0001834494FALSE00018344942024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2024

MeridianLink, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40680 | 82-4844620 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

3560 Hyland Avenue, Suite 200

Costa Mesa, CA 92626

(Address of principal executive offices and Zip Code)

(714) 708-6950

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | MLNK | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 6, 2024, MeridianLink, Inc. (the “Company”) disclosed the following unaudited preliminary operating results representing the Company’s estimates for the three months ended December 31, 2023, and the Company’s cash and cash equivalents as of December 31, 2023.

•Revenue of approximately between $73.5 million and $74.5 million;

•Net income (loss) of approximately between $(40.0) million and $(20.0) million;

•Adjusted EBITDA of approximately between $30.0 million and $31.0 million; and

•Cash and cash equivalents as of December 31, 2023, of approximately $80.4 million.

These preliminary unaudited financial results are only preliminary estimates, are based only on financial information available to management as of the date hereof, and are subject to change. The Company is in the process of finalizing its audited financial results as of and for the year ended December 31, 2023. Upon completion of the Company’s independent auditor’s review of the results for the three months ended December 31, 2023, it is possible significant changes to such preliminary results may be necessary. Accordingly, it is possible that the Company’s final operating results will differ from these preliminary unaudited estimates, including as a result of review adjustments, and any resulting changes could be material. Complete financial statements as of and for the year ended December 31, 2023, will be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. A copy of the press release disclosing this information is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 2.02 by reference.

The preliminary financial information included in this Current Report on Form 8-K has been provided by management. BDO USA, P.C. has not compiled or examined this information and accordingly does not express an opinion or any other form of assurance on the prospective financial information included herein.

Reconciliation of Non-GAAP Financial Measures

To supplement the Company’s financial statements presented in accordance with U.S. generally accepted accounting principles (“GAAP”), the Company reports certain non-GAAP financial measures, including adjusted EBITDA. The Company believes that adjusted EBITDA provides useful information to investors and others in understanding and evaluating its operating results because adjusted EBITDA is widely used by investors and securities analysts to measure a company’s operating performance without regard to items that can vary substantially from company to company and because the Company’s management uses adjusted EBITDA, in conjunction with GAAP financial measures, to assess the effectiveness of its business strategies and for planning purposes, including in the preparation of its annual operating budget, and as a measure of the Company’s operating performance. Moreover, the Company believes adjusted EBITDA provides more consistency and comparability with its past financial performance, facilitates period-to-period comparisons of its operations, and also facilitates comparisons with other companies, many of which use similar non-GAAP financial measures to supplement their GAAP results.

The following table presents a reconciliation of net income (loss), the most directly comparable GAAP financial measure, to adjusted EBITDA for the three months ended December 31, 2023.

| | | | | | | | | | | | | | |

(in thousands) | | Three months ended December 31, 2023 |

| Low (estimated) | | High (estimated) |

Reconciliation of net income (loss) to adjusted EBITDA(1) | | | | |

Net income (loss) | | $ | (40,000) | | | $ | (20,000) | |

| Interest expense | | 9,700 | | | 10,000 | |

Taxes(2) | | 38,200 | | | 18,200 | |

| Depreciation and amortization | | 14,100 | | | 14,400 | |

| Share-based compensation expense | | 8,000 | | | 8,300 | |

| Employer payroll taxes on employee stock transactions | | — | | | 85 | |

| Restructuring related costs | | — | | | — | |

Acquisition related costs | | — | | | — | |

Deferred revenue reduction from purchase accounting for acquisitions prior to 2022 | | — | | | 15 | |

Adjusted EBITDA(1) | | $ | 30,000 | | | $ | 31,000 | |

(1)The Company defines adjusted EBITDA as net income (loss) before interest expense, taxes, depreciation and amortization, share-based compensation expense, employer payroll taxes on employee stock transactions, restructuring related costs, sponsor and third-party acquisition related costs, and deferred revenue reductions from purchase accounting.

(2)Reflects estimate for the range of the valuation allowance to be applied against the Company’s deferred tax assets in its provision for income taxes that will be recorded upon the completion of its results as of and for the three months ended December 31, 2023. The Company has identified certain potential non-cash charges to our deferred tax assets that may require it to record a valuation allowance as we complete our interim financial statements, and any resulting changes could be material and materially impact the Company’s reported net income (loss).

The information contained in this Item 2.02 of this Current Report on Form 8-K, including the Exhibit 99.1 attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

The information provided in Item 2.02 above is incorporated herein by reference.

On February 6, 2024, the Company filed a preliminary prospectus supplement with the Securities and Exchange Commission (the “Preliminary Prospectus Supplement”) in connection with a proposed underwritten secondary offering of shares of its common stock (the “Offering”) by certain of its existing stockholders (the “Selling Stockholders”). The Preliminary Prospectus Supplement contains information relating to recent developments concerning the Company’s business and includes the following disclosure under the heading “Recent Developments”:

“Preliminary and Unaudited Operating Results

We are in the process of finalizing our results as of and for the three months ended December 31, 2023. We have presented below certain preliminary unaudited operating results representing our estimates as of and for the three months ended December 31, 2023, which are based only on currently available financial information and do not present all necessary information for an understanding of our financial condition as of and for the period ended December 31, 2023. The financial information has been provided by management. BDO USA, P.C. has not compiled or examined this information and accordingly does not express an opinion or any other form of assurance on the prospective financial information included herein.

We expect to complete our financial statements as of and for the year ended December 31, 2023, subsequent to the completion of this offering. While we are currently unaware of any items that would require us to make adjustments to the financial information set forth below, it is possible that we may identify such items as we complete our interim financial statements and any resulting changes could be material. Accordingly, undue reliance should not be placed on these preliminary estimates. Additionally, we have identified certain deficiencies in our internal control over financial reporting for the fiscal year ended December 31, 2023, which we could conclude constitute a material weakness. This determination will be made in connection with the completion of the audit for the fiscal year ended December 31, 2023, which will be completed subsequent to the completion of this offering. The deficiencies relate to discrepancies we have identified in our process and procedures for customer contract review and revenue recognition.

We have begun remediation efforts, which include our implementation of additional review processes, procedures, and controls, including with respect to customer contracts, as well as system improvements and implementations, staffing, and training.

The actions we will take are subject to continued review supported by confirmation and testing by management as well as audit committee oversight. While we are implementing a plan to remediate these deficiencies, we cannot assure you that we will be able to remediate them, which could impair our ability to accurately and timely report our financial position, results of operations or cash flows. See the section titled “Risk Factors — We have identified certain deficiencies in our internal control over financial reporting for the fiscal year ended December 31, 2023, which could constitute significant deficiencies and/or a material weakness. If we are unable to maintain effective internal controls over financial reporting and disclosure controls and procedures, we may be unable to accurately report our financial results, or report them within the time frames required.” for additional information.

These preliminary estimates are not necessarily indicative of any future period and should be read together with “Risk Factors”, “Special Note Regarding Forward-Looking Statements”, and our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2022, our subsequent Quarterly Reports on Form 10-Q and our other SEC filings. Adjusted EBITDA is a supplemental measure that is not calculated and presented in accordance with GAAP and we urge you to review the reconciliations found below and elsewhere in this prospectus supplement. See the section titled “Non-GAAP Financial Measures” for a reconciliation of Adjusted EBITDA to other periods and a discussion of management’s use of Adjusted EBITDA.

| | | | | | | | | | | | | | |

(in thousands) | | As of December 31, |

| 2022 | | 2023 (estimated) |

Cash and cash equivalents | | $ | 55,780 | | | $ | 80,440 | |

| | | | | | | | | | | | | | | | | |

(in thousands) | Three months ended December 31, 2022 | | Three months ended December 31, 2023 |

| Low (estimated) | | High (estimated) |

| Revenue | $ | 70,551 | | | $ | 73,500 | | | $ | 74,500 | |

Net income (loss) | (5,463) | | | (40,000) | | | (20,000) | |

| Adjusted EBITDA | 23,171 | | | 30,000 | | | 31,000 | |

Our preliminary estimation of revenues reflects an increase for the three months ended December 31, 2023, compared to the three months ended December 31, 2022. The increase was primarily driven by increases from new and ramping customers as well as increases in volume and revenue from existing customers, and is partially offset by the general decline in mortgage-related volume.

Our preliminary estimation of net income (loss) reflects a decrease for the three months ended December 31, 2023, compared to the three months ended December 31, 2022. This decrease was primarily driven by a non-cash charge to our deferred tax assets in our provision for income taxes, as well as increased interest expense and share-based compensation expense, and is partially offset by decreases in costs of revenue and operating expenses for the three months ended December 31, 2023.

Our preliminary estimation of adjusted EBITDA reflects an increase for the three months ended December 31, 2023, compared to the three months ended December 31, 2022. This increase was primarily driven by a decrease in costs of revenues and operating expenses.

The following table presents a reconciliation of net income (loss), the most directly comparable GAAP financial measure, to adjusted EBITDA for each of the periods presented:

| | | | | | | | | | | | | | | | | |

(in thousands) | Three months ended December 31, 2022 | | Three months ended December 31, 2023 |

| Low (estimated) | | High (estimated) |

| Reconciliation of net income (loss) to adjusted EBITDA | | | | | |

Net income (loss) | $ | (5,463) | | | $ | (40,000) | | | $ | (20,000) | |

| Interest expense | 7,578 | | | 9,700 | | | 10,000 | |

Taxes(1) | (1,188) | | | 38,200 | | | 18,200 | |

| Depreciation and amortization | 14,234 | | | 14,100 | | | 14,400 | |

| Share-based compensation expense | 6,260 | | | 8,000 | | | 8,300 | |

| Employer payroll taxes on employee stock transactions | 20 | | | — | | | 85 | |

| Restructuring related costs | — | | | — | | | — | |

Acquisition related costs | 1,679 | | | — | | | — | |

Deferred revenue reduction from purchase accounting for acquisitions prior to 2022 | 51 | | | — | | | 15 | |

| Adjusted EBITDA | $ | 23,171 | | | $ | 30,000 | | | $ | 31,000 | |

(1)Reflects estimate for the range of the valuation allowance to be applied against our deferred tax assets in our provision for income taxes that will be recorded upon the completion of our results as of and for the three months ended December 31, 2023. We have identified certain potential non-cash charges to our deferred tax assets that may require us to record a valuation allowance as we complete our interim financial statements, and any resulting changes could be material and materially impact our reported net income (loss). See section titled “Risk Factors — Our ability to recognize the benefits of deferred tax assets is dependent on future cash flows and taxable income.” for additional information.

Stock Repurchase

In connection with this offering, we intend to purchase from the underwriters up to $50.0 million of shares of our Common Stock offered in this offering at a price per share equal to the per share price at which the underwriters will purchase the shares from the selling stockholders in this offering. Assuming that the underwriters purchase the shares of our Common Stock from the selling shareholders at a price of $22.23 per share, which was the last reported sale price per share of our Common Stock on the NYSE on February 5, 2024, we expect to repurchase up to 2,249,212 shares of our Common Stock from the underwriters as part of this offering. The underwriters will not receive any compensation for the shares of our Common Stock being repurchased by us. The repurchased shares of our Common Stock will no longer be outstanding following the completion of this offering and will be automatically returned to the status of authorized but unissued shares of our Common Stock.

The description of and the other information in this prospectus supplement regarding the Stock Repurchase is included solely for informational purposes. Nothing in this prospectus supplement should be construed as an offer to sell, or the solicitation of an offer to buy, any of our Common Stock, subject to the Stock Repurchase. The completion of the Stock Repurchase is conditioned upon the completion of this offering. The completion of this offering is not conditioned upon the completion of the Stock Repurchase. We cannot assure you that either this offering or the Stock Repurchase will be consummated.

The Stock Repurchase will be funded with up to $50.0 million of our current cash and cash equivalents. The terms and conditions of the Stock Repurchase were reviewed and approved by our board of directors, and the board of directors has authorized a pricing committee of our board of directors to determine the actual number of shares that will be repurchased by us in the Stock Repurchase.

Stock Repurchase Program

On January 29, 2024, our board of directors authorized a new stock repurchase program, or the Repurchase Program, to acquire up to $125.0 million of our Common Stock, with no fixed expiration date and no requirement to purchase any minimum number of shares. Shares may be repurchased under the Repurchase Program through privately negotiated transactions, or open market purchases, including through the use of trading plans intended to qualify under Rule 10b5-1 under the Exchange Act. The Repurchase Program may be commenced, suspended, or terminated at any time by us at our discretion without prior notice. Up to $50.0 million of the Repurchase Program will be used for the Stock Repurchase. Any shares of Common Stock repurchased under the Repurchase Program, including pursuant to the Stock Repurchase, will be retired and automatically returned to the status of authorized but unissued shares of Common Stock.”

The information contained in this Item 7.01 of this Current Report on Form 8-K, including the Exhibit 99.1 attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On February 6, 2024, the Company issued a press release announcing the Offering. A copy of this press release is filed as Exhibit 99.2 to this report and is incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains statements which are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act. Generally, these statements can be identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions, although not all forward-looking statements contain these identifying words. Further, statements describing our strategy, outlook, guidance, plans, intentions, or goals are also forward-looking statements. These forward-looking statements reflect our predictions, expectations, or forecasts, including, but not limited to, statements regarding our preliminary unaudited fourth quarter financial results, our year-end cash position, our stock repurchase program, including the execution and amount of repurchases, the Stock Repurchase in connection with the Offering, and the consummation of the Offering. Actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, the completion of our audit, final adjustments, and other developments that may arise in the course of audit and review procedures and changes in market and economic condition, the risk related to market conditions, the risk that the Offering may not close and that we may not consummate the Stock Repurchase, as well as those risks set forth in Item 1A. Risk Factors, or elsewhere, in our Annual Report on Form 10-K for the most recently ended fiscal year, any updates in our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K, and our other SEC filings. These forward-looking statements are based on reasonable assumptions as of the date hereof. The plans, intentions, or expectations disclosed in our forward-looking statements may not be achieved, and you should not rely upon forward-looking statements as predictions of future events. We undertake no obligation, other than as required by applicable law, to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Exhibit Description |

| |

| 99.1 | |

| |

99.2 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| MERIDIANLINK, INC. |

Date: February 6, 2024 | |

| By: | /s/ Sean Blitchok |

| | Sean Blitchok |

| | Chief Financial Officer |

Press Release – MeridianLink Announces Preliminary Unaudited Fourth Quarter Operating Results and Year-End Cash Position

Costa Mesa, Calif., Feb. 6, 2024 — MeridianLink, Inc. (the “Company”) (NYSE: MLNK), a leading provider of modern software platforms for financial institutions and consumer reporting agencies, today announced preliminary unaudited operating results for the fourth quarter ended December 31, 2023, and its year-end cash position. Additionally, the Company’s Board of Directors has approved a stock repurchase program with authorization to purchase up to $125.0 million of common stock.

Select Preliminary Unaudited Fourth Quarter 2023 Highlights

•Revenue of approximately between $73.5 million and $74.5 million;

•Net income (loss) of approximately between $(40.0) million and $(20.0) million;

•Adjusted EBITDA of approximately between $30.0 million and $31.0 million; and

•Cash and cash equivalents as of December 31, 2023, of approximately $80.4 million.

These financial results are only preliminary estimates, which are based only on financial information available to the Company’s management as of the date hereof and are subject to change. The Company is in the process of finalizing its audited financial results as of and for the year ended December 31, 2023. Upon completion of the Company’s independent auditor’s review of the results for the three months ended December 31, 2023, it is possible significant changes to such preliminary results may be necessary. Accordingly, it is possible that the Company’s final operating results will differ from these preliminary estimates, including as a result of review adjustments, and any resulting changes could be material. Complete financial statements as of and for the year ended December 31, 2023, will be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Stock Repurchase Program

Our Board of Directors has authorized a new stock repurchase program to acquire up to $125.0 million of the Company’s common stock. Stock repurchases are subject to the Company’s discretion based on various factors, including market conditions.

About MeridianLink

MeridianLink® (NYSE: MLNK) powers digital lending and account opening for financial institutions and provides data verification solutions for consumer reporting agencies. MeridianLink’s scalable, cloud-based platforms help customers build deeper relationships with consumers through data-driven, personalized experiences across the entire lending life cycle.

MeridianLink enables customers to accelerate revenue growth, reduce risk, and exceed consumer expectations through seamless digital experiences. Its partner marketplace supports hundreds of integrations for tailored innovation. For more than 20 years, MeridianLink has prioritized the democratization of lending for consumers, businesses, and communities. Learn more at www.meridianlink.com.

Non-GAAP Financial Measures

To supplement the financial measures presented in accordance with generally accepted accounting principles, or GAAP, we provide certain non-GAAP financial measures, such as adjusted EBITDA. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Rather, we believe that these non-GAAP financial measures, when viewed in addition to and not in lieu of our reported GAAP financial results, provide investors with additional meaningful information to assess our financial performance and trends, enable comparison of financial results between periods, and allow for greater transparency with respect to key metrics utilized internally in analyzing and operating our business.

We define adjusted EBITDA as net income (loss) before interest expense, taxes, depreciation and amortization, share-based compensation expense, employer payroll taxes on employee stock transactions, restructuring related costs, sponsor and third-party acquisition related costs, and deferred revenue reductions from purchase accounting for acquisitions prior to the adoption of ASU 2021-08, “Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers,” which we early adopted on January 1, 2022 on a prospective basis. Deferred revenue from acquisitions prior to the adoption of ASU 2021-08 was recognized on a straight line basis through December 31, 2023.

The reconciliation of net income (loss), the most directly comparable GAAP financial measure, to adjusted EBITDA for the three months ended December 31, 2023, is provided in the table below.

| | | | | | | | | | | | | | |

| (in thousands) | | Three months ended December 31, 2023 |

| Low (estimated) | | High (estimated) |

Reconciliation of net income (loss) to adjusted EBITDA | | | | |

| Net income (loss) | | $ | (40,000) | | | $ | (20,000) | |

| Interest expense | | 9,700 | | | 10,000 | |

Taxes(1) | | 38,200 | | | 18,200 | |

| Depreciation and amortization | | 14,100 | | | 14,400 | |

| Share-based compensation expense | | 8,000 | | | 8,300 | |

| Employer payroll taxes on employee stock transactions | | — | | | 85 | |

| Restructuring related costs | | — | | | — | |

| Acquisition related costs | | — | | | — | |

Deferred revenue reduction from purchase accounting for acquisitions prior to 2022 | | — | | | 15 | |

Adjusted EBITDA | | $ | 30,000 | | | $ | 31,000 | |

(1)Reflects estimate for the range of the valuation allowance to be applied against the Company’s deferred tax assets in its provision for income taxes that will be recorded upon the completion of its results as of and for the three months ended December 31, 2023. The Company has identified certain potential non-cash charges to our deferred tax assets that may require it to record a valuation allowance as we complete our interim financial statements, and any resulting changes could be material and materially impact the Company’s reported net income (loss).

Forward-Looking Statements

This press release contains statements which are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Generally, these statements can be identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions, although not all forward-looking statements contain these identifying words. Further, statements describing our strategy, outlook, guidance, plans, intentions, or goals are also forward-looking statements. These forward-looking statements reflect our predictions, expectations, or forecasts, including, but not limited to, statements regarding our preliminary unaudited fourth quarter financial results; our year-end cash position; and our stock repurchase program, including the execution and amount of repurchases. Actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, the completion of our audit, final adjustments, and other developments that may arise in the course of audit and review procedures and changes in market and economic condition, as well as those risks set forth in Item 1A. Risk Factors, or elsewhere, in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, any updates in our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K, and our other SEC filings. These forward-looking statements are based on reasonable assumptions as of the date hereof. The plans, intentions, or expectations disclosed in our forward-looking statements may not be achieved, and you should not

rely upon forward-looking statements as predictions of future events. We undertake no obligation, other than as required by applicable law, to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

For More Information:

Press Contact

Becky Frost

(714) 784-5839

Media@meridianlink.com

Investor Relations Contact

Gianna Rotellini

(714) 332-6357

InvestorRelations@meridianlink.com

Press Release – MeridianLink Announces Launch of Proposed Secondary Offering of 6,500,000 Shares by Certain Selling Stockholders and Related Common Stock Repurchase

Costa Mesa, Calif., Feb. 6, 2024 — MeridianLink, Inc. (the “Company”) (NYSE: MLNK), a leading provider of modern software platforms for financial institutions and consumer reporting agencies, today announced the commencement of a proposed underwritten secondary offering of 6,500,000 shares (the "Firm Shares") of its common stock (the “Offering”) by certain of its existing stockholders (the “Selling Stockholders”). In addition, the Selling Stockholders intend to grant the underwriters a 30-day option to purchase up to an additional number of shares equal to 15% of the Firm Shares net of the shares purchased in the concurrent Stock Repurchase (as defined below), at the public offering price, less underwriting discounts and commissions. The Offering consists entirely of shares of the Company’s common stock to be sold by the Selling Stockholders, and the Company will not receive any proceeds from the sale of the shares being offered by the Selling Stockholders.

In connection with the Offering, the Company intends to purchase from the underwriters up to $50.0 million of the Company’s common stock at a price per share equal to the price per share at which the underwriters purchase shares of the Company’s common stock in the Offering (the “Stock Repurchase”). The Company intends to fund the concurrent Stock Repurchase with existing cash on hand.

Citigroup Global Markets Inc. and J.P. Morgan Securities LLC are acting as lead book-running managers for the Offering.

The Offering is being made pursuant to an effective shelf registration statement on Form S-3 (Registration No. 333-276336), which was filed with the Securities and Exchange Commission (“SEC”) on December 29, 2023 and became effective on January 8, 2024. The Offering will be made only by means of a preliminary prospectus supplement and the accompanying base prospectus. You may get these documents for free, including the prospectus supplement, once available, by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, copies of the preliminary prospectus supplement, once available, and the accompanying base prospectus may be obtained by contacting: Citigroup, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by telephone at 800-831-9146; or J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by telephone at (866) 803-9204, or by email at prospectus-eq_fi@jpmchase.com.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any offer or sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or jurisdiction.

Forward-Looking Statements

This press release contains statements which are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Generally, these statements can be identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions, although not all forward-looking statements contain these identifying words. Further, statements describing our strategy, outlook, guidance, plans, intentions, or goals are also forward-looking statements. These forward-looking statements reflect our predictions, expectations, or forecasts, including, but not limited to, statements regarding the Offering and Stock Repurchase on the anticipated terms or at all; market conditions; the satisfaction of customary closing conditions related to the Offering and Stock Repurchase; and the expected closing of the Offering and Stock Repurchase. Actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, changes in market and economic condition and in the selling stockholders’ plan of Offering, as well as those risks set forth in Item 1A. Risk Factors, or elsewhere, in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, any updates in our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K, and our other SEC filings, including the prospectus and prospectus supplement pursuant to which the Offering will be made. These forward-looking statements are based on reasonable assumptions as of the date hereof. The plans, intentions, or expectations disclosed

in our forward-looking statements may not be achieved, and you should not rely upon forward-looking statements as predictions of future events. We undertake no obligation, other than as required by applicable law, to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Press Contact

Becky Frost

(714) 784-5839

media@meridianlink.com

Investor Relations Contact

Gianna Rotellini

(714) 332-6357

InvestorRelations@meridianlink.com

v3.24.0.1

Cover

|

Feb. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 06, 2024

|

| Entity Registrant Name |

MeridianLink, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40680

|

| Entity Tax Identification Number |

82-4844620

|

| Entity Address, Address Line One |

3560 Hyland Avenue, Suite 200

|

| Entity Address, City or Town |

Costa Mesa

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92626

|

| City Area Code |

714

|

| Local Phone Number |

708-6950

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

MLNK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001834494

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

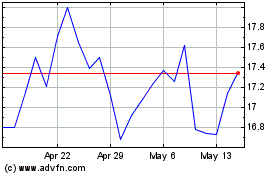

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Apr 2023 to Apr 2024