Performance Marked by Global Growth in Composites TOLEDO, Ohio, May

7 /PRNewswire-FirstCall/ -- Owens Corning (NYSE:OC) today reported

that consolidated net sales increased 20 percent to $1.35 billion

during the first quarter, compared with $1.12 billion in the first

quarter of 2007. First-quarter sales increased year-over-year as a

result of the acquisition of Saint-Gobain's reinforcements and

composite fabrics businesses in November 2007. These sales were

offset by weaker demand for the company's building materials

products associated with the continued downturn of the U.S. housing

market. The company experienced weaker demand and lower selling

prices for residential insulation as well as significant energy and

raw material inflation in the Roofing and Asphalt business.

Combined with an impairment associated with the recent divestiture

of composite manufacturing assets in Belgium and Norway, this led

to a first-quarter loss from continuing operations of $15 million,

or a loss of $0.12 per diluted share. Adjusted earnings from

continuing operations were $10 million, or earnings of $0.07 per

adjusted diluted share, excluding comparability items (see attached

Table 3 for a discussion and reconciliation of such items).

Comparability items affecting net earnings in the first quarter

amounted to approximately $31 million, which included items related

to restructuring activities, business acquisitions and

dispositions, the employee equity program related to the company's

emergence from Chapter 11 in 2006, and asset impairments.

Consolidated First-Quarter Results - Earnings before interest and

taxes (EBIT) from continuing operations in the first quarter of

2008 were $19 million, compared with $32 million during the same

period in 2007. Excluding comparability items (see Table 2),

adjusted EBIT from continuing operations for the first quarter of

2008 was $54 million compared with $59 million during the same

period in 2007, a decrease of 8 percent. The decrease reflects

lower demand for building materials products and inflation in

energy and raw material costs. The decline in EBIT in the building

materials businesses was partially offset by incremental earnings

resulting from the acquisition of Saint-Gobain's reinforcements and

composite fabrics businesses, and improvement in the Composite

Solutions business related to manufacturing productivity. - Gross

margin as a percentage of consolidated net sales was 14 percent

during the first quarter of 2008, compared with 17 percent during

the same period in 2007. The decrease was the result of sales

volume and price declines in the Insulating Systems business, and

the inability to achieve price increases during the quarter to

offset the impact of inflation in energy and raw materials in the

Roofing and Asphalt business. These decreases were partially offset

by improved margins in the Composite Solutions segment. "Business

results for the first quarter were encouraging and met our

expectations," said Mike Thaman, chairman and chief executive

officer. "Our performance for the quarter validates the actions we

took during the second half of 2007 to rework our business mix. The

$100 million in cost-reduction actions that we targeted for 2008

are now fully in place. "Our acquisition of Saint-Gobain's

reinforcements and composite fabrics businesses is paying off,

delivering sales growth outside the U.S.," said Thaman. "We are on

track to achieve at least $30 million in acquisition- related

synergies in Composites in 2008 with EBIT margins approaching 10

percent, excluding metal lease expense. We are very pleased with

the performance of this segment. Our Insulating Systems business

made money in the first quarter in a very challenging U.S. housing

market. Our Roofing and Asphalt business struggled during the

quarter due to a lack of housing-related demand and escalating cost

inflation. We expect stronger performance in this business and a

return to profitability in the second quarter of the year. The

strength of our Composites business and our excellent market

position in building materials will carry us through a weak U.S.

housing market in 2008." Business Highlights - Global demand for

glass fiber reinforcement products grew during the first quarter,

leading to higher capacity utilization and improved productivity. -

Demand for insulation products met our expectations during the

first quarter despite further weakness in the U.S. housing market.

- Owens Corning achieved a significant reduction in workplace

injuries of 52 percent during the first quarter of 2008, compared

with the company's Dec. 31, 2007 rate. Other Financial Items -

During the first quarter of 2008, depreciation and amortization

from continuing operations totaled $77 million. - At the end of the

first quarter of 2008, Owens Corning had net debt of $2.1 billion,

comprised of $2.2 billion of short- and long-term debt and

cash-on-hand of $118 million. - Owens Corning's federal tax net

operating loss carryforward resulting from the distribution of cash

and stock to settle its prior Chapter 11 case in 2006 was $3.0

billion at the end of the first quarter of 2008. The company's U.S.

cash tax rate is expected to be less than 2 percent for at least

the next five to seven years. Owens Corning announced a share

buy-back program in the first quarter of 2007 under which the

company is authorized to repurchase up to 5 percent of Owens

Corning's outstanding common stock. The company did not repurchase

any shares under this program during the first quarter of 2008.

Recent Developments During the first quarter of 2008, Owens Corning

reached a definitive agreement to divest its composite

manufacturing facilities in Battice, Belgium, and Birkeland,

Norway, to address regulatory remedies associated with its purchase

of the businesses acquired from Saint-Gobain. The company completed

the divestiture of these facilities on May 1, 2008. The aggregate

gross purchase price for the sale was euro 155 million ($242

million). After costs associated with the transaction and to

position the business as an ongoing concern, Owens Corning expects

to realize net proceeds of approximately $197 million, consisting

of cash proceeds of $184 million plus the assumption of certain

liabilities by the purchaser. As a result of the sale, Owens

Corning recorded an additional impairment charge of approximately

$10 million in the first quarter of 2008. These amounts are subject

to post- closing adjustments. Outlook Owens Corning's recent

reinforcements and composite fabrics acquisition has significantly

strengthened the company's presence in the global composites

market. As Owens Corning continues to realize synergies from the

acquisition, the company expects operating margins in its

composites business to approach 10 percent in 2008, excluding the

financial cost of leasing precious metals. Most economists expect

the current weakness in the U.S. housing market to continue

throughout 2008, which will affect demand for Owens Corning's

building materials products. Owens Corning will continue to focus

on stimulating insulation demand by promoting the vital role of

insulation in energy efficiency and greenhouse gas reduction, and

developing new products and customer promotions under the company's

PINK is Green(TM) initiative. The company currently estimates that

depreciation and amortization from continuing operations will total

approximately $315 million in 2008. Capital expenditures in 2008

are estimated to be about $325 million, which will allow the

company to invest to achieve synergies associated with its recent

composites acquisition. Owens Corning anticipates that its 2008

global effective tax rate will be substantially below the U.S.

federal income tax rate. The company expects its U.S. cash taxes

will be minimal, and that its cash effective tax rate in its

operations will be 15 percent or less in 2008. Despite the declines

in U.S. housing starts, Owens Corning continues to estimate that

2008 adjusted EBIT should be at least $240 million. The company

excludes from its estimate items impacting comparability as well as

the financial cost of leasing precious metals. Business Segment

Highlights Composite Solutions - Net sales for the first quarter of

2008 were $666 million, an 82-percent increase from $366 million

during the same period in 2007. The increase was driven by

incremental sales associated with the recent acquisition of

Saint-Gobain's reinforcements and composite fabrics businesses. -

EBIT from continuing operations for the first quarter of 2008 was

$64 million, compared with $25 million during the same period in

2007. The increase was primarily due to incremental earnings

associated with the company's composites acquisition and the impact

of improved manufacturing productivity. Insulating Systems - Net

sales for the first quarter of 2008 were $373 million, an 11-

percent decrease from $419 million during the same period in 2007.

Sales for residential insulation products were significantly

impacted by the reduction in new residential construction and

repair and remodeling in the United States. - EBIT from continuing

operations for the first quarter of 2008 was $16 million, compared

with $53 million during the same period in 2007. The decline was

primarily due to lower selling prices driven by the weakness in the

U.S. housing market. Roofing and Asphalt - Net sales for the first

quarter of 2008 and 2007 were $306 million in both years on

generally flat volumes and price. - EBIT from continuing operations

for the first quarter of 2008 was a loss of $17 million, compared

with a loss of $8 million during the same period in 2007. The

increased loss reflected the company's inability to achieve

sufficient price increases during the quarter to offset the impact

of inflation on energy and raw materials, including asphalt. Other

Building Materials and Services - Net sales for the first quarter

of 2008 were $53 million, a 23-percent decrease from $69 million

during the same period in 2007. The decline was primarily the

result of declines in the company's Masonry Products business

related to the lower demand from new construction and repair and

remodeling markets in the United States. - EBIT from continuing

operations for the first quarter of 2008 was a loss of $3 million,

compared with earnings of $4 million during the same period in

2007. The change was primarily due to the decline in volumes and

idle facility costs in Masonry Products. Second-quarter 2008

results are currently scheduled to be announced on July 30, 2008.

Conference Call and Presentation Wednesday, May 7, 2008 11 a.m. ET

All Callers Live dial-in telephone number: 1-800-329-9097 or

1-617-614-4929 (Please dial in 10 minutes before conference call

start time) Passcode: 63985478 Presentation To view the slide

presentation during the conference call, please log on to the live

webcast at http://www.owenscorning.com/investors. A telephone

replay will be available through May 21, 2008 at 1-888-286- 8010 or

1-617-801-6888. Passcode: 80352426. A replay of the webcast will

also be available at http://www.owenscorning.com/investors. About

Owens Corning Owens Corning (NYSE:OC) is a leading global producer

of residential and commercial building materials, glass fiber

reinforcements and engineered materials for composite systems. A

Fortune 500 company for 54 consecutive years, Owens Corning is

committed to driving sustainability through delivering solutions,

transforming markets and enhancing lives. Founded in 1938, Owens

Corning is a market-leading innovator of glass fiber technology

with sales of $5 billion in 2007 and 19,000 employees in 26

countries on five continents. Additional information is available

at http://www.owenscorning.com/. This news release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. These forward-looking statements are subject to risks,

uncertainties and other factors, many of which are outside the

control of the company, which could cause actual results to differ

materially from those projected in these statements and from the

company's historical results and experience. Such factors include

competitive factors, pricing pressures, availability and cost of

energy and materials, acquisitions and achievement of expected

synergies therefrom, general economic conditions and factors

detailed from time to time in the company's Securities and Exchange

Commission filings. Since it is not possible to predict or identify

all of the risks, uncertainties and other factors that may affect

future results, the above list should not be considered a complete

list. Any forward-looking statement speaks only as of the date on

which such statement is made, and the company undertakes no

obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or otherwise.

Table 1 Owens Corning and Subsidiaries Consolidated Statements of

Earnings (Loss) (Unaudited) (in millions, except per share amounts)

Three Months Three Months Ended Ended March 31, March 31, 2008 2007

NET SALES $1,353 $1,124 COST OF SALES 1,161 937 Gross margin 192

187 OPERATING EXPENSES Marketing and administrative expenses 142

127 Science and technology expenses 19 15 Restructuring costs

(credits) 2 (2) Chapter 11-related reorganization items - 3

Employee emergence equity program expense 7 8 Loss on sale of fixed

assets and other 3 4 Total operating expenses 173 155 EARNINGS FROM

CONTINUING OPERATIONS BEFORE INTEREST AND TAXES 19 32 Interest

expense, net 32 32 LOSS FROM CONTINUING OPERATIONS BEFORE TAXES

(13) - Income tax expense 2 - LOSS FROM CONTINUING OPERATIONS

BEFORE MINORITY INTEREST AND EQUITY IN NET EARNINGS OF AFFILIATES

(15) - Minority interest and equity in net earnings (loss) of

affiliates - - LOSS FROM CONTINUING OPERATIONS (15) - Earnings from

discontinued operations, net of tax of $0 - 1 NET EARNINGS (LOSS)

$(15) $1 BASIC EARNINGS (LOSS) PER COMMON SHARE Loss from

continuing operations $(0.12) $- Earnings from discontinued

operations - 0.01 Basic net earnings (loss) per common share

$(0.12) $0.01 DILUTED EARNINGS (LOSS) PER COMMON SHARE Loss from

continuing operations $(0.12) $- Earnings from discontinued

operations - 0.01 Diluted net earnings (loss) per common share

$(0.12) $0.01 WEIGHTED AVERAGE COMMON SHARES Basic 128.8 128.2

Diluted 128.8 129.0 Table 2 Owens Corning and Subsidiaries EBIT

Reconciliation Schedules (Unaudited) (in millions) Because of the

nature of certain items included in reported earnings (loss) from

continuing operations before interest and taxes ("EBIT"), net

earnings (loss) and diluted earnings (loss) per share, management

does not find the reported measures to be the most useful and

transparent financial measures of our year-over-year operational

performance. Certain of these comparability items, consisting of

items related to restructuring activities, business acquisitions

and dispositions, the employee emergence equity program and cost of

our prior Chapter 11 proceedings, are not the result of current

operations. In addition, the reported measures also include the

cost of leasing precious metals, including the cost of leases

assumed in the acquisition of Saint-Gobain's reinforcements and

composite fabrics businesses. To facilitate our evaluation of these

acquired businesses on a basis consistent with the purchase of all

precious metals necessary to operate the businesses, we consider

the net metal lease expense to be a financing cost which should be

included in interest expense in measuring our year-over-year

performance. As described more fully in the following financial

schedules, such comparability items affecting EBIT amounted to

charges of $35 million and $27 million in the three months ended

March 31, 2008 and 2007, respectively. Three Months Three Months

Ended Ended March 31, March 31, 2008 2007 RECONCILIATION TO

ADJUSTED EARNINGS FROM CONTINUING OPERATIONS BEFORE INTEREST AND

TAXES: NET EARNINGS (LOSS) $(15) $1 Earnings from discontinued

operations, net of tax of $0 - 1 LOSS FROM CONTINUING OPERATIONS

(15) - Minority interest and equity in net earnings (loss) of

affiliates - - LOSS FROM CONTINUING OPERATIONS BEFORE MINORITY

INTEREST AND EQUITY IN NET EARNINGS OF AFFILIATES (15) - Income tax

expense 2 - LOSS FROM CONTINUING OPERATIONS BEFORE TAXES (13) -

Interest expense, net 32 32 EARNINGS FROM CONTINUING OPERATIONS

BEFORE INTEREST AND TAXES 19 32 Adjustments to remove items

impacting comparability: Chapter 11-related reorganization items $-

$3 Net metal lease expense (income) 4 (1) Restructuring and other

costs (credits) 2 (2) Acquisition integration and transaction costs

12 11 Losses related to the exit of our HOMExperts service line - 8

Employee emergence equity program expense 7 8 Asset impairments 10

- Total adjustments to remove comparability items 35 27 ADJUSTED

EARNINGS FROM CONTINUING OPERATIONS BEFORE INTEREST AND TAXES $54

$59 Table 3 Owens Corning and Subsidiaries EPS Reconciliation

Schedules (Unaudited) (in millions, except per share amounts)

Because of the nature of certain items included in reported

earnings (loss) from continuing operations before interest and

taxes ("EBIT"), net earnings (loss) and diluted earnings (loss) per

share, management does not find the reported measures to be the

most useful and transparent financial measures of our

year-over-year operational performance. Certain of these

comparability items, consisting of items related to restructuring

activities, business acquisitions and dispositions, the employee

emergence equity program and cost of our prior Chapter 11

proceedings, are not the result of current operations. In addition,

the reported measures also include the cost of leasing precious

metals, including the cost of leases assumed in the acquisition of

Saint-Gobain's reinforcements and composite fabrics businesses. To

facilitate our evaluation of these acquired businesses on a basis

consistent with the purchase of all precious metals necessary to

operate the businesses, we consider the net metal lease expense to

be a financing cost which should be included in interest expense in

measuring our year-over-year performance. As described more fully

in the following financial schedules, such comparability items

affecting net earnings amounted to charges of $31 million and $28

million in the three months ended March 31, 2008 and 2007,

respectively, after the adjustment to classify net metal lease

expense as interest. Three Months Three Months Ended Ended March

31, March 31, 2008 2007 RECONCILIATION TO ADJUSTED EARNINGS FROM

CONTINUING OPERATIONS NET EARNINGS (LOSS) $(15) $1 Earnings from

discontinued operations, net of tax of $0 - 1 LOSS FROM CONTINUING

OPERATIONS (15) - Adjustments to remove items impacting

comparability: Chapter 11-related reorganization items $- $3 Net

metal lease expense (income) 4 (1) Restructuring and other costs

(credits) 2 (2) Acquisition integration and transaction costs 12 11

Losses related to the exit of our HOMExperts service line - 8

Employee emergence equity program expense 7 8 Asset impairments 10

- Total adjustments to remove comparability items 35 27 Adjustment

to classify net metal lease (expense) income as interest (4) 1 Tax

effect of adjustments at 19% in 2008 and 37% in 2007 (6) (10)

ADJUSTED EARNINGS FROM CONTINUING OPERATIONS $10 $18 RECONCILIATION

TO ADJUSTED DILUTED EARNINGS (LOSS) PER SHARE FROM CONTINUING

OPERATIONS: DILUTED LOSS PER SHARE FROM CONTINUING OPERATIONS

$(0.12) $- Adjustment to remove comparability items 0.27 0.20

Adjustment to classify net metal lease (expense) income as interest

(0.03) 0.01 Tax effect of adjustments at 19% in 2008 and 37% in

2007 (0.05) (0.08) ADJUSTED DILUTED EARNINGS PER SHARE FROM

CONTINUING OPERATIONS $0.07 $0.13 DILUTED EARNINGS PER SHARE FROM

DISCONTINUED OPERATIONS $- $0.01 RECONCILIATION TO ADJUSTED DILUTED

SHARES OUTSTANDING: Weighted-average shares outstanding used for

diluted earnings per share 128.8 129.0 Shares related to employee

emergence program 2.3 3.0 Adjusted diluted shares outstanding 131.1

132.0 Table 4 Owens Corning and Subsidiaries Condensed Consolidated

Balance Sheets (Unaudited) (in millions) March 31, December 31,

2008 2007 ASSETS Current Assets Cash and cash equivalents $118 $135

Receivables, less allowances of $23 million in 2008 and $23 million

in 2007 796 721 Inventories 883 821 Restricted cash - disputed

distribution reserve 33 33 Assets held for sale - current 63 53

Other current assets 115 89 Total current assets 2,008 1,852

Property, plant and equipment, net 2,777 2,772 Goodwill 1,173 1,174

Intangible assets 1,208 1,210 Deferred income taxes 492 487 Assets

held for sale - non- current 181 178 Other non-current assets 194

199 TOTAL ASSETS $8,033 $7,872 LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities Accounts payable and accrued liabilities $1,079

$1,137 Accrued interest 31 12 Short-term debt 32 47 Long-term debt

- current portion 13 10 Liabilities held for sale - current 47 40

Total current liabilities 1,202 1,246 Long-term debt, net of

current portion 2,138 1,993 Pension plan liability 125 146 Other

employee benefits liability 292 293 Liabilities held for sale -non-

current 12 8 Other liabilities 192 161 Commitments and

contingencies Minority interest 36 37 Stockholders' equity 4,036

3,988 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $8,033 $7,872

Table 5 Owens Corning and Subsidiaries Condensed Consolidated

Statements of Cash Flows (Unaudited) (in millions) Three Months

Three Months Ended Ended March 31, March 31, 2008 2007 NET CASH

FLOW USED FOR OPERATING ACTIVITIES Net earnings (loss) $(15) $1

Adjustments to reconcile net earnings (loss) to cash used for

operating activities: Depreciation and amortization 77 77 Gain on

sale of businesses and fixed assets - (1) Impairment of fixed and

intangible assets and investment in affiliates 10 - Deferred income

taxes (10) (9) Provision for pension and other employee benefits

liabilities 11 11 Employee emergence equity program expense 7 8

Stock-based compensation expense 5 - Payments related to Chapter 11

filings (1) (8) Increase in receivables (65) (117) Increase in

inventories (57) (94) (Increase) decrease in prepaid and other

assets (5) 2 Decrease in accounts payable and accrued liabilities

(48) (124) Pension fund contribution (24) (9) Payments for other

employee benefits liabilities (8) (7) Other 16 (16) Net cash flow

used for operating activities (107) (286) NET CASH FLOW USED FOR

INVESTING ACTIVITIES Additions to plant and equipment (52) (42)

Investment in subsidiaries and affiliates, net of cash acquired -

(1) Proceeds from the sale of assets or affiliates 2 12 Net cash

flow used for investing activities (50) (31) NET CASH FLOW PROVIDED

BY (USED FOR) FINANCING ACTIVITIES Proceeds from long-term debt 12

609 Payments on long-term debt (2) (6) Proceeds from revolving

credit facility 175 110 Payments on revolving credit facility (40)

- Payment of contingent note to 524(g) trust - (1,390) Net decrease

in short-term debt (17) (2) Net cash flow provided by (used for)

financing activities 128 (679) Effect of exchange rate changes on

cash 12 - NET DECREASE IN CASH AND CASH EQUIVALENTS (17) (996) Cash

and cash equivalents at beginning of period 135 1,089 CASH AND CASH

EQUIVALENTS AT END OF PERIOD $118 $93 Table 6 Owens Corning and

Subsidiaries Year-to-Date Business Segment Information (Unaudited)

(in millions) Three Months Three Months Ended Ended March 31, March

31, 2008 2007 NET SALES Composite Solutions $666 $366 Insulating

Systems 373 419 Roofing and Asphalt 306 306 Other Building

Materials and Services 53 69 Total reportable segments 1,398 1,160

Corporate Eliminations (45) (36) Consolidated $1,353 $1,124

EARNINGS (LOSS) FROM CONTINUING OPERATIONS BEFORE INTEREST AND

TAXES Composite Solutions 64 25 Insulating Systems $16 $53 Roofing

and Asphalt (17) (8) Other Building Materials and Services (3) 4

Total reportable segments $60 $74 RECONCILIATION TO CONSOLIDATED

EARNINGS FROM CONTINUING OPERATIONS BEFORE INTEREST AND TAXES

Chapter 11-related reorganization items $- $(3) Metal lease

financing (expense) income (4) 1 Restructuring and other (costs)

credits (2) 2 Acquisition integration and transaction costs (12)

(11) Losses related to the exit of our HOMExperts service line -

(8) Employee emergence equity program expense (7) (8) Asset

impairments (10) - General corporate expense (6) (15) CONSOLIDATED

EARNINGS FROM CONTINUING OPERATIONS BEFORE INTEREST AND TAXES $19

$32 DATASOURCE: Owens Corning CONTACT: Media Inquiries, Jason

Saragian, +1-419-248-8987, or Investor Inquiries: Scott Deitz,

+1-419-248-8935, both of Owens Corning Web site:

http://www.owenscorning.com/ http://www.owenscorning.com/investors

Company News On-Call: http://www.prnewswire.com/comp/677350.html

Copyright

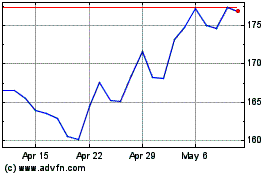

Owens Corning (NYSE:OC)

Historical Stock Chart

From Jun 2024 to Jul 2024

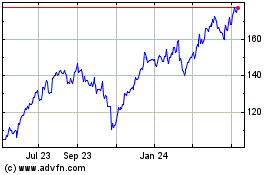

Owens Corning (NYSE:OC)

Historical Stock Chart

From Jul 2023 to Jul 2024