- Free Writing Prospectus - Filing under Securities Act Rules 163/433 (FWP)

February 16 2010 - 7:36AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-164903

February 16, 2010

NEWS RELEASE

|

|

|

|

|

|

|

Contact: Investor Relations

708.483.1300 Ext 1331

|

TreeHouse Announces $400 Senior Notes Offering to Fund Sturm Foods Acquisition

Westchester, IL, February 16, 2010 — TreeHouse Foods, Inc. (NYSE: THS) announced today that it

intends to offer, subject to market and other conditions, $400 million of senior unsecured notes

due 2018 in an underwritten public offering. The offering will be made pursuant to a shelf

registration statement filed with the Securities and Exchange Commission on February 16, 2010,

which has been declared effective, and a prospectus supplement to TreeHouse’s prospectus, dated

February 16, 2010, filed with the shelf registration statement.

TreeHouse will use the net proceeds of the notes offering to fund, in part, the previously

announced and pending acquisition of Sturm Foods, Inc. TreeHouse expects to close the acquisition

of Sturm Foods in March, 2010. The notes offering will close concurrently with the acquisition of

Sturm Foods, Inc. TreeHouse intends to finance the remaining portion of the acquisition of Sturm

Foods through a draw-down on its existing credit facility as well as an underwritten public

offering of common stock, pursuant to a separate prospectus supplement, following the pricing of

the notes offering. BofA Merrill Lynch and Wells Fargo Securities, LLC are acting as joint

book-running managers for the notes offering.

Copies of the preliminary prospectus relating to the notes offering may be obtained, when

available, from BofA Merrill Lynch, Attention: Prospectus Department, 100 West 33rd Street, 3rd

Floor, New York, NY 10001 (1-800-294-1322 or dg.prospectus_distribution@bofasecurities.com) or

Wells Fargo Securities, LLC, Attention: High Yield Capital Markets, One Wachovia Center, 301 South

College Street, Charlotte, NC 28288-0604.

TreeHouse has filed a registration statement (including a prospectus and, with regard to the notes

offering, a preliminary prospectus supplement dated February 16, 2010) with the Securities and

Exchange Commission for the offerings to which this communication relates. Before you invest, you

should read the prospectus in that registration statement and other documents TreeHouse has filed

with the Securities and Exchange Commission for more complete information about TreeHouse and the

offerings. You may get these documents for free by visiting EDGAR on the SEC Web site at

www.sec.gov. Alternatively, TreeHouse, any underwriter or any dealer participating in the offerings

will arrange to send you the relevant prospectus, when available, if you request it by calling

TreeHouse’s Investor Relations department at 708-483-1300 Ext 1331.

This press release does not constitute an offer to sell, or the solicitation of an offer to

buy, any securities of TreeHouse, nor will there be any sale of securities in any state or

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification.

ABOUT TREEHOUSE FOODS

TreeHouse is a food manufacturer servicing primarily the retail grocery and foodservice channels.

Its products include non-dairy powdered coffee creamer; canned soup, salad dressings and sauces;

salsa and Mexican sauces; jams and pie fillings under the E.D. Smith brand name; pickles and

related products; infant feeding products; and other food products including aseptic sauces,

refrigerated salad dressings, and liquid non-dairy creamer. TreeHouse believes it is the largest

manufacturer of pickles and non-dairy powdered creamer in the United States and the largest

manufacturer of private label salad dressings in the United States and Canada based on sales

volume.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements.” Forward-looking statements include all

statements that do not relate solely to historical or current facts, and can generally be

identified by the use of words such as “may,” “should,” “could,” “expects,” “seek to,”

“anticipates,” “plans,” “believes,” “estimates,” “intends,” “predicts,” “projects,” “potential” or

“continue” or the negative of such terms and other comparable terminology. These statements are

only predictions. The outcome of the events described in these forward-looking statements is

subject to known and unknown risks, uncertainties and other factors that may cause TreeHouse’s or

its industry’s actual results, levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance or achievement expressed or

implied by these forward-looking statements. TreeHouse’s Form 10-K for the year ended December 31,

2010 and the prospectus (including any prospectus supplements) related to the offerings discuss

some of the factors that could contribute to these differences. You are cautioned not to unduly

rely on such forward-looking statements, which speak only as of the date made, when evaluating the

information presented in this presentation. TreeHouse expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any forward-looking statement contained

herein, to reflect any change in its expectations with regard thereto, or any other change in

events, conditions or circumstances on which any statement is based.

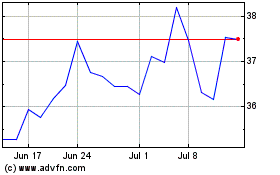

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Oct 2024 to Nov 2024

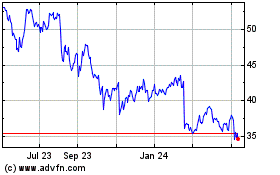

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Nov 2023 to Nov 2024