WESTCHESTER, Ill., Aug. 2 /PRNewswire-FirstCall/ -- TreeHouse

Foods, Inc. (NYSE:THS) today announced that net income from

continuing operations rose 42.9% to $0.30 per diluted share for the

quarter ended June 30, 2007 compared to the second quarter of 2006.

The results for the quarter included a $0.01 benefit from the sale

of closed facilities, while last year's results of $0.21 included

$0.04 relating to costs associated with a closed facility and

acquisition related accounting adjustments. Excluding these unusual

items in 2007 and 2006, second quarter 2007 results increased 16%

to $0.29 per share compared to $0.25 per share last year due to

higher revenues. Commenting on the results, Sam K. Reed, Chairman

and CEO, said, "Second quarter results finished at the high end of

our expectations as we began to see the results of our pricing and

cost containment programs. We showed good progress in margin

improvement and expect that quarter over quarter progress will

continue over the balance of the year despite the ongoing pressures

of our key input costs." Adjusted operating earnings before

interest, taxes, depreciation, amortization and unusual items

(adjusted EBITDA, as defined below, and reconciled to net earnings,

the most directly comparable GAAP measure, on the attached

schedule) increased to $29.9 million in the quarter compared to

$26.6 million in the same period last year. The 12.4% increase is

due to the addition of the Soup and Infant Feeding (SIF) business

for a full quarter and improved operating margins in the legacy

business. Net sales for the second quarter of 2007 totaled $256.0

million, an increase of 10.3% over the second quarter of 2006,

reflecting growth from the Company's acquisition of its SIF

business effective April 24, 2006 and the acquisition of San

Antonio Farms and DeGraffenreid, LLC in the second quarter of 2007.

Excluding the SIF business and the second quarter 2007

acquisitions, revenues decreased 1.0%. Pickle revenues declined by

4.1%, while non-dairy powdered creamer sales increased 8.0% over

the same period last year due to both volume increases and higher

selling prices. SIF revenues increased by 43.6% over the second

quarter of 2006 because the current year includes a full three

months of sales, while last year included only a partial quarter.

Other product sales increased 14.5% as aseptic sales improvement

offset lower refrigerated product sales and the results included

one month of San Antonio Farms. Gross margin for the second quarter

of 20.9% was flat compared to the prior year but improved 80 basis

points on a sequential basis from the first quarter due to improved

pricing. Operating costs were flat compared to last year at $34.5

million as higher costs associated with a full quarter of the SIF

business were offset by lower stock option and other

benefit-related expenses. As a percent of revenues, operating

expense decreased from 14.9% last year to 13.4% in the second

quarter of 2007. Net interest expense in the quarter was $4.0

million compared to $3.3 million last year due to higher bank debt

used to fund the SIF and San Antonio Farms acquisitions. Commenting

further on the results, Mr. Reed said, "We began the year with high

input costs that put pressure on our margins. We have since been

successful in our pricing programs and continue to manage our

internal controllable costs as evidenced by the continued

improvement in operating costs to revenue. The improvement in

margins from first quarter to second quarter was encouraging,

especially in light of our expectation that most of the pricing

programs will be realized during the key fourth quarter shipping

season." SEGMENT RESULTS TreeHouse's measure of segment performance

is adjusted gross margin. Adjusted gross margin is gross profit

less delivery and commission costs. Pickle segment net sales were

$94.3 million for the second quarter, a decrease of 4.1% from the

second quarter last year, despite the acquisition of DeGraffenreid,

LLC, due to continued softness in both foodservice and retail

channels. Adjusted gross margins declined in the quarter from 13.1%

last year to 11.2% this year as a result of significantly higher

sweetener, vinegar and packaging costs, which were not offset by

higher prices. Margins did increase slightly from the first quarter

of 2007 as pricing is beginning to be realized in this category.

Powder segment sales increased by 8.0% compared to the same quarter

a year ago due to higher selling prices and increased sales

volumes. Adjusted gross margins in the quarter improved to 19.4%

compared to 18.5% last year and 17.2% in the first quarter of 2007,

reflecting a pass through of higher input costs, especially nonfat

dry milk. SIF, acquired on April 24, 2006, had revenues for the

second quarter of $61.3 million compared to $42.7 million in the

partial quarter last year. Adjusted gross margins for the quarter

were 15.8% compared to 10.2% last year due to cost reduction

programs in 2007 and last year's inclusion of an unfavorable

purchase accounting adjustment to opening inventories. ACQUISITION

ACTIVITY In April, the Company acquired 49% of the voting stock of

Santa Fe Ingredients, a New Mexico based chile processing company

supplying leading packaged food companies with industrial green

chiles and jalapeno peppers. The terms of the transaction have not

been disclosed as we believe the amounts involved are not material

to TreeHouse. On May 7, 2007 the Company acquired DeGraffenreid,

LLC, a leading processor and distributor of pickles and related

products to the foodservice industry, from Bell-Carter Foods, Inc.

for $10 million plus an adjustment for working capital. The company

is located in Springfield, Missouri and has annual sales of

approximately $23 million. The purchase included all of the

company's working capital and production equipment. Concurrent with

the acquisition of assets, TreeHouse entered into a lease for the

land and buildings used in the operation of the acquired business.

Due to the small size of the company and first year integration

activities, the Company estimates this transaction will be neutral

to earnings in 2007. On May 31, 2007 the Company completed its

acquisition of San Antonio Farms from Silver Ventures, Inc. for

$88.8 million. San Antonio Farms is a producer of Mexican sauces

for the retail, foodservice and industrial markets. The transaction

was financed through borrowings under the Company's existing $500

million credit facility. For the 12 months ending March 31, 2007,

San Antonio Farms had revenues of $45.3 million. TreeHouse expects

that San Antonio Farms will generate partial year operating

earnings of approximately $0.02 per share in 2007 before one-time

acquisition and integration expenses of approximately $0.03 per

share. Earnings for the full year 2008 are expected to be $0.05 per

share with no unusual items anticipated. The Company also announced

on June 25, 2007 that they had entered into a definitive agreement

with E.D. Smith Income Fund (JAM-UN.TO) (the "Fund") to acquire

substantially all of the assets of the Fund for approximately $203

million plus the assumption of existing debt and transaction costs.

It is anticipated that the unitholders of E.D. Smith Income Fund

will receive up to CDN$9.15 per unit, subject to a holdback to

cover certain contingencies associated with a potential tax

liability and wind-up costs. Headquartered in Winona, Ontario, E.D.

Smith is a leading manufacturer of high-quality branded and private

label food products, which it markets and distributes to the retail

grocery and foodservice markets in Canada and the United States.

E.D. Smith's diverse portfolio includes fruit-based products, pie

fillings, ketchup, sauces, and pourable and spoonable salad

dressings. In both the U.S. and Canada, it is the private label

market leader in pourable salad dressings. For the 12 months ending

March 31, 2007, E.D. Smith had revenues of approximately $245

million. E.D. Smith headquarters will remain in Winona, Ontario.

E.D. Smith announced today that the special meeting of unitholders

to approve TreeHouse's acquisition of the operating assets of E.D.

Smith will be postponed until September 27, 2007 to provide E.D.

Smith with additional time to resolve certain tax matters. The

resolution of these tax matters will not affect the economics of

the transaction to TreeHouse, nor is it expected to result in a

meaningful delay in the consummation of the transaction. TreeHouse

expects the transaction to close early in the fourth quarter of

2007. E.D. Smith is expected to contribute approximately $0.07 per

share on an annualized basis but will only contribute $0.01 per

share of operating earnings in the fourth quarter based on the

anticipated close date of the transaction. These earnings estimates

will be reduced by one-time acquisition accounting adjustments and

integration activities of approximately $0.07 in the fourth quarter

and $0.02 in 2008. "We are extremely excited about the distribution

opportunities that exist for us with the addition of E.D. Smith,"

commented David Vermylen, President and COO of TreeHouse. "We

currently have very little distribution of TreeHouse products into

Canada, while E.D. Smith can benefit greatly from our reach across

the US retail and foodservice markets. We see great opportunities

to move our existing products across each other's distribution

networks to grow revenues and gain efficiencies in warehousing and

freight costs. Our complementary product lines will offer retail

and foodservice customers an even stronger one stop shop for shelf

stable food products." OUTLOOK FOR THE REMAINDER OF 2007 "We had a

very active second quarter, as evidenced by the acquisition

activity and our strong second quarter results. Our pricing

programs are progressing as planned, and although they are skewed

towards our seasonally strong fourth quarter, we still expect to

see similar year over year earnings improvement in the third

quarter," said Reed. "As such, we expect third quarter earnings to

be in the $0.29 to $0.32 range and are reaffirming our guidance for

full year earnings per share of $1.29 to $1.34 before the effect of

new acquisitions. Further, although the acquisitions will

contribute approximately $0.03 per share in operating earnings over

the second half of the year, one time accounting and integration

costs of $0.10 will result in dilution of about $0.07 per share in

2007." COMPARISON OF ADJUSTED INFORMATION TO GAAP INFORMATION The

adjusted financial results contained in this press release are from

continuing operations and are adjusted to eliminate the net expense

or net income related to items identified below. This information

is provided in order to allow investors to make meaningful

comparisons of the Company's operating performance between periods

and to view the Company's business from the same perspective as

company management. Because the Company cannot predict the timing

and amount of charges associated with non-recurring items or

facility closings and reorganizations, management does not consider

these costs when evaluating the Company's performance, when making

decisions regarding the allocation of resources, in determining

incentive compensation for management, or in determining earnings

estimates. These costs are not recorded in any of the Company's

operating segments. Adjusted EBITDA represents net income before

net interest expense, income tax expense, depreciation and

amortization expense, stock option expense and non-recurring items.

Adjusted EBITDA is a performance measure and liquidity measure used

by our management, and we believe is commonly reported and widely

used by investors and other interested parties, as a measure of a

company's operating performance and ability to incur and service

debt. This non-GAAP financial information is provided as additional

information for investors and is not in accordance with or an

alternative to GAAP. These non-GAAP measures may be different than

similar measures used by other companies. A full reconciliation

table between earnings for the three and six month periods ended

June 30, 2007 and June 30, 2006 calculated according to GAAP and

adjusted EBITDA is attached. Conference Call Webcast A webcast to

discuss the Company's financial results will be held at 5:00 p.m.

(Eastern Standard Time) today and may be accessed by visiting the

"Investor Overview" page through the "Investor Relations" menu of

the Company's website at http://www.treehousefoods.com/. About

TreeHouse Foods TreeHouse is a food manufacturer servicing

primarily the retail grocery and foodservice channels. Its products

include pickles and related products; non-dairy powdered coffee

creamer; private label soup; infant feeding products; salsa and

Mexican sauces; and other food products including aseptic sauces,

refrigerated salad dressings, and liquid non-dairy creamer.

TreeHouse believes it is the largest manufacturer of pickles and

non-dairy powdered creamer in the United States based on sales

volume. FORWARD LOOKING STATEMENTS This press release contains

"forward-looking statements." Forward-looking statements include

all statements that do not relate solely to historical or current

facts, and can generally be identified by the use of words such as

"may," "should," "could," "expects," "seek to," "anticipates,"

"plans," "believes," "estimates," "intends," "predicts,"

"projects," "potential," "will" or "continue" or the negative of

such terms and other comparable terminology. These statements are

only predictions. The outcome of the events described in these

forward-looking statements is subject to known and unknown risks,

uncertainties and other factors that may cause the Company or its

industry's actual results, levels of activity, performance or

achievements to be materially different from any future results,

levels of activity, performance or achievement expressed or implied

by these forward-looking statements. TreeHouse's Form 10-K for the

year ended December 31, 2006 and subsequent quarterly report on

Form 10-Q discusses some of the factors that could contribute to

these differences. You are cautioned not to unduly rely on such

forward-looking statements, which speak only as of the date made,

when evaluating the information presented in this presentation. The

Company expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward-looking

statement contained herein, to reflect any change in its

expectations with regard thereto, or any other change in events,

conditions or circumstances on which any statement is based.

TREEHOUSE FOODS, INC. CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share data) Three Months Ended Six Months

Ended June 30 June 30 2007 2006 2007 2006 (unaudited) (unaudited)

Net sales $256,031 $232,118 $515,015 $404,842 Cost of sales 202,424

183,595 409,319 315,929 Gross profit 53,607 48,523 105,696 88,913

Operating expenses: Selling and distribution 21,483 18,847 42,949

32,897 General and administrative 12,096 13,791 25,622 26,614 Other

operating (income) expense - net (365) 1,006 (311) 1,952

Amortization expense 1,244 845 2,310 1,309 Total operating expenses

34,458 34,489 70,570 62,772 Operating income 19,149 14,034 35,126

26,141 Other expense: Interest expense, net 3,977 3,252 7,801 3,413

Total other expense 3,977 3,252 7,801 3,413 Income from continuing

operations before income taxes 15,172 10,782 27,325 22,728 Income

taxes 5,789 4,182 10,519 8,722 Income from continuing operations

9,383 6,600 16,806 14,006 Loss from discontinued operations, net of

tax (21) (6) (30) (13) Net income $9,362 $6,594 $16,776 $13,993

Weighted average common shares: Basic 31,202 31,145 31,202 31,121

Diluted 31,311 31,231 31,312 31,224 Basic earnings per common

share: Income from continuing operations $0.30 $0.21 $0.54 $0.45

Loss from discontinued operations, net of tax -- -- -- -- Net

income $0.30 $0.21 $0.54 $0.45 Diluted earnings per common share:

Income from continuing operations $0.30 $0.21 $0.54 $0.45 Loss from

discontinued operations, net of tax -- -- -- -- Net income $0.30

$0.21 $0.54 $0.45 Supplemental Information: Depreciation and

Amortization 8,036 6,251 15,853 10,766 Expense under FAS123R,

before tax 3,077 4,423 6,789 9,238 Segment Information: Pickle

Segment Net Sales 94,296 98,291 166,736 172,432 Adjusted Gross

Margin 10,596 12,877 18,572 24,710 Adjusted Gross Margin Percent

11.2% 13.1% 11.1% 14.3% Powder Segment Net Sales 65,642 60,775

137,456 127,613 Adjusted Gross Margin 12,710 11,226 25,044 24,385

Adjusted Gross Margin Percent 19.4% 18.5% 18.2% 19.1% Soup &

Infant Feeding Segment Net Sales 61,279 42,659 147,063 42,659

Adjusted Gross Margin 9,660 4,355 22,592 4,355 Adjusted Gross

Margin Percent 15.8% 10.2% 15.4% 10.2% The following table

reconciles our net income to adjusted EBITDA for the months ended

June 30, 2007 and 2006: TREEHOUSE FOODS, INC. RECONCILIATION OF

REPORTED INCOME TO ADJUSTED EBITDA (In thousands, except per share

data) Three Months Ended Six Months Ended June 30 June 30 2007 2006

2007 2006 (unaudited) (unaudited) Net income as reported $9,362

$6,594 $16,776 $13,993 Net Interest expense 3,977 3,252 7,801 3,413

Income taxes 5,789 4,182 10,519 8,722 Discontinued operations 21 6

30 13 Depreciation and amortization 8,036 6,251 15,853 10,766 Stock

option expense 3,077 4,423 6,789 9,238 Plant shut-down costs, asset

sales and purchase accounting (356) 1,927 (277) 2,879 Adjusted

EBITDA $29,906 $26,635 $57,491 $49,024

http://www.newscom.com/cgi-bin/prnh/20050726/CGTREELOGO

http://photoarchive.ap.org/ DATASOURCE: TreeHouse Foods, Inc.

CONTACT: TreeHouse Foods, Inc., Investor Relations,

+1-708-483-1300, ext. 1331 Web site: http://www.treehousefoods.com/

Copyright

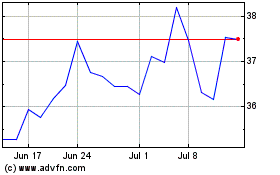

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jun 2024 to Jul 2024

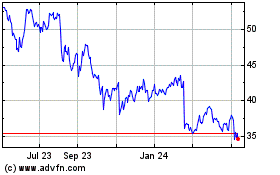

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jul 2023 to Jul 2024