40% of Americans Anticipate Financial Challenges in 2024, According to MeridianLink Survey

March 12 2024 - 9:05AM

Business Wire

MeridianLink provides timely insight into

consumer sentiment on payments, customer service, and innovation in

digital lending

MeridianLink, Inc. (NYSE: MLNK), a leading provider of modern

software platforms for financial institutions and consumer

reporting agencies, today announced the results of a nationwide

survey of more than 1,000 Americans about consumer expectations and

preferences in financial services. The survey revealed that 40% of

Americans anticipate challenges making regular, monthly payments in

2024, with younger respondents (ages 18-34) more likely to foresee

difficulties, particularly related to managing credit card debt and

housing costs. Additional survey findings include insight into

customer loyalty, consumer expectations for financial institutions,

and trends in artificial intelligence and digital lending.

Among respondents, customer engagement emerged as a key factor

influencing consumer loyalty to financial institutions, with nearly

a third (30%) reporting they would consider switching institutions

if they received poor service at their local branch. More than a

quarter (26%) would switch if they experienced slow or inconsistent

service online, in-person, or over the phone.

Financial institutions looking to provide better consumer

experiences can offer strong omnichannel digital pathways that

complement their in-person capabilities. One integral part of that

digital strategy includes proactively connecting consumers with

helpful information and offers for products that are tailored to

their unique needs. MeridianLink® Engage, the Company’s solution to

build deeper customer engagement, enables financial institutions to

provide these personalized communications as quickly and

efficiently as possible, allowing employees more time to provide

better consumer support.

Protection from fraud and seamless experiences across platforms

were also high on the list of consumer priorities this year. Almost

half of respondents (48%) want their bank or credit union to place

increased importance on protecting consumers from fraud, and more

than a third (36%) want their institution to focus on providing

seamless omnichannel experiences. MeridianLink® One, the Company’s

unified platform, helps institutions offer cohesive and

frictionless digital lending experiences across devices and

channels. Customers can also take advantage of MeridianLink®

Marketplace and tap into a vast network of configurable

capabilities from partners. For example, in leveraging partnerships

with leading fraud and risk mitigation organizations, MeridianLink®

customers can benefit from industry-trusted solutions.

While one-third of respondents (33%) ages 18-34 plan to rely on

digital banking more in 2024, respondents also reported skepticism

about the role of AI in banking. In fact, 42% of respondents

expressed some level of discomfort with financial institutions

using AI to improve customer experience. Because the use of AI is

just beginning, the road ahead will likely be determined by how

vendors responsibly leverage the technology, making sure to keep

customer sentiment in mind.

“These findings demonstrate that consumers have high

expectations for their financial institutions when it comes to

customer service, availability, and digital innovation,” said Chris

Maloof, President of Go-To-Market at MeridianLink. “We are proud to

partner with banks and credit unions across the country to provide

industry-leading tools that help institutions meet and exceed those

expectations.”

To access more detailed survey findings, please download the

findings report here.

ABOUT MERIDIANLINK

MeridianLink® (NYSE: MLNK) empowers financial institutions and

consumer reporting agencies to drive efficient growth.

MeridianLink’s cloud-based digital lending, account opening,

background screening, and data verification solutions leverage

shared intelligence from a unified data platform, MeridianLink®

One, to enable customers of all sizes to identify growth

opportunities, effectively scale up, and support compliance

efforts, all while powering an enhanced experience for staff and

consumers alike.

For more than 25 years, MeridianLink has prioritized the

democratization of lending for consumers, businesses, and

communities. Learn more at www.meridianlink.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240312860753/en/

Becky Frost (714) 784-5839 media@meridianlink.com

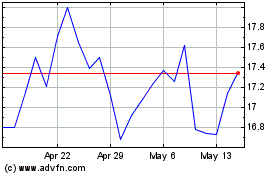

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Apr 2023 to Apr 2024