0001121484false00011214842023-07-272023-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

Form 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 27, 2023

Oil States International, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-16337 | | 76-0476605 |

| (State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

Three Allen Center, 333 Clay Street, Suite 4620, Houston, Texas 77002

Registrant's telephone number, including area code: (713) 652-0582

Not Applicable

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | OIS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On July 27, 2023, Oil States International, Inc. (the "Company") published a press release providing information regarding its results of operation and financial condition for the quarter ended June 30, 2023. The information provided in this Report is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference in any filings under the Securities Act of 1933, as amended, unless specifically stated so therein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | OIL STATES INTERNATIONAL, INC. |

| | | | (Registrant) |

| | | | |

| Date: | July 27, 2023 | | By: | /s/ LLOYD A. HAJDIK |

| | | | Lloyd A. Hajdik |

| | | | Executive Vice President, Chief Financial Officer & Treasurer |

EXHIBIT 99.1

Oil States Announces Second Quarter 2023 Results

•Net income of $0.6 million, or $0.01 per diluted share, reported for the quarter

•Revenue of $183.5 million, while down 6% sequentially, increased 1% year-over-year

•Adjusted EBITDA (a non-GAAP measure(1)) of $19.0 million decreased $2.4 million sequentially but increased $2.0 million year-over-year

•Generated operating cash flow of $44.7 million in the quarter

•Offshore/Manufactured Products segment's backlog increased sequentially for a fourth consecutive quarter totaling $338 million as of June 30, with a quarterly book-to-bill ratio of 1.1x

•Invested $3.0 million in share repurchases

HOUSTON, July 27, 2023 – Oil States International, Inc. (NYSE: OIS):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | % Change |

(Unaudited, In Thousands, Except Per Share Amounts) | June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | Sequential | | Year-over-Year |

| Consolidated results: | | | | | | | | | |

| Revenues | $ | 183,529 | | | $ | 196,199 | | | $ | 181,834 | | | (6) | % | | 1 | % |

| Operating income (loss) | $ | 3,269 | | | $ | 5,875 | | | $ | (1,090) | | | (44) | % | | nm |

| Net income (loss) | $ | 558 | | | $ | 2,158 | | | $ | (5,144) | | | (74) | % | | nm |

| Diluted earning per share | $ | 0.01 | | | $ | 0.03 | | | $ | (0.08) | | | (67) | % | | nm |

Adjusted EBITDA(1) | $ | 19,016 | | | $ | 21,407 | | | $ | 16,988 | | | (11) | % | | 12 | % |

| | | | | | | | | |

| Revenues by segment: | | | | | | | | | |

| Offshore/Manufactured Products | $ | 94,086 | | | $ | 98,199 | | | $ | 96,467 | | | (4) | % | | (2) | % |

| Well Site Services | 64,536 | | | 67,058 | | | 54,819 | | | (4) | % | | 18 | % |

| Downhole Technologies | 24,907 | | | 30,942 | | | 30,548 | | | (20) | % | | (18) | % |

| | | | | | | | | |

| Operating income (loss) by segment: | | | | | | | | | |

| Offshore/Manufactured Products | $ | 11,253 | | | $ | 11,090 | | | $ | 9,441 | | | 1 | % | | 19 | % |

| Well Site Services | 4,732 | | | 6,966 | | | 601 | | | (32) | % | | nm |

| Downhole Technologies | (2,536) | | | (1,519) | | | (1,485) | | | (67) | % | | (71) | % |

| | | | | | | | | |

Adjusted Segment EBITDA (a non-GAAP measure(1)): |

| Offshore/Manufactured Products | $ | 15,981 | | | $ | 15,923 | | | $ | 14,735 | | | — | % | | 8 | % |

| Well Site Services | 11,425 | | | 13,223 | | | 8,874 | | | (14) | % | | 29 | % |

| Downhole Technologies | 1,639 | | | 2,756 | | | 2,854 | | | (41) | % | | (43) | % |

___________________

(1)Adjusted EBITDA and Adjusted Segment EBITDA are non-GAAP measures, see "Reconciliations of GAAP to Non-GAAP Financial Information" tables below for reconciliations to their most comparable GAAP measures as well as further clarification and explanation.

Oil States International, Inc. reported net income of $0.6 million, or $0.01 per share, for the second quarter of 2023 on revenues of $183.5 million and Adjusted EBITDA of $19.0 million. These results compare to revenues of $196.2 million, net income of $2.2 million, or $0.03 per share, and Adjusted EBITDA of $21.4 million reported in the first quarter of 2023.

Oil States' President and Chief Executive Officer, Cindy B. Taylor, stated,

"Our reported second quarter results reflect the dueling trends of activity declines in U.S. shale basins with offsetting growth in offshore and international regions. Despite sequentially weaker second quarter revenues and Adjusted EBITDA, we confirm our full-year guidance of $92 to $100 million of Adjusted EBITDA based upon expected contributions from the ongoing recovery in offshore activity. Our forecast is supported by the backlog growth that we have witnessed at our Offshore/Manufactured Products segment, which increased to $338 million in the second quarter of 2023 – a quarter-end level last observed at the end of 2015.

"We generated very strong cash flow from operations of $45 million in the second quarter, invested $11 million in capital equipment, repurchased $3 million of our common stock and repaid all amounts outstanding under the revolving credit facility. With cash on-hand of $42 million and no significant debt maturities until 2026, we are in a strong position to create stockholder value.

"We remain encouraged by the continued recovery in offshore activity coupled with future benefits to be gained from new product introductions."

Business Segment Results

(See Segment Data and Adjusted Segment EBITDA tables below)

Offshore/Manufactured Products

Offshore/Manufactured Products reported revenues of $94.1 million, operating income of $11.3 million and Adjusted Segment EBITDA of $16.0 million in the second quarter of 2023, compared to revenues of $98.2 million, operating income of $11.1 million and Adjusted Segment EBITDA of $15.9 million reported in the first quarter of 2023. Adjusted Segment EBITDA margin in the second quarter of 2023 was 17%, compared to 16% in the prior quarter.

Backlog totaled $338 million as of June 30, 2023, an increase of $12 million, or 4%, from March 31, 2023 and $97 million, or 40%, from June 30, 2022. The current quarter-end backlog is at its highest level since December 31, 2015. Second quarter 2023 bookings totaled $106 million, yielding a quarterly book-to-bill ratio of 1.1x (1.2x year-to-date).

Well Site Services

Well Site Services reported revenues of $64.5 million, operating income of $4.7 million and Adjusted Segment EBITDA of $11.4 million in the second quarter of 2023, compared to revenues of $67.1 million, operating income of $7.0 million and Adjusted Segment EBITDA of $13.2 million reported in the first quarter of 2023. Adjusted Segment EBITDA margin was 18% in the second quarter of 2023, compared to 20% in the first quarter of 2023.

Downhole Technologies

Downhole Technologies reported revenues of $24.9 million, an operating loss of $2.5 million and Adjusted Segment EBITDA of $1.6 million in the second quarter of 2023, compared to revenues of $30.9 million, an operating loss of $1.5 million and Adjusted Segment EBITDA of $2.8 million reported in the first quarter of 2023. The segment's second quarter operating results included a $1.0 million non-cash provision for excess and obsolete inventory. Adjusted Segment EBITDA margin in the second quarter of 2023 was 7%, compared to 9% in the first quarter of 2023.

Corporate

Corporate operating expenses in the second quarter of 2023 totaled $10.2 million.

Interest Expense, Net

Net interest expense totaled $2.1 million in the second quarter of 2023, which included $0.4 million of non-cash amortization of deferred debt issuance costs.

Income Taxes

The Company recognized tax expense of $0.9 million on pre-tax income of $1.4 million during the second quarter of 2023. In the first quarter of 2023, the Company recognized a tax expense of $1.6 million on pre-tax income of $3.8 million.

Cash Flows

During the second quarter of 2023, the Company generated cash flows from operations of $44.7 million and invested $10.8 million in new equipment to support future growth.

The Company also repurchased 439 thousand shares of its common stock for $3.0 million in the second quarter of 2023. A total of $22.0 million remains available under the share repurchase authorization, which extends through February 2025.

Financial Condition

No borrowings were outstanding under the Company's asset-based revolving credit facility (the "ABL Facility") at June 30, 2023. Cash on-hand increased from $15.8 million at March 31, 2023 to $42.4 million at June 30, 2023. Liquidity (cash plus borrowing availability) totaled $133.4 million at June 30, 2023, with amounts available to be drawn under the ABL Facility totaling $90.9 million.

Conference Call Information

The call is scheduled for July 27, 2023 at 10 a.m. Central Daylight Time, is being webcast and can be accessed from the Company's website at www.ir.oilstatesintl.com. Participants may also join the conference call by dialing 1 (888) 210-3346 in the United States or by dialing +1 (646) 960-0253 internationally and using the passcode 7534957. A replay of the conference call will be available approximately two hours after the completion of the call and can be accessed from the Company's website at www.ir.oilstatesintl.com.

About Oil States

Oil States International, Inc. is a global provider of manufactured products and services to customers in the energy, industrial and military sectors. The Company's manufactured products include highly engineered capital equipment and consumable products. Oil States is headquartered in Houston, Texas with manufacturing and service facilities strategically located across the globe. Oil States is publicly traded on the New York Stock Exchange under the symbol "OIS".

For more information on the Company, please visit Oil States International's website at www.oilstatesintl.com.

Cautionary Language Concerning Forward Looking Statements

The foregoing contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are those that do not state historical facts and are, therefore, inherently subject to risks and uncertainties. The forward-looking statements included herein are based on current expectations and entail various risks and uncertainties that could cause actual results to differ materially from those forward-looking statements. Such risks and uncertainties include, among others, the level of supply and demand for oil and natural gas, fluctuations in the current and future prices of oil and natural gas, the level of exploration, drilling and completion activity, general global economic conditions, the cyclical nature of the oil and natural gas industry, geopolitical tensions, the financial health of our customers, the actions of the Organization of Petroleum Exporting Countries ("OPEC") and other producing nations with respect to crude oil production levels and pricing, the impact of environmental matters, including executive actions and regulatory efforts to adopt environmental or climate change regulations that may result in increased operating costs or reduced oil and natural gas production or demand globally, our ability to access and the cost of capital in the bank and capital markets, our ability to develop new competitive technologies and products, and other factors discussed in the "Business" and "Risk Factors" sections of the Company's Annual Report on Form 10-K for the year ended December 31, 2022 and the subsequently filed Quarterly Report on Form 10-Q and Periodic Reports on Form 8-K. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof, and, except as required by law, the Company undertakes no obligation to update those statements or to publicly announce the results of any revisions to any of those statements to reflect future events or developments.

OIL STATES INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In Thousands, Except Per Share Amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Revenues: | | | | | | | | | |

| Products | $ | 92,630 | | | $ | 99,840 | | | $ | 99,033 | | | $ | 192,470 | | | $ | 184,794 | |

| Services | 90,899 | | | 96,359 | | | 82,801 | | | 187,258 | | | 161,084 | |

| 183,529 | | | 196,199 | | | 181,834 | | | 379,728 | | | 345,878 | |

| | | | | | | | | |

| Costs and expenses: | | | | | | | | | |

| Product costs | 72,659 | | | 78,677 | | | 79,388 | | | 151,336 | | | 144,189 | |

| Service costs | 69,371 | | | 72,058 | | | 62,768 | | | 141,429 | | | 124,571 | |

| Cost of revenues (exclusive of depreciation and amortization expense presented below) | 142,030 | | | 150,735 | | | 142,156 | | | 292,765 | | | 268,760 | |

| Selling, general and administrative expense | 23,528 | | | 24,016 | | | 23,757 | | | 47,544 | | | 47,590 | |

| Depreciation and amortization expense | 15,537 | | | 15,256 | | | 17,239 | | | 30,793 | | | 35,056 | |

Other operating (income) expense, net | (835) | | | 317 | | | (228) | | | (518) | | | (102) | |

| 180,260 | | | 190,324 | | | 182,924 | | | 370,584 | | | 351,304 | |

Operating income (loss) | 3,269 | | | 5,875 | | | (1,090) | | | 9,144 | | | (5,426) | |

| | | | | | | | | |

| Interest expense, net | (2,059) | | | (2,391) | | | (2,638) | | | (4,450) | | | (5,310) | |

Other income, net | 210 | | | 276 | | | 376 | | | 486 | | | 1,401 | |

Income (loss) before income taxes | 1,420 | | | 3,760 | | | (3,352) | | | 5,180 | | | (9,335) | |

Income tax provision | (862) | | | (1,602) | | | (1,792) | | | (2,464) | | | (5,233) | |

Net income (loss) | $ | 558 | | | $ | 2,158 | | | $ | (5,144) | | | $ | 2,716 | | | $ | (14,568) | |

| | | | | | | | | |

Net income (loss) per share: | | | | | | | | | |

| Basic | $ | 0.01 | | | $ | 0.03 | | | $ | (0.08) | | | $ | 0.04 | | | $ | (0.24) | |

| Diluted | 0.01 | | | 0.03 | | | (0.08) | | | 0.04 | | | (0.24) | |

| | | | | | | | | |

| Weighted average number of common shares outstanding: | | | | | | | | |

| Basic | 62,803 | | | 62,825 | | | 60,704 | | | 62,814 | | | 60,601 | |

| Diluted | 63,174 | | | 63,072 | | | 60,704 | | | 63,161 | | | 60,601 | |

OIL STATES INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In Thousands)

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| (Unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 42,420 | | | $ | 42,018 | |

| Accounts receivable, net | 180,917 | | | 218,769 | |

| Inventories, net | 205,132 | | | 182,658 | |

| Prepaid expenses and other current assets | 28,217 | | | 19,317 | |

| Total current assets | 456,686 | | | 462,762 | |

| | | |

| Property, plant, and equipment, net | 296,015 | | | 303,835 | |

| Operating lease assets, net | 23,266 | | | 23,028 | |

| Goodwill, net | 79,778 | | | 79,282 | |

| Other intangible assets, net | 161,476 | | | 169,798 | |

| Other noncurrent assets | 27,799 | | | 25,687 | |

| Total assets | $ | 1,045,020 | | | $ | 1,064,392 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 513 | | | $ | 17,831 | |

| Accounts payable | 56,726 | | | 73,251 | |

| Accrued liabilities | 42,987 | | | 49,057 | |

| Current operating lease liabilities | 6,750 | | | 6,142 | |

| Income taxes payable | 2,740 | | | 2,605 | |

| Deferred revenue | 53,027 | | | 44,790 | |

| Total current liabilities | 162,743 | | | 193,676 | |

| | | |

| Long-term debt | 135,273 | | | 135,066 | |

| Long-term operating lease liabilities | 20,027 | | | 20,658 | |

| Deferred income taxes | 8,601 | | | 6,652 | |

| Other noncurrent liabilities | 20,271 | | | 18,782 | |

| Total liabilities | 346,915 | | | 374,834 | |

| | | |

| Stockholders' equity: | | | |

| Common stock | 772 | | | 766 | |

| Additional paid-in capital | 1,125,647 | | | 1,122,292 | |

| Retained earnings | 274,743 | | | 272,027 | |

| Accumulated other comprehensive loss | (71,522) | | | (78,941) | |

| Treasury stock | (631,535) | | | (626,586) | |

| Total stockholders' equity | 698,105 | | | 689,558 | |

| Total liabilities and stockholders' equity | $ | 1,045,020 | | | $ | 1,064,392 | |

OIL STATES INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 2,716 | | | $ | (14,568) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization expense | 30,793 | | | 35,056 | |

| Stock-based compensation expense | 3,361 | | | 3,504 | |

| Amortization of deferred financing costs | 892 | | | 944 | |

| Deferred income tax provision | 997 | | | 2,584 | |

| | | |

| Gains on disposals of assets | (561) | | | (1,185) | |

| Settlement of disputes with seller of GEODynamics, Inc. | — | | | 620 | |

| Other, net | (267) | | | 360 | |

| Changes in operating assets and liabilities, net of effect from acquired business: | | | |

| Accounts receivable | 39,042 | | | (20,469) | |

| Inventories | (21,197) | | | (14,664) | |

| Accounts payable and accrued liabilities | (25,924) | | | (5,994) | |

| Deferred revenue | 8,237 | | | 4,647 | |

| Other operating assets and liabilities, net | 653 | | | (870) | |

| Net cash flows provided by (used in) operating activities | 38,742 | | | (10,035) | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (17,338) | | | (6,453) | |

| Proceeds from disposition of property and equipment | 690 | | | 1,652 | |

| Acquisition of business, net of cash acquired | — | | | (8,125) | |

| Other, net | (66) | | | (85) | |

| Net cash flows used in investing activities | (16,714) | | | (13,011) | |

| | | |

| Cash flows from financing activities: | | | |

| Revolving credit facility borrowings | 35,592 | | | 9,725 | |

| Revolving credit facility repayments | (35,592) | | | (9,725) | |

| Repayment of 1.50% convertible senior notes | (17,315) | | | (6,272) | |

| Other debt and finance lease repayments | (226) | | | (359) | |

| Payment of financing costs | (95) | | | (74) | |

| Purchases of treasury stock | (3,001) | | | — | |

Shares added to treasury stock as a result of net share settlements

due to vesting of stock awards | (1,948) | | | (1,002) | |

| Net cash flows used in financing activities | (22,585) | | | (7,707) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | 959 | | | 147 | |

| Net change in cash and cash equivalents | 402 | | | (30,606) | |

| Cash and cash equivalents, beginning of period | 42,018 | | | 52,852 | |

| Cash and cash equivalents, end of period | $ | 42,420 | | | $ | 22,246 | |

| | | |

| Cash paid (received) for: | | | |

| Interest | $ | 4,060 | | | $ | 4,105 | |

| Income taxes, net | (1,475) | | | 291 | |

OIL STATES INTERNATIONAL, INC. AND SUBSIDIARIES

SEGMENT DATA

(In Thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

Revenues(1): | | | | | | | | | |

| Offshore/Manufactured Products | | | | | | | | | |

| Project-driven: | | | | | | | | | |

| Products | $ | 32,210 | | | $ | 39,132 | | | $ | 41,098 | | | $ | 71,342 | | | $ | 74,942 | |

| Services | 24,846 | | | 24,630 | | | 23,995 | | | 49,476 | | | 48,293 | |

| 57,056 | | | 63,762 | | | 65,093 | | | 120,818 | | | 123,235 | |

| Military and other products | 7,965 | | | 6,997 | | | 7,763 | | | 14,962 | | | 13,109 | |

| Short-cycle products | 29,065 | | | 27,440 | | | 23,611 | | | 56,505 | | | 44,235 | |

| Total Offshore/Manufactured Products | 94,086 | | | 98,199 | | | 96,467 | | | 192,285 | | | 180,579 | |

| Well Site Services | 64,536 | | | 67,058 | | | 54,819 | | | 131,594 | | | 102,991 | |

| Downhole Technologies | 24,907 | | | 30,942 | | | 30,548 | | | 55,849 | | | 62,308 | |

| Total revenues | $ | 183,529 | | | $ | 196,199 | | | $ | 181,834 | | | $ | 379,728 | | | $ | 345,878 | |

| | | | | | | | | |

| Operating income (loss): | | | | | | | | | |

| Offshore/Manufactured Products | $ | 11,253 | | | $ | 11,090 | | | $ | 9,441 | | | $ | 22,343 | | | $ | 19,637 | |

| Well Site Services | 4,732 | | | 6,966 | | | 601 | | | 11,698 | | | (2,794) | |

| Downhole Technologies | (2,536) | | | (1,519) | | | (1,485) | | | (4,055) | | | (2,990) | |

| Corporate | (10,180) | | | (10,662) | | | (9,647) | | | (20,842) | | | (19,279) | |

| Total operating income (loss) | $ | 3,269 | | | $ | 5,875 | | | $ | (1,090) | | | $ | 9,144 | | | $ | (5,426) | |

________________

(1)The Company revised its supplemental disclosure of disaggregated revenue information in the second quarter of 2023. Prior-period disclosures of disaggregated revenue information were conformed with the current-period presentation.

OIL STATES INTERNATIONAL, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL INFORMATION

ADJUSTED EBITDA (A)

(In Thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| | | | | | | | | |

| Net income (loss) | $ | 558 | | | $ | 2,158 | | | $ | (5,144) | | | $ | 2,716 | | | $ | (14,568) | |

| Interest expense, net | 2,059 | | | 2,391 | | | 2,638 | | | 4,450 | | | 5,310 | |

| Income tax provision | 862 | | | 1,602 | | | 1,792 | | | 2,464 | | | 5,233 | |

| Depreciation and amortization expense | 15,537 | | | 15,256 | | | 17,239 | | | 30,793 | | | 35,056 | |

| Settlement of disputes with seller of GEODynamics, Inc. | — | | | — | | | 620 | | | — | | | 620 | |

| Gains on extinguishment of 1.50% convertible senior notes | — | | | — | | | (157) | | | — | | | (157) | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 19,016 | | | $ | 21,407 | | | $ | 16,988 | | | $ | 40,423 | | | $ | 31,494 | |

________________

(A)The term Adjusted EBITDA consists of net income (loss) plus net interest expense, taxes, depreciation and amortization expense, and loss on settlement of disputes with the seller of GEODynamics, Inc., less gains on extinguishment of 1.50% convertible senior notes (the "2023 Notes"). Adjusted EBITDA is not a measure of financial performance under generally accepted accounting principles ("GAAP") and should not be considered in isolation from or as a substitute for net income (loss) or cash flow measures prepared in accordance with GAAP or as a measure of profitability or liquidity. Additionally, Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. The Company has included Adjusted EBITDA as a supplemental disclosure because its management believes that Adjusted EBITDA provides useful information regarding its ability to service debt and to fund capital expenditures and provides investors a helpful measure for comparing its operating performance with the performance of other companies that have different financing and capital structures or tax rates. The Company uses Adjusted EBITDA to compare and to monitor the performance of the Company and its business segments to other comparable public companies and as a benchmark for the award of incentive compensation under its annual incentive compensation plan. The table above sets forth reconciliations of Adjusted EBITDA to net income (loss), which is the most directly comparable measure of financial performance calculated under GAAP.

OIL STATES INTERNATIONAL, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL INFORMATION

ADJUSTED SEGMENT EBITDA (B)

(In Thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Offshore/Manufactured Products: | | | | | | | | | |

| Operating income | $ | 11,253 | | | $ | 11,090 | | | $ | 9,441 | | | $ | 22,343 | | | $ | 19,637 | |

| Other income, net | 81 | | | 165 | | | 45 | | | 246 | | | 86 | |

| Depreciation and amortization expense | 4,647 | | | 4,668 | | | 5,249 | | | 9,315 | | | 10,579 | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted Segment EBITDA | $ | 15,981 | | | $ | 15,923 | | | $ | 14,735 | | | $ | 31,904 | | | $ | 30,302 | |

| | | | | | | | | |

| Well Site Services: | | | | | | | | | |

| Operating income (loss) | $ | 4,732 | | | $ | 6,966 | | | $ | 601 | | | $ | 11,698 | | | $ | (2,794) | |

| Other income, net | 129 | | | 111 | | | 878 | | | 240 | | | 1,864 | |

| Depreciation and amortization expense | 6,564 | | | 6,146 | | | 7,395 | | | 12,710 | | | 15,327 | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted Segment EBITDA | $ | 11,425 | | | $ | 13,223 | | | $ | 8,874 | | | $ | 24,648 | | | $ | 14,397 | |

| | | | | | | | | |

| Downhole Technologies: | | | | | | | | | |

| Operating loss | $ | (2,536) | | | $ | (1,519) | | | $ | (1,485) | | | $ | (4,055) | | | $ | (2,990) | |

| Other expense, net | — | | | — | | | (84) | | | — | | | (86) | |

| Depreciation and amortization expense | 4,175 | | | 4,275 | | | 4,423 | | | 8,450 | | | 8,807 | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted Segment EBITDA | $ | 1,639 | | | $ | 2,756 | | | $ | 2,854 | | | $ | 4,395 | | | $ | 5,731 | |

| | | | | | | | | |

| Corporate: | | | | | | | | | |

| Operating loss | $ | (10,180) | | | $ | (10,662) | | | $ | (9,647) | | | $ | (20,842) | | | $ | (19,279) | |

| Other expense, net | — | | | — | | | (463) | | | — | | | (463) | |

| Depreciation and amortization expense | 151 | | | 167 | | | 172 | | | 318 | | | 343 | |

| Settlement of disputes with seller of GEODynamics, Inc. | — | | | — | | | 620 | | | — | | | 620 | |

| Gains on extinguishment of 1.50% convertible senior notes | — | | | — | | | (157) | | | — | | | (157) | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted Segment EBITDA | $ | (10,029) | | | $ | (10,495) | | | $ | (9,475) | | | $ | (20,524) | | | $ | (18,936) | |

________________

(B)The term Adjusted Segment EBITDA consists of operating income (loss) plus other income (expense), depreciation and amortization expense, and loss on settlement of disputes with the seller of GEODynamics, Inc., less gains on extinguishment of the 2023 Notes. Adjusted Segment EBITDA is not a measure of financial performance under GAAP and should not be considered in isolation from or as a substitute for operating income (loss) or cash flow measures prepared in accordance with GAAP or as a measure of profitability or liquidity. Additionally, Adjusted Segment EBITDA may not be comparable to other similarly titled measures of other companies. The Company has included Adjusted Segment EBITDA as supplemental disclosure because its management believes that Adjusted Segment EBITDA provides useful information regarding its ability to service debt and to fund capital expenditures and provides investors a helpful measure for comparing its operating performance with the performance of other companies that have different financing and capital structures or tax rates. The Company uses Adjusted Segment EBITDA to compare and to monitor the performance of its business segments to other comparable public companies and as a benchmark for the award of incentive compensation under its annual incentive compensation plan. The table above sets forth reconciliations of Adjusted Segment EBITDA to operating income (loss), which is the most directly comparable measure of financial performance calculated under GAAP.

Company Contact:

Lloyd A. Hajdik

Oil States International, Inc.

Executive Vice President, Chief Financial Officer and Treasurer

(713) 652-0582

SOURCE: Oil States International, Inc.

v3.23.2

Document And Entity Information Document

|

Jul. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 27, 2023

|

| Entity Registrant Name |

Oil States International, Inc

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-16337

|

| Entity Tax Identification Number |

76-0476605

|

| Entity Address, Address Line One |

Three Allen Center, 333 Clay Street

|

| Entity Address, Address Line Two |

Suite 4620

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77002

|

| City Area Code |

713

|

| Local Phone Number |

652-0582

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

OIS

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0001121484

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

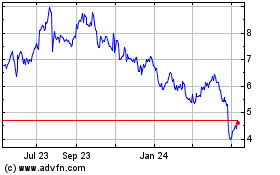

Oil States (NYSE:OIS)

Historical Stock Chart

From Apr 2024 to May 2024

Oil States (NYSE:OIS)

Historical Stock Chart

From May 2023 to May 2024