Telesp Profits on Vivo Merger - Analyst Blog

July 29 2011 - 11:30AM

Zacks

Brazilian telecom carrier Telecomunicacoes de Sao Paulo

SA (VIV), better known as Telesp, reported second quarter

net income of R$1.1 billion ($0.69 million), up 30% year over year.

Earnings per ADS came in at $1.02 in the reported quarter.

Telesp merged its fixed-line operations with the mobile service

provider Vivo Participacoes in early June. Hence, the second

quarter reflects the combined result.

Telesp, the Brazilian subsidiary of Spanish telecom giant

Telefonica (TEF), reported total revenue of R$8.23

billion ($5.16 billion), up 6.7% year over year. Both mobile and

fixed-line revenues drove the increase.

Consolidated EBITDA rose 9.1% year over year to R$3.06 billion

($1.92 billion) with EBITDA margin increasing 80 bps to 37.2%.

Operating expenses grew 5.4% to R$5.2 billion ($3.2 billion) from

the year-ago quarter.

Revenue Segments

Mobile revenue climbed 13.9% year over

to R$5 billion ($3.1 billion), driven primarily by data revenues

and network usage revenues. Telesp added 2 million customers to

reach 64 million (up 14.4% year over year) subscribers at the end

of the reported quarter. Post-paid and prepaid subscribers grew

25.4% and 11.6% year over year to 14.2 million and 49.8 million,

respectively.

Average revenue per user (ARPU) inched up 0.4% from the year-ago

quarter to R$25.1 ($15.7), owing to subscriber growth as well as

high data and voice services. Churn deteriorated slightly to 2.8%

in the reported quarter from 2.6% in the year-ago quarter.

Fixed revenue increased 8.1% to R$4.2 billion

($2.6 billion) from the year-ago quarter. Pay TV saw the largest

growth of 88% year over year. Other services (up 28.7%), data

transmission (up 15%), Interconnection (up 2.9%) and fixed voice

(up 1.7%) revenues also aided revenue growth.

Total fixed access lines reached 15.28 million at the end of the

second quarter, reflecting a 3.9% year-over-year increase. Telesp

registered 93,000 net additions for its fixed broadband service

(offered under the “Speedy”, “Ajato” and “Fiber” brands), bringing

the total subscriber base to roughly 3.5 million (up 16.8% year

over year).

The Pay TV subscriber base grew 45.5% year over year to 682,000

customers. Fixed voice lost 46,000 customers, touching 11.1 million

at the end of the second quarter.

Liquidity

Telesp exited the quarter with cash and cash equivalents of

R$2.66 billion ($1.67 billion) compared with R$2.36 billion in the

year-ago quarter. Total debt reduced substantially to R$5.7 billion

($3.57 billion) from R$6.6 billion in the year-ago quarter.

Capital expenditure increased 94.6% year over year to R$1.8

billion ($1.13 billion).

Our Analysis

Telesp as a stand-alone entity was struggling to perform so far

as it was significantly challenged by persistent erosion in its

voice telephony business due to stiff competition.

We believe the Vivo integration would bring back the company’s

profitability through its strong mobile service business. The

combined company will now offer bundled (fixed-line and wireless)

services that will improve its competitive position and expand its

opportunities beyond the current expectations. The combined company

expects R$8.2 ($5.3 billion) synergies from the merger that will

start reaping results from the fourth quarter.

We are currently maintaining our long-term Neutral rating on

Telesp. The stock retains a Zacks #3 Rank (Hold) for the short term

(1-3 months).

TELEFONICA S.A. (TEF): Free Stock Analysis Report

TELECOM DE SP (VIV): Free Stock Analysis Report

Zacks Investment Research

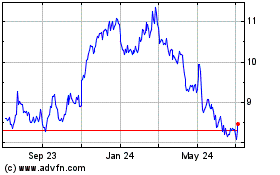

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

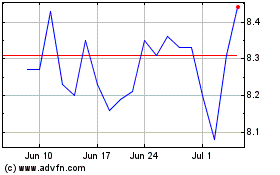

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Apr 2023 to Apr 2024