Eaton Partners Adds Depth to Private Capital Advisory Team

September 06 2023 - 8:30AM

Eaton Partners, one of the world’s largest placement agents and

fund advisory firms and a wholly owned subsidiary of Stifel

Financial Corp. (NYSE: SF), today announced the hiring of Adrian

Siew as a Managing Director in its Private Capital Advisory (“PCA”)

business. In this role, Mr. Siew will be responsible for co-heading

the GP Solutions specialty alongside Dirk Jonske, who joined the

firm last month, also as a Managing Director.

Prior to joining Eaton Partners, Mr. Siew was in

Credit Suisse’s Private Fund Group, where he provided strategic

advice to financial sponsors and private market investors on GP-led

secondary transactions, sales of private fund interests, and

bespoke liquidity solutions. Before joining Credit Suisse, Mr. Siew

spent five years at Lazard Frères & Co., also specializing in

secondary advisory assignments.

“Our clients are increasingly utilizing

secondary solutions as an active portfolio management tool,” said

Eric Deyle, Managing Director at Eaton Partners. “Bringing onboard

someone of Adrian’s caliber significantly enhances our platform and

adds additional expertise to our full-service, holistic offering to

the financial sponsor community. We welcome Adrian to the team and

look forward to his contributions.”

Last month, Eaton Partners announced its newly

branded PCA business will be organized into four distinct

specialties – GP Solutions, LP Solutions, Direct Equity, and GP

Stakes – to provide financial sponsors and their investors with

differentiated strategic advice and liquidity solutions, in

combination with the broader Stifel Investment Banking

platform.

“I am thrilled to join Eaton Partners, a true

pioneer in the fund placement business,” commented Mr. Siew.

“GP-led secondary transactions continue to be at the forefront of

sponsors’ minds, highlighting the durability and attractiveness of

this product. The PCA platform is uniquely positioned to advise on

how to best access this evolving market, and I am excited to be

part of the team.”

Eaton Partners, which provides leading

fundraising, advisory, and capital solutions capabilities as part

of the investment banking team at Stifel, offers investment

managers direct access to Stifel’s broader banking services,

including over 600 professionals across 24 offices. With deep

experience in the secondaries market, Stifel and Eaton combined

have advised and executed on more than $2.5 billion worth of

secondary transactions over just the last three years.

About Eaton PartnersEaton

Partners, a Stifel Company, is one of the world’s largest capital

placement agents and fund advisory firms, having raised more than

$140 billion for over 185 highly differentiated alternative

investment funds and offerings. Founded in 1983, Eaton advises and

raises institutional capital for investment managers across

alternative strategies – private equity, private credit, real

assets, real estate, and hedge funds/public market – in both the

primary and secondary markets. Eaton Partners maintains offices and

operates throughout North America, Europe, and Asia.

Eaton Partners is a division of Stifel, Nicolaus

& Company, Incorporated, Member SIPC and NYSE. Eaton Partners

subsidiary Eaton Partners (UK) LLP is authorized and regulated by

the Financial Conduct Authority (FCA). Eaton Partners subsidiary

Stifel Hong Kong Limited, doing business as Eaton Partners Hong

Kong, is approved as a Type 1-licensed company under the Securities

and Futures Commission (SFC) in Hong Kong. Eaton Partners and the

Eaton Partners logo are trademarks of Eaton Partners, LLC, a

limited liability company. ® Eaton Partners, 2023. For more

information, please visit https://eaton-partners.com/.

Stifel Company

InformationStifel Financial Corp. (NYSE: SF) is a

financial services holding company headquartered in St. Louis,

Missouri, that conducts its banking, securities, and financial

services business through several wholly owned

subsidiaries. Stifel’s broker-dealer clients are served in the

United States through Stifel, Nicolaus & Company, Incorporated,

including its Eaton Partners business division; Keefe, Bruyette

& Woods, Inc.; Miller Buckfire & Co., LLC; and Stifel

Independent Advisors, LLC. The Company’s broker-dealer affiliates

provide securities brokerage, investment banking, trading,

investment advisory, and related financial services to individual

investors, professional money managers, businesses, and

municipalities. Stifel Bank and Stifel Bank & Trust offer a

full range of consumer and commercial lending solutions. Stifel

Trust Company, N.A. and Stifel Trust Company Delaware, N.A. offer

trust and related services. To learn more about Stifel, please

visit the Company’s website at www.stifel.com. For global

disclosures, please visit

https://www.stifel.com/investor-relations/press-releases.

Media ContactsNeil Shapiro,

(212) 271-3447shapiron@stifel.com

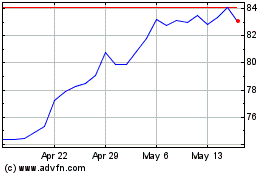

Stifel Financial (NYSE:SF)

Historical Stock Chart

From Mar 2024 to Apr 2024

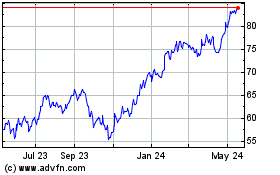

Stifel Financial (NYSE:SF)

Historical Stock Chart

From Apr 2023 to Apr 2024