New Business Intelligence Solution Gives Financial Institutions Automated, Direct Access to Structured MeridianLink Origination Data

October 17 2023 - 9:05AM

Business Wire

With MeridianLink Data Connect, Financial

Institutions Can Now Bring Data In-House for Insight into the

Entire Origination Lifecycle while Quickly Identifying Ways to

Increase Efficiency

MeridianLink, Inc. (NYSE: MLNK), a leading provider of modern

software platforms for financial institutions and consumer

reporting agencies, today announced the availability of

MeridianLink® Data Connect. The offering enables financial

institutions (FIs) to integrate their MeridianLink® Consumer and

MeridianLink® Opening data directly into their data warehouse. This

allows for more insightful reporting for FIs, combined with the

ability to develop more complete key performance indicators that

would otherwise be limited to single data sources.

“In today's consumer-centric market, harnessing insights from

diverse data sources and seamlessly accessing essential knowledge

in one central hub empowers financial institutions to accelerate

growth,” said Devesh Khare, chief product officer at MeridianLink.

“By integrating Data Connect with MeridianLink® Insight,

institutions can gain rapid, comprehensive data analysis and a

unified view across all platforms, enabling profound and holistic

insights to drive the business forward.”

Financial institutions can fulfill modern data warehousing and

analytics needs through secure, daily, automated transfers of

MeridianLink origination data into their data warehouse, removing

the need for manual or batch uploads.

“We needed a solution to consolidate our reporting, combining

our internal analysis of core data with origination insights. It

was a challenge to find an efficient way to achieve this,” said

Harold Singleton, information and system support manager at Credit

Human Federal Credit Union. “MeridianLink Data Connect's approach

makes it possible for us to seamlessly integrate MeridianLink

Consumer and Opening data into our data warehouse. The opportunity

to simplify our processes and save time will help us make

better-informed decisions to enhance our member service.”

The simple, streamlined transfer of structured data such as

credit information, time series, queues, configuration tables, and

so much more into one centralized location allows institutions to

quickly identify and address areas for improvement.

“Compared to the many other external cloud-based data sources we

pull from, the MeridianLink Data Connect solution is a step above,”

said Richard Kaznicki, data development and operations lead with

Global Credit Union in Alaska. “We can now easily pull down

structured relational data that saves both development and

analytics teams countless hours. This time saved enables us to

focus on what matters most, our members.”

Click here to learn more about MeridianLink Data Connect.

ABOUT MERIDIANLINK

MeridianLink® (NYSE: MLNK) powers digital lending and account

opening for financial institutions and provides data verification

solutions for consumer reporting agencies. MeridianLink’s scalable,

cloud-based platforms help customers build deeper relationships

with consumers through data-driven, personalized experiences across

the entire lending life cycle.

MeridianLink enables customers to accelerate revenue growth,

reduce risk, and exceed consumer expectations through seamless

digital experiences. Its partner marketplace supports hundreds of

integrations for tailored innovation. For more than 20 years,

MeridianLink has prioritized the democratization of lending for

consumers, businesses, and communities. Learn more at

www.meridianlink.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231017256458/en/

Becky Frost (714) 784-5839 media@meridianlink.com

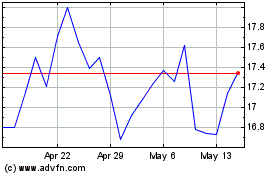

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Apr 2023 to Apr 2024