- Company Provides Update on COVID-19 Impact and Response

Strategies

- Company First Quarter Net Income of $0.74 Per Share

- Closings Increased 16% to 5,373 Homes

- Home Sale Gross Margin Increased 30 Basis Points to

23.7%

- Net New Orders Increased 16% to 7,495 Homes; Net New Order

Value Increased 19% to $3.3 Billion

- Unit Backlog Higher by 20% to 12,629 Homes; Backlog Value

Increased 21% to $5.6 Billion

- Company Maintains Outstanding Liquidity and Balance Sheet

Strength

In conjunction with announcing its first quarter financial

results today, PulteGroup, Inc. (NYSE: PHM) also discussed the

impact of the COVID-19 pandemic on housing demand, its workforce

and the Company’s overall homebuilding operations.

“The U.S. housing industry carried tremendous momentum into

2020, until the devastating effects of the COVID-19 pandemic began

impacting the country,” said Ryan Marshall, PulteGroup President

and CEO. “As the coronavirus spread and state and local governments

implemented various restrictions and stay-in-place orders, we

experienced a material slowdown in consumer traffic and sales

activity beginning in mid-March.”

Mr. Marshall added, “In response to the pandemic’s impact, we

have altered our operating processes and short-term objectives to

help protect the health and safety of our customers and employees,

while working to properly position our business for the current

economic crisis and ultimate business recovery. As part of this

effort, we are maximizing the use of technology to enable the

virtual selling, design and closing of our homes. Where in-person

interactions are required, we have implemented appropriate

social-distancing practices and enhanced on-site cleaning and

disinfecting processes.”

“Within those markets where residential construction has been

deemed an essential service, we have also refined our building

practices to help ensure our trades can operate safely and with

appropriate distancing within our homes. We are also working

closely with our trade partners to maintain building and cost

efficiencies during this period of volatility.”

“Benefitting from our success in running a highly profitable and

high returning business, we entered this period of economic

weakness in an extremely strong financial position. Still, given

the severity of the slowdown and the general uncertainty about the

speed of recovery in the U.S. economy, we have taken steps to

closely manage our cash flows and overall liquidity. Broadly, our

focus is on minimizing future cash outflows associated with home

construction, land development, land acquisition and general

operating costs, while maximizing cash inflows through home

closings.”

“Given the extent of business disruption and the uncertainty

relating to government efforts to restart local economies, we are

withdrawing our previous guidance for PulteGroup’s 2020 financial

results and will suspend providing such guidance for the

foreseeable future. Beyond the business implications of COVID-19,

we are fully aware of the devastating personal impacts this disease

is having. Our thoughts and best wishes go out to the people

impacted by this virus and to all those battling to control its

spread.”

First-Quarter Financial Results

For the first quarter ended March 31, 2020, PulteGroup reported

net income of $204 million, or $0.74 per share, which is an

increase over prior year reported net income of $167 million, or

$0.59 per share.

Home sale revenues for the first quarter increased 14% to $2.2

billion. The increase in revenue for the period was driven by a 16%

increase in the number of homes closed to 5,373, partially offset

by a 2% decrease in average selling price to $413,000. The lower

average sales price primarily reflects changes in the product and

geographic mix of homes closed in this quarter compared with the

first quarter of 2019.

Home sale gross profit for the quarter increased to $527

million, or 23.7% of home sale revenues, compared with prior year

first quarter gross profit of $457 million, or 23.4% of home sale

revenues. SG&A expense for the first quarter was $264 million,

or 11.9% of home sale revenues, compared with prior year first

quarter SG&A expense of $253 million, or 13.0% of home sale

revenues. Operating margin for the period increased by 130 basis

points to 11.8%.

Net new orders for the first quarter increased 16% to 7,495

homes, while the value of orders increased 19% to $3.3 billion. For

the first quarter, the Company operated from an average of 873

communities, which is an increase of 4% over the first quarter

average of 843 communities last year.

Quarter-end backlog increased 20% over last year to 12,629

homes, while related backlog value increased 21% to $5.6 billion.

The average sales price in backlog increased $4,000, or 1%, over

the prior year to $442,000.

PulteGroup’s financial services operations generated pretax

income of $20 million, up from pretax income in the first quarter

of last year of $12 million. Mortgage capture rate for the quarter

increased to 87%, up from 80% last year.

Liquidity Update

The Company ended the quarter with $1.9 billion of cash, which

includes the receipt of $700 million in connection with the

Company’s decision to draw on its revolving bank facility in March

of this year. During the quarter, the Company repurchased 2.8

million common shares for $96 million, or an average price of

$33.86 per share.

“While our strong business results have allowed us to maintain

an elevated cash position, we elected to draw on our revolving

credit agreement in an abundance of caution due to the dramatic

impact and broad economic uncertainties the COVID-19 pandemic has

created,” said Bob O’Shaughnessy, Executive Vice President and CFO.

“Further, given the economic uncertainties, we have also elected to

suspend all stock repurchase activities.”

A conference call to discuss PulteGroup's first quarter results

is scheduled for Thursday, April 23, 2020, at 8:30 a.m. Eastern

Time. Interested investors can access the live webcast via

PulteGroup's corporate website at www.pultegroup.com.

Forward-Looking Statements

This release includes "forward-looking statements." These

statements are subject to a number of risks, uncertainties and

other factors that could cause our actual results, performance,

prospects or opportunities, as well as those of the markets we

serve or intend to serve, to differ materially from those expressed

in, or implied by, these statements. You can identify these

statements by the fact that they do not relate to matters of a

strictly factual or historical nature and generally discuss or

relate to forecasts, estimates or other expectations regarding

future events. Generally, the words “believe,” “expect,” “intend,”

“estimate,” “anticipate,” “plan,” “project,” “may,” “can,” “could,”

“might,” "should," “will” and similar expressions identify

forward-looking statements, including statements related to any

potential impairment charges and the impacts or effects thereof,

expected operating and performing results, planned transactions,

planned objectives of management, future developments or conditions

in the industries in which we participate and other trends,

developments and uncertainties that may affect our business in the

future.

Such risks, uncertainties and other factors include, among other

things: interest rate changes and the availability of mortgage

financing; competition within the industries in which we operate;

the availability and cost of land and other raw materials used by

us in our homebuilding operations; the impact of any changes to our

strategy in responding to the cyclical nature of the industry,

including any changes regarding our land positions and the levels

of our land spend; the availability and cost of insurance covering

risks associated with our businesses; shortages and the cost of

labor; weather related slowdowns; slow growth initiatives and/or

local building moratoria; governmental regulation directed at or

affecting the housing market, the homebuilding industry or

construction activities; uncertainty in the mortgage lending

industry, including revisions to underwriting standards and

repurchase requirements associated with the sale of mortgage loans;

the interpretation of or changes to tax, labor and environmental

laws which could have a greater impact on our effective tax rate or

the value of our deferred tax assets than we anticipate; economic

changes nationally or in our local markets, including inflation,

deflation, changes in consumer confidence and preferences and the

state of the market for homes in general; legal or regulatory

proceedings or claims; our ability to generate sufficient cash flow

in order to successfully implement our capital allocation

priorities; required accounting changes; terrorist acts and other

acts of war; the negative impact of the COVID-19 pandemic on our

financial position and ability to continue our Homebuilding or

Financial Services activities at normal levels or at all in

impacted areas; the duration, effect and severity of the COVID-19

pandemic; the measures that governmental authorities take to

address the COVID-19 pandemic which may precipitate or exacerbate

one or more of the above-mentioned and/or other risks and

significantly disrupt or prevent us from operating our business in

the ordinary course for an extended period of time; and other

factors of national, regional and global scale, including those of

a political, economic, business and competitive nature. See

PulteGroup's Annual Report on Form 10-K for the fiscal year ended

December 31, 2019, and other public filings with the Securities and

Exchange Commission (the "SEC") for a further discussion of these

and other risks and uncertainties applicable to our businesses.

PulteGroup undertakes no duty to update any forward-looking

statement, whether as a result of new information, future events or

changes in PulteGroup's expectations.

About PulteGroup

PulteGroup, Inc. (NYSE: PHM), based in Atlanta, Georgia, is one

of America’s largest homebuilding companies with operations in more

than 40 markets throughout the country. Through its brand portfolio

that includes Centex, Pulte Homes, Del Webb, DiVosta Homes,

American West and John Wieland Homes and Neighborhoods, the company

is one of the industry’s most versatile homebuilders able to meet

the needs of multiple buyer groups and respond to changing consumer

demand. PulteGroup’s purpose is building incredible places where

people can live their dreams.

For more information about PulteGroup, Inc. and PulteGroup’s

brands, go to pultegroup.com; www.pulte.com; www.centex.com;

www.delwebb.com; www.divosta.com; www.jwhomes.com; and

www.americanwesthomes.com. Follow PulteGroup, Inc. on Twitter:

@PulteGroupNews.

PulteGroup, Inc.

Consolidated Statements of

Operations

($000's omitted, except per

share data)

(Unaudited)

Three Months Ended

March 31,

2020

2019

Revenues:

Homebuilding

Home sale revenues

$

2,221,503

$

1,949,856

Land sale and other revenues

18,927

2,975

2,240,430

1,952,831

Financial Services

54,550

43,862

Total revenues

2,294,980

1,996,693

Homebuilding Cost of Revenues:

Home sale cost of revenues

(1,694,865

)

(1,492,791

)

Land sale and other cost of revenues

(15,014

)

(2,050

)

(1,709,879

)

(1,494,841

)

Financial Services expenses

(34,949

)

(31,449

)

Selling, general, and administrative

expenses

(263,669

)

(252,727

)

Goodwill impairment

(20,190

)

—

Other expense, net

(2,524

)

(973

)

Income before income taxes

263,769

216,703

Income tax expense

(60,058

)

(49,946

)

Net income

$

203,711

$

166,757

Per share:

Basic earnings

$

0.75

$

0.59

Diluted earnings

$

0.74

$

0.59

Cash dividends declared

$

0.12

$

0.11

Number of shares used in

calculation:

Basic

270,000

277,637

Effect of dilutive securities

1,218

1,003

Diluted

271,218

278,640

PulteGroup, Inc.

Condensed Consolidated Balance

Sheets

($000's omitted)

(Unaudited)

March 31,

2020

December 31,

2019

ASSETS

Cash and equivalents

$

1,816,778

$

1,217,913

Restricted cash

34,475

33,543

Total cash, cash equivalents, and

restricted cash

1,851,253

1,251,456

House and land inventory

7,857,664

7,680,614

Land held for sale

31,636

24,009

Residential mortgage loans

available-for-sale

363,854

508,967

Investments in unconsolidated entities

54,495

59,766

Other assets

935,532

895,686

Intangible assets

178,553

124,992

Deferred tax assets, net

150,387

170,107

$

11,423,374

$

10,715,597

LIABILITIES AND SHAREHOLDERS’

EQUITY

Liabilities:

Accounts payable

$

429,724

$

435,916

Customer deposits

344,973

294,427

Accrued and other liabilities

1,319,808

1,399,368

Income tax liabilities

72,546

36,093

Financial Services debt

270,000

326,573

Revolving credit facility

700,000

—

Notes payable

2,755,932

2,765,040

5,892,983

5,257,417

Shareholders' equity

5,530,391

5,458,180

$

11,423,374

$

10,715,597

PulteGroup, Inc.

Consolidated Statements of

Cash Flows

($000's omitted)

(Unaudited)

Three Months Ended

March 31,

2020

2019

Cash flows from operating

activities:

Net income

$

203,711

$

166,757

Adjustments to reconcile net income to net

cash from operating activities:

Deferred income tax expense

19,955

24,690

Land-related charges

9,729

2,979

Goodwill impairment

20,190

—

Depreciation and amortization

15,149

13,210

Share-based compensation expense

11,479

9,019

Other, net

(903

)

(39

)

Increase (decrease) in cash due to:

Inventories

(189,364

)

(259,865

)

Residential mortgage loans

available-for-sale

145,113

134,217

Other assets

(3,534

)

64,533

Accounts payable, accrued and other

liabilities

(26,910

)

3,404

Net cash provided by (used in) operating

activities

204,615

158,905

Cash flows from investing

activities:

Capital expenditures

(20,139

)

(16,070

)

Investments in unconsolidated entities

5,837

(1,289

)

Business acquisition

(83,200

)

—

Other investing activities, net

1,706

291

Net cash provided by (used in) investing

activities

(95,796

)

(17,068

)

Cash flows from financing

activities:

Repayments of notes payable

(9,245

)

(3,605

)

Borrowings under revolving credit

facility

700,000

—

Financial Services borrowings

(repayments)

(56,573

)

(126,273

)

Stock option exercises

50

1,445

Share repurchases

(95,676

)

(24,999

)

Cash paid for shares withheld for

taxes

(14,838

)

(10,350

)

Dividends paid

(32,740

)

(30,802

)

Net cash provided by (used in) financing

activities

490,978

(194,584

)

Net increase (decrease) in cash, cash

equivalents, and restricted cash

599,797

(52,747

)

Cash, cash equivalents, and restricted

cash at beginning of period

1,251,456

1,133,700

Cash, cash equivalents, and restricted

cash at end of period

$

1,851,253

$

1,080,953

Supplemental Cash Flow

Information:

Interest paid (capitalized), net

$

14,019

$

17,164

Income taxes paid (refunded), net

$

5,540

$

(30,850

)

PulteGroup, Inc.

Segment Data

($000's omitted)

(Unaudited)

Three Months Ended

March 31,

2020

2019

HOMEBUILDING:

Home sale revenues

$

2,221,503

$

1,949,856

Land sale and other revenues

18,927

2,975

Total Homebuilding revenues

2,240,430

1,952,831

Home sale cost of revenues

(1,694,865

)

(1,492,791

)

Land sale and other cost of revenues

(15,014

)

(2,050

)

Selling, general, and administrative

expenses ("SG&A")

(263,669

)

(252,727

)

Goodwill impairment

(20,190

)

—

Other expense, net

(2,474

)

(969

)

Income before income taxes

$

244,218

$

204,294

FINANCIAL SERVICES:

Income before income taxes

$

19,551

$

12,409

CONSOLIDATED:

Income before income taxes

$

263,769

$

216,703

OPERATING METRICS:

Gross margin % (a)(b)

23.7

%

23.4

%

SG&A % (a)

(11.9

)%

(13.0

)%

Operating margin % (a)

11.8

%

10.5

%

(a) As a percentage of home sale

revenues

(b) Gross margin represents home sale

revenues minus home sale cost of revenues

PulteGroup, Inc.

Segment Data,

continued

($000's omitted)

(Unaudited)

Three Months Ended

March 31,

2020

2019

Home sale revenues

$

2,221,503

$

1,949,856

Closings - units

Northeast

310

219

Southeast

928

897

Florida

1,210

1,008

Midwest

708

726

Texas

1,128

849

West

1,089

936

5,373

4,635

Average selling price

$

413

$

421

Net new orders - units

Northeast

448

361

Southeast

1,141

1,073

Florida

1,685

1,346

Midwest

1,019

1,024

Texas

1,509

1,366

West

1,693

1,293

7,495

6,463

Net new orders - dollars

$

3,268,749

$

2,735,852

Unit backlog

Northeast

727

612

Southeast

2,078

1,786

Florida

2,781

2,227

Midwest

1,851

1,700

Texas

2,231

2,009

West

2,961

2,216

12,629

10,550

Dollars in backlog

$

5,583,051

$

4,622,145

PulteGroup, Inc.

Segment Data,

continued

($000's omitted)

(Unaudited)

Three Months Ended

March 31,

2020

2019

MORTGAGE ORIGINATIONS:

Origination volume

3,870

2,998

Origination principal

$

1,213,266

$

914,711

Capture rate

86.8

%

79.7

%

Supplemental Data

($000's omitted)

(Unaudited)

Three Months Ended

March 31,

2020

2019

Interest in inventory, beginning of

period

$

210,383

$

227,495

Interest capitalized

39,913

42,381

Interest expensed

(36,871

)

(34,563

)

Interest in inventory, end of period

$

213,425

$

235,313

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200423005154/en/

Company Contact Investors: Jim Zeumer (404) 978-6434 Email:

jim.zeumer@pultegroup.com

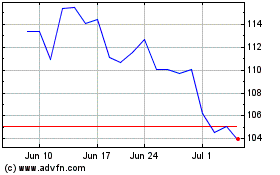

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Apr 2023 to Apr 2024