Form N-CEN - Annual Report for Registered Investment Companies

February 09 2024 - 12:30PM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

January-2023

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.02143

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

$0.00771

|

36%

|

$0.01529

|

36%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.01372

|

64%

|

0.02718

|

64%

|

|

Total

(per common share)

|

$0.02143

|

100%

|

$0.04247

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 12-31-2022

|

|

|

0.12%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 12-31-2022

|

7.37%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 12-31-2022

|

|

|

|

-0.79%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 12-31-2022

|

|

|

|

1.22%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital

distribution does not necessarily reflect the fund's investment performance

and should not be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send

you a Form 1099-DIV for the calendar year that will tell you how to report

these distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

December-2022

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.02104

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

$0.02104

|

100%

|

$0.02104

|

100%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Total

(per common share)

|

$0.02104

|

100%

|

$0.02104

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 11-30-2022

|

|

|

0.36%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 11-30-2022

|

7.13%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 11-30-2022

|

|

|

|

-12.08%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 11-30-2022

|

|

|

|

0.59%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital

distribution does not necessarily reflect the fund's investment performance

and should not be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send

you a Form 1099-DIV for the calendar year that will tell you how to report

these distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

October-2023

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.01997

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

0.00859

|

43%

|

0.09456

|

41%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.01138

|

57%

|

0.13608

|

59%

|

|

Total

(per common share)

|

0.01997

|

100%

|

0.23064

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 9-30-2023

|

|

|

0.23%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 9-30-2023

|

7.35%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 9-30-2023

|

|

|

|

-1.78%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 9-30-2023

|

|

|

|

7.07%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital

distribution does not necessarily reflect the fund's investment performance

and should not be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send you

a Form 1099-DIV for the calendar year that will tell you how to report these

distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

April-2023

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.02118

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

$0.01038

|

49%

|

$0.04364

|

41%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.01080

|

51%

|

0.06280

|

59%

|

|

Total

(per common share)

|

$0.02118

|

100%

|

$0.10644

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 3-31-2023

|

|

|

1.09%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 3-31-2023

|

7.18%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 3-31-2023

|

|

|

|

2.58%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 3-31-2023

|

|

|

|

3.01%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital

distribution does not necessarily reflect the fund's investment performance

and should not be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send

you a Form 1099-DIV for the calendar year that will tell you how to report

these distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

August-2023

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.02063

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

0.00825

|

40%

|

0.07618

|

40%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.01238

|

60%

|

0.11426

|

60%

|

|

Total

(per common share)

|

0.02063

|

100%

|

0.19044

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 7-31-2023

|

|

|

0.81%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 7-31-2023

|

7.28%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 7-31-2023

|

|

|

|

1.11%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 7-31-2023

|

|

|

|

5.60%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital distribution

does not necessarily reflect the fund's investment performance and should not

be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send you

a Form 1099-DIV for the calendar year that will tell you how to report these

distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

February-2023

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.02155

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

$0.00927

|

43%

|

$0.02561

|

40%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.01228

|

57%

|

0.03841

|

60%

|

|

Total

(per common share)

|

$0.02155

|

100%

|

$0.06402

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 1-31-2023

|

|

|

0.98%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 1-31-2023

|

7.22%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 1-31-2023

|

|

|

|

2.41%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 1-31-2023

|

|

|

|

1.79%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital

distribution does not necessarily reflect the fund's investment performance

and should not be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send

you a Form 1099-DIV for the calendar year that will tell you how to report

these distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

To the Board of Trustees of and the

Shareholders of MFS Government Markets Income Trust:

In planning and performing our audit of the

financial statements of MFS Government Markets Income Trust (the “Fund”) as of

and for the year ended November 30, 2023, in accordance with the standards of

the Public Company Accounting Oversight Board (United States), we considered

the Fund’s internal control over financial reporting, including controls over

safeguarding securities, as a basis for designing our auditing procedures for

the purpose of expressing our opinion on the financial statements and to comply

with the requirements of Form N-CEN, but not for the purpose of expressing an

opinion on the effectiveness of the Fund’s internal control over financial

reporting. Accordingly, we express no such opinion.

The management of the Fund is responsible for

establishing and maintaining effective internal control over financial

reporting. In fulfilling this responsibility, estimates and judgments by

management are required to assess the expected benefits and related costs of controls.

A fund’s internal control over financial reporting is a process designed to

provide reasonable assurance regarding the reliability of financial reporting

and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles. A fund’s internal control

over financial reporting includes those policies and procedures that (1) pertain

to the maintenance of records that, in reasonable detail, accurately and fairly

reflect the transactions and dispositions of the assets of the fund; (2)

provide reasonable assurance that transactions are recorded as necessary to

permit preparation of financial statements in accordance with generally

accepted accounting principles, and that receipts and expenditures of the fund

are being made only in accordance with authorizations of management of the fund

and trustees of the trust; and (3) provide reasonable

assurance regarding prevention or timely detection of unauthorized acquisition,

use, or disposition of a fund’s assets that could have a material effect on the

financial statements.

Because of its inherent limitations, internal

control over financial reporting may not prevent or detect misstatements. Also,

projections of any evaluation of effectiveness to future periods are subject to

the risk that controls may become inadequate because of changes in conditions

or that the degree of compliance with the policies or procedures may

deteriorate.

A deficiency in internal control over

financial reporting exists when the design or operation of a control does not

allow management or employees, in the normal course of performing their

assigned functions, to prevent or detect misstatements on a timely basis. A

material weakness is a deficiency, or a combination of deficiencies, in

internal control over financial reporting, such that there is a reasonable

possibility that a material misstatement of a fund’s annual or interim financial

statements will not be prevented or detected on a timely basis.

Our consideration of the Fund’s internal

control over financial reporting was for the limited purpose described in the

first paragraph and would not necessarily disclose all deficiencies in internal

control that might be material weaknesses under standards established by the

Public Company Accounting Oversight Board (United States). However, we noted no

deficiencies in the Fund’s internal control over financial reporting and its operations,

including controls for safeguarding securities, that we consider to be a material

weakness, as defined above, as of November 30, 2023.

This report is

intended solely for the information and use of management, the Board of Trustees

of MFS Government Markets Income Trust and the Securities and Exchange

Commission and is not intended to be and should not be used by anyone other

than these specified parties.

/s/ Deloitte & Touche LLP

Boston,

Massachusetts

January

12, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

July-2023

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.02085

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

$0.00855

|

41%

|

$0.06792

|

40%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.01230

|

59%

|

0.10189

|

60%

|

|

Total

(per common share)

|

$0.02085

|

100%

|

$0.16981

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 6-30-2023

|

|

|

0.82%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 6-30-2023

|

7.29%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 6-30-2023

|

|

|

|

1.34%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 6-30-2023

|

|

|

|

4.95%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital

distribution does not necessarily reflect the fund's investment performance

and should not be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send

you a Form 1099-DIV for the calendar year that will tell you how to report

these distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

May-2023

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.02140

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

$0.00942

|

44%

|

$0.05241

|

41%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.01198

|

56%

|

0.07543

|

59%

|

|

Total

(per common share)

|

$0.02140

|

100%

|

$0.12784

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 4-30-2023

|

|

|

1.33%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 4-30-2023

|

7.25%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 4-30-2023

|

|

|

|

3.24%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 4-30-2023

|

|

|

|

3.61%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital

distribution does not necessarily reflect the fund's investment performance

and should not be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send

you a Form 1099-DIV for the calendar year that will tell you how to report

these distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

March-2023

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.02124

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

$0.00743

|

35%

|

$0.03240

|

38%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.01381

|

65%

|

0.05286

|

62%

|

|

Total

(per common share)

|

$0.02124

|

100%

|

$0.08526

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 2-28-2023

|

|

|

0.68%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 2-28-2023

|

7.35%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 2-28-2023

|

|

|

|

-0.08%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 2-28-2023

|

|

|

|

2.46%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital

distribution does not necessarily reflect the fund's investment performance

and should not be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send

you a Form 1099-DIV for the calendar year that will tell you how to report

these distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

June-2023

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.02112

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

$0.00718

|

34%

|

$0.05958

|

40%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.01394

|

66%

|

0.08938

|

60%

|

|

Total

(per common share)

|

$0.02112

|

100%

|

$0.14896

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 5-31-2023

|

|

|

0.99%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 5-31-2023

|

7.28%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 5-31-2023

|

|

|

|

2.15%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 5-31-2023

|

|

|

|

4.28%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital

distribution does not necessarily reflect the fund's investment performance

and should not be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send

you a Form 1099-DIV for the calendar year that will tell you how to report

these distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

September-2023

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.02023

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

0.00971

|

48%

|

0.08637

|

41%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.01052

|

52%

|

0.12430

|

59%

|

|

Total

(per common share)

|

0.02023

|

100%

|

0.21067

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 8-31-2023

|

|

|

0.57%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 8-31-2023

|

7.23%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 8-31-2023

|

|

|

|

0.56%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 8-31-2023

|

|

|

|

6.27%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital

distribution does not necessarily reflect the fund's investment performance

and should not be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send you

a Form 1099-DIV for the calendar year that will tell you how to report these

distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS®

Government Markets Income Trust

|

|

|

|

|

|

|

|

P.O. Box 43078

Providence,

RI 02940-3078

Notice to

shareholders — Source

of distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution

period

|

November-2023

|

|

|

|

|

|

|

|

|

Distribution amount per share

|

$0.01938

|

|

|

|

|

|

|

|

|

The

following table sets forth the estimated amounts of the current distribution

and the cumulative distributions paid this fiscal year to date from the

following sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital or other

capital source. The fund’s fiscal year begins each December 1st.

All amounts are expressed per common share.

|

|

|

|

|

|

|

|

Total cumulative

distributions for the fiscal year to date

|

% Breakdown of the

total cumulative distributions for the fiscal year to date

|

|

|

|

Current distribution

|

% Breakdown of current

distribution

|

|

|

|

|

Net

Investment Income

|

0.00756

|

39%

|

0.10251

|

41%

|

|

Net

Realized ST Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Net

Realized LT Cap Gains

|

0.00000

|

0%

|

0.00000

|

0%

|

|

Return

of Capital or

Other Capital Source

|

0.01182

|

61%

|

0.14751

|

59%

|

|

Total

(per common share)

|

0.01938

|

100%

|

0.25002

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

annual total return (in relation to NAV) for the five years ended 10-31-2023

|

|

|

0.03%

|

|

|

Annualized

current distribution rate expressed as a percentage of month end NAV as of 10-31-2023

|

7.31%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative

total return (in relation to NAV) for the fiscal year through 10-31-2023

|

|

|

|

-3.56%

|

|

|

Cumulative

fiscal year distributions as a percentage of NAV as of 10-31-2023

|

|

|

|

7.86%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You

should not draw any conclusions about the fund's investment performance from

the amount of this distribution or from the terms of the fund's managed

distribution plan.

|

|

The

fund estimates that it has distributed more than its income and capital

gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money

that you invested in the fund is paid back to you. A return of capital

distribution does not necessarily reflect the fund's investment performance

and should not be confused with "yield" or "income."

The

amounts and sources of distributions reported in this notice are only

estimates and are not being provided for tax-reporting purposes. The actual

amounts and sources of the amounts for tax-reporting purposes will depend

upon the fund's investment experience during the remainder of its fiscal year

and may be subject to changes based on tax regulations. The fund will send you

a Form 1099-DIV for the calendar year that will tell you how to report these

distributions for federal income tax purposes.

If

you have any questions regarding this information, please call our fund

service department at 1-800-637-2304 any business day from 9 a.m. to 5 p.m.

Eastern time.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

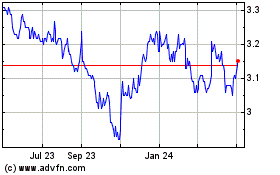

MFS Government Markets I... (NYSE:MGF)

Historical Stock Chart

From Apr 2024 to May 2024

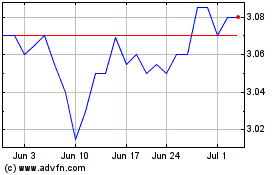

MFS Government Markets I... (NYSE:MGF)

Historical Stock Chart

From May 2023 to May 2024