Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

October 21 2019 - 5:22PM

Edgar (US Regulatory)

ISSUER FREE WRITING PROSPECTUS

RELATING TO PRELIMINARY PROSPECTUS SUPPLEMENT

DATED OCTOBER 21, 2019 FOR SENIOR NOTES DUE 2029

FILED PURSUANT TO RULE 433

REGISTRATION NUMBER 333-219293

KB HOME

$300,000,000

4.800% Senior Notes due 2029

Final Pricing Term Sheet

October 21, 2019

This Final Pricing

Term Sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement. The information in this Final Pricing Term Sheet supplements the Preliminary Prospectus Supplement and supersedes the information in the Preliminary

Prospectus Supplement to the extent inconsistent with the information in the Preliminary Prospectus Supplement.

|

|

|

|

|

Issuer:

|

|

KB Home

|

|

|

|

|

Securities:

|

|

4.800% Senior Notes due 2029 (“Notes”)

|

|

|

|

|

Amount:

|

|

$300,000,000

|

|

|

|

|

Coupon (Interest Rate):

|

|

4.800%

|

|

|

|

|

Yield to Maturity:

|

|

4.800%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+300 bps

|

|

|

|

|

Benchmark Treasury:

|

|

UST 1.625% due August 15, 2029

|

|

|

|

|

Scheduled Maturity Date:

|

|

November 15, 2029

|

|

|

|

|

Public Offering Price:

|

|

100.000%

|

|

|

|

|

Gross Proceeds:

|

|

$300,000,000

|

|

|

|

|

Underwriting Discount:

|

|

1.000% of principal amount

|

|

|

|

|

Payment Dates:

|

|

May 15 and November 15 of each year, commencing on May 15, 2020

|

|

|

|

|

Record Dates:

|

|

May 1 and November 1 of each year

|

|

|

|

|

Redemption:

|

|

The Notes will be redeemable, in whole at any time or from time to time in part, at the Issuer’s option on any date of redemption (each, a “Redemption Date”). Prior to May 15, 2029 (the date that is six months

prior to the maturity of the Notes) (the “Par Call Date”), the redemption price for the Notes to be redeemed will be equal to the greater of:

|

|

|

|

|

|

|

|

|

|

|

(a) 100% of the principal amount of the Notes to be redeemed on that Redemption Date, and

|

|

|

|

|

|

|

(b) the sum of the present values of the remaining scheduled payments of principal and interest on the Notes to be

redeemed that would be due if the Notes matured on the Par Call Date (exclusive of interest accrued to the applicable Redemption Date) discounted to such Redemption Date on a semiannual basis, assuming a

360-day year consisting of twelve 30-day months, at the Treasury Rate (as defined in the Preliminary Prospectus Supplement) plus 50 basis points, plus, in the case of

both clause (a) and (b) above, accrued and unpaid interest on the principal amount of the Notes being redeemed to, but excluding, such Redemption Date.

|

|

|

|

|

|

|

On or after the Par Call Date, the redemption price for the Notes to be redeemed will be equal to 100% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest on the principal amount of the Notes

being redeemed to, but excluding, such Redemption Date.

|

|

|

|

|

Change of Control Triggering Event:

|

|

If a change of control triggering event occurs, the Issuer will generally be required to make an offer to repurchase all outstanding Notes at a price in cash equal to 101% of the principal amount of the Notes, plus accrued and

unpaid interest to, but excluding, the repurchase date.

|

|

|

|

|

CUSIP:

|

|

48666K AY5

|

|

|

|

|

ISIN:

|

|

US48666KAY55

|

|

|

|

|

Distribution:

|

|

SEC Registered (Registration No. 333-219293)

|

|

|

|

|

Listing:

|

|

None

|

|

|

|

|

Expected Ratings (Moody’s/S&P):*

|

|

Ba3 / BB-

|

|

|

|

|

Trade Date:

|

|

October 21, 2019

|

|

|

|

|

Settlement Date:**

|

|

November 4, 2019 (T+10)

|

|

|

|

|

Joint Book-Running Managers:

|

|

Citigroup Global Markets Inc.

BofA

Securities, Inc.

Credit Suisse Securities (USA) LLC

Deutsche

Bank Securities Inc.

Wells Fargo Securities, LLC

|

|

|

|

|

Passive Book-Running Manager:

|

|

BNP Paribas Securities Corp.

|

|

|

|

|

Co-Managers:

|

|

Fifth Third Securities, Inc.

WoodRock

Securities, L.P.

BMO Capital Markets Corp.

CIBC World Markets

Corp.

MUFG Securities Americas Inc.

Regions Securities

LLC

|

|

*

|

Ratings may be changed, suspended or withdrawn at any time and are not a recommendation to buy, hold or sell

any security.

|

|

**

|

It is expected that delivery of the Notes will be made, against payment for the Notes, on or about

November 4, 2019, which will be the tenth business day following the pricing of the Notes. Under Rule 15c6-1 under the Exchange Act, trades in the secondary market generally are required to settle in two

business days, unless the parties to a trade expressly agree otherwise. Accordingly, purchasers of the Notes who wish to trade the Notes on the date of the prospectus supplement or the next succeeding seven business days will be required, because

the Notes initially will settle within ten business days (T+10), to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade on the date of the prospectus

supplement or the next seven succeeding business days should consult their own legal advisors.

|

The Issuer has filed a

Registration Statement (including a Prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the Prospectus in that Registration Statement and other documents the Issuer has filed with the SEC

for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, copies may be obtained by contacting Citigroup at the following address: c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, email: prospectusdept@citi.com or toll free at

1-800-831-9146, or BNP PARIBAS at the following address: Attn: Syndicate Desk, 787 Seventh Avenue, New York, NY 10019, email:

new.york.syndicate@bnpparibas.com or toll free at 1-800-854-5674, or BofA Securities at the following address: BofA Securities, NC1-004-03-43, 200 North College Street, 3rd floor, Charlotte, NC 28255-0001, Attn: Prospectus Department, email:

dg.prospectus_requests@bofa.com, or Credit Suisse at the following address: Attention: Prospectus Department, One Madison Avenue, New York, NY 10010, email: newyork.prospectus@credit-suisse.com, or Deutsche Bank Securities at the following address:

Attn: Prospectus Group, 60 Wall Street, New York, NY 10005, email: prospectus.CPDG@db.com or toll free at 1-800-503-4611, or

Wells Fargo Securities at the following address: Attn: WFS Customer Service, 608 2nd Avenue South, Suite 1000, Minneapolis, MN 55402, email: wfscustomerservice@wellsfargo.com or toll free at 1-800-645-3751.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR

BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

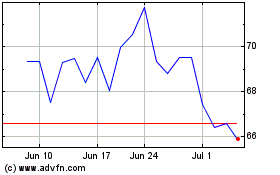

KB Home (NYSE:KBH)

Historical Stock Chart

From Aug 2024 to Sep 2024

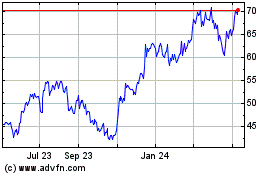

KB Home (NYSE:KBH)

Historical Stock Chart

From Sep 2023 to Sep 2024