Stifel Financial Corp. (NYSE: SF) today reported net revenues of

$1.0 billion for the three months ended September 30, 2023,

compared with $1.0 billion a year ago. Net income available to

common shareholders was $58.8 million, or $0.52 per diluted common

share, compared with $141.8 million, or $1.21 per diluted common

share for the third quarter of 2022. Non-GAAP net income available

to common shareholders was $67.4 million, or $0.60 per diluted

common share for the third quarter of 2023.

Ronald J. Kruszewski, Chairman

and Chief Executive Officer, said “Stifel generated a solid quarter

despite challenging market conditions. Our bottom line was impacted

by non-recurring legal accruals, primarily associated with an

industry-wide SEC review of off-channel communications that totaled

$0.58 per diluted common share, after tax. Excluding the impact of

these charges, our results are consistent with those in the

sequential and year-ago quarters. Although the near-term

environment remains uncertain, we remain well positioned to

generate stable returns and strong growth as the market

improves.”

Highlights

- The Company reported net revenues

of $1.05 billion as our business navigated an environment that

remains challenging.

- Non-GAAP net income available to

common shareholders of $0.60 per diluted common share was

negatively impacted by elevated provisions for legal and regulatory

matters of $0.58 per diluted common share (after-tax).

- Net interest income up $40.2

million, or 17%, over the year-ago quarter.

- Recruited 36 financial advisors

during the quarter, including 24 experienced employee

advisors.

- Non-GAAP pre-tax margin of 12% was

negatively impacted by elevated provisions for legal and regulatory

matters.

- Annualized return on tangible

common equity (ROTCE) (5) of 9%.

- Tangible book value per common

share (7) of $30.06, up 2% from prior year.

- The Board of Directors approved an

increase to the Company’s share repurchase program of an additional

10.0 million shares, bringing the authorized share repurchase

amount to 14.2 million shares.

|

Financial Summary (Unaudited) |

|

(000s) |

3Q 2023 |

3Q 2022 |

9m 2023 |

9m 2022 |

|

GAAP Financial Highlights: |

|

|

|

|

Net revenues |

$ |

1,045,051 |

|

$ |

1,045,139 |

|

$ |

3,202,565 |

|

$ |

3,269,792 |

|

| Net income (1) |

$ |

58,840 |

|

$ |

141,849 |

|

$ |

332,091 |

|

$ |

457,573 |

|

| Diluted EPS (1) |

$ |

0.52 |

|

$ |

1.21 |

|

$ |

2.91 |

|

$ |

3.89 |

|

| Comp. ratio |

|

58.7 |

% |

|

58.5 |

% |

|

58.7 |

% |

|

59.3 |

% |

| Non-comp. ratio |

|

30.8 |

% |

|

21.8 |

% |

|

25.7 |

% |

|

20.8 |

% |

| Pre-tax

margin |

|

10.5 |

% |

|

19.7 |

% |

|

15.6 |

% |

|

19.9 |

% |

|

Non-GAAP Financial Highlights: |

|

|

|

|

Net revenues |

$ |

1,045,028 |

|

$ |

1,045,133 |

|

$ |

3,202,539 |

|

$ |

3,269,847 |

|

| Net income (1) (2) |

$ |

67,413 |

|

$ |

150,756 |

|

$ |

364,937 |

|

$ |

490,196 |

|

| Diluted EPS (1) (2) |

$ |

0.60 |

|

$ |

1.29 |

|

$ |

3.20 |

|

$ |

4.17 |

|

| Comp. ratio (2) |

|

58.0 |

% |

|

58.0 |

% |

|

58.0 |

% |

|

58.5 |

% |

| Non-comp. ratio (2) |

|

30.2 |

% |

|

21.2 |

% |

|

24.9 |

% |

|

20.2 |

% |

| Pre-tax margin (3) |

|

11.8 |

% |

|

20.8 |

% |

|

17.1 |

% |

|

21.3 |

% |

| ROCE (4) |

|

5.8 |

% |

|

13.3 |

% |

|

10.4 |

% |

|

14.7 |

% |

| ROTCE

(5) |

|

8.5 |

% |

|

19.2 |

% |

|

15.1 |

% |

|

21.5 |

% |

|

Global Wealth Management (assets and loans

in millions) |

|

| Net revenues |

$ |

768,558 |

|

$ |

701,820 |

|

$ |

2,283,934 |

|

$ |

2,081,525 |

|

| Pre-tax net income |

$ |

298,449 |

|

$ |

279,935 |

|

$ |

914,462 |

|

$ |

750,500 |

|

| Total client assets |

$ |

412,458 |

|

$ |

364,824 |

|

|

|

| Fee-based client assets |

$ |

150,982 |

|

$ |

135,521 |

|

|

|

| Bank

loans (6) |

$ |

20,435 |

|

$ |

20,911 |

|

|

|

|

Institutional Group |

|

|

|

|

|

Net revenues |

$ |

256,888 |

|

$ |

339,408 |

|

$ |

867,025 |

|

$ |

1,182,135 |

|

| Equity |

$ |

144,764 |

|

$ |

223,147 |

|

$ |

508,371 |

|

$ |

715,474 |

|

| Fixed Income |

$ |

112,124 |

|

$ |

116,261 |

|

$ |

358,654 |

|

$ |

466,661 |

|

| Pre-tax

net income/ (loss) |

$ |

(27,804 |

) |

$ |

40,000 |

|

$ |

(5,671 |

) |

$ |

209,620 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Global Wealth Management

Global Wealth Management reported record net

revenues of $768.6 million for the three months ended September 30,

2023 compared with $701.8 million during the third quarter of 2022.

Pre-tax net income was $298.4 million compared with $279.9 million

in the third quarter of 2022.

Highlights

- Recruited 36

financial advisors during the quarter, including 24 experienced

employee advisors with total trailing 12 month production of $24

million.

- Client assets of

$412.5 billion, up 13% over the year-ago quarter.

- Fee-based client

assets of $151.0 billion, up 11% over the year-ago quarter.

Net revenues increased 10% from a year

ago:

- Transactional

revenues increased 6% from the year-ago quarter reflecting an

increase in client activity.

- Asset management

revenues increased 11% from the year-ago quarter primarily due to

higher asset values.

- Net interest income

increased 11% over the year-ago quarter primarily driven by higher

interest rates.

Total Expenses:

- Compensation expense

as a percent of net revenues increased to 46.8% primarily as a

result of higher compensable revenues.

- Provision for credit

losses was primarily impacted by a deterioration in certain asset

classes, partially offset by a slightly better macroeconomic

forecast.

- Non-compensation

operating expenses as a percent of net revenues increased to 14.4%

primarily as a result of an increase in the provision for credit

losses over the year-ago quarter, partially offset by revenue

growth.

|

Summary Results of Operations |

|

(000s) |

|

3Q 2023 |

|

|

3Q 2022 |

|

|

Net revenues |

$ |

768,558 |

|

$ |

701,820 |

|

| Transactional revenues |

|

165,547 |

|

|

156,565 |

|

| Asset management |

|

333,088 |

|

|

300,540 |

|

| Net interest income |

|

269,431 |

|

|

242,194 |

|

| Investment banking |

|

3,895 |

|

|

4,498 |

|

| Other

income |

|

(3,403 |

) |

|

(1,977 |

) |

|

Total expenses |

$ |

470,109 |

|

$ |

421,885 |

|

| Compensation expense |

|

359,325 |

|

|

326,116 |

|

| Provision for credit

losses |

|

9,992 |

|

|

6,453 |

|

|

Non-comp. opex |

|

100,792 |

|

|

89,316 |

|

|

Pre-tax net income |

$ |

298,449 |

|

$ |

279,935 |

|

|

Compensation ratio |

|

46.8 |

% |

|

46.5 |

% |

| Non-compensation ratio |

|

14.4 |

% |

|

13.6 |

% |

|

Pre-tax margin |

|

38.8 |

% |

|

39.9 |

% |

| |

|

|

|

|

|

|

Institutional Group

Institutional Group reported net revenues of

$256.9 million for the three months ended September 30, 2023

compared with $339.4 million during the third quarter of 2022.

Institutional Group reported pre-tax net loss of $27.8 million for

the three months ended September 30, 2023 compared with pre-tax net

income of $40.0 million in the third quarter of 2022.

Highlights

Investment banking revenues decreased 34%

from a year ago:

- Advisory revenues of

$97.3 million decreased 42% from the year-ago quarter driven by

lower levels of completed advisory transactions.

- Equity capital

raising revenues decreased 12% over the year-ago quarter driven by

lower volumes.

- Fixed income capital

raising revenues decreased 8% over the year-ago quarter

as macroeconomic conditions contributed to lower municipal

bond and debt issuances.

Fixed income transactional revenues

decreased 9% from a year ago:

- Fixed income

transactional revenues decreased from the year-ago quarter driven

by declines across most products as a result of lower volumes and

lower market volatility compared with elevated levels in the prior

year period, partially offset by higher trading gains.

Equity transactional revenues increased 1%

from a year ago:

- Equity transactional

revenues increased from the year-ago quarter driven by an increase

in equities trading commissions, partially offset by lower trading

gains.

Total Expenses:

- Compensation expense

as a percent of net revenues increased to 75.0% primarily as a

result of lower net revenues, partially offset by lower

discretionary compensation.

- Non-compensation

operating expenses as a percent of net revenues increased to 35.8%

as a result of lower net revenues, higher travel-related expenses,

occupancy costs, and professional fees, as well as continued

investments in technology, partially offset by lower investment

banking transaction expenses.

|

Summary Results of Operations |

|

(000s) |

|

3Q 2023 |

|

|

3Q 2022 |

|

| Net

revenues |

$ |

256,888 |

|

$ |

339,408 |

|

| Investment banking |

|

142,991 |

|

|

217,361 |

|

| Advisory |

|

97,272 |

|

|

166,736 |

|

| Equity capital raising |

|

21,049 |

|

|

23,883 |

|

| Fixed income capital

raising |

|

24,670 |

|

|

26,742 |

|

| Fixed income

transactional |

|

67,439 |

|

|

74,384 |

|

| Equity transactional |

|

46,930 |

|

|

46,483 |

|

|

Other |

|

(472 |

) |

|

1,180 |

|

| Total

expenses |

$ |

284,692 |

|

$ |

299,408 |

|

| Compensation expense |

|

192,638 |

|

|

211,818 |

|

|

Non-comp. opex. |

|

92,054 |

|

|

87,590 |

|

|

Pre-tax net income/(loss) |

$ |

(27,804 |

) |

$ |

40,000 |

|

|

Compensation ratio |

|

75.0 |

% |

|

62.4 |

% |

| Non-compensation ratio |

|

35.8 |

% |

|

25.8 |

% |

|

Pre-tax margin |

|

(10.8 |

%) |

|

11.8 |

% |

| |

|

|

|

|

|

|

Other Matters

Highlights

- Total assets increased $265.5

million, or 1%, over the year-ago quarter.

- The Company repurchased $118.8

million of its outstanding common stock during the third

quarter.

- Weighted average diluted shares

outstanding decreased primarily as a result of the increase in

share repurchases over the comparable period.

- The Board of Directors declared a

$0.36 quarterly dividend per share payable on September 15, 2023 to

common shareholders of record on September 1, 2023.

- The Board of Directors declared a

quarterly dividend on the outstanding shares of the Company’s

preferred stock payable on September 15, 2023 to shareholders of

record on September 1, 2023.

|

|

3Q 2023 |

3Q 2022 |

|

Common stock repurchases |

|

|

|

Repurchases (000s) |

$ |

118,810 |

|

$ |

0 |

|

| Number of shares (000s) |

|

1,886 |

|

|

0 |

|

| Average price |

$ |

63.00 |

|

|

NA |

|

| Period end shares (000s) |

|

103,120 |

|

|

106,225 |

|

|

Weighted average diluted shares outstanding (000s) |

|

113,195 |

|

|

117,218 |

|

|

Effective tax rate |

|

37.7 |

% |

|

26.5 |

% |

|

Stifel Financial Corp. (8) |

|

|

| Tier 1 common capital

ratio |

|

13.9 |

% |

|

14.1 |

% |

| Tier 1 risk based capital

ratio |

|

16.9 |

% |

|

17.0 |

% |

| Tier 1 leverage capital

ratio |

|

10.8 |

% |

|

11.1 |

% |

| Tier 1 capital (MM) |

$ |

3,914 |

|

$ |

3,964 |

|

| Risk weighted assets (MM) |

$ |

23,219 |

|

$ |

23,300 |

|

| Average assets (MM) |

$ |

36,356 |

|

$ |

35,620 |

|

| Quarter

end assets (MM) |

$ |

37,878 |

|

$ |

37,612 |

|

|

Agency |

Rating |

Outlook |

| Fitch Ratings |

BBB+ |

Stable |

| S&P

Global Ratings |

BBB- |

Positive |

Conference Call Information

Stifel Financial Corp. will host its

third quarter 2023 financial results conference call on Wednesday,

October 25, 2023, at 9:30 a.m. Eastern Time. The

conference call may include forward-looking statements.

All interested parties are invited to listen to

Stifel’s Chairman and CEO, Ronald J. Kruszewski, by dialing (866)

409-1555 and referencing conference ID 4717221. A live audio

webcast of the call, as well as a presentation highlighting the

Company’s results, will be available through the Company’s web

site, www.stifel.com. For those who cannot listen to the live

broadcast, a replay of the broadcast will be available through the

above-referenced web site beginning approximately one hour

following the completion of the call.

Company Information

Stifel Financial Corp. (NYSE: SF) is a financial

services holding company headquartered in St. Louis, Missouri, that

conducts its banking, securities, and financial services business

through several wholly owned subsidiaries. Stifel’s broker-dealer

clients are served in the United States through Stifel, Nicolaus

& Company, Incorporated, including its Eaton Partners and

Miller Buckfire business divisions; Keefe, Bruyette & Woods,

Inc.; and Stifel Independent Advisors, LLC; in Canada through

Stifel Nicolaus Canada Inc.; and in the United Kingdom and Europe

through Stifel Nicolaus Europe Limited. The Company’s broker-dealer

affiliates provide securities brokerage, investment banking,

trading, investment advisory, and related financial services to

individual investors, professional money managers, businesses, and

municipalities. Stifel Bank and Stifel Bank & Trust offer a

full range of consumer and commercial lending solutions. Stifel

Trust Company, N.A. and Stifel Trust Company Delaware, N.A. offer

trust and related services. To learn more about Stifel, please

visit the Company’s website at www.stifel.com. For global

disclosures, please visit

www.stifel.com/investor-relations/press-releases.

A financial summary follows. Financial,

statistical and business-related information, as well as

information regarding business and segment trends, is included in

the financial supplement. Both the earnings release and the

financial supplement are available online in the Investor Relations

section at www.stifel.com/investor-relations.

The information provided herein and in the

financial supplement, including information provided on the

Company’s earnings conference calls, may include certain non-GAAP

financial measures. The definition of such measures or

reconciliation of such measures to the comparable U.S. GAAP figures

are included in this earnings release and the financial supplement,

both of which are available online in the Investor Relations

section at www.stifel.com/investor-relations.

Cautionary Note Regarding Forward-Looking

Statements

This earnings release contains certain

statements that may be deemed to be “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements

in this earnings release not dealing with historical results are

forward-looking and are based on various assumptions. The

forward-looking statements in this earnings release are subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed in or implied by the statements.

Factors that may cause actual results to differ materially from

those contemplated by such forward-looking statements include,

among other things, the following possibilities: the ability to

successfully integrate acquired companies or the branch offices and

financial advisors; a material adverse change in financial

condition; the risk of borrower, depositor, and other customer

attrition; a change in general business and economic conditions;

changes in the interest rate environment, deposit flows, loan

demand, real estate values, and competition; changes in accounting

principles, policies, or guidelines; changes in legislation and

regulation; other economic, competitive, governmental, regulatory,

geopolitical, and technological factors affecting the companies’

operations, pricing, and services; and other risk factors referred

to from time to time in filings made by Stifel Financial Corp. with

the Securities and Exchange Commission. For information about the

risks and important factors that could affect the Company’s future

results, financial condition and liquidity, see “Risk Factors” in

Part I, Item 1A of the Company’s Annual Report on Form 10-K for the

year ended December 31, 2022. Forward-looking statements speak only

as to the date they are made. The Company disclaims any intent or

obligation to update forward-looking statements to reflect

circumstances or events that occur after the date the

forward-looking statements are made.

Summary Results of Operations

(Unaudited)

|

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

|

(000s, except per share amounts) |

9/30/2023 |

9/30/2022 |

% Change |

6/30/2023 |

% Change |

9/30/2023 |

9/30/2022 |

% Change |

|

Revenues: |

|

|

|

|

|

|

|

|

|

Commissions |

$ |

165,075 |

$ |

159,054 |

3.8 |

|

$ |

165,358 |

(0.2 |

) |

$ |

499,983 |

|

$ |

541,644 |

(7.7 |

) |

| Principal transactions |

|

114,841 |

|

118,379 |

(3.0 |

) |

|

105,700 |

8.6 |

|

|

336,063 |

|

|

403,252 |

(16.7 |

) |

| Investment banking |

|

146,887 |

|

221,858 |

(33.8 |

) |

|

166,825 |

(12.0 |

) |

|

525,591 |

|

|

747,779 |

(29.7 |

) |

| Asset management |

|

333,127 |

|

300,557 |

10.8 |

|

|

320,264 |

4.0 |

|

|

968,960 |

|

|

973,457 |

(0.5 |

) |

| Other income |

|

459 |

|

852 |

(46.1 |

) |

|

894 |

(48.7 |

) |

|

(940 |

) |

|

7,823 |

(112.0 |

) |

| Operating

revenues |

|

760,389 |

|

800,700 |

(5.0 |

) |

|

759,041 |

0.2 |

|

|

2,329,657 |

|

|

2,673,955 |

(12.9 |

) |

| Interest revenue |

|

505,198 |

|

304,195 |

66.1 |

|

|

482,770 |

4.6 |

|

|

1,439,532 |

|

|

682,384 |

111.0 |

|

| Total

revenues |

|

1,265,587 |

|

1,104,895 |

14.5 |

|

|

1,241,811 |

1.9 |

|

|

3,769,189 |

|

|

3,356,339 |

12.3 |

|

| Interest expense |

|

220,536 |

|

59,756 |

269.1 |

|

|

191,090 |

15.4 |

|

|

566,624 |

|

|

86,547 |

554.7 |

|

| Net

revenues |

|

1,045,051 |

|

1,045,139 |

(0.0 |

) |

|

1,050,721 |

(0.5 |

) |

|

3,202,565 |

|

|

3,269,792 |

(2.1 |

) |

| Non-interest

expenses: |

|

|

|

|

|

|

|

|

| Compensation and benefits |

|

613,287 |

|

611,870 |

0.2 |

|

|

615,667 |

(0.4 |

) |

|

1,880,144 |

|

|

1,938,270 |

(3.0 |

) |

| Non-compensation operating

expenses |

|

322,335 |

|

227,500 |

41.7 |

|

|

253,669 |

27.1 |

|

|

821,724 |

|

|

680,103 |

20.8 |

|

| Total non-interest

expenses |

|

935,622 |

|

839,370 |

11.5 |

|

|

869,336 |

7.6 |

|

|

2,701,868 |

|

|

2,618,373 |

3.2 |

|

| Income before income

taxes |

|

109,429 |

|

205,769 |

(46.8 |

) |

|

181,385 |

(39.7 |

) |

|

500,697 |

|

|

651,419 |

(23.1 |

) |

| Provision for income

taxes |

|

41,268 |

|

54,600 |

(24.4 |

) |

|

47,033 |

(12.3 |

) |

|

140,645 |

|

|

165,885 |

(15.2 |

) |

| Net

income |

|

68,161 |

|

151,169 |

(54.9 |

) |

|

134,352 |

(49.3 |

) |

|

360,052 |

|

|

485,534 |

(25.8 |

) |

| Preferred dividends |

|

9,321 |

|

9,320 |

0.0 |

|

|

9,320 |

0.0 |

|

|

27,961 |

|

|

27,961 |

0.0 |

|

| Net income available

to common shareholders |

$ |

58,840 |

$ |

141,849 |

(58.5 |

) |

$ |

125,032 |

(52.9 |

) |

$ |

332,091 |

|

$ |

457,573 |

(27.4 |

) |

| Earnings per common

share: |

|

|

|

|

|

|

|

|

| Basic |

$ |

0.55 |

$ |

1.30 |

(57.7 |

) |

$ |

1.16 |

(52.6 |

) |

$ |

3.09 |

|

$ |

4.20 |

(26.4 |

) |

| Diluted |

$ |

0.52 |

$ |

1.21 |

(57.0 |

) |

$ |

1.10 |

(52.7 |

) |

$ |

2.91 |

|

$ |

3.89 |

(25.2 |

) |

| Cash dividends

declared per common share |

$ |

0.36 |

$ |

0.30 |

20.0 |

|

$ |

0.36 |

0.0 |

|

$ |

1.08 |

|

$ |

0.90 |

20.0 |

|

| Weighted

average number of common shares outstanding: |

|

|

|

|

|

| Basic |

|

106,068 |

|

108,767 |

(2.5 |

) |

|

107,944 |

(1.7 |

) |

|

107,580 |

|

|

109,017 |

(1.3 |

) |

|

Diluted |

|

113,195 |

|

117,218 |

(3.4 |

) |

|

113,864 |

(0.6 |

) |

|

114,170 |

|

|

117,649 |

(3.0 |

) |

Non-GAAP Financial Measures

(9)

|

|

|

|

| |

Three Months Ended |

Nine Months Ended |

| (000s, except per share

amounts) |

9/30/2023 |

9/30/2022 |

9/30/2023 |

9/30/2022 |

|

GAAP net income |

$ |

68,161 |

|

$ |

151,169 |

|

$ |

360,052 |

|

$ |

485,534 |

|

| Preferred dividend |

|

9,321 |

|

|

9,320 |

|

|

27,961 |

|

|

27,961 |

|

| Net income available

to common shareholders |

|

58,840 |

|

|

141,849 |

|

|

332,091 |

|

|

457,573 |

|

| |

|

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

| Merger-related (10) |

|

13,771 |

|

|

11,958 |

|

|

46,301 |

|

|

43,602 |

|

| Provision for income taxes

(11) |

|

(5,198 |

) |

|

(3,051 |

) |

|

(13,455 |

) |

|

(10,979 |

) |

| Total non-GAAP

adjustments |

|

8,573 |

|

|

8,907 |

|

|

32,846 |

|

|

32,623 |

|

| Non-GAAP net income

available to common shareholders |

$ |

67,413 |

|

$ |

150,756 |

|

$ |

364,937 |

|

$ |

490,196 |

|

| |

|

|

|

|

| Weighted average diluted

shares outstanding |

|

113,195 |

|

|

117,218 |

|

|

114,170 |

|

|

117,649 |

|

| |

|

|

|

|

| GAAP earnings per diluted

common share |

$ |

0.60 |

|

$ |

1.29 |

|

$ |

3.15 |

|

$ |

4.13 |

|

| Non-GAAP adjustments |

|

0.08 |

|

|

0.08 |

|

|

0.29 |

|

|

0.28 |

|

| Non-GAAP earnings per diluted

common share |

$ |

0.68 |

|

$ |

1.37 |

|

$ |

3.44 |

|

$ |

4.41 |

|

|

|

|

|

|

|

| GAAP earnings per diluted

common share available to common shareholders |

$ |

0.52 |

|

$ |

1.21 |

|

$ |

2.91 |

|

$ |

3.89 |

|

| Non-GAAP adjustments |

|

0.08 |

|

|

0.08 |

|

|

0.29 |

|

|

0.28 |

|

|

Non-GAAP earnings per diluted common share available to common

shareholders |

$ |

0.60 |

|

$ |

1.29 |

|

$ |

3.20 |

|

$ |

4.17 |

|

GAAP to Non-GAAP Reconciliation

(9)

|

|

|

|

| |

Three Months Ended |

Nine Months Ended |

| (000s) |

9/30/2023 |

9/30/2022 |

9/30/2023 |

9/30/2022 |

|

GAAP compensation and benefits |

$ |

613,287 |

|

$ |

611,870 |

|

$ |

1,880,144 |

|

$ |

1,938,270 |

|

| As a percentage of net

revenues |

|

58.7 |

% |

|

58.5 |

% |

|

58.7 |

% |

|

59.3 |

% |

| Non-GAAP adjustments: |

|

|

|

|

| Merger-related (10) |

|

(7,171 |

) |

|

(6,059 |

) |

|

(22,947 |

) |

|

(24,544 |

) |

| Non-GAAP compensation

and benefits |

$ |

606,116 |

|

$ |

605,811 |

|

$ |

1,857,197 |

|

$ |

1,913,726 |

|

| As a percentage of non-GAAP

net revenues |

|

58.0 |

% |

|

58.0 |

% |

|

58.0 |

% |

|

58.5 |

% |

| |

|

|

|

|

| GAAP non-compensation

expenses |

$ |

322,335 |

|

$ |

227,500 |

|

$ |

821,724 |

|

$ |

680,103 |

|

| As a percentage of net

revenues |

|

30.8 |

% |

|

21.8 |

% |

|

25.7 |

% |

|

20.8 |

% |

| Non-GAAP adjustments: |

|

|

|

|

| Merger-related (10) |

|

(6,623 |

) |

|

(5,905 |

) |

|

(23,380 |

) |

|

(19,003 |

) |

| Non-GAAP

non-compensation expenses |

$ |

315,712 |

|

$ |

221,595 |

|

$ |

798,344 |

|

$ |

661,100 |

|

| As a percentage of non-GAAP

net revenues |

|

30.2 |

% |

|

21.2 |

% |

|

24.9 |

% |

|

20.2 |

% |

|

Total merger-related expenses |

$ |

13,771 |

|

$ |

11,958 |

|

$ |

46,301 |

|

$ |

43,602 |

|

Footnotes

(1) Represents available to common

shareholders.

(2) Reconciliations of the Company’s GAAP

results to these non-GAAP measures are discussed within and under

“Non-GAAP Financial Measures” and “GAAP to Non-GAAP

Reconciliation.”

(3) Non-GAAP pre-tax margin is calculated

by adding total merger-related expenses (non-GAAP adjustments) and

dividing it by non-GAAP net revenues. See “Non-GAAP Financial

Measures” and “GAAP to Non-GAAP Reconciliation.”

(4) Return on average common equity

(“ROCE”) is calculated by dividing annualized net income applicable

to common shareholders by average common shareholders’ equity or,

in the case of non-GAAP ROCE, calculated by dividing non-GAAP net

income applicable to commons shareholders by average common

shareholders’ equity.

(5) Return on average tangible common

equity (“ROTCE”) is calculated by dividing annualized net income

applicable to common shareholders by average tangible shareholders’

equity or, in the case of non-GAAP ROTCE, calculated by dividing

non-GAAP net income applicable to common shareholders by average

tangible common equity. Tangible common equity, also a non-GAAP

financial measure, equals total common shareholders’ equity less

goodwill and identifiable intangible assets and the deferred taxes

on goodwill and intangible assets. Average deferred taxes on

goodwill and intangible assets was $67.4 million and $59.2 million

as of September 30, 2023 and 2022, respectively.

(6) Includes loans held for sale.

(7) Tangible book value per common share

represents shareholders’ equity (excluding preferred stock) divided

by period end common shares outstanding. Tangible common

shareholders’ equity equals total common shareholders’ equity less

goodwill and identifiable intangible assets and the deferred taxes

on goodwill and intangible assets.

(8) Capital ratios are estimates at time of

the Company’s earnings release, October 25, 2023.

(9) The Company prepares its Consolidated

Financial Statements using accounting principles generally accepted

in the United States (U.S. GAAP). The Company may disclose certain

“non-GAAP financial measures” in the course of its earnings

releases, earnings conference calls, financial presentations and

otherwise. The Securities and Exchange Commission defines a

“non-GAAP financial measure” as a numerical measure of historical

or future financial performance, financial position, or cash flows

that is subject to adjustments that effectively exclude, or

include, amounts from the most directly comparable measure

calculated and presented in accordance with U.S. GAAP. Non-GAAP

financial measures disclosed by the Company are provided as

additional information to analysts, investors and other

stakeholders in order to provide them with greater transparency

about, or an alternative method for assessing the Company’s

financial condition or operating results. These measures are not in

accordance with, or a substitute for U.S. GAAP, and may be

different from or inconsistent with non-GAAP financial measures

used by other companies. Whenever the Company refers to a non-GAAP

financial measure, it will also define it or present the most

directly comparable financial measure calculated and presented in

accordance with U.S. GAAP, along with a reconciliation of the

differences between the non-GAAP financial measure it references

and such comparable U.S. GAAP financial measure.

(10) Primarily related to charges

attributable to integration-related activities, signing bonuses,

amortization of restricted stock awards, debentures, and promissory

notes issued as retention, additional earn-out expense, and

amortization of intangible assets acquired. These costs were

directly related to acquisitions of certain businesses and are not

representative of the costs of running the Company’s on-going

business.

(11) Primarily represents the Company’s

effective tax rate for the period applied to the non-GAAP

adjustments.

Media Contact: Neil Shapiro (212) 271-3447 |

Investor Contact: Joel Jeffrey (212) 271- 3610 |

www.stifel.com/investor-relations

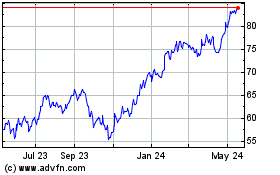

Stifel Financial (NYSE:SF)

Historical Stock Chart

From Mar 2024 to Apr 2024

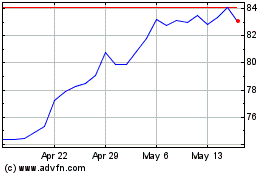

Stifel Financial (NYSE:SF)

Historical Stock Chart

From Apr 2023 to Apr 2024