0001834494FALSE00018344942023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2023

MeridianLink, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40680 | 82-4844620 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

3560 Hyland Avenue, Suite 200

Costa Mesa, CA 92626

(Address of principal executive offices and Zip Code)

(714) 708-6950

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | MLNK | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 1, 2023, MeridianLink, Inc. (the “Company”) issued a press release announcing its financial results for the third quarter ended September 30, 2023. A copy of this press release is furnished as Exhibit 99.1 and is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On November 1, 2023, the Company issued a press release announcing its financial results for the third quarter ended September 30, 2023. A copy of this press release is furnished as Exhibit 99.1 and is incorporated by reference herein.

The Company also furnishes herewith, as Exhibit 99.2, a presentation, dated November 2023, to be given to investors and others and made available on the Company's investor relations website at ir.meridianlink.com.

The information contained in this Item 2.02 and 7.01 of this Current Report on Form 8-K, including the Exhibit 99.1 and 99.2 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Exhibit Description |

| |

| 99.1 | |

| |

| 99.2 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| MERIDIANLINK, INC. |

Date: November 1, 2023 | |

| By: | /s/ Sean Blitchok |

| | Sean Blitchok |

| | Chief Financial Officer |

Exhibit 99.1

MeridianLink Reports Third Quarter 2023 Results

Revenue of $76.5 million grows 7% year-over-year driven by lending software solutions revenue of $58.9 million, reflecting growth of 12% year-over-year

COSTA MESA, Calif., November 1, 2023 — MeridianLink, Inc. (NYSE: MLNK), a leading provider of modern software platforms for financial institutions and consumer reporting agencies, today announced financial results for the third quarter ended September 30, 2023.

“Q3 was another solid quarter of execution, and the strategic key drivers of our business continue to yield consistent performance,” said Nicolaas Vlok, chief executive officer of MeridianLink. “We are continuously improving MeridianLink® One through product innovation and value-added partner integrations. In addition, we have a talented Go-to-Market team capturing strong demand as financial institutions invest in enhancing the consumer experience through improving their digital capabilities.”

Quarterly Financial Highlights:

•Revenue of $76.5 million, an increase of 7% year-over-year

•Lending software solutions revenue of $58.9 million, an increase of 12% year-over-year

•Operating income of $5.6 million, or 7% of revenue, and non-GAAP operating income of $14.0 million, or 18% of revenue

•Net loss of $(2.1) million, or (3)% of revenue, and adjusted EBITDA of $29.8 million, or 39% of revenue

•Cash flows from operations of $21.3 million, or 28% of revenue, and free cash flow of $18.8 million, or 25% of revenue

Business and Operating Highlights:

•MeridianLink® captured strong demand for MeridianLink One, as demonstrated by an impressive roster of new logo and cross-sell wins, including a solid bookings quarter in mortgage lending.

•The Company launched its new point-of-sale solution, MeridianLink® Access, for MeridianLink® Consumer and MeridianLink® Mortgage, to provide enhanced configurability and a more personalized consumer experience.

•MeridianLink continued to innovate in the data and analytics space by launching MeridianLink® Data Connect, a solution that brings transactional data in-house for the customer to gain more insightful reporting, and expanding MeridianLink® Insight, our business intelligence tool, to integrate with MeridianLink® Engage and MeridianLink® Collect.

•The Company integrated with a variety of leading partner solutions such as Experian’s Verify™ and PowerCurve®, designed to automate loan approvals and decisioning, as well as Cox Automotive’s Dealertrack®, a comprehensive suite of indirect lending solutions for the auto industry’s largest dealer-lender network.

Business Outlook

Based on information as of today, November 1, 2023, the Company issues fourth quarter financial guidance and reaffirms full year 2023 financial guidance as follows:

Fourth Quarter Fiscal 2023:

•Revenue is expected to be in the range of $73.0 million to $77.0 million

•Adjusted EBITDA is expected to be in the range of $22.0 million to $26.0 million

Full Year 2023:

•Revenue is expected to be in the range of $302.0 million to $306.0 million

•Adjusted EBITDA is expected to be in the range of $104.0 million to $108.0 million

Conference Call Information

MeridianLink will hold a conference call to discuss our third quarter results today, November 1, 2023, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time). The conference call can be accessed by dialing (888) 259-6580 from North America toll-free or the International number of (416) 764-8624 with Conference ID 96695077. A live webcast of the conference call can be accessed

from the investor relations page of MeridianLink’s website at ir.meridianlink.com. An archived replay of the webcast will be available at the same website following the conclusion of the call. A telephonic replay will be available until 8:59 p.m. Pacific Time (11:59 p.m. Eastern Time) on Wednesday, November 8, 2023, by dialing (877) 674-7070 from North America or the International number of (416) 764-8692 with Playback Passcode 695077.

For More Information:

Press Contact

Becky Frost

(714) 784-5839

Media@meridianlink.com

Investor Relations Contact

Gianna Rotellini

(714) 332-6357

InvestorRelations@meridianlink.com

About MeridianLink

MeridianLink® (NYSE: MLNK), headquartered in Costa Mesa, California, powers digital lending and account opening for financial institutions and provides data verification solutions for consumer reporting agencies. MeridianLink’s scalable, cloud-based platforms help customers build deeper relationships with consumers through data-driven, personalized experiences across the entire lending life cycle.

MeridianLink enables customers to accelerate revenue growth, reduce risk, and exceed consumer expectations through seamless digital experiences. Its partner marketplace supports hundreds of integrations for tailored innovation. For more than 20 years, MeridianLink has prioritized the democratization of lending for consumers, businesses, and communities.

Learn more at www.meridianlink.com.

Operational Measures Definitions

We reference bookings, which is an internal operational measure of the business. Bookings is defined as the total of the minimum annual contracted value for newly sold capabilities of our software-as-a-service, or SaaS, products over a given time period, inclusive of any corresponding vendor fees owed to Third Parties.

Non-GAAP Financial Measures

To supplement the financial measures presented in accordance with generally accepted accounting principles, or GAAP, we provide certain non-GAAP financial measures, such as adjusted EBITDA and adjusted EBITDA margin; non-GAAP operating income (loss); non-GAAP net income (loss); non-GAAP cost of revenue; non-GAAP sales and marketing expenses; non-GAAP research and development expenses; non-GAAP general and administrative expenses; and free cash flow. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Rather, we believe that these non-GAAP financial measures, when viewed in addition to and not in lieu of our reported GAAP financial results, provide investors with additional meaningful information to assess our financial performance and trends, enable comparison of financial results between periods, and allow for greater transparency with respect to key metrics utilized internally in analyzing and operating our business. The following definitions are provided:

•Non-GAAP operating income (loss): GAAP operating income (loss), excluding the impact of share-based compensation, employer payroll taxes on employee stock transactions, restructuring related costs, and sponsor and third-party acquisition-related costs.

•Non-GAAP net income (loss): GAAP net income (loss), excluding the impact of share-based compensation, employer payroll taxes on employee stock transactions, restructuring related costs, sponsor and third-party acquisition-related costs, and the effect of income taxes on non-GAAP items. The effects of income taxes on non-GAAP items reflect a fixed long-term projected tax rate of 24%.

The Company employs a structural long-term projected non-GAAP income tax rate of 24% for greater consistency across reporting periods, eliminating effects of items not directly related to the Company's operating structure that may vary in size and frequency. This long-term projected non-GAAP income tax rate is determined by analyzing a mix of historical and projected tax filing positions, assumes no additional acquisitions during the projection period, and takes into account various factors, including the Company’s anticipated tax structure, its tax positions in different jurisdictions, and current impacts from key U.S. legislation where the Company operates. We will reevaluate this tax rate, as necessary, for significant events such as significant alterations in the U.S. tax environment, substantial changes in the Company’s geographic earnings mix due to acquisition activity, or other shifts in the Company’s strategy or business operations.

•Adjusted EBITDA: net income (loss) before interest expense, taxes, depreciation and amortization, share-based compensation expense, employer payroll taxes on employee stock transactions, restructuring related costs, sponsor and third-party acquisition related costs, and deferred revenue reductions from purchase accounting for acquisitions prior to the adoption of ASU 2021-08, “Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers,” which we early adopted on January 1, 2022 on a prospective basis. As of September 30, 2023, the remaining deferred revenue from acquisitions prior to the adoption of ASU 2021-08 was less than $0.1 million, which will be recognized on a straight line basis through December 31, 2023.

•Non-GAAP cost of revenue: GAAP cost of revenue, excluding the impact of share-based compensation, employer payroll taxes on employee stock transactions, and amortization of developed technology.

•Non-GAAP operating expenses: GAAP operating expenses, excluding the impact of share-based compensation, employer payroll taxes on employee stock transactions, and depreciation and amortization, as applicable.

•Free cash flow: GAAP cash flow from operating activities less GAAP purchases of property and equipment (Capital Expenditures) and capitalized costs related to developed technology (Capitalized Software).

Reconciliations to comparable GAAP financial measures are available in the accompanying schedules, which are posted as part of this earnings release on our website. No reconciliation is provided with respect to certain forward-looking non-GAAP financial measures as the GAAP measures are not accessible on a forward-looking basis. We cannot reliably predict all necessary components or their impact to reconcile such financial measures without unreasonable effort. The events necessitating a non-GAAP adjustment are inherently unpredictable and may have a significant impact on our future GAAP financial results.

Forward-Looking Statements

This release contains, and our above-referenced conference call and webcast will contain, statements which are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Generally, these statements can be identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions, although not all forward-looking statements contain these identifying words. Further, statements describing our strategy, outlook, guidance, plans, intentions, or goals are also forward-looking statements. These forward-looking statements reflect our predictions, expectations, or forecasts, including, but not limited to, statements regarding, and guidance with respect to, our strategy, our future financial and operational performance, future economic and market conditions, our strategic initiatives, including anticipated benefits and integration of an acquisition, our stock repurchase program, including the execution and amount of repurchases, our restructuring plan, including expected associated timing, benefits, and costs, our ability to retain and attract customers and product partners, potential losses related to any commercial disputes, our development or delivery of new or enhanced solutions and anticipated results of those solutions for our customers, our ability to effectively implement, integrate, and service our customers, our market size and growth opportunities, our competitive positioning, projected costs, technological capabilities and plans, and objectives of management. Actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, risks related to our business and industry, as well as those set forth in Item 1A. Risk Factors, or elsewhere, in our Annual Report on Form 10-K for the most recently ended fiscal year, any updates in our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K, and our other SEC filings. These forward-looking statements are based on reasonable assumptions as of the date hereof. The plans, intentions, or expectations disclosed in our forward-looking statements may not be achieved, and you should not rely upon forward-looking statements as predictions of future events. We undertake no obligation, other than as required by applicable law, to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Condensed Consolidated Balance Sheets

(unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | |

| As of |

| September 30, 2023 | | December 31, 2022 |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 97,560 | | $ | 55,780 |

| | | |

| Accounts receivable, net | 33,996 | | 32,905 |

| Prepaid expenses and other current assets | 12,640 | | 9,447 |

| Escrow deposit | — | | 30,000 |

| Total current assets | 144,196 | | 128,132 |

| Property and equipment, net | 3,651 | | 4,245 |

| Right of use assets | 1,407 | | 2,185 |

| Intangible assets, net | 262,791 | | 297,475 |

| Deferred tax assets, net | 18,201 | | 13,939 |

| Goodwill | 609,333 | | 608,657 |

| Other assets | 5,738 | | 4,524 |

| Total assets | $ | 1,045,317 | | | $ | 1,059,157 |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 4,847 | | $ | 1,249 |

| Accrued liabilities | 34,159 | | 32,500 |

| Deferred revenue | 26,694 | | 16,945 |

| Current portion of long-term debt, net of debt issuance costs | 3,548 | | 3,505 |

| Total current liabilities | 69,248 | | 54,199 |

| Long-term debt, net of debt issuance costs | 420,921 | | 423,404 |

| Long-term deferred revenue | 692 | | 1,141 |

| Other long-term liabilities | 690 | | 1,322 |

| Total liabilities | 491,551 | | 480,066 |

| Commitments and contingencies | | | |

| Stockholders’ Equity | | | |

| Preferred stock, $0.001 par value; 50,000,000 shares authorized; zero shares issued and outstanding at September 30, 2023 and December 31, 2022 | — | | — |

| Common stock, $0.001 par value; 600,000,000 shares authorized, 79,627,213 and 80,644,452 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 130 | | 128 |

| Additional paid-in capital | 644,854 | | 621,396 |

| Accumulated deficit | (91,218) | | (42,433) |

| Total stockholders’ equity | 553,766 | | 579,091 |

| Total liabilities and stockholders’ equity | $ | 1,045,317 | | $ | 1,059,157 |

Condensed Consolidated Statements of Operations

(unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues, net | $ | 76,488 | | | $ | 71,754 | | | $ | 229,038 | | | $ | 217,495 | |

| Cost of revenues: | | | | | | | |

| Subscription and services | 22,488 | | | 23,812 | | | 69,973 | | | 68,292 | |

| Amortization of developed technology | 4,524 | | | 4,003 | | | 13,488 | | | 11,287 | |

| Total cost of revenues | 27,012 | | | 27,815 | | | 83,461 | | | 79,579 | |

| Gross profit | 49,476 | | | 43,939 | | | 145,577 | | | 137,916 | |

| Operating expenses: | | | | | | | |

| General and administrative | 23,218 | | | 21,423 | | | 70,182 | | | 60,416 | |

| Research and development | 11,248 | | | 11,518 | | | 36,814 | | | 30,414 | |

| Sales and marketing | 9,441 | | | 6,311 | | | 26,212 | | | 16,519 | |

| | | | | | | |

| | | | | | | |

| Acquisition related costs | — | | | 163 | | | — | | | 2,549 | |

| Restructuring related costs | — | | | — | | | 3,621 | | | — | |

| Total operating expenses | 43,907 | | | 39,415 | | | 136,829 | | | 109,898 | |

| Operating income | 5,569 | | | 4,524 | | | 8,748 | | | 28,018 | |

| Other (income) expense, net: | | | | | | | |

| Interest and other income | (1,342) | | | (327) | | | (2,596) | | | (706) | |

| Interest expense | 9,780 | | | 6,855 | | | 28,127 | | | 16,649 | |

| | | | | | | |

| Total other expense, net | 8,438 | | | 6,528 | | | 25,531 | | | 15,943 | |

| (Loss) income before (benefit from) provision for income taxes | (2,869) | | | (2,004) | | | (16,783) | | | 12,075 | |

| | | | | | | |

| (Benefit from) provision for income taxes | (800) | | | 890 | | | (3,818) | | | 5,318 | |

| Net (loss) income | $ | (2,069) | | | $ | (2,894) | | | $ | (12,965) | | | $ | 6,757 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net (loss) income per share: | | | | | | | |

| Basic | $ | (0.03) | | | $ | (0.04) | | | $ | (0.16) | | | $ | 0.08 | |

| Diluted | $ | (0.03) | | | $ | (0.04) | | | $ | (0.16) | | | $ | 0.08 | |

| Weighted average common stock outstanding: | | | | | | | |

| Basic | 81,073,915 | | | 80,659,320 | | | 80,883,310 | | | 80,353,399 | |

| Diluted | 81,073,915 | | | 80,659,320 | | | 80,883,310 | | | 82,364,835 | |

Net Revenues by Major Source

(unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Subscription fees | $ | 64,613 | | $ | 61,861 | | $ | 194,788 | | $ | 188,860 |

| Professional services | 8,706 | | 7,293 | | 26,143 | | 21,070 |

| Other | 3,169 | | 2,600 | | 8,107 | | 7,565 |

| Total | $ | 76,488 | | $ | 71,754 | | $ | 229,038 | | $ | 217,495 |

Net Revenues by Solution Type

(unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Lending software solutions | $ | 58,949 | | $ | 52,414 | | $ | 172,728 | | $ | 153,249 |

| Data verification software solutions | 17,539 | | 19,340 | | 56,310 | | 64,246 |

Total (1) | $ | 76,488 | | $ | 71,754 | | $ | 229,038 | | $ | 217,495 |

% Growth attributable to: |

| | | | | | |

Lending software solutions | 9% | | | | 9% | | |

Data verification software | (3)% | | | | (4)% | | |

Total % growth | 7% | | | | 6% | | |

|

| | | | | | |

(1) % Revenue related to mortgage loan market: |

| | | | | | |

| Lending software solutions | 12% | | 6% | | 12% | | 7% |

| Data verification software | 57% | | 62% | | 60% | | 66% |

| Total % revenue related to mortgage loan market | 22% | | 21% | | 24% | | 24% |

Condensed Consolidated Statements of Cash Flows

(unaudited)

(in thousands)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net (loss) income | $ | (12,965) | | $ | 6,757 |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 43,388 | | 39,746 |

| Provision for expected credit losses | 627 | | — |

| Amortization of debt issuance costs | 897 | | 1,705 |

| Share-based compensation expense | 22,216 | | 16,501 |

| Loss on disposal of property and equipment | — | | 164 |

| | | |

| | | |

| | | |

| | | |

| | | |

| Deferred income taxes | (4,507) | | 5,193 |

| Changes in operating assets and liabilities, net of acquisitions: | | | |

| Accounts receivable | (1,726) | | (6,964) |

| Prepaid expenses and other assets | (4,595) | | (2,480) |

| Accounts payable | 3,632 | | (450) |

| Accrued liabilities | (782) | | (247) |

| Deferred revenue | 9,301 | | 7,472 |

| | | |

| Net cash provided by operating activities | 55,486 | | 67,235 |

| Cash flows from investing activities: | | | |

| Acquisition, net of cash acquired – Beanstalk Networks L.L.C. | 326 | | — |

| Acquisition, net of cash and restricted cash acquired – StreetShares, Inc. | — | | (23,138) |

| | | |

| | | |

| | | |

| Return (payment) of escrow deposit | 30,000 | | (30,000) |

| Funds payable in connection with former business combination | 1,219 | | — |

| Capitalized software additions | (7,004) | | (6,323) |

| Purchases of property and equipment | (347) | | (889) |

| Net cash provided by (used in) investing activities | 24,194 | | (60,350) |

| Cash flows from financing activities: | | | |

| Repurchases of common stock | (35,660) | | (262) |

| | | |

| | | |

| | | |

| Proceeds from exercise of stock options | 1,633 | | 186 |

| | | |

| Proceeds from employee stock purchase plan | 793 | | 922 |

| Taxes paid related to net share settlement of restricted stock units | (1,403) | | (184) |

| | | |

| Principal payments of debt | (3,263) | | (2,175) |

| Payment of Regulation A+ investor note | — | | (3,265) |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash used in financing activities | (37,900) | | (4,778) |

| Net increase in cash and cash equivalents | 41,780 | | 2,107 |

| Cash and cash equivalents, beginning of period | 55,780 | | 113,645 |

| Cash and cash equivalents, end of period | $ | 97,560 | | $ | 115,752 |

| | | | | | | | | | | |

| |

| | | |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid for interest | $ | 27,498 | | $ | 14,852 |

| Cash paid for income taxes | 2,610 | | 1,179 |

| Non-cash investing and financing activities: | | | |

| Shares withheld with respect to net settlement of restricted stock units | $ | 1,403 | | $ | 184 |

| Purchase price allocation adjustment for BeanStalk Networks acquisition | 757 | | — |

| Purchases of property and equipment included in accounts payable and accrued liabilities | 611 | | 2 |

| Purchase price allocation adjustment related to income tax effects for StreetShares acquisition | 245 | | — |

| Share-based compensation expense capitalized to software additions | 219 | | 255 |

| Excise taxes payable included in repurchases of common stock | 162 | | — |

| Vesting of restricted stock awards and restricted stock units | 4 | | 40 |

| Regulation A+ investor note assumed in business combination | — | | 3,265 |

| Initial recognition of operating lease liabilities | — | | 3,786 |

| Initial recognition of operating lease right-of-use assets | — | | 3,096 |

| | | |

| | | |

| | | |

Reconciliation from GAAP to Non-GAAP Results

(unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Operating income | $ | 5,569 | | $ | 4,524 | | $ | 8,748 | | $ | 28,018 |

| Add: Share-based compensation expense | 8,322 | | 7,253 | | 22,879 | | 16,501 |

| Add: Employer payroll taxes on employee stock transactions | 150 | | 182 | | 598 | | 329 |

| Add: Restructuring related costs | — | | — | | 3,621 | | — |

| Add: Sponsor and third-party acquisition related costs | — | | 163 | | — | | 2,549 |

| Non-GAAP operating income | $ | 14,041 | | $ | 12,122 | | $ | 35,846 | | $ | 47,397 |

| Operating margin | 7% | | 6% | | 4% | | 13% |

Non-GAAP operating margin | 18% | | 17% | | 16% | | 22% |

| | | | | | | |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net (loss) income | $ | (2,069) | | $ | (2,894) | | $ | (12,965) | | $ | 6,757 |

| Add: Share-based compensation expense | 8,322 | | 7,253 | | 22,879 | | 16,501 |

| Add: Employer payroll taxes on employee stock transactions | 150 | | 182 | | 598 | | 329 |

| Add: Restructuring related costs | — | | — | | 3,621 | | — |

| Add: Sponsor and third-party acquisition related costs | — | | 163 | | — | | 2,549 |

| | | | | | | |

| Add: Income tax effect on non-GAAP items | 2,033 | | 1,824 | | 6,503 | | 4,651 |

| Non-GAAP net income | $ | 8,436 | | $ | 6,528 | | $ | 20,636 | | $ | 30,787 |

| Non-GAAP basic net income per share | $ | 0.10 | | $ | 0.08 | | $ | 0.26 | | $ | 0.38 |

| Non-GAAP diluted net income per share | $ | 0.10 | | $ | 0.08 | | $ | 0.25 | | $ | 0.37 |

Weighted average shares used to compute Non-GAAP basic net income per share | 81,073,915 | | 80,659,320 | | 80,883,310 | | 80,353,399 |

| Weighted average shares used to compute Non-GAAP diluted net income per share | 83,716,804 | | 82,543,631 | | 83,331,901 | | | 82,364,835 |

| Net (loss) income margin | (3)% | | (4)% | | (6)% | | 3% |

| Non-GAAP net income margin | 11% | | 9% | | 9% | | 14% |

| | | | | | | |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net (loss) income | $ | (2,069) | | $ | (2,894) | | $ | (12,965) | | $ | 6,757 |

Interest expense | 9,780 | | 6,855 | | 28,127 | | 16,649 |

Taxes | (800) | | 890 | | (3,818) | | 5,318 |

Depreciation and amortization | 14,433 | | 13,370 | | 43,388 | | 39,746 |

| Share-based compensation expense | 8,322 | | 7,253 | | 22,879 | | 16,501 |

| Employer payroll taxes on employee stock transactions | 150 | | 182 | | 598 | | 329 |

| | | | | | | |

| Restructuring related costs | — | | — | | 3,621 | | — |

Sponsor and third-party acquisition related costs | — | | 163 | | — | | 2,549 |

| | | | | | | |

| Deferred revenue reduction from purchase accounting for acquisitions prior to 2022 | 19 | | 60 | | 58 | | 179 |

| | | | | | | |

| | | | | | | |

| Adjusted EBITDA | $ | 29,835 | | $ | 25,879 | | $ | 81,888 | | $ | 88,028 |

| Net (loss) income margin | (3)% | | (4)% | | (6)% | | 3% |

| Adjusted EBITDA margin | 39% | | 36% | | 36% | | 40% |

| | | | | | | |

|

Reconciliation from GAAP to Non-GAAP Results

(unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cost of revenue | $ | 27,012 | | $ | 27,815 | | $ | 83,461 | | $ | 79,579 |

| Less: Share-based compensation expense | 910 | | 1,352 | | 2,919 | | 3,567 |

| Less: Employer payroll taxes on employee stock transactions | 26 | | 67 | | 135 | | 121 |

| Less: Amortization of developed technology | 4,524 | | 4,003 | | 13,488 | | 11,287 |

| Non-GAAP cost of revenue | $ | 21,552 | | $ | 22,393 | | $ | 66,919 | | $ | 64,604 |

| Cost of revenue as a % of revenue | 35% | | 39% | | 36% | | 37% |

| Non-GAAP cost of revenue as a % of revenue | 28% | | 31% | | 29% | | 30% |

| | | | | | | |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| General and administrative | $ | 23,218 | | $ | 21,423 | | $ | 70,182 | | $ | 60,416 |

| Less: Share-based compensation expense | 4,443 | | 3,170 | | 11,938 | | 6,947 |

| Less: Employer payroll taxes on employee stock transactions | 59 | | 42 | | 217 | | 74 |

| Less: Depreciation expense | 490 | | 577 | | 1,480 | | 1,718 |

| Less: Amortization of intangibles | 9,419 | | 8,790 | | 28,420 | | 26,741 |

| Non-GAAP general & administrative | $ | 8,807 | | $ | 8,844 | | $ | 28,127 | | $ | 24,936 |

| General and administrative as a % of revenue | 30% | | 30% | | 31% | | 28% |

| Non-GAAP general and administrative as a % of revenue | 12% | | 12% | | 12% | | 11% |

| | | | | | | |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Research and development | $ | 11,248 | | $ | 11,518 | | $ | 36,814 | | $ | 30,414 |

| Less: Share-based compensation expense | 1,709 | | 2,092 | | 5,368 | | 4,457 |

| Less: Employer payroll taxes on employee stock transactions | 38 | | 56 | | 163 | | 97 |

| Non-GAAP research and development | $ | 9,501 | | $ | 9,370 | | $ | 31,283 | | $ | 25,860 |

| Research and development as a % of revenue | 15% | | 16% | | 16% | | 14% |

| Non-GAAP research and development as a % of revenue | 12% | | 13% | | 14% | | 12% |

|

| | | | | | |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Sales and marketing | $ | 9,441 | | $ | 6,311 | | $ | 26,212 | | $ | 16,519 |

| Less: Share-based compensation expense | 1,260 | | 639 | | 2,654 | | 1,530 |

| Less: Employer payroll taxes on employee stock transactions | 27 | | 17 | | 83 | | 37 |

| Non-GAAP sales and marketing | $ | 8,154 | | $ | 5,655 | | $ | 23,475 | | $ | 14,952 |

| Sales and marketing as a % of revenue | 12% | | 9% | | 11% | | 8% |

| Non-GAAP sales and marketing as a % of revenue | 11% | | 8% | | 10% | | 7% |

|

| | | | | | |

|

| | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net cash provided by operating activities | $ | 21,301 | | $ | 19,565 | | $ | 55,486 | | $ | 67,235 |

| Less: Capitalized software | 2,442 | | 2,244 | | 7,004 | | 6,323 |

| Less: Capital expenditures | 42 | | 409 | | 347 | | 889 |

| Free cash flow | $ | 18,817 | | $ | 16,912 | | $ | 48,135 | | $ | 60,023 |

|

| | | | | | |

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. 1 Connecting you to better Third Quarter 2023 Review November 2023 Exhibit 99.2

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Information in this presentation and the accompanying oral presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. All statements other than statements of historical fact included in this presentation and the accompanying oral presentation, including statements regarding, and guidance with respect to, our strategy, future operations, financial position, projected costs, projected long-term operating model, our future financial and operational performance, prospects, market size and growth opportunities, future economic conditions, competitive position, strategic initiatives, development or delivery of new or enhanced solutions, technological capabilities, plans, and objectives of management are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “may,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. These forward-looking statements reflect our predictions, expectations, or forecasts. Actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, risks related to economic and market conditions, including interest rate fluctuations; our ability to retain and attract customers; our ability to expand and evolve our offerings, features, and functionalities or respond to rapid technological changes; our ability to identify and integrate strategic initiatives, including anticipated benefits of an acquisition; our restructuring plan, including expected associated timing, benefits, and costs; our stock repurchase program, including the execution and amount of repurchases; our ability to compete in a highly-fragmented and competitive landscape; market demand for our products and solutions; our ability to effectively implement, integrate, and service our customers; our ability to retain and attract product partners; our commercial disputes, including potential losses related thereto; our future financial performance, including, but not limited to, trends in revenue, costs of revenue, gross profit or gross margin, operating expenses, and number of customers; and our high levels of indebtedness; as well as those set forth in Item 1A. Risk Factors, or elsewhere, in our Annual Report on Form 10-K for the year ended December 31, 2022, any updates in our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K, and our other SEC filings. These forward-looking statements are based on reasonable assumptions as of the date hereof. The plans, intentions, or expectations disclosed in our forward-looking statements may not be achieved, and you should not rely upon forward-looking statements as predictions of future events. We undertake no obligation, other than as required by applicable law, to update any forward-looking statements, whether as a result of new information, future events, or otherwise. Information in this presentation and the accompanying oral presentation, including any statements regarding MeridianLink’s customer data and other metrics, is based on data and analyses from various sources as of December 31, 2022, unless otherwise indicated. This presentation contains statistical data, estimates, and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on our internal sources. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information. Accordingly, we make no representations as to the accuracy or completeness of that data nor do we undertake to update such data after the date of this presentation. Copyright Notice: All copyrightable text and graphics, the selection, arrangement, and presentation of all materials (including information in the public domain) are ©2023 MeridianLink, Inc. All rights reserved. This presentation includes trademarks, which are protected under applicable intellectual property laws and are the property of MeridianLink, Inc. or its subsidiaries. This presentation may also contain trademarks, service marks, copyrights, and trade names of other companies, which are the property of their respective owners and are used for reference purposes only. Such use should not be construed as an endorsement of the platform and products of MeridianLink. Solely for convenience, trademarks and trade names may appear without the ® or ™ symbols, but such references are not intended to indicate that, with respect to our intellectual property, we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names. Forward-Looking Statements and Disclaimers 2

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. MeridianLink at a Glance 3 • Provider of SaaS-based lending, credit data, and account opening solutions to financial institutions • Named to IDC Global FinTech Top 50(1) • Headquartered in Costa Mesa, CA • Founded in 1998 GROWTH AND SCALE $71.8M 6% Growth YoY $227.8M$299.6M (15)% Growth 16% Growth YoY PREDICTABLE, RECURRING & ATTRACTIVE MARGIN PROFILE 86% Subscription Fee Revenue 71% Adj. Gross Margin(2) 35% Adj. EBITDA Margin(2) Total Revenue Lending Solutions Revenue Data Verification Solutions Revenue Note: Financial data as of the LTM period ending September 30, 2023. (1) Source: 2023 IDC FinTech Rankings Top 100, as of September 2023 (2) Adj. gross profit and adj. EBITDA are non-GAAP Measures. Adj. gross profit is calculated by subtracting non-GAAP cost of revenue from net revenues. Adj. gross profit margin represents adj. gross profit as a percentage of revenues. Adj. EBITDA margin represents Adj. EBITDA as a percentage of revenues. For a definition and reconciliation of non-GAAP cost of revenue and adj. EBITDA, please refer to the Appendix.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Digital Lending Acceleration Has Been Dramatic 4 I N N O V AT O R S E A R LY A D O P T E R S E A R LY M A J O R I T Y L AT E M A J O R I T Y L A G G A R D S 100% 0% Consumer Lending Mortgage Lending Continued digital growth expected as laggards follow the market trends COVID-19 fast-tracked the consumer adoption to digital Growth in Digital Transactions Accelerated Growth vs. pre-COVID Substantial Expected Future YoY Increases

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Large TAM with Significant Runway 5 Data Access: Consumer Data & CRA Enablement Total Addressable Market $0.3B $0.6B $1.0B $2.4B $5.8B Collections Portfolio & Lending Performance Account Opening & Point-of-Sale Loan Origination(1) Source: Cornerstone Advisors. (1) Loan origination market size is inclusive of consumer, mortgage, and commercial loan origination.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Targeting New Logos and Expanding the Sweet Spot for Sales 6 <$100M AUM 3,600+ FIs $10B+ AUM 175+ FIs $100M – $1B AUM 4,250+ FIs $1B – $10B AUM 1,200+ FIs D O W N M A R K E T U P M A R K E T Inside Sales Big Game Hunters Multi-Pronged Direct Sales Focused on Market Segments

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. 2023 and Beyond 7 Engage more deeply with customers through an effective Go-to-Market, platform strategy Expand the innovative capabilities of our platform, creating a best-of-breed solution that wins in the market Empower customer growth with frictionless software solutions and access to hundreds of partners Strengthen competitive positioning by acquiring differentiating capabilities and increasing market share Structure organization to serve more customers with greater efficiency and accelerate ACV released 1 2 3 4 5 Strategic Restructuring Enhancing Product Innovation Fueling Go-to-Market Accelerating Time-to- Revenue

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. MeridianLink’s Next-Generation Unified Platform 8 Financial Institutions Borrowers Marketing Automation Universal Portal Universal Platform Intelligent Cross-Sell Collections Data & Analytics Checking / Savings Certificates of Deposits Personal Loan Auto Loan Credit Card Mortgage Home Equity Small Business Data-driven workflows to acquire new customers and extend the financial relationship over time

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Multi-Vector Growth Strategy 9 Paper-to-Digital Transition in Target Market Pursue Unrealized Upsell & Cross-Sell Expand Product Offerings Enhance Partner Marketplace Monetization Robust Pipeline of M&A Opportunities Add New Logos Capitalize on Organic Volume Growth Competition Among Financial Institutions

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Lending Revenues Have Shown Continued Growth at Scale 10 Lending Solutions Revenue Data Verification Solutions Revenue LTM Q3’23A Total Revenue: $300M % YoY Lending Revenue Growth¹Revenue from Mortgage Loan Market % of Total Revenue % of Lending Software Solutions 2022 LTM Q3’23A 8% 64% 12% 60% Mortgage Contribution to Revenue ($ millions) % of Data Verification Software Solutions (1) YoY Growth is calculated as either the LTM quarter or fiscal year financial performance divided by financial performance of the same LTM quarter a year earlier or previous fiscal year minus one.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Historical Financials 11 Total Revenue Quarterly Revenue Breakdown ($ millions) ($ millions) % Subscription Professional Services OtherSubscription Fees Lending Software Solutions Revenue Data Verification Software Solutions Revenue (1) YoY Growth is calculated as current quarter financial performance divided by financial performance of the same quarter a year earlier minus one.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Mortgage Loan Market Contribution to Revenue 12 Lending Software Solutions Data Verification Software Solutions Revenue from Mortgage Loan Market ($ millions) ($ millions)

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Strong Margin Profile 13 Adj. Gross Profit ($ millions) Adj. EBITDA ($ millions) Adj. EBITDA Adj. EBITDA Margin % YoY LTM Lending Revenue Growth 32% 18% 16% Note: YTD and LTM metrics are as of the period ended September 30, 2023. Adj. gross profit and adj. EBITDA are non-GAAP Measures. Adj. gross profit is calculated by subtracting non-GAAP cost of revenue from net revenues. Adj. gross profit margin represents adj. gross profit as a percentage of revenues. Adj. EBITDA margin represents Adj. EBITDA as a percentage of revenues. For a definition and reconciliation of non-GAAP cost of revenue and adj. EBITDA, please refer to the Appendix.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Capitalizing on Operating Leverage and Investing in Growth 14 Adj. General & Administrative Adj. Research & Development Adj. Sales & Marketing ($ millions) ($ millions) ($ millions) S&M % of RevenueR&D % of RevenueG&A % of Revenue Note: Note: YTD metrics are as of the period ended September 30, 2023. Adj. Sales & Marketing, Adj. Research & Development, and Adj. General & Administrative expenses are non-GAAP measures. For a definition and reconciliation of non-GAAP operating expenses, please refer to the Appendix.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Operating and Cash Flow Margins 15 Non-GAAP Operating Income Free Cash Flow ($ millions) ($ millions) Non-GAAP Operating Income Non-GAAP Operating Margin Free Cash Flow Free Cash Flow Margin Note: Non-GAAP operating income and free cash flow are non-GAAP measures. Non-GAAP operating margin represents non-GAAP operating income as a percentage of revenues. Free cash flow margin represents free cash flow as a percentage of revenues. For a definition and reconciliation of non-GAAP operating income and free cash flow, please refer to the Appendix. % YoY LTM Lending Revenue Growth 32% 18% 16%

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Resilient Customer Base and ARR Growth 16 Lending Software Solutions CAGR: ~4% Total Customers¹ Annual Recurring Revenue² ($’s in millions) 11% 12%15%21%20%% YoY Lending Software Solutions ARR Growth Data Verification Software SolutionsLending Software Solutions (1) Customer defined as a legal entity that has a contractual relationship with us to use our software solutions. (2) Annual Recurring Revenue, or ARR, is calculated as the total subscription fee revenues calculated in the latest twelve-month measurement period for those revenue-generating entities in place throughout the entire twelve-month measurement period plus the subscription fee revenues calculated on an annualized basis from new entity activations in the measurement period.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Q3 2023 Performance 17 ($ in thousands) Q3 2022A Q3 2023A Delta Consolidated Statements of Operations Data Revenue $71,754 $76,488 $4,734 Gross profit 43,939 49,476 5,537 % Gross margin 61.2% 64.7% 3.4% Net income (loss) (2,894) (2,069) 825 % Net income (loss) margin (4.0)% (2.7)% 1.3% Non-GAAP Financial Data Adj. EBITDA(1) 25,879 29,835 3,956 % Adj. EBITDA margin(1) 36.1% 39.0% 2.9% Note: This financial information has been prepared by and is the responsibility of our management. Our independent registered public accounting firm has not audited, reviewed or performed any procedures with respect to this preliminary financial data or the accounting treatment thereof and does not express an opinion or any other form of assurance with respect thereto. (1) Adj. EBITDA is a non-GAAP measure. Adj. EBITDA margin represents Adj. EBITDA as a percentage of revenues. For a definition and reconciliation of Adj. EBITDA, please refer to the Appendix.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Guidance Update 18 Guidance Update Three Months Ended December 31, 2023 Year Ended December 31, 2023 ($ in thousands) Q4 2022A Low (Estimated) High (Estimated) 2022A Low (Estimated) High (Estimated) Revenue $70,551 $73,000 $77,000 $288,046 $302,000 $306,000 % Growth 10% 3% 9% 8% 5% 6% Adj. EBITDA(1) 25,879 22,000 26,000 111,199 104,000 108,000 % Growth 5% (15)% 0% (10)% (6)% (3)% % Margin(1) 37% 30% 34% 39% 34% 35% Note: This financial information has been prepared by and is the responsibility of our management. Our independent registered public accounting firm has not audited, reviewed or performed any procedures with respect to this preliminary financial data or the accounting treatment thereof and does not express an opinion or any other form of assurance with respect thereto. (1) Adj. EBITDA is a non-GAAP measure. Adj. EBITDA margin represents Adj. EBITDA as a percentage of revenues. For a definition and reconciliation of Adj. EBITDA, please refer to the Appendix.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. 19 Appendix

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED.©2023 MERIDIA LINK, INC. ALL IGHTS RESERVED. Non-GAAP Financial Measures To supplement the financial measures presented in accordance with United States generally accepted accounting principles, or GAAP, we provide certain non-GAAP financial measures, such as adjusted EBITDA and adjusted EBITDA margin; non-GAAP operating income (loss); non-GAAP net income (loss); non-GAAP cost of revenue; non-GAAP sales and marketing expenses; non-GAAP research and development expenses; non-GAAP general and administrative expenses; and free cash flow. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Rather, we believe that these non-GAAP financial measures, when viewed in addition to and not in lieu of our reported GAAP financial results, provide investors with additional meaningful information to assess our financial performance and trends, enable comparison of financial results between periods, and allow for greater transparency with respect to key metrics utilized internally in analyzing and operating our business. The following definitions are provided: • Non-GAAP operating income (loss): GAAP operating income (loss), excluding the impact of share-based compensation, employer payroll taxes on employee stock transactions, restructuring related costs, and sponsor and third-party acquisition-related costs. • Non-GAAP net income (loss): GAAP net income (loss), excluding the impact of share-based compensation, employer payroll taxes on employee stock transactions, restructuring related costs, sponsor and third-party acquisition-related costs, and the effect of income taxes on non-GAAP items. The effects of income taxes on non-GAAP items reflect a fixed long-term projected tax rate of 24%. The Company employs a structural long-term projected non-GAAP income tax rate of 24% for greater consistency across reporting periods, eliminating effects of items not directly related to the Company's operating structure that may vary in size and frequency. This long-term projected non-GAAP income tax rate is determined by analyzing a mix of historical and projected tax filing positions, assumes no additional acquisitions during the projection period, and takes into account various factors, including the Company’s anticipated tax structure, its tax positions in different jurisdictions, and current impacts from key U.S. legislation where the Company operates. We will reevaluate this tax rate, as necessary, for significant events such as significant alterations in the U.S. tax environment, substantial changes in the Company’s geographic earnings mix due to acquisition activity, or other shifts in the Company’s strategy or business operations. • Adjusted EBITDA: net income (loss) before interest expense, taxes, depreciation and amortization, share-based compensation expense, employer payroll taxes on employee stock transactions, restructuring related costs, sponsor and third-party acquisition related costs, and deferred revenue reductions from purchase accounting for acquisitions prior to the adoption of ASU 2021-08, “Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers,” which we early adopted on January 1, 2022 on a prospective basis. As of September 30, 2023, the remaining deferred revenue from acquisitions prior to the adoption of ASU 2021-08 was less than $0.1 million, which will be recognized on a straight line basis through December 31, 2023. • Non-GAAP cost of revenue: GAAP cost of revenue, excluding the impact of share-based compensation, employer payroll taxes on employee stock transactions, and amortization of developed technology. • Non-GAAP operating expenses: GAAP operating expenses, excluding the impact of share-based compensation, employer payroll taxes on employee stock transactions, and depreciation and amortization, as applicable. • Free cash flow: GAAP cash flow from operating activities less GAAP purchases of property and equipment (Capital Expenditures) and capitalized costs related to developed technology (Capitalized Software). Reconciliations to comparable GAAP financial measures are available in the accompanying schedules, which are included in the Appendix of this presentation. No reconciliation is provided with respect to certain forward-looking non-GAAP financial measures as the GAAP measures are not accessible on a forward-looking basis. We cannot reliably predict all necessary components or their impact to reconcile such financial measures without unreasonable effort. The events necessitating a non-GAAP adjustment are inherently unpredictable and may have a significant impact on our future GAAP financial results. 20

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Financial Reconciliations 21 ($ in thousands) 2021A 2022A Q3’23A Reconciliation of Net Loss to Adjusted EBITDA(1) Net income (loss) ($9,996) $1,294 ($2,069) (+) Interest expense, net 32,615 24,227 9,780 (+/-) Tax expense 5,141 4,130 (800) (+) Depreciation & amortization 50,453 53,982 14,433 (+) Share-based compensation expense 30,736 22,761 8,322 (+) Employer payroll taxes on employee stock transactions 95 350 150 (+) Expenses associated with IPO 424 – – (+) Restructuring related costs – – – (+) Sponsor and third-party acquisition related costs 2,348 4,228 – (+) Loss on debt prepayment 9,944 – – (+) Deferred revenue reduction from purchase accounting for acquisitions prior to 2022 733 227 19 (+) Lease termination charges 879 – – Adjusted EBITDA(1) $123,372 $111,199 $29,835 Net (loss) income margin (4)% 0% (3)% Adjusted EBITDA margin(2) 46% 39% 39% Non-GAAP Adjusted EBITDA (1) We define Adj. EBITDA as net income (loss) before interest expense, taxes, depreciation, amortization, share-based compensation expense, employer payroll taxes on employee stock transactions, certain expenses associated with our IPO, sponsor and third-party acquisition related costs, losses resulting from early repayment of debt, impairment of trademarks, lease termination charges, and deferred revenue reductions from purchase accounting. (2) Adj. EBITDA margin represents Adj. EBITDA as a percentage of revenues.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Financial Reconciliations (Cont’d) 22 ($ in thousands) 2021A 2022A Q3’23A Revenues, net $267,676 $288,046 $76,488 Cost of revenue 89,622 106,331 27,012 (-) Share-based compensation expense 6,478 4,630 910 (-) Employer payroll taxes on employee stock transactions 3 127 26 (-) Amortization of developed technology 12,519 15,553 4,524 Non-GAAP cost of revenue 70,622 86,021 21,552 Adjusted gross profit $197,054 $202,025 $54,936 GAAP gross margin 67% 63% 65% Adjusted gross margin 74% 70% 72% Adjusted Gross Profit ($ in thousands) 2021A 2022A Q3’23A Operating Income $37,655 $28,588 $5,569 (+) Share-based compensation expense 30,736 22,761 8,322 (+) Employer payroll taxes on employee stock transactions 95 350 150 (+) Sponsor and third-party acquisition related costs 2,348 4,228 – Non-GAAP operating income $70,834 $55,927 $14,041 GAAP operating margin 14% 10% 7% Non-GAAP operating margin 26% 19% 18% Non-GAAP Operating Income Note: Adj. gross profit is a non-GAAP Measure. Adj. gross profit is calculated by subtracting non-GAAP cost of revenue from net revenues. Adj. gross profit margin represents adj. gross profit as a percentage of revenues. ($ in thousands) 2021A 2022A Q3’23A Net cash provided by operating activities $89,835 $74,587 $21,301 (-) Capital expenditures 843 1,136 42 (-) Capitalized software 4,906 8,228 2,442 Non-GAAP sales and marketing $84,086 $65,223 $18,817 Net cash provided by operating activities as a % of revenue 34% 26% 28% Free cash flow as a % of revenue 31% 23% 25% Free Cash Flow

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Financial Reconciliations (Cont’d) 23 ($ in thousands) 2021A 2022A Q3’23A Sales and marketing $18,122 $23,658 $9,441 (-) Share-based compensation expense 2,247 2,160 1,260 (-) Employer payroll taxes on employee stock transactions 11 40 27 Non-GAAP sales and marketing $15,864 $21,458 $8,154 GAAP sales and marketing as a % of revenue 7% 8% 12% Non-GAAP sales and marketing as a % of revenue 6% 7% 11% Non-GAAP Sales and Marketing Expense ($ in thousands) 2021A 2022A Q3’23A Research and development $36,336 $42,592 $11,248 (-) Share-based compensation expense 7,453 6,472 1,709 (-) Employer payroll taxes on employee stock transactions 8 102 38 Non-GAAP research and development $28,875 $36,018 $9,501 GAAP research and development as a % of revenue 14% 15% 15% Non-GAAP research and development as a % of revenue 11% 13% 12% Non-GAAP Research and Development Expense ($ in thousands) 2021A 2022A Q3’23A General and administrative $85,160 $82,649 $23,218 (-) Share-based compensation expense 14,558 9,499 4,443 (-) Employer payroll taxes on employee stock transactions 73 81 59 (-) Depreciation expense 2,303 2,319 490 (-) Amortization of intangibles 35,631 36,110 9,419 Non-GAAP general and administrative $32,595 $34,640 $8,807 GAAP general and administrative as a % of revenue 32% 29% 30% Non-GAAP general and administrative as a % of revenue 12% 12% 12% Non-GAAP General and Administrative Expense

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Balance Sheet Highlights 24 ($ in thousands) 2021A 2022A Q3’23A Total current assets $147,956 $128,132 $144,196 Property and equipment, net 5,989 4,245 3,651 Intangible assets, net 298,597 297,475 262,791 Goodwill 564,799 608,657 609,333 Other assets 8,552 20,648 25,346 Total assets $1,025,893 $1,059,157 $1,045,317 Total current liabilities $43,848 $54,199 $69,248 Long-term debt, net of debt issuance costs 425,371 423,404 420,921 Other liabilities 396 2,463 1,382 Total liabilities $469,615 $480,066 $491,551 Total stockholders’ equity 556,278 579,091 553,766 Total liabilities and stockholders’ equity $1,025,893 $1,059,157 $1,045,317

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Net Leverage 25 ($ in thousands) 2021A 2022A Q3’23A 2021 Term loan $435,000 $431,738 $428,475 (-) Debt issuance costs 7,490 4,829 4,006 (-) Cash and cash equivalents 113,645 55,780 97,560 Net Leverage $313,865 $371,129 $326,909 LTM Adjusted EBITDA 123,372 111,199 105,059 Leverage multiple 2.5x 3.3x 3.1x 3.1

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Financial Supplement 26 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Lending software solutions $187.8 $185.8 $184.9 $182.1 $167.2 $161.3 $153.3 $151.8 $150.7 Data verification software solutions $69.3 $71.3 $73.4 $77.1 $81.8 $85.1 $87.0 $88.4 $90.7 Total $257.1 $257.2 $258.3 $259.2 $249.1 $246.4 $240.3 $240.1 $241.5 Annual Recurring Revenue (ARR)¹ Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Lending software solutions 104.5% 105.9% 111.4% 110.8% 106.1% 104.0% 101.4% 112.5% 117.0% Data verification software solutions 84.0% 83.3% 83.7% 80.5% 85.4% 88.2% 92.3% 104.7% 122.5% Total 97.7% 98.0% 100.9% 100.3% 98.9% 98.4% 98.1% 109.5% 118.8% ARR Net Retention Rate² Organic Customer Growth Rate4 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Lending software solutions 1,588 1,594 1,603 1,606 1,519 1,510 1,488 1,473 1,462 Data verification software solutions 435 436 430 427 431 427 422 425 431 Total 2,023 2,030 2,033 2,033 1,950 1,937 1,910 1,898 1,893 Total Customer³ Count Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Lending software solutions (0.9)% 0.1% 1.5% 2.8% 3.3% 2.9% 2.3% 2.1% 3.1% Data verification software solutions 0.9% 2.1% 1.9% 0.5% 0.0% 0.2% (0.2)% 0.5% 6.7% Total (0.5)% 0.5% 1.6% 2.3% 2.5% 2.3% 1.7% 1.7% 3.4% (1) Annual Recurring Revenue, or ARR, is calculated as the total subscription fee revenues calculated in the latest twelve-month measurement period for those revenue-generating entities in place throughout the entire twelve-month measurement period plus the subscription fee revenues calculated on an annualized basis from new entity activations in the measurement period. (2) ARR Net Retention Rate takes the ARR recorded in the latest twelve-month measurement period for the cohort of revenue-generating entities in place throughout the entire prior twelve-month measurement period divided by the cohort’s ARR recorded in the twelve-month period that is immediately prior to the beginning of the current measurement period. (3) Customer defined as a legal entity that has a contractual relationship with us to use our software solutions. (4) Organic Customer Growth Rate is the percentage increase in the number of total customers on the last day of the measurement period compared to the number of total customers on the day twelve months prior to the measurement date, which measures the change in total customers, net of both customer terminations and customer additions between the respective measurement periods.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED. Financial Supplement 27 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Lending software solutions $187.7 $185.9 $184.8 $181.8 $167.1 $161.1 $153.3 $151.8 $150.7 Data verification software solutions $69.3 $71.3 $73.4 $77.1 $81.8 $85.1 $87.1 $88.4 $90.7 Total $257.0 $257.2 $258.2 $258.9 $248.9 $246.2 $240.4 $240.1 $241.5 Annual Recurring Revenue (ARR)¹ Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Lending software solutions 104.7% 106.2% 111.2% 110.6% 106.0% 103.9% 101.4% 112.5% 117.0% Data verification software solutions 84.0% 83.3% 83.7% 80.5% 85.4% 88.2% 92.3% 104.7% 122.5% Total 97.7% 98.1% 100.9% 100.2% 98.8% 98.3% 98.1% 109.5% 118.8% ARR Net Retention Rate² Organic Customer Growth Rate4 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Lending software solutions 1,583 1,593 1,597 1,604 1,519 1,516 1,495 1,475 1,459 Data verification software solutions 437 436 430 430 433 429 431 426 430 Total 2,020 2,029 2,027 2,034 1,952 1,945 1,926 1,901 1,889 Total Customer³ Count Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Lending software solutions (1.3)% (0.4)% 0.7% 2.5% 3.5% 3.5% 3.1% 2.5% 3.2% Data verification software solutions 1.9% 1.6% (0.2)% 0.9% 0.7% 1.4% 2.4% 0.9% 6.7% Total (0.8)% 0.1% 0.5% 2.2% 2.9% 3.0% 2.9% 2.2% 3.5% During the three months ended September 30, 2023, we refined our methodology to incorporate process improvements around customer count, resulting in immaterial adjustments in prior periods to total customers, and, in turn, immaterially affecting other key operating measures such as annual recurring revenue, organic customer growth rate, and ARR net retention rate, as described below. Using our prior methodology, the key operating measures are provided in the tables below. We continue to improve our processes to track our key operating measures, which may subject these measures to future refinement.

©2023 MERIDIANLINK, INC. ALL RIGHTS RESERVED.©2023 MERIDIA LINK, INC. ALL IGHTS RESERVED. InvestorRelations@MeridianLink.com 28

v3.23.3

Cover

|

Nov. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 01, 2023

|

| Entity Registrant Name |

MeridianLink, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40680

|

| Entity Tax Identification Number |

82-4844620

|

| Entity Address, Address Line One |

3560 Hyland Avenue, Suite 200

|

| Entity Address, City or Town |

Costa Mesa

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92626

|

| City Area Code |

714

|

| Local Phone Number |

708-6950

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

MLNK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001834494

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

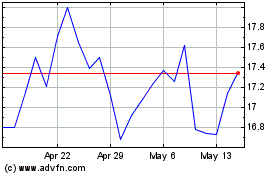

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Apr 2023 to Apr 2024