WESTCHESTER, Ill., Feb. 15 /PRNewswire-FirstCall/ -- TreeHouse

Foods, Inc. (NYSE:THS) today announced a loss from continuing

operations of $0.18 per diluted share for the quarter ended

December 31, 2005, compared to income of $0.28 per diluted share in

the fourth quarter of 2004. The loss from continuing operations was

$5.6 million in the fourth quarter of 2005 compared to income of

$8.7 million in the fourth quarter of 2004. (Logo:

http://www.newscom.com/cgi-bin/prnh/20050726/CGTREELOGO ) Results

for the fourth quarter of 2005 include pre-tax charges of $9.9

million associated with the previously announced closure of the

company's La Junta, Colorado pickle manufacturing plant. The

company also recorded $4.7 million of charges to write down the

value of certain trademarks, reflecting the company's strategic

focus on private label instead of branded product. Expense

recognized under Statement of Financial Accounting Standards No.

123R, Share-Based Payment, was $4.8 million for the quarter.

Together these items reduced operating income by $19.4 million and

income from continuing operations by $.37 per diluted share.

Excluding these items, income from continuing operations per

diluted share would have been $0.19 compared to $0.28 in the fourth

quarter of 2004. Net sales for the fourth quarter of 2005 totaled

$184.5 million, an increase of 2.8% over the fourth quarter of

2004. Increases in non-dairy powdered creamer and other product

sales more than offset declines in pickle sales. Commenting on the

fourth quarter results, Sam K. Reed, Chairman and CEO, said, "The

fourth quarter saw TreeHouse take decisive action following the

unusual operational difficulties and surging cost inflation that

affected the September quarter. We instituted a comprehensive price

increase, announced the closure of one of our pickle plants and

made several management changes." RESULTS FOR THE YEAR ENDED

DECEMBER 31, 2005 For the full year ended December 31, 2005

TreeHouse reported income from continuing operations of $0.39 per

diluted share compared to $1.44 in 2004. Income from continuing

operations was $12.3 million in 2005 compared to $44.7 million in

2004. Results for 2005 include pre-tax charges of $9.9 million to

write down the La Junta, Colorado pickle manufacturing plant, $4.7

million of charges to write down the value of certain trademarks,

$1.7 million of gains on asset sales and $1.2 million of gains from

a litigation settlement. TreeHouse also recorded $9.7 million for

the non-recurring costs of accomplishing the spin- off of TreeHouse

from Dean Foods Company (NYSE:DF) completed on June 27, 2005. These

spin-off costs are not deductible for income tax purposes.

Together, these items reduced operating income by $21.4 million and

income from continuing operations by $0.54 per diluted share. These

items are included in the accompanying Condensed Consolidated

Statements of Income as "Other operating (income) expense - net."

TreeHouse adopted Statement of Financial Accounting Standards No.

123R, Share-Based Payment, at the beginning of the third quarter of

2005. The total amount of expense recognized in 2005 was $9.6

million, equivalent to $0.18 in income from continuing operations

per diluted share. The expense was primarily attributable to the

restricted stock and restricted stock units granted to TreeHouse's

management investors on June 28, 2005 under the terms of agreements

with Dean Foods in conjunction with the spin-off of TreeHouse from

Dean Foods. Both the restricted stock and restricted stock units

are subject to performance conditions for vesting. Excluding both

Other operating (income) expense -- net of $21.4 million and FAS

No, 123R, Share-Based Payment, expense of $9.6 million from 2005's

reported results would show operating income of $59.6 million for

2005 versus $71.6 million in 2004. This represents 8.4% of net

sales, down from 10.3% of sales in 2004. Income from continuing

operations per diluted share, again excluding these two items,

would be $1.11 per share versus $1.44 in 2004. Net sales for 2005

were $707.7 million, an increase of 1.9% compared to $694.6 million

in 2004. Increases in non-dairy powdered creamer and other product

sales more than offset declines in pickle sales. SEGMENT RESULTS

Pickle segment net sales for the fourth quarter decreased by

approximately $4.4 million driven primarily by declining volumes.

For the year, sales were down 5.6% or $19.1 million. Adjusted gross

margin rose by $0.1 million to 10.5% of net sales for the fourth

quarter, compared to 9.7% a year ago. Adjusted gross margin is

gross profit less delivery and commission costs and is TreeHouse's

measure of segment performance. The margin in the quarter is below

the full year 2005 rate of 13.0%, reflecting cost increases and the

negative impact on overhead of reduced volumes. Cost increases in

the quarter included higher utility, glass and plastic container

costs, largely driven by the underlying increases in natural gas

and oil. Powder segment sales increased $6.1 million or 8.9% in the

fourth quarter, almost all due to volume. For the year, powder

sales were up 9.6%. In the fourth quarter of 2005, adjusted gross

margin fell by $.2 million and declined as a percentage of net

sales from 16.5% to 14.8%. Full year 2005 adjusted gross margins

for powder were 15.6%. The decline in margin was primarily due to

increases in raw material, plastic packaging and natural gas costs

which have not been completely passed through to customers by

higher prices. GUIDANCE FOR 2006 TreeHouse expects that its

operating cost structure will continue to increase in 2006. We

expect cost increases for commodities, particularly sweeteners,

packaging, vegetable crop, processing and freight. Many of these

increases are driven by the underlying increases in the cost of

energy, both natural gas and oil, that the company has experienced

in the second half of 2005. TreeHouse has initiated price increase

and cost reduction programs to attempt to offset these costs

increases. Net sales are expected to increase by 2.0% to 2.5% in

2006. Continuing strong sales of powder products should more than

offset continued weakness in pickle sales. Operating income should

be around 9% of net sales as the effects of pricing and cost

control are felt. We expect income from continuing operations,

before FAS123R expense and restructuring costs, in the range of $38

to $40 million, or $1.25 to $1.30 per diluted share, based on 31.1

million weighted average shares outstanding. We expect to complete

the closing of our La Junta plant and distribution center in 2006,

which will result in approximately $0.05 per diluted share in

additional restructuring costs. In addition, the non-cash, after

tax costs of recording the value of stock based incentive programs

will be approximately $0.38 per fully diluted share in 2006

compared to $0.18 per fully diluted share in 2005. The increase in

costs is due to recognizing a full year of expense in 2006 compared

to a partial year in 2005. We expect to see fully diluted EPS

increase from $0.37 per share to a range of $0.81 to $0.86 per

share. Commenting on the outlook for 2006, Sam K. Reed said,

"TreeHouse has taken a series of actions that should lead to good

growth in 2006. Pickle sales remain soft and costs will increase

substantially in 2006, particularly for packaging, crop and

sweeteners. We have a realistic view of conditions, have

successfully implemented price increases with our customers and

continue to look at opportunities to manage our cost structure. We

believe we have the plans in place to achieve 10% growth in

operating earnings this year." Conference Call Webcast A webcast to

discuss the company's financial results will be held at 10:00 a.m.

(Eastern Standard Time) today and may be accessed by visiting the

"Webcast" section of the company website at

http://www.treehousefoods.com/ . About TreeHouse Foods TreeHouse is

a food manufacturer servicing primarily the retail grocery and

foodservice channels. Its products include pickles and related

products; non-dairy powdered coffee creamer; and other food

products including aseptic sauces, refrigerated salad dressings,

and liquid non-dairy creamer. TreeHouse believes it is the largest

manufacturer of pickles and non-dairy powdered creamer in the

United States based on sales volume. FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements."

Forward-looking statements include all statements that do not

relate solely to historical or current facts, and can generally be

identified by the use of words such as "may," "should," "could,"

"expect," "seek to," "anticipates," "plans," "believes,"

"estimates," "intends," "predicts," "projects," "potential" or

"continue" or the negative of such terms and other comparable

terminology. These statements are only predictions. The outcome of

the events described in these forward-looking statements is subject

to known and unknown risks, uncertainties and other factors that

may cause the company or its industry's actual results, levels of

activity, performance or achievements to be materially different

from any future results, levels of activity, performance or

achievement expressed or implied by these forward-looking

statements. TreeHouse's Registration Statement on Form 10 discusses

some of the factors that could contribute to these differences. You

are cautioned not to unduly rely on such forward-looking

statements, which speak only as of the date made, when evaluation

the information presented in this presentation. The company

expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained

herein, to reflect any change in its expectations with regard

thereto, or any other change in events, conditions or circumstances

on which any statement is based. FINANCIAL INFORMATION TREEHOUSE

FOODS, INC. CONDENSED CONSOLIDATED STATEMENTS OF INCOME (In

thousands, except per share data) Three Months Ended Year Ended

December 31 December 31 2005 2004 2005 2004 Net sales $184,476

$179,486 $707,731 $694,619 Cost of sales 149,423 140,710 560,094

537,970 Gross profit 35,053 38,776 147,637 156,649 Operating

expenses: Selling and distribution 15,940 15,162 60,976 61,484

General and administrative 7,411 2,860 22,359 11,020 Management fee

paid to Dean Foods - 6,375 2,940 11,100 Stock based compensation

4,814 - 9,618 - Other operating (income) expense - net 14,461 -

21,423 - Amortization expense 452 453 1,732 1,477 Total operating

expenses 43,078 24,850 119,048 85,081 Operating income (loss)

(8,025) 13,926 28,589 71,568 Other (income) expense: Interest

expense, net 448 165 1,216 710 Other (income) expense, net - 37

(66) 116 Total other (income) expense 448 202 1,150 826 Income

(Loss) from continuing operations before income taxes (8,473)

13,724 27,439 70,742 Income taxes (2,866) 5,028 15,174 26,071

Income (Loss) from continuing operations (5,607) 8,696 12,265

44,671 Loss from discontinued operations, net of tax (41) (250)

(689) (9,595) Net income (Loss) $(5,648) $8,446 $11,576 $35,076

Weighted average common shares: Basic 31,088 30,801 30,905 30,801

Diluted 31,088 31,060 31,108 31,060 Basic earnings per common

share: Income (Loss) from continuing operations $(0.18) $0.28 $0.40

$1.45 Loss from discontinued operations, net of tax - (0.01) (0.02)

(0.31) Net income $(0.18) $0.27 $0.38 $1.14 Diluted earnings per

common share: Income (Loss) from continuing operations $(0.18)

$0.28 $0.39 $1.44 Loss from discontinued operations, net of tax -

(0.01) (0.02) (0.31) Net income (Loss) $(0.18) $0.27 $0.37 $1.13

Supplemental Information: Depreciation and Amortization 4,254 2,380

16,942 14,863 Expense under FAS123R, before tax 4,814 - 9,618 -

Segment Information: Pickle Segment Net Sales 76,103 80,524 320,149

339,249 Adjusted Gross Margin 7,991 7,851 41,645 46,954 Adjusted

Gross Margin Percent 10.5% 9.7% 13.0% 13.8% Powder Segment Net

Sales 75,302 69,165 263,770 240,644 Adjusted Gross Margin 11,171

11,395 41,138 40,913 Adjusted Gross Margin Percent 14.8% 16.5%

15.6% 17.0% First Call Analyst: FCMN Contact:

michelle_junkas@treehousefoods.com

http://www.newscom.com/cgi-bin/prnh/20050726/CGTREELOGO

http://photoarchive.ap.org/ DATASOURCE: TreeHouse Foods, Inc.

CONTACT: Investor Relations for TreeHouse Foods, Inc.,

+1-708-483-1300 Ext. 1344 Web site: http://www.treehousefoods.com/

Copyright

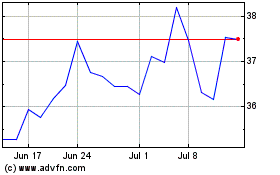

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jun 2024 to Jul 2024

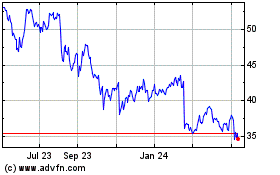

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jul 2023 to Jul 2024