Regions Financial Corporation (NYSE:RF) today reported financial

results for the quarter ending June 30, 2010.

Key points for the quarter included:

- Loss of 28 cents per diluted

share for the quarter ended June 30, 2010, reflecting a $200

million charge related to Morgan Keegan regulatory proceedings

- Excluding the Morgan Keegan

charge, Regions’ loss was 11 cents per diluted share which compares

to a loss of 21 cents in the prior quarter and reflects core

revenue growth and continued improvement in key credit metrics

- Pre-tax pre-provision net

revenue, as adjusted, increased $89 million or 22% linked

quarter

- Total adjusted revenues grew 3

percent and adjusted non-interest expenses declined 4 percent

versus the previous quarter

- Loans outstanding contracted

$2.2 billion or 3 percent during the quarter, reflecting

challenging loan demand and the company’s efforts to reduce

investor real estate lending

- Average low-cost deposits

increased for the sixth consecutive quarter, growing 4 percent

linked quarter, up $10.3 billion or 17 percent compared with the

prior year

- Reduced total deposit costs by

21 basis points to 0.79 percent in the second quarter

- Net interest margin improved ten

basis points to 2.87 percent

- Non-performing assets, excluding

loans held for sale, declined $297 million or 7 percent linked

quarter driven by a significant drop in inflows of non-performing

loans which declined for the fourth consecutive quarter

- Net loan charge-offs declined to

$651 million or an annualized 2.99 percent of average loans

- Allowance for loan losses

increased to 3.71 percent of loans; provision for loan losses of

$651 million declined $119 million linked quarter

- Solid capital with a Tier 1

Capital ratio estimated at 12.0 percent and a Tier 1 Common ratio

estimated at 7.7 percent

Earnings Highlights

Three months ended:

(In millions. except per share data) June 30, 2010 March 31,

2010 June 30, 2009

Amount Dil. EPS

Amount Dil. EPS Amount Dil.

EPS Earnings Net interest income

$856

$831

$831

Non-interest income * 756 812 1,199 Regulatory charge 200 0 0

Non-interest expense, excluding regulatory charge 1,126 1,230 1,231

Pre-tax pre-provision net revenue 286 413 799 Provision for loan

losses 651 770 912 Net income (loss) ($277 ) ($0.23 ) ($196 )

($0.16 ) ($188 ) ($0.22 ) Preferred dividends and accretion 58

(0.05 ) 59 (0.05 ) 56 (0.06 ) Net income (loss) available to common

shareholders ($335 ) ($0.28 ) ($255 ) ($0.21 ) ($244 ) ($0.28 )

GAAP to Non-GAAP Reconciliation Net income

(loss) available to common shareholders (GAAP) ($335 ) ($0.28 )

($255 ) ($0.21 ) ($244 ) ($0.28 ) Regulatory charge** 200 0.17 - -

- - Net income (loss) available to common shareholders, excluding

regulatory charge (Non-GAAP)** ($135 ) ($0.11 ) ($255 ) ($0.21 )

($244 ) ($0.28 )

Key ratios Net interest margin (FTE)

2.87%

2.77% 2.62% Tier 1 Capital*** 12.0% 11.7% 12.2% Tier 1 Common

risk-based ratio (non-GAAP)*** 7.7% 7.1% 8.1% Tangible common

stockholders’ equity to tangible assets (non-GAAP)** 6.26% 6.09%

6.59% Tangible common book value per share (non-GAAP)** $6.45 $6.71

$7.58

Asset quality

Allowance for loan losses as % of

net loans

3.71% 3.61% 2.37% Net charge-offs as % of average net loans~ 2.99%

3.16% 2.06% Non-performing assets as % of loans and other real

estate 4.94% 5.15% 3.55% Non-performing assets as % of loans and

other real estate (excluding loans held for sale) 4.65% 4.86% 3.17%

Non-performing assets (including 90+ past due) as % of loans and

other real estate 5.65% 5.94% 4.18% Non-performing assets

(including 90+ past due) as % of loans and other real estate

(excluding loans held for sale) 5.35% 5.65% 3.80%

*Quarter ended March 31, 2010,

reflects $19 million gain related to leveraged lease transactions,

which was offset by $18 million of incremental tax expense; quarter

ended June 30, 2009, reflects $189 million gain related to

leveraged lease transactions, which was offset by $196 million of

incremental tax expense.

** See “Use of non-GAAP financial

measures” at the end of this release

*** Current quarter ratio is

estimated

~ Annualized

Morgan Keegan regulatory proceedings

As previously disclosed, on April 7, 2010, the Securities and

Exchange Commission, a joint state task force of securities

regulators from Alabama, Kentucky, Mississippi and South Carolina

and the Financial Industry Regulatory Authority announced that they

were commencing administrative proceedings against Morgan Keegan,

Morgan Asset Management and certain of their employees for

violations of federal and state securities laws and NASD rules

relating to certain funds previously administered by Morgan Keegan

and Morgan Asset Management. Based on the current status of

settlement negotiations, Regions believes that a loss on this

matter is probable and reasonably estimable. Accordingly, at June

30, 2010, Morgan Keegan recorded a non-tax deductible $200 million

charge representing the estimate of probable loss.

Strong core business performance, improving asset quality

metrics

“We remain intensely focused on returning the company to

sustainable profitability as our core business performance and risk

profile incrementally continue to improve,” said Grayson Hall,

president and chief executive officer. “The recently approved

financial reform legislation includes many aspects that will prove

to be beneficial to the industry but will require a substantial

number of rules to be written. Our focus is on customers and

adjusting our business models to serve them under the eventual new

operating rules. We are committed to serving our customers’

financial needs with products and services that deliver value. Our

challenge is to accomplish this while protecting the future of the

company, ensuring balance in our business, closely managing

critical risk exposures and maintaining strong capital and

liquidity.”

Non-performing assets decline; risk profile continues to

improve

For the first time in six quarters, the company’s non-performing

assets, excluding loans held for sale, declined by $297 million or

7 percent linked quarter. Reflecting the continued improvement in

non-performing assets and net charge-offs, the company’s provision

for loan losses decreased to $651 million. At the same time, the

allowance for loan losses as a percentage of loans increased 10

basis points linked quarter to 3.71 percent of loans. Net

charge-offs declined from $700 million to $651 million or an

annualized 2.99 percent of average loans, compared to the first

quarter’s annualized 3.16 percent. The company’s loan loss

allowance coverage of non-performing loans improved to 0.92x at

June 30, 2010.

Low-cost deposits grow and net interest margin

expands

Net interest income increased $25 million on a linked quarter

basis and contributed to the increase in the net interest margin,

which climbed another 10 basis points this quarter to 2.87 percent.

The most significant catalysts to the increase in net interest

income were improvements in deposit cost and mix, highlighted by

the addition of $2.7 billion of average low-cost deposits, offset

by the beneficial reduction of $2.7 billion of higher-cost

certificates of deposit. This shift helped drive total deposit

costs down 21 basis points to 0.79 percent. The company expects the

net interest margin to continue improving gradually throughout the

year. The main drivers of the improvement will be beneficial

certificate of deposit repricing, a shift in the mix of total

deposits to include more low-cost deposits, and continued reduction

in deposit costs.

Increasing non-interest income

Second quarter non-interest income increased $22 million or 3

percent versus the first quarter, excluding the prior quarter’s

gain on sale of securities and a gain related to leveraged lease

terminations. Brokerage revenues were the main driver of growth,

with an $18 million increase reflecting higher private client

revenues and an increase in fixed income capital markets and

investment banking activity.

Mortgage income declined $4 million linked quarter, primarily

reflecting the impact of a reduced benefit from mortgage servicing

rights hedging activities. However, origination volumes of $1.8

billion were strong compared to the prior quarter’s $1.4 billion,

with a solid 59 percent representing new purchases in the second

quarter, compared to 45 percent in the prior quarter and just 24

percent a year ago.

Higher non-interest income also reflects a 5 percent increase in

service charges, primarily from higher interchange transaction

activity. Policy changes associated with Regulation E began in the

second quarter with minimal impact, but will be fully implemented

during the third quarter and are expected to place downward

pressure on service charge revenues in the future.

Declining non-interest expenses; higher performance and

efficiency

Continuing a recent trend, non-interest expenses declined 4

percent linked quarter, after excluding the Morgan Keegan

regulatory proceedings charge and first quarter’s loss on early

extinguishment of debt and branch consolidation charges. A $15

million reduction in salaries and benefits cost, reflecting lower

headcount and a seasonal payroll tax decline, drove the

improvement.

The company continues to control discretionary expenses and

improve its operating efficiency. However, certain headwinds,

including higher FDIC premiums and credit-related costs, will

continue to impact the bottom-line for the foreseeable future. The

company expects certain of the credit-related costs to subside as

the economy recovers. Given that much of these are tied to other

real estate and loan workout costs, declines in non-performing

assets serve as a leading indicator of an eventual decline in

credit-related costs.

Low-cost deposits continue to grow

Average low-cost deposits grew for the sixth consecutive

quarter, rising $2.7 billion on a linked quarter basis. This growth

continues to reflect outstanding customer acquisition and

retention, bolstered by service and satisfaction levels that are

higher today than at any point in the company’s history. The

company continues to execute its core business operations in a

manner that attracts and retains customers. Year-to-date, the

company has opened approximately 488,000 new business and consumer

checking accounts and is on track to open approximately 1 million

new accounts this year—matching or exceeding 2009’s record

level.

Assisting customers; continued lending to businesses and

consumers

Since inception of the company’s Customer Assistance Program,

approximately 16,000 consumer real estate loans have been

restructured totaling more than $2.3 billion while a total of

30,000 homeowners have received some type of assistance. In

addition, Regions has remained an active lender in the current

environment, having made new or renewed loan commitments totaling

$15.2 billion during the second quarter of 2010, primarily driven

by residential first mortgage production and lending to small

businesses.

- 33,039 home loans and other

lending to consumers totaling $2.4 billion

- 11,176 commitments totaling $1.9

billion to small businesses and $10.9 billion to other commercial

customers

Despite these lending commitments, loans outstanding declined

$2.2 billion or 3 percent versus the previous quarter, reflecting

reduced demand from creditworthy borrowers. Also a factor was the

company’s continued effort to reduce exposure to higher-risk

investor real estate, which declined another $1.5 billion in the

second quarter or $4.7 billion over the last 12 months.

As customers see more confidence in the sustainability of the

economic recovery, Regions expects loan demand to increase at a

measured pace. In anticipation of this, small business and

middle-market loan officers are actively calling on existing

customers, as well as potential new customers. The company remains

confident in its ability to attract and retain customers with

attractive lending products, particularly in small business.

Success in acquiring new business clients is continuing this year

as Regions has continued to strengthen its branch focus on small

business.

Gulf oil spill

The company continues to closely monitor the situation in the

Gulf coast area. From the beginning of the oil spill, the company

has proactively reached out to its customers across the affected

area to help them deal with the potential financial impact of the

oil spill and to know the options they have for assistance, if

needed. The company’s Customer Assistance Program, which helps

distressed borrowers, was developed from its experience in dealing

with Hurricane Katrina and the recession.

In assessing the potential financial impact to the company,

Regions has performed a thorough review of the potentially impacted

geographic area stretching from Lake Charles, Louisiana to just

north of Tampa, Florida. Within that geographic range, Regions

analyzed exposure to businesses that rely on tourism, fishing,

boating and hospitality, for example. Based on preliminary stress

testing, the company estimates potential future losses to be a

maximum of $100 million in its adverse case. This loss estimate

conservatively assumes no benefit from private insurance payments,

government support or stimulus money that BP has committed, any of

which would reduce potential losses. Historically, Regions has

experienced strong resilience from the Gulf coast markets in

responding to environmental and economic challenges.

Regulatory reform

With the Dodd-Frank Wall Street Reform and Consumer Protection

Act becoming law, the legislation has provided some level of

clarity regarding how the industry and Regions’ specific business

will move forward. Additional rule writing is required under this

legislation and will require substantial time before the business

implications are completely defined. The company is diligently

assessing the potential effects of the legislation to its specific

business units and is attempting to forecast related earnings and

capital impact. Regions is also analyzing steps that can be taken

to mitigate any potential negative financial impact of the various

reform measures. The company expects that while the legislation

will require adjustments to its business strategies, these and

other associated challenges are manageable over time.

Regions is committed to being part of the solution to restore

the vitality of the economy. Operating by the principles of

fairness, clarity and transparency, the company will continue

focusing on customer needs and preferences.

Strong capital position

As of June 30, 2010, Tier 1 Capital stands at an estimated 12.0

percent, while the estimated Tier 1 Common ratio is 7.7 percent,

compared to 11.7 percent and 7.1 percent, respectively, for the

previous quarter (see non-GAAP discussion).

As to the capital implications of regulatory reform, trust

preferred securities will be phased out as an allowable component

of Tier 1 capital over a three year period beginning in 2012. This

change does not significantly impact Regions since trust preferred

securities totaled $846 million or approximately 86 basis points of

its Tier 1 capital at June 30, 2010.

About Regions Financial Corporation

Regions Financial Corporation, with $135 billion in assets, is a

member of the S&P 100 Index and one of the nation’s largest

full-service providers of consumer and commercial banking, trust,

securities brokerage, mortgage and insurance products and services.

Regions serves customers in 16 states across the South, Midwest and

Texas, and through its subsidiary, Regions Bank, operates

approximately 1,800 banking offices and 2,200 ATMs. Its investment

and securities brokerage trust and asset management division,

Morgan Keegan & Company Inc., provides services from over 300

offices. Additional information about Regions and its full line of

products and services can be found at www.regions.com.

Forward-looking statements

This press release may include forward-looking statements which

reflect Regions’ current views with respect to future events and

financial performance. The Private Securities Litigation Reform Act

of 1995 (“the Act”) provides a “safe harbor” for forward-looking

statements which are identified as such and are accompanied by the

identification of important factors that could cause actual results

to differ materially from the forward-looking statements. For these

statements, we, together with our subsidiaries, claim the

protection afforded by the safe harbor in the Act. Forward-looking

statements are not based on historical information, but rather are

related to future operations, strategies, financial results or

other developments. Forward-looking statements are based on

management’s expectations as well as certain assumptions and

estimates made by, and information available to, management at the

time the statements are made. Those statements are based on general

assumptions and are subject to various risks, uncertainties and

other factors that may cause actual results to differ materially

from the views, beliefs and projections expressed in such

statements. These risks, uncertainties and other factors include,

but are not limited to, those described below:

- The Dodd-Frank Wall Street

Reform and Consumer Protection Act became law on July 21, 2010, and

a number of legislative, regulatory and tax proposals remain

pending. Additionally, the U.S. Treasury and federal banking

regulators continue to implement, but are also beginning to wind

down, a number of programs to address capital and liquidity in the

banking system. All of the foregoing may have significant effects

on Regions and the financial services industry, the exact nature of

which cannot be determined at this time.

- The impact of compensation and

other restrictions imposed under the Troubled Asset Relief Program

(“TARP”) until Regions repays the outstanding preferred stock and

warrant issued under the TARP, including restrictions on Regions’

ability to attract and retain talented executives and

associates.

- Possible additional loan losses,

impairment of goodwill and other intangibles, and valuation

allowances on deferred tax assets and the impact on earnings and

capital.

- Possible changes in interest

rates may increase funding costs and reduce earning asset yields,

thus reducing margins.

- Possible changes in general

economic and business conditions in the United States in general

and in the communities Regions serves in particular, including any

prolonging or worsening of the current unfavorable economic

conditions, including unemployment levels.

- Possible changes in the

creditworthiness of customers and the possible impairment of the

collectability of loans.

- Possible changes in trade,

monetary and fiscal policies, laws and regulations, and other

activities of governments, agencies, and similar organizations,

including changes in accounting standards, may have an adverse

effect on business.

- The current stresses in the

financial and real estate markets, including possible continued

deterioration in property values.

- Regions' ability to manage

fluctuations in the value of assets and liabilities and off-balance

sheet exposure so as to maintain sufficient capital and liquidity

to support Regions' business.

- Regions' ability to achieve the

earnings expectations related to businesses that have been acquired

or that may be acquired in the future.

- Regions' ability to expand into

new markets and to maintain profit margins in the face of

competitive pressures.

- Regions' ability to develop

competitive new products and services in a timely manner and the

acceptance of such products and services by Regions' customers and

potential customers.

- Regions' ability to keep pace

with technological changes.

- Regions' ability to effectively

manage credit risk, interest rate risk, market risk, operational

risk, legal risk, liquidity risk, and regulatory and compliance

risk.

- Regions’ ability to ensure

adequate capitalization which is impacted by inherent uncertainties

in forecasting credit losses.

- The cost and other effects of

material contingencies, including litigation contingencies and any

adverse judicial, administrative or arbitral rulings or

proceedings.

- The effects of increased

competition from both banks and non-banks.

- The effects of geopolitical

instability and risks such as terrorist attacks.

- Possible changes in consumer and

business spending and saving habits could affect Regions' ability

to increase assets and to attract deposits.

- The effects of weather and

natural disasters such as floods, droughts and hurricanes, and the

effects of the Gulf of Mexico oil spill.

- Regions’ ability to maintain

favorable ratings from rating agencies.

- Potential dilution of holders of

shares of Regions’ common stock resulting from the U.S. Treasury’s

investment in TARP.

- Possible changes in the speed of

loan prepayments by Regions’ customers and loan origination or

sales volumes.

- The effects of problems

encountered by larger or similar financial institutions that

adversely affect Regions or the banking industry generally.

- Regions’ ability to receive

dividends from its subsidiaries.

- The effects of the failure of

any component of Regions’ business infrastructure which is provided

by a third party.

- The effects of any damage to

Regions’ reputation resulting from developments related to any of

the items identified above.

The words "believe," "expect," "anticipate," "project," and

similar expressions often signify forward-looking statements. You

should not place undue reliance on any forward-looking statements,

which speak only as of the date made. We assume no obligation to

update or revise any forward-looking statements that are made from

time to time.

See also Item 1A. “Risk Factors” of Regions’ Annual Report

on Form 10-K for the year ended December 31, 2009 and

Quarterly Report on Form 10-Q for the quarter ended March 31,

2010.

Use of non-GAAP financial measures

Page two of this earnings release presents computation of

earnings and certain other financial measures excluding regulatory

charge (non-GAAP), tier 1 common risk-based ratio and tangible

common equity. Page seven of the financial supplement shows

additional ratios based on return on average assets, tangible

common stockholders equity, as well as the Tier 1 common risk-based

ratio. Tangible common stockholders’ equity ratios have become a

focus of some investors, and management believes they may assist

investors in analyzing the capital position of the company absent

the effects of intangible assets and preferred stock.

Traditionally, the Federal Reserve and other banking regulatory

bodies have assessed a bank’s capital adequacy based on Tier 1

capital, the calculation of which is codified in federal banking

regulations. In connection with the Supervisory Capital Assessment

Program, these regulators began supplementing their assessment of

the capital adequacy of a bank based on a variation of Tier 1

capital, known as Tier 1 common equity. While not codified,

analysts and banking regulators have assessed Regions’ capital

adequacy using the tangible common stockholders’ equity and/or the

Tier 1 common equity measure. Because tangible common stockholders’

equity and Tier 1 common equity are not formally defined by GAAP or

codified in the federal banking regulations, these measures are

considered to be non-GAAP financial measures and other entities may

calculate them differently than Regions’ disclosed calculations.

Since analysts and banking regulators may assess Regions’ capital

adequacy using tangible common stockholders’ equity and Tier 1

common equity, we believe that it is useful to provide investors

the ability to assess Regions’ capital adequacy on these same

bases.

Tier 1 common equity is often expressed as a percentage of

risk-weighted assets. Under the risk-based capital framework, a

bank’s balance sheet assets and credit equivalent amounts of

off-balance sheet items are assigned to one of four broad risk

categories. The aggregated dollar amount in each category is then

multiplied by the risk weighted category. The resulting weighted

values from each of the four categories are added together and this

sum is the risk-weighted assets total that, as adjusted, comprises

the denominator of certain risk-based capital ratios. Tier 1

capital is then divided by this denominator (risk-weighted assets)

to determine the Tier 1 capital ratio. Adjustments are made to Tier

1 capital to arrive at Tier 1 common equity. Tier 1 common equity

is also divided by the risk-weighted assets to determine the Tier 1

common equity ratio. The amounts disclosed as risk-weighted assets

are calculated consistent with banking regulatory requirements.

Non-GAAP financial measures have inherent limitations, are not

required to be uniformly applied and are not audited. To mitigate

these limitations, Regions has policies and procedures in place to

identify and address expenses that qualify for non-GAAP

presentation, including authorization and system controls to ensure

accurate period to period comparisons. Although these non-GAAP

financial measures are frequently used by stakeholders in the

evaluation of a company, they have limitations as analytical tools,

and should not be considered in isolation, or as a substitute for

analyses of results as reported under GAAP. In particular, a

measure of earnings that excludes the regulatory charge does not

represent the amount that effectively accrues directly to

stockholders (i.e. the regulatory charge is a reduction in earnings

and stockholders’ equity).

See pages 27 and 28 of the supplement to this earnings release

for 1) computation of GAAP net income (loss) available to common

shareholders, earnings (loss) per common share and return on

average assets to non-GAAP financial measures, 2) a reconciliation

of average and ending stockholders’ equity (GAAP) to average and

ending tangible common stockholders’ equity (non-GAAP), and 3) a

reconciliation of stockholders’ equity (GAAP) to Tier 1 capital

(regulatory) and to Tier 1 common equity (non-GAAP).

Photos/Multimedia Gallery Available:

http://www.businesswire.com/cgi-bin/mmg.cgi?eid=6373471&lang=en

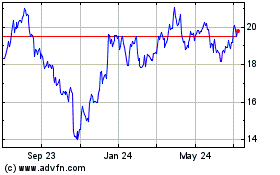

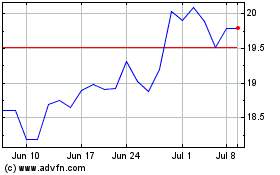

Regions Financial (NYSE:RF)

Historical Stock Chart

From May 2024 to Jun 2024

Regions Financial (NYSE:RF)

Historical Stock Chart

From Jun 2023 to Jun 2024