For Immediate Release

Chicago, IL – December 5, 2011 – Zacks Equity Research

highlights Tenet Healthcare (THC) as the Bull of

the Day and China Life Insurance (LFC) as the Bear

of the Day. In addition, Zacks Equity Research provides analysis on

Groupon Inc. (GRPN), Google

(GOOG) and Amazon (AMZN).

Full analysis of all these stocks is available at

http://at.zacks.com/?id=2678.

Here is a synopsis of all five stocks:

Bull of the Day:

We are upgrading our recommendation on Tenet

Healthcare (THC) to Outperform based on its strong

operating performance in the recent third quarter, which surpassed

the Zacks Consensus Estimate, driven by strong results in all lines

of the business, especially the robust performance in outpatient

volumes and higher admissions.

New debt financing has improved Tenet's maturity profile and is

also likely to reduce the company's future interest payments

significantly. Moreover, we believe that volume growth can

substantially help boost the earnings outlook of Tenet in future,

while also facilitating growth through the acquisitions.

Our six-month target price of $5.50 per share equates to about

12.8x our earnings estimate for 2011. With no dividend supplement,

this target price implies an expected total return of 18.3% over

that period.

Bear of the Day:

China Life Insurance's (LFC)

third-quarter earnings witnessed a steep decline from the

comparable period of last year. High surrenders, low premium income

and increased impairment losses led to a decline in the net income,

while increased unrealized losses in the investment portfolio led

to reduced shareholders equity.

Additionally, China Life inherently faces substantial interest

rate, market and currency risk. Although the company has a strong

brand name, it has to deal with considerable competition on the

domestic front, which limits earnings growth. However, the debt

issue is expected to improve solvency margin, while high liquidity

will enable the company to take the high surrender rate in its

stride.

Our six-month target price of $35.00 equates to 19.2x our

earnings estimate for 2011. Combined with the $0.81 per ADR annual

dividend, this target price implies an expected negative total

return of 7.1% over that period. This is consistent with our

Underperform recommendation on the ADRs.

Latest Posts on the Zacks Analyst Blog:

Daily Deals: The Future in Retail

What has become commonplace for tech companies and others aiming

to lower costs is now seeping into the retail segment as well. The

idea is the same: outsource routine functions to a specialized

party, making them responsible for volumes that could generate

higher profits than those shared with them.

This is what the tech companies had been doing previously, although

they outsourced the manufacturing function, which is easier to

understand given the tangible nature of goods produced. Also, the

outsourcing of manufacturing was to lower-cost regions, so the cost

advantage was significant. Naturally, the impact on profits was

also greater, enabling them to pour funds into R&D and thereby

increase product differentiation.

Background

Things are different in retail, however, especially for the small

retailers that have been more willing to experiment. Here, store

location is of paramount importance, since adequate space is

required to stock and display wares, and also attract customers.

Therefore, the primary concern for the small retailer is real

estate that suits his or her needs.

After selecting the location, there are only a handful of things

that the retailer could do to differentiate his or her store from

the one next door. This lack of differentiation makes it impossible

for retailers to generate high margins, forcing them to compete on

price instead.

The retailer’s next focus is the generation of traffic. Here, he or

she is limited by the physical location of the store. As a result,

there is reason for retailers to be interested in companies that

send customers to their stores directly. And this is what the

specialized companies like recently public Groupon

Inc. (GRPN) and LivingSocial have been doing.

Google (GOOG) Offers and Amazon

(AMZN) Local are other similar services.

Business Model of the “Specialized” Players

The concept started pretty crudely, with the daily deals companies

offering coupons that promised huge discounts. The coupon was

priced in a manner that could induce the buyer to spend more.

However, the system didn’t really work, because many customers did

not spend the full coupon value and the initiative failed to

generate repeat customers.

While the basic concept remains the same, most companies are now

changing the rules of the game. They are tracking customer

preferences through their registered credit cards to determine the

kinds of products that induce a particular customer to repeat the

purchase. This information is then being used to create customer

profiles.

Customer profile data is perhaps the most valuable asset that these

companies possess -- this is their bread and butter. Therefore,

companies with a larger customer base (people purchasing coupons)

and number of partners (retailers signing up for the service) stand

a greater chance of creating valuable information. This clearly

makes Groupon the leader in the space since its user and partner

bases are both significantly higher than other players.

Moreover, the selection is also broader these days, with electronic

goods, events, services and travel joining retail and restaurants.

The inclusion of electronic goods is a big positive because this is

an area that is expected to attract the largest percentage of

consumer discretionary dollars in the next few years.

Get the full analysis of all these stocks by going to

http://at.zacks.com/?id=2649.

About the Bull and Bear of the Day

Every day, the analysts at Zacks Equity Research select two

stocks that are likely to outperform (Bull) or underperform (Bear)

the markets over the next 3-6 months.

About the Analyst Blog

Updated throughout every trading day, the Analyst Blog provides

analysis from Zacks Equity Research about the latest news and

events impacting stocks and the financial markets.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous analyst coverage is provided for a universe of 1,150

publicly traded stocks. Our analysts are organized by industry

which gives them keen insights to developments that affect company

profits and stock performance. Recommendations and target prices

are six-month time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today by visiting

http://at.zacks.com/?id=7158.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD from MIT Len

knew he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment

Research is through our free daily email newsletter; Profit from

the Pros. In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=4582.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

AMAZON.COM INC (AMZN): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

GROUPON INC (GRPN): Free Stock Analysis Report

CHINA LIFE INS (LFC): Free Stock Analysis Report

TENET HEALTH (THC): Free Stock Analysis Report

Zacks Investment Research

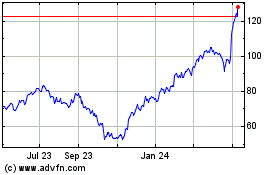

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Jun 2024 to Jul 2024

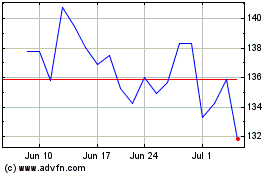

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Jul 2023 to Jul 2024