0001834494FALSE00018344942024-01-082024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 8, 2024

MeridianLink, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40680 | 82-4844620 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

3560 Hyland Avenue, Suite 200

Costa Mesa, CA 92626

(Address of principal executive offices and Zip Code)

(714) 708-6950

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | MLNK | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On January 8, 2024, the Board of Directors (the “Board”) of MeridianLink, Inc. (the “Company”) authorized an organizational realignment plan (the “Plan”) that is designed to manage operating costs, enable efficient delivery on business objectives, and allow for growth in areas of strategic importance. The Plan includes a reduction of the Company’s current workforce by approximately 9%.

The Company estimates that it will incur charges of approximately $3.3 million to $4.3 million in connection with the Plan, consisting primarily of cash expenditures and relating to employee severance payments, employee benefits, and employee transition costs.

The actions associated with the workforce reduction under the Plan are expected to be substantially complete by the end of the first quarter of 2024, subject to local law and consultation requirements.

The estimates of the charges and expenditures that the Company expects to incur in connection with the Plan, and timing thereof, are subject to a number of assumptions, including local law requirements in various jurisdictions, and actual amounts may differ from the estimates discussed above.

Item 7.01 Regulation FD Disclosure.

On January 11, 2024, Nicolaas Vlok, chief executive officer of the Company, sent a communication to Company employees. A copy of this communication is furnished as Exhibit 99.1 and is incorporated by reference herein.

The information contained in this Item 7.01 of this Current Report on Form 8-K, including the Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K contains statements which are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Generally, these statements can be identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions, although not all forward-looking statements contain these identifying words. Further, statements describing our strategy, outlook, guidance, plans, intentions, or goals are also forward-looking statements. These forward-looking statements reflect our predictions, expectations, or forecasts, including, but not limited to, statements regarding our organizational realignment plan, including expected or contemplated timing, benefits, and costs associated with such plan. Actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, the risk that the realignment costs and charges may be greater than anticipated or incurred in different periods than anticipated; the risk that the Company’s realignment efforts may adversely affect the Company’s internal programs and the Company’s ability to recruit and retain skilled and motivated personnel, and may be distracting to employees and management; the risk that the Company’s realignment efforts may negatively impact the Company’s business operations and reputation with or ability to serve customers; the risk that the Company’s realignment efforts may not generate their intended benefits to the extent or as quickly as anticipated, as well as those risks set forth in Item 1A. Risk Factors, or elsewhere, in our Annual Report on Form 10-K for the most recently ended fiscal year, any updates in our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K, and our other SEC filings. These forward-looking statements are based on reasonable assumptions as of the date hereof. The plans, intentions, or expectations disclosed in our forward-looking statements may not be achieved, and you should not rely upon forward-looking statements as predictions of future events. We undertake no obligation, other than as required by applicable law, to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Exhibit Description |

| |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| MERIDIANLINK, INC. |

Date: January 11, 2024 | |

| By: | /s/ Sean Blitchok |

| | Sean Blitchok |

| | Chief Financial Officer |

Exhibit 99.1

To: All MeridianLink Employees

From: Nicolaas Vlok

Date: January 11, 2024

Team MLNK,

The last few years have been an exciting time to work at MeridianLink as we scaled up to support several important innovation initiatives, including the cloud migration and the integration of acquired companies. Since we have completed these significant technology projects, we find ourselves at an inflection point where we must prioritize our spend and invest in our future.

That’s why we have made the decision to undertake a thoughtful and comprehensive organizational realignment. Following an overall review of our strategic and operational priorities and the skill sets needed to accelerate those priorities on a go-forward basis, we identified certain roles that will be eliminated and employees who will be transitioning from the organization. The size of our team will be reduced by about 9%. Realignment is taking place across the entire organization, with the largest impact in technology and R&D.

All employees will receive an email within the next 15 minutes about the status of their role. Impacted employees will also receive a Teams invitation for a call with management and HR to go over transition and severance details.

We know this is a difficult process for many, but we are confident that this change will improve efficiencies and better enable us to meet our current business needs. We did not make this decision lightly, and we want to share how we got here and what is next for the Company.

Realigning our investment

In the last few years, we have grown our team to make significant technological strides forward. We are pleased to have accomplished our project goals. Yet, with the completion of several key projects and the economy rebounding at its current pace, we have determined that cutting costs and returning to our historical level of R&D investment is prudent and necessary.

Our Culture of Caring

Saying goodbye is never easy, especially to teammates who made significant contributions to our Company. We are communicating and supporting each impacted employee as we work through this process together.

Departing employees will be offered the following support through their separation agreements:

•Eight weeks of severance pay, plus two additional weeks for every completed year of service, up to a total of 26 weeks of severance pay;

•Up to three months of employer-paid COBRA; and

•Career support with coaching through Lee Hecht Harrison (LHH), an outplacement agency dedicated to this process.

What’s Next

These changes, while difficult today, will better enable us to efficiently deliver on our business objectives and grow in the areas of strategic importance. We are optimistic about the future and sincerely appreciate the work that has gone into completing our significant technology projects over the last few years.

We believe there are ample opportunities in the current market for those who help their customers succeed. Today’s realignment is designed to position us best to serve and grow our customer base effectively while managing costs and investing in innovation.

Over the next few days, we’ll discuss these changes at the team level. In the meantime, please reach out to your manager, HR, or me with any questions.

Best,

Nicolaas Vlok

v3.23.4

Cover

|

Jan. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity Registrant Name |

MeridianLink, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40680

|

| Entity Tax Identification Number |

82-4844620

|

| Entity Address, Address Line One |

3560 Hyland Avenue, Suite 200

|

| Entity Address, City or Town |

Costa Mesa

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92626

|

| City Area Code |

714

|

| Local Phone Number |

708-6950

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

MLNK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001834494

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

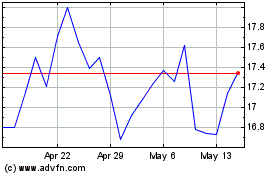

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Apr 2023 to Apr 2024