Current Report Filing (8-k)

July 15 2020 - 4:54PM

Edgar (US Regulatory)

Noble Corp plcNOBLE CORPfalse00014588910001169055 0001458891 2020-07-15 2020-07-15 0001458891 ne:NobleCorporationMember 2020-07-15 2020-07-15

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): July 15, 2020

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

|

|

|

|

|

|

|

|

|

10 Brook Street, London, England

|

|

|

(Address of principal executive offices)

|

|

|

Registrant’s telephone number, including area code: +44 20 3300 2300

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

|

|

|

|

|

|

|

|

|

Suite 3D, Landmark Square

|

|

|

|

|

|

|

|

|

|

|

Georgetown, Grand Cayman, Cayman Islands, BWI

|

|

|

(Address of principal executive offices)

|

|

|

Registrant’s telephone number, including area code: (345) 938-0293

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

Shares, Nominal Value $0.01 per Share

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

This combined filing on Form

8-K

is separately filed by Noble Corporation plc, a public limited company incorporated under the laws of England and Wales

(“Noble-U.K.”),

and Noble Corporation, a Cayman Islands company (“Noble-Cayman”). Information in this filing relating to Noble-Cayman is filed by

Noble-U.K.

and separately by Noble-Cayman on its own behalf. Noble-Cayman makes no representation as to information relating to

Noble-U.K.

(except as it may relate to Noble-Cayman) or any other affiliate or subsidiary of

Noble-U.K.

This report should be read in its entirety as it pertains to each of

Noble-U.K.

and Noble-Cayman.

|

Item 7.01

|

Regulation FD Disclosure

|

Noble Holding International Limited (the “Issuer” and, collectively with

Noble-U.K.

and Noble-Cayman, the “Company”), an indirect, wholly owned subsidiary of

Noble-U.K.

and Noble-Cayman, has elected not to make on the due date the approximately $15 million interest payment (the “Interest Payment”) due and payable on July 15, 2020 with respect to its 7.750% Senior Notes due 2024 (the “2024 Senior Notes”). Under the indenture governing the 2024 Senior Notes, the Issuer has a

30-day

grace period to make the Interest Payment before such

non-payment

constitutes an “event of default” with respect to the 2024 Senior Notes. The Issuer has elected to use the

30-day

grace period with respect to the Interest Payment in connection with the evaluation by the Company of certain strategic alternatives. In that regard, the Company is actively engaged in discussions with certain of its creditors regarding a potential consensual restructuring transaction. No agreement has been reached, and the Company cannot provide any assurance whether, or when, the Company will reach an agreement with such creditors or as to the terms of any such agreement.

The information contained in this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any filings made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Cautionary Statement Regarding Forward-Looking Information

The Company has included statements in this Current Report on Form

8-K

that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expect,” “potential,” “will” and similar expressions identify forward-looking statements. Forward-looking statements are based only on the Company’s current assumptions and views of future events and financial performance and include statements about the Company’s evaluation of strategic alternatives, discussions with creditors and any potential agreement or transaction. These statements are subject to known and unknown risks and uncertainties, many of which are outside of the Company’s control that may cause the Company’s actual results to be materially different from planned or expected results. Those risks and uncertainties include, but are not limited to, the potential outcome of the Company’s evaluation of strategic alternatives and discussions with creditors and the Company’s debt levels, liquidity and ability to access financing sources and capital markets, in particular as the Company manages its business through the

COVID-19

pandemic and the resulting restrictions

and uncertainties in the general economic and business environment. Please refer to the Company’s Quarterly Report on Form

10-Q

for the quarter ended March 31, 2020 for a further discussion of risks and uncertainties. Investors should take such risks into account and should not rely on forward-looking statements when making investment decisions. Any forward-looking statement made by us in this Current Report on Form

8-K

is based only on information currently available to us and speaks only as of the date on which it is made. We do not undertake to update these forward-looking statements as of any future date.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document.

|

Pursuant to the requirements of the Securities Exchange Act of 1934, each Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Senior Vice President and Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director, Senior Vice President and Chief Financial Officer

|

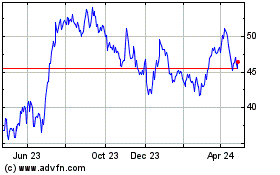

Noble (NYSE:NE)

Historical Stock Chart

From Mar 2024 to Apr 2024

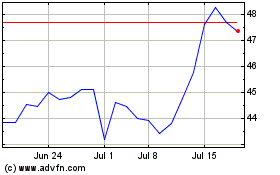

Noble (NYSE:NE)

Historical Stock Chart

From Apr 2023 to Apr 2024