Natuzzi S.p.A. (NYSE: NTZ): First Quarter 2006 Financial Highlights

-0- *T -- Net Sales Increased 13.0%, Units Sold up 6.1% over 1Q05

-- Net Earnings at Eur 6.8 Million versus Net Losses of Eur 3.5

Million in 1Q05 -- Operating Cash Flow at Eur 23.7 up from Eur 8.7

Million in 1Q05 *T The Board of Directors of Natuzzi S.p.A. (NYSE:

NTZ) ('Natuzzi' or 'the Company'), the world's leading manufacturer

of leather-upholstered furniture, today announces the approval of

the financial results for the three months ended on March 31, 2006.

NET SALES In the first quarter ended on March 31, 2006, Natuzzi

total net sales increased by 13.0 percent at EUR 188.2 million, or

$226.5 million, as compared to EUR 166.6 million, or $218.4

million, reported for first quarter 2005. During the same period

total seats sold increased by 6.1 percent. During the first three

months of 2006, upholstery net sales were at EUR 167.4 million, or

$201.4 million, up 14.3 percent from EUR 146.4 million, or $192.0

million, reported for the same period last year. Other sales

(principally living-room accessories and raw materials produced by

the Company and sold to third parties) increased by 3.0 percent at

EUR 20.8 million, or $25.0 million. In the first quarter of 2006

net sales in the Americas were at EUR 63.8 million, or $76.8

million, increasing by 6.5 percent from EUR 59.9 million, or $78.5

million, reported in first quarter 2005. In Europe sales were at

EUR 92.9 million, or $111.8 million, up by 21.1 percent from EUR

76.7 million, or $100.6 million, reported in the same quarter last

year, and in the rest of the world net sales were up 9.2 percent at

EUR 10.7 million, or $12.9 million, from EUR 9.8 million, or $12.8

million, reported in the previous year's comparable period. In the

quarter ended on March 31, 2006, total net sales to our chain of

Divani & Divani by Natuzzi Stores and Natuzzi Stores were at

EUR 34.2 million, or $41.2 million, increasing by 14.0 percent as

compared to EUR 30.0 million, or $39.3 million reported one year

ago. During the same quarter six new stores were opened (2 in

France and one each in Croatia, Russia, Poland and Australia),

whereas sixteen stores were closed (9 in UK, 4 in Italy, 2 in

Greece, and 1 in Lebanon), thus bringing the total number of stores

at 280 as at March 31, 2006. At the same date there were 594

galleries, 11 less than three months earlier. Leather-upholstered

furniture sales in the first quarter 2006 were at EUR 143.4

million, or $172.6 million, 19.1 percent up from last year's first

quarter, whereas over the same period fabric-upholstered furniture

decreased by 7.7 percent, at EUR 24.0 million, or $28.9 million.

First quarter 2006 net sales for the Natuzzi branded products,

representing 65.2 percent of total upholstery net sales, were at

EUR 109.1 million, or $131.3 million, 3.5 percent up with respect

to the last year's comparable quarter, and sales for the Italsofa

products at EUR 58.3 million, or $70.2 million, from EUR 41.0

million, or $53.8 million, in first quarter 2005. Pasquale Natuzzi,

Chairman and Chief Executive Officer, commented: "First quarter

2006 results confirmed the recovery in sales, particularly

consistent in Europe, although the economic and currency scenario

in which the Company has been operating remains unfavorable as a

whole. We continue to see mixed results, with the Italsofa line

that drove the quarterly performance, and the Natuzzi brand still

curbed by a deflationary environment, particularly evident in U.S."

GROSS PROFIT & OPERATING INCOME For the three months ended on

March 31, 2006, Natuzzi's gross profit was at EUR 64.5 million, or

$77.6 million, 17.1 percent up from EUR 55.1 million, or $72.2

million, reported one year earlier. As a percentage of sales, gross

profit margin increased at 34.3 percent from 33.1 percent in the

first quarter 2005. Over the same period, the Company reported an

operating income of EUR 8.8 million, or $10.6 million, versus an

operating loss of EUR 1.1 million, or $1.4 million, in first

quarter 2005. FOREX & TAXES For the first quarter 2006 the

Company reported a net foreign exchange loss of EUR 0.5 million, or

$0.6 million, as compared to a net foreign exchange loss of EUR 1.5

million, or $2.0 million, reported in last year's comparable

period. Over the same period, Company's income taxes were at EUR

4.0 million, or $4.8 million, as compared to EUR 1.0 million income

taxes, or $1.3 million, in first quarter 2005. NET INCOME &

EARNINGS PER SHARE In the first three months of 2006, the Company

reported net earnings of EUR 6.8 million, or $8.2 million, versus a

net loss of EUR 3.5 million, or $4.6 million, in first quarter

2005. Earnings per share (ADR) were EUR 0.12, or $0.14, from EUR

0.06 losses per share, or $ 0.08, reported for the first quarter of

2005. Pasquale Natuzzi continued: "After a difficult year in which

the Company reported net losses for the first time ever, the

Company is back to profitability as a result of the restructuring

actions we have been implementing since June 2005 - namely, a more

efficient cost management and the closing of non-performing retail

units - together with more favorable currency conditions in the

period". CASH FLOW During the first three months of 2006, the

Company generated EUR 23.7 million of cash flow from operations, or

$28.5 million, increasing from EUR 8.7 million, or $11.4 million,

generated in the same period of last year. On a per ADR basis, net

operating cash flow was EUR 0.43, or $0.52, versus EUR 0.16, or $

0.21 generated during the first three months of 2005. OUTLOOK

Concluded Mr. Natuzzi: "The positive performance achieved in the

first quarter 2006 is an encouraging sign for the near future.

However, we are aware that rising energy prices, the current

unfavorable level of the Euro against the US dollar, as well as

upward trending interest rates, will continue to challenge

consumers' discretionary spending and, as a consequence, the

furniture industry. In consideration of this we consider the

current restructuring process of our operations and the improvement

of retail activities fundamental for the competitiveness of the

Company. In light of the above, we confirm the previously announced

targets for the whole 2006 of a positive net profit margin at most

at 3 percent together with an increase in units sold of about 5

percent." CONVERSION RATES The first quarter 2006 and 2005 dollar

figures presented in this announcement were converted at an average

noon buying rate of $1.2033 per EUR and $1.3112 per EUR,

respectively. FIRST QUARTER 2006 TELECONFERENCE Pasquale Natuzzi,

Chief Executive Officer and Chairman, Daniele Tranchini, Chief

Sales & Marketing Officer, Nicola Dell'Edera, Finance Director

and Chief Financial Officer a.i., and Fred Starr, Chief Executive

Officer and President of Natuzzi Americas, will discuss financial

results, followed by a question and answer session, in a

teleconference at 10:00 a.m. New York time (3:00 p.m. London time -

4:00 p.m. Italian time) on Thursday May 25th, 2006. Replay of this

event will be available on our web-site, www.natuzzi.com, starting

from 15:00 Italian time, on Friday May 26th, 2006. About NATUZZI

S.p.A. Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. designs

and manufactures a broad collection of leather-upholstered

residential furniture. Italy's largest furniture manufacturer,

Natuzzi is the global leader in the leather segment, exporting its

innovative, high-quality sofas and armchairs to 123 markets on 5

continents. Since 1990, Natuzzi has sold its furnishings in Italy

through the popular Divani & Divani by Natuzzi chain of 131

stores, which it licenses to qualified furniture dealers. Outside

Italy, the Company sells to various furniture retailers, as well as

through 149 licensed Divani & Divani by Natuzzi Stores and

Natuzzi Stores. Natuzzi S.p.A. was listed on the New York Stock

Exchange on May 13, 1993. The Company is ISO 9001 and 14001

certified. FORWARD-LOOKING STATEMENTS Statements in this press

release other than statements of historical fact are

"forward-looking statements". Forward-looking statements are based

on management's current expectations and beliefs and therefore you

should not place undue reliance on them. These statements are

subject to a number of risks and uncertainties, including risks

that may not be subject to the Company's control, that could cause

actual results to differ materially from those contained in any

forward-looking statement. These risks include, but are not limited

to, fluctuations in exchange rates, economic and weather factors

affecting consumer spending, competitive and regulatory

environment, as well as other political, economical and

technological factors, and other risks identified from time to time

in the Company's filings with the Securities and Exchange

Commission, particularly in the Company's annual report on Form

20-F. Forward looking statements speak as of the date they were

made, and the Company undertakes no obligation to update publicly

any of them in light of new information or future events. -0- *T

NATUZZI S.P.A. AND SUBSIDIARIES Unaudited Consolidated Statement of

Earnings for the first quarter ended March 31, 2006 and 2005 on the

basis of Italian GAAP (Expressed in millions of EUR except per

share data) Three months ended on % Over Percentage of Sales

31-Mar-06 31-Mar-05 (Under) 31-Mar-06 31-Mar-05 ----------------

----------- ----------- --------- -------- --------- Upholstery net

sales 167.4 146.4 14.3% 88.9% 87.9% Other sales 20.8 20.2 3.0%

11.1% 12.1% ---------------- ----------- ----------- ---------

-------- --------- Net Sales 188.2 166.6 13.0% 100.0% 100.0%

---------------- ----------- ----------- --------- --------

--------- Purchases (79.0) (79.0) 0.0% ( 42.0)% ( 47.4)% Labor

(27.2) (28.2) 3.5% ( 14.5)% ( 16.9)% Third-party Manufacturers

(5.6) (6.6) 15.2% ( 3.0)% ( 4.0)% Manufacturing Costs (7.9) (8.1)

2.5% ( 4.2)% ( 4.9)% Inventories, net (4.0) 10.4 ( 138.5)% ( 2.1)%

6.2% ---------------- ----------- ----------- --------- --------

--------- Cost of Sales (123.7) (111.5) ( 10.9)% ( 65.7)% ( 66.9)%

---------------- ----------- ----------- --------- --------

--------- Gross Profit 64.5 55.1 17.1% 34.3% 33.1% ----------------

----------- ----------- --------- -------- --------- Selling

Expenses (46.5) (46.0) ( 1.1)% ( 24.7)% ( 27.6)% General and

Administrative Expenses (9.2) (10.2) 9.8% ( 4.9)% ( 6.1)%

---------------- ----------- ----------- --------- --------

--------- Operating Income (Loss) 8.8 (1.1) 900.0% 4.7% ( 0.7)%

---------------- ----------- ----------- --------- --------

--------- Interest Income, net 0.3 0.1 0.2% 0.1% Foreign Exchange,

net (0.5) (1.5) ( 0.3)% ( 0.9)% Other Income, net 2.2 0.0 1.2% 0.0%

---------------- ----------- ----------- --------- --------

--------- Earnings (Losses) before taxes and minority interest 10.8

(2.5) 532.0% 5.7% ( 1.5)% ----------------- ----------- -----------

--------- -------- --------- Income taxes (4.0) (1.0) ( 2.1)% (

0.6)% ---------------- ----------- ----------- --------- --------

--------- Earnings (Losses) before minority interest 6.8 (3.5)

294.3% 3.6% ( 2.1)% ----------------- ----------- -----------

--------- -------- --------- Minority Interest 0.0 0.0 0.0% 0.0%

Net Earnings (Losses) 6.8 (3.5) 294.3% 3.6% ( 2.1)%

---------------- ----------- ----------- --------- --------

--------- Earnings (Losses) Per Share 0.12 (0.06) ----------------

----------- ----------- --------- -------- --------- Average Number

of Shares Outstanding* 54,738,538 54,681,628 -----------------

----------- ----------- --------- -------- --------- (*) Net of

shares repurchased 1 EUR = 1,936.27 ITL -----------------

---------------------------------------------------- Key Figures in

Three months ended on U.S. dollars (millions) March 31, 2006 March

31, 2005 ----------------- ----------- ---------------------

------------------ Net Sales 226.5 218.4 Gross Profit 77.6 72.2

Operating Income (Loss) 10.6 (1.4) Net Earnings (Losses) 8.2 (4.6)

Earnings (Losses) per Share 0.14 (0.08) Average exchange rate (U.S.

dollar per Euro) 1.2033 1.3112

----------------------------------------------------------------------

*T -0- *T GEOGRAPHIC BREAKDOWN ---------------------- ------ ------

------- -------- -------- ------- Sales* Seat Units 1st Quarter %

Over 1st Quarter % Over 2006 2005 (Under) 2006 2005 (Under)

====================== ====== ====== ======= ======== ========

======= Americas 63.8 59.9 6.5% 324,922 348,355 (6.7%) % of total

38.1% 40.9% 43.5% 49.5% ---------------------- ------ ------

------- -------- -------- ------- Europe 92.9 76.7 21.1% 379,159

314,272 20.6% % of total 55.5% 52.4% 50.7% 44.6%

---------------------- ------ ------ ------- -------- --------

------- Rest of world 10.7 9.8 9.2% 43,071 41,447 3.9% % of total

6.4% 6.7% 5.8% 5.9% ---------------------- ------ ------ -------

-------- -------- ------- TOTAL 167.4 146.4 14.3% 747,152 704,074

6.1% ---------------------- ------ ------ ------- -------- --------

------- * Expressed in millions of EUR BREAKDOWN BY COVERING

---------------------- ------ ------ ------- -------- --------

------- Sales* Seat Units 1st Quarter % Over 1st Quarter % Over

2006 2005 (Under) 2006 2005 (Under) ====================== ======

====== ======= ======== ======== ======= Leather 143.4 120.4 19.1%

613,543 539,511 13.7% % of total 85.7% 82.2% 82.1% 76.6%

---------------------- ------ ------ ------- -------- --------

------- Fabric 24.0 26.0 (7.7%) 133,609 164,563 (18.8%) % of total

14.3% 17.8% 17.9% 23.4% ---------------------- ------ ------

------- -------- -------- ------- TOTAL 167.4 146.4 14.3% 747,152

704,074 6.1% ---------------------- ------ ------ ------- --------

-------- ------- * (Expressed in millions of EUR) BREAKDOWN BY

BRAND ---------------------- ------ ------ ------- --------

-------- ------- Sales* Seat Units 1st Quarter % Over 1st Quarter %

Over 2006 2005 (Under) 2006 2005 (Under) ======================

====== ====== ======= ======== ======== ======= Natuzzi 109.1 105.4

3.5% 387,095 418,676 (7.5%) % of total 65.2% 72.0% 51.8% 59.5%

---------------------- ------ ------ ------- -------- --------

------- Italsofa 58.3 41.0 42.2% 360,057 285,398 26.2% % of total

34.8% 28.0% 48.2% 40.5% ---------------------- ------ ------

------- -------- -------- ------- TOTAL 167.4 146.4 14.3% 747,152

704,074 6.1% ---------------------- ------ ------ ------- --------

-------- ------- *T -0- *T NATUZZI S.P.A. AND SUBSIDIARIES

Unaudited Consolidated Balance Sheet as of March 31, 2006 and

December 31, 2005 (Expressed in millions of EUR) 31-Mar-06

31-Dec-05 --------------------------------------------

------------- ---------- ASSETS Current Assets: Cash and cash

equivalents 111.3 89.7 Marketable debt securities 0.0 0.0 Trade

receivables, net 125.4 123.6 Other receivables 46.9 46.3

Inventories 111.7 115.7 Unrealized foreign exchange gains 0.6 0.0

Prepaid expenses and accrued income 4.5 2.6 Deferred income taxes

7.4 6.6 -------------------------------------------- -------------

---------- Total current assets 407.8 384.5

-------------------------------------------- -------------

---------- Non-Current Assets: Net property, plant and equipment

256.9 262.8 Treasury shares 0.0 0.0 Other assets 15.9 16.6 Deferred

income taxes 1.1 1.1 --------------------------------------------

------------- ---------- TOTAL ASSETS 681.7 665.0

-------------------------------------------- -------------

---------- LIABILITIES AND SHAREHOLDERS' EQUITY Current

Liabilities: Short-term borrowings 9.1 7.7 Current portion of

long-term debt 0.4 0.4 Accounts payable-trade 86.9 73.5 Accounts

payable-other 25.8 24.2 Accounts payable shareholders for dividends

0.6 0.6 Unrealized foreign exchange losses 0.0 4.8 Income taxes 4.2

2.9 Salaries, wages and related liabilities 20.5 22.1

-------------------------------------------- -------------

---------- Total current liabilities 147.5 136.2

-------------------------------------------- -------------

---------- Long-Term Liabilities: Employees' leaving entitlement

32.4 32.3 Long-term debt 3.6 3.6 Deferred income taxes 0.0 0.0

Deferred income for capital grants 14.5 14.8 Other liabilities 4.4

4.4 -------------------------------------------- -------------

---------- Minority Interest 0.8 0.7

-------------------------------------------- -------------

---------- Shareholders' Equity: Share capital 54.7 54.7 Reserves

42.3 42.3 Additional paid-in capital 8.3 8.3 Retained earnings

373.2 367.7 --------------------------------------------

------------- ---------- Total shareholders' equity 478.5 473.0

-------------------------------------------- -------------

---------- TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 681.7 665.0

----------------------------------------------------------

---------- *T -0- *T NATUZZI S.P.A. AND SUBSIDIARIES Unaudited

Consolidated Statements of Cash Flows as of March 31, 2006 and 2005

(Expressed in millions of EUR) 31-Mar-06 31-Mar-05 ----------

---------- Cash flows from operating activities: Net earnings

(losses) 6.8 (3.5) Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization 7.6

6.9 Employees' leaving entitlement 0.2 0.7 Deferred income taxes

(0.8) 0.3 Minority interest 0.0 0.0 (Gain) loss on disposal of

assets 0.1 0.1 Unrealized foreign exchange (losses) / gain (5.4)

6.4 Deferred income for capital grants (0.3) 0.0 Change in assets

and liabilities: Receivables, net (1.7) 0.9 Inventories 4.0 (10.4)

Prepaid expenses and accrued income (2.0) (1.8) Other assets (0.5)

3.4 Accounts payable 13.4 4.5 Income taxes 1.3 (0.5) Salaries,

wages and related liabilities (1.5) 0.2 Other liabilities 2.5 1.5

------------------------------------------------ ----------

---------- Total adjustments 16.9 12.2

------------------------------------------------ ----------

---------- NET CASH PROVIDED BY OPERATING ACTIVITIES 23.7 8.7

------------------------------------------------ ----------

---------- Cash flows from investing activities: Property, plant

and equipment: Additions (3.6) (8.4) Disposals 0.0 0.0 Government

grants received 0.0 0.0 Marketable debt securities: Proceeds from

sales 0.0 0.0 Purchase of business, net of cash acquired 0.0 0.0

Disposal of business 0.0 0.0

------------------------------------------------ ----------

---------- NET CASH USED IN INVESTING ACTIVITIES (3.6) (8.4)

------------------------------------------------ ----------

---------- Cash flows from financing activities: Long term debt:

Proceeds 0.1 0.0 Repayments 0.0 (0.3) Short-term borrowings 1.3 0.8

Dividends paid to shareholders 0.0 0.0 Dividends paid to minority

shareholders 0.0 (0.1)

------------------------------------------------ ----------

---------- NET CASH USED IN FINANCING ACTIVITIES 1.4 0.4

------------------------------------------------ ----------

---------- Effect of translation adjustments on cash 0.1 0.9

------------------------------------------------ ----------

---------- INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 21.6

1.6 ------------------------------------------------ ----------

---------- Cash and cash equivalents, beginning of the year 89.7

87.3 ------------------------------------------------ ----------

---------- CASH AND CASH EQUIVALENTS, END OF THE PERIOD 111.3 88.9

------------------------------------------------ ----------

---------- *T

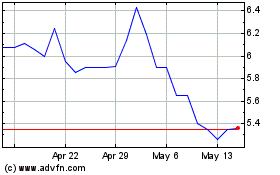

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

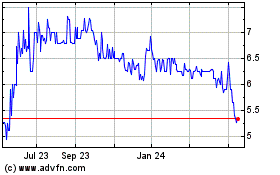

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Nov 2023 to Nov 2024