WESTCHESTER, Ill., Aug. 10 /PRNewswire-FirstCall/ -- TreeHouse

Foods, Inc. (NYSE:THS) today announced that income from continuing

operations was $0.21 per diluted share for the quarter ended June

30, 2006, compared to $0.05 per diluted share in the second quarter

of 2005. Results for the 2006 quarter include $0.09 per share of

expense recognized under Statement of Financial Accounting

Standards No. 123R, Share-Based Payment, $0.02 relating to the

previously announced closure of the La Junta, CO pickle factory and

$0.02 per share relating to purchase accounting adjustments

resulting from the previously announced acquisition of the soup and

infant feeding ("SIF") business from Del Monte Foods on April 24,

2006. Results for the second quarter 2005 included expenses of

$0.31 per share related to the spin-off of the company from Dean

Foods, partially offset by $0.05 in one-time gains from legal

settlements and asset sales. Excluding these items, quarterly

earnings per share would have increased to $0.34 per share in 2006

compared to $0.31 per share in 2005. Net sales for the second

quarter of 2006 totaled $232.1 million, an increase of 25.5% over

the second quarter of 2005 reflecting the additional revenues of

soup and infant feeding products. Excluding SIF, revenues increased

2.4%. Pickle revenues increased by 3.7% due to the acquisition of

the Oxford Foods book of business in February 2006. Non-dairy

powdered creamer sales decreased by .8% as private label gains were

offset by branded creamer and ingredient sales declines. Other

product sales grew 5.1% due to higher co-pack revenues in our

refrigerated business. Gross margin for the second quarter was

20.9% compared to 21.9%, with the decrease resulting from lower

overall margins in the soup and infant feeding business compared to

the historical business segments. Excluding SIF, gross margins

increased by 0.1 percentage point to 22.0%. Operating expenses

increased from $31.4 million during the second quarter of 2005 to

$34.5 million. This year's expenses include the addition of the SIF

business ($5.1 million), share based compensation expense ($4.4

million), and plant shutdown costs ($1.0 million). Last year's

expenses included costs related to the spin-off of the business

from Dean Foods ($9.5 million) and gains relating to asset sales

and legal settlements ($2.3 million). After considering these

items, operating expenses in the historical business were lower

this year compared to last year as 2006 had lower branded marketing

expenditures which more than offset higher administrative costs. On

a sequential basis, second quarter 2006 operating expenses improved

to 14.9% of sales compared to 16.4% in the first quarter of this

year due primarily to overhead efficiencies when adding the SIF

business. Commenting on the results, Sam K. Reed, Chairman and CEO,

said, "We continued to increase revenues, adjusted gross margin and

operating income in our legacy private label and foodservice

businesses. Operating performance improved as a combination of

price increases and productivity gains outweighed energy and input

cost inflation. The recently acquired soup and infant feeding

segment showed strong top line growth, even though the quarter

included only nine weeks of their results. We are very pleased with

the positive results in the quarter, especially including the

addition of such a strategically important acquisition as canned

soup." SEGMENT RESULTS Pickle segment net sales for the second

quarter increased by approximately $3.5 million from the prior year

due to both higher pricing and increased volumes from the book of

business acquired from Oxford Foods. These increases offset a

baseline volume reduction of 7.0% led by a decline in non-strategic

regional brands. Adjusted gross margin is gross profit less

delivery and commission costs and is TreeHouse's measure of segment

performance. Excluding Oxford Foods, our pickle margins remained

flat at 14.1%. However, total gross margins in the pickle segment

declined from 14.1% to 13.1% due to selling the higher cost

inventories and production from Oxford Foods during most of the

quarter. Production shifted to our plants late in the quarter so

the margin reduction will not recur. Powder segment sales decreased

by .8% compared to a year ago, as volume declines were largely

offset by price increases. Adjusted gross margins increased from

15.7% to 18.5% as internal cost savings programs and pricing

adjustments offset higher input costs and freight charges. Soup and

Infant Feeding products are new as a result of the acquisition of

this business on April 24, 2006. On a comparative basis to last

year, revenues increased from $37.6 million to $42.7 million or

13.5% primarily due to our arrangements to co-pack certain products

for other food companies. Co-pack revenues are at much lower

margins than typical customer revenues, resulting in lower overall

margins compared to last year. OUTLOOK FOR THE REMAINDER OF 2006

"In the second quarter we successfully completed the acquisition of

the soup and infant feeding business that opens a new strategic

vista for TreeHouse. Additionally, we maintained the discipline and

focus necessary to increase revenues and profitability of our

legacy private label and food service business," said Reed. "We

have been very pleased with the dedication and commitment shown by

our new SIF management team and will continue to focus on

integration activities during the balance of 2006. We have seen

continued price pressures with a variety of key input costs, but we

have managed resourcefully to offset their negative affects. We are

confident that we have sufficient plans in place to meet our goals

for this year, and as such, are confirming our earlier guidance of

earnings per share in the range of $0.86 to $0.91 per share for our

full year results." Conference Call Webcast A webcast to discuss

the company's financial results will be held at 10:00 a.m. (Eastern

Standard Time) today and may be accessed by visiting the "Webcast"

section of the company website at http://www.treehousefoods.com/ .

About TreeHouse Foods TreeHouse is a food manufacturer servicing

primarily the retail grocery and foodservice channels. Its products

include pickles and related products; non-dairy powdered coffee

creamer; private label soup and infant feeding products, and other

food products including aseptic sauces, refrigerated salad

dressings, and liquid non-dairy creamer. TreeHouse believes it is

the largest manufacturer of pickles and non-dairy powdered creamer

in the United States based on sales volume. FORWARD LOOKING

STATEMENTS This press release contains "forward-looking

statements." Forward-looking statements include all statements that

do not relate solely to historical or current facts, and can

generally be identified by the use of words such as "may,"

"should," "could," "expects," "seek to," "anticipates," "plans,"

"believes," "estimates," "intends," "predicts," "projects,"

"potential" or "continue" or the negative of such terms and other

comparable terminology. These statements are only predictions. The

outcome of the events described in these forward-looking statements

is subject to known and unknown risks, uncertainties and other

factors that may cause the company or its industry's actual

results, levels of activity, performance or achievements to be

materially different from any future results, levels of activity,

performance or achievement expressed or implied by these

forward-looking statements. TreeHouse's Form 10-K for the year

ended December 31, 2005 discusses some of the factors that could

contribute to these differences. You are cautioned not to unduly

rely on such forward-looking statements, which speak only as of the

date made, when evaluation the information presented in this

presentation. The company expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein, to reflect any change

in its expectations with regard thereto, or any other change in

events, conditions or circumstances on which any statement is

based. FINANCIAL INFORMATION TREEHOUSE FOODS, INC. CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share

data) Three Months Ended Six Months Ended June 30 June 30 2006 2005

2006 2005 (unaudited) (unaudited) Net sales $232,118 $185,008

$404,842 $351,383 Cost of sales 183,595 144,544 315,929 273,075

Gross profit 48,523 40,464 88,913 78,308 Operating expenses:

Selling and distribution 18,847 16,675 32,897 30,780 General and

administrative 14,797 5,662 28,566 9,239 Management fee paid to

Dean Foods 1,470 2,940 Other Operating expense, net 7,135 7,279

Amortization expense 845 414 1,309 828 Total operating expenses

34,489 31,356 62,772 51,066 Operating income 14,034 9,108 26,141

27,242 Other (income) expense: Interest expense, net 3,252 172

3,413 365 Other (income) expense, net - (5) - (66) Total other

(income) expense 3,252 167 3,413 299 Income from continuing

operations before income taxes 10,782 8,941 22,728 26,943 Income

taxes 4,182 7,404 8,722 14,024 Income from continuing operations

6,600 1,537 14,006 12,919 Loss from discontinued operations, net of

tax (6) (256) (13) (595) Net income $6,594 $1,281 $13,993 $12,324

Weighted average common shares: Basic 31,145 30,801 31,121 30,801

Diluted 31,231 31,060 31,224 31,060 Basic earnings per common

share: Income from continuing operations $0.21 $0.05 $0.45 $0.42

Loss from discontinued operations, net of tax (0.00) (0.01) (0.00)

(0.02) Net income $0.21 $0.04 $0.45 $0.40 Diluted earnings per

common share: Income from continuing operations $0.21 $0.05 $0.45

$0.42 Loss from discontinued operations, net of tax (0.00) (0.01)

(0.00) (0.02) Net income $0.21 $0.04 $0.45 $0.40 Supplemental

Information: Depreciation and Amortization 6,251 4,125 10,766 8,256

Expense under FAS123R, before tax 4,423 - 9,239 - Segment

Information: Pickle Segment Net Sales 98,291 94,798 172,432 168,001

Adjusted Gross Margin 12,877 13,354 24,710 23,621 Adjusted Gross

Margin Percent 13.1% 14.1% 14.3% 14.1% Powder Segment Net Sales

60,775 61,289 127,613 125,838 Adjusted Gross Margin 11,226 9,614

24,385 20,816 Adjusted Gross Margin Percent 18.5% 15.7% 19.1% 16.5%

Soup & Infant Feeding Segment Net Sales 42,659 - 42,659 -

Adjusted Gross Margin 4,355 - 4,355 - Adjusted Gross Margin Percent

10.2% - 10.2% -

http://www.newscom.com/cgi-bin/prnh/20050726/CGTREELOGO

http://photoarchive.ap.org/ DATASOURCE: TreeHouse Foods, Inc.

CONTACT: Investor Relations, +1-708.483.1300 ext 1344 Web site:

http://www.treehousefoods.com/

Copyright

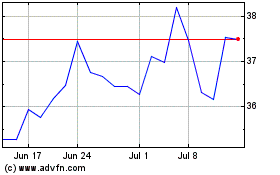

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From May 2024 to Jun 2024

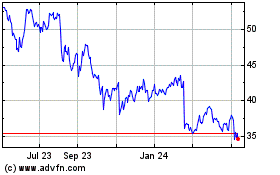

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jun 2023 to Jun 2024