unity.com. These filings will be available as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information contained on our website is not part of this prospectus.

The Registrant hereby undertakes to provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon written or oral request of any such person, a copy of any and all of the information that has been incorporated by reference in this prospectus but not delivered with the prospectus other than the exhibits to those documents, unless the exhibits are specifically incorporated by reference into the information that this prospectus incorporates. Requests for documents should be directed to Unity Software Inc., Attention: General Counsel, 30 3rd Street, San Francisco, California 94103, (415) 539-3162.

PART I

INFORMATION REQUIRED IN THE SECTION 10(A) PROSPECTUS

Item 1. Plan Information.*

Item 2. Registration Information and Employee Plan Annual Information.*

|

|

|

|

|

|

|

|

*

|

Information required by Part I to be contained in the Section 10(a) prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act and the “Note” to Part I of Form S-8.

|

PART II

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed with the SEC are hereby incorporated by reference in this prospectus:

•The Registrant’s Prospectus filed on September 18, 2020 pursuant to Rule 424(b) under the Securities Act, relating to the Registration Statement on Form S-1, as amended (File No. 333-248255), which contains the Registrant’s audited financial statements for the latest fiscal year for which such statements have been filed.

•The Registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on September 22, 2020 (File No. 001-39497).

•The description of the Registrant’s common stock which is contained in a registration statement on Form 8-A filed on September 9, 2020 (File No. 001-39497) under the Exchange Act, including any amendment or report filed for the purpose of updating such description.

All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished and not filed in accordance with the rules of the SEC shall not be deemed incorporated by reference into this Registration Statement. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document which also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Section 145 of the Delaware General Corporation Law (the “DGCL”) authorizes a corporation’s board of directors to grant, and authorizes a court to award, indemnity to officers, directors and other corporate agents.

The Registrant’s amended and restated certificate of incorporation contains provisions that limit the liability of its directors for monetary damages to the fullest extent permitted by Delaware law. Consequently, the Registrant’s directors are not personally liable to it or its stockholders for monetary damages for any breach of fiduciary duties as directors, except liability for the following:

•any breach of their duty of loyalty to the Registrant or its stockholders;

•any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

•unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the DGCL; or

•any transaction from which they derived an improper personal benefit.

Any amendment to, or repeal of, these provisions will not eliminate or reduce the effect of these provisions in respect of any act, omission or claim that occurred or arose prior to that amendment or repeal. If the DGCL is amended to provide for further limitations on the personal liability of directors of corporations, then the personal liability of the Registrant’s directors will be further limited to the greatest extent permitted by the DGCL.

In addition, the Registrant’s amended and restated bylaws provide that it will indemnify, to the fullest extent permitted by law, any person who is or was a party or is threatened to be made a party to any action, suit or proceeding by reason of the fact that he or she is or was one of its directors or officers or is or was serving at its request as a director or officer of another corporation, partnership, joint venture, trust or other enterprise. The Registrant’s amended and restated bylaws provide that it may indemnify, to the fullest extent permitted by law, any person who is or was a party or is threatened to be made a party to any action, suit or proceeding by reason of the fact that he or she is or was one of its employees or agents or is or was serving at its request as an employee or agent of another corporation, partnership, joint venture, trust or other enterprise. The Registrant’s amended and restated bylaws also provide that the Registrant must advance expenses incurred by or on behalf of a director or officer in advance of the final disposition of any action or proceeding, subject to limited exceptions.

Further, the Registrant has entered into indemnification agreements with each of its directors and executive officers that may be broader than the specific indemnification provisions contained in the DGCL. These indemnification agreements require the Registrant, among other things, to indemnify its directors and executive officers against liabilities that may arise by reason of their status or service. These indemnification agreements also require the Registrant to advance all expenses incurred by the directors and executive officers in investigating or defending any such action, suit or proceeding. The Registrant believes that these agreements are necessary to attract and retain qualified individuals to serve as directors and executive officers.

The limitation of liability and indemnification provisions that are included in the Registrant’s amended and restated certificate of incorporation, amended and restated bylaws and in indemnification agreements that the Registrant has entered into or will enter into with its directors and executive officers may discourage stockholders from bringing a lawsuit against its directors and executive officers for breach of their fiduciary duties. They may also reduce the likelihood of derivative litigation against the Registrant’s directors and executive officers, even though an action, if successful, might benefit the Registrant and other stockholders. Further, a stockholder’s investment may be adversely affected to the extent that the Registrant pays the costs of settlement and damage awards against directors and executive officers as required by these indemnification provisions. At present, the Registrant is not aware of any pending litigation or proceeding involving any person who is or was one of its directors, officers, employees or other agents or is or was serving at its request as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, for which indemnification is sought, and the Registrant is not aware of any threatened litigation that may result in claims for indemnification.

The Registrant has obtained insurance policies under which, subject to the limitations of the policies, coverage is provided to its directors and executive officers against loss arising from claims made by reason of breach of fiduciary duty or other wrongful acts as a director or executive officer, including claims relating to public securities matters, and to the Registrant with respect to payments that may be made by it to these directors and executive officers pursuant to its indemnification obligations or otherwise as a matter of law.

Certain of the Registrant’s non-employee directors may, through their relationships with their employers, be insured and/or indemnified against certain liabilities incurred in their capacity as members of the Registrant’s board of directors.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the company pursuant to the foregoing provisions, the Registrant has been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incorporated by Reference

|

|

Exhibit Number

|

|

Description of Exhibit

|

|

Form

|

File Number

|

|

Exhibit

|

|

Filing Date

|

|

|

|

|

|

|

|

|

4.1

|

|

|

|

8-K

|

|

001-39497

|

|

3.1

|

|

September 22, 2020

|

|

|

|

|

|

|

|

|

4.2

|

|

|

|

S-1/A

|

|

333-248255

|

|

3.4

|

|

September 9, 2020

|

|

|

|

|

|

|

|

|

4.3

|

|

|

|

S-1/A

|

|

333-248255

|

|

4.1

|

|

September 9, 2020

|

|

|

|

|

|

|

|

|

5.1*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23.1*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23.2*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24.1*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

99.1

|

|

|

|

10-Q

|

|

001-39497

|

|

10.1

|

|

November 13, 2020

|

|

|

|

|

|

|

|

|

99.2

|

|

|

|

10-Q

|

|

001-39497

|

|

10.2

|

|

November 13, 2020

|

Item 9. Undertakings.

A.The undersigned registrant hereby undertakes:

1.To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

i.To include any prospectus required by Section 10(a)(3) of the Securities Act;

ii.To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

iii.To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement.

Provided, however, that paragraphs (A)(1)(i) and (A)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

2.That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3.To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

B. The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Francisco, State of California, on November 13, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITY SOFTWARE INC.

|

|

|

|

|

|

|

|

By:

|

/s/ John Riccitiello

|

|

|

|

|

John Riccitiello

|

|

|

|

|

President and Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints John Riccitiello and Ruth Ann Keene, and each one of them, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in their name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

/s/ John Riccitiello

|

|

President, Chief Executive Officer, and Director

|

|

November 13, 2020

|

|

John Riccitiello

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

/s/ Kimberly Jabal

|

|

Senior Vice President and Chief Financial Officer

|

|

November 13, 2020

|

|

Kimberly Jabal

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

|

|

|

/s/ Roelof Botha

|

|

Director

|

|

November 13, 2020

|

|

Roelof Botha

|

|

|

|

|

|

|

|

|

|

|

/s/ Mary Schmidt Campbell

|

|

Director

|

|

November 13, 2020

|

|

Mary Schmidt Campbell, Ph.D.

|

|

|

|

|

|

|

|

|

|

|

/s/ Egon Durban

|

|

Director

|

|

November 13, 2020

|

|

Egon Durban

|

|

|

|

|

|

|

|

|

|

|

/s/ David Helgason

|

|

Director

|

|

November 13, 2020

|

|

David Helgason

|

|

|

|

|

|

|

|

|

|

|

/s/ Alyssa Henry

|

|

Director

|

|

November 13, 2020

|

|

Alyssa Henry

|

|

|

|

|

|

|

|

|

|

|

/s/ Barry Schuler

|

|

Director

|

|

November 13, 2020

|

|

Barry Schuler

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Robynne Sisco

|

|

Director

|

|

November 13, 2020

|

|

Robynne Sisco

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Luis Felipe Visoso

|

|

Director

|

|

November 13, 2020

|

|

Luis Felipe Visoso

|

|

|

|

|

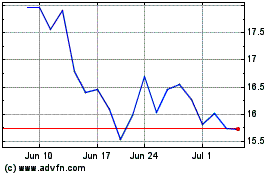

Unity Software (NYSE:U)

Historical Stock Chart

From Aug 2024 to Sep 2024

Unity Software (NYSE:U)

Historical Stock Chart

From Sep 2023 to Sep 2024