Nuveen Closed-End Funds Declare Monthly Distributions

December 01 2009 - 6:20PM

Business Wire

Nuveen Investments, a leading global provider of investment

services to institutions and high-net-worth investors, today

announced that 108 Nuveen closed-end funds had declared regular

monthly distributions. These funds represent a broad range of

tax-exempt, taxable fixed and floating rate income investment

strategies for investors seeking to build sophisticated and

diversified long-term investment portfolios for cash flow. The

funds’ monthly distributions are listed below.

Monthly distributions from Nuveen's municipal closed-end funds

and portfolios are generally exempt from regular Federal income

taxes, and monthly distributions of single-state municipal funds

and portfolios are also exempt from state and, in some cases, local

income taxes for in-state residents. Unless otherwise stated in the

funds' objectives, monthly distributions of the municipal funds and

portfolios may be subject to the Federal Alternative Minimum Tax

for some shareholders.

NEW PREFERRED SHARES DISTRIBUTIONS INCLUDED IN DISTRIBUTION

ANNOUNCEMENT

Additionally, the distribution declaration of the MuniFund Term

Preferred (MTP) shares of the Nuveen Insured Dividend Advantage

Municipal Fund (NVG PrC) is also listed below. Moving forward,

after the initial distribution declaration is announced for

Nuveen’s closed-end funds' MTP shares, these distributions will be

part of the larger CEF group and will appear in the monthly

distribution announcement.

Nuveen funds generally seek to pay stable distributions at rates

that reflect each fund’s past results and projected future

performance. During certain periods, each fund may pay

distributions at a rate that may be more or less than the amount of

net investment income actually earned by the fund during the

period. If a fund cumulatively earned more than it has paid in

distributions, it holds the excess in reserve as undistributed net

investment income (UNII) as part of the fund’s net asset value

(NAV). Conversely, if a fund has cumulatively paid distributions in

excess of its earnings, the excess constitutes negative UNII that

is likewise reflected in the fund’s NAV. Each fund will, over time,

pay all of its net investment income as distributions to

shareholders. The funds’ positive or negative UNII balances are

disclosed from time to time in their periodic shareholder reports,

and are also on www.nuveen.com/cef.

In addition, distributions for certain funds investing in real

estate investment trusts (REITs) may later be characterized as

capital gains and/or a return of capital, depending on the

character of the dividends reported to each fund after year-end by

REIT securities held by each fund. The Nuveen preferred securities

funds, JTP, JPS and JHP may invest in REITs; a list of funds that

are likely to be affected by re-characterization is posted to

www.nuveen.com each January, and updated tax characteristics are

posted to the web site and mailed to shareholders via form 1099-DIV

during the first quarter of the year.

Although the monthly distribution amount for JFP shown below was

established at a level that the fund expects will cause the fund’s

yearly distributions to closely match its net earnings for the

fiscal year, uncertainties about the ability of certain issuers of

securities held in that fund’s portfolio to continue to timely pay

dividends or interest scheduled or due on those securities means

that there is a chance that the fund’s net earnings for the year

will be less than the amount of dividends. If that happens, any

amount of fund dividends paid in excess of the amount of such net

earnings will be treated for tax purposes as a return of capital to

fund shareholders.

The following dates apply to today’s distribution

declarations:

Record Date December 15, 2009

Ex-Dividend Date

December 11, 2009

Payable Date December 31, 2009

Monthly Tax-Free

Distribution Per Share

Change From Amount Previous Month

Ticker

Closed-End Portfolios

NXP Select Portfolio $.0595 - NXQ Select Portfolio 2 .0555 - NXR

Select Portfolio 3 .0535 - NXC CA Select Portfolio .0555 - NXN NY

Select Portfolio .0510 -

Closed-End Funds

Non-Leveraged Funds

NUV Municipal Value .0390 - NUW Municipal Value 2 .0750 - NCA CA

Municipal Value .0380 - NNY NY Municipal Value .0355 - NMI

Municipal Income .0470 - NIM Select Maturities .0350 - NYV NY

Municipal Value 2 .0640 - NCB CA Municipal Value 2 .0690 - NJV NJ

Municipal Value .0640 - NPN PA Municipal Value .0650 -

Leveraged Funds

National

NPI Premium Income .0710 .0010 NPP Performance Plus .0760 .0040 NMA

Advantage .0810 .0050 NMO Market Opportunity .0800 .0060 NQM

Investment Quality .0750 .0050 NQI Insured Quality .0710 .0030 NQS

Select Quality .0820 .0070 NQU Quality Income .0760 .0040 NIO

Insured Opportunity .0675 .0010 NPF Premier .0700 .0040 NIF Premier

Insured .0720 .0060 NPM Premium Income 2 .0730 .0010 NPT Premium

Income 4 .0670 .0010 NPX Insured Premium 2 .0620 .0010 NAD Dividend

Advantage .0760 .0020 NXZ Dividend Advantage 2 .0800 .0020 NZF

Dividend Advantage 3 .0780 .0035 NVG Insured Dividend Advantage

.0700 - NEA Insured Tax-Free Advantage .0680 .0030 NMZ High Income

Opportunity Fund .0835 - NMD High Income Opportunity Fund 2 .0800 -

NEV Enhanced Municipal Value Fund .0760 -

California

NCP Performance Plus .0710 .0020 NCO Market Opportunity .0750 .0020

NQC Investment Quality .0730 .0010 NVC Select Quality .0790 .0040

NUC Quality Income .0800 .0050 NPC Insured Premium Income .0650

.0020 NCL Insured Premium Income 2 .0690 .0020 NCU Premium Income

.0665 .0045 NAC Dividend Advantage .0720 .0040 NVX Dividend

Advantage 2 .0790 .0030 NZH Dividend Advantage 3 .0750 .0050 NKL

Insured Dividend Advantage .0750 .0045 NKX Insured Tax-Free

Advantage .0660 .0010

New York

NNP Performance Plus .0680 .0010 NQN Investment Quality .0635 .0010

NVN Select Quality .0640 .0020 NUN Quality Income .0630 .0020 NNF

Insured Premium Income .0600 .0040 NAN Dividend Advantage .0655

.0010 NXK Dividend Advantage 2 .0665 .0010 NKO Insured Dividend

Advantage .0645 .0010 NRK Insured Tax-Free Advantage .0615 .0035

Other State Funds

NAZ AZ Premium Income .0590 .0020 NFZ AZ Dividend Advantage .0570

.0030 NKR AZ Dividend Advantage 2 .0640 .0045 NXE AZ Dividend

Advantage 3 .0620 .0030 NTC CT Premium Income .0590 .0010 NFC CT

Dividend Advantage .0640 .0040 NGK CT Dividend Advantage 2 .0650

.0030 NGO CT Dividend Advantage 3 .0600 .0040 NPG GA Premium Income

.0590 .0040 NZX GA Dividend Advantage .0640 .0030 NKG GA Dividend

Advantage 2 .0600 .0020 NMY MD Premium Income .0620 - NFM MD

Dividend Advantage .0650 .0020 NZR MD Dividend Advantage 2 .0650

.0020 NWI MD Dividend Advantage 3 .0630 .0010 NMT MA Premium Income

.0650 .0010 NMB MA Dividend Advantage .0640 .0010 NGX Insured MA

Tax-Free Advantage .0630 .0030 NUM MI Quality Income .0660 .0040

NMP MI Premium Income .0640 .0030 NZW MI Dividend Advantage .0640

.0020 NOM MO Premium Income .0570 .0010 NQJ NJ Investment Quality

.0650 .0020 NNJ NJ Premium Income .0630 .0010 NXJ NJ Dividend

Advantage .0650 .0040 NUJ NJ Dividend Advantage 2 .0680 .0030 NNC

NC Premium Income .0620 .0030 NRB NC Dividend Advantage .0690 .0010

NNO NC Dividend Advantage 2 .0680 .0040 NII NC Dividend Advantage 3

.0660 .0040 NUO OH Quality Income .0740 .0060 NXI OH Dividend

Advantage .0700 .0060 NBJ OH Dividend Advantage 2 .0690 .0060 NVJ

OH Dividend Advantage 3 .0730 .0060 NQP PA Investment Quality .0700

.0060 NPY PA Premium Income 2 .0660 .0015 NXM PA Dividend Advantage

.0690 .0030 NVY PA Dividend Advantage 2 .0700 .0010 NTX TX Quality

Income .0680 .0010 NPV VA Premium Income .0670 .0020 NGB VA

Dividend Advantage .0640 - NNB VA Dividend Advantage 2 .0660 -

Monthly Taxable

Distribution Per Share

Closed-End Funds:

Change From

Ticker

Taxable Funds

Amount Previous Month

Preferred Securities

JTP Quality Preferred Income Fund .0480 - JPS Quality Preferred

Income Fund 2 .0540 - JHP Quality Preferred Income Fund 3 .0510 -

Floating Rate: Corporate Loans

NSL Senior Income Fund .0400 .0030 JFR Floating Rate Income Fund

.0510 .0060 JRO Floating Rate Income Opportunity Fund .0620 .0070

Floating Rate: Tax Advantaged

JFP Tax-Advantaged Floating Rate Fund .0150 (.0070)

MuniFund Term Preferred

Tax-FreeDistribution Per Share

Ticker

Fund Name

Amount NVG PrC Nuveen Insured Dividend Advantage Municipal Fund

MuniFund Term Preferred Shares $.024583

Nuveen Investments provides high quality investment services

designed to help secure the long-term goals of institutions and

high net worth investors as well as the consultants and financial

advisors who serve them. Nuveen Investments markets its growing

range of specialized investment solutions under the high-quality

brands of HydePark, NWQ, Nuveen, Santa Barbara, Symphony,

Tradewinds and Winslow Capital. In total, the Company managed $141

billion of assets on September 30, 2009. For more information,

please visit the Nuveen Investments website at www.nuveen.com.

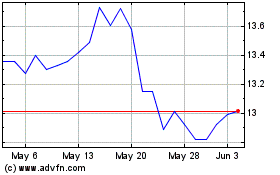

Nuveen California Select... (NYSE:NXC)

Historical Stock Chart

From Jun 2024 to Jul 2024

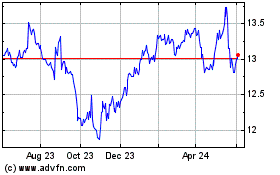

Nuveen California Select... (NYSE:NXC)

Historical Stock Chart

From Jul 2023 to Jul 2024