TEN, Ltd. (TEN) (NYSE: TNP) (the “Company”) reports results

(unaudited) for the fourth quarter and the year ended December 31,

2019.

2019 YEAR

RESULTSIn 2019, TEN produced profits of $42.7

million before non-cash impairment charges and positive net income

of $15.1 million, a $76 million turnaround from 2018. Such

improvement in profitability was primarily due to the very strong

freight market that arose in the fourth quarter of the year, and

still the case today, and resulted in voyage revenues reaching

$597.5 million.

Operating income reached $113.5 million compared

to $37.8 million in 2018, both before non-cash impairment charges,

a threefold increase.

Adjusted EBITDA totaled $257 million in 2019,

$66.2 million more than in 2018, a 35% increase.

The average daily time charter equivalent rate

per vessel climbed to almost $21,400 with fleet utilization again

at a high 96.2% as a result of the Company’s time-charter policy

and the continued excellent relationship with our first-class

clients, with many of the contracts renewed in the year on

attractive terms.

Excluding impairment charges, in nearly all

expense categories, the numbers were almost the same as in 2018,

except for depreciation which decreased due to the sale of vessels

and impairments at the end of 2018. Average daily operating

expenses remained stable at about $7,700. Vessel overhead costs per

ship per day averaged $1,182, similar to 2018.

The outstanding loan balance decreased to $1.545

billion from $1.607 billion at the end of 2018, resulting to a $2.0

million interest and financing savings in 2019.

FOURTH QUARTER 2019

RESULTSIn the fourth quarter of 2019, TEN Ltd.

generated profits of $40.7 million, before non-cash impairment

charges, compared to $2.8 million before non-cash impairment

charges for the equivalent quarter in 2018. Net income for the

fourth quarter of 2019 was at $13.1 million compared to a net loss

of $63.1 million in the same quarter of 2018.

Operating income in the fourth quarter, before

non-cash impairment charges, amounted to $55.0 million, more than

double the operating income generated in the 2018 fourth quarter,

before non-cash impairment charges.

Adjusted EBITDA increased by 36% to $90 million

and total cash balances by the end of the quarter (and year) neared

$200 million.

This substantial and material improvement in

fourth quarter net income results was mostly due to gross revenues

increasing by $21.6 million, 14.1% up from the 2018 fourth quarter

with an almost identical number of vessels in the fleet,

elevating total voyage revenues to $175.4 million for the

quarter.

The increase in revenue was due to a greatly

improved crude tanker market during the quarter, in which 16

vessels operating in spot trades enjoyed the strongest rates seen

in the last five years, as oil demand strengthened and oil supplies

increased, especially from the U.S, while growth of the global

fleet continued its downward trend. Moreover, vessels on time

charter with profit sharing provisions began to see significant

income over and above their applicable minimum rates helping the

average daily TCE per vessel in the fleet to reach $25,576, a 19.3%

increase from the fourth quarter of 2018.

In addition, the two LNG carriers Neo Energy and

Maria Energy, again earned higher rates in the fourth quarter of

2019 than in the 2018 fourth quarter, by 45% and 58%

respectively.

Our fleet of 65 operating vessels achieved again

high utilization rates, averaging 98.4%, with only one vessel in

dry-dock for just part of the quarter.

Expenses incurred by the Company in the fourth

quarter were relatively stable in all categories compared to the

2018 fourth quarter. Voyage expenses, however, experienced a 22%

reduction much due to lower bunker costs. Total operating costs

remained almost the same at $46.0 million, while daily average

operating costs per vessel stayed at approximately $7,800.

G&A expenses remained at $7.3 million and

depreciation and amortization charges were somewhat lower due to

vessels held for sale that no longer incurred depreciation.

Interest and finance costs were down by nearly

half that of the 2018 fourth quarter, falling to $13.7 million from

$26.2 million, mainly due to bunker hedge positive valuation

movements.

Dividend (Common Shares) and Stock BuybackThe

Company will pay a dividend of $0.05 per common share in June 2020

and has received authorization from the Company’s Board of

Directors to commence an up to $50 million common and preferred

stock buyback.

Corporate Strategy& OutlookIn hindsight,

2019 looks now a very normal year regardless of its rollercoaster

market changes. In today’s turbulent environment, TEN maintains its

steady course navigating unprecedented challenges with success.

With oil prices collapsing the demand for inventory build-up and

transportation services is booming. TEN with its flexible

employment model is taking advantage of that to the full. The

increasing floating storage of oil and the developing contango

following the precipitous decline in the price of crude, has led to

a reduction in fleet capacity which should assist in maintaining

the strong rates currently in evidence.

“As the impact of the coronavirus is being felt

around the globe, TEN’s business model is able not only to sustain

such shocks, but also profit from them as well. Our

long-established strategy of providing downside protection and

upside potential is working well and we remain confident that we

will continue taking advantage of the strong freight environment

while offering investors healthy returns,” Mr. George Saroglou, COO

of TEN commented. “With significant cash flow visibility, a healthy

balance sheet and favorable industry fundamentals, like the

continuously low orderbook, we remain confident that once the panic

selling stops TEN will be ascribed a valuation that it merits and

deserves. In the meantime, management top priority is to maintain

the good health of its seafarers and onshore employees and wishes

all good health in these challenging times,” Mr. Saroglou

concluded.

CONFERENCE CALL As previously

announced, today, Tuesday, March 24, 2020 at 9:00 a.m. Eastern

Time, TEN will host a conference call to review the results as well

as management's outlook for the business. The call, which will be

hosted by TEN's senior management, may contain information beyond

that which is included in the earnings press release.

Participants should dial into the call 10

minutes before the scheduled time using the following numbers: 1

877 55 39962 (US Toll Free Dial In), 0808 2380 669 (UK Toll Free

Dial In) or +44 (0)2071 928592 (Standard International Dial In).

Please quote "Tsakos" to the operator.

A telephonic replay of the conference call will

be available until Tuesday, March 31, 2020 by dialing 1 866 331

1332 (US Toll Free Dial In), 0808 2380 667 (UK Toll Free Dial In)

or +44 (0)3333 00 9785 (Standard International Dial In). Access

Code: 90295809#

Simultaneous Slides and Audio

Webcast: There will also be a simultaneous live, and then

archived, slides webcast of the conference call, available through

TEN's website (www.tenn.gr). The slides webcast will also provide

details related to fleet composition and deployment and other

related company information. This presentation will be available on

the Company's corporate website reception page at www.tenn.gr.

Participants for the live webcast should register on the website

approximately 10 minutes prior to the start of the webcast.

|

TEN’s Growth Program |

|

# |

Name |

Type |

Delivery |

Status |

Employment |

|

1 |

HN8041 |

Suezmax |

Q3 2020 |

Under Construction |

Yes |

|

2 |

HN8042 |

Suezmax |

Q4 2020 |

Under Construction |

Yes |

|

3 |

HN3157 |

LNG |

Q4 2021 |

Under Construction |

Under Discussion |

ABOUT FORWARD-LOOKING

STATEMENTS Except for the historical information contained

herein, the matters discussed in this press release are

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from those

predicted by such forward-looking statements. TEN undertakes no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events, or

otherwise.

ABOUT TSAKOS ENERGY

NAVIGATIONTEN, founded in 1993 and celebrating this year

27 years as a public company, is one of the first and most

established public shipping companies in the world. TEN’s

diversified energy fleet currently consists of 68 double-hull

vessels including two suezmax tankers and one LNG carrier under

construction, constituting a mix of crude tankers, product tankers

and LNG carriers, totaling 7.4 million dwt.

For further information please contact:

CompanyTsakos Energy Navigation Ltd. George

Saroglou, COO+30210 94 07 710gsaroglou@tenn.gr

Investor Relations / MediaCapital Link,

Inc.Nicolas Bornozis Markella Kara+212 661

7566ten@capitallink.com

| |

| |

| TSAKOS

ENERGY NAVIGATION LIMITED AND SUBSIDIARIES |

| Selected

Consolidated Financial and Other Data |

| (In Thousands of

U.S. Dollars, except share, per share and fleet data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months

ended |

|

|

Year

ended |

| |

|

December 31 (unaudited) |

|

|

December 31 (unaudited) |

|

STATEMENT OF OPERATIONS DATA |

|

2019 |

|

|

|

2018 |

|

|

2019 |

|

|

|

2018 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voyage revenues |

$ |

175,386 |

|

|

|

$ |

153,755 |

|

|

$ |

597,452 |

|

|

|

$ |

529,879 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Voyage

expenses |

|

28,914 |

|

|

|

|

34,790 |

|

|

|

125,802 |

|

|

|

|

125,350 |

|

| Charter hire

expense |

|

2,728 |

|

|

|

|

2,719 |

|

|

|

10,822 |

|

|

|

|

10,822 |

|

| Vessel

operating expenses |

|

46,070 |

|

|

|

|

45,428 |

|

|

|

180,233 |

|

|

|

|

181,693 |

|

| Depreciation

and amortization |

|

35,359 |

|

|

|

|

37,225 |

|

|

|

139,424 |

|

|

|

|

146,798 |

|

| General and

administrative expenses |

|

7,321 |

|

|

|

|

7,261 |

|

|

|

27,696 |

|

|

|

|

27,032 |

|

| Loss on sale

of vessels |

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

|

364 |

|

| Impairment

charges |

|

27,613 |

|

|

|

|

65,965 |

|

|

|

27,613 |

|

|

|

|

65,965 |

|

| Total

expenses |

|

148,005 |

|

|

|

|

193,388 |

|

|

|

511,590 |

|

|

|

|

558,024 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

27,381 |

|

|

|

|

(39,633 |

) |

|

|

85,862 |

|

|

|

|

(28,145 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and

finance costs, net |

|

(13,735 |

) |

|

|

|

(26,226 |

) |

|

|

(74,723 |

) |

|

|

|

(76,809 |

) |

| Interest

income |

|

456 |

|

|

|

|

832 |

|

|

|

3,694 |

|

|

|

|

2,507 |

|

| Other,

net |

|

(791 |

) |

|

|

|

1,730 |

|

|

|

(825 |

) |

|

|

|

1,405 |

|

| Total other

expenses, net |

|

(14,070 |

) |

|

|

|

(23,664 |

) |

|

|

(71,854 |

) |

|

|

|

(72,897 |

) |

|

Net income (loss) |

|

13,311 |

|

|

|

|

(63,297 |

) |

|

|

14,008 |

|

|

|

|

(101,042 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net (income) loss attributable to the noncontrolling

interest |

|

(194 |

) |

|

|

|

148 |

|

|

|

1,118 |

|

|

|

|

1,839 |

|

| Net

income (loss) attributable to Tsakos Energy Navigation

Limited |

$ |

13,117 |

|

|

|

$ |

(63,149 |

) |

|

$ |

15,126 |

|

|

|

$ |

(99,203 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of

preferred dividends |

|

(9,788 |

) |

|

|

|

(10,204 |

) |

|

|

(40,400 |

) |

|

|

|

(33,763 |

) |

| Deemed

dividend on Series B preferred shares |

|

- |

|

|

|

|

- |

|

|

|

(2,750 |

) |

|

|

|

- |

|

| Net

income (loss) attributable to common stockholders of Tsakos Energy

Navigation Limited |

$ |

3,329 |

|

|

|

$ |

(73,353 |

) |

|

$ |

(28,024 |

) |

|

|

$ |

(132,966 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings

(Loss) per share, basic and diluted |

$ |

0.04 |

|

|

|

$ |

(0.84 |

) |

|

$ |

(0.32 |

) |

|

|

$ |

(1.53 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of common shares, basic and diluted |

|

90,510,341 |

|

|

|

|

87,604,645 |

|

|

|

88,757,923 |

|

|

|

|

87,111,636 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE SHEET DATA |

|

December

31 |

|

|

|

December

31 |

|

|

|

|

|

|

|

| |

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

| Cash |

|

197,770 |

|

|

|

|

220,526 |

|

|

|

|

|

|

|

|

| Other

assets |

|

261,607 |

|

|

|

|

138,924 |

|

|

|

|

|

|

|

|

| Vessels,

net |

|

2,633,251 |

|

|

|

|

2,829,447 |

|

|

|

|

|

|

|

|

| Advances for

vessels under construction |

|

61,475 |

|

|

|

|

16,161 |

|

|

|

|

|

|

|

|

|

Total assets |

$ |

3,154,103 |

|

|

|

$ |

3,205,058 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debt, net of

deferred finance costs |

|

1,534,296 |

|

|

|

|

1,595,601 |

|

|

|

|

|

|

|

|

| Other

liabilities |

|

147,488 |

|

|

|

|

102,680 |

|

|

|

|

|

|

|

|

|

Stockholders' equity |

|

1,472,319 |

|

|

|

|

1,506,777 |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

$ |

3,154,103 |

|

|

|

$ |

3,205,058 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months

ended |

|

|

Year

ended |

|

OTHER FINANCIAL DATA |

|

December

31 |

|

|

December

31 |

| |

|

2019 |

|

|

|

2018 |

|

|

2019 |

|

|

|

2018 |

| Net cash

from operating activities |

$ |

62,976 |

|

|

|

$ |

39,000 |

|

|

$ |

184,349 |

|

|

|

$ |

73,945 |

|

| Net cash

used in investing activities |

$ |

(41,908 |

) |

|

|

$ |

(5,552 |

) |

|

$ |

(102,205 |

) |

|

|

$ |

(179 |

) |

| Net cash

used in financing activities |

$ |

(302 |

) |

|

|

$ |

(45,490 |

) |

|

$ |

(104,900 |

) |

|

|

$ |

(55,913 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| TCE per ship

per day |

$ |

25,576 |

|

|

|

$ |

21,439 |

|

|

$ |

21,378 |

|

|

|

$ |

18,226 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses per ship per day |

$ |

7,828 |

|

|

|

$ |

7,715 |

|

|

$ |

7,716 |

|

|

|

$ |

7,745 |

|

| Vessel

overhead costs per ship per day |

$ |

1,228 |

|

|

|

$ |

1,233 |

|

|

$ |

1,182 |

|

|

|

$ |

1,152 |

|

| |

|

9,056 |

|

|

|

|

8,948 |

|

|

|

8,898 |

|

|

|

|

8,897 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FLEET DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

number of vessels during period |

|

64.8 |

|

|

|

|

64.0 |

|

|

|

64.2 |

|

|

|

|

64.3 |

|

| Number of

vessels at end of period |

|

65.0 |

|

|

|

|

64.0 |

|

|

|

65.0 |

|

|

|

|

64.0 |

|

| Average age

of fleet at end of period |

Years |

9.1 |

|

|

|

|

8.2 |

|

|

|

9.1 |

|

|

|

|

8.2 |

|

| Dwt at end

of period (in thousands) |

|

7,051 |

|

|

|

|

6,936 |

|

|

|

7,051 |

|

|

|

|

6,936 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Time charter

employment - fixed rate |

Days |

2,647 |

|

|

|

|

2,660 |

|

|

|

9,737 |

|

|

|

|

9,600 |

|

| Time charter

employment - variable rate |

Days |

1,733 |

|

|

|

|

1,288 |

|

|

|

6,550 |

|

|

|

|

6,464 |

|

| Period

employment (coa) at market rates |

Days |

169 |

|

|

|

|

224 |

|

|

|

799 |

|

|

|

|

1,215 |

|

| Spot voyage

employment at market rates |

Days |

1,313 |

|

|

|

|

1,501 |

|

|

|

5,456 |

|

|

|

|

5,294 |

|

|

Total operating days |

|

5,862 |

|

|

|

|

5,673 |

|

|

|

22,542 |

|

|

|

|

22,573 |

|

|

Total available days |

|

5,960 |

|

|

|

|

5,888 |

|

|

|

23,432 |

|

|

|

|

23,460 |

|

|

Utilization |

|

98.4 |

% |

|

|

|

96.3 |

% |

|

|

96.2 |

% |

|

|

|

96.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Measures |

|

Reconciliation of Net income (loss) to Adjusted

EBITDA |

| |

|

Three months

ended |

|

|

Year

ended |

| |

|

December 31 |

|

|

December 31 |

| |

|

2019 |

|

|

|

2018 |

|

|

2019 |

|

|

|

2018 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) attributable to Tsakos Energy Navigation Limited |

|

13,117 |

|

|

|

|

(63,149 |

) |

|

|

15,126 |

|

|

|

|

(99,203 |

) |

| Depreciation

and amortization |

|

35,359 |

|

|

|

|

37,225 |

|

|

|

139,424 |

|

|

|

|

146,798 |

|

| Interest

Expense |

|

13,735 |

|

|

|

|

26,226 |

|

|

|

74,723 |

|

|

|

|

76,809 |

|

| Loss on sale

of vessel |

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

|

364 |

|

| Impairment

charges |

|

27,613 |

|

|

|

|

65,965 |

|

|

|

27,613 |

|

|

|

|

65,965 |

|

| Adjusted

EBITDA |

$ |

89,824 |

|

|

|

$ |

66,267 |

|

|

$ |

256,886 |

|

|

|

$ |

190,733 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| The Company reports

its financial results in accordance with U.S. generally accepted

accounting principles (GAAP). However, management believes that

certain non-GAAP measures used within the financial community may

provide users of this financial information additional meaningful

comparisons between current results and results in prior operating

periods as well as comparisons between the performance of Shipping

Companies. Management also uses these non-GAAP financial measures

in making financial, operating and planning decisions and in

evaluating the Company’s performance. We are using the following

Non-GAAP measures: |

| |

| (i) TCE which

represents voyage revenue less voyage expenses is divided by the

number of operating days less 107 days lost for the fourth quarter

of 2019 and 446 for the year of 2019 as a result of calculating

revenue on a loading to discharge basis, compared to 124 for the

fourth quarter of 2018 and 378 for the year of 2018. |

| |

| (ii) Vessel overhead

costs are General & Administrative expenses, which also include

Management fees, Stock compensation expense and Management

incentive award. |

| |

| (iii) Operating

expenses per ship per day which exclude Management fees, General

& Administrative expenses, Stock compensation expense and

Management incentive award. |

| |

| (iv) EBITDA. See above

for reconciliation to net income (loss). |

| |

| Non-GAAP financial

measures should be viewed in addition to and not as an alternative

for, the Company’s reported results prepared in accordance with

GAAP. |

| |

| The Company does not

incur corporation tax. |

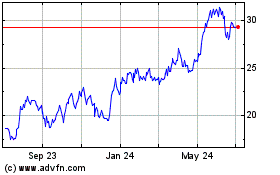

Tsakos Energy Navigation (NYSE:TNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

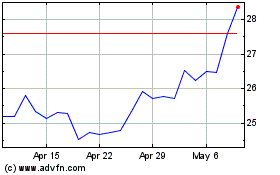

Tsakos Energy Navigation (NYSE:TNP)

Historical Stock Chart

From Apr 2023 to Apr 2024