Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July 2019

Commission File Number: 001-13464

Telecom

Argentina S.A.

(Translation of registrant’s name into English)

Alicia Moreau de Justo, No. 50, 1107

Buenos Aires, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes

o

No

x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes

o

No

x

Table of Contents

FREE TRANSLATION

Buenos Aires, July 19, 2019

Comisión Nacional de Valores

Dear Sirs,

RE.: Telecom Argentina S.A.

Mandatory Public Tender Offer

I am writing to you as Attorney in Fact of Telecom Argentina S.A. (“Telecom Argentina” or the “Company”),

regarding the Mandatory Public Tender Offer promoted by Cablevisión Holding S.A. (“CVH”) on June 21, 2018.

In this regard, we attach herewith the note received today from CVH informing us that on the date hereof it had been served notice of a resolution rendered on July 19, 2019 (a copy of which is attached) by the Chamber No. I of the Federal Civil and Commercial Court of Appeals of the City of Buenos Aires in re “Cablevisión Holding SA v. Argentine Securities Commission on Injunctions”(File No. 7998/2018), pending before the Federal Civil and Commercial Court of First Instance No. 3.

Sincerely,

|

|

|

|

|

Telecom Argentina S.A.

|

|

|

|

|

|

/s/ Alejandra Lea Martínez

|

|

|

Attorney in Fact

|

3

Table of Contents

Buenos Aires, July 19, 2019

Mr. Chairman of the Board of Directors of

Telecom Argentina S.A.

Alicia Moreau de Justo 50, Floor 13th,

City of Buenos Aires

RE.: Mandatory Public Tender Offer promoted and formulated by Cablevisión Holding S.A.

Dear Sirs,

María Lucila Romero, in my capacity of attorney in fact of Cablevisión Holding S.A. (the “Company”), I am witting to you in order to inform you that the Company has been notified today of a resolution rendered on the date hereof

by the Chamber No. I of the Federal Civil and Commercial Court of Appeals of the City of Buenos Aires in re “Cablevisión Holding S.A. v. Argentine Securities Commission on Injunctions” (File No. 7998/2018), pending before the Federal Civil and Commercial Court of First Instance No. 3 by virtue of which the injunction obtained by the Company ordering the Argentine Securities Commission to abstain (for a term of six months subsequently extended for three additional months) from issuing and resolving on the authorization of the Public Mandatory Tender Offer for the class B shares of Telecom Argentina promoted and formulated by the Company on June 21, 2018 was lifted.

The resolution lifting the injunction indicates that the eventual appeal by the Company against CNV’s decision with respect to the Mandatory Public Tender Offer promoted and formulated by the Company will have a suspensive effect. A copy of the resolution is attached.

The Company emphasizes that the main action continues to be pending before the court of first instance.

As of the date hereof, the Public Mandatory Tender Offer promoted by the Company is still subject to that other injunction rendered in re “

Burgueño Daniel a / EN-CNV a / Injunctions (Autonomous)” (File No. 89537/2018), which was notified to the Company on June 10, 2019 and remains in full force and effect.

Sincerely,

|

|

|

|

|

Cablevisión Holding S.A.

|

|

|

|

|

|

/s/ María Lucia Romero

|

|

|

Attorney in Fact

|

4

Table of Contents

|

CASE 7998/2018/CA2 -I-

|

|

“CABLEVISIÓN HOLDING SA

|

|

Judgment n° 3

|

|

A/ ARGENTINE SECURITIES

COMMISSION ON

|

|

Secretariat n° 5

|

|

INJUNCTIONS”

|

|

|

|

|

|

Buenos Aires, July 19, 2019.

|

[

Procedural formalities intentionally omitted

]

RECITALS

:

1. The claimant requested, as an autonomous injunction, that the Argentine Securities Commission (hereinafter, CNV [for its Spanish acronym]) be ordered to refrain from issuing and ruling on the authorization of the Mandatory Public Tender Offer to Acquire Class B Shares of Telecom Argentina, formulated on June 21, 2018, in accordance with the provisions of Law No 26,831, its amendment by Law No 27,440 and the rules of the CNV, until a final judgment is issued. In its initial brief, the claimant also raised the unconstitutionality of articles 4 (paragraphs 1 and 2), 5, 6 (paragraph 1), 9, 10, 13, 14, 15 and 16 of Law No 26,854 (on injunctions in which the National State intervenes) and of the last paragraph of Law No. 26,944 -on the State’s responsibility- (see pp. 1/26).

Subsequently, Cablevisión expanded the grounds of its pleading, withdrew its constitutionality claims with respect to article 4 of Law No 26,854 and requested the issuance of an interim injunction before performing the notification provided for by said rule . (see pp. 219/226). The Honorable Judge granted the required injunction, ordered the CNV to produce the corresponding report and referred the proceedings to the prosecutor (see pp. 227/228).

After the response of the CNV (see pp. 254/279) and the prosecutor’s report —opinion at pp. 303/307-, the judge —although dismissing the unconstitutionality claim - issued the required injunction for a period of 6 months. In deciding to do so, the magistrate weighed the potential harm to the claimant if -during the main 6-month process and even if the claimant’s right was recognized in the judgment- the rejection of the Mandatory Public Tender Offer to Acquire Shares, formulated by setting its value in U.S. dollars payable according to the applicable exchange rate on the day prior to the settlement date (which would mean to assume the exchange rate risk),

5

Table of Contents

inasmuch as it could be forced to pay a price higher than that the price provided in the Capital Market Law, which could cause the effects of an indirect expropriation of its investments. Likewise, the Judge took into account the negative effect that the communication of such rejection would cause in the market price of its shares and, consequently, in the value of the company, generating a decrease in its financing opportunities.

Beyond that, the judge understood that a grant of the injunction did not affect the public interest, nor did it compromise the Republic of Argentina’s own resources. Finally, the magistrate set bond at AR$20,000,000 (see pp. 316/320).

In accordance with the decision, the treatment of CNV’s appeal was declared abstract at pp. 247/252 -answered at pp. 297/299- against the pre-injunction of pp. 227/228 (see p. 350).

The grievances raised by the CNV against the resolution of pp. 316/320 can be summarized —in their substance- as follows:

a)

the Argentine Securities Commission is the authority of application and authorization of the tender offer to acquire shares made by the claimant, and it has not yet issued a decision in this respect. Therefore, the injunction granted prevents the CNV from resolving the matter within its competence, in violation of the principle of division of powers;

b)

the appealed injunction justifies the alleged irreparable harm with the reports issued by the operative departments of the CNV assuming that the CNV will resolve based on such reports, without taking into account that any reports in an administrative proceeding are not binding for the institution issuing the decision;

c)

the contested decision leaves the CNV in a state of uncertainty with respect to its response to the complaint in the ordinary lawsuit filed by the claimant, since, on the one hand, it must make a pronouncement on the tender offer made —in order to guarantee its right to defense- and, on the other hand, it is forbidden from issuing a pronouncement because of the injunction;

d)

the CNV does not fix the value and/or price of the Tender Offer to Acquire Shares. Its powers are limited to the possibility of objecting the price offered, without prejudice to the administrative and judicial remedies available to the claimant;

6

Table of Contents

f)

the communication of the injunction - which took for granted that the CNV’s decision would be the rejection of the price offered - did not cause the negative effect feared by the claimant in the listing of its shares on the market;

g)

the requirements established in article 15 of Law No 26,854 for the granting of an injunction to not innovate against the State are not present.

Once the proceedings were elevated for the purpose of processing this appeal, the case was referred to the Public Prosecutor before the Chamber (see the opinion of the Assistant Public Prosecutor at pp. 503/506). Meanwhile, the claimant requested the referral of the proceedings to the first instance in order to request the extension of the injunction, which expired on May 1, 2019 (see pp. 508/509).

The term of the injunction was extended by three months on May 6 (see p. 511). This decision gave rise to a new appeal by the CNV, in which -in essence- it argued that the legal situation had been modified by the issuance of the CNV General Resolution No. 779/18 of December 27, 2018, which regulated the tender offer regime, enshrining the principle of equal treatment of investors as one of the fundamental pillars of the procedure. The appeal also pointed out that, in the case of objection to the CNV price, the CNV reiterates its challenge procedure and, finally, the appeal questioned the dilatory conduct displayed by the claimant in this filing, as well as in the merely declaratory action filed (in which -according to the statement made at p. 645vta.

in fine

- the lawsuit has not yet been transferred).

2. In the terms in which the issue is raised, it is appropriate to recall that the High Court has repeatedly decided that judges are not obliged to analyze all the arguments articulated by the parties or evidence produced in the case, but only those that in their judgment are decisive for the resolution of the dispute (Judgments 276:132, 280:320, 303:2088, 304:819, 305:537, 307:1121).

The being said, it is necessary to ponder that, as this Court has expressed, the merits of the claim for injunction does not depend on an exhaustive and profound knowledge of the disputed matters in the main trial, but on the analysis of its mere probability regarding the invoked right (conf. this Chamber, cases 6655 of 5.7.99, 235/07 of 10.25.07, 10,408/07 of 11.13.07, 6759/07 of 2.28.08, 5537/08 of 6.4.09, among others). This permits the judge to issue a ruling without the need for a conclusive categorical study of the

7

Table of Contents

different circumstances of the legal relationship involved (conf. Judgments: 314:711), by means of a limited and reasonable approach to the underlying issue, in accordance with the narrow knowledge framework and the provisional purpose that are specific to injunctions (conf. this Chamber, case 9643/2001 of 12.14.01, 726/02 of 3.21.02, 2498/08 of 7.8.08, 2859/10 of 11.4.10, 3465/12 of 9.13.12, 7968/11 of 11.12.13, among many others; Chamber II, cases 19.392/95 of 5.30.95, 53.558/95 of 12.7.95 and 1555/98 of 10.22.98).

In this vein, the analysis of said requirement, even with this preliminary scope, also called the “superficiality of judicial knowledge” (conf. Palacio,

“Derecho Procesal Civil”,

volume VIII, p. 47), which configures a characteristic specific and exclusive to injunctive processes, must persuade the judge in sufficient terms of the reasons that injunctive relief would assist whoever is requesting jurisdictional assistance. That is to say, in the same way that it is not possible to demand certainty, it is not appropriate to declare its origin without a convincing demonstration regarding its admissibility (conf. this Chamber, case 998/02 of 3.21.02, 8164/11 of 11.29.11, 138/12 of 3.26.13, 1025/12 of 3.7.13, 6070/13 of 12.10.13, 3289/10 of 3.18.14, among many others).

3. Under such conditions, it is appropriate to state that, effectively, Article 80 of Law No 26,831 on Capital Markets establishes that the CNV will be the authority for the application and authorization of the public offering of negotiable securities falling within the entire scope of the Republic of Argentina.

It should also kept in mind that the CNV’s powers are determined by Resolution 779/18 -dictated as a consequence of the sanction of Law No 27,440 on productive financing- which establishes that the CNV shall have a period of 20 working days to resolve the request, that it may object to the price offered within that term and, finally, that -in the case of objecting to the price offered- the offeror may challenge the objection by filing the direct appeal referred to in section 143, sub-section b) of Law No 26,831.

This rule (replaced by art. 95 of Law No 27,440), establishes that the Federal Appellate Chambers with competence in commercial matters are responsible for reviewing denials of registration and authorizations.

In the circumstances set out above, the Court considers that the injunction is not appropriate for the reasons set out below.

In the first place, because the viability of the injunction is subject to the demonstration of the plausibility of the right invoked, as well as

8

Table of Contents

the danger caused by serious and irreparable harm (conf. CNAT, Chamber III, 12.20.99, DJ, 2000-2-248). Such danger must be objective, that is, not just a simple fear or apprehension of the applicant; instead, it must arise from facts that can be perceived in their possible consequences, even by third parties (conf. Cam, 1° Civ. Circ. 1° Mendoza, 2.27.96, Dial - MC18A1). On this point, the Court considers that such requirement is not sufficiently accredited, since the injunctive measure is requested on the basis of the alleged damages that an eventual adverse resolution of the CNV would cause in relation to the offer made.

On the other hand, the restrictive and exceptional framework implied by the suspension of a public act requires that, together with the general requirements of plausibility in law and danger in delay, there exist specific requirements such as irreparable damage, manifest illegality or reasons of public interest. With respect to the first question, it should not be forgotten that when it comes to injunctions directed against acts of the public authorities, compliance with the aforementioned requirements becomes stricter, to the extent that it is presented as the only way to preserve the presumption of legitimacy of the contested act (conf. this Chamber, 10.31.97, JA, 2001 - III, summary).

In addition, the

sub examination

does not seek to challenge the effects of a public act carried out, but to order the body in question to refrain from exercising a legally established competence.

In these terms, if the injunction ordered was confirmed -and as correctly stated in the prosecutor opinion at pp. 503/506-, the criterion of the Administration to resolve the fairness of the price offered were directly substituted by the Judge of the case, the procedure established by Law No 26,831 to guarantee the determination of the reasonable price would be unacceptably altered, especially where that procedure provides for direct appeal against the administrative act objecting -eventually- to the price of the offer.

It should be noted here, that on one hand, the unconstitutionality of the aforementioned law has not been raised, and therefore it can be concluded that both the procedure determined for the determination of the price and the recursive regime instituted there are fully in force and, therefore, applicable to the case. Finally, it should not be overlooked that, in accordance with the provisions of Article 13 of Law 26,854, the appeal filed will have suspensive effect, unless the protection of

9

Table of Contents

the cases listed in article 2, paragraph 2 is compromised (that is, when a dignified life is compromised in accordance with the American Convention on Human Rights, health or a food- or environmentally-related right, situations that are totally unrelated to the issues discussed here). Likewise, it should also be borne in mind that this general principle is not modified by Law No 26,831, art. 145 of which only establishes the devolutive effect for the granting of direct remedies provided for in paragraph I) a) of article 143 (with the exception of the appeal against the imposition of fines).

In summary, based on the arguments presented -and consistent with the opinion of the Assistant Attorney General before this Chamber-, the Court understands that the decision granting the injunction to the claimant (based on a hypothetical grievance) preventing the CNV from complying with its legally imposed obligations and powers, restricting the exercise of the CNV’s right of defense (by not being able to take an adequate intervention in the ordinary proceedings) and disregarding the recursive procedure instituted by the CNV, all of the above without having raised the constitutional validity of such norms, must be revoked.

In view of the fact that the granting of an interim measure, the admission of the injunction itself and its subsequent extension could have led the plaintiff to believe that the claimant was assisted by a better right for resisting the progress of the resources submitted, the costs of trial should be distributed in the order caused (articles 68, second paragraph, and 69 of the Code of Procedure).

Therefore, WE RESOLVE: to revoke the appealed judgments. The costs of trial are distributed in the order in which they were incurred.

[

Procedural formalities intentionally omitted

]

10

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Telecom

Argentina S.A.

|

|

|

|

|

|

|

|

Date: July 22, 2019

|

By:

|

/s/ Gabriel P. Blasi

|

|

|

|

Name:

|

Gabriel P. Blasi

|

|

|

|

Title:

|

Responsible for Market Relations

|

12

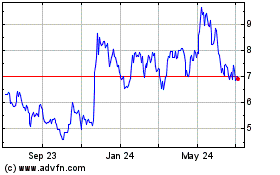

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

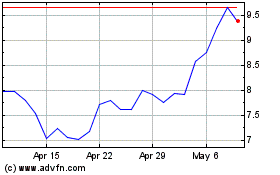

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Apr 2023 to Apr 2024